Overview

Navigating the process of calculating disability benefits can be challenging, especially when considering the two main programs available in the U.S. We understand that many individuals may feel overwhelmed.

- Social Security Disability Insurance (SSDI) is designed for those with a work history, while

- Supplemental Security Income (SSI) caters to low-income individuals.

Each program has specific eligibility criteria and benefit calculations that can seem daunting.

In this article, we outline a step-by-step process to help you determine your benefits. We emphasize the importance of factors like your work history and Average Indexed Monthly Earnings (AIME). Remember, you are not alone in this journey; there are online resources available to assist you in accurately assessing your potential financial support.

We encourage you to take the first step toward understanding your options. By exploring these resources, you can gain clarity and confidence in your situation. It's common to feel uncertain, but with the right information, you can navigate this process more easily.

Introduction

Navigating the intricate world of disability benefits can feel overwhelming for many individuals facing physical or mental challenges. We understand that this journey can be daunting. With two primary programs—Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI)—offering crucial financial support, it's essential to grasp how to accurately calculate these benefits. This understanding is vital for maximizing assistance and ensuring your financial stability.

However, the complexity of eligibility criteria, income assessments, and the impact of work history can leave many feeling lost. It's common to feel unsure about where to begin. How can you effectively demystify the calculation process and secure the benefits you rightfully deserve? We're here to help you navigate these challenges with clarity and support.

