Introduction

Understanding the complexities of Social Security Disability Income (SSDI) is crucial for many Americans who depend on it as a financial lifeline. We know that navigating this system can feel overwhelming. This guide aims to provide a clear pathway through the often-complex calculation process, helping you determine your potential benefits with confidence.

It's common to feel uncertain about how various factors, like work history and inflation adjustments, can impact your SSDI payments. But don’t worry; you’re not alone in this journey. Together, we can explore the steps you need to take to ensure you receive the support you deserve.

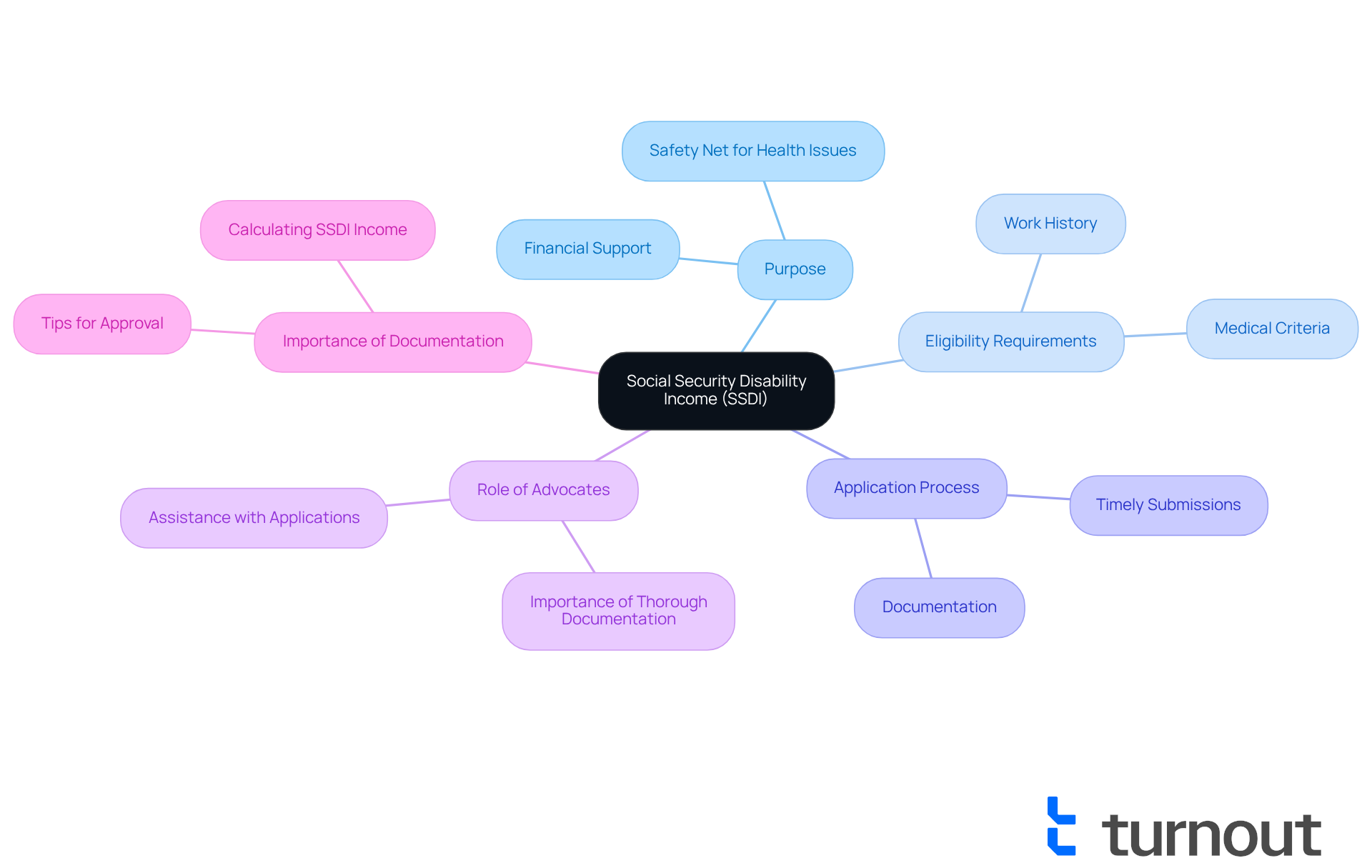

Understand Social Security Disability Income (SSDI)

