Overview

Navigating the world of Social Security Disability Insurance (SSDI) can feel overwhelming, and we understand the challenges you may be facing. This article sheds light on the payments and eligibility criteria for SSDI, aiming to provide clarity and support.

SSDI payments are influenced by several important factors, including:

- Your employment history

- Medical evidence

- Income limits

It's essential to know that these elements play a crucial role in determining the support you may receive. Furthermore, eligibility hinges on specific criteria set by the Social Security Administration. This includes having a sufficient work history and a medically determinable disability.

We know that understanding these requirements can be daunting. You're not alone in this journey, and we're here to help you through it. If you have any questions or need assistance, please don't hesitate to reach out for support. Remember, taking the first step is often the hardest, but it can lead to the help you truly deserve.

Introduction

Understanding Social Security Disability Insurance (SSDI) can feel overwhelming. Many individuals face the complexities of eligibility and payment calculations, and it’s common to feel uncertain about where to start. With millions depending on these benefits, grasping the nuances of SSDI—like employment history requirements, income limits, and the effects of recent legislative changes—is essential for those seeking support. You might be wondering: how are SSDI payments determined, and what factors could influence your benefits?

In this article, we’re here to demystify the SSDI process. We aim to provide essential insights and practical tools to help you better understand your potential entitlements. Remember, you are not alone in this journey, and we’re here to help you navigate through it.

