Introduction

Navigating the complexities of tax season can often feel like wandering through a maze. We understand that tracking down the Missouri state tax refund phone number can be particularly challenging. This crucial contact point not only provides direct access to the state Revenue Agency but also serves as a lifeline for taxpayers seeking clarity on their refund status and tax submissions.

It's common to feel overwhelmed with so much information available online. How can you efficiently locate this essential number? And how can you ensure effective communication with tax officials? We're here to help you through this journey.

Understand the Importance of the Missouri State Tax Refund Phone Number

If you're looking for information about your tax refund, having the Missouri state tax refund phone number can be a real lifesaver. We understand that navigating tax season can be overwhelming, and the Missouri state tax refund phone number connects you directly to the state Revenue Agency. Here, you can easily inquire about the status of your refund, ask questions about your tax submissions, and get help with any issues, including how to reach the Missouri state tax refund phone number.

Imagine saving time and reducing frustration during those busy tax months! You can reach out to the Department of Revenue at (573) 751-3505 for assistance. Plus, the Return Inquiry System provides a convenient way to check your tax refund status anytime.

With the tax filing deadline extended to April 18, 2025, it’s more important than ever to utilize these resources. Alana M. Barragán-Scott, the Director of the state's Revenue Agency, emphasizes the importance of communication. She reassures us, "No employee of the Revenue Agency will ever reach out to anyone to obtain a person's credit card number to process an income tax refund." This commitment to direct communication is vital for enhancing your experience and satisfaction.

Remember, you are not alone in this journey. We’re here to help you navigate the complexities of tax inquiries with confidence.

Access the Missouri Department of Revenue Website

Finding the Missouri state tax refund phone number can feel overwhelming, but we’re here to help. Start by visiting the Department of Revenue's official website at dor.mo.gov. This site is your go-to resource for all tax-related inquiries in the state. It offers essential contact information, forms, and materials designed specifically for individuals like you who are navigating tax responsibilities.

Using the official site is crucial. It ensures you receive accurate and reliable information, which can ease your worries. Did you know that many people now turn to online resources for tax information? This shift highlights the importance of accessible platforms that can guide you through the process.

The state Revenue agency emphasizes the need for precise tax reporting. Official tax resources are essential as they clarify complex tax processes, empowering you to make informed decisions. For instance, the Citizen Transparency Tool has significantly improved communication and trust between tax authorities and the community. This initiative has led to better compliance and satisfaction among taxpayers.

Remember, you are not alone in this journey. If you have questions or need assistance, don’t hesitate to reach out through the official website. We're here to support you every step of the way.

