Overview

Understanding the calculation of Social Security Disability Insurance (SSDI) benefits can feel overwhelming. We recognize that navigating this process is often filled with uncertainty and concern. Several key factors play a role in determining the financial support you receive, including:

- Your work history

- Average Indexed Monthly Earnings (AIME)

- The Primary Insurance Amount (PIA)

This article provides a step-by-step guide to help you through the calculation of these benefits. It emphasizes the importance of maintaining accurate earnings records and highlights how various elements, such as the severity of your disability and potential regulatory changes, can impact the assistance you receive. Remember, you are not alone in this journey; we’re here to help you ensure that you receive the correct amount of support.

If you have any questions or need further assistance, please don’t hesitate to reach out. Your well-being is important to us, and we want to ensure you have all the resources you need.

Introduction

Understanding the intricacies of Social Security Disability Insurance (SSDI) is crucial for millions who rely on this program for financial support during challenging times. We understand that as the number of recipients grows, so does the complexity surrounding how benefits are calculated. This guide offers a comprehensive breakdown of the factors influencing SSDI calculations, empowering you to navigate the often daunting process with clarity and confidence.

But what happens when unexpected challenges arise, or when the calculations seem overwhelmingly complicated? You're not alone in this journey. We're here to help you through it.

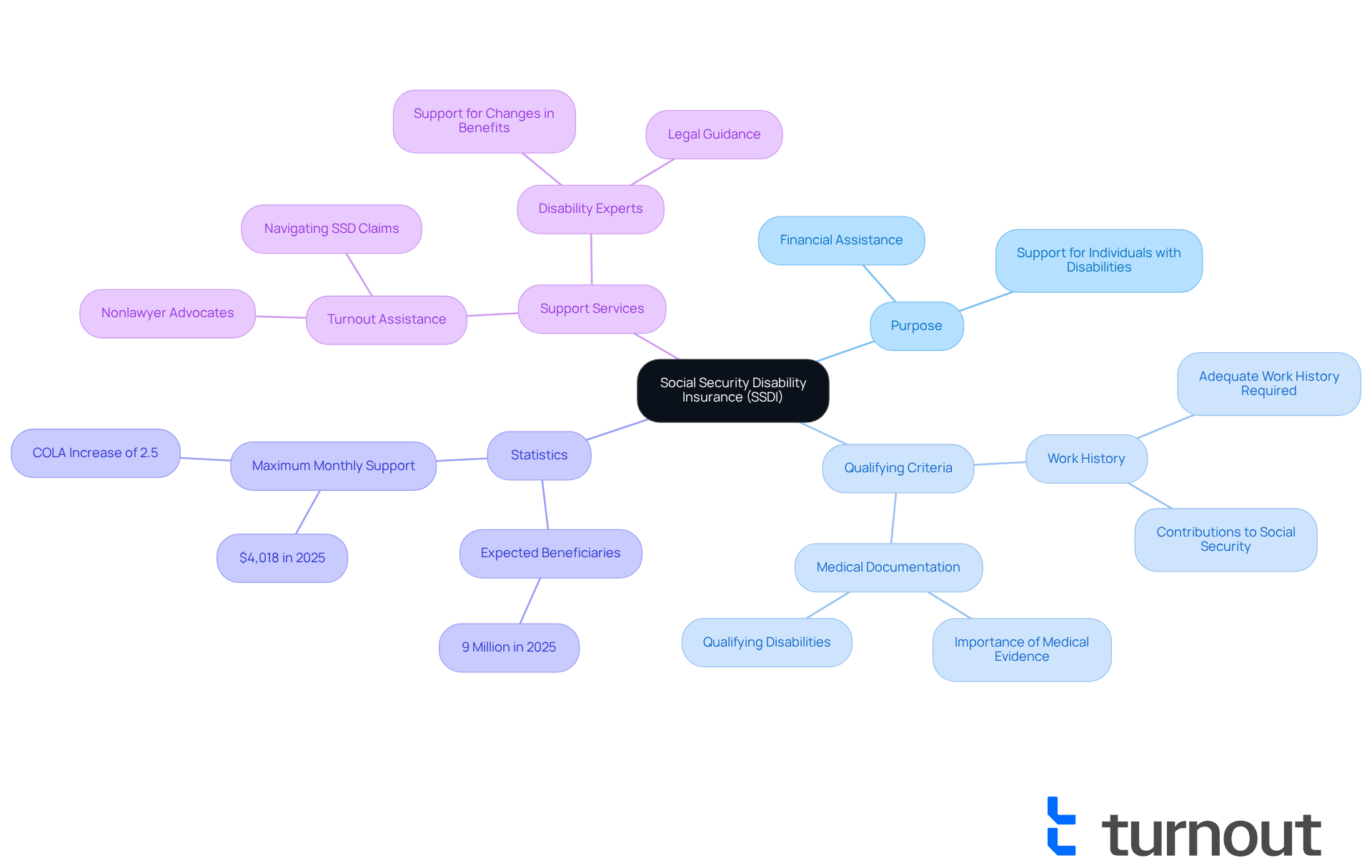

Define Social Security Disability Insurance (SSDI)

Disability Insurance is a vital federal program that offers financial assistance to individuals unable to work due to qualifying disabilities. We understand that navigating this process can be overwhelming, and it's important to know that help is available. To qualify for disability benefits, applicants need to demonstrate an adequate work history and have contributed to Social Security through payroll taxes. This program is designed specifically for those whose disabilities prevent them from securing gainful employment, ensuring they have a reliable income during challenging times.

In 2025, approximately 9 million individuals are expected to receive disability support, highlighting the program's crucial role in providing financial stability for those in need. The highest monthly disability support amount for 2025 is set at $4,018, reflecting the program's commitment to helping recipients maintain their quality of life. Additionally, a cost-of-living adjustment (COLA) of 2.5% will enhance assistance, offering further financial relief.

Understanding the complexities of Social Security Disability Insurance, including the importance of medical documentation for qualifying, is essential for successfully navigating the support system. We recognize that this can be a daunting task, but Turnout is here to help. Utilizing trained nonlawyer advocates, Turnout assists clients in navigating SSD claims. It’s important to note that Turnout is not a legal practice and does not provide legal guidance or advocacy, ensuring that individuals seeking assistance can access the support they need without the complications of legal representation.

You are not alone in this journey. We are here to help you every step of the way.

