Introduction

Navigating the complexities of IRS debt can feel overwhelming, and we understand that. As tax obligations grow more stringent, the implications of unpaid taxes can weigh heavily on your mind. It’s crucial to recognize that these challenges can lead to serious consequences, like tax liens that threaten your credit score and financial stability.

This guide is here to offer you a comprehensive roadmap for relief. We’ll detail essential strategies for assessing your tax situation, exploring available resolution options, and communicating effectively with the IRS. But what happens when the burden of these obligations feels too heavy to bear alone?

You’re not alone in this journey. Discover how to take control of your financial future and find the support you need to tackle IRS debt head-on. Together, we can navigate these challenges and work towards a brighter financial outlook.

Understand IRS Debt: Key Concepts and Implications

Dealing with IRS obligations can feel overwhelming, especially when seeking help with IRS debt related to unpaid taxes. These obligations can stem from various issues, like underreporting income or failing to file tax returns. It’s important to understand the implications of these situations, so let’s break it down together.

-

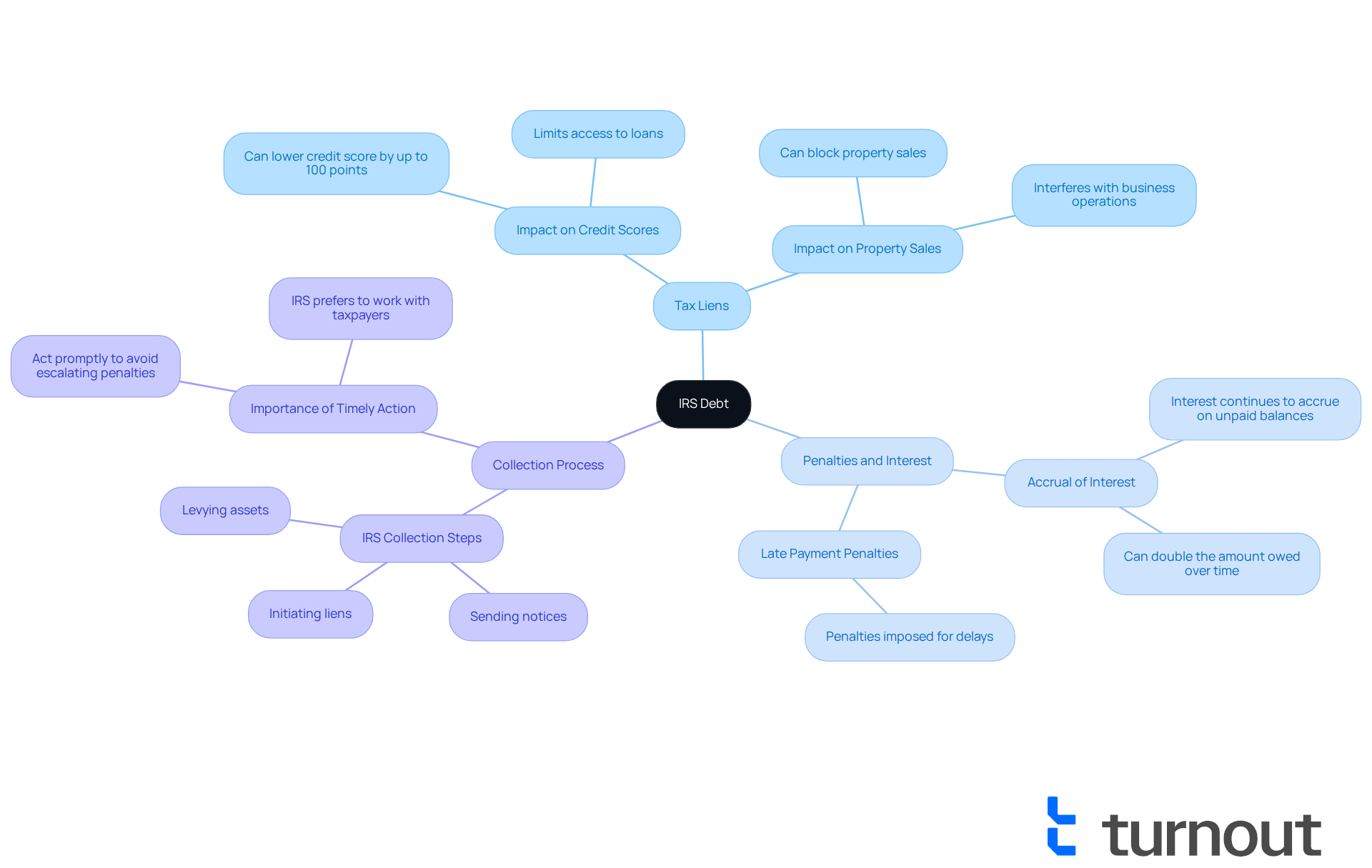

Tax Liens: Imagine receiving a legal claim against your property because of unpaid tax debt. In 2025, the IRS has stepped up its enforcement, leading to a noticeable rise in tax liens. These liens can have a serious impact on your credit score, making it harder to secure loans or refinance existing debts. Did you know that a federal tax lien can lower your credit score by as much as 100 points? This can limit your financial opportunities and even block property sales, which adds to the urgency of addressing any unpaid taxes.

-

Penalties and Interest: It’s common to feel anxious about late payments. The IRS imposes penalties for these delays, and interest continues to accrue on unpaid balances, which can significantly increase the total amount owed over time. For instance, if you owe $10,000 and don’t pay, the penalties and interest could potentially double that amount within just a few years.

-

Collection Process: Understanding the IRS collection process can help ease your worries. The IRS follows a structured procedure that includes sending notices, initiating liens, or levying assets. We understand that discovering you owe money can be stressful, but it’s crucial to act promptly to avoid escalating penalties and interest. The good news is that the IRS typically prefers to help with IRS debt by working with taxpayers to find manageable solutions rather than resorting to forceful collection measures.

Grasping these concepts is essential for recognizing the urgency of addressing IRS obligations. Remember, you are not alone in this journey. If you’re feeling overwhelmed, we’re here to help you navigate these challenges and protect your financial well-being.

Assess Your Tax Situation: Gather Necessary Information

To effectively assess your tax situation, it’s important to gather some key information.