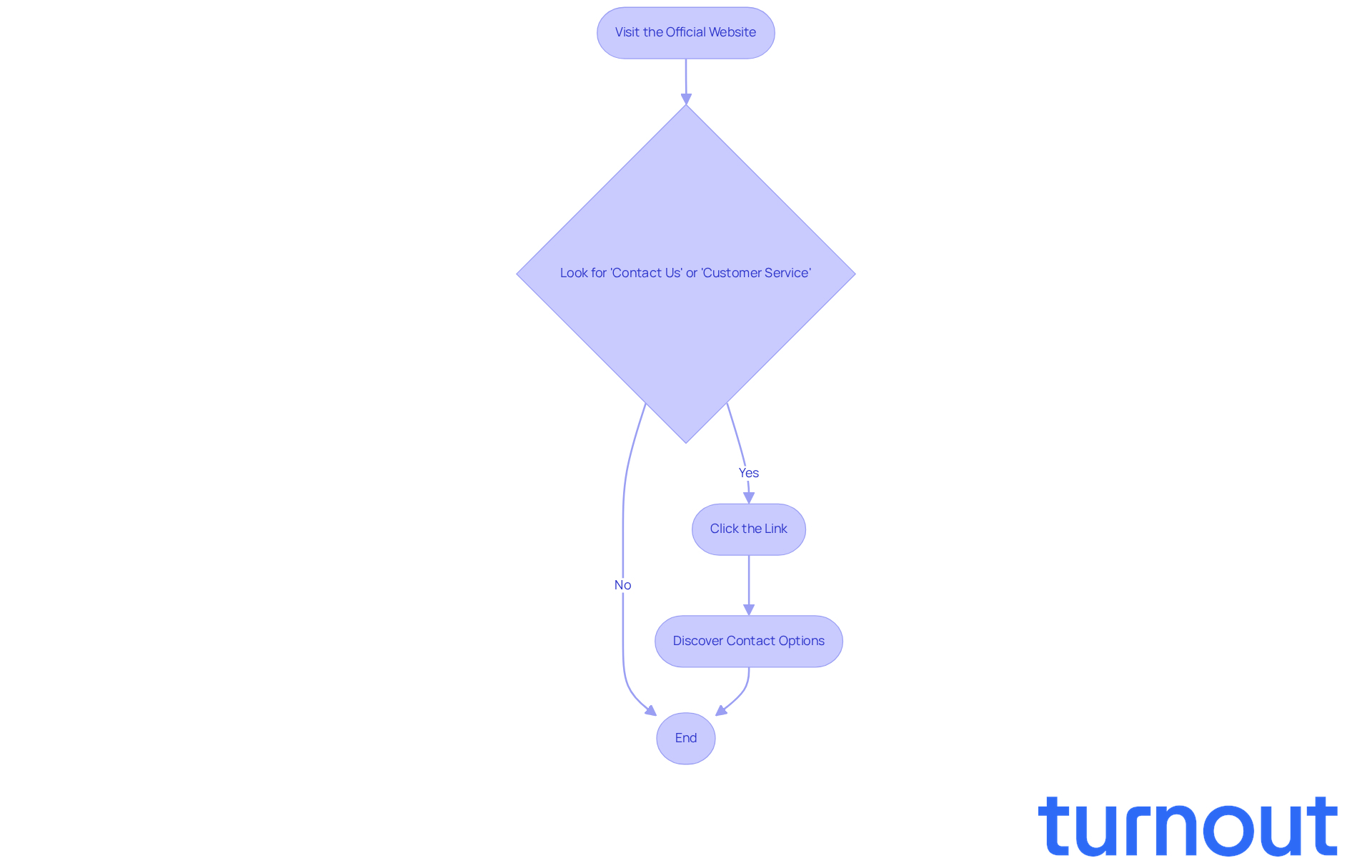

Navigate to the Contact Information Section

Finding the Missouri Department of Revenue's contact information, including the Missouri state tax refund phone number, can feel overwhelming, but we're here to help. Start by visiting their official website. You’ll want to look for the 'Contact Us' or 'Customer Service' section, typically found in the main menu or at the bottom of the homepage. By clicking this link, you’ll discover various contact options, including the Missouri state tax refund phone number, email addresses, and office locations.

This section is designed with you in mind, making it easier to locate the assistance you need. We understand that time is precious, and efficient access to this information can save you valuable minutes. Studies show that many individuals spend several minutes searching for contact details on state tax websites.

As Marshall Field famously said, 'The customer is always right.' This highlights the importance of accessible customer service. By streamlining this process, the revenue agency aims to enhance your experience when paying taxes. This aligns with broader IRS efforts to improve service, which have led to average wait times of just over three minutes. Remember, you are not alone in this journey; help is just a click away.

