Overview

Navigating Illinois taxes can feel overwhelming, but you’re not alone in this journey. Understanding your tax obligations is the first step, and we’re here to help you through it. By utilizing various payment methods, such as the MyTax portal, you can simplify the process and ease your concerns.

We understand that issues may arise, and that’s completely normal. This article outlines essential steps to determine your tax responsibilities and highlights convenient payment options available to you. Additionally, we provide solutions for potential problems you might encounter, ensuring you can navigate your tax obligations effectively.

Remember, you are not alone in this. We encourage you to explore these resources and take action. Together, we can make this process smoother and less stressful.

Introduction

Navigating the complexities of tax obligations can feel overwhelming for Illinois residents. We understand that the ever-evolving landscape of state tax laws adds to this stress. It's crucial to grasp the flat income tax rate and the various other taxes that may apply. This knowledge is essential for compliance and effective financial planning.

In this guide, we’ll outline the necessary steps to fulfill your tax responsibilities. We’ll also explore convenient payment methods and provide troubleshooting tips for common issues that may arise. Remember, you are not alone in this journey. How can you ensure compliance while effectively managing your tax payments amidst these challenges? Let's find the answers together.

Understand Your Illinois Tax Obligations

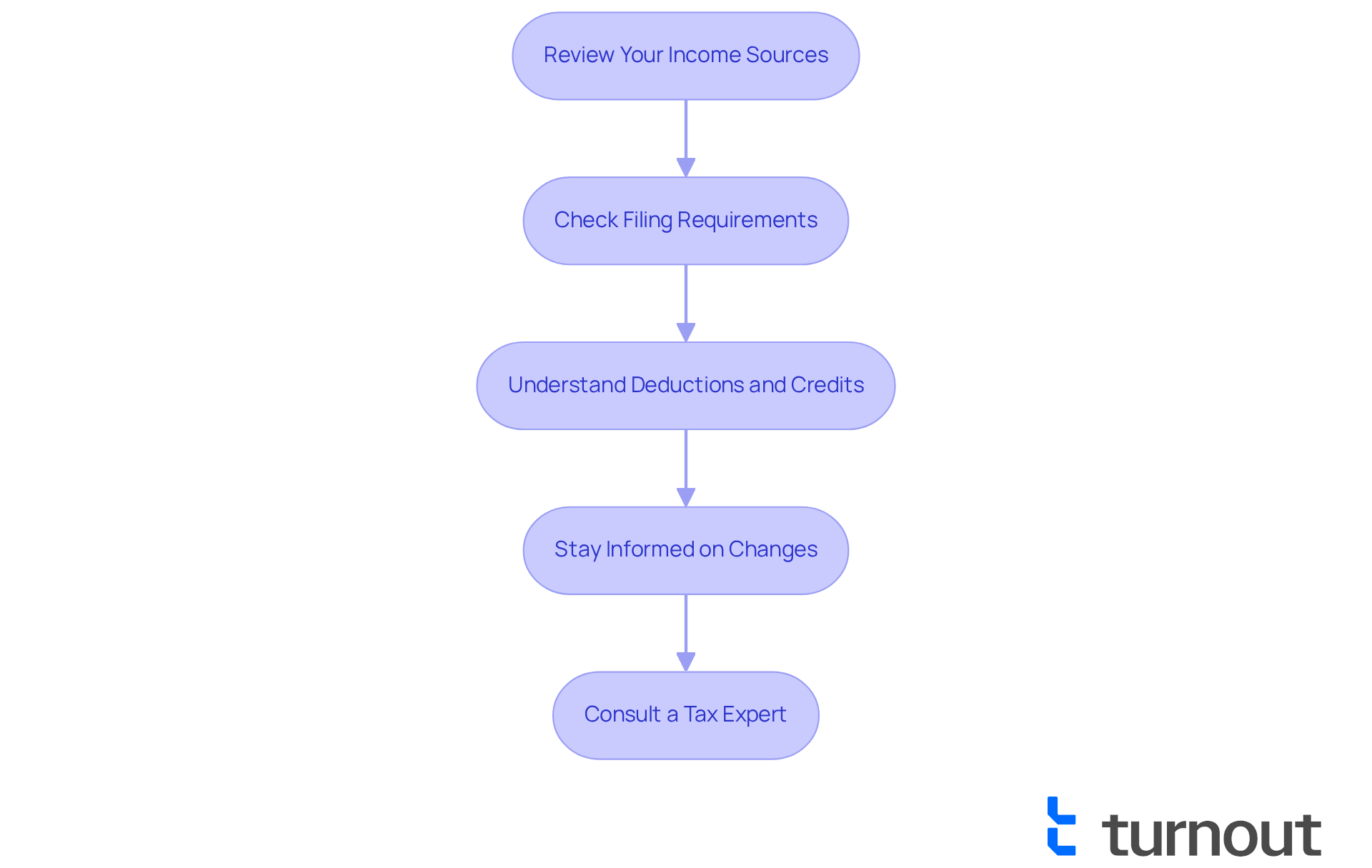