-

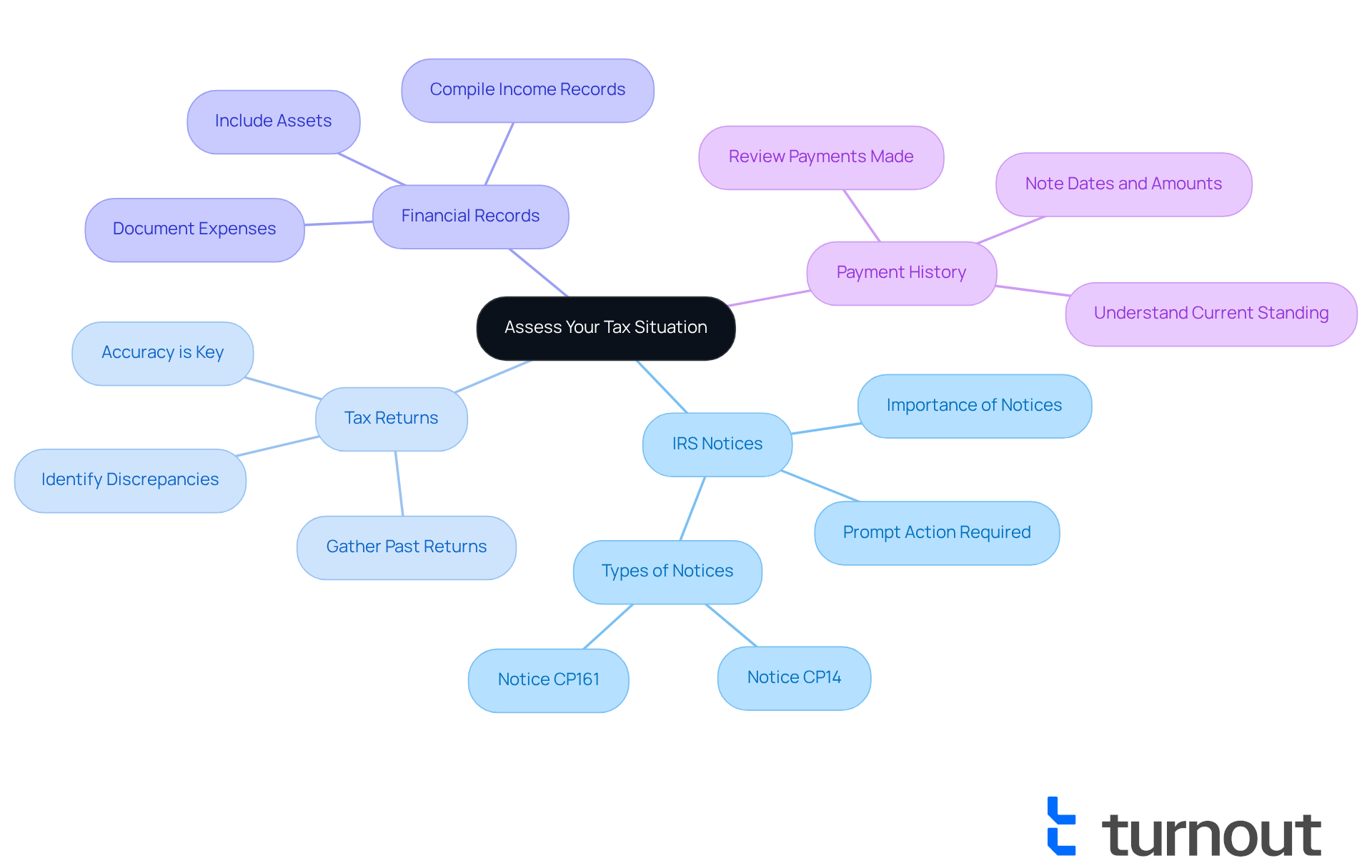

IRS Notices: Have you received any notices or letters from the IRS regarding your tax obligations? These documents are crucial as they detail the amount owed and any deadlines you need to meet. Prompt action on these notices is essential to minimize additional penalties and interest.

-

Tax Returns: Make sure to have copies of your past tax returns, especially for the years in question. This will help you understand your tax obligations and identify any discrepancies. Accurate tax returns are vital for evaluating your overall tax circumstances and can significantly influence your ability to address any unresolved financial obligations.

-

Financial Records: It’s also helpful to compile comprehensive records of your income, expenses, and assets. This includes pay stubs, bank statements, and any other relevant financial documents that reflect your financial situation.

-

Payment History: Take a moment to review all payments made towards your tax obligations, noting the dates and amounts. This will give you insight into your current standing and any remaining balance.

It is crucial to organize this information to help with IRS debt. It will facilitate discussions with the IRS to help with IRS debt and explore your options for resolution. With roughly 150 million tax returns submitted each year in the U.S., understanding your tax circumstances is essential for effective financial resolution.

Additionally, consider using IRS Direct Pay to manage your payments directly from your bank account. Remember, precise tax returns are key for evaluating your overall tax situation and can greatly influence your ability to address any unpaid obligations.

We’re here to help you navigate this process. You are not alone in this journey.

Explore Resolution Options: Payment Plans, Offers in Compromise, and More

Dealing with IRS debt can be overwhelming, but there are several effective options available to help you find relief:

-

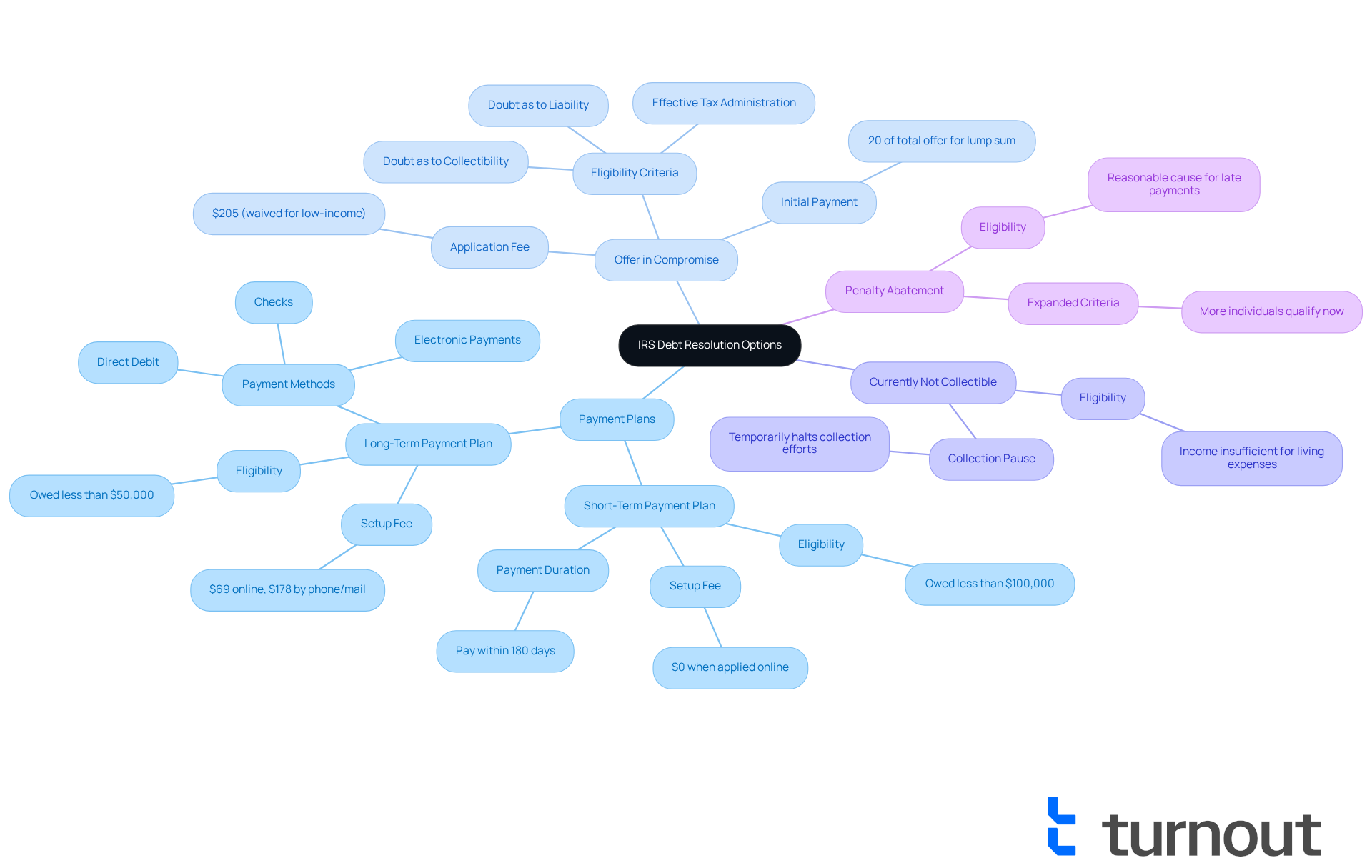

Payment Plans: The IRS offers installment agreements that allow you to settle your tax obligations over time. You can apply for a short-term payment plan, which lets you pay within 180 days without a setup fee, or a long-term payment plan for balances under $50,000, which incurs a setup fee of $69 when applied online.

-

Offer in Compromise (OIC): This program enables you to resolve your tax obligations for less than the full amount due, especially if paying the total would cause financial strain. In 2025, the IRS made the OIC more accessible by adopting flexible evaluation standards, such as considering increased living expenses. The application fee for the OIC is $205, but low-income taxpayers may be exempt from this fee. You can use the Offer in Compromise Pre-Qualifier tool to check your eligibility, and success rates are improving as the IRS adjusts its criteria.

-

Currently Not Collectible (CNC): If you're struggling to pay your tax obligation while covering basic living expenses, you may request CNC status. This status temporarily pauses collection efforts, providing relief during tough times. To qualify, you’ll need to show that your income isn’t enough to cover necessary living expenses.

-

Penalty Abatement: If you have a reasonable cause for late payments, you can request penalty abatement to reduce or eliminate penalties. The IRS has expanded its criteria for penalty relief, allowing more individuals to qualify based on circumstances beyond their control.

It's crucial to help with IRS debt in a timely manner. Ignoring it may lead to a Notice of Federal Tax Lien or IRS levy action. Each option has specific eligibility criteria and application procedures, so take the time to assess which solution aligns best with your financial situation. Remember, you're not alone in this journey, and we're here to help you navigate these options.