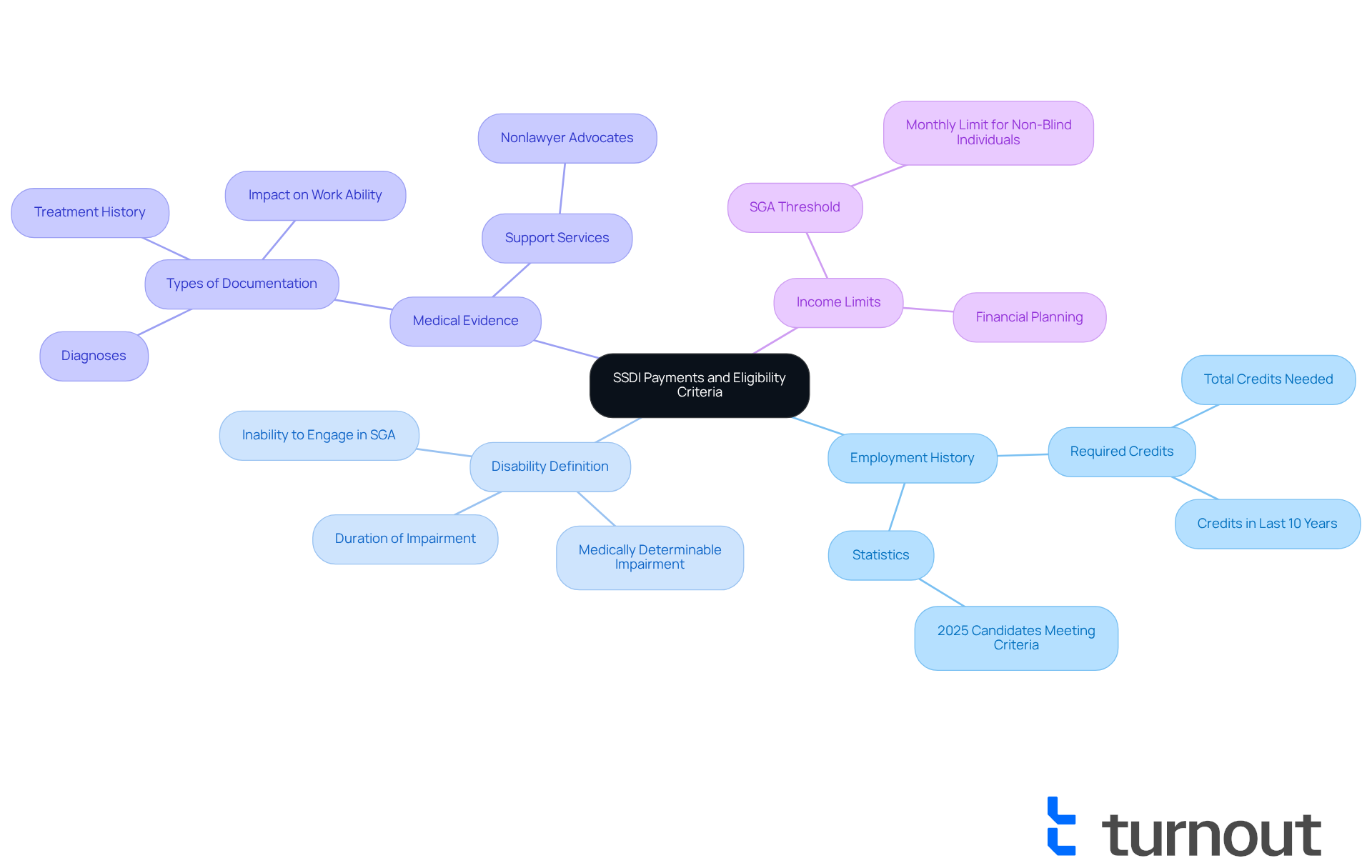

Understand SSDI Payments and Eligibility Criteria

To qualify for Insurance (SSDI), you must meet (SSA). We understand that this process can feel overwhelming, so let’s break it down together.

- Employment History: You need to have gathered sufficient credits—usually 40—with at least 20 obtained in the past 10 years. In 2025, approximately 70% of candidates meet these employment history criteria, underscoring the importance of steady job experience.

- Disability Definition: The SSA defines disability as the inability to engage in substantial gainful activity (SGA) due to a medically determinable physical or mental impairment expected to last at least one year or result in death. It's common to feel uncertain about what this means for you, but is crucial.

- Medical Evidence: Providing comprehensive is vital. This includes diagnoses, treatment history, and evidence of how your condition impacts your ability to work. to assist you in gathering and presenting this information effectively, ensuring you feel supported throughout the process.

- Income Limits: Your , which is set at $1,620 per month for non-blind individuals in 2025. We understand that financial concerns can increase your stress, but can assist you in planning better.

Recent updates from the SSA indicate that the application process is being streamlined, with forms being simplified from 54 questions to just 12 essential ones. This change aims to reduce confusion and errors, making it easier for you to navigate the system. As mentioned by the SSA, "This yearly modification is referred to as the , and it assists in guaranteeing that disability payments retain their purchasing power against inflation."

It's important to note that Turnout is not a law firm and does not provide legal advice. Comprehending these criteria is crucial for . Remember, you are not alone in this journey; we're here to help you every step of the way.

