Overview

Choosing a Los Angeles tax attorney can feel overwhelming, but you are not alone in this journey. It's essential to evaluate their qualifications, experience, and client feedback. Preparing relevant questions for initial consultations can help you feel more at ease. Understanding the attorney's expertise and track record is crucial; it can significantly influence your compliance outcomes and financial success.

We understand that clear communication and alignment with your specific tax needs are vital. By taking the time to find the right attorney, you are investing in your peace of mind. Remember, you deserve to have someone who truly understands your situation and is committed to supporting you every step of the way.

Introduction

Navigating the complex world of tax regulations can feel overwhelming, especially in a bustling city like Los Angeles where the stakes are high. We understand that choosing the right tax attorney is not just about compliance; it’s about securing peace of mind and maximizing your financial outcomes.

With the current uncertainties in tax processes, how can you ensure that you are selecting a qualified professional who truly understands your unique needs? This guide delves into essential steps for finding a Los Angeles tax attorney who can effectively support you on your journey.

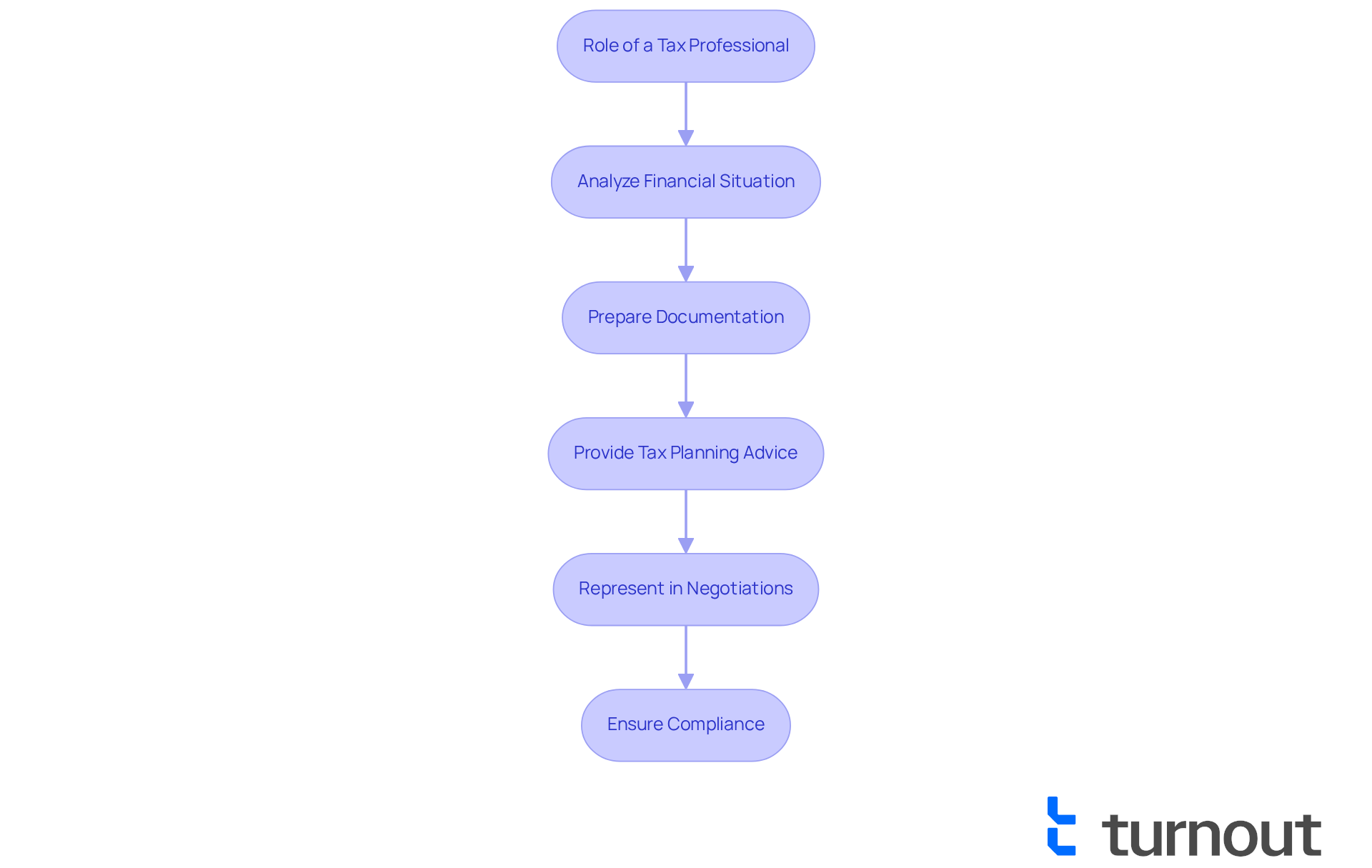

Understand the Role of a Tax Professional

A Los Angeles tax attorney is truly essential in helping you navigate the intricate landscape of tax regulations and compliance. They provide valuable advice on tax planning and assist in resolving disputes with tax authorities, ensuring that you are well-informed about your rights and obligations through a Los Angeles tax attorney. By analyzing your financial situation, preparing necessary documentation, and representing you during negotiations or disputes, a Los Angeles tax attorney plays a crucial role in your tax journey. Understanding their roles is vital for determining the support you need from a Los Angeles tax attorney based on your specific tax circumstances.

