Overview

Navigating the process of paying Utah state taxes can feel overwhelming, but we're here to help. This article offers a comprehensive step-by-step guide designed to ease your concerns. You'll find detailed information on the necessary forms, deadlines, and payment methods, allowing you to approach this task with greater confidence.

We understand that gathering documents and accurately completing the TC-40 form can be daunting. However, taking these steps is crucial to ensure timely submissions and avoid penalties. By breaking down the process into manageable parts, we aim to make your tax filing experience smoother and less stressful.

Remember, you are not alone in this journey. Many residents share similar feelings, and this guide is crafted with your needs in mind. We encourage you to take the time to familiarize yourself with the information provided, as it can significantly impact your experience.

In conclusion, we urge you to act promptly. By submitting your payments on time and following the outlined steps, you can alleviate much of the stress associated with tax season. Together, we can make this process more manageable for you.

Introduction

Navigating the complexities of state taxes can often feel overwhelming, especially in Utah, where tax obligations come with specific deadlines and requirements. We understand that this journey may seem daunting, and that’s why we’re here to help. This guide aims to demystify the process, providing a clear roadmap for individuals looking to pay their Utah state taxes effectively.

It’s common to feel uncertain about various payment methods and the potential pitfalls that may arise. How can you ensure a smooth filing experience while avoiding costly mistakes? Together, we will explore the steps you can take to make this process easier and more manageable.

