Overview

Navigating the world of Social Security Disability Insurance (SSDI) benefits can feel overwhelming. We understand that many people face challenges in understanding how to calculate their benefits. This guide is here to help you through that process, step by step.

First, it’s essential to grasp the significance of your work history and average indexed monthly earnings. These factors play a crucial role in determining your SSDI benefits. By understanding these elements, you can gain clarity on what to expect.

Next, we’ll delve into the specific calculations involved. It’s common to feel confused by the numbers, but don’t worry. We’ll break it down for you, detailing the adjustments for cost of living and other factors that influence your payment amounts. This knowledge will empower you to navigate your SSDI benefits effectively.

Remember, you are not alone in this journey. Many have walked this path and found success. By equipping yourself with the right information, you can take control of your situation. We’re here to help you every step of the way.

So, let’s get started on this important journey together. Understanding your SSDI benefits is not just about numbers; it’s about securing the support you need. You deserve to feel confident and informed as you move forward.

Introduction

Understanding the complexities of Social Security Disability Insurance (SSDI) is crucial for anyone navigating the often overwhelming world of disability benefits. This federal program offers vital financial support to those unable to work due to qualifying disabilities. However, it’s essential to grasp the eligibility criteria and the calculation process involved.

Many individuals face the daunting task of figuring out their SSDI benefits. The challenge lies in accurately calculating the amount they may receive and understanding the various factors that influence it. We understand that this can feel like a heavy burden. How can you ensure you’re fully prepared to tackle this process and maximize your potential support?

You are not alone in this journey. We're here to help you navigate these waters with clarity and confidence.

