Overview

Understanding disability payments can feel overwhelming, but we're here to help you navigate this important process. Two key concepts to grasp are Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA). These figures determine the monthly benefits you may receive, and knowing how to calculate them can make a significant difference in your financial well-being.

To simplify this journey, the article outlines a step-by-step process for calculating these amounts. It's essential to:

- Keep accurate income records

- Consider adjustments for the cost of living

By doing so, you can maximize your benefits and ensure that you receive the support you deserve.

Remember, you are not alone in this journey. Many individuals face similar challenges, and taking the time to understand these concepts can empower you to make informed decisions about your financial future.

Introduction

Understanding how to calculate disability payments can feel overwhelming. The complexities of the Social Security system often loom large, leaving many unsure of where to begin. However, grasping foundational concepts like Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA) is essential for anyone navigating this process. We understand that the stakes are high; a miscalculation can lead to significant financial repercussions.

As you seek to maximize your benefits, consider what strategies you can employ to ensure you receive the full support you deserve. It's common to feel uncertain about the next steps, but you're not alone in this journey. Together, we can explore ways to avoid common pitfalls and secure the assistance you need.

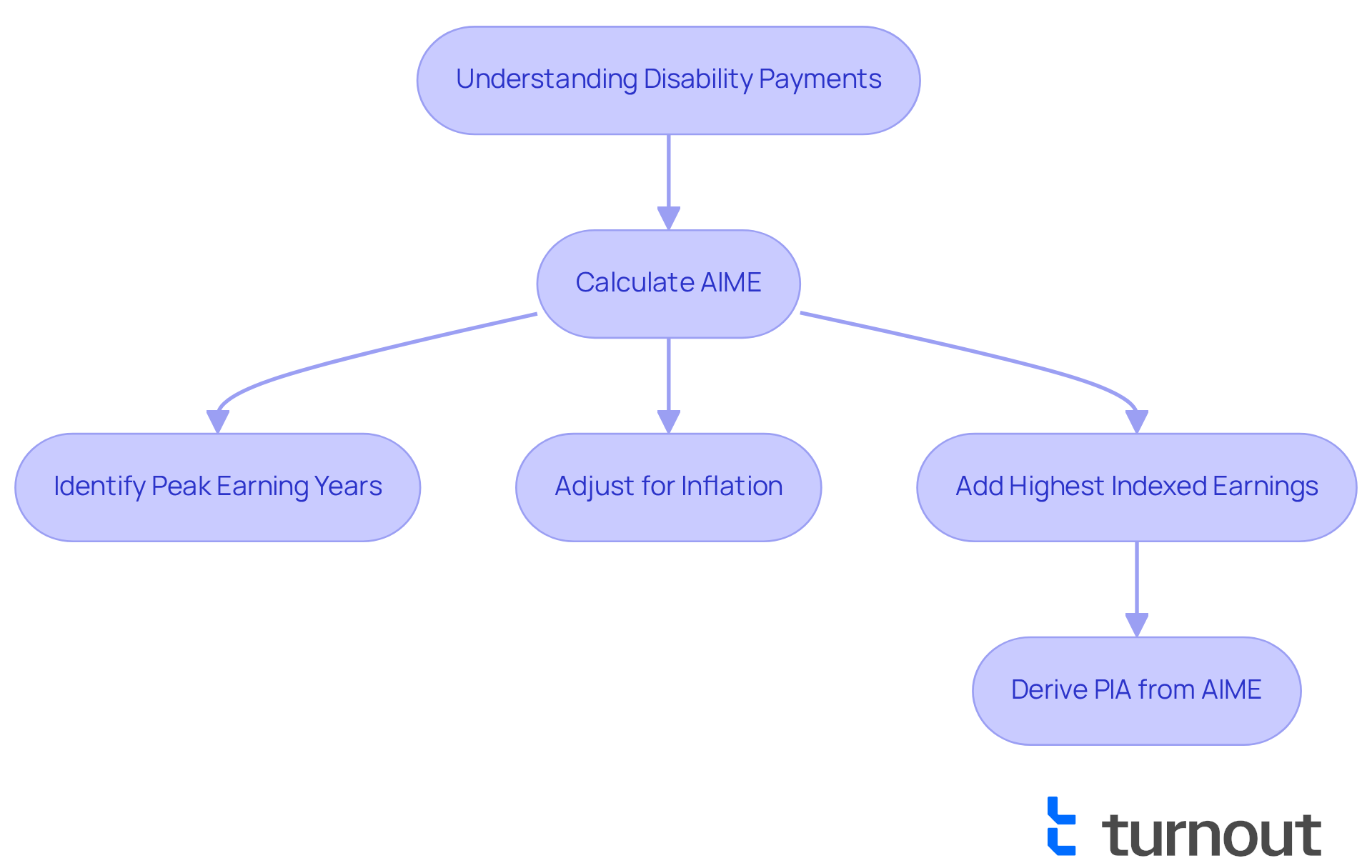

Understand Key Concepts: AIME and PIA

Understanding how to calculate disability payments can feel overwhelming, but we're here to help you navigate this process. Two key concepts are crucial: Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA).

Average Indexed Monthly Earnings reflects your peak earning years—typically the 35 years in which you earned the most. The Social Security Administration (SSA) adjusts these earnings for inflation, ensuring they mirror current wage levels. To understand how to calculate disability payments, you need to add your highest indexed earnings and divide by the total number of months in those years.

To understand how to calculate disability payments, the Primary Insurance Amount is derived from your AIME using a formula that applies specific percentages to different portions of your AIME. This figure determines the monthly assistance you will receive.

Understanding how to calculate disability payments is essential, as this knowledge directly impacts the amount of disability benefits you can expect. At Turnout, we provide valuable tools and services, including support from trained nonlawyer advocates and IRS-licensed enrolled agents. We’re committed to guiding you through these calculations and the complexities of SSD claims, ensuring you have the assistance you need without the burden of legal representation. You're not alone in this journey—we're here to support you every step of the way.

