Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming, especially for those in Texas who depend on it for financial support during tough times. We understand that this federal program is meant to help individuals who can’t work due to disabilities, yet many find themselves unsure about how to assess their benefits or navigate the application process.

What factors influence SSDI amounts? How can you ensure you meet the eligibility requirements? It’s common to feel lost in these questions, but exploring them can empower you to take control of your financial future. Remember, you are not alone in this journey. We’re here to help you secure the assistance you need.

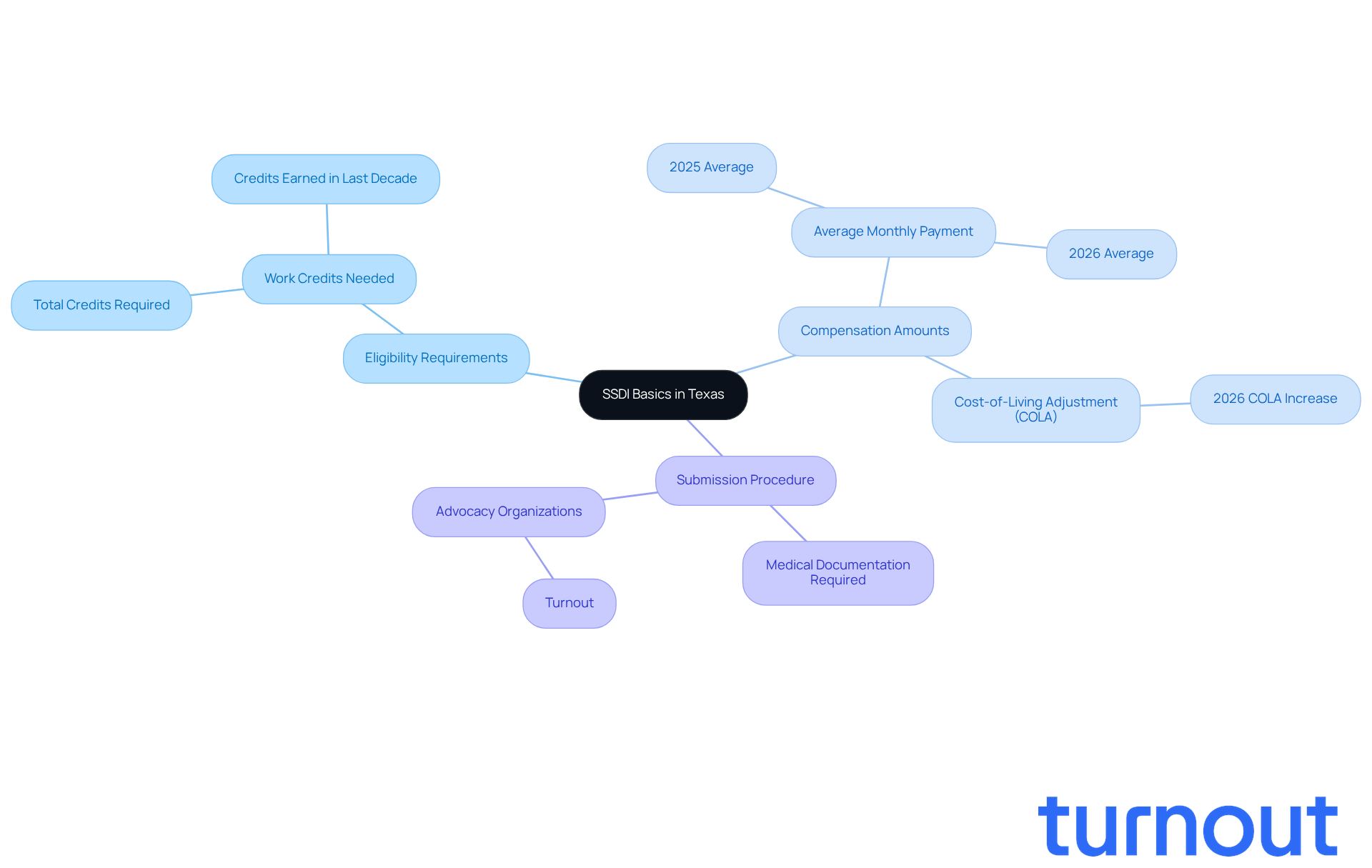

Understand SSDI Basics in Texas

Social Security Disability Insurance is a vital federal program designed to offer financial support to those who can’t work due to qualifying disabilities. If you’re in Texas and have contributed to the Social Security system through your work, you may want to find out how much is SSDI in Texas to see if you are eligible for this assistance. We understand that navigating this process can feel overwhelming, especially when you’re dealing with health challenges. To qualify, you’ll need to show that a medical condition significantly limits your ability to engage in substantial gainful activity (SGA).

Here are some key points to keep in mind:

- Eligibility Requirements: Generally, you’ll need to have earned a specific number of work credits-typically 40, with at least 20 earned in the last decade. This can feel like a lot, but it’s important to know where you stand.

- Compensation Amounts: The amount you receive is based on your average lifetime earnings. In 2026, many are inquiring about how much is SSDI in Texas, which averages around $1,630 per month, thanks to a recent 2.8% cost-of-living adjustment (COLA). Just a year earlier, in 2025, the average was about $1,586. Staying informed about these changes can make a real difference in your planning.

- Submission Procedure: The application process can be complex, often requiring detailed medical documentation and proof of your work history. We understand that this can be daunting. Familiarizing yourself with these requirements is crucial for successfully navigating the steps to determine your benefits. Organizations like Turnout offer access to trained nonlawyer advocates who can help you understand these complexities and improve your chances of a successful application. Their expertise in navigating government assistance can be invaluable in your journey toward securing disability support.

Remember, you’re not alone in this process. Disability advocates emphasize the importance of understanding these fundamentals to empower you in your pursuit of social security assistance. Seeking help can significantly enhance your chances of a successful application. We’re here to help you every step of the way.

