Introduction

Understanding widow's benefits is crucial for anyone facing the emotional and financial aftermath of losing a spouse. Millions are expected to rely on these essential support systems in the coming years. Knowing how to calculate the amount one may receive isn’t just beneficial - it’s necessary.

We understand that determining eligibility and navigating the application process can feel overwhelming. What challenges might arise, and how can survivors ensure they receive the full benefits they deserve? This guide delves into the intricacies of widow's benefits, offering clarity and support for those in need. Remember, you are not alone in this journey; we're here to help.

Understand Widow's Benefits and Their Types

Widow's assistance, often called survivor assistance, provides essential financial support to the surviving spouse of a deceased worker. In 2026, about 1.5 million individuals are expected to receive Social Security survivor support. This highlights how vital these programs are in offering stability during tough times.

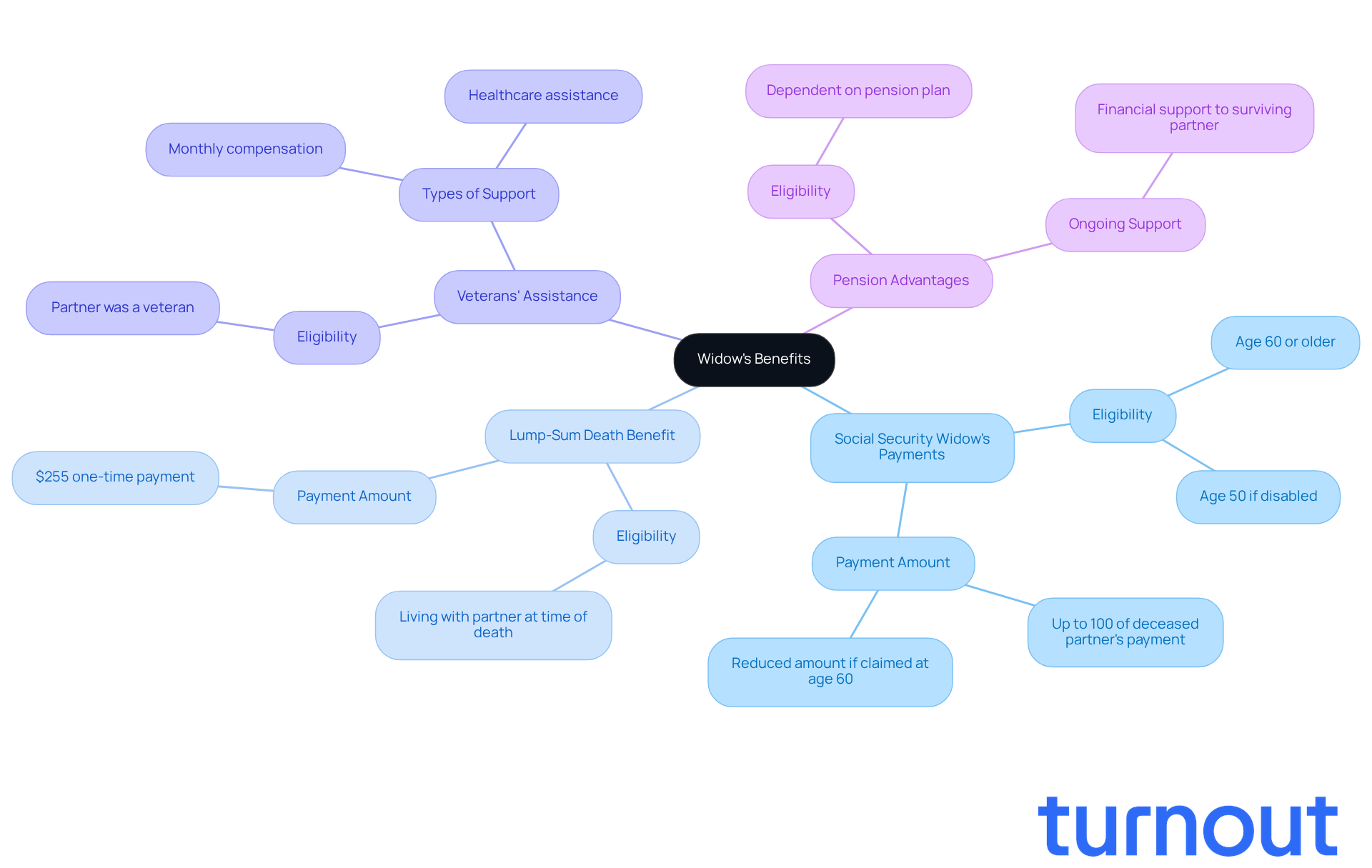

The main types of widow's benefits include:

-

Social Security Widow's Payments: If you’ve reached full retirement age, you can receive up to 100% of your deceased partner's payment based on their earnings record. For instance, if you request support at age 60, you might receive a reduced amount, but you can later switch to your own benefits if they’re higher. Remember, you must be at least 60 years old to claim these benefits, or 50 if you’re disabled.

-

Lump-Sum Death Benefit: If you were living with your partner at the time of their passing, you may be eligible for a one-time payment of $255. This can help cover immediate expenses after your loss.

-

Veterans' Assistance: If your partner was a veteran, you might qualify for additional support through the Department of Veterans Affairs, which can include monthly compensation and healthcare assistance.

-

Pension Advantages: Some pension plans offer survivor assistance, providing ongoing financial support to the surviving partner, which can be a significant source of income.

Understanding how much is widow's benefit is crucial for determining eligibility and navigating the application process smoothly. For example, if your husband passed away after more than ten years of marriage, you may qualify for assistance based on his income. Even a surviving ex-spouse can access these benefits if the marriage lasted at least a decade.

We encourage you to apply for survivor assistance as soon as possible to avoid missing out on potential retroactive payments. Remember, you’re not alone in this journey. Turnout is here to help simplify the process, using trained nonlawyer advocates to guide you through the complexities of applying for survivor assistance and ensuring you receive the financial support you deserve.

Determine Eligibility for Widow's Benefits

To qualify for widow's benefits, it's important to understand the specific eligibility criteria that can help you navigate this challenging time:

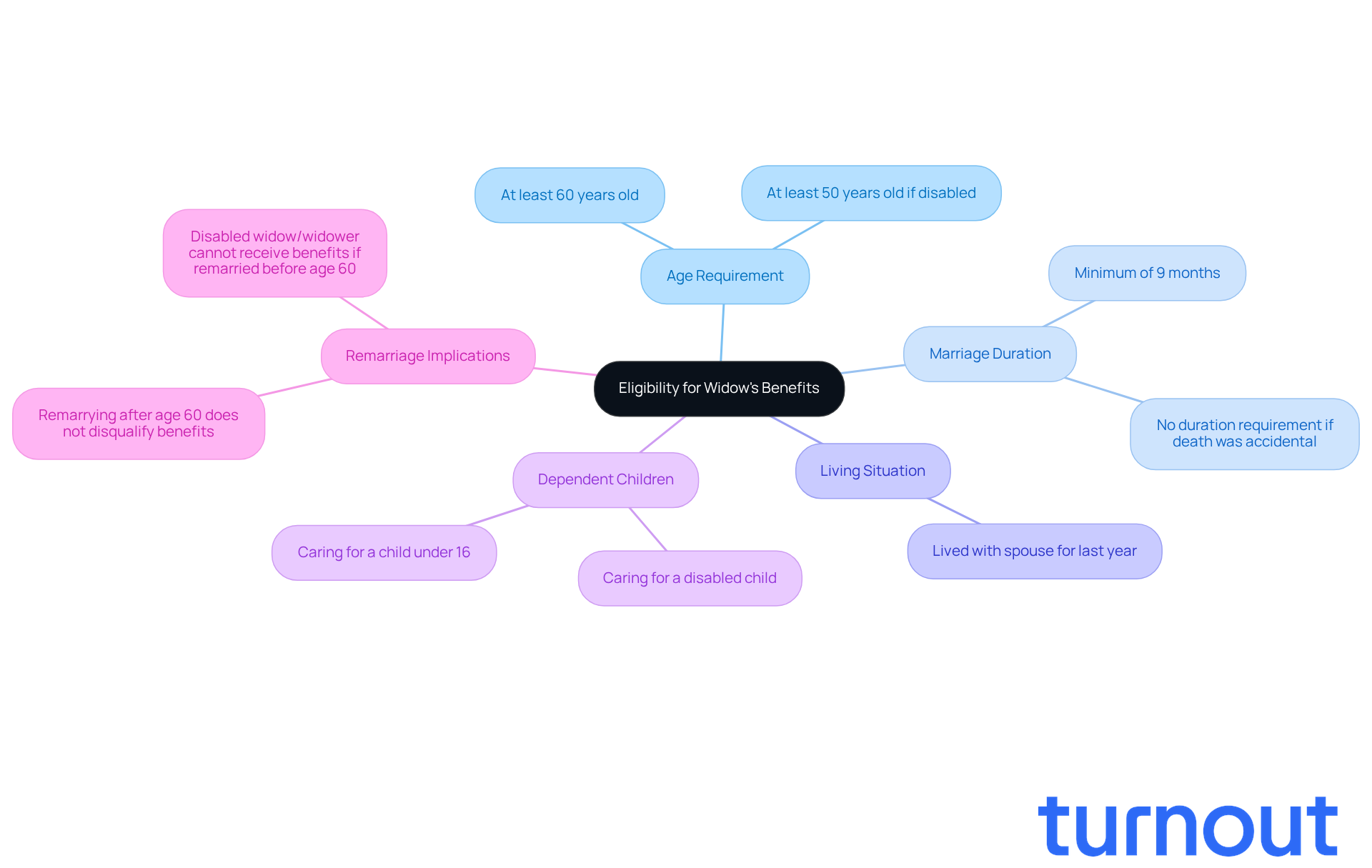

- Age Requirement: You must be at least 60 years old to claim widow's allowances, or 50 if you are disabled.

- Marriage Duration: A minimum marriage duration of nine months is required unless the death was accidental.

- Living Situation: You should have lived with your spouse for at least the last year of their life.

- Dependent Children: If you’re caring for a child under 16 or a disabled child, you may qualify for assistance at any age. Remember, if you remarry after age 60, this won’t disqualify you from obtaining entitlements on the deceased wage-earner's record.

Understanding these standards is essential for assessing your qualification to apply for spousal assistance. In 2026, the average age of widows receiving assistance is projected to be around 62. This reflects a growing awareness of rights and available support.

For instance, consider this: a surviving partner of full retirement age can receive 100% of the deceased wage-earner’s payment. Those aged 60 to full retirement age receive between 71.5% and 99%. This highlights the importance of age and marital duration in determining potential benefits. Additionally, the Social Security Administration defines disability for surviving spouses similarly to disabled wage-earners, emphasizing the need for a medically diagnosed condition that prevents work for at least 12 consecutive months.

We understand that navigating these complex procedures can be overwhelming. Turnout offers valuable support to ensure that clients comprehend their eligibility and the application process for spousal assistance. By examining these standards and understanding the implications of your circumstances, you can more effectively maneuver through the application process for spousal support. Remember, you are not alone in this journey; we're here to help.

Gather Required Documentation for Application

Applying for widow's benefits can feel overwhelming, but gathering the right documentation can make the process smoother. Here’s what you’ll need:

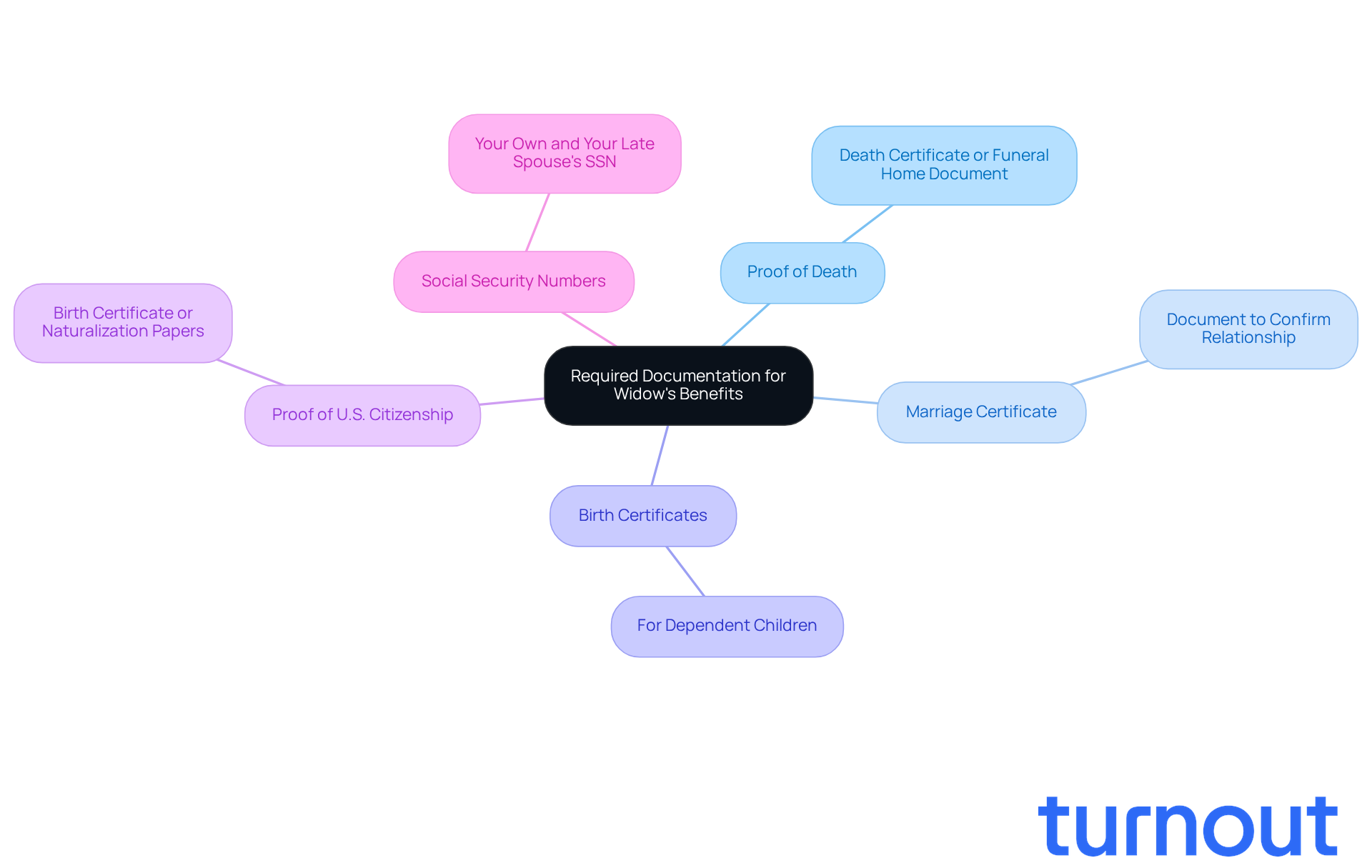

- Proof of Death: A death certificate or a document from the funeral home will suffice.

- Marriage Certificate: This is essential to confirm your relationship with your late spouse.

- Birth Certificates: If you have dependent children, their birth certificates are necessary for assistance.

- Proof of U.S. Citizenship: Acceptable documents include a birth certificate or naturalization papers.

- Social Security Numbers: You’ll need both your own and your late spouse's Social Security numbers.

We understand that organizing these documents in advance can help reduce delays and ensure you meet all requirements efficiently. At Turnout, we’re committed to making it easier for you to access government support, including help with SSD claims and tax debt relief. Being well-prepared can significantly improve your chances of a seamless approval process.

It's important to note that Turnout is not a law firm and does not provide legal advice. However, our trained nonlawyer advocates are here to support you every step of the way. Did you know that children of deceased workers can qualify for an average monthly payment of $1,135.34? This highlights the importance of having all necessary documentation ready.

Furthermore, be aware that the average duration to process survivors' assistance applications in 2026 is expected to be around 3 to 6 months. Real-world examples show that being well-prepared can greatly enhance your chances of a smooth approval process. Remember, you are not alone in this journey; we’re here to help.