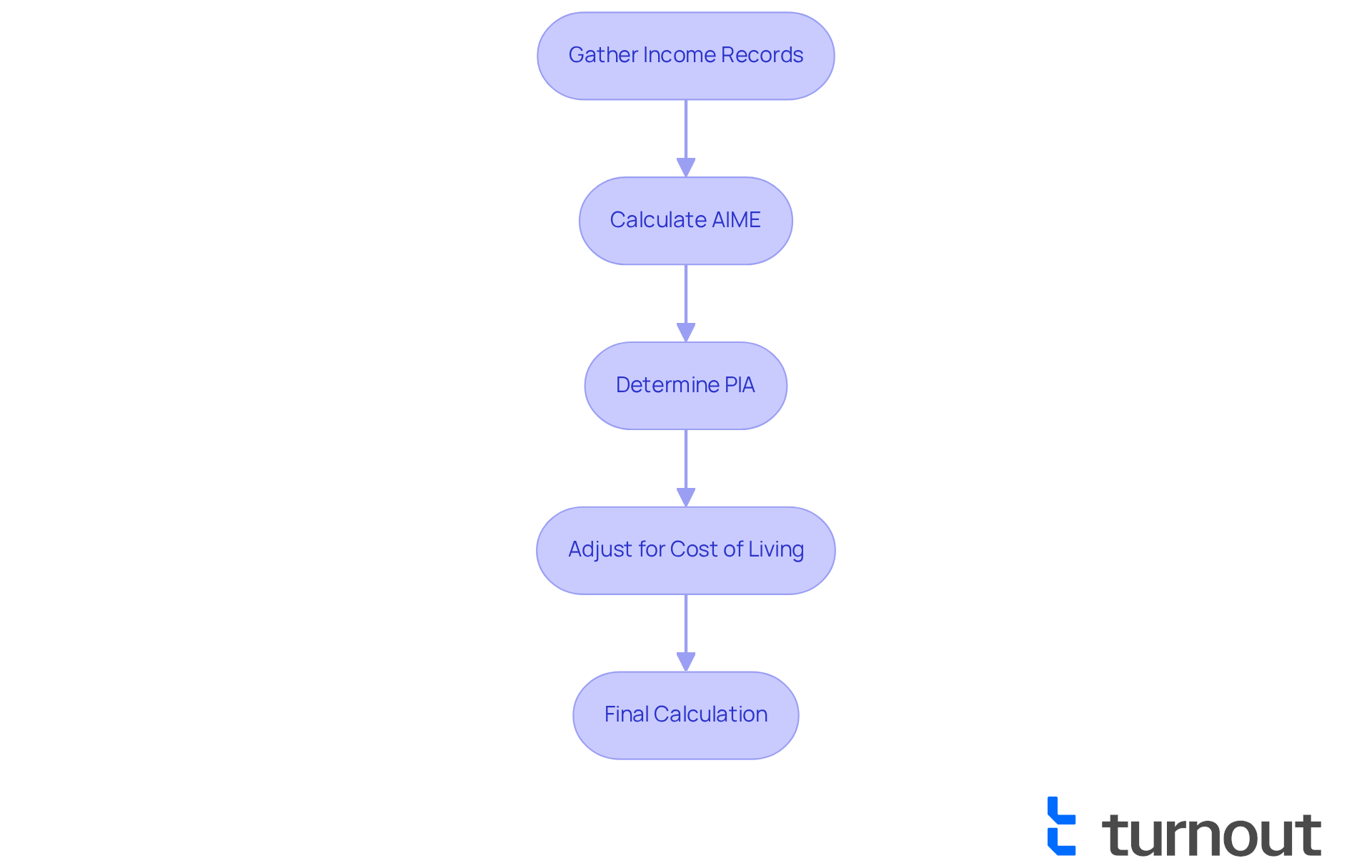

Calculate Your SSDI Payment: Step-by-Step Process

Calculating how to calculate disability payments can feel overwhelming, but we're here to help you through the process. Follow these steps to ensure you understand the process and maximize your benefits:

-

Gather Your Income Records: Start by collecting your Social Security income statements from the past 3 years. This information is vital for determining your Average Indexed Monthly Earnings (AIME). It's important to consistently track your income records, as even small errors can lead to significant financial losses. For instance, a $1,000 mistake could reduce your benefits by over $100 each year for a lifetime. This highlights the importance of accuracy in your financial records, which is essential for knowing how to calculate disability payments.

-

Calculate Your AIME:

- Identify your highest-earning years and adjust those earnings for inflation.

- Add the adjusted earnings together and divide by the total number of months (20 months for 3 years) to find your Average Indexed Monthly Earnings.

-

Determine Your Primary Insurance Amount (PIA):

- Use the Social Security Administration's (SSA) formula to calculate your PIA based on your AIME. This formula typically involves applying different percentages to portions of your AIME:

- 90% of the first $1,111 of AIME

- 32% of AIME between $1,111 and $6,721

- 15% of AIME above $6,721

- Add these amounts together to arrive at your PIA.

- Use the Social Security Administration's (SSA) formula to calculate your PIA based on your AIME. This formula typically involves applying different percentages to portions of your AIME:

To understand the process, it's essential to learn how to calculate disability payments. Adjust for Cost of Living: Remember, understanding how to calculate disability payments may require adjustments each year based on the Cost of Living Adjustment (COLA). This ensures your benefits keep pace with inflation.

Final Calculation: Your monthly SSDI payment will be your PIA, which demonstrates how to calculate disability payments that you will receive each month.

Currently, over 800,000 Americans are waiting for payments from Social Security Disability Insurance, and many are facing delays that can be life-altering. Tragically, thousands of Americans pass away before receiving any payments. This underscores the importance of ensuring the accuracy of your income record to maximize your benefits, including disability, survivors, and retirement. The SSA recommends reviewing your income records in August, when updated information is available, to help avoid potential financial losses. Remember, you are not alone in this journey; Turnout's trained nonlawyer advocates are here to assist you in understanding these calculations and ensuring you receive the financial support you deserve.