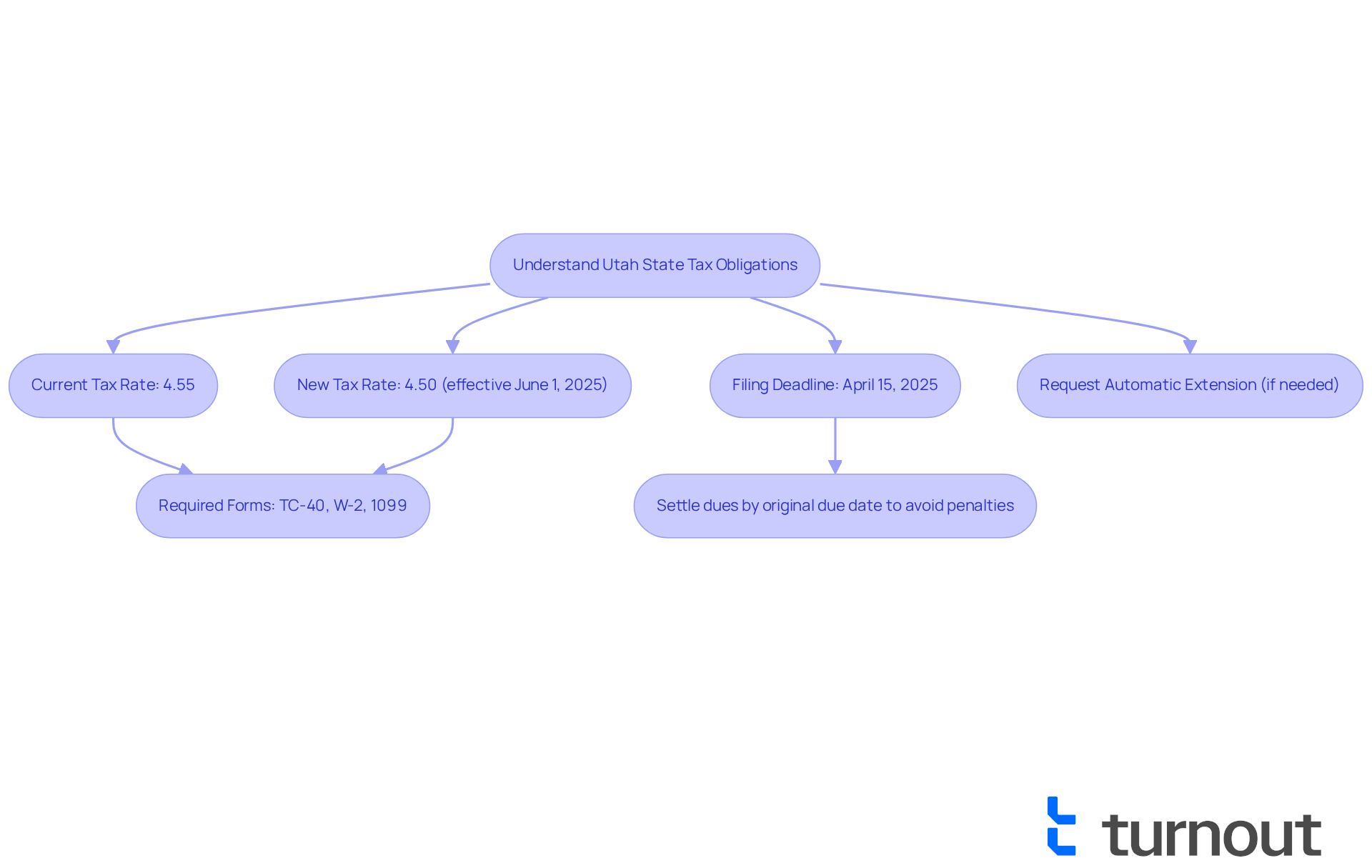

Understand Utah State Tax Obligations

Before submitting your forms in the Beehive State, we understand that navigating your responsibilities to pay Utah state taxes can feel overwhelming. It's important to know that the state has a flat income tax rate of 4.55% for the 2024 tax year, applicable to all income levels. Starting June 1, 2025, this rate will be reduced to 4.50%. We want to remind you that if you are on a calendar year basis, you must file your returns by April 15, 2025. Missing this deadline can be stressful, but you can request an automatic six-month extension. Just remember, any dues, including those to pay Utah state taxes, must still be settled by the original due date to avoid penalties.

To make this process easier, familiarize yourself with the required forms, such as the TC-40 for individual income tax returns. Ensure you have all necessary documentation ready, including your W-2s and 1099s. We’re here to help you through this journey, so take a deep breath—you are not alone in this.