We understand that the influence of tax experts on compliance rates is significant. Studies show that individuals who engage with qualified tax preparers are more likely to file accurate returns and claim eligible benefits, which can greatly reduce the risk of audits and penalties. For instance, 96% of Earned Income Tax Credit (EITC) audit changes were linked to returns handled by unqualified preparers. This highlights the importance of collaborating with skilled professionals. Experts emphasize that having a solid grasp of tax compliance with the help of a Los Angeles tax attorney is crucial for taxpayers, as it not only helps avoid costly mistakes but also empowers you to maximize your entitlements.

Furthermore, a Los Angeles tax attorney is available to represent you effectively. They ensure that all necessary documentation is accurately prepared and submitted with the help of a Los Angeles tax attorney, which is critical for maintaining compliance with tax laws. By working with an informed expert, you can prevent the drawbacks associated with erroneous submissions and unclaimed advantages.

Considering the current government shutdown, which has impacted IRS operations, the role of a Los Angeles tax attorney becomes even more vital. They can guide you through the complexities of tax filing during this uncertain period with the help of a Los Angeles tax attorney, ensuring that all submissions are timely and accurate.

In summary, enlisting a Los Angeles tax attorney not only assists in compliance but also enhances your understanding of tax responsibilities. Ultimately, this leads to better financial outcomes for you. Remember, you are not alone in this journey, and we’re here to help.