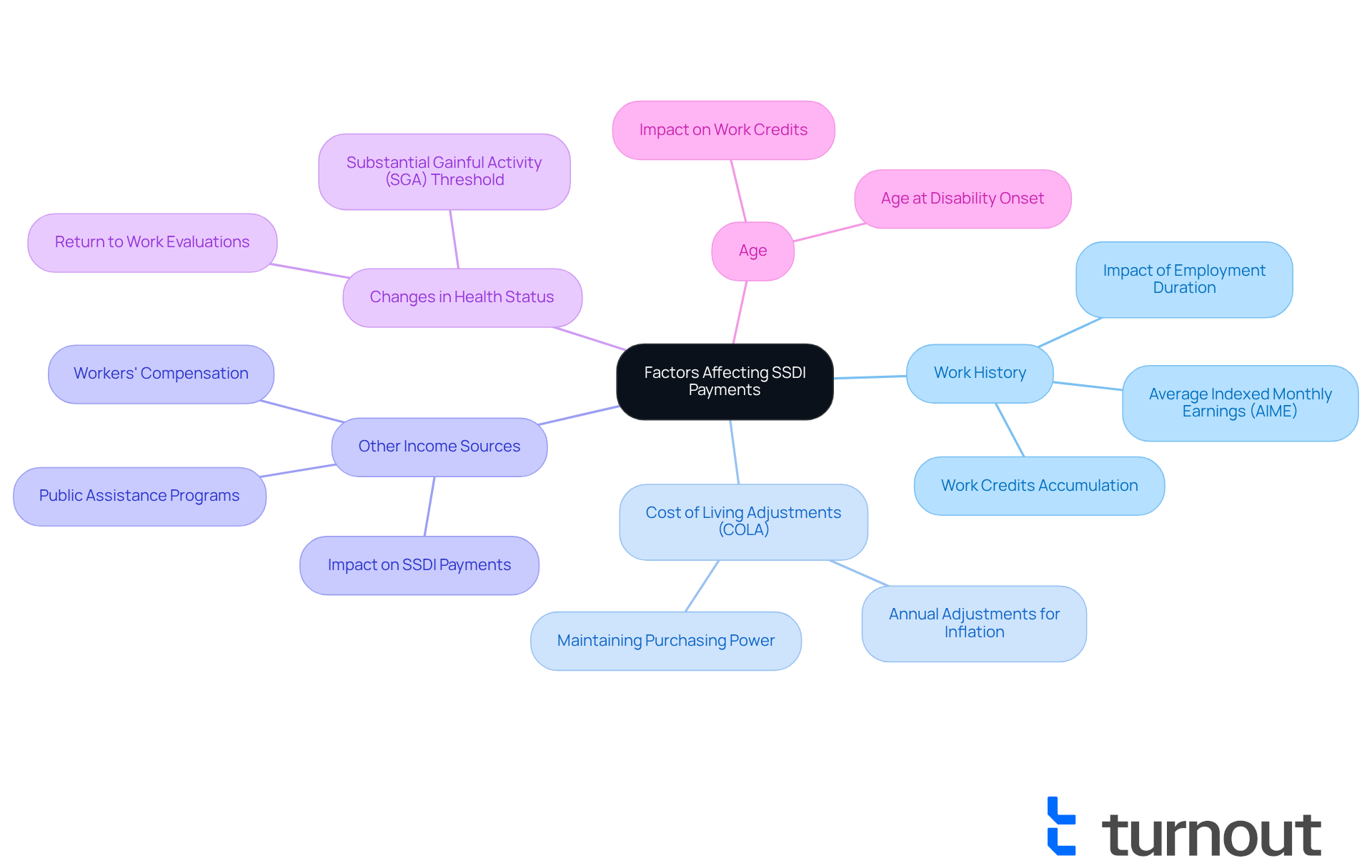

Identify Factors Affecting Your SSDI Payments

Several factors can significantly influence your SSDI payments, and it's important to understand them as you navigate this journey.

- Work History: The duration of your employment and your earnings during those years are crucial in determining your Average Indexed Monthly Earnings (AIME), which directly affects your SSDI payment. Greater lifetime earnings typically result in increased advantages, as the Social Security Administration (SSA) employs a formula that substitutes a larger percentage of earnings for lower-income workers. If you have a strong employment background, you may find that you receive larger disability payments. However, if you’ve experienced interruptions in your job history, it’s common to feel concerned about reduced financial assistance.

