Overview

Navigating the world of Social Security Disability Insurance (SSDI) can feel overwhelming. We understand that many individuals face challenges when it comes to understanding their benefits. The amount of SSDI payment varies based on several factors, including:

- Work history

- Earnings level

- Cost-of-living adjustments

For 2025, the average payment is estimated to be around $1,754.64 per month.

This calculation is derived from the Average Indexed Monthly Earnings (AIME). It’s essential to grasp these factors to effectively estimate potential benefits. By doing so, you can better manage your financial planning. Remember, you are not alone in this journey; many are in the same boat, seeking clarity and support.

Understanding how these elements come together can empower you. It’s common to feel uncertain, but with the right information, you can take control of your financial future. We’re here to help you navigate this process and ensure you have the resources you need.

Introduction

Understanding the complexities of Social Security Disability Insurance (SSDI) is crucial for those facing the challenges of a qualifying disability. We recognize that navigating this system can feel overwhelming. SSDI offers vital financial support that can significantly enhance your quality of life, making it essential to know how to estimate potential benefits.

It's common to feel lost when faced with the intricacies of the application process and the factors that influence payment amounts. How can you effectively navigate these complexities to ensure you receive the support you need? This article will guide you through the necessary steps to estimate SSDI payments, providing clarity and support as you embark on this important journey. Remember, you are not alone in this process; we're here to help.

Understand SSDI Payments and Their Importance

Social Security Disability Insurance (SSDI) provides vital financial support for individuals unable to work due to a qualifying disability. We understand that navigating this process can feel overwhelming, and knowing how these funds operate is essential for anyone considering applying for assistance. SSDI benefits aim to replace lost income, helping recipients manage essential living expenses like housing, food, and medical care. Understanding how much is ssdi payment is crucial, as the amount you receive can significantly influence your quality of life and it's important to estimate your potential benefits accurately. By understanding how much is ssdi payment and the maximum and average disbursement amounts, you can plan your finances more effectively while tackling the complexities of the application process.

As of 2025, when considering how much is ssdi payment for disabled workers, the average amount is around $1,754.64 per month, reflecting a 2.5% cost-of-living adjustment (COLA). This adjustment is designed to help beneficiaries cope with rising living costs, ensuring that benefits keep pace with inflation and preserving the purchasing power of recipients. The Social Security Administration emphasizes that this COLA is vital for maintaining financial stability in an ever-changing economic landscape.

But the impact of disability payments goes beyond mere financial assistance; they play a crucial role in enhancing the overall quality of life for recipients. With Social Security Disability Insurance, individuals can afford necessary medical treatments and maintain a sense of normalcy in their daily lives. The Compassionate Allowances program, which currently includes 300 conditions, accelerates the decision process for those facing serious medical issues, underscoring the importance of timely access to these resources.

At Turnout, we recognize the challenges involved in applying for disability support. Our trained nonlawyer advocates are here to guide you through the application process, ensuring you have the support you need to navigate these government benefits effectively. Remember, understanding disability benefits and their implications is vital for individuals experiencing disabilities. By familiarizing yourself with average payment amounts, such as how much is ssdi payment, and their potential impact on your quality of life, you can better navigate the complexities of the application process and plan your financial future with confidence. You're not alone in this journey; we're here to help.

Learn the SSDI Benefit Calculation Formula

Understanding SSDI benefits can feel overwhelming, but we’re here to help you navigate this journey with compassion and clarity. The formula that determines how much is SSDI payment is primarily based on the Average Indexed Monthly Earnings (AIME). Let’s break it down together:

- Calculate Your Average Indexed Monthly Earnings: The Social Security Administration (SSA) looks at your highest-earning 35 years of work history. They adjust those earnings for inflation and then average them out. This step is crucial in determining your benefits.