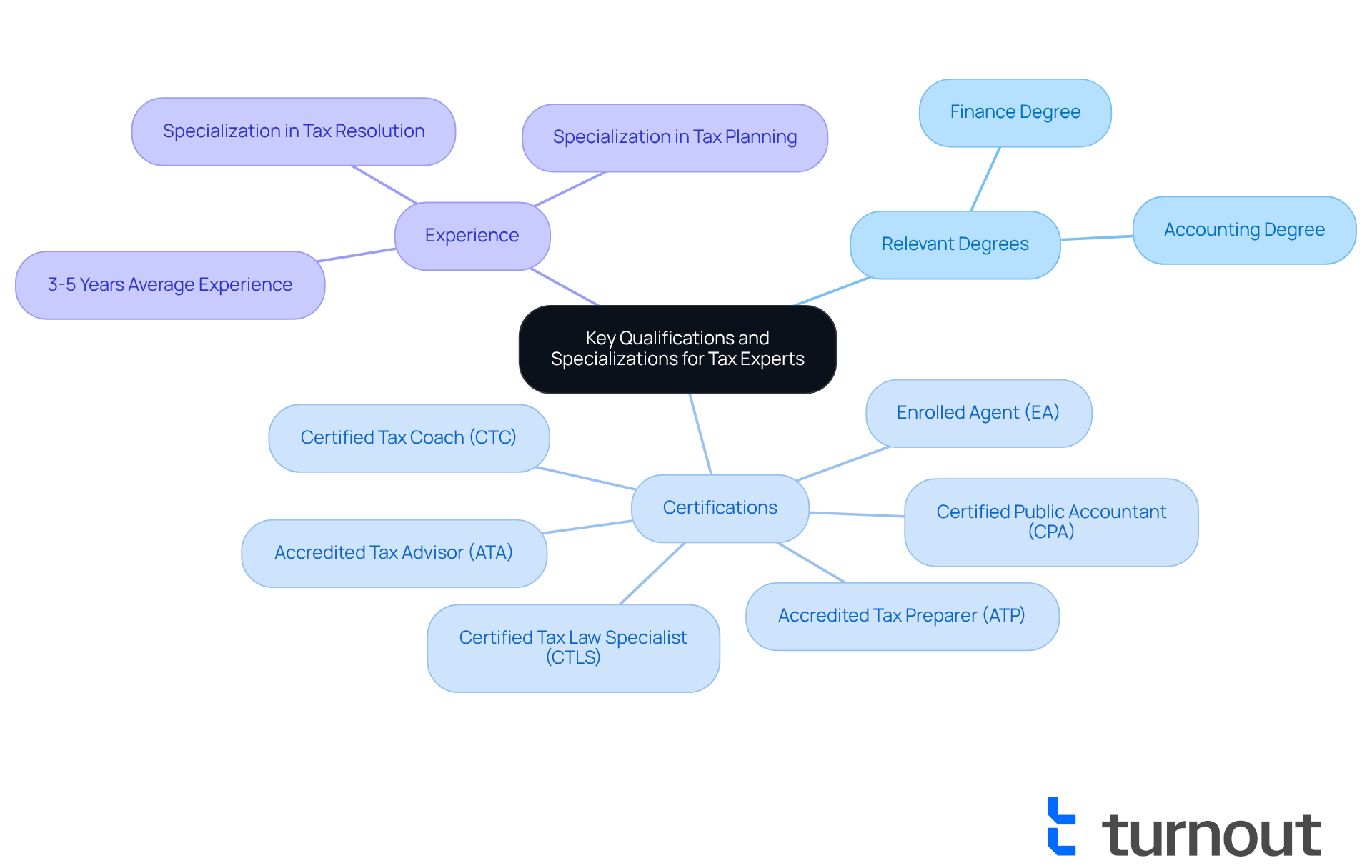

Identify Key Qualifications and Specializations

When seeking a tax expert, it's important to prioritize credentials that can truly make a difference. Look for a relevant degree in finance or accounting, along with certifications in tax preparation. We understand that navigating tax law can be overwhelming, and specialized training is essential for managing complex tax issues effectively. Certifications like the Certified Tax Law Specialist (CTLS) and Accredited Tax Advisor (ATA) signify advanced expertise, enhancing the ability to provide tailored guidance and solutions.

In California, many tax specialists have an average of three to five years of experience. This experience is crucial for handling the intricacies of both individual and business tax matters. Selecting a Los Angeles tax attorney who specializes in your specific needs ensures that you receive knowledgeable advice, particularly in areas like tax resolution or planning. Remember, this expertise can significantly influence the outcomes of your tax-related challenges.

It's common to feel uncertain about where to find qualified help. Consider utilizing the Directory of Federal Tax Return Preparers with Credentials and Select Qualifications. We're here to help you navigate this journey with confidence, knowing that you are not alone in seeking the right support.