- Cost of Living Adjustments (COLA): Payments from Social Security Disability Insurance are modified every year to reflect inflation. This ensures that your monthly payment remains aligned with increasing living expenses, helping to preserve the purchasing power of your benefits.

- Other Income Sources: If you obtain extra income, such as workers' compensation or specific public assistance, your disability payment may be decreased. Understanding how these sources interact with your disability support is crucial for effective financial planning, and we’re here to help you navigate these complexities.

- Changes in Health Status: Improvements in your health that enable you to return to work can influence your SSDI entitlements. The SSA performs regular evaluations to determine your eligibility. It’s important to know that if you surpass the Substantial Gainful Activity (SGA) threshold, it may result in a reduction or termination of assistance.

- Age: Your age at the time of disability onset can influence your entitlements. Younger individuals may qualify for reduced advantages due to fewer work credits, while older individuals may possess a more extensive work history that can increase their payment amounts.

Turnout provides access to tools and services that help consumers navigate these complexities, including assistance with SSD claims through trained nonlawyer advocates. Grasping these dynamics is essential for optimizing your disability support and securing financial stability. Furthermore, the SSA offers resources to calculate disability support, which can be a useful asset for understanding your possible payments. As a disability advocate points out, "Understanding how to enhance your Social Security Disability Insurance payments can be a game changer.