Social Security Disability Income is a vital federal program designed to provide financial support to those who can’t work due to qualifying disabilities. If you’re considering applying for Social Security Disability Insurance, it’s important to know that you’ll need a solid work history that includes paying Social Security taxes, along with meeting specific medical criteria. As of 2025, around 9 million Americans are receiving these benefits, underscoring the program's role as a crucial lifeline for individuals facing serious health challenges.

We understand that navigating the disability benefits framework can feel overwhelming. It’s not just about financial assistance; it’s also about having a safety net when dealing with complex health issues. Many recipients have successfully gone through the application process, often with the help of advocates who stress the importance of thorough documentation and timely submissions. Disability advocates highlight that learning how to calculate social security disability income can greatly improve your chances of approval, allowing you to present your case more effectively.

In 2025, this program continues to be essential in supporting individuals with disabilities, ensuring access to necessary resources and stability during tough times. As the landscape of disability support evolves, staying informed about Social Security Disability Insurance eligibility and application processes is crucial for anyone seeking help. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Identify Key Factors Affecting SSDI Payments

Several key factors can influence the amount of SSDI payments you may receive, and understanding them is essential for your journey.

-

Work History: We know that the number of years you’ve worked and your earnings during those years are critical. SSDI payments are determined by your average lifetime earnings, meaning that greater earnings can lead to a larger payment amount.

-

Average Indexed Monthly Income: This figure comes from your top-earning years and plays a crucial role in determining your entitlements. The Social Security Administration (SSA) uses your Average Indexed Monthly Earnings to calculate your Primary Insurance Amount (PIA).

-

Primary Insurance Amount (PIA): The PIA is the fundamental figure of your social security disability income, calculated from a formula applied to your AIME. Understanding how your employment background influences your PIA is vital, as it directly affects your monthly payments.

-

Cost of Living Adjustments (COLA): Disability payments are subject to annual adjustments to account for inflation, ensuring that your disbursements maintain their purchasing power over time.

By grasping these factors, you can better anticipate your potential SSDI benefits and learn how to calculate social security disability income effectively. We understand that this can be overwhelming, but Turnout is here to assist you. Our trained nonlawyer advocates are ready to help you understand these elements and navigate the complexities of SSD claims. Remember, Turnout does not provide legal representation, which is important to keep in mind as you seek support. You are not alone in this journey.