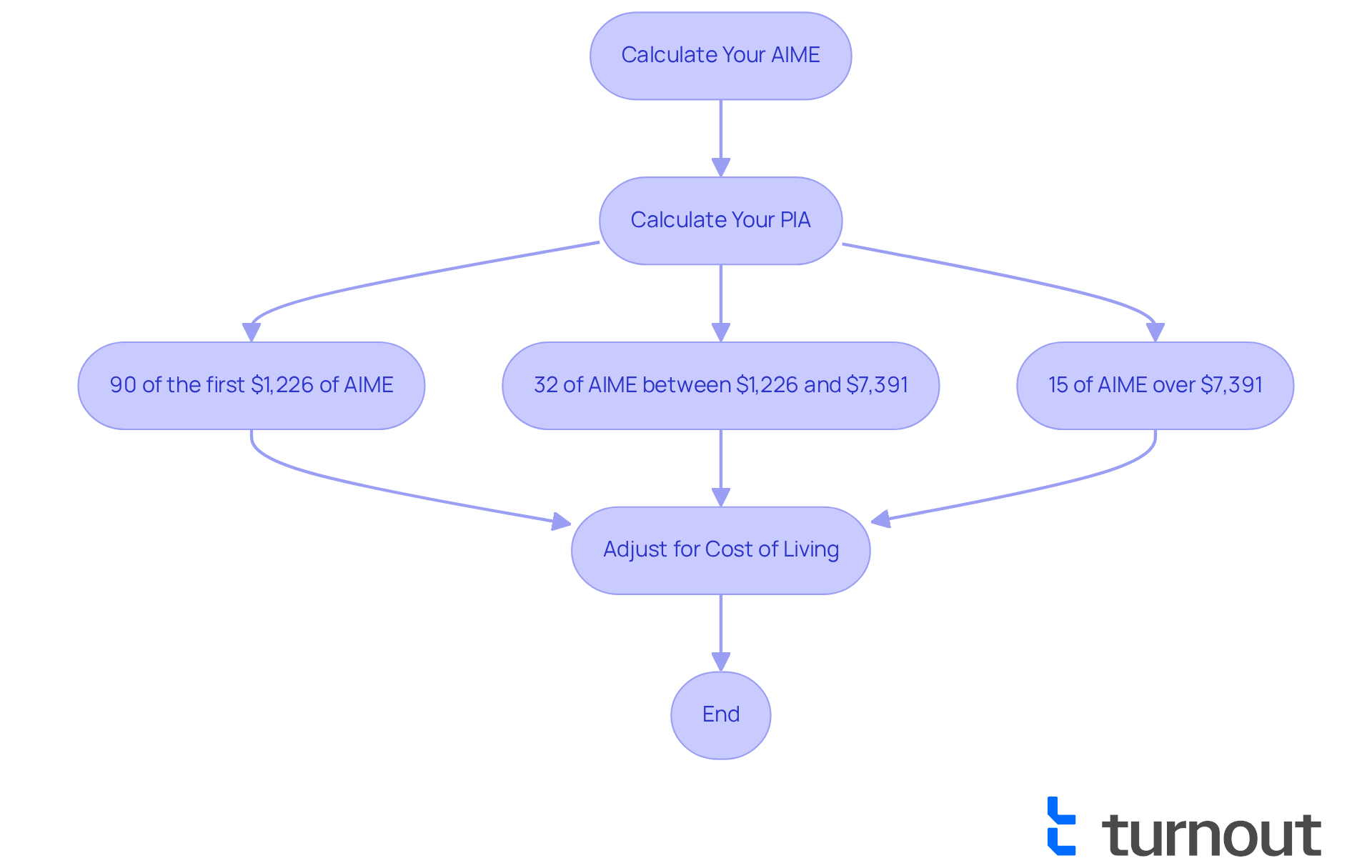

- Calculate Your Primary Insurance Amount (PIA): Your PIA is calculated using a formula that applies different percentages to segments of your AIME. For 2025, here’s how it works:

- 90% of the first $1,226 of your AIME

- 32% of the AIME between $1,226 and $7,391

- 15% of the AIME over $7,391

- Adjust for Cost of Living: Disability payments are adjusted annually for cost-of-living increases (COLA). For 2025, this adjustment is set at 2.5%, helping your payment keep pace with inflation.

By grasping this formula, you can better evaluate your potential disability benefits based on your work history. For example, if your AIME is calculated at $3,000, your PIA would be around $1,000, reflecting the percentages we discussed. It’s important to keep accurate records of your income history, as higher lifetime earnings typically lead to greater disability benefits.

Also, be aware that receiving other government assistance might reduce your disability support if the total exceeds 80% of your earnings before the disability. In 2025, when considering your financial future, it's essential to know how much is SSDI payment, as the maximum SSDI benefit is $4,018 per month.

At Turnout, we understand that navigating the complexities of SSD claims can be challenging. Our trained nonlawyer advocates are here to assist you in understanding these calculations and preparing for your financial future during disability. You are not alone in this journey, and we’re committed to providing the support you need without legal representation. Please remember, Turnout is not a law firm and does not provide legal advice.