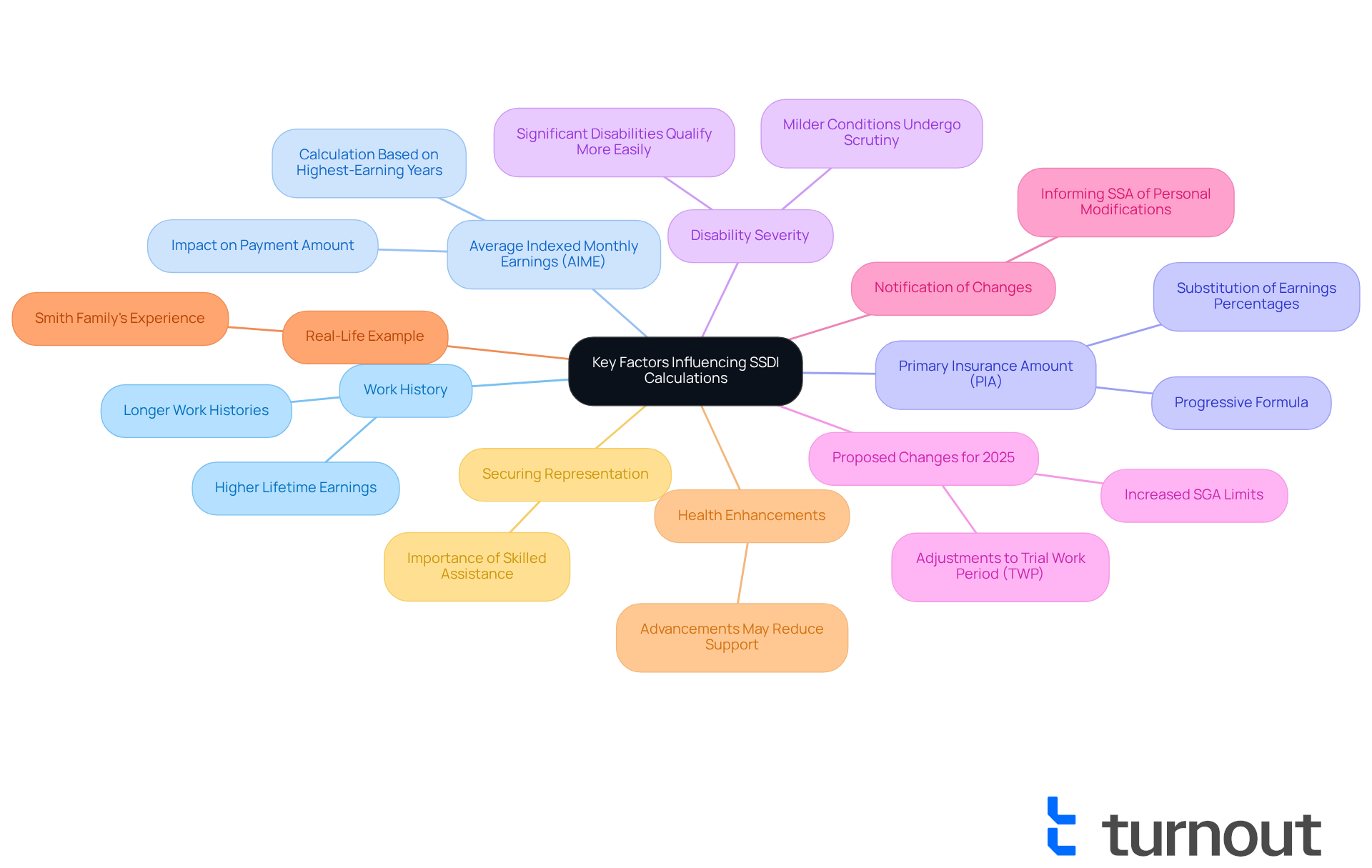

Identify Key Factors Influencing SSDI Calculations

Several key factors influence the calculation of SSDI benefits:

-

Work History: We understand that your work history plays a crucial role in determining your eligibility and payment amount. The number of years you've contributed to Social Security can make a significant difference. Typically, individuals with longer work histories and higher lifetime earnings enjoy greater advantages. For instance, those with a robust work history may find their SSDI payments reflect their contributions more favorably compared to those with shorter work histories.

-

Average Indexed Monthly Earnings (AIME): This important figure is calculated based on your highest-earning years, adjusted for inflation. It's vital in determining your payment amount. In 2025, AIME will consider up to 35 years of indexed earnings, ensuring your entitlement accurately reflects your lifetime earnings. For example, if your AIME is $4,000, your Social Security Disability Insurance payment would be approximately $1,925.70, calculated using the Primary Insurance Amount (PIA) formula.

-

Primary Insurance Amount (PIA): The PIA is the foundational figure used to compute your SSDI payments, derived from your AIME. The PIA formula is progressive, meaning it substitutes a greater percentage of lower earnings and a smaller percentage of higher earnings. This indicates that lower earners gain more proportionately from the system, which is an essential aspect to consider.

-

Disability Severity: It's common to feel uncertain about how the nature and extent of your disability can affect your eligibility and the level of assistance you receive. Individuals with significant disabilities may qualify more easily for assistance, while those with milder conditions might encounter additional scrutiny.