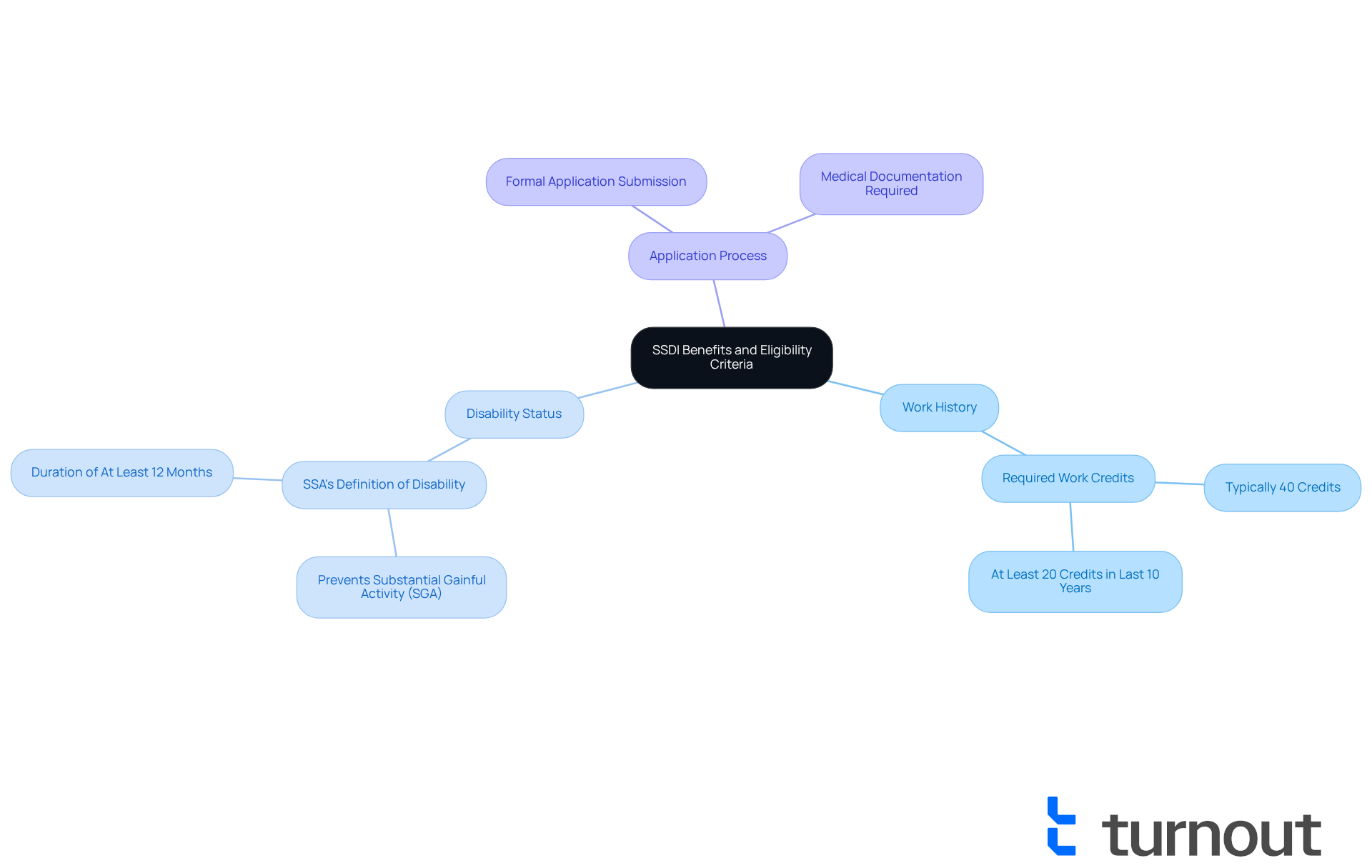

Understand SSDI Benefits and Eligibility Criteria

Social Security Disability Insurance (SSDI) is a vital federal program designed to provide financial support to those unable to work due to qualifying disabilities. If you’re considering applying for SSDI, it’s important to understand the criteria involved:

- Work History: You need to have worked in jobs covered by Social Security, earning enough work credits—typically 40 credits, with at least 20 earned in the last 10 years.

- Disability Status: Your medical condition must align with the Social Security Administration's (SSA) definition of disability, meaning it prevents you from engaging in substantial gainful activity (SGA) for at least 12 months.

- Application Process: A formal application must be submitted to the SSA, along with medical documentation that supports your claim.

We understand that navigating the SSDI application process can feel overwhelming. At Turnout, our trained nonlawyer advocates are here to help you every step of the way. We’re committed to guiding you through these criteria and the application process, ensuring you have the support you need without the necessity of legal representation. Remember, Turnout is not a law firm and has no affiliation with any law firm or government agency. We provide tools and services designed to help you effectively navigate the disability benefits process.

Understanding how to calculate SSDI benefits is crucial for accurately determining your eligibility for disability assistance. You are not alone in this journey; we’re here to help.