Before processing any payments, we understand that it’s crucial to comprehend your responsibilities to pay Illinois taxes as a resident of this state. The state has a flat income tax rate of 4.95%, which means all residents pay Illinois taxes at the same percentage regardless of income level. Additionally, you may be responsible for other taxes, such as property taxes or sales taxes, and you may also need to pay Illinois taxes depending on your circumstances. To help you determine your specific obligations, here are some steps to consider:

- Review Your Income Sources: Take a moment to identify all sources of income, including wages, self-employment income, and any other earnings.

- Check Filing Requirements: If you were required to submit a federal income tax return, you must also pay Illinois taxes by filing a state tax return using Form IL-1040.

- Understand Deductions and Credits: Familiarize yourself with available deductions and credits that may reduce your taxable income.

- Stay Informed on Changes: Tax laws can change, so it’s common to feel overwhelmed. Keep an eye on updates from the state Department of Revenue regarding any new regulations or tax amnesty programs that may apply to you. Notably, starting in 2025, the state will adopt the Finnigan method of apportionment, which may affect tax liabilities for businesses, and the SALT deduction cap will temporarily increase to $40,000, presenting new planning opportunities.

As tax obligations can vary based on individual circumstances, consulting with a tax liability expert can provide tailored advice to help you navigate these complexities effectively. Remember, you are not alone in this journey. As one specialist remarked, "A tax liability expert with years of experience in the state can explain methods of decreasing your exposure and optimizing your deductions." We’re here to help you through this process.