-

Proposed Changes for 2025: Staying informed about potential changes in 2025 is crucial. Increased Substantial Gainful Activity (SGA) limits and adjustments to the Trial Work Period (TWP) could significantly impact new applicants and current recipients.

-

Notification of Changes: Always remember to inform the SSA of any personal modifications that may affect your disability benefits. This step is essential for ensuring precise benefit calculations.

-

Real-Life Example: The Smith Family expressed appreciation for the acceptance and endorsement of their situation, demonstrating the beneficial results that can come from understanding and navigating the disability benefits process effectively. Turnout's trained non-professional advocates can assist you in this journey, ensuring you have the support needed to navigate the complexities of disability claims. It's important to note that Turnout is not a law firm and does not provide legal advice.

-

Health Enhancements: Be mindful that advancements in health situations may lead to a reduction or cessation of disability support, which is a significant factor for recipients.

-

Securing Representation: Comprehending your rights and obtaining skilled assistance, such as that offered by Turnout's trained advocates, can improve your likelihood of a favorable outcome when applying for disability support.

Understanding these elements will empower you to manage the calculation process of how SSDI is calculated more effectively and prepare for possible adjustments in 2025. Remember, staying updated on these developments is crucial for enhancing your advantages. You are not alone in this journey; we’re here to help.