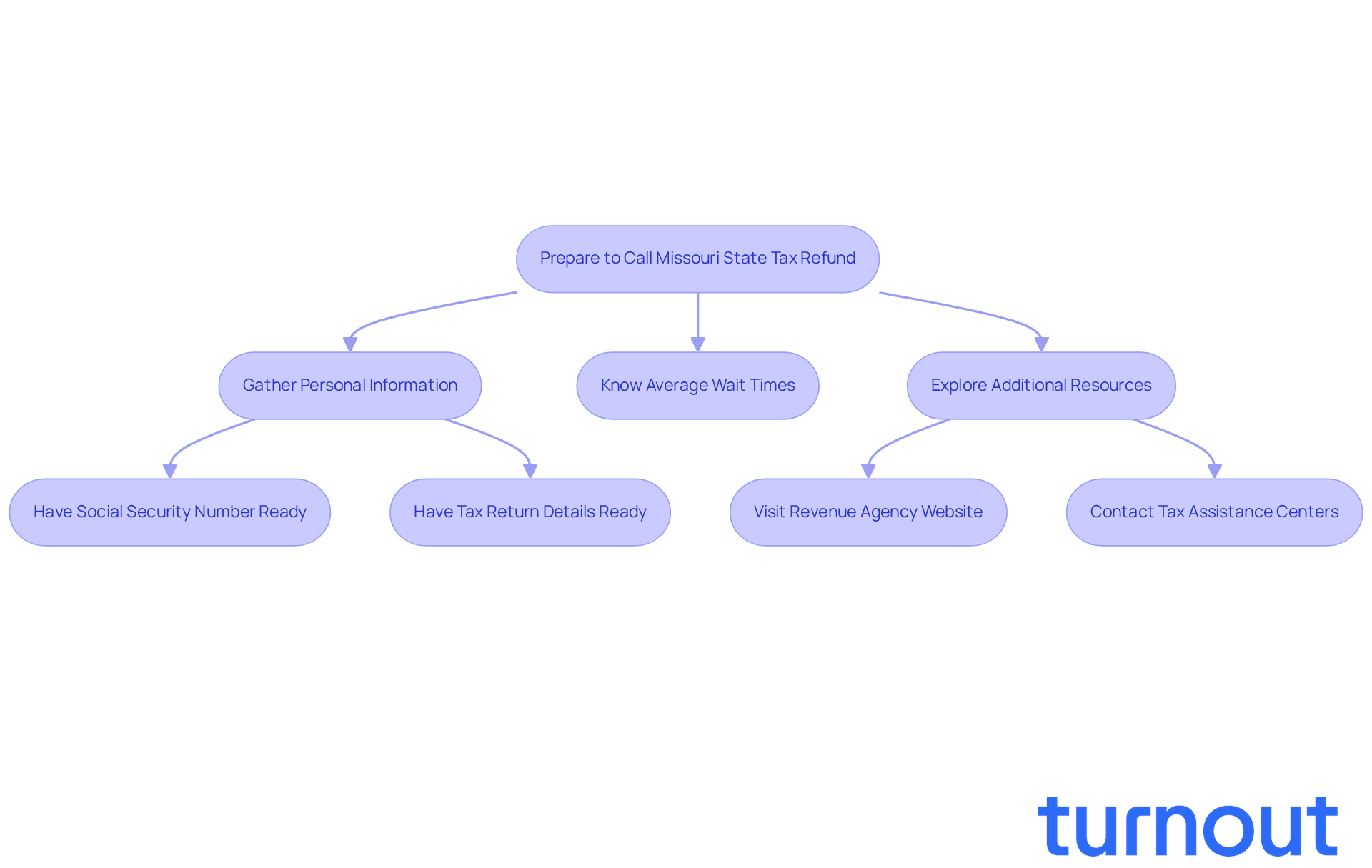

Identify the Missouri State Tax Refund Phone Number

If you're wondering about your state tax refund, we understand how important this is for you. To get the answers you need regarding your inquiries, simply dial the Missouri state tax refund phone number at 573-751-3505. This number, the Missouri State Tax Refund phone number, connects you directly to the revenue agency's individual income tax division, where help is just a call away.

Before you call, it’s a good idea to gather some essential personal information. Having your Social Security number and specific details about your tax return ready can make a big difference. This preparation not only helps the representative assist you more efficiently but also shows that you’re ready to engage effectively.

We know that waiting on the phone can be frustrating. Average wait times for inquiries can vary, typically ranging from 10 to 30 minutes. Being prepared for potential delays can ease some of that stress. When you have your tax return details handy, it speeds up the process and demonstrates your commitment to resolving your concerns.