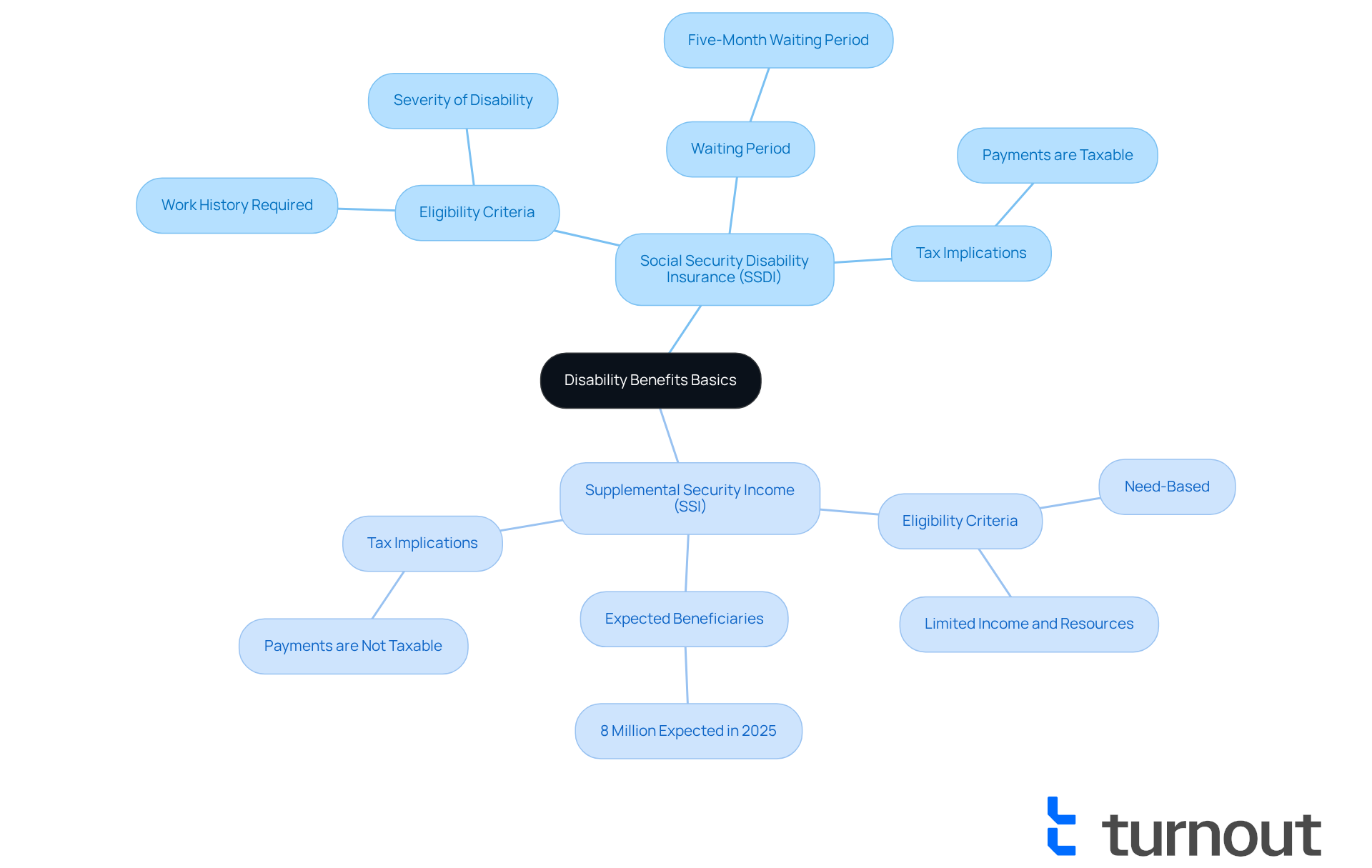

Understand Disability Benefits Basics

Disability assistance programs are vital financial support systems crafted to help individuals who cannot work due to physical or mental challenges. We understand that navigating these options can be overwhelming, but there are two primary types of disability benefits available in the United States that can provide relief:

-

Social Security Disability Insurance (SSDI): This program is designed for individuals with a work history who have contributed to Social Security taxes. Eligibility depends on both the severity of the disability and the individual’s work history. It's important to note that there is a five-month waiting period for disability benefits to begin after approval. Turnout offers compassionate support through trained non-legal advocates who assist clients in navigating the complexities of disability claims, ensuring they receive the help they need.

-

Supplemental Security Income (SSI): In contrast to SSDI, this program is need-based, providing financial assistance to individuals with limited income and resources, regardless of their work history. In 2025, approximately 8 million people are expected to receive SSI assistance, highlighting its crucial role in supporting low-income disabled individuals. Turnout also helps clients understand and apply for SSI support, utilizing a streamlined online application process established by the Social Security Administration.

In addition to disability support, Turnout provides services related to tax debt relief, aiding clients in effectively managing their financial responsibilities. Understanding how to calculate disability benefits is essential for accurately determining the distinctions between these programs. For instance, Social Security Disability Insurance payments are subject to taxation, while Supplemental Security Income payments are not, which can significantly impact financial planning.

Real-life stories, such as Arna's journey, who successfully navigated the challenges of Social Security Disability Insurance with the guidance of a Work Incentive Planner, illustrate how personalized support can lead to improved outcomes and financial stability. By grasping the fundamentals of how to calculate disability benefits through disability assistance programs and supplemental security income, you can better manage the application process and maximize your benefits with the expert support provided by Turnout. Remember, you are not alone in this journey, and we are here to help.

Identify Key Factors Affecting Benefit Calculations

Navigating the calculation of disability benefits can feel overwhelming, but understanding a few key factors can help ease your journey:

-

Work History: The number of work credits you earn through employment plays a crucial role in determining your eligibility and payment amounts for Social Security Disability Insurance. Typically, you will need 40 credits, with at least 20 acquired in the last 10 years. As we look ahead to 2025, this requirement remains unchanged, highlighting the importance of a solid work history.

-

Average Indexed Monthly Earnings (AIME): Your AIME, calculated based on your highest-earning years, is vital for determining your SSDI benefits. For instance, if your AIME is $2,000, your monthly payment might be around $1,200, depending on other influencing factors.

-

Disability Severity: The Social Security Administration (SSA) evaluates the severity of your disability through medical evidence, significantly impacting your eligibility and the level of assistance you may receive. Recent discussions among social security experts suggest that medical evidence from psychologists and psychiatrists may carry more weight for mental health-related claims.

-

Income and Resources: When applying for SSI, your income and assets are assessed to establish eligibility and payment amounts. To qualify, you must have limited income and resources. In 2025, the maximum monthly SSI assistance is set at $967 for individuals and $1,450 for couples, reflecting ongoing adjustments to support those in need.

Additionally, a 2.5% cost-of-living adjustment (COLA) for SSDI and SSI recipients is anticipated, which is crucial for understanding potential changes in your support.

By understanding these elements, you can better navigate how to calculate disability benefits, ensuring you are informed about your potential benefits. Remember, you are not alone in this journey; we are here to help you every step of the way.