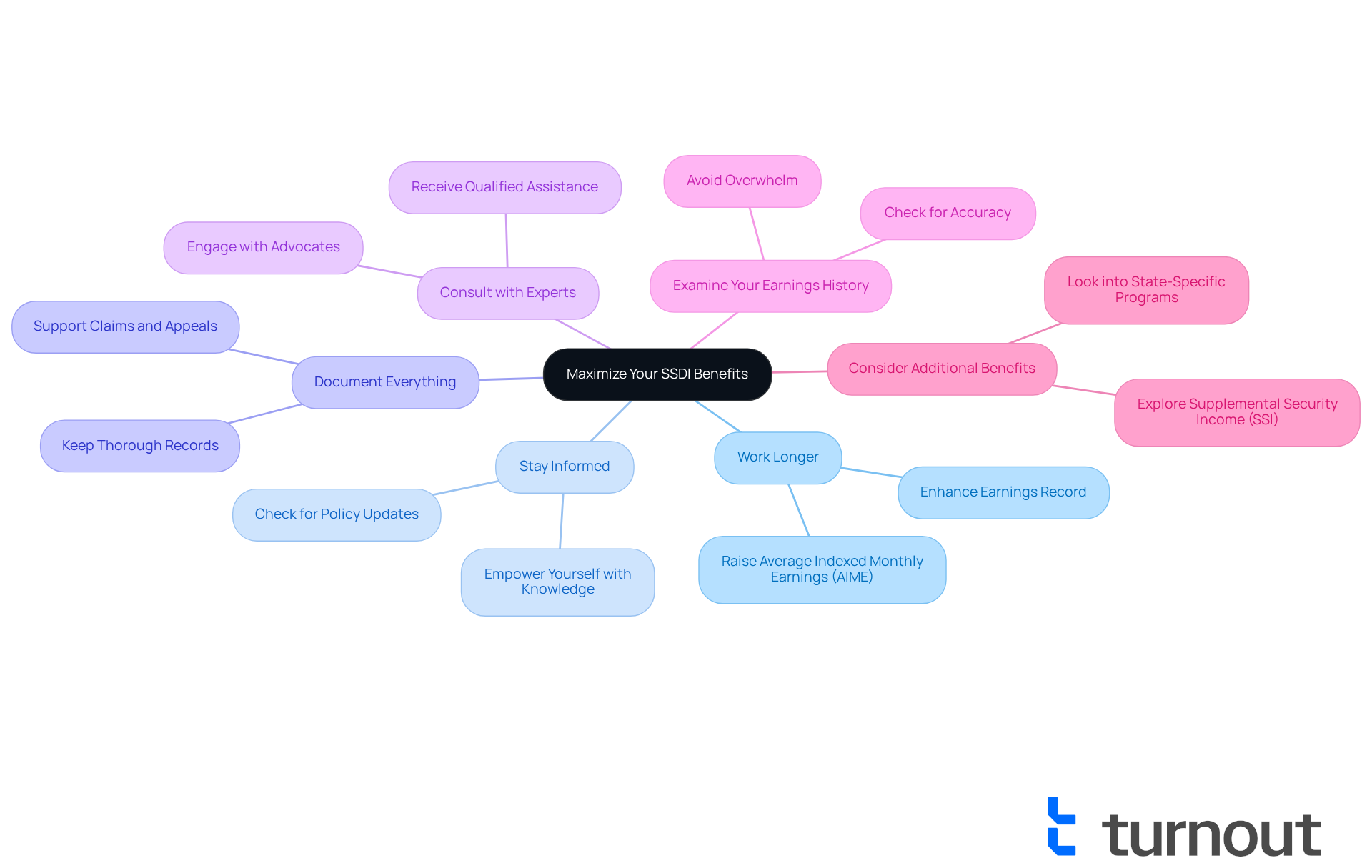

Maximize Your SSDI Benefits: Practical Tips

To maximize your SSDI benefits, we understand how to calculate disability payments can be a challenging process. Here are some practical tips that may help you along the way:

- Work Longer: If possible, continuing to work can enhance your earnings record, which might raise your Average Indexed Monthly Earnings (AIME).

- Stay Informed: It's important to regularly check for updates on SSDI policies. Changes could impact your benefits, and being informed is empowering.

- Document Everything: Keeping thorough records of your medical conditions and treatments is crucial. This documentation can support your claims and appeals, giving you a stronger case.

- Consult with Experts: Engaging with advocates or professionals who specialize in disability entitlements can be incredibly beneficial. They can ensure you receive all the assistance you qualify for.

- Examine Your Earnings History: Regularly checking your Social Security earnings history for accuracy is essential. Mistakes can affect how to calculate disability payments, and it's common to feel overwhelmed by this process.

- Consider Additional Benefits: Exploring other assistance programs, such as Supplemental Security Income (SSI) or state-specific programs, may complement your SSDI benefits.

Remember, you're not alone in this journey. We're here to help you every step of the way.

Conclusion

Understanding how to calculate disability payments is crucial for anyone navigating the complexities of Social Security Disability Insurance (SSDI). We understand that this process can feel overwhelming. This guide has illuminated the essential components, such as Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA), which form the foundation of your potential benefits. By grasping these concepts, you can better anticipate your financial support and make informed decisions.

The article has detailed a step-by-step process for calculating SSDI payments, emphasizing the importance of:

- Accurate income records