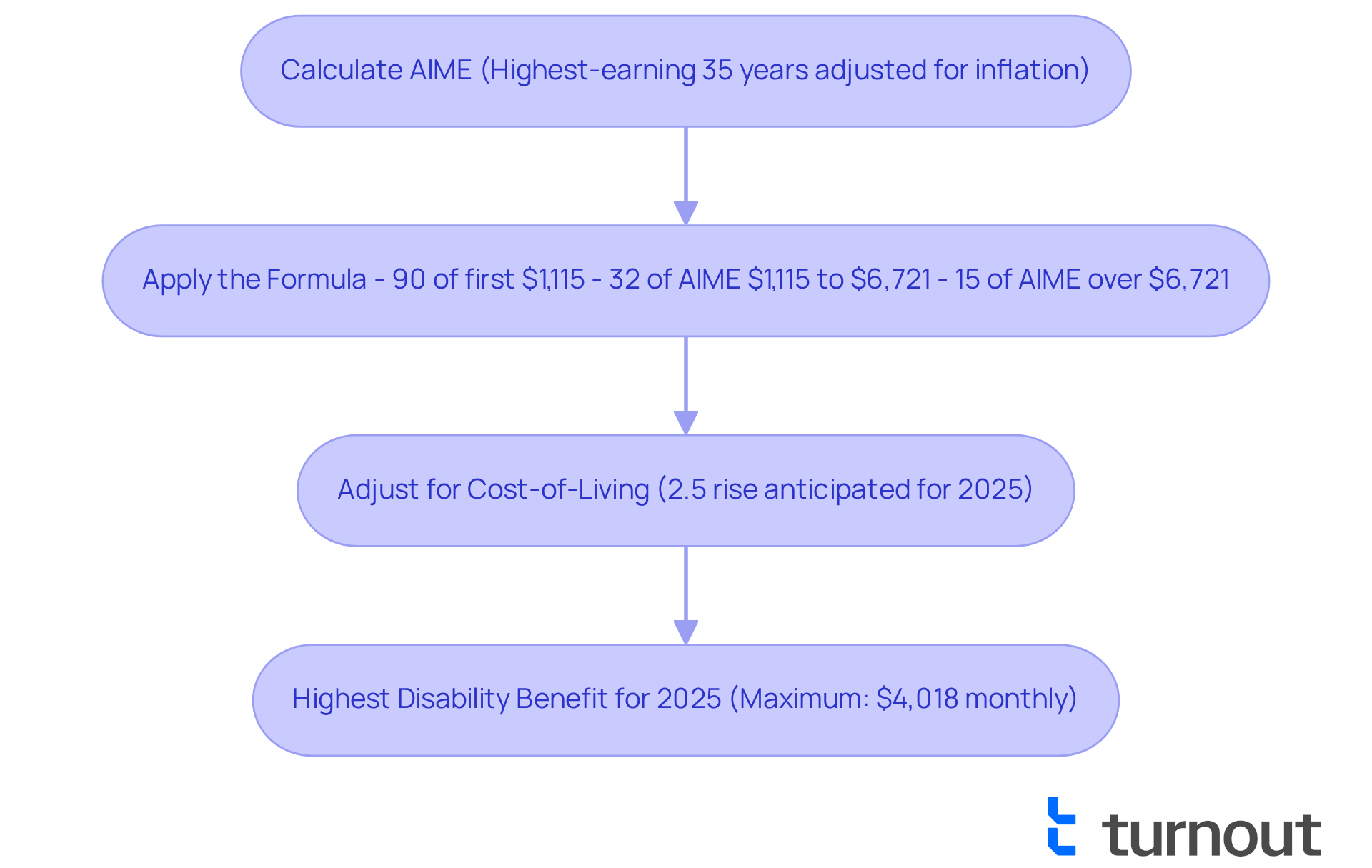

Learn How SSDI Payments Are Calculated

Understanding SSDI payments can feel overwhelming, but we're here to help you . SSDI payments are calculated based on your average indexed monthly earnings (AIME) during your working years. Here’s how the process works:

- Calculate AIME: The SSA takes your highest-earning 35 years of work history, adjusts those earnings for inflation, and averages them to determine your AIME.

- Apply the Formula: The SSA utilizes a formula to transform your AIME into your Primary Insurance Amount (PIA), which is the monthly payment you will receive. For 2025, the formula is:

- 90% of the first $1,115 of your AIME,

- 32% of the AIME over $1,115 and up to $6,721,

- 15% of the AIME over $6,721.

- Adjust for Cost-of-Living: Your each year according to the , which is based on fluctuations in the Consumer Price Index. For 2025, a 2.5% rise is anticipated, which will impact the overall compensation amounts.

It's common to feel uncertain about and your benefits. The is $4,018 each month, although few beneficiaries meet the criteria for this complete sum. To enhance your disability support, consider obtaining professional help from . Skilled advocates can assist you in navigating the intricacies of the disability system without requiring legal representation. Please note that Turnout is not a law firm, and the information provided does not constitute legal advice.

To obtain a general approximation of how much is SSDI, you can utilize the SSA's benefit calculators accessible on their website. Remember, you are not alone in this journey, and there are resources available to support you.