Communicate with the IRS: Best Practices for Effective Dialogue

When it comes to communicating with the IRS, we understand that it can feel overwhelming, but we are here to help with IRS debt. But don’t worry; you’re not alone in this journey. Here are some caring practices to help you navigate the process with confidence:

-

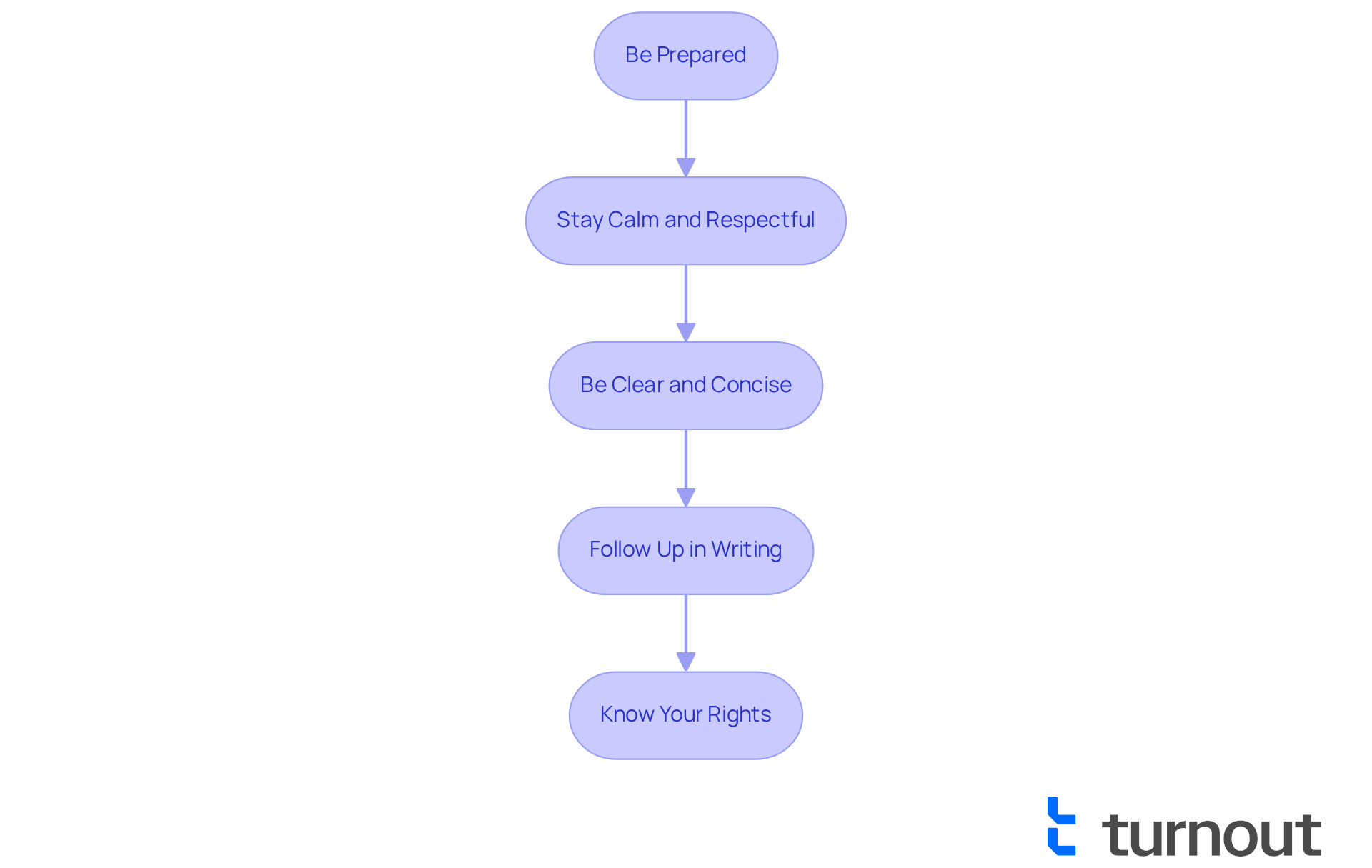

Be Prepared: Gather all relevant documents and information before reaching out to the IRS. This includes your tax returns, notices, and financial records. Being prepared can ease your mind and make the conversation smoother.

-

Stay Calm and Respectful: It’s common to feel anxious, but approaching the conversation with a calm demeanor can make a difference. IRS representatives are more likely to assist you if you remain respectful and composed.

-

Be Clear and Concise: Clearly state your situation and what you need. Avoid unnecessary details that might confuse the issue. Remember, clarity helps in getting the assistance you seek.

-

Follow Up in Writing: After your conversation, consider sending a follow-up letter summarizing your discussion and any agreements made. This creates a record of your communication and reinforces your commitment to resolving the matter.