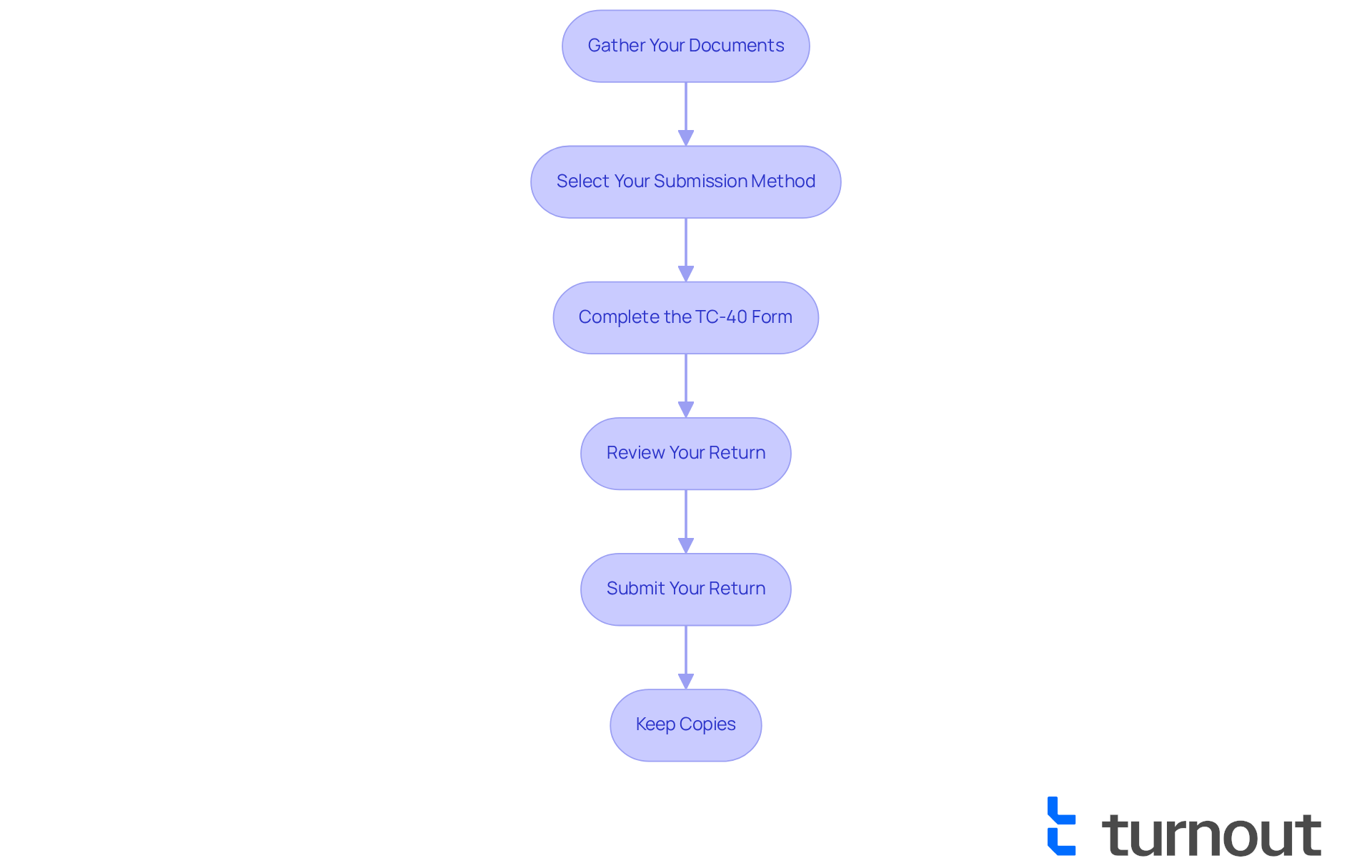

File Your Utah State Taxes: Step-by-Step Process

Filing your pay Utah state taxes can feel overwhelming, but we're here to help you through it. By following these steps, you can make the process smoother and less stressful.

-

Gather Your Documents: Start by collecting all necessary documents, including your W-2 forms, 1099s, and any other income statements. Don’t forget to have your Social Security number handy, along with any relevant deductions or credits that could benefit you.

-

Select Your Submission Method: You have options! You can file your returns online through the State Tax Commission's Taxpayer Access Point (TAP) or choose to mail a paper return. Online filing is often faster and more efficient, which can save you time and worry.

-

Complete the TC-40 Form: If you opt for online filing, simply follow the prompts on TAP to fill out the TC-40 form. If you prefer to send it by mail, download and print the form from the State Tax Commission website. Take your time filling it out carefully to ensure all your information is accurate.

-

Review Your Return: It’s common to feel anxious about mistakes, so double-check all entries for accuracy, including your income, deductions, and credits. Remember, this step is crucial—mistakes can delay your refund or even lead to penalties.

-

Submit Your Return: If you’re filing online, submit your return through TAP. For those mailing it, ensure your completed TC-40 form is sent to the address specified in the instructions and is postmarked by April 15, 2025. This deadline to pay Utah state taxes is important, so mark it on your calendar!

-

Keep Copies: Finally, retain copies of your filed return and all supporting documents for your records. This is vital for future reference and can be incredibly helpful in case of audits.

Remember, you are not alone in this journey. If you have any questions or need assistance, don’t hesitate to reach out for help. We’re here to support you every step of the way.