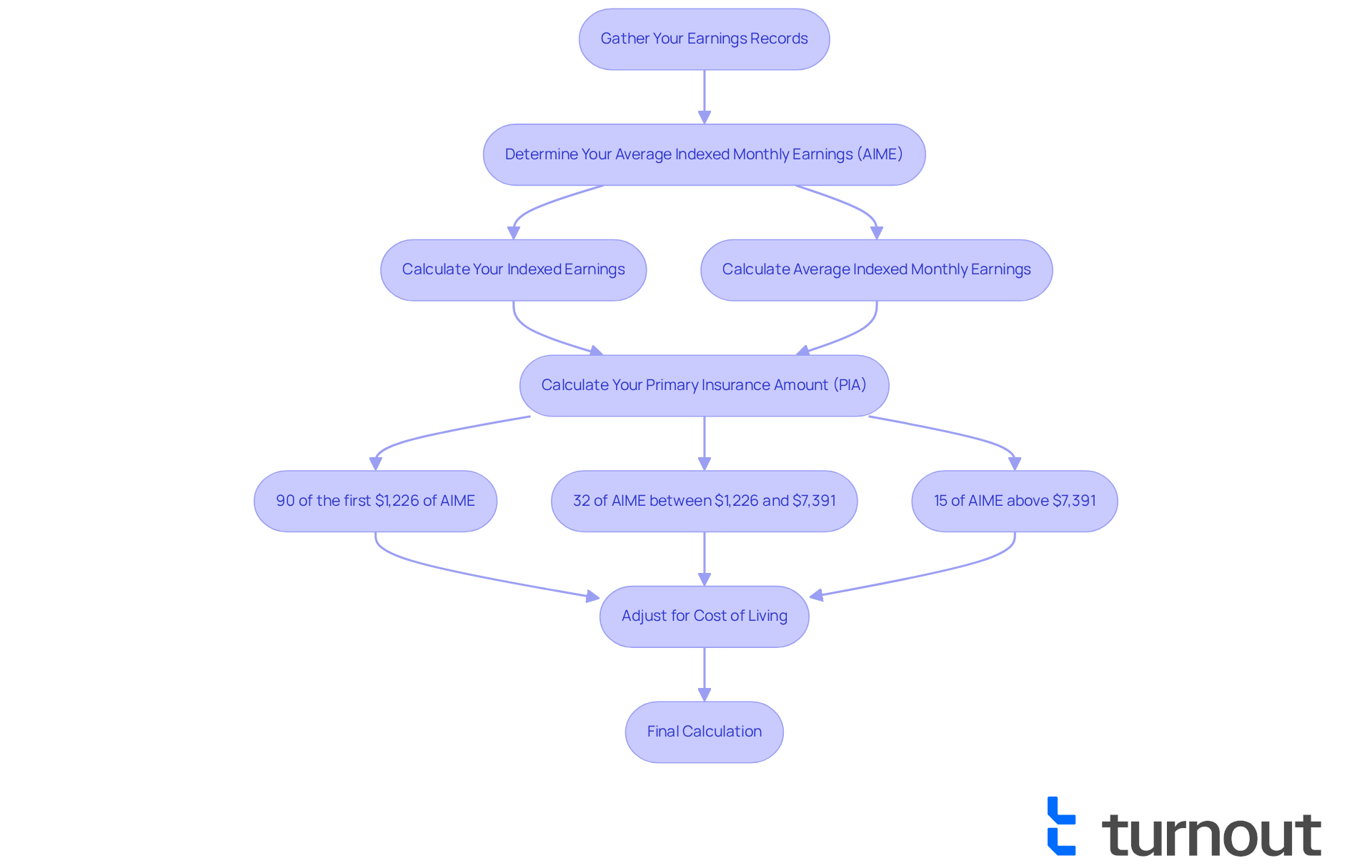

Follow the Step-by-Step Calculation Process for SSDI Benefits

Calculating your SSDI benefits can feel overwhelming, but we're here to guide you on how to calculate SSDI benefits. Follow these steps to gain clarity and confidence in your calculations:

-

Gather Your Earnings Records: Start by accessing your Social Security earnings record on the SSA's website. This record outlines your earnings throughout your working life, which is essential for accurate calculations.

-

Determine Your Average Indexed Monthly Earnings (AIME):

- Calculate Your Indexed Earnings: Adjust your past earnings for inflation using the SSA's indexing factors. This adjustment ensures your earnings reflect current dollar values, making your calculations more precise.

- Calculate Average Indexed Monthly Earnings: Sum your highest-earning 35 years of indexed earnings and divide by the total number of months in those years (420 months).

-

Calculate Your Primary Insurance Amount (PIA): The PIA is determined using a formula based on your Average Indexed Monthly Earnings. For 2025, the formula is as follows:

- 90% of the first $1,226 of your AIME

- 32% of your AIME between $1,226 and $7,391

- 15% of your AIME above $7,391

-

Adjust for Cost of Living: Remember, the SSA modifies payments each year according to the cost of living. Be sure to factor in any applicable adjustments to your calculations.