-

Know Your Rights: Familiarize yourself with your rights as a taxpayer, including the right to appeal and the right to representation. Knowing your rights empowers you in this process.

Effective communication can significantly help with IRS debt resolution. So take a moment to prepare and approach each interaction thoughtfully. Remember, we’re here to help you every step of the way.

Seek Professional Assistance: When and How to Get Help

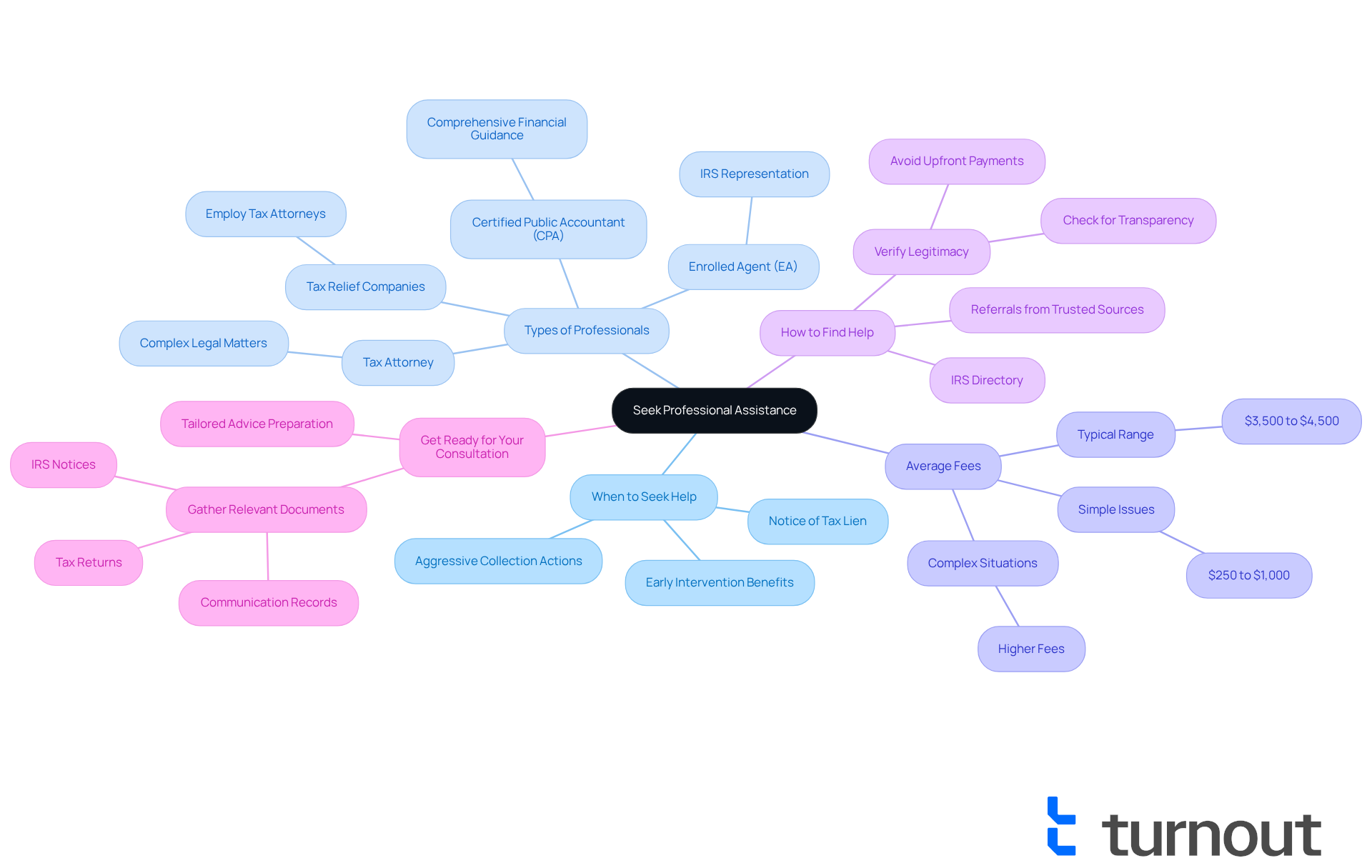

If you’re feeling overwhelmed by your IRS obligations, know that seeking professional assistance can truly make a difference. Here’s when and how to get the help you need:

-

When to Seek Help: It’s common to feel stressed when facing aggressive collection actions or receiving a notice of a tax lien. If you find yourself in this situation, it’s crucial to consult a professional. Early intervention can lead to better outcomes and provide you with peace of mind.