Identify Factors Affecting Your SSDI Payment Amount

Navigating the complexities of government benefits can feel overwhelming, but understanding how much is SSDI payment and the factors that influence it is crucial. At Turnout, we’re here to help you every step of the way, even though we’re not a law firm and don’t provide legal advice.

-

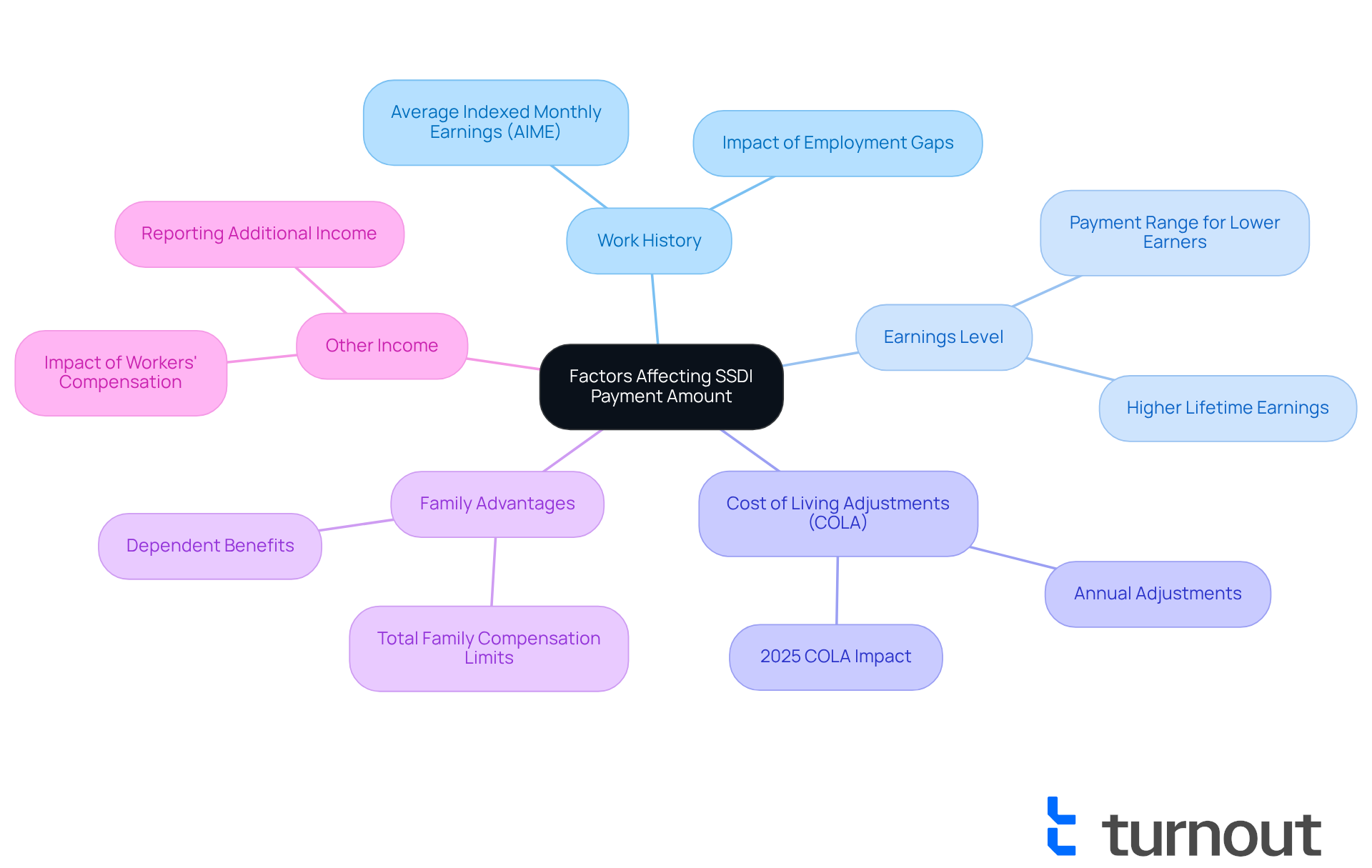

Work History: Your employment history plays a significant role in determining your Average Indexed Monthly Earnings (AIME), which is vital for calculating your disability assistance. A strong work history can enhance your eligibility and increase your compensation, while gaps in employment might complicate your application.