-

Final Calculation: The outcome from the PIA calculation indicates your projected monthly disability support value. It's important to note that while we provide guidance, Turnout does not offer legal advice, and using our services does not establish an attorney-client relationship. Our trained nonlawyer advocates are here to help clarify these calculations and support you in your SSD claims.

By following these steps, you can effectively learn how to calculate SSDI benefits. You are not alone in this journey; we’re here to help you navigate the intricacies of the Social Security system with enhanced assurance.

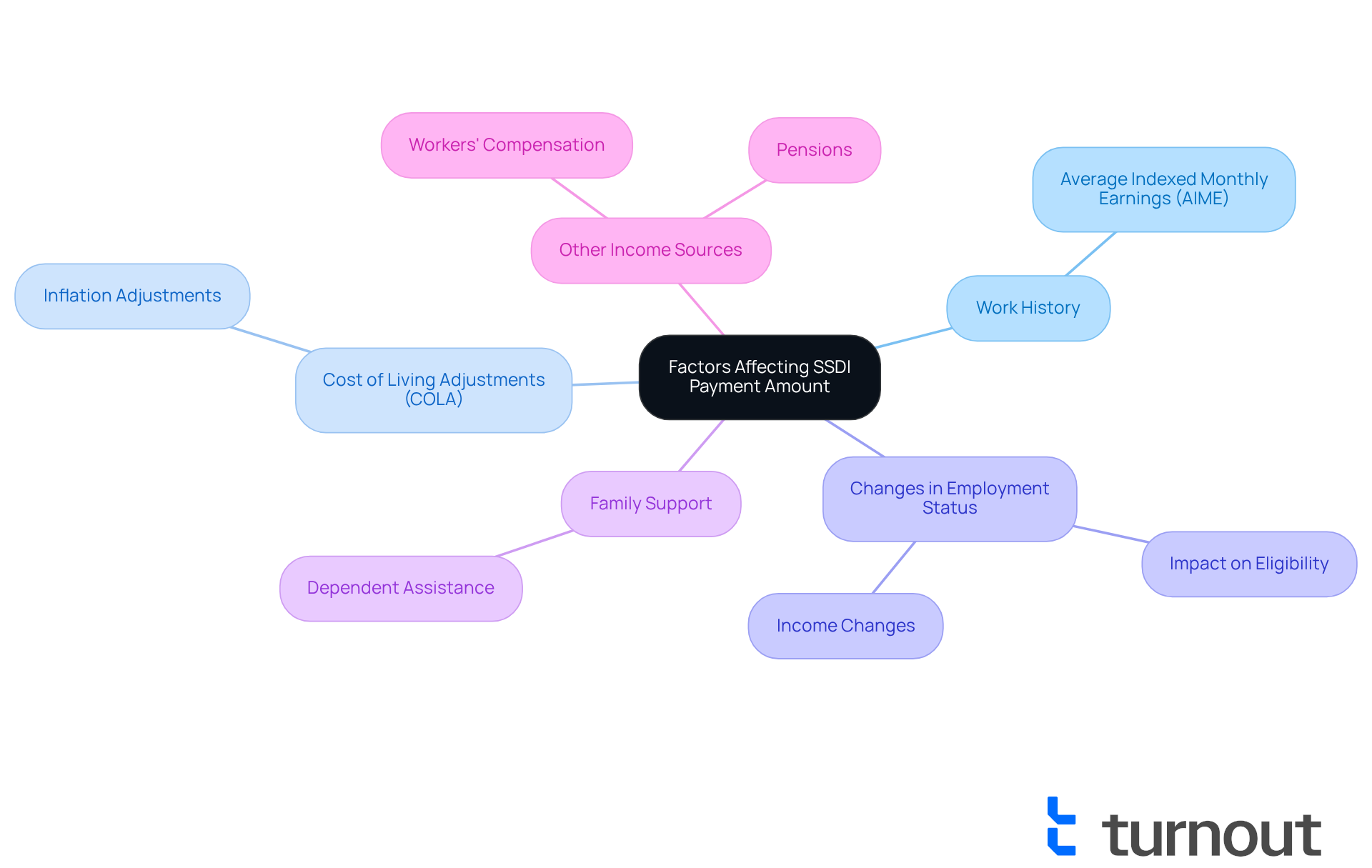

Identify Factors Affecting Your SSDI Payment Amount

Understanding how to calculate SSDI benefits can feel overwhelming, but you’re not alone in this journey. Several factors can influence how to calculate SSDI benefits, and being aware of them can help you navigate your situation more effectively.

-

Work History: The total you earned during your peak working years plays a significant role in determining your Average Indexed Monthly Earnings (AIME). This, in turn, directly impacts your disability support.

-

Cost of Living Adjustments (COLA): Each year, your disability payments are adjusted to reflect inflation. These COLA adjustments can increase your monthly compensation, helping you keep pace with rising costs.

-

Changes in Employment Status: If you decide to return to work or if your income changes, it could affect your eligibility for benefits or the amount you receive. It’s common to feel uncertain about these changes, but understanding them can empower you.

-

Family Support: If you have dependents, they might qualify for additional assistance based on your disability payments. This can influence the total amount you receive, providing extra support for your family.

-

Other Income Sources: Income from other sources, like workers' compensation or pensions, may reduce your disability benefits. It’s important to consider how these factors interact with your SSDI payments.

By keeping these factors in mind, you can gain a clearer picture of how to calculate SSDI benefits and how your payment amount might fluctuate. Remember, we’re here to help you navigate this process and plan accordingly.

Conclusion

Understanding how to calculate SSDI benefits is essential for anyone seeking financial support due to disabilities. We know that navigating this process can feel overwhelming, but this guide has illuminated the critical steps involved in determining eligibility and calculating potential benefits. By empowering individuals with this knowledge, we hope to help you navigate the complexities of the Social Security Disability Insurance program with confidence.