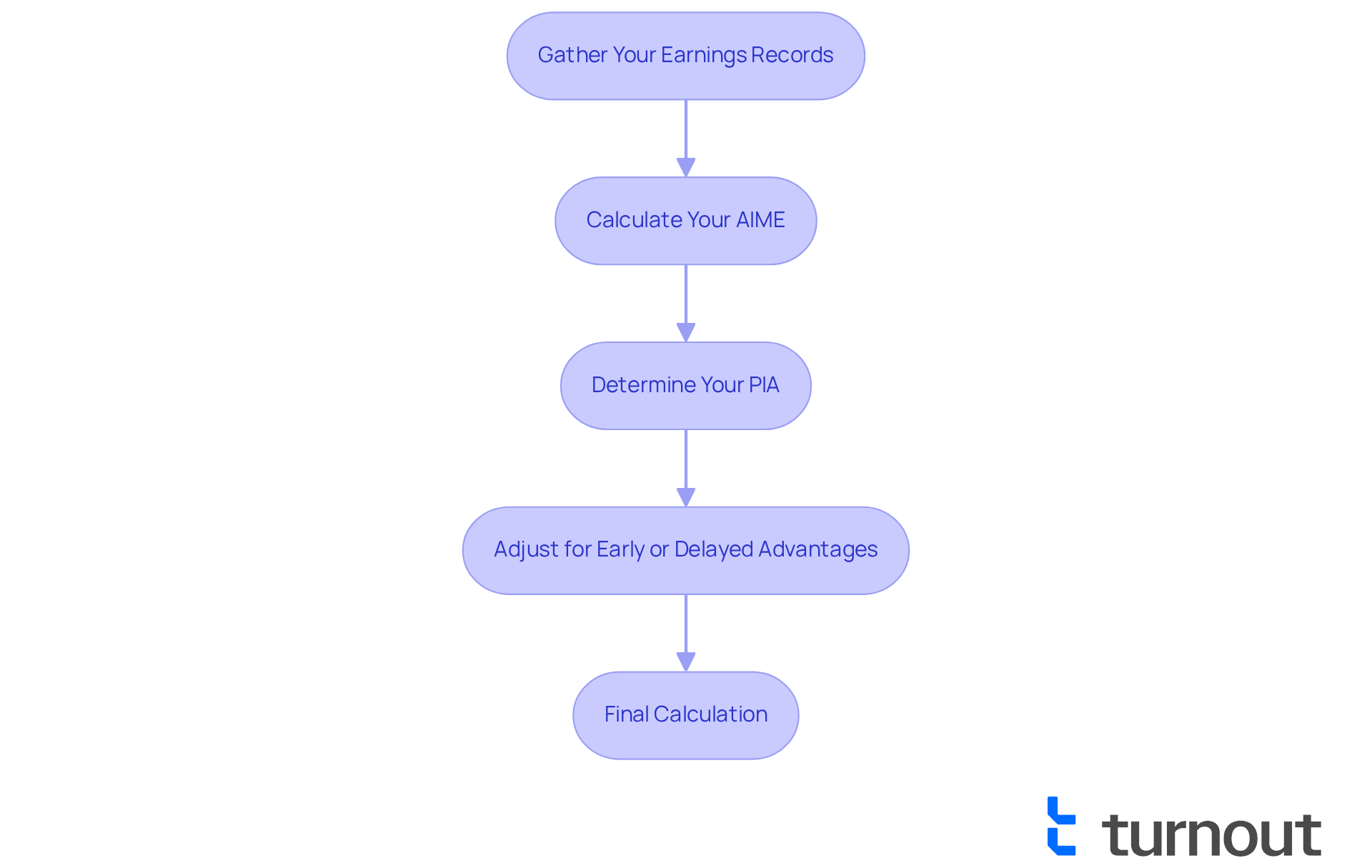

Calculate Your SSDI Benefits: Step-by-Step Process

Calculating your SSDI benefits and understanding how SSDI is calculated can feel overwhelming, but we're here to guide you through it with care and compassion. Follow these steps to help you understand the process better:

- Gather Your Earnings Records: Start by collecting your earnings statements from the government. These documents outline your work history and income, which are essential for the next steps.

- Calculate Your AIME:

- Identify your highest-earning 35 years of work.

- Adjust these earnings for inflation using the Social Security Administration's indexing factors.

- Divide the total by 420 (the number of months in 35 years) to find your Average Indexed Monthly Earnings (AIME).

- Determine Your PIA: To calculate your Primary Insurance Amount (PIA), use this formula:

- For the first $1,115 of your AIME, multiply by 90%.