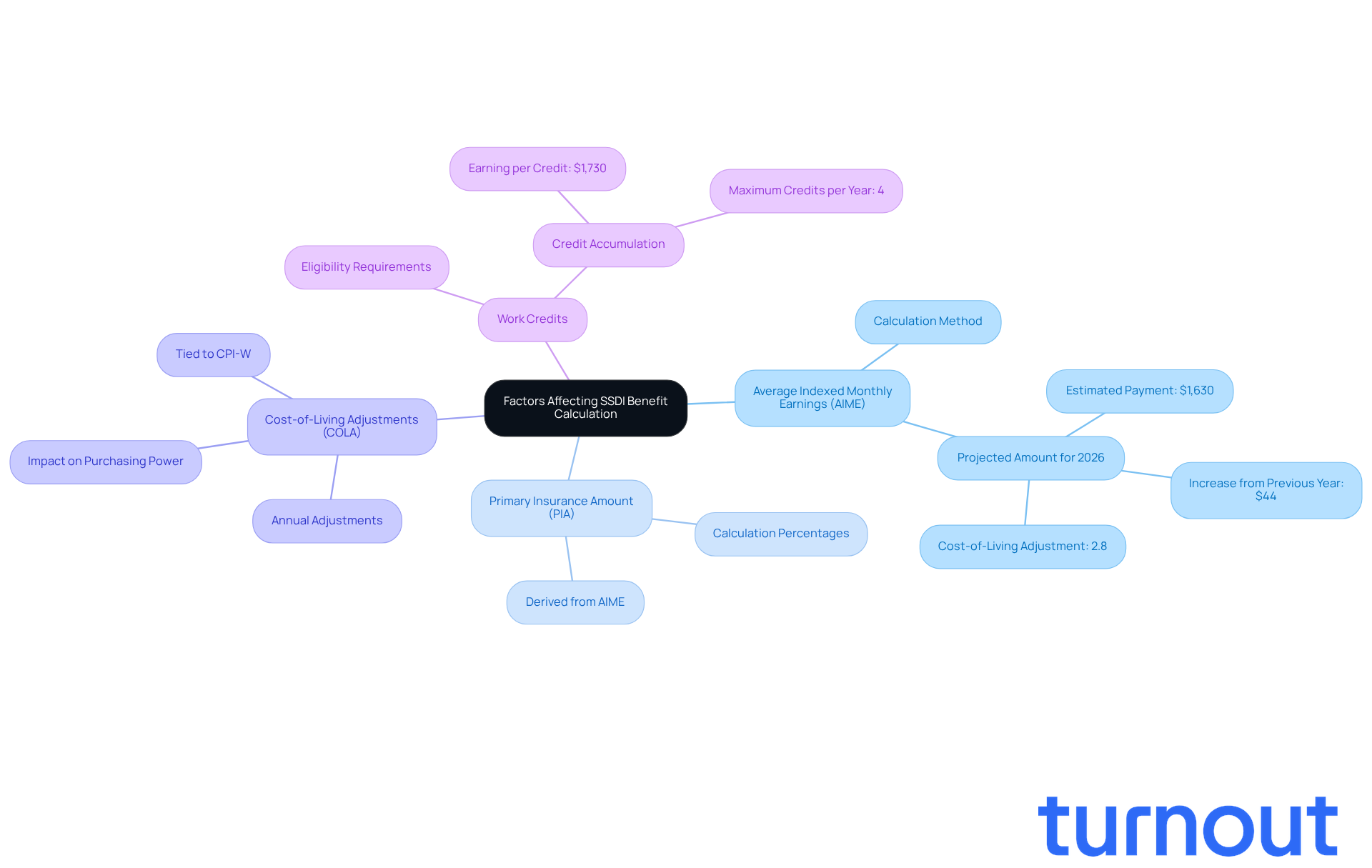

Identify Factors Affecting SSDI Benefit Calculation

Navigating the world of SSDI benefits in Texas can feel overwhelming, but understanding a few key factors can make a significant difference in your journey:

-

Average Indexed Monthly Earnings (AIME): This figure is crucial in determining your SSDI benefit amount. AIME is calculated based on your highest-earning years, typically the 35 years when you earned the most. For 2026, the projected amount for how much is ssdi in texas is estimated to be $1,630 per month, which reflects a $44 increase from the previous year due to a 2.8% cost-of-living adjustment (COLA). This adjustment is designed to help you keep pace with rising costs.

-

Primary Insurance Amount (PIA): Your PIA is derived from your AIME and serves as the foundation for your monthly disability payment. The calculation involves applying various percentages to segments of your AIME, ensuring that while higher earners may receive more, the advantage is proportionately reduced.

-

Cost-of-Living Adjustments (COLA): Each year, disability support payments are adjusted to align with inflation. The 2.8% COLA for 2026 is particularly important for helping beneficiaries maintain their purchasing power, especially for those relying on fixed incomes, and many are wondering how much is ssdi in texas. We understand how vital this support is during challenging times.

-

Work Credits: Your accumulated work credits play a direct role in both your eligibility and the amount you receive. You earn one credit for every $1,730 in wages or self-employment income, with a maximum of four credits available each year. Understanding your employment background and credits is essential for accurately assessing your potential disability support.

By grasping these elements, you can navigate the disability system with greater confidence. Remember, you’re not alone in this journey. Turnout is here to assist you, offering trained nonlawyer advocates and various tools designed to simplify access to government services. We’re committed to ensuring you receive the support you need to overcome the complexities of the system.