Explore Payment Methods for Illinois Taxes

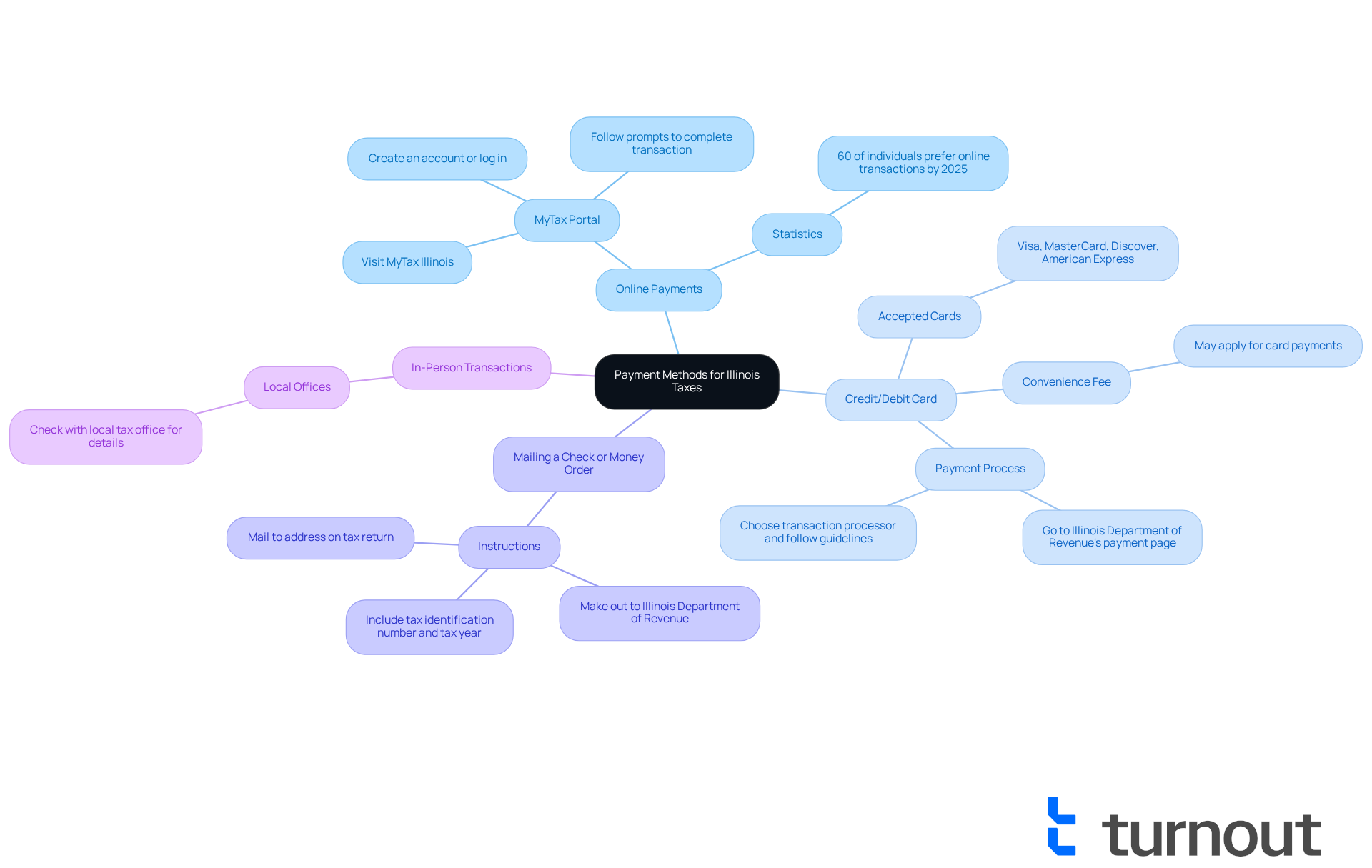

We understand that managing tax payments can feel overwhelming. Fortunately, the state offers several convenient methods for residents to pay Illinois taxes. Here are the primary options that can help ease this process:

-

Online Payments: The simplest method is through the MyTax portal. You can pay directly from your checking or savings account without incurring additional fees. To use this method:

- Visit MyTax Illinois.

- Create an account or log in.

- Follow the prompts to complete your transaction.

-

Credit or Debit Card: If you prefer, you can also pay your taxes using a credit or debit card. Acceptable cards include Visa, MasterCard, Discover, and American Express. Please note that a convenience fee may apply. To pay by card:

- Go to the Illinois Department of Revenue's payment page.

- Choose your transaction processor and adhere to the guidelines.

-

Mailing a Check or Money Order: If mailing is more your style, you can send a check or money order made out to the Illinois Department of Revenue. Just include your tax identification number and the tax year on the transaction. Mail it to the address specified on your tax return.

-

In-Person Transactions: Some local offices may accept payments in person. We encourage you to check with your local tax office for details on this option.

By 2025, roughly 60% of individuals in the state are choosing online tax transactions, indicating a growing trend towards digital solutions. Financial advisors often suggest utilizing the MyTax Illinois portal to pay Illinois taxes because of its easy-to-navigate interface and effectiveness. They state, "The MyTax Illinois portal streamlines the transaction process and assists in preventing possible penalties for delays in submissions." Many residents have successfully navigated their tax obligations through this platform. For instance, one resident was able to resolve their tax debt efficiently using the online system.

Remember, if you find a mistake on your return and owe extra fees, you can submit a revised return (IL-1040-X) and contribute any amount you can manage. Further contributions can be made at any time. However, please keep in mind that contributions made after the April 15 deadline may incur late fees and interest. You're not alone in this journey, and we're here to help you every step of the way.

