Overview

Determining if you owe taxes can feel overwhelming, and it's important to consider various factors. These include:

- The types of income you receive

- Your filing status

- Any applicable deductions or credits that might influence your tax liability

We understand that navigating this process can be daunting, but we're here to help.

This article outlines a step-by-step process for assessing your tax situation. It emphasizes the importance of:

- Gathering your documentation

- Reviewing past tax returns

- Consulting with a tax professional

By taking these steps, you can avoid unexpected liabilities and gain peace of mind.

Remember, you are not alone in this journey. Many people face similar challenges, and seeking assistance can make a significant difference. Take a moment to reflect on your situation, and consider reaching out for support. Your financial well-being is worth it.

Introduction

Tax obligations can often feel like a labyrinth, leaving many individuals puzzled about whether they owe money to the IRS. We understand that navigating the nuances of income types, deductions, and life changes can be overwhelming, especially as tax season approaches. What if there was a clear roadmap to help you confidently assess your tax situation?

This guide offers essential steps and insights designed to support you in determining your tax liabilities. By exploring available resources, you can prepare yourself for the financial responsibilities ahead. Remember, you are not alone in this journey; we’re here to help you every step of the way.

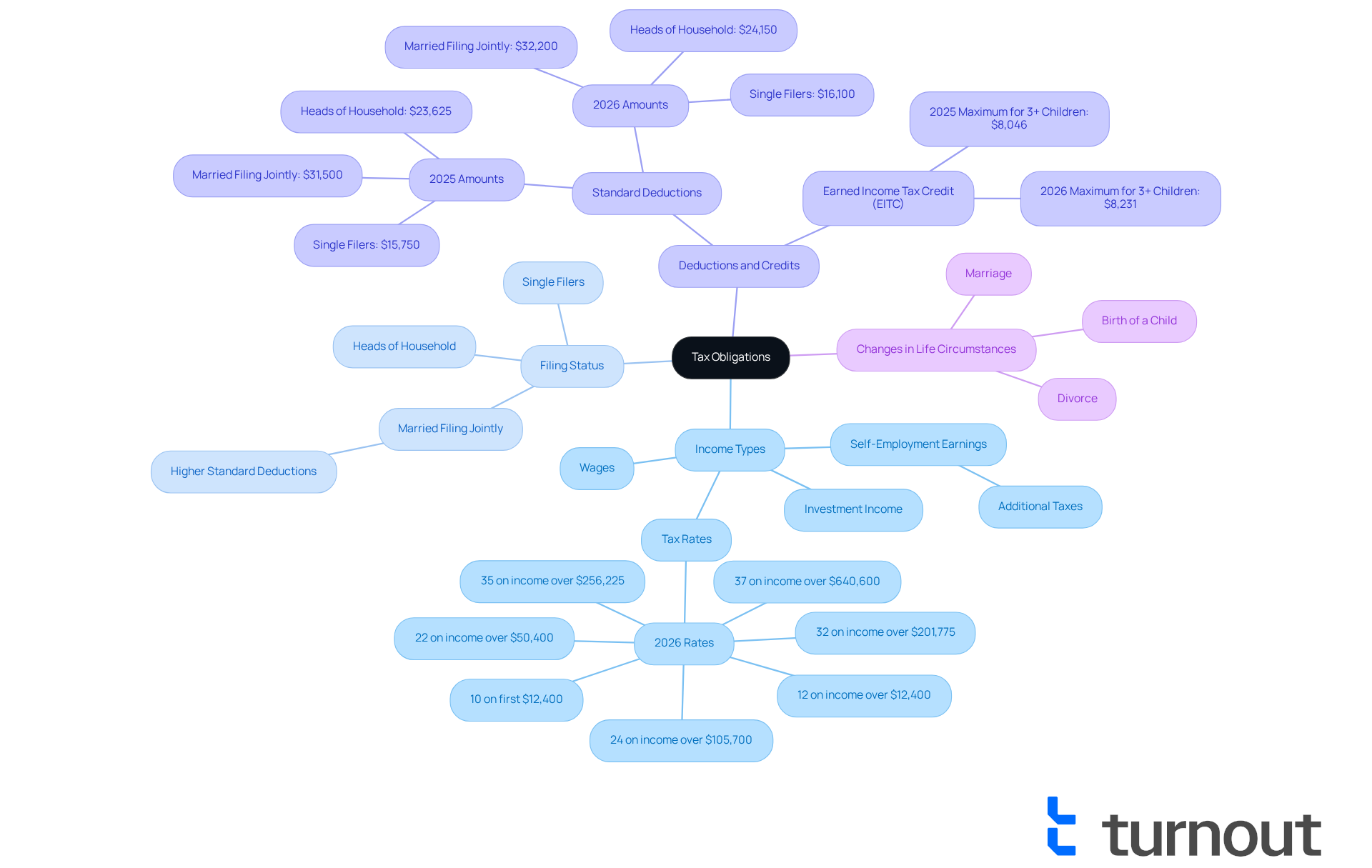

Clarify Tax Obligations: Understanding Why You Might Owe Taxes

can feel overwhelming, and many people ask how do you know if you owe taxes from various sources like earnings, investments, and other financial activities. We understand that knowing how do you know if you owe taxes is crucial to avoiding . Here are some key factors to consider:

- Income Types: —such as wages, self-employment earnings, and investment income—are taxed at varying rates. For instance, self-employment earnings may incur additional taxes compared to regular wages. In 2026, the tax rates will be structured as follows: 10% on the first $12,400 of taxable income, 12% on income over $12,400, and so on, up to 37% for income greater than $640,600 for joint filers.

- Filing Status: Your marital status and family situation can significantly influence your tax rate and available deductions. often benefit from higher standard deductions, which can ease some financial burdens.

- Deductions and Credits: Understanding the deductions and credits for which you qualify can greatly affect your . The standard deduction for single filers in 2025 is set at $15,750, while married couples filing jointly can claim $31,500. Additionally, eligible tax filers with three or more children may claim a maximum Earned Income Tax Credit (EITC) of $8,231 in 2026, up from $8,046, providing crucial support for families.

- Changes in Life Circumstances: can alter your tax situation, potentially affecting your filing status and eligibility for certain credits. It's common to feel uncertain about how do you know if you owe taxes during these transitions.

Statistics show that a significant percentage of Americans struggle with , which can lead to unintentional errors or missed opportunities for savings. As noted by tax professionals, "many taxpayers will see modest relief simply because the deductions and thresholds move upward, allowing for a more favorable tax situation." By clarifying these obligations, you can better prepare for your tax duties and reduce the risk of accumulating liabilities, helping you understand how do you know if you owe taxes. Remember, the final day to file your or request an extension for 2025 is April 15, 2025. We're here to help you navigate this journey.