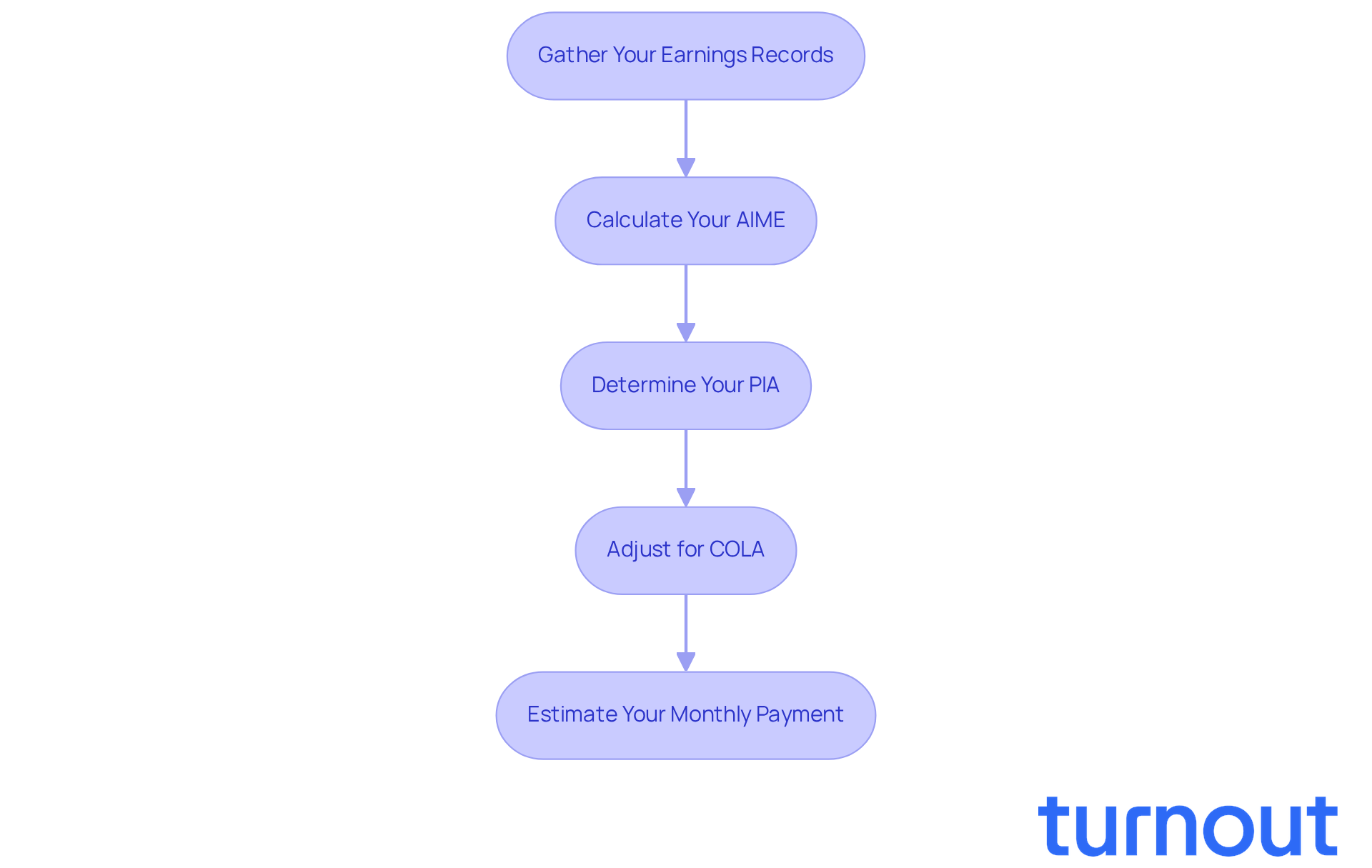

Calculate Your Estimated SSDI Benefits

Estimating how much is SSDI in Texas can seem overwhelming, but we're here to help you through the process. By following these steps, you can gain a clearer understanding of how much is SSDI in Texas and the support that is available to you.

-

Gather Your Earnings Records: Start by collecting your work history and earnings records for the past 35 years. This information is crucial for calculating your Average Indexed Monthly Earnings (AIME).

-

Calculate Your AIME: Here’s how to do it:

- Identify your highest-earning years (up to 35 years) and adjust them for inflation using the Social Security Administration's indexing factors.

- Total these adjusted earnings and divide by the number of months in those years (420 months for 35 years).

-

Determine Your Primary Insurance Amount (PIA): Now, let’s apply the following formula to your AIME:

- 90% of the first $1,115 of your AIME

- 32% of the AIME over $1,115 and up to $6,721

- 15% of the AIME over $6,721

- Add these amounts together to find your PIA.

-

Adjust for Cost-of-Living Adjustments (COLA): If applicable, modify your PIA for any cost-of-living adjustments that may affect your entitlements. For 2026, disability support payments will see a 2.8% increase, which can significantly impact your monthly assistance.