Troubleshoot Common Tax Payment Issues

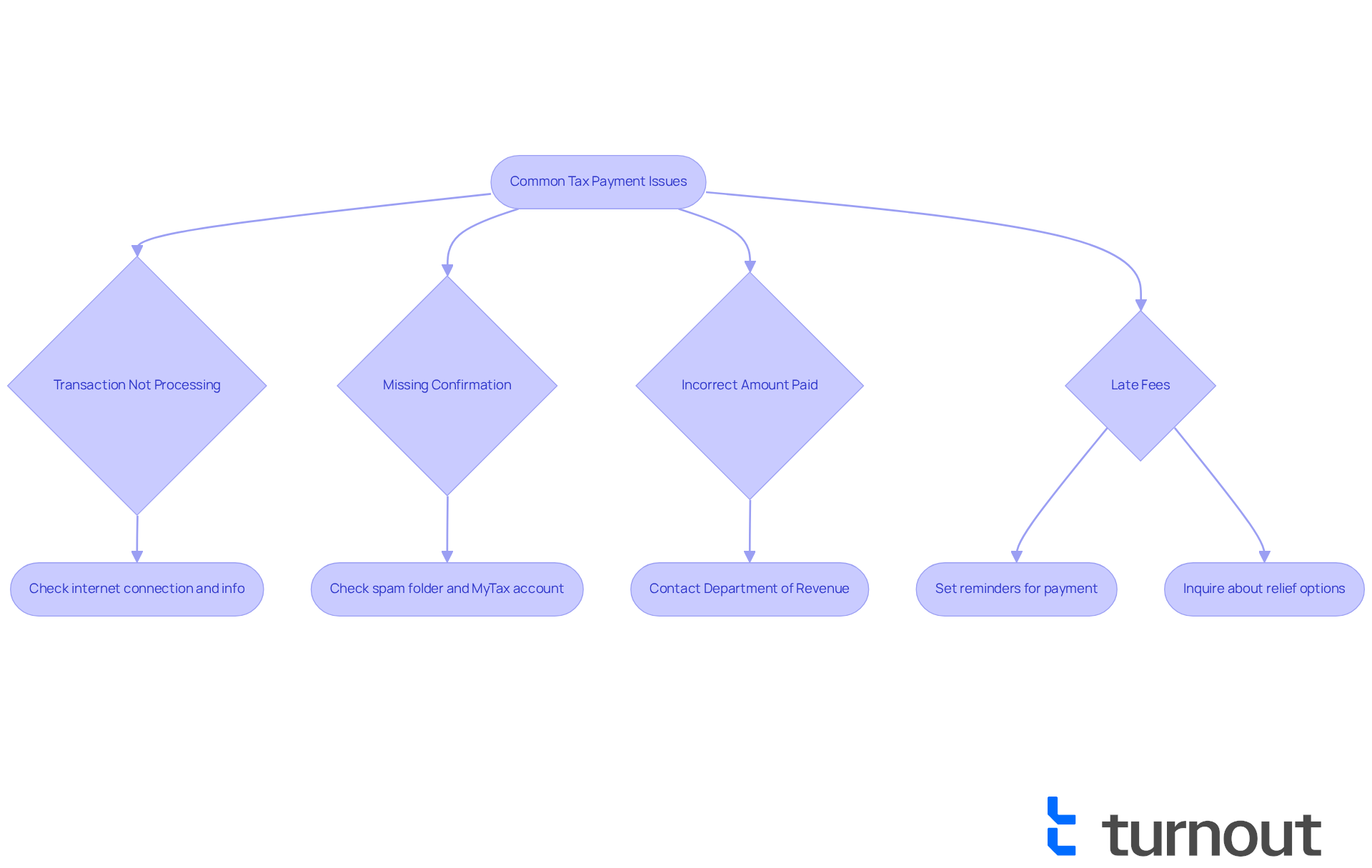

Even with a clear understanding of tax responsibilities and methods of remittance, we understand that residents may face challenges when they pay Illinois taxes. Here are some common problems and how to resolve them:

-

Transaction Not Processing: It's common to feel frustrated if your online transaction fails. Please check your internet connection and ensure that all entered information is correct. If the issue continues, consider using an alternative method for transactions or reach out to the Department of Revenue for support.