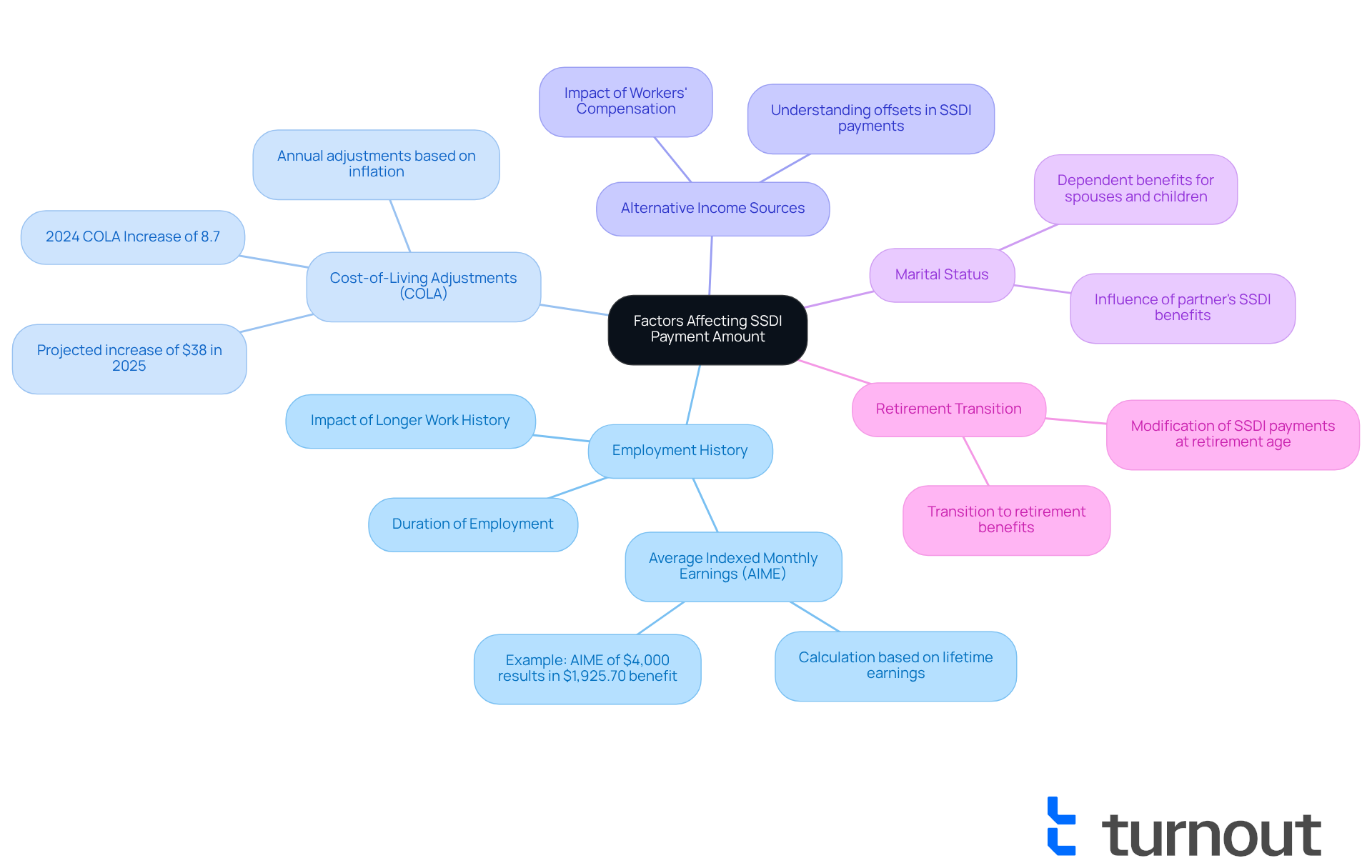

Identify Factors That Affect Your SSDI Payment Amount

Several factors can significantly impact the amount you receive in SSDI benefits:

- : We understand that your employment history is crucial. The duration you were employed and your income during that time directly affect your Average Indexed Monthly Earnings (AIME), which dictates your disability payment. Individuals with longer employment histories and greater lifetime earnings generally receive larger advantages. In 2025, the highest disability assistance will amount to $4,018 per month. This highlights the significance of a strong employment record.

- : It's common to feel concerned about inflation. Annual COLA increases are designed to help entitlements keep pace with rising costs. In , the highest in decades. This increase will continue to influence disbursements into 2025, with average monthly allocations expected to rise by approximately $38.

- Alternative Income Sources: If you obtain additional disability payments, such as workers' compensation, this may result in a decrease in your SSDI payments. Understanding how these offsets work is crucial for accurate financial planning.

- : Your marital status can also affect your advantages. If your partner is receiving Insurance or other payments from Social Security, it may influence the total amount you receive.