-

Earnings Level: Generally, higher lifetime earnings lead to greater disability benefits. For instance, in 2025, individuals with the highest lifetime earnings could receive up to $3,822 each month, which raises the question of how much is SSDI payment for those with lower earnings, as they might see assistance ranging from $800 to $1,200 monthly. This difference underscores the importance of maintaining a solid earnings record.

-

Cost of Living Adjustments (COLA): SSDI payments are adjusted annually to keep up with inflation. In 2025, as people consider how much is SSDI payment, a 2.5% COLA will increase the average monthly payment to around $1,620, providing essential support as living expenses rise.

-

Family Advantages: If you have dependents, they may qualify for additional benefits, which can increase the total amount you receive. Eligible family members can receive up to 50% of your disability amount, but the total family compensation cannot exceed 150-180% of your personal benefit.

-

Other Income: Additional income sources, like workers' compensation or unemployment benefits, can affect your disability benefit amount. It’s important to report all income accurately to comply with disability benefits regulations.

We understand that this can be a lot to take in. With the support of Turnout's skilled non-professional advocates, you can receive personalized assistance tailored to your unique situation. We’re here to help you grasp these factors and evaluate your potential benefits efficiently. Remember, you’re not alone in this journey.

Estimate Your Potential SSDI Payments

Estimating how much is SSDI payment can feel overwhelming, but we're here to help. By following these steps, you can gain clarity and confidence in your financial future.