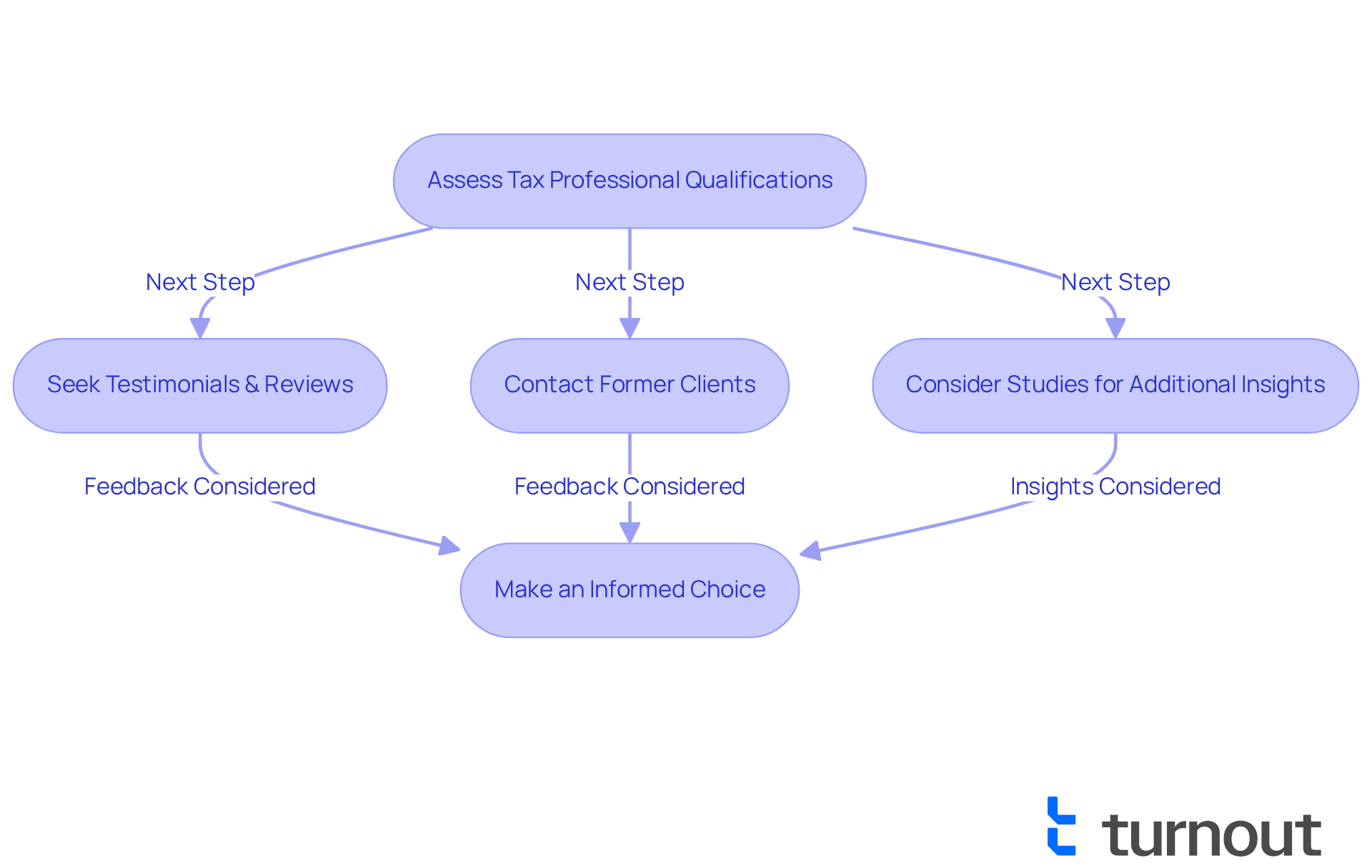

Evaluate Experience and Client Feedback

When assessing a tax professional's qualifications, we understand that you want to ensure they are the right fit for your needs. It's essential to examine their track record with cases similar to yours. Start by seeking out testimonials and reviews from former customers. These insights can shed light on satisfaction levels and the effectiveness of the services offered. Platforms like Yelp and niche legal directories are excellent resources for gathering customer experiences.