Calculate Your Potential Widow's Benefits Amount

Calculating how much is widows benefit can feel overwhelming, but we're here to help you through it. Follow these steps to understand what you might receive:

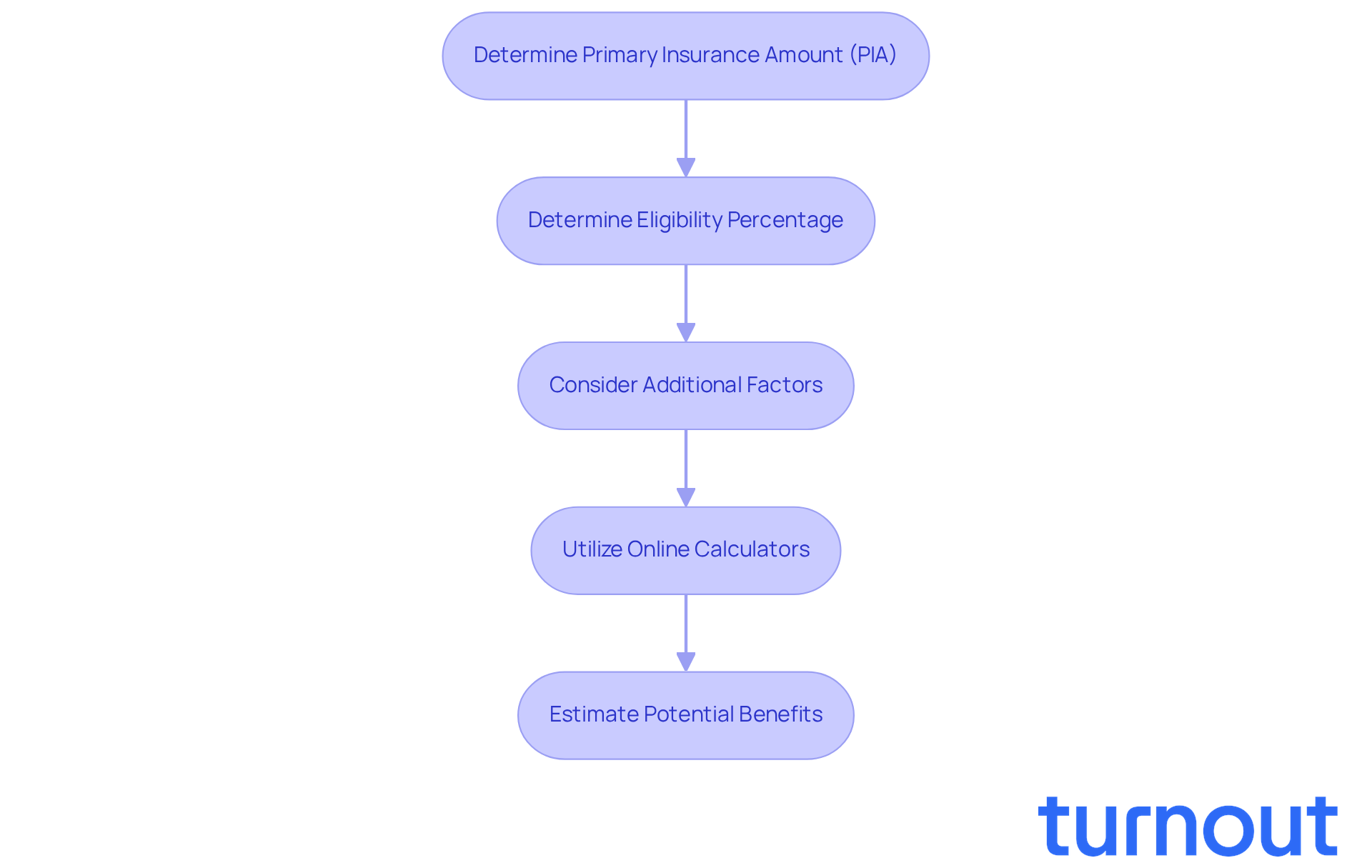

- Determine the individual's Primary Insurance Amount (PIA): This is the amount the individual would have received at full retirement age. You can find this on their Social Security statement or by reaching out to the Social Security Administration.

- Determine Your Eligibility Percentage: Depending on your age when claiming benefits, you may receive:

- 100% of the PIA if you claim at full retirement age.

- Between 71.5% and 99% if you claim before full retirement age, with a reduction of up to 28.5% for early claims.

- Consider Additional Factors: If you're caring for a child under 16, you may be eligible for a higher percentage of the departed's support.