-

Estimate Your Monthly Payment: To understand how much is SSDI in Texas, your projected monthly disability payment will be your PIA, which can be adjusted based on your specific circumstances.

By following these steps, you can arrive at a reasonable estimate of your disability benefits. Remember, you are not alone in this journey, and understanding your benefits is a vital step toward securing the support you need.

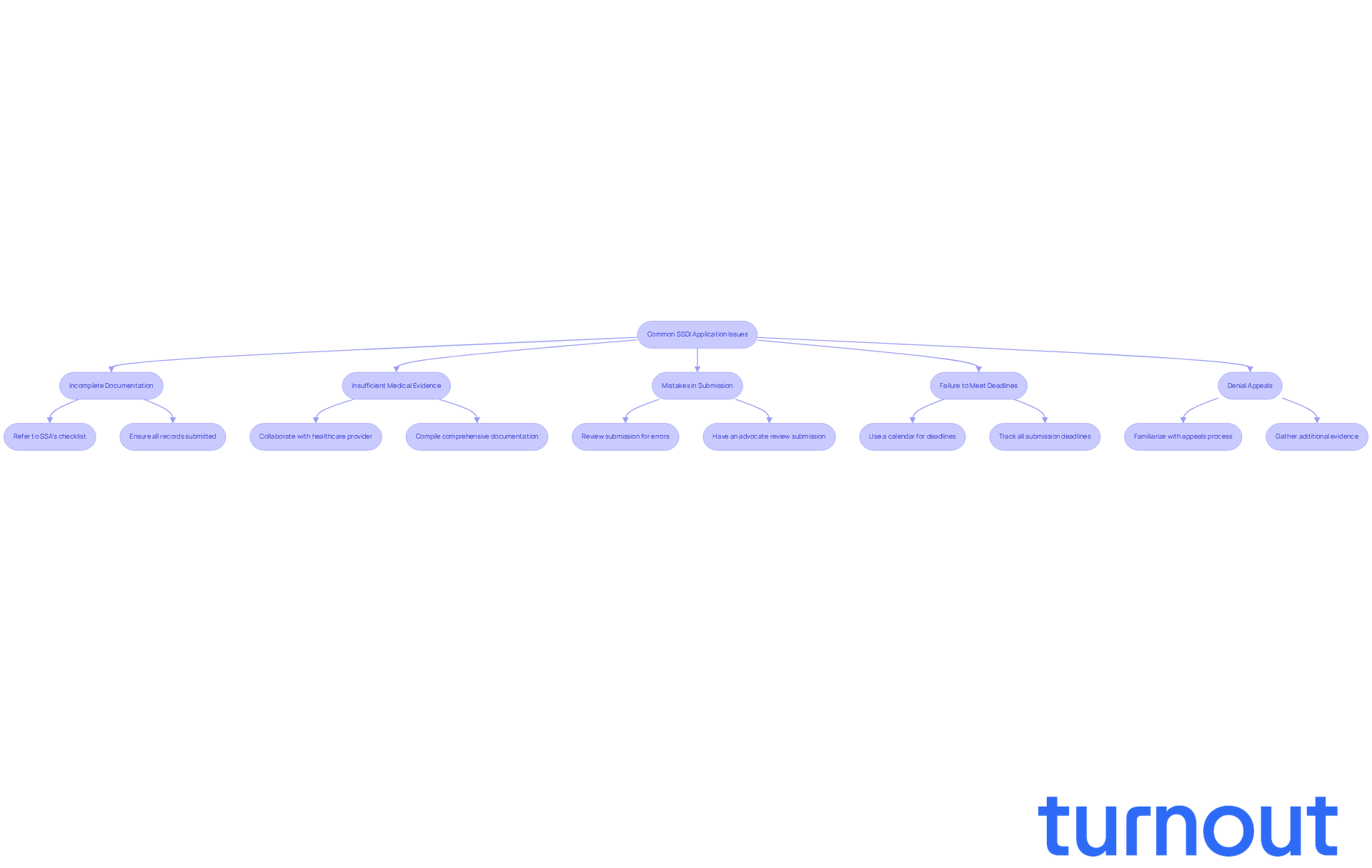

Troubleshoot Common SSDI Application Issues

When applying for SSDI, we understand that you may face several common challenges. Here’s how to effectively troubleshoot them:

- Incomplete Documentation: It’s crucial to ensure that all required medical records and employment history are submitted. Missing documents can lead to significant delays or outright denials. Always refer to the SSA's checklist for required documents to avoid oversights. Did you know that more than half of SSD requests are denied in most states? This makes thorough documentation essential.