Additionally, consider reaching out directly to former clients. Their firsthand feedback about interactions and outcomes can be invaluable. This approach will empower you to make a well-informed choice when selecting a tax expert. Remember, selecting someone with a proven success rate is crucial. For instance, companies like Tax Network USA have successfully handled over 40,000 IRS-compliant cases.

Furthermore, insights from studies such as the J.D. Power U.S. Tax Preparation Satisfaction Study can provide additional context on customer satisfaction. This highlights the importance of customer feedback in your decision-making process. You're not alone in this journey; we're here to help you find the right support.

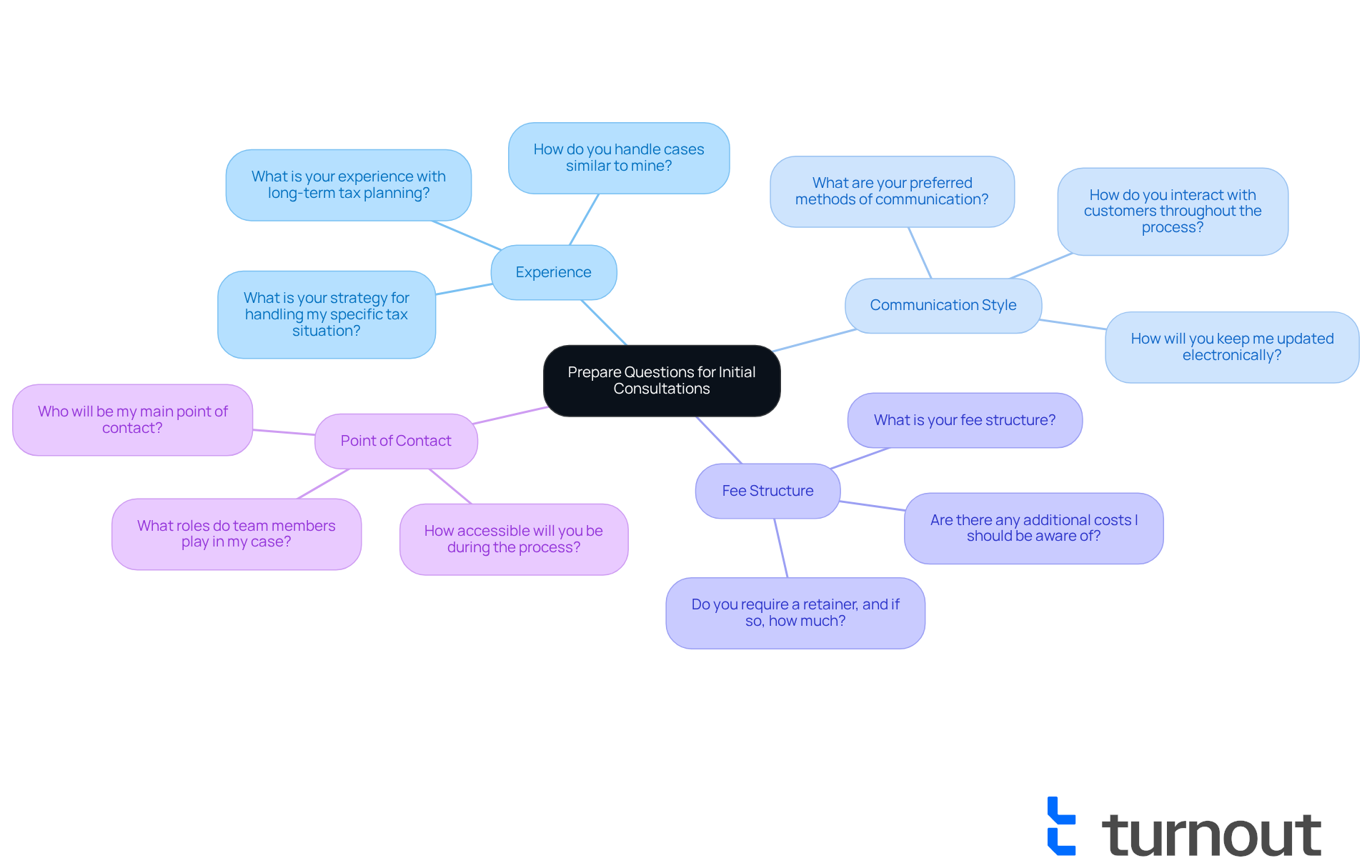

Prepare Questions for Initial Consultations

Before meeting with a tax professional, we understand that preparing a list of questions can feel overwhelming. It's crucial to maximize the value of your consultation. Start by inquiring about their experience with cases similar to yours and their approach to resolving tax issues. Key questions to consider include:

- What is your strategy for handling my specific tax situation?

- How do you interact with customers throughout the process?

It's common to feel anxious about communication, so understanding their style, including how they will keep you updated electronically, is particularly important. Studies show that clients prefer clear and consistent updates regarding their cases. Additionally, discussing their fee structure upfront, including any service fees and government fees that may apply, can help you avoid unexpected costs later on.

Knowing who will be your main point of contact within their team is essential for effective communication. This preparation will not only provide valuable insights into their methods but also help you determine if they are the right fit for your tax challenges. Remember, you are not alone in this journey, and we're here to help you navigate it with confidence.

Conclusion

Selecting a Los Angeles tax attorney is a crucial step in ensuring compliance with tax regulations and achieving favorable financial outcomes. We understand that navigating tax matters can be overwhelming. The right attorney not only provides expert guidance but also empowers you to understand your rights and obligations, leading to a more informed approach to tax planning and dispute resolution.