-

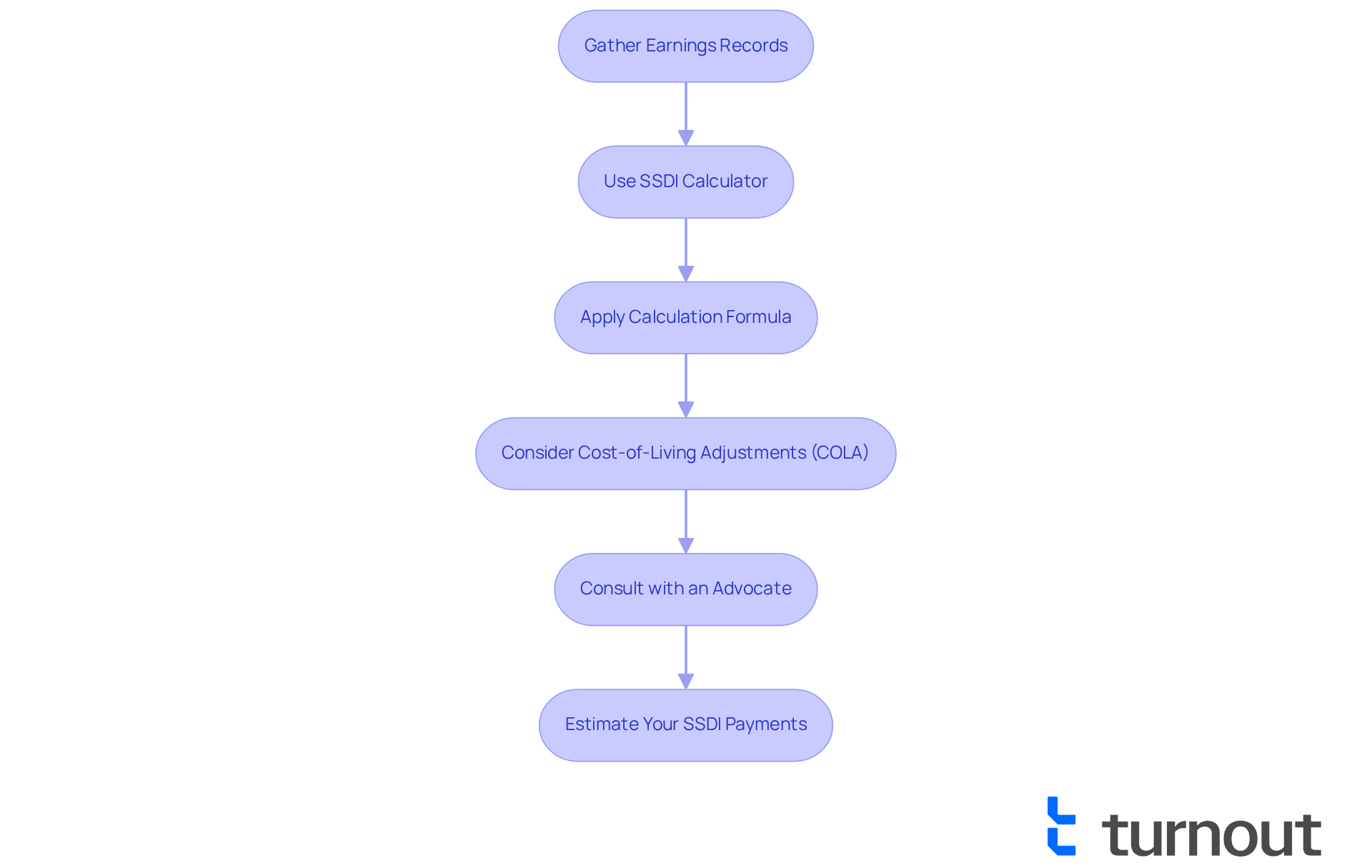

Gather Your Earnings Records: Start by collecting your work history and earnings records for the past 35 years. This information is crucial for calculating your Average Indexed Monthly Earnings (AIME). The Social Security Administration relies on this data to assess your benefits. Remember, any missing work years are treated as zero income, which can significantly lower your average indexed monthly earnings.

-

Use the SSDI Calculator: Take advantage of online tools like the SSA's Benefit Calculators or other SSDI calculators found on various advocacy websites. By entering your earnings information, you can receive an estimate of your AIME and potential benefits. Many individuals have found these calculators invaluable for understanding their financial outlook.

-

Apply the Calculation Formula: Now, use the formula provided in earlier sections to estimate your Primary Insurance Amount (PIA) based on your AIME. This formula incorporates progressive percentage rates that support lower-income workers, ensuring a fair evaluation of your benefits.

-

Consider Cost-of-Living Adjustments (COLA): Don’t forget to factor in potential cost-of-living adjustments to your estimated benefits. The Social Security Administration adjusts distributions each year based on inflation. For 2025, the COLA adjustment is set at 2.5%, which can significantly impact your future payments.

-

Consult with an Advocate: If you have questions or need assistance, consider reaching out to Turnout's trained nonlawyer advocates. They can provide personalized guidance and help you navigate the application process. Their expertise can clarify any complexities and enhance your understanding of the disability benefits system.

By following these steps, you can arrive at a reasonable estimate of how much is SSDI payment. This knowledge allows you to plan your finances with greater confidence, knowing that you are not alone in this journey.

Conclusion

Understanding the complexities of Social Security Disability Insurance (SSDI) payments is crucial for those facing the challenges of disability. We recognize that navigating this system can feel overwhelming. That’s why it’s so important to estimate potential benefits accurately. These payments are designed to provide essential financial support for individuals unable to work. By knowing what to expect from SSDI, you can prepare for your financial future and approach the application process with greater confidence.

Key points to consider include:

- How SSDI benefits are calculated through Average Indexed Monthly Earnings (AIME) and the Primary Insurance Amount (PIA).

- Cost-of-living adjustments play a significant role in determining your benefits.

- Factors like your work history, earnings levels, and any additional income sources can also influence the assistance you receive.

Understanding these elements empowers you to take informed steps toward securing your benefits, ensuring you have the support necessary to maintain your quality of life.

Ultimately, grasping SSDI payments goes beyond just numbers; it reflects a commitment to enhancing the well-being of individuals with disabilities. By leveraging available resources and seeking guidance from knowledgeable advocates, you can navigate the SSDI landscape more effectively. This proactive approach not only fosters financial stability but also highlights the importance of community support in overcoming the hurdles associated with disability. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a program that provides financial support to individuals who are unable to work due to a qualifying disability.

Why is understanding SSDI payments important?

Understanding SSDI payments is crucial because the amount received can significantly influence a recipient's quality of life and help in planning finances effectively.

How much is the average SSDI payment as of 2025?

As of 2025, the average SSDI payment for disabled workers is around $1,754.64 per month.

What is the purpose of the cost-of-living adjustment (COLA) for SSDI payments?

The COLA is designed to help beneficiaries cope with rising living costs, ensuring that benefits keep pace with inflation and maintain the purchasing power of recipients.

How do SSDI payments impact the quality of life for recipients?

SSDI payments help recipients afford necessary medical treatments and maintain a sense of normalcy in their daily lives, enhancing their overall quality of life.

What is the Compassionate Allowances program?

The Compassionate Allowances program includes 300 conditions that accelerate the decision process for individuals facing serious medical issues, ensuring timely access to resources.

How can individuals get help with the SSDI application process?

Trained nonlawyer advocates at organizations like Turnout can guide individuals through the SSDI application process, providing support to navigate government benefits effectively.