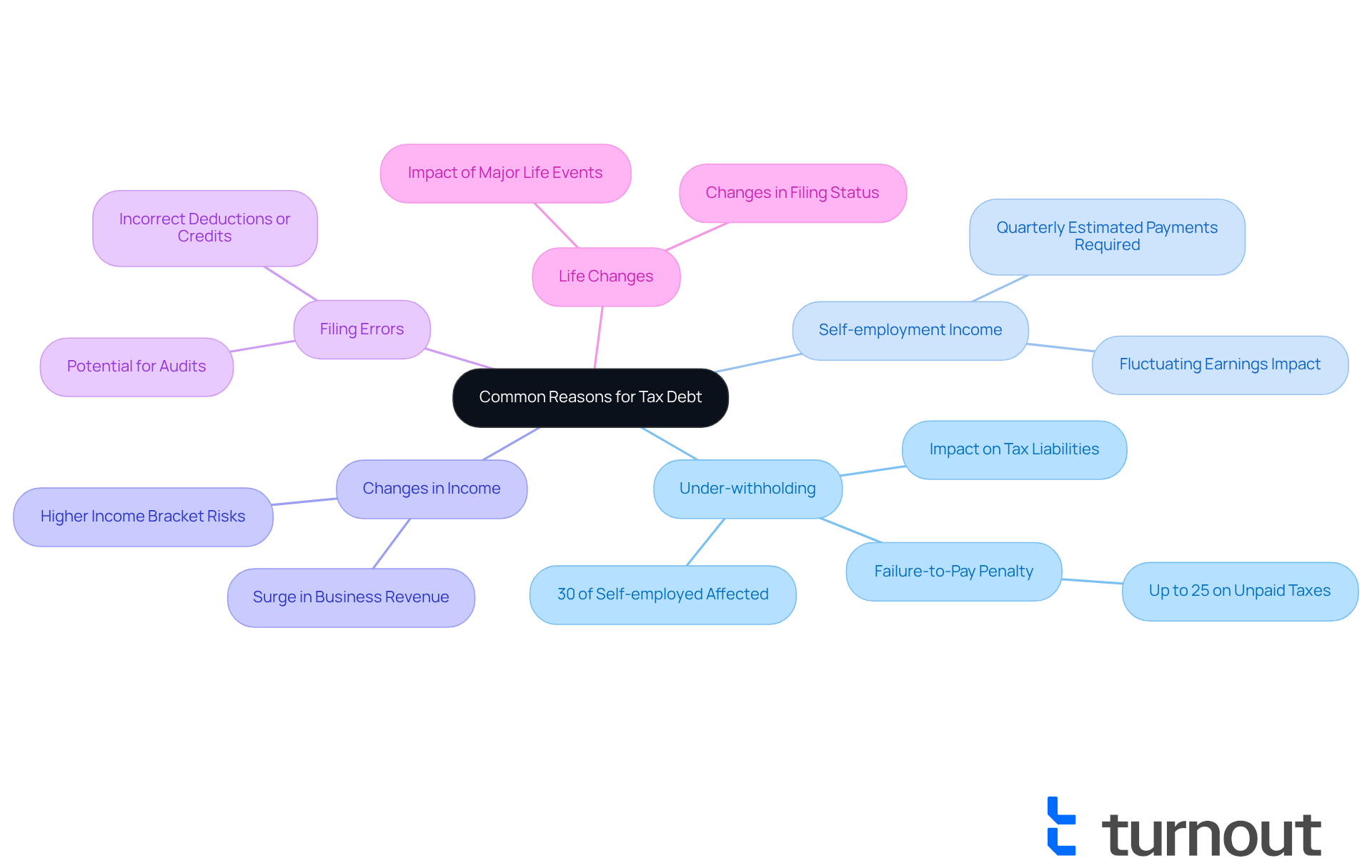

Identify Common Reasons for Tax Debt: Factors Leading to Owed Taxes

Several factors can lead to , and it's important to recognize them so you can more effectively:

- Under-withholding: If not enough tax is withheld from your paycheck, you may find yourself owing money at tax time. Many tax advisors emphasize the importance of proper withholding, as it can prevent unexpected . It's common for self-employed individuals to face this issue, with approximately 30% encountering tax liabilities due to insufficient estimated tax payments. Remember, the IRS can impose a failure-to-pay fee of up to 25% on outstanding dues, which can accumulate quickly.

- Self-employment Income: If you are self-employed, it's crucial to pay . Neglecting this responsibility can lead to significant , especially if your earnings fluctuate or rise unexpectedly.

- Changes in Income: A sudden increase in earnings may elevate you into a higher income bracket, resulting in greater amounts owed. For example, if a self-employed individual experiences a surge in business revenue, they might feel unprepared for the increased tax burden.

- Filing Errors: Mistakes on tax returns, such as incorrect deductions or credits, can lead to owing additional taxes. Even minor errors can trigger audits or adjustments that result in unexpected liabilities.

- Life Changes: Major life events—like marriage, divorce, or the birth of a child—can significantly impact your and obligations. These changes may affect your filing status or eligibility for specific credits, potentially leading to [tax obligations](https://blog.turnout.co/10-essential-tips-to-maximize-your-group-tax-benefits) if not properly accounted for.

By understanding these factors, you can better manage your tax liabilities and avoid accumulating debt. It's also essential to stay informed about potential changes in tax law. With the expiration of the Tax Cuts and Jobs Act on the horizon, more than 62% of tax filers could face tax increases in 2026. Remember, you are not alone in this journey; we're here to help you navigate your tax obligations.