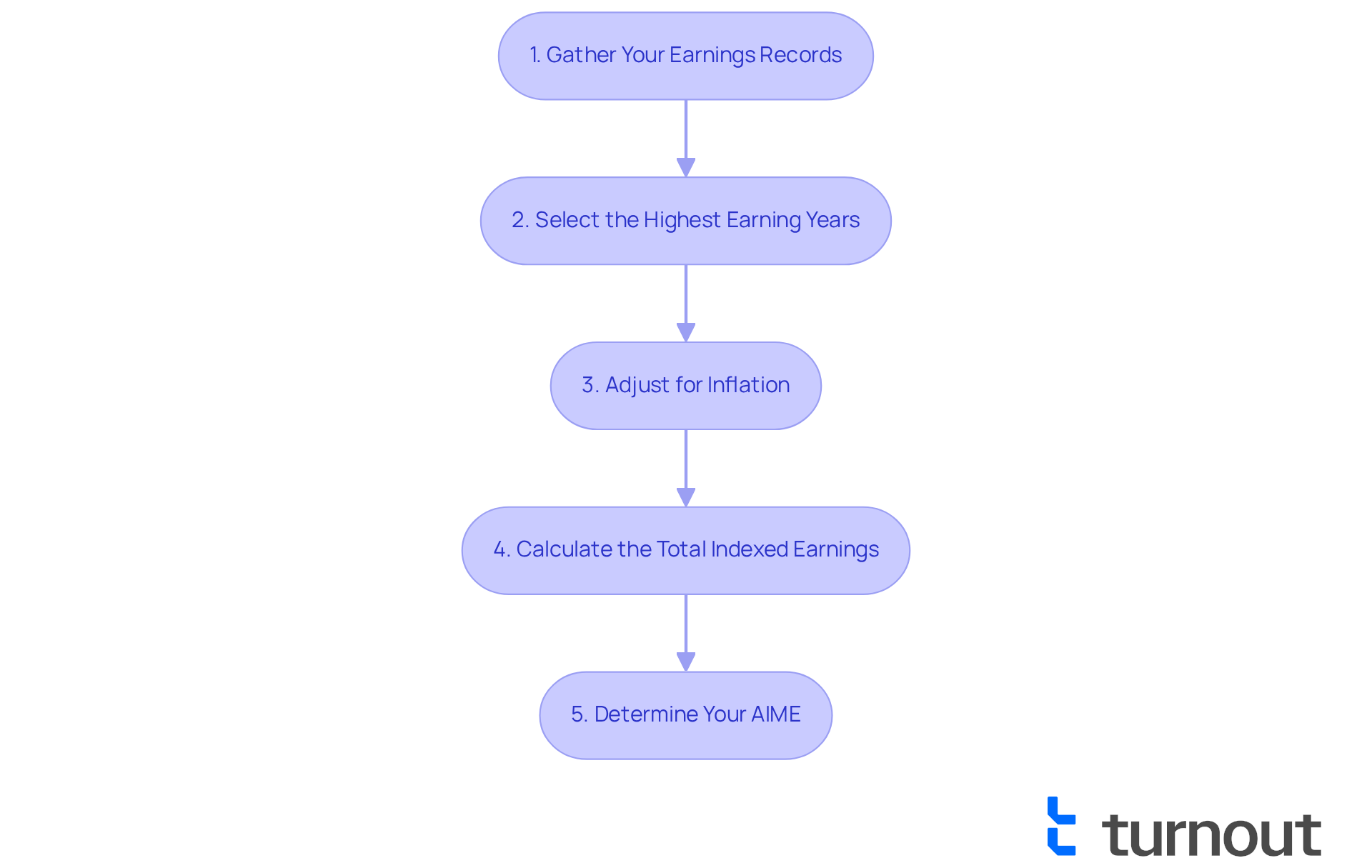

Calculate Your Average Indexed Monthly Earnings (AIME)

Calculating your Average Indexed Monthly Earnings (AIME) can feel overwhelming, but we're here to help you through it. Let’s break it down into manageable steps:

-

Gather Your Earnings Records: Start by collecting your Social Security earnings statements from your working years. This includes reviewing your SSA-1099 forms, which detail your earnings and contributions. We understand that this might seem like a lot, but having these records is essential for an accurate calculation.

-

Select the Highest Earning Years: Next, identify your highest 35 years of earnings. If you have less than 35 years of work history, don’t worry-just include zeros for the missing years. This ensures your calculation remains accurate and fair.

-

Adjust for Inflation: It’s important to adjust each year’s earnings for inflation. The Social Security Administration (SSA) provides specific indexing factors for this purpose, reflecting changes in average wages over time. For 2026, keep in mind that the income subject to Social Security tax will rise to $184,500. This is crucial as it affects your average indexed monthly earnings calculation.

-

Calculate the Total Indexed Earnings: Now, add together the indexed earnings for your highest 35 years. This total will be used to calculate your average indexed monthly earnings.

-

Determine Your AIME: Finally, divide the total indexed earnings by 420 (the number of months in 35 years). This will give you your Average Indexed Monthly Earnings.

Understanding how to calculate social security disability income is vital, as it lays the groundwork for determining your SSDI benefits. Financial advisors emphasize that understanding how to calculate social security disability income, particularly through your Average Indexed Monthly Earnings, can significantly influence your compensation, making it a key aspect of successful financial planning. With the 2.8% cost-of-living adjustment (COLA) for 2026, it’s essential to grasp how inflation impacts your benefits.