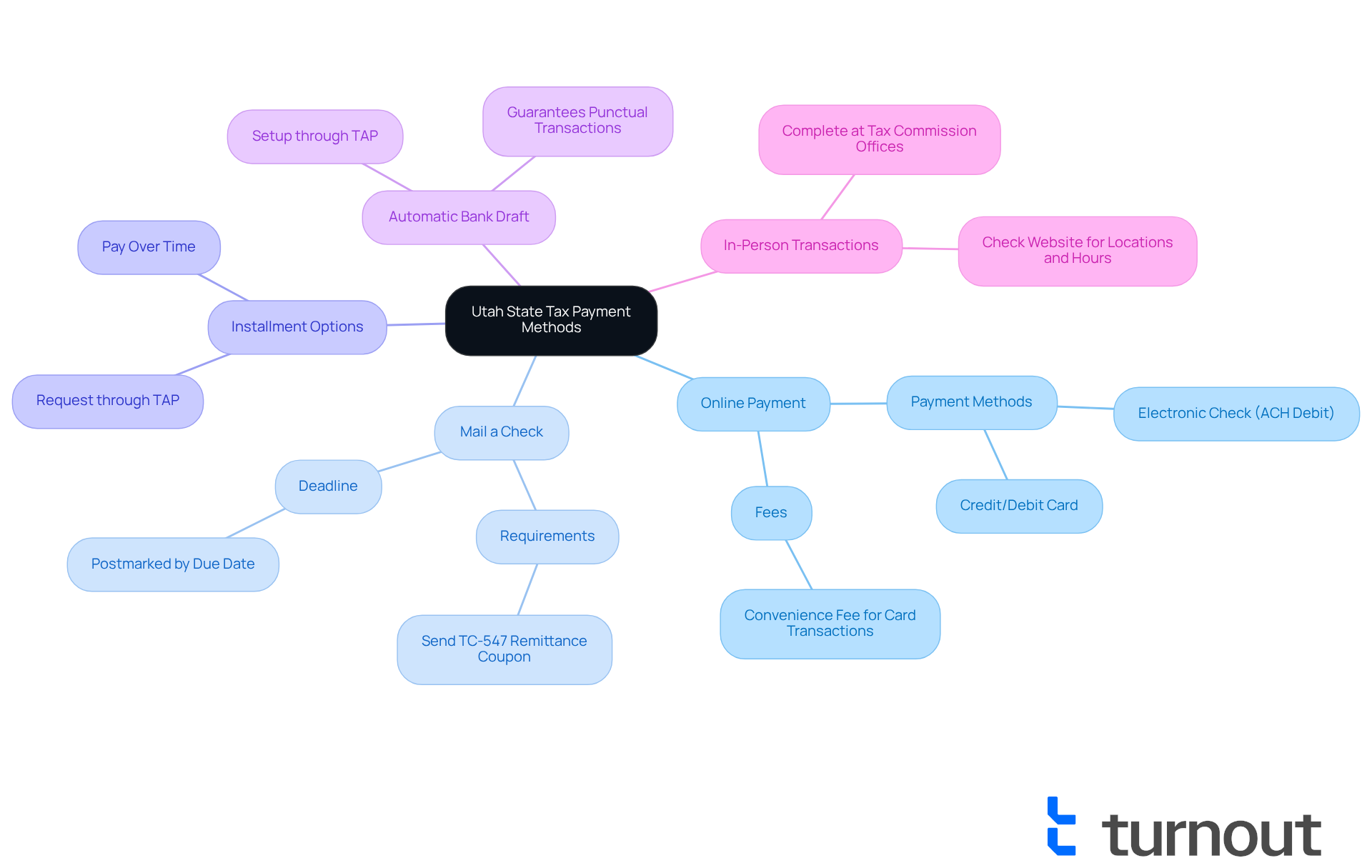

Choose Your Payment Method for Utah State Taxes

After submitting your state revenue documents, we understand that choosing a method for remittance can feel overwhelming. Here are some caring options to consider:

-

Online Payment: The easiest way to pay Utah State taxes is by using the Utah State Tax Commission's Taxpayer Access Point (TAP). You can pay using an electronic check (ACH debit) or a credit/debit card. Please note that a convenience fee may apply for card transactions.

-

Mail a Check: If you prefer to pay by mail, you can send a check or money order along with your TC-547 remittance coupon. Just ensure your remittance is postmarked by the due date to prevent any penalties.

-

Installment Options: If settling your taxes in total feels daunting, you may request an installment arrangement through TAP. This allows you to pay your tax liability over time, making it more manageable.

-

Automatic Bank Draft: For those who wish to guarantee punctual transactions, establishing an automatic bank draft can be a practical choice. This can also be arranged through TAP.

-

In-Person Transactions: You can complete transactions in person at designated Utah State Tax Commission offices. Please check their website for locations and hours.

Choose the method that best suits your financial situation to pay Utah state taxes. Remember, we're here to help, and completing your payment by the deadline can help you avoid any penalties.

Conclusion

Navigating the intricacies of paying Utah state taxes can feel overwhelming, and we understand that. However, grasping the process is essential for ensuring compliance and achieving peace of mind. With a flat income tax rate and clear filing deadlines, you can approach your obligations with confidence, knowing that resources and support are readily available to guide you through each step.

This guide has highlighted essential steps for filing your taxes, from gathering necessary documents to selecting the right payment method. Remember, accuracy in completing the TC-40 form is crucial, and there are various options for remitting payment, whether online, by mail, or through installment plans. Each of these aspects plays a vital role in successfully managing your tax responsibilities in Utah.

Ultimately, taking the time to familiarize yourself with Utah state tax obligations not only helps you avoid penalties but also empowers you to make informed decisions. As the 2025 tax year approaches, it’s important to stay organized and proactive. Embrace the resources available, and know that it’s perfectly okay to reach out for assistance if you need it. By doing so, you can ensure a smoother experience and contribute positively to your financial well-being.

Frequently Asked Questions

What is the income tax rate for Utah for the 2024 tax year?

The income tax rate for Utah for the 2024 tax year is a flat 4.55% applicable to all income levels.

When will the Utah income tax rate change?

Starting June 1, 2025, the Utah income tax rate will be reduced to 4.50%.

What is the deadline for filing Utah state tax returns for the calendar year?

If you are on a calendar year basis, you must file your Utah state tax returns by April 15, 2025.

What happens if I miss the tax filing deadline?

If you miss the tax filing deadline, you can request an automatic six-month extension; however, any taxes owed must still be paid by the original due date to avoid penalties.

What forms do I need to file my Utah state taxes?

You need to use form TC-40 for individual income tax returns.

What documentation should I have ready for filing my taxes?

You should have all necessary documentation ready, including your W-2s and 1099s.