Key points discussed include:

- The importance of your work history and disability status

- The step-by-step calculation of Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA)

- The various factors that can influence payment amounts

Each of these elements plays a vital role in ensuring that you can accurately assess your benefits and make informed decisions about your financial future.

As you embark on this journey toward securing SSDI benefits, it’s crucial to remain informed and proactive. We understand that this can be a challenging time, and engaging with resources and support systems, such as the trained nonlawyer advocates at Turnout, can provide invaluable assistance. By understanding the intricacies of SSDI calculations and eligibility, you can take confident steps toward securing the financial support you need to navigate your circumstances effectively. Remember, you are not alone in this journey.

Frequently Asked Questions

What is SSDI?

Social Security Disability Insurance (SSDI) is a federal program that provides financial support to individuals who are unable to work due to qualifying disabilities.

What are the eligibility criteria for SSDI?

To be eligible for SSDI, you must have a sufficient work history, which typically requires 40 work credits (20 of which must be earned in the last 10 years), and your medical condition must meet the Social Security Administration's definition of disability, preventing you from engaging in substantial gainful activity for at least 12 months.

How do I apply for SSDI?

To apply for SSDI, you need to submit a formal application to the Social Security Administration, along with medical documentation that supports your claim.

Can I get assistance with the SSDI application process?

Yes, organizations like Turnout offer support through trained nonlawyer advocates who can guide you through the SSDI application process, helping you understand the criteria and requirements.

Does Turnout provide legal representation for SSDI applications?

No, Turnout is not a law firm and does not provide legal representation. Instead, they offer tools and services to assist you in navigating the disability benefits process.

Why is it important to calculate SSDI benefits?

Understanding how to calculate SSDI benefits is crucial for accurately determining your eligibility for disability assistance.