-

Missing Confirmation: After completing a transaction, you should receive a confirmation email. If you do not receive this, check your spam folder. If it’s still absent, log into your MyTax account to check your status regarding the fee. Remember, you are not alone in this; many experience similar situations.

-

Incorrect Amount Paid: If you realize you paid the wrong amount, don’t hesitate to contact the Illinois Department of Revenue immediately to rectify the situation. They are there to assist you in understanding how to modify your financial transaction.

-

Late Fees: If you miss the due date, you may incur penalties. To avoid this, consider setting reminders for when to pay Illinois taxes. If you believe you have a valid reason for the delay, you can inquire about possible relief options through the Department of Revenue. We’re here to help you navigate these complexities.

In 2025, Illinois has experienced a significant rise in transaction processing failures, urging specialists to recommend that individuals remain alert. For example, one individual shared their experience resolving a billing issue, emphasizing the significance of verifying all information prior to submission. As Austin Berg, executive director of the Chicago Policy Center, noted, "If this keeps dragging for months and months, we're in uncharted territory really for the city and the county," emphasizing the need for timely resolutions in the face of ongoing challenges. Additionally, property owners are advised to save money in anticipation of potential changes in their tax bills, as this can help mitigate financial strain. By following these steps and staying informed, you can navigate the complexities of tax payments more effectively.

Conclusion

Understanding how to pay Illinois taxes effectively is essential for residents to fulfill their obligations and avoid unnecessary penalties. We understand that navigating the complexities of tax responsibilities can be overwhelming. This guide outlines the necessary steps to ensure a smoother experience for taxpayers in the state.

Recognizing your individual tax obligations is crucial. Illinois has a flat income tax rate, but there may also be additional taxes like property or sales taxes to consider. It's common to feel unsure about these responsibilities. Fortunately, the MyTax Illinois portal offers convenient payment options that many residents have found helpful.

By addressing common challenges and providing practical solutions, you can feel more confident in managing your tax payments. Staying informed about Illinois tax laws and utilizing available resources can significantly ease the tax payment process. Remember, you are not alone in this journey; residents are encouraged to take proactive steps, such as consulting with tax experts and utilizing online platforms.

By being diligent and informed, you can navigate your obligations with confidence and ensure compliance with state regulations. We’re here to help you optimize your tax experience and make this process as smooth as possible.

Frequently Asked Questions

What is the income tax rate for residents of Illinois?

Illinois has a flat income tax rate of 4.95%, meaning all residents pay the same percentage regardless of their income level.

What additional taxes might I be responsible for as an Illinois resident?

In addition to income tax, residents may also be responsible for property taxes and sales taxes, depending on their specific circumstances.

What steps should I take to understand my Illinois tax obligations?

To understand your tax obligations, you should review your income sources, check your filing requirements, understand available deductions and credits, and stay informed about any changes in tax laws.

What should I do if I was required to submit a federal income tax return?

If you were required to submit a federal income tax return, you must also file a state tax return using Form IL-1040 to pay your Illinois taxes.

How can I reduce my taxable income in Illinois?

You can reduce your taxable income by familiarizing yourself with available deductions and credits that apply to your situation.

Why is it important to stay informed about tax law changes in Illinois?

Tax laws can change, and staying informed helps you understand new regulations or tax amnesty programs that may affect your tax obligations. For example, starting in 2025, the state will adopt the Finnigan method of apportionment, which could impact business tax liabilities.

What is the SALT deduction cap, and how will it change in the future?

The SALT (State and Local Tax) deduction cap will temporarily increase to $40,000 starting in 2025, which may present new planning opportunities for taxpayers.

Should I consult a tax liability expert for my Illinois taxes?

Yes, consulting with a tax liability expert can provide tailored advice to help you navigate the complexities of your tax obligations and optimize your deductions.