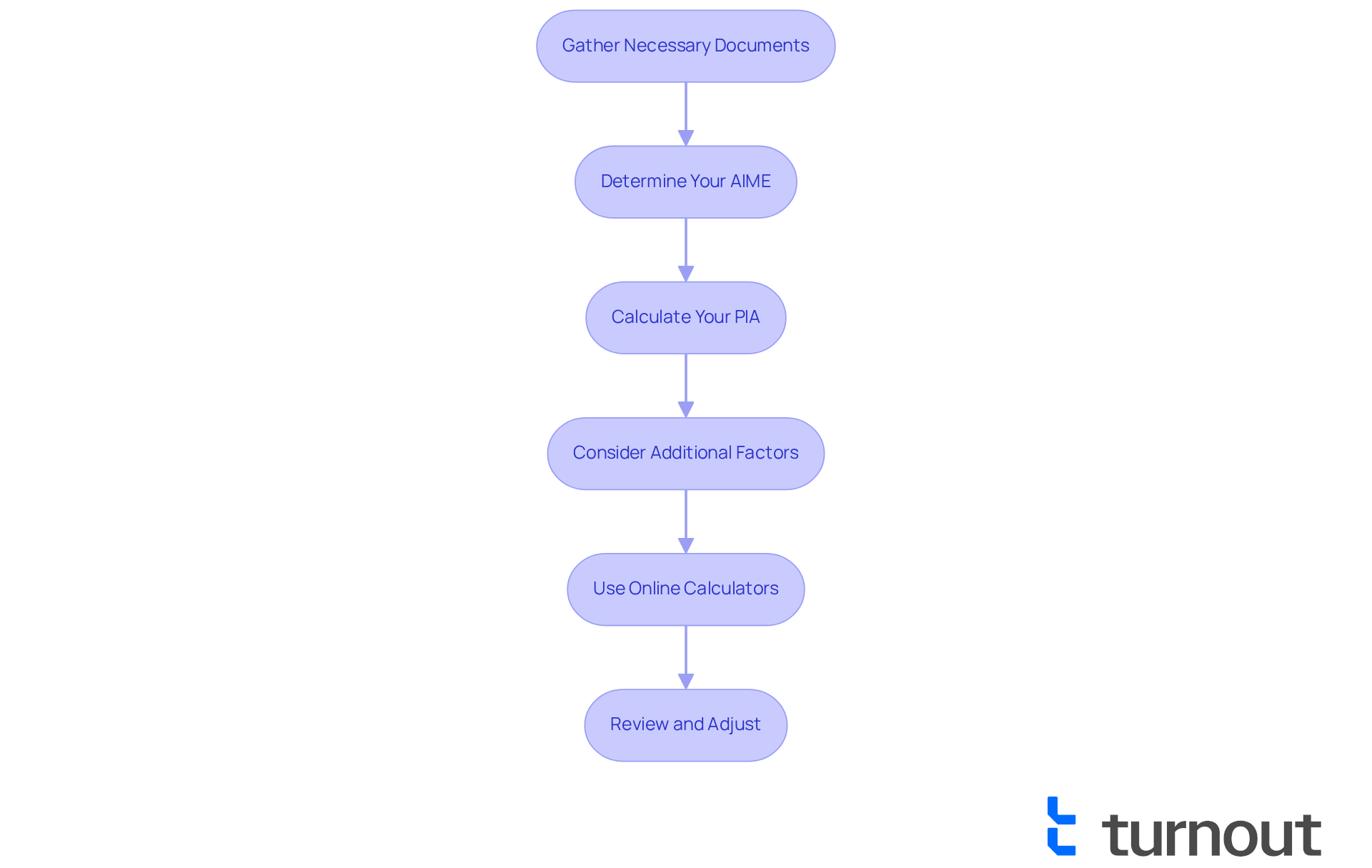

Calculate Your Disability Benefits Step-by-Step

Understanding how to calculate disability benefits can feel overwhelming, but we're here to help you through it. By following these steps, you can gain clarity and confidence in your journey.

-

Gather Necessary Documents: Start by collecting your work history, tax returns, and medical records. Having these documents organized is crucial for accurate calculations and can significantly streamline the application process.

-

Determine Your AIME: Next, calculate your Average Indexed Monthly Earnings (AIME) by averaging your highest-earning years, specifically up to 35 years of earnings. The Social Security Administration (SSA) offers online calculators to assist with this important calculation.

-

Calculate Your Primary Insurance Amount (PIA): Your PIA, which is derived from your AIME, plays a vital role in determining your SSDI assistance. For 2025, the PIA calculation includes:

- 90% of the first $1,226 of AIME

- 32% of earnings between $1,226 and $7,391

- 15% of earnings over $7,391

-

Consider Additional Factors: If you're also applying for Supplemental Security Income (SSI), it's essential to assess your income and resources to ensure they meet eligibility limits. As of December 2023, the average monthly SSI payment was $675, underscoring the importance of understanding your financial situation.

-

Use Online Calculators: Take advantage of tools like the SSA's calculators to input your data and receive an estimate of your monthly payments. These calculators can provide a clearer picture of how to calculate disability benefits based on your unique circumstances.