Many taxpayers have found that being concise and direct about their issues leads to quicker resolutions. It’s common to feel overwhelmed, but remember, you’re not alone in this journey. You can also take advantage of the resources available through the Revenue Agency. Their website and tax assistance centers in seven cities offer valuable support and can clarify any questions you may have regarding your tax situation.

These centers provide in-person assistance, which can be incredibly helpful. If you’re feeling uncertain, reaching out for help is a great step. Remember, we’re here to help you navigate this process.

Utilize the Phone Number for Effective Communication

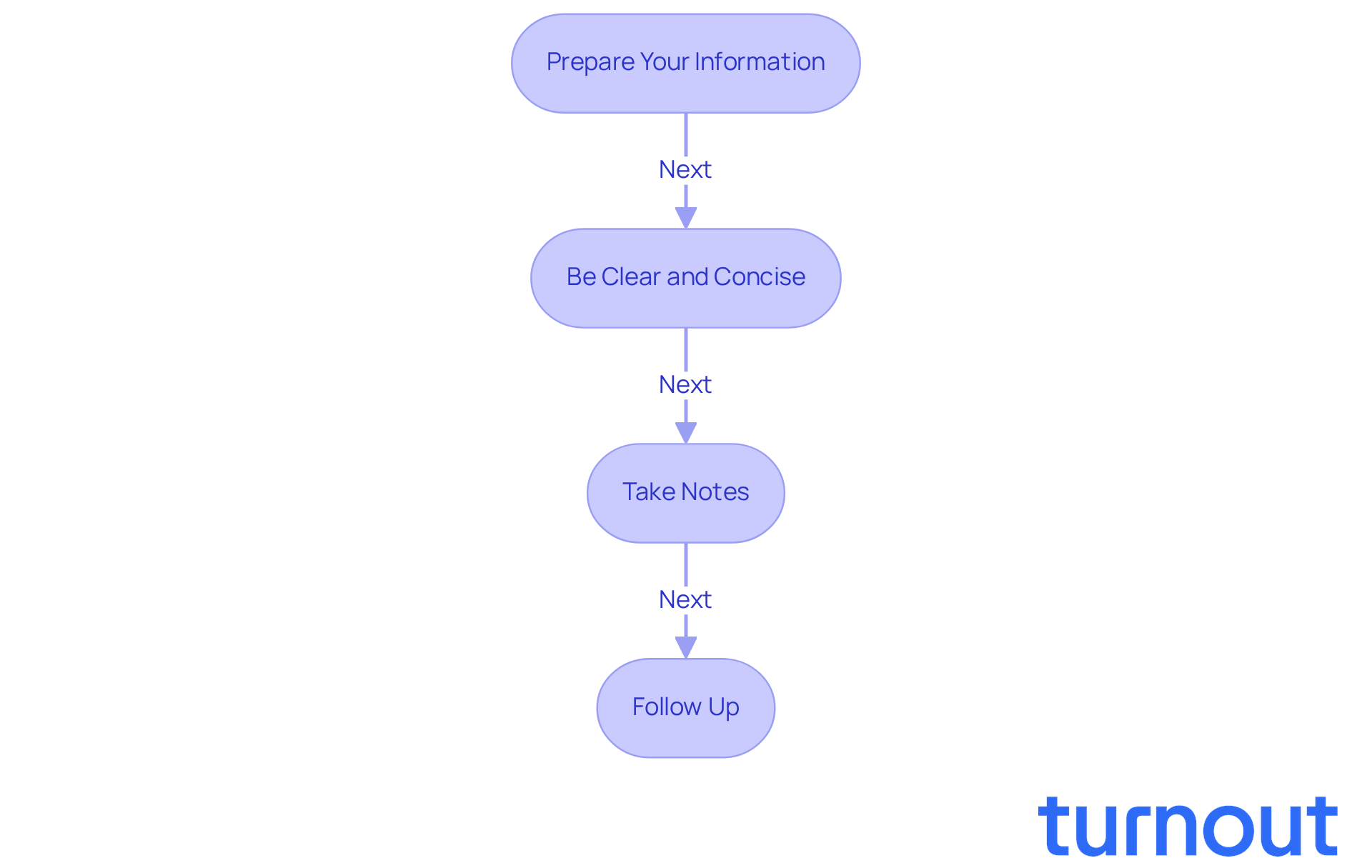

When you contact the Missouri State Tax Refund phone number, it’s important to approach the conversation with care and preparation.