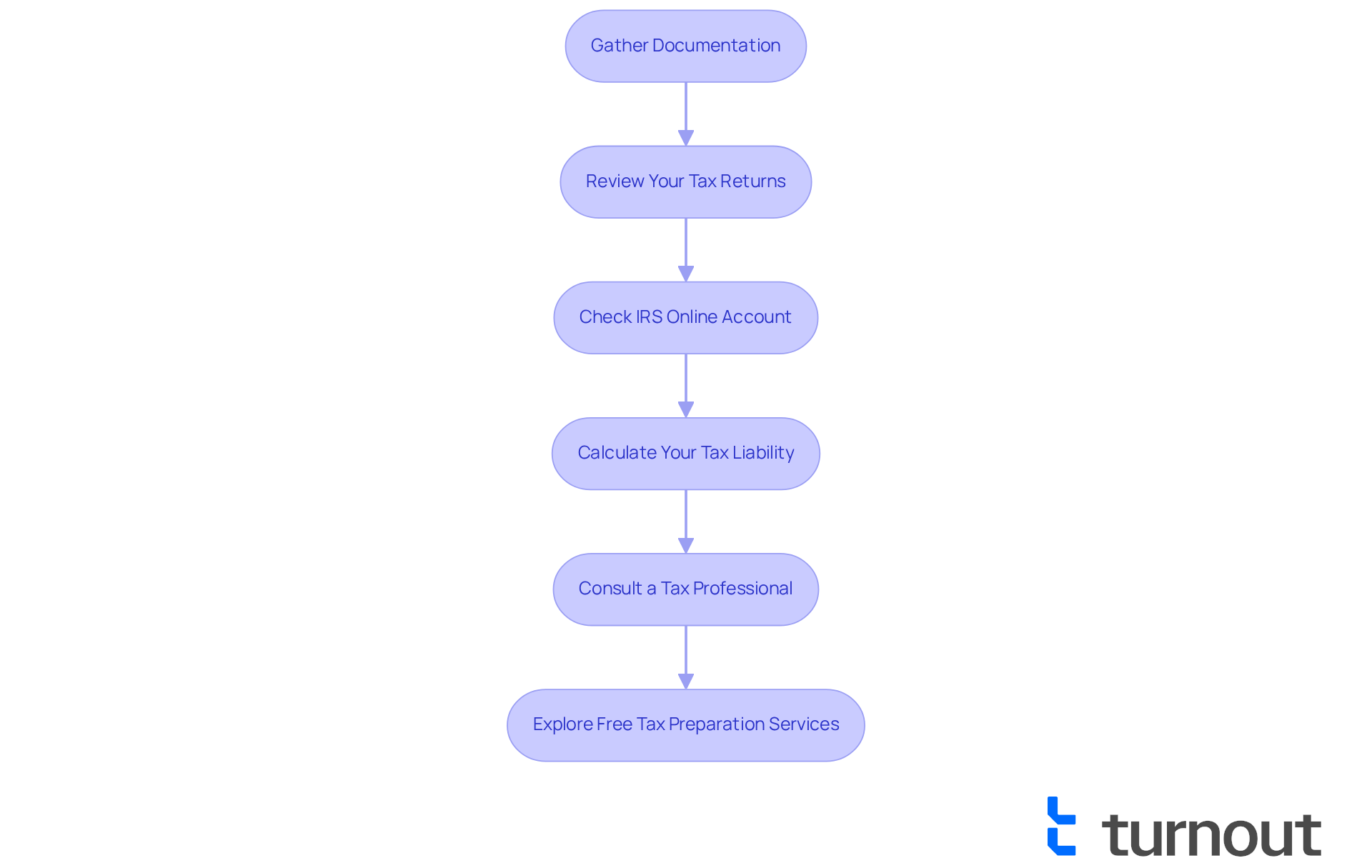

Assess Your Tax Situation: Steps to Determine If You Owe Taxes

To determine if you owe taxes, follow these essential steps:

- Gather Documentation: Start by collecting all relevant documents, including W-2s, 1099s, and any other earnings statements. Keeping these organized will streamline your tax preparation process.

- : We understand that reviewing previous tax returns can feel daunting. However, examining them can help you identify any discrepancies or unreported earnings. This practice can help you avoid potential issues with the IRS. In fact, about 5 million taxpayers eligible for the Earned Income Tax Credit (EITC) do not claim the credit each year, highlighting the importance of reviewing past returns to avoid missing out on benefits.

- : It's common to feel uncertain about your tax situation. Logging into your IRS online account allows you to view your tax balance, payment history, and any notices from the IRS. This resource provides immediate insight into your tax situation and can help you stay informed.