- : As you near retirement age, your [social security disability](https://myturnout.com/service) payments may be modified according to your retirement rewards. This adjustment is important for individuals transitioning from disability support to retirement assistance.

Being aware of these factors can help you better comprehend and plan accordingly. For instance, submitting a thorough work history during your application process can prevent undervaluing your lifetime earnings, possibly resulting in greater rewards. Staying updated on yearly COLA adjustments and their effects on your payments is also essential for ensuring your entitlements reflect inflation rises. Additionally, to assist you in navigating these complexities. We're here to help you receive the support you need without the necessity of legal representation.

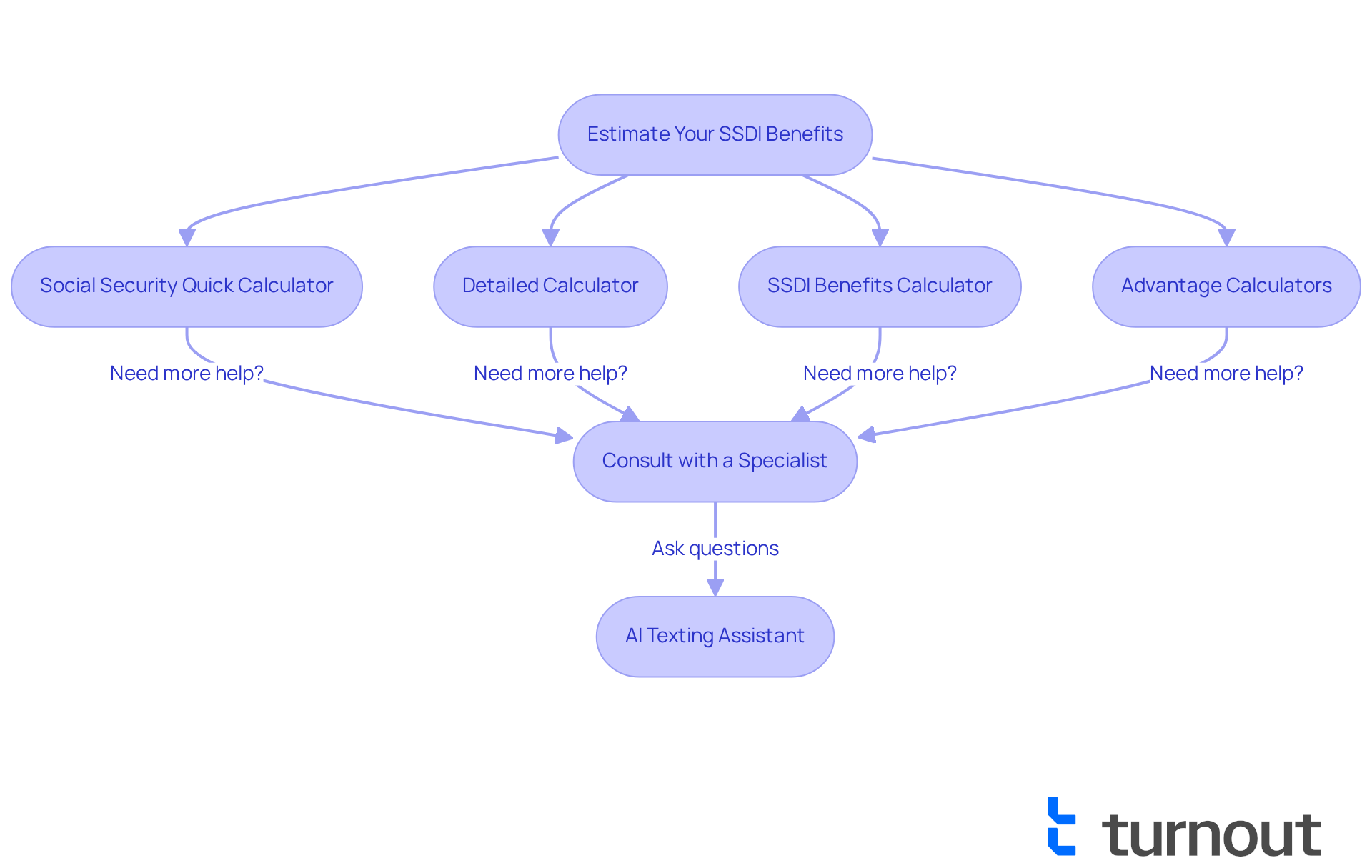

Estimate Your SSDI Benefits Using Available Tools

Calculating can feel overwhelming, but various online resources offered by the (SSA) can help you navigate this process with ease. Here’s how to utilize them:

- Social Security Quick Calculator: This user-friendly tool allows you to enter your earnings to get a swift estimate of your benefits. It’s an excellent starting point for understanding your potential financial obligations. Access it .