-

Prepare Your Information: Before you call, gather your Social Security number, tax return details, and any correspondence from the Department of Revenue. This preparation can make a world of difference. Did you know that only 32% of calls to the IRS are answered by a live assistor? Being well-prepared can help you navigate this process more smoothly.

-

Be Clear and Concise: When you speak with the representative, clearly articulate your inquiry or issue. A focused approach not only helps them assist you more efficiently but also eases your own stress. As Albert Einstein once said, understanding income tax can be quite challenging, so clarity in your communication is essential.

-

Take Notes: It’s a good idea to document the representative's name, the information they provide, and any next steps you need to take. This record will be invaluable for future reference, ensuring you have everything you need at your fingertips.

-

Follow Up: If your issue isn’t resolved after the call, don’t hesitate to request a reference number and ask about the best way to follow up. Remember, successful taxpayer interactions often involve diligent follow-up, ensuring your concerns are addressed.

By following these guidelines, you can foster a productive conversation that effectively addresses your tax refund inquiries. We’re here to help you through this process, and you are not alone in this journey.

Conclusion

Having access to the Missouri state tax refund phone number is crucial for navigating the often complex world of tax inquiries. We understand that tax season can be overwhelming, and this direct line to the Missouri Department of Revenue not only provides clarity regarding your tax refund status but also ensures you have the support needed to address any concerns or questions that may arise.

Throughout this guide, we’ve shared key insights to empower you in your communication with the Revenue Agency. From understanding the importance of the phone number to preparing the necessary information before making a call, each step is designed to enhance efficiency and reduce frustration. Utilizing the official website for accurate contact details and resources further streamlines the process, ensuring you are well-informed and equipped to handle your inquiries effectively.

Ultimately, reaching out to the Missouri state tax refund phone number is not just about getting answers; it’s about taking control of your tax situation and ensuring your concerns are addressed promptly. By being prepared and clear in your communication, you can foster a more productive dialogue with the Department of Revenue. Remember, you are not alone in this journey. Engaging with these resources not only enhances your experience but also contributes to a more transparent and efficient tax system for everyone.

Frequently Asked Questions

Why is the Missouri state tax refund phone number important?

The Missouri state tax refund phone number is important because it connects you directly to the state Revenue Agency, allowing you to inquire about the status of your refund, ask questions about tax submissions, and get help with any related issues.

What is the phone number for the Missouri Department of Revenue?

The phone number for the Missouri Department of Revenue is (573) 751-3505.

How can I check the status of my tax refund in Missouri?

You can check the status of your tax refund anytime through the Return Inquiry System provided by the Missouri Department of Revenue.

What is the tax filing deadline for Missouri in 2025?

The tax filing deadline for Missouri in 2025 is extended to April 18, 2025.

What should I know about communication with the Missouri Revenue Agency?

It is important to know that no employee of the Revenue Agency will ever reach out to obtain a person's credit card number to process an income tax refund, emphasizing a commitment to direct communication.

Where can I find more information about tax-related inquiries in Missouri?

You can find more information by visiting the Missouri Department of Revenue's official website at dor.mo.gov, which offers essential contact information, forms, and materials for tax responsibilities.

Why is using the official Missouri Department of Revenue website crucial?

Using the official website is crucial because it ensures you receive accurate and reliable information, which can help alleviate worries related to tax inquiries.

What is the Citizen Transparency Tool?

The Citizen Transparency Tool is an initiative by the state Revenue agency that has improved communication and trust between tax authorities and the community, leading to better compliance and satisfaction among taxpayers.