- : Utilize tax calculators or consult tax tables to estimate your tax liability based on your income and deductions. This step is crucial for understanding your financial obligations and can alleviate some stress.

- : If you have uncertainties about your findings, consider seeking assistance from a tax professional who can offer personalized guidance tailored to your situation. As one tax expert notes, " is essential for a smooth tax filing process and can prevent costly mistakes."

- Explore : If you need assistance, consider utilizing free tax preparation services available through programs like VITA or AARP Foundation Tax-Aide. These services can help you navigate the tax filing process without incurring costs.

By following these steps, you can effectively assess your tax situation and learn how do you know if you owe taxes. Remember, you're not alone in this journey. A significant percentage of taxpayers review their previous tax returns to ensure accuracy and compliance, underscoring the importance of thorough documentation and assessment.

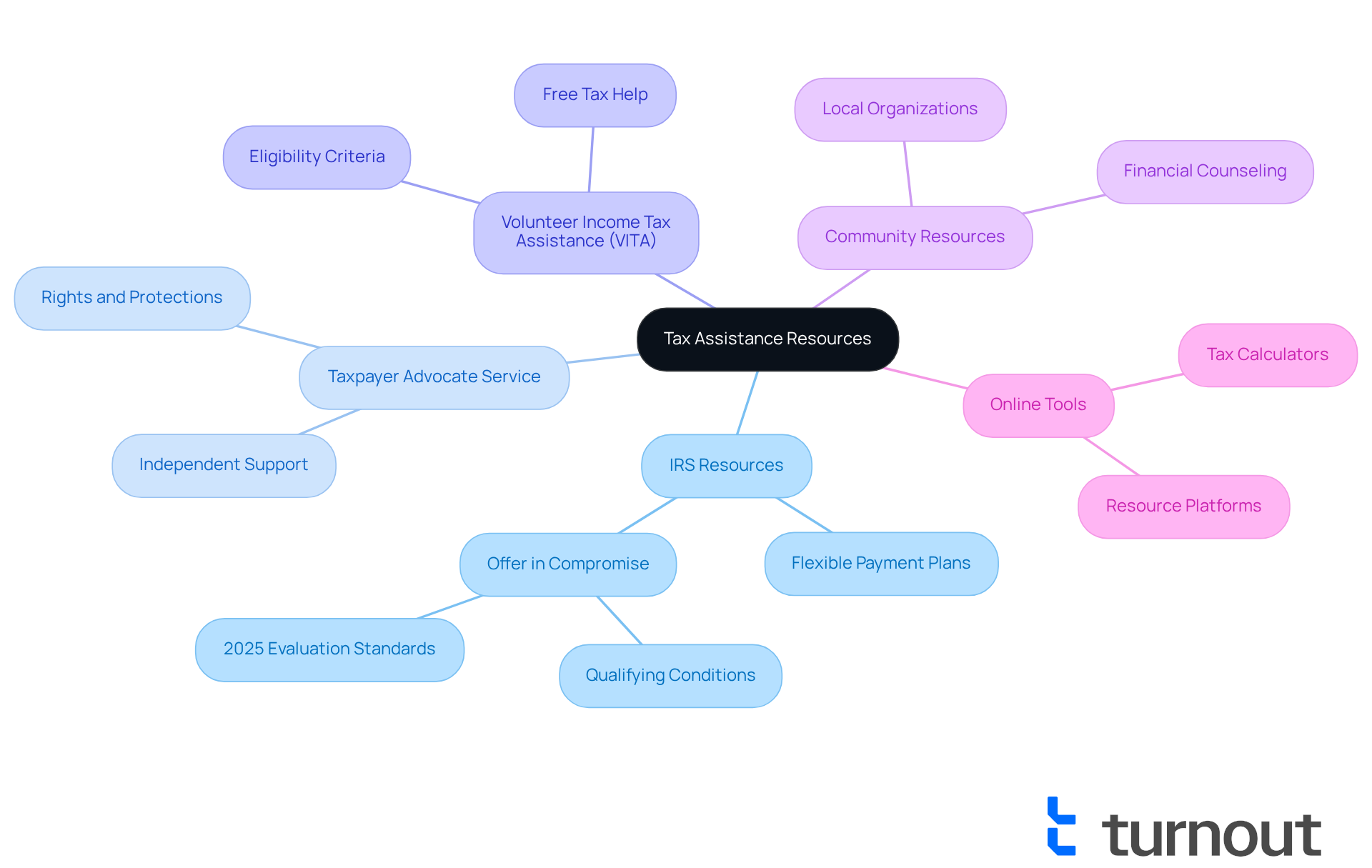

Explore Resources for Tax Assistance: Finding Help with Tax Debt

If you find yourself in , know that you're not alone, and several resources are available to help you navigate your situation:

- : The IRS offers various programs for taxpayers struggling with debt. These include flexible payment plans and the Offer in Compromise program, which allows qualifying individuals to settle their tax debt for less than the full amount owed. For further details, we encourage you to check the IRS's dedicated page on tax assistance.

- : This independent organization within the IRS is here to help you resolve issues and navigate the complexities of the tax system. They provide support for those facing , ensuring that you are treated fairly and understand your rights.

- (VITA): VITA offers free tax help to individuals who qualify, particularly those with low to moderate income. Local VITA sites can provide valuable assistance in preparing your tax returns, making this a great option for many.

- Community Resources: Numerous local organizations and nonprofits offer free and financial counseling. Exploring resources in your area can connect you with additional support tailored to your needs.

- Online Tools: Utilize online platforms that provide tax calculators and resources to help you better understand your tax situation. These tools can assist you in assessing your obligations and exploring your options.

By leveraging these resources, you can find the support you need to manage your tax obligations effectively and understand how do you know if you owe taxes. Remember, reaching out for help is a strong and positive step towards resolving your tax debt.

Conclusion

Understanding whether taxes are owed can feel overwhelming, and we understand that this is a common concern for many. This article serves as a comprehensive guide to help you navigate your tax obligations, highlighting the importance of recognizing the various factors that contribute to tax liability. By clarifying income types, filing status, deductions, and life changes, you can better prepare for potential tax dues and avoid unwelcome surprises during tax season.

Key insights include:

- The impact of under-withholding

- Self-employment income

- Filing errors that can lead to tax debt

We outline actionable steps to assess your tax situation, such as:

- Gathering documentation

- Reviewing past returns

- Consulting tax professionals

Additionally, valuable resources like IRS programs and community assistance are highlighted to support you in facing tax challenges.

Ultimately, staying informed and proactive about your tax obligations is essential for your financial well-being. By utilizing the strategies and resources outlined here, you can take control of your tax situation, ensuring you are well-prepared and informed. Embracing this knowledge not only alleviates the stress associated with tax season but also empowers you to make sound financial decisions moving forward. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Frequently Asked Questions

What factors determine if I owe taxes?

Several factors can determine if you owe taxes, including the types of income you earn (such as wages, self-employment earnings, and investment income), your filing status (which can be influenced by marital status), and the deductions and credits for which you qualify.

How do different income types affect tax obligations?

Different types of income are taxed at varying rates. For instance, self-employment earnings may incur additional taxes compared to regular wages. In 2026, tax rates will range from 10% on the first $12,400 of taxable income to 37% for income over $640,600 for joint filers.

How does my filing status influence my taxes?

Your marital status and family situation can significantly impact your tax rate and available deductions. For example, married couples filing jointly often benefit from higher standard deductions, which can reduce their overall tax burden.

What are the standard deductions for 2025?

For single filers in 2025, the standard deduction is set at $15,750, while married couples filing jointly can claim a standard deduction of $31,500.

What is the Earned Income Tax Credit (EITC) for 2026?

Eligible tax filers with three or more children may claim a maximum Earned Income Tax Credit (EITC) of $8,231 in 2026, which is an increase from $8,046.

How can life changes affect my tax situation?

Life events such as marriage, divorce, or the birth of a child can alter your tax situation, potentially affecting your filing status and eligibility for certain credits, which may lead to uncertainty about whether you owe taxes.

What should I do if I'm unsure about my tax obligations?

If you're uncertain about your tax obligations, it's advisable to seek guidance from tax professionals who can help clarify your responsibilities and ensure you take advantage of available deductions and credits.

When is the deadline to file my tax return for 2025?

The final day to file your tax return or request an extension for 2025 is April 15, 2025.