- The method to determine AIME

- The subsequent calculation of PIA

It's common to feel uncertain about how various factors influence SSDI payments, including:

- Work history

- Cost of living adjustments

- Changes in health status

Each of these elements plays a vital role in ensuring that you receive the maximum benefits you are entitled to.

Ultimately, the journey to securing disability payments can be daunting, but it is made easier with the right knowledge and resources. Engaging with trained advocates, regularly reviewing income records, and staying informed about policy changes can significantly enhance your understanding and management of SSDI benefits. By taking proactive steps, remember, you are not alone in this journey; we’re here to help you ensure you receive the financial support you need to navigate your challenges effectively.

Frequently Asked Questions

What are Average Indexed Monthly Earnings (AIME)?

Average Indexed Monthly Earnings (AIME) reflects your peak earning years, typically the 35 years in which you earned the most. The Social Security Administration (SSA) adjusts these earnings for inflation to mirror current wage levels.

How is AIME calculated?

AIME is calculated by adding your highest indexed earnings and dividing that total by the total number of months in those years.

What is the Primary Insurance Amount (PIA)?

The Primary Insurance Amount (PIA) is derived from your AIME using a formula that applies specific percentages to different portions of your AIME. It determines the monthly assistance you will receive.

Why is it important to understand how to calculate disability payments?

Understanding how to calculate disability payments is essential because it directly impacts the amount of disability benefits you can expect to receive.

What support does Turnout provide for calculating disability payments?

Turnout provides valuable tools and services, including support from trained nonlawyer advocates and IRS-licensed enrolled agents, to help guide you through the calculations and complexities of SSD claims.