- For AIME between $1,115 and $6,721, multiply by 32%.

- For AIME above $6,721, multiply by 15%.

- Add these amounts together to find your PIA.

- Adjust for Early or Delayed Advantages: If you choose to take your benefits early or delay them, remember to adjust your PIA accordingly.

- Final Calculation: Your disability support amount will be your PIA, modified for any applicable factors.

By following these steps, you can assess your disability support with greater precision. It's important to recognize that many people make frequent mistakes in their disability payment calculations, which can lead to significant differences in expected amounts. For instance, many candidates overlook the impact of non-covered employment on their AIME, potentially reducing their payment amounts. According to the Social Security Administration, the projected average monthly disability payment for all impaired workers in January 2025 is $1,580. Understanding how SSDI is calculated and gathering accurate earnings records are crucial for ensuring you receive the benefits you deserve.

Please remember that Turnout is not a law firm and does not provide legal advice. We utilize trained nonlawyer advocates to assist you with your SSD claims. If you have questions about your eligibility or need help, consider reaching out to Turnout. We're here to provide resources that guide you through the SSD claims process without the need for legal representation. You are not alone in this journey.

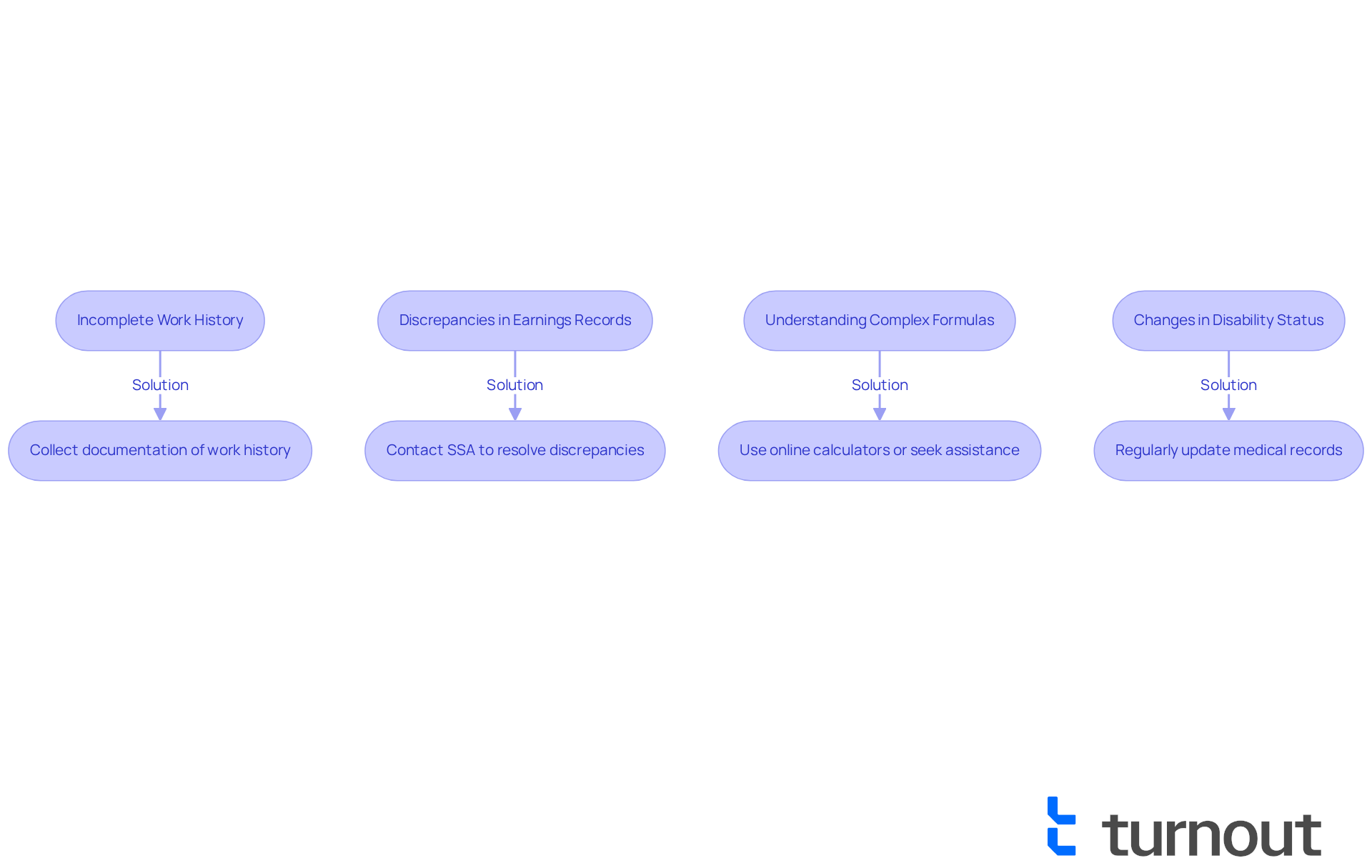

Navigate Common Challenges in SSDI Calculations

Navigating disability benefit calculations can be challenging, and we understand that you may feel overwhelmed. Here are some common issues and supportive solutions to help you through the process:

-

Incomplete Work History: Gaps in your work history can lead to SSDI claims being denied. To enhance your application, please collect documentation of any pertinent work or contributions to social welfare. This may include pay stubs, tax returns, or letters from employers that confirm your work history. Remember, financial hardship can also be considered for gaps in medical records, so document any relevant circumstances.

-

Discrepancies in Earnings Records: If your earnings records do not align with your expectations, it’s crucial to contact the Social Security Administration promptly to resolve these discrepancies. Incomplete or incorrect records can significantly affect your benefits.

-

Understanding complex formulas: The formulas used to compute benefits can be overwhelming, especially when considering how SSDI is calculated. To simplify this process, consider using online calculators provided by the Social Security Administration or seek assistance from knowledgeable advocates, such as those at Turnout. They can help clarify the calculations. Please note that Turnout is not a law firm and does not provide legal advice; our trained nonlawyer advocates support clients in navigating these complexities without the need for legal representation.

-

Changes in Disability Status: Your support may be influenced if your condition improves or worsens. It’s important to stay informed about how alterations in your health can affect your disability benefits and eligibility. Regularly updating your medical records and treatment history can provide the necessary evidence to support your claim.