- : For a more thorough estimate, the Detailed Calculator considers your complete work history, offering a more precise projection of your benefits. You can find it .

- : This specific tool provides rapid, no-obligation estimates of possible monthly payments and backpay, helping you gain immediate insights into your entitlements. Explore it .

- : The SSA offers a range of calculators tailored for various needs, including those for retirement and disability support. These tools can help you explore your options and understand your entitlements better.

- Consult with a Specialist: If the calculations seem daunting, consider reaching out to a . They can offer personalized assistance and help you navigate the complexities of the process. Additionally, the newly introduced 24/7 is available to answer questions regarding eligibility and documentation in real time, providing further support.

Using these tools can empower you with a better understanding of how much is ssdi, which will aid your financial planning. Recent updates indicate that these calculators are designed to support applicants, helping them embark on this journey with more confidence and fewer mistakes. As Josh Pugen, Co-Founder and Senior Disability Benefits Specialist, states, "We built these tools because people deserve clarity instead of confusion, support instead of silence, and guidance that respects their time and effort." Staying informed about is crucial, as these updates may significantly impact your benefits. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Conclusion

Understanding the intricacies of Social Security Disability Insurance (SSDI) is essential for anyone navigating the eligibility and payment landscape. We recognize that this journey can feel overwhelming. This guide has illuminated the critical components that determine SSDI payments, including:

- Employment history

- The definition of disability

- The importance of medical evidence

- Income limits

By grasping these aspects, individuals can better assess their qualifications and potential benefits under the SSDI program.

Key insights shared throughout this article highlight the significance of:

- Thorough documentation

- The updated application process

- The various factors influencing benefit amounts

It's common to feel uncertain about how these elements, from the calculation of Average Indexed Monthly Earnings (AIME) to the impact of Cost-of-Living Adjustments (COLA), affect your situation. Understanding these factors can empower you to make informed decisions about your financial future. Additionally, utilizing available online tools and resources can simplify the process of estimating potential benefits.

Ultimately, the journey to securing SSDI benefits may seem daunting, but it is crucial to remember that support is available. Engaging with knowledgeable advocates and using the SSA's calculators can provide clarity and confidence in navigating this complex system. You are not alone in this journey. By staying informed and proactive, you can ensure you receive the assistance you need to thrive despite your challenges.

Frequently Asked Questions

What are the eligibility criteria for Social Security Disability Insurance (SSDI)?

To qualify for SSDI, you must have sufficient employment history, which typically requires 40 credits, with at least 20 of those credits earned in the past 10 years. Additionally, you must meet the SSA's definition of disability and provide comprehensive medical evidence.

How does the SSA define disability?

The SSA defines disability as the inability to engage in substantial gainful activity (SGA) due to a medically determinable physical or mental impairment expected to last at least one year or result in death.

What type of medical evidence is needed for SSDI applications?

You need to provide comprehensive medical documentation, including diagnoses, treatment history, and evidence showing how your condition affects your ability to work.

What are the income limits for SSDI eligibility?

Your income must be below the SGA threshold, which is set at $1,620 per month for non-blind individuals in 2025.

How has the SSDI application process changed recently?

The application process has been streamlined, reducing the number of questions from 54 to just 12 essential ones to decrease confusion and errors.

What is the Cost-of-Living Adjustment (COLA) in relation to SSDI?

The COLA is a yearly modification made by the SSA to ensure that disability payments retain their purchasing power against inflation.

Can Turnout provide legal advice regarding SSDI?

No, Turnout is not a law firm and does not provide legal advice, but they offer assistance in gathering and presenting the necessary information for SSDI applications.