-

Review and Adjust: After calculating, take a moment to examine your figures. Adjust for any changes in income or work history that may impact your entitlements. Regularly updating your information is crucial, especially if your financial situation changes.

By adhering to these steps, you can reach a knowledgeable assessment of your possible support allowances. Remember, navigating the Social Security system can be complex, but you are not alone in this journey. Together, we can manage the intricacies with assurance.

Access Tools and Resources for Accurate Calculations

To assist you in accurately calculating your disability benefits, we want to share some helpful tools and resources that can make this process easier for you:

-

Social Security Administration (SSA) Calculators: We understand that navigating the world of disability benefits can be overwhelming. The SSA provides various online calculators that show how to calculate disability benefits based on your earnings and work history. These tools are essential for understanding your possible advantages and can be accessed through the SSA's official website. With the forthcoming 2.5% rise in advantages for 2025, it’s crucial to utilize these calculators to understand how to calculate disability benefits and how these changes may impact you.

-

State-Specific Impairment Insurance Payment Amounts: Each state has its own impairment insurance regulations and compensation structures, which can be confusing. For instance, California's Employment Development Department (EDD) provides a Disability Insurance Calculator that assists residents in learning how to calculate disability benefits according to local guidelines. We encourage you to check your state's insurance website for customized estimates. Engaging with local advocacy groups can also help you navigate these resources effectively.

-

Veterans Affairs (VA) Compensation Rates: If you are a veteran, you have access to resources that can help you calculate your compensation based on your impairment rating. The VA's dedicated site for compensation offers comprehensive details and resources, ensuring that veterans understand their entitlements.

-

Community Resources: We know that local advocacy groups and non-profit organizations often provide valuable support for individuals managing the intricacies of support programs. For example, organizations like the National Disability Rights Network can offer personalized assistance tailored to your specific situation.

-

Turnout's Expert Guidance: Turnout provides access to trained nonlawyer advocates who can assist you in navigating the complexities of SSD claims and other financial support systems. It’s important to note that Turnout is not a law firm and does not provide legal representation. However, their expertise can help simplify the process and ensure you are informed about your options.

By leveraging these tools and resources, including Turnout's expert guidance, you can enhance your understanding of how to calculate disability benefits accurately. Remember, you are not alone in this journey. Stay informed about any changes in the system, including the new appointment-based system for services starting January 6, 2025. We’re here to help you every step of the way.

Conclusion

Understanding how to calculate disability benefits is essential for individuals seeking financial support due to disabilities. We recognize that this process can be overwhelming. This guide has illuminated the intricacies of two primary programs—Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI)—and emphasized the importance of knowing how these benefits are calculated and accessed.

Key factors affecting benefit calculations include:

- Work history

- Average Indexed Monthly Earnings (AIME)

- Severity of the disability

These elements play a significant role in determining eligibility and payment amounts. It's common to feel uncertain about these factors, but utilizing available tools and resources, such as SSA calculators and local advocacy groups, can simplify the process. By doing so, you can ensure that you are well-informed about your options.

Ultimately, navigating the world of disability benefits may seem daunting, but with the right knowledge and support, you can effectively manage your applications and maximize your assistance. Remember, you are not alone in this journey. It is crucial to stay updated on changes in the system and to seek guidance from experts. By taking proactive steps and utilizing the resources at hand, you can secure the financial stability you deserve.

Frequently Asked Questions

What are the main types of disability benefits available in the United States?

The two primary types of disability benefits are Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

Who is eligible for Social Security Disability Insurance (SSDI)?

SSDI is designed for individuals with a work history who have contributed to Social Security taxes. Eligibility is based on the severity of the disability and the individual’s work history.

Is there a waiting period for SSDI benefits?

Yes, there is a five-month waiting period for disability benefits to begin after approval for SSDI.

What is Supplemental Security Income (SSI)?

SSI is a need-based program that provides financial assistance to individuals with limited income and resources, regardless of their work history.

How many people are expected to receive SSI assistance in 2025?

Approximately 8 million people are expected to receive SSI assistance in 2025.

Are SSDI payments subject to taxation?

Yes, SSDI payments are subject to taxation, while SSI payments are not.

How can Turnout assist individuals with disability claims?

Turnout offers compassionate support through trained non-legal advocates who help clients navigate the complexities of disability claims and understand the application process for both SSDI and SSI.

What additional services does Turnout provide?

In addition to disability support, Turnout provides services related to tax debt relief, helping clients manage their financial responsibilities.

Can you provide an example of someone who successfully navigated the SSDI process?

An example is Arna, who successfully navigated the challenges of SSDI with the guidance of a Work Incentive Planner, illustrating how personalized support can lead to improved outcomes and financial stability.