You’re not alone in this journey. Many individuals have successfully gathered their earnings records, and their experiences can provide valuable insights into this process. Remember, we’re here to support you every step of the way.

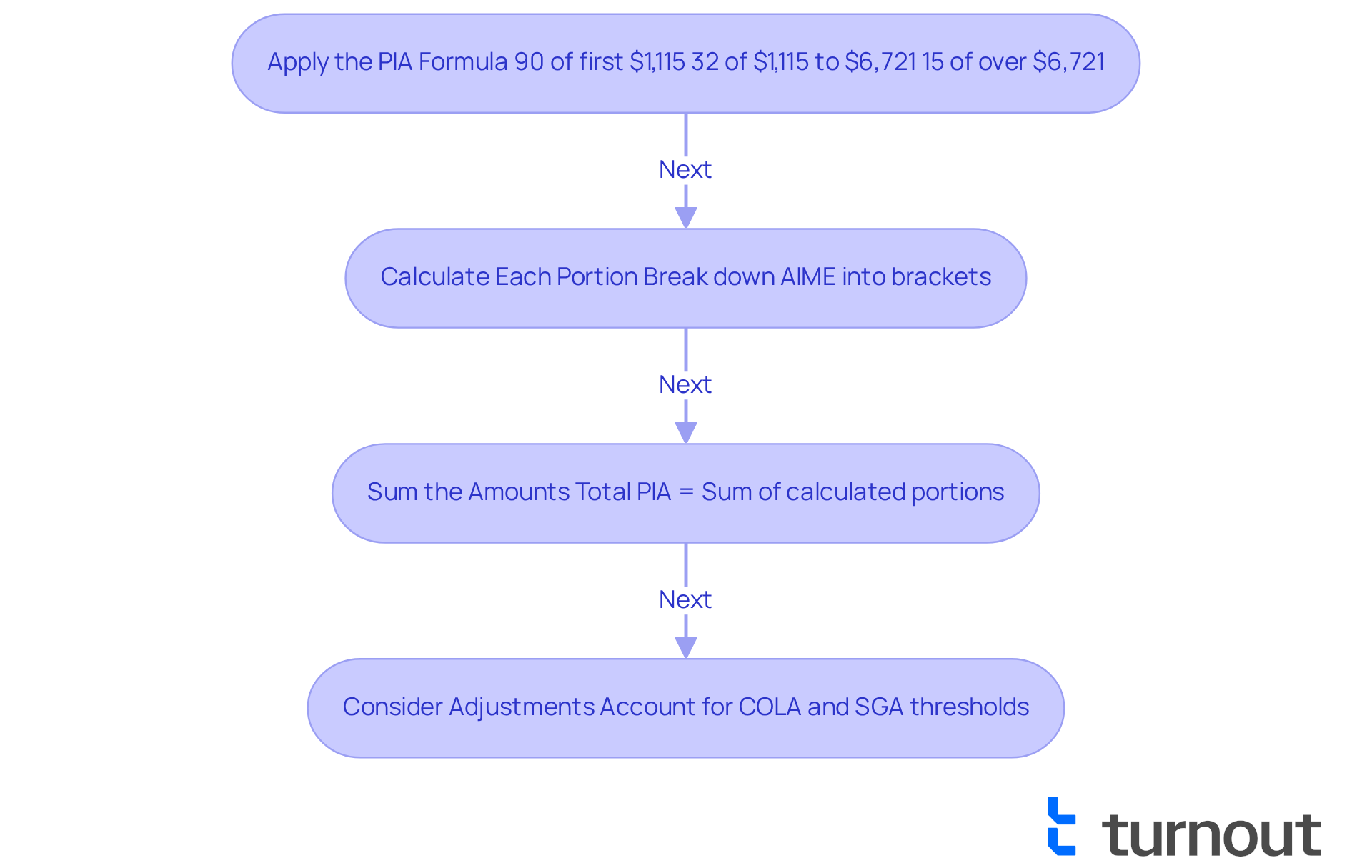

Determine Your Primary Insurance Amount (PIA) and Adjustments

Determining your Primary Insurance Amount (PIA) can feel overwhelming, but we're here to help you through it. Follow these steps to make the process easier:

-

Apply the PIA Formula: The PIA is calculated using a formula that applies different percentages to portions of your Average Indexed Monthly Income (AIME). For 2025, the formula is:

- 90% of the first $1,115 of AIME

- 32% of AIME between $1,115 and $6,721

- 15% of AIME over $6,721

-

Calculate Each Portion: Break down your AIME into the specified brackets to see how much you can gain from each segment. For example, if your AIME is $3,000, you would calculate:

- 90% of $1,115 = $1,003.50

- 32% of the amount between $1,115 and $3,000 (which is $1,885) = $601.20

- 15% of the amount over $6,721 (which is $0 in this case) = $0

-

Sum the Amounts: Now, add the results from each bracket to find your total PIA. Continuing with our example:

- Total PIA = $1,003.50 + $601.20 + $0 = $1,604.70

-

Consider Adjustments: It's important to be aware of any adjustments that may apply, like the Cost of Living Adjustment (COLA). For 2025, disability payments received a 2.5% COLA increase, and a projected 2.7% COLA for 2026 could further enhance your PIA over time. Also, keep in mind the Substantial Gainful Activity (SGA) thresholds for 2025, which are $1,620 per month for non-blind beneficiaries and $2,700 for blind beneficiaries. These thresholds are crucial if you plan to work while receiving disability assistance, as they directly affect your eligibility.

By following these steps, you will understand how to calculate social security disability income and plan your finances accordingly. Understanding how to calculate social security disability income is vital, as it directly impacts your financial stability during disability. Remember, you are not alone in this journey, and we're here to support you every step of the way.

Conclusion

Understanding how to calculate Social Security Disability Income (SSDI) is essential for anyone navigating the complexities of disability benefits. We know this journey can feel overwhelming, but this guide offers a comprehensive overview of the steps involved. From determining your eligibility to calculating your Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA), we’re here to help you grasp these concepts. By doing so, you can take meaningful steps toward securing the financial support you need during challenging times.

Key factors influencing SSDI payments include:

- Your work history

- Average earnings

- Cost-of-living adjustments

Each of these elements plays a crucial role in determining the benefits you may receive. It’s common to feel uncertain about the calculation process, which is why thorough documentation is so important. With the right knowledge and support, you can effectively present your case and improve your chances of approval.

Ultimately, the journey toward securing Social Security Disability Income can be daunting, but it is a vital resource for millions. Staying informed about eligibility requirements and calculation methods empowers you to advocate for yourself and navigate the system with confidence. Whether you seek assistance from advocates or utilize this guide, remember that understanding these processes is a key step toward achieving financial stability in the face of adversity. You are not alone in this journey.

Frequently Asked Questions

What is Social Security Disability Income (SSDI)?

Social Security Disability Income is a federal program that provides financial support to individuals who cannot work due to qualifying disabilities.

Who is eligible to apply for SSDI?

To be eligible for SSDI, applicants must have a solid work history that includes paying Social Security taxes and must meet specific medical criteria.

How many Americans are receiving SSDI benefits as of 2025?

As of 2025, around 9 million Americans are receiving Social Security Disability Income benefits.

Why is SSDI considered important for individuals with disabilities?

SSDI serves as a crucial lifeline for individuals facing serious health challenges, providing financial assistance and a safety net during difficult times.

What role do advocates play in the SSDI application process?

Advocates help applicants navigate the disability benefits framework, emphasizing the importance of thorough documentation and timely submissions to improve chances of approval.

How can understanding SSDI calculations improve my application?

Learning how to calculate Social Security Disability Income can enhance your application by allowing you to present your case more effectively.

What should I do if I need help with the SSDI application process?

If you need help with the application process, consider reaching out for assistance from advocates or organizations that specialize in disability benefits.