-

Types of Professionals: Consider reaching out to a tax attorney, certified public accountant (CPA), or enrolled agent (EA) who specializes in tax resolution. Tax attorneys are invaluable for complex legal matters, while CPAs can offer comprehensive financial guidance. EAs, licensed by the IRS, can represent you in negotiations, making them a great resource. Many tax relief companies also employ tax attorneys for representation during audits, enhancing their ability to assist clients effectively.

-

Average Fees: The cost of hiring a tax professional can vary widely. On average, fees for tax relief services typically range from $3,500 to $4,500, depending on your case's complexity. Simple issues like penalty abatement may cost between $250 and $1,000, while more intricate situations could require higher fees. Understanding these costs upfront can help you budget accordingly and reduce anxiety.

-

How to Find Help: Utilize resources like the IRS directory of federal tax return preparers or seek referrals from trusted sources. Look for professionals with a proven track record in IRS negotiations and positive client reviews. Be cautious of companies that demand upfront payments or lack transparency, as these can be red flags for scams. It’s essential to verify the legitimacy of tax relief companies to protect yourself from potential fraud.

-

Get Ready for Your Consultation: Before meeting with a tax expert, gather all relevant documents, including tax returns, notices from the IRS, and any communication related to your financial obligations. Being prepared will enable the professional to provide tailored advice and develop a strategy that best suits your situation.

Engaging with a qualified tax professional can help with IRS debt, alleviate stress, and enhance your chances of successfully resolving it. Remember, you’re not alone in this journey, and taking that first step can help you regain control of your financial future.

Conclusion

Navigating IRS debt can feel overwhelming, and we understand that. But remember, you’re not alone in this journey. By grasping the key concepts related to your IRS obligations and assessing your financial situation, you can explore various resolution options that may lead to relief.

This guide has highlighted the importance of understanding tax liens, penalties, and the structured collection process the IRS employs. Gathering necessary documentation, like IRS notices and financial records, is vital for evaluating your tax situation. With various resolution strategies available - such as payment plans, offers in compromise, and professional assistance - you have the power to find a path forward.

Ultimately, addressing IRS debt isn’t just about compliance; it’s about regaining your financial stability and peace of mind. Taking action sooner rather than later can help prevent further complications and financial strain. Whether you choose to self-assess or engage with a tax professional, know that the path to resolution is within reach.

We’re here to help, and exploring these options can lead to a brighter financial future. Remember, support is available, and taking that first step can make all the difference.

Frequently Asked Questions

What are the main issues that can lead to IRS debt?

IRS debt can arise from various issues, including underreporting income or failing to file tax returns.

What is a tax lien and how does it affect me?

A tax lien is a legal claim against your property due to unpaid tax debt. It can significantly impact your credit score, potentially lowering it by as much as 100 points, which can make it harder to secure loans or sell property.

How do penalties and interest work with unpaid taxes?

The IRS imposes penalties for late payments, and interest continues to accrue on unpaid balances, which can substantially increase the total amount owed over time. For example, a $10,000 debt could potentially double within a few years due to penalties and interest.

What is the IRS collection process?

The IRS collection process includes sending notices, initiating liens, or levying assets. It is important to act promptly upon discovering you owe money to avoid escalating penalties and interest. The IRS generally prefers to work with taxpayers to find manageable solutions rather than resorting to forceful collection measures.

What information should I gather to assess my tax situation?

To assess your tax situation, gather IRS notices regarding your tax obligations, copies of past tax returns, financial records (including income, expenses, and assets), and a review of your payment history towards tax obligations.

Why is it important to organize my tax information?

Organizing your tax information is crucial for facilitating discussions with the IRS about your debt and exploring options for resolution. Accurate tax returns and comprehensive financial records can significantly influence your ability to address any unpaid obligations.

How can I manage my tax payments?

You can manage your tax payments directly from your bank account using IRS Direct Pay, which helps streamline the payment process.

What should I do if I feel overwhelmed by my IRS obligations?

If you feel overwhelmed, it's important to seek help and guidance to navigate the challenges of IRS debt. You are not alone in this journey, and there are resources available to assist you.