- Utilize Online Calculators: The Social Security Administration offers online tools to help estimate your entitlements based on the deceased's earnings record.

It's common to feel uncertain about these processes. In January 2026, about 79% of women who have lost their spouses receive their full PIA at retirement age. This highlights the importance of strategic planning. For example, George and Alice's story shows how optimizing their claiming strategy significantly increased their total lifetime payout. By following these steps, you can estimate how much is widows benefit you may receive, and remember, you are not alone in this journey.

Apply for Widow's Benefits: Step-by-Step Process

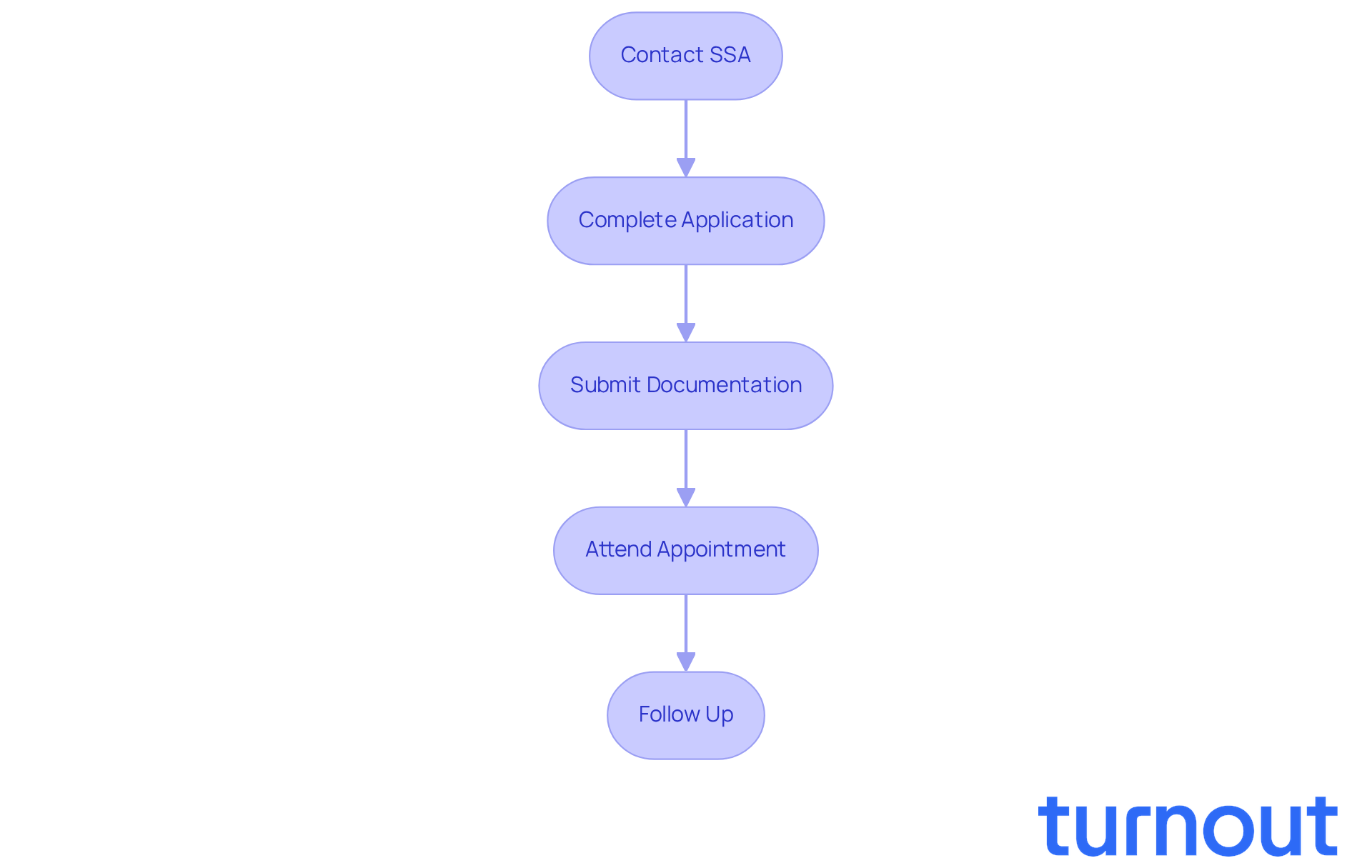

Applying for widow's benefits can feel overwhelming, but we're here to help you through it. Follow these steps to ensure you receive the support you need during this challenging time:

-

Contact the Social Security Administration (SSA): Start by calling 1-800-772-1213 or visiting your local SSA office to schedule an appointment. We understand that reaching out can be daunting, but this is an important first step.