Throughout this article, we’ve highlighted several essential aspects. Understanding the role of a tax professional is vital. Identifying key qualifications and specializations can make a difference. Evaluating experience and client feedback helps you find the right fit. Preparing thoughtful questions for initial consultations is equally important. Each of these steps plays a significant role in choosing a tax attorney who can effectively address your specific needs and navigate the intricacies of tax law.

In conclusion, engaging a qualified Los Angeles tax attorney is not just about compliance; it’s about securing peace of mind in a challenging financial landscape. By taking the time to thoroughly evaluate potential candidates and preparing for consultations, you can make informed decisions that will facilitate smoother interactions with tax authorities. Remember, you are not alone in this journey. This proactive approach is vital in maximizing your entitlements and minimizing risks, ensuring that you have the support you need as you navigate the complexities of tax obligations.

Frequently Asked Questions

What is the role of a Los Angeles tax attorney?

A Los Angeles tax attorney helps navigate tax regulations and compliance, provides advice on tax planning, and assists in resolving disputes with tax authorities.

How does a tax attorney assist in tax compliance?

They analyze your financial situation, prepare necessary documentation, and represent you during negotiations or disputes to ensure you understand your rights and obligations.

What impact do tax professionals have on compliance rates?

Engaging with qualified tax preparers significantly increases the likelihood of filing accurate returns and claiming eligible benefits, thus reducing the risk of audits and penalties.

Why is it important to work with a skilled tax professional?

Collaborating with skilled professionals helps avoid costly mistakes and maximizes your entitlements, as evidenced by the high percentage of audit changes linked to unqualified preparers.

How can a tax attorney help during a government shutdown?

A Los Angeles tax attorney can guide you through the complexities of tax filing during a government shutdown, ensuring that all submissions are timely and accurate.

What are the benefits of hiring a Los Angeles tax attorney?

Hiring a Los Angeles tax attorney assists in compliance, enhances your understanding of tax responsibilities, and ultimately leads to better financial outcomes.