- Insufficient Medical Evidence: A common reason for denial is a lack of robust medical evidence supporting your disability claim. Collaborate closely with your healthcare provider to compile comprehensive documentation that clearly outlines your condition and its impact on your ability to work. The award rate for SSI disability requests was only 31 percent in 2023, highlighting how competitive the submission process can be.

- Mistakes in Submission: Carefully reviewing your submission for any errors or inconsistencies is vital. Simple mistakes can result in denials. It’s advisable to have a trusted advocate or professional review your submission before sending it to catch any potential issues. Turnout provides trained nonlawyer advocates who can assist you in this process, ensuring that your submission is as strong as possible.

- Failure to Meet Deadlines: Staying organized is crucial. Keep track of all deadlines associated with your submission and any necessary follow-ups. Utilizing a calendar or reminder system can help ensure you remain on top of important dates.

- Denial Appeals: If your request is denied, don’t lose hope. You have the right to appeal the decision. Familiarize yourself with the appeals process and gather additional evidence to strengthen your case. Remember, many applicants successfully overturn initial denials through diligent follow-up and additional documentation.

By proactively addressing these common issues, you can significantly enhance your chances of a successful SSDI application. Remember, you are not alone in this journey - Turnout is here to help you navigate these challenges without the need for legal representation.

Conclusion

Understanding the complexities of Social Security Disability Insurance (SSDI) in Texas is crucial for anyone seeking financial support due to qualifying disabilities. We know this journey can feel overwhelming, but this guide aims to clarify the essential aspects of SSDI - from eligibility requirements to how benefits are calculated. By grasping these concepts, you can better prepare yourself to secure the assistance you need.

Key points to consider include:

- The importance of work credits

- How Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA) are calculated

- The impact of cost-of-living adjustments on your monthly benefits

It's common to face challenges during the application process, such as incomplete documentation or insufficient medical evidence. But don’t worry; we’ve also included strategies to help you troubleshoot these issues effectively. Resources like Turnout can provide valuable support, connecting you with nonlawyer advocates who can help streamline the process.

Ultimately, understanding how to calculate SSDI benefits in Texas and recognizing the factors that influence these amounts can empower you in your pursuit of assistance. Taking proactive steps, seeking help when needed, and being aware of common pitfalls can significantly enhance your chances of a successful application. Remember, the journey to securing disability benefits may seem daunting, but with the right knowledge and resources, you can navigate the system with confidence and clarity. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a federal program that provides financial support to individuals who cannot work due to qualifying disabilities.

Who is eligible for SSDI in Texas?

To be eligible for SSDI in Texas, you generally need to have earned a specific number of work credits-typically 40, with at least 20 earned in the last decade. You must also demonstrate that a medical condition significantly limits your ability to engage in substantial gainful activity (SGA).

How much can I expect to receive from SSDI in Texas?

As of 2026, the average SSDI payment in Texas is around $1,630 per month, which reflects a 2.8% cost-of-living adjustment (COLA). In 2025, the average payment was about $1,586.

What is the application process for SSDI?

The application process for SSDI can be complex and typically requires detailed medical documentation and proof of your work history. Familiarizing yourself with these requirements is essential for successfully navigating the application steps.

Can I get help with my SSDI application?

Yes, organizations like Turnout provide access to trained nonlawyer advocates who can assist you in understanding the application process and improve your chances of a successful application.

Why is it important to understand SSDI basics?

Understanding SSDI basics empowers you in your pursuit of social security assistance and helps you navigate the complexities of the application process more effectively. Seeking help can significantly enhance your chances of a successful application.