-

Complete the Application: Fill out Form SSA-10, which is the application for survivors' insurance payments. You can complete this form online or in person, whichever feels more comfortable for you.

-

Submit Required Documentation: Gather all necessary documents, including proof of death, your marriage certificate, and identification. Having everything ready can make the process smoother.

-

Attend Your Appointment: Bring all your documents to your SSA appointment. The representative will assist you in completing your application, so don’t hesitate to ask questions if you need clarification.

-

Follow Up: After submitting your application, keep track of your case status by contacting the SSA. It’s common to feel anxious during this time, but they may request additional information or documentation to help with your case.

By following these steps, you can successfully apply for widow's benefits and learn how much is widows benefit to secure the financial support you need. Remember, you are not alone in this journey; we’re here to support you every step of the way.

Conclusion

Understanding the complexities of widow's benefits is crucial for ensuring that surviving spouses receive the financial support they deserve during such a challenging time. This guide has explored the various types of widow's benefits available, including:

- Social Security payments

- Lump-sum death benefits

- Veterans' assistance

- Pension advantages

Knowing your options and eligibility is vital.

We recognize that navigating these benefits can feel overwhelming. Key insights include the eligibility criteria necessary to qualify, such as:

- Age requirements

- Marriage duration

- Living situations

Additionally, we’ve outlined the necessary documentation for the application process and provided a clear step-by-step guide to help you through the complexities involved. By understanding how to calculate potential benefits and gather required paperwork, you can take meaningful steps toward securing your financial future.

The significance of widow's benefits cannot be overstated. They serve as a critical lifeline for those grieving the loss of a spouse, offering much-needed support during a difficult transition. It’s important to act swiftly and utilize available resources, like Turnout, to simplify the application process and ensure that all eligible individuals receive the benefits they deserve. Taking these steps not only eases the financial burden but also honors the memory of loved ones, ensuring their legacy continues to provide support.

Frequently Asked Questions

What is widow's assistance?

Widow's assistance, also known as survivor assistance, provides financial support to the surviving spouse of a deceased worker, helping them during difficult times.

What are the main types of widow's benefits?

The main types of widow's benefits include Social Security Widow's Payments, Lump-Sum Death Benefit, Veterans' Assistance, and Pension Advantages.

How do Social Security Widow's Payments work?

If you’ve reached full retirement age, you can receive up to 100% of your deceased partner's payment based on their earnings record. If you claim support at age 60, you may receive a reduced amount but can switch to your own benefits later if they are higher. You must be at least 60 years old to claim these benefits, or 50 if you’re disabled.

What is the Lump-Sum Death Benefit?

If you were living with your partner at the time of their passing, you may be eligible for a one-time payment of $255 to help cover immediate expenses after the loss.

What additional support is available for veterans' spouses?

If your partner was a veteran, you might qualify for additional support through the Department of Veterans Affairs, including monthly compensation and healthcare assistance.

What are Pension Advantages in relation to widow's benefits?

Some pension plans offer survivor assistance, providing ongoing financial support to the surviving partner, which can be a significant source of income.

What are the eligibility criteria for widow's benefits?

To qualify, you must be at least 60 years old (or 50 if disabled), have been married for at least nine months (unless the death was accidental), have lived with your spouse for at least the last year of their life, and if caring for a child under 16 or a disabled child, you may qualify at any age.

Does remarriage affect eligibility for widow's benefits?

If you remarry after age 60, it does not disqualify you from obtaining entitlements on the deceased wage-earner's record.

Why is it important to apply for widow's benefits as soon as possible?

Applying early helps avoid missing out on potential retroactive payments you may be entitled to receive.

How can Turnout assist with the application process for widow's benefits?

Turnout provides trained nonlawyer advocates to help guide you through the complexities of applying for survivor assistance and ensure you receive the financial support you deserve.