By being aware of these challenges and understanding how SSDI is calculated, you can navigate the SSDI calculation process more effectively. Remember, maintaining thorough documentation and proactive communication with the Social Security Administration is key to a successful claim. You are not alone in this journey, and we’re here to help.

Conclusion

Understanding how SSDI benefits are calculated is crucial for individuals navigating the complexities of Social Security Disability Insurance. This program not only provides essential financial support for those unable to work due to disabilities but also ensures that recipients have a reliable income during difficult times. By grasping the intricacies of the calculation process, you can better prepare for your financial future and advocate for your rights.

We understand that the journey through SSDI calculations may seem daunting. Key factors influencing SSDI calculations include:

- Work history

- Average Indexed Monthly Earnings (AIME)

- Primary Insurance Amount (PIA)

It's common to face challenges during this process, such as discrepancies in earnings records and the impact of changes in disability status. By being informed about these elements and utilizing available resources, you can navigate the SSDI system more effectively and secure the benefits you deserve.

Remember, support is available. Staying proactive, maintaining thorough documentation, and seeking assistance from trained advocates can significantly enhance the likelihood of a favorable outcome. Empowerment through knowledge and support not only helps you secure your benefits but also fosters a sense of community and resilience among those facing similar challenges. You are not alone in this journey; we're here to help.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a federal program that provides financial assistance to individuals who are unable to work due to qualifying disabilities.

Who qualifies for SSDI benefits?

To qualify for SSDI benefits, applicants must demonstrate an adequate work history and have contributed to Social Security through payroll taxes.

How many individuals are expected to receive SSDI support in 2025?

Approximately 9 million individuals are expected to receive disability support from SSDI in 2025.

What is the highest monthly disability support amount for 2025?

The highest monthly disability support amount for 2025 is set at $4,018.

Will there be any adjustments to the SSDI benefits in 2025?

Yes, there will be a cost-of-living adjustment (COLA) of 2.5% to enhance assistance for SSDI recipients.

Why is medical documentation important for SSDI claims?

Medical documentation is essential for qualifying for SSDI benefits, as it helps demonstrate the severity of the disability.

How can individuals get help with SSDI claims?

Individuals can receive assistance with SSDI claims through trained nonlawyer advocates, such as those offered by Turnout, which helps clients navigate the SSDI support system.

Does Turnout provide legal guidance for SSDI claims?

No, Turnout is not a legal practice and does not provide legal guidance or advocacy. It focuses on offering support without the complications of legal representation.