Overview

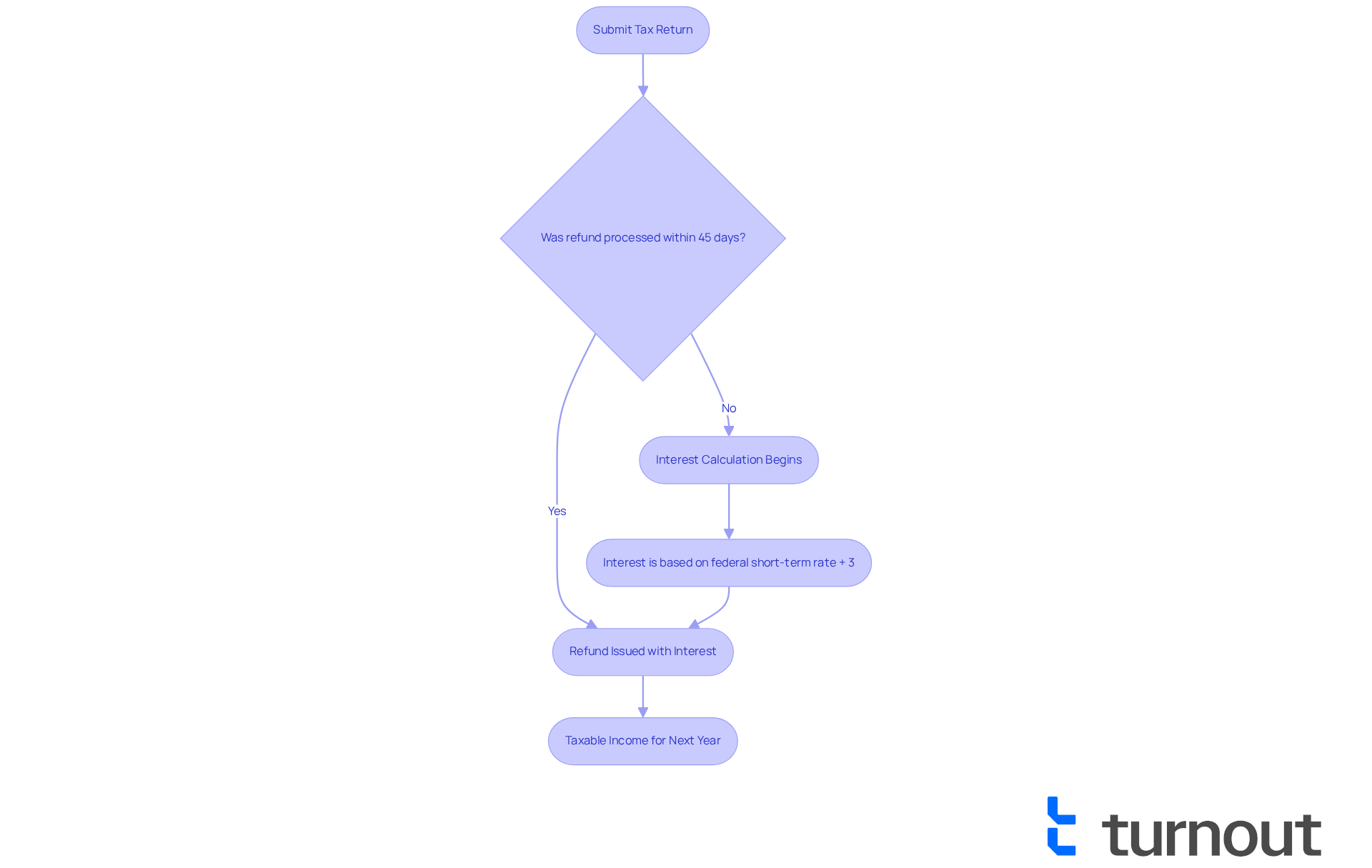

We understand that waiting for a tax refund can be a stressful experience. The IRS pays interest on delayed refunds at a rate of the federal short-term rate plus 3%. For the fourth quarter of 2025, this rate is set at 7% annually, compounded daily.

This system is designed to support you. If your refund is not processed within 45 days of the tax deadline or submission date, you will receive compensation for the delay. This compensation is calculated using a straightforward formula based on the principal amount and the number of days delayed.

You are not alone in this journey. Knowing that you can receive interest on your delayed refund can provide some peace of mind. If you have any questions or need assistance, we're here to help.

Introduction

Understanding the intricacies of tax refunds can feel overwhelming, especially when delays occur. We know how stressful it can be to wait for your hard-earned money. The IRS has established a system to compensate taxpayers for these delays through interest payments, raising an important question: how much interest does the IRS actually pay on delayed refunds?

This article will explore the specific conditions that trigger these payments, the calculation methods used, and potential exceptions that could affect the outcome. As you navigate the complexities of your refunds, clarity on these processes is essential.

What happens when a refund is delayed beyond the expected timeframe? How can you ensure you receive the compensation you are entitled to? We're here to help you understand your rights and options.

Explore IRS Interest Payments on Delayed Refunds

We understand that dealing with postponed s can be stressful. The reimburses taxpayers for these delays by providing , raising the question of . If a refund isn't processed within 45 days of the tax deadline or the date the return was submitted, you might be curious about how much interest does the IRS pay on delayed refunds as . This charge is calculated based on the federal short-term rate, plus an additional 3%, similar to how much interest does the IRS pay on delayed refunds. For the fourth quarter of 2025, this rate is set at 7% annually, compounded daily. This means that for each day a reimbursement is delayed beyond the 45-day period, the IRS owes compensation, leading to inquiries about how much interest does the IRS pay on delayed refunds, which can add up significantly over time.

For instance, if you submit a revised return on August 1 for an extra payment of $1,000, the IRS must provide that payment by September 15 to avoid any additional charges. If the reimbursement is delayed beyond this timeframe, you will receive compensation on the remaining amount, and you may wonder how much interest does the IRS pay on delayed refunds. Rest assured, this process is automatically monitored by the IRS, so you won’t need to take further action to claim this compensation. Most taxpayers can expect an , and these payments are typically directly deposited or sent as checks labeled 'INT Amount' to signify them as earnings.

It's important to recognize that any earnings from postponed reimbursements are taxable and must be reported on the following year's tax return. Additionally, the IRS may not provide compensation for in certain situations, such as when there are mathematical errors on the tax return or during inquiries related to fraud or identity theft. Understanding these processes is crucial for you to know your rights and what to expect when facing delays in receiving your reimbursements. Remember, you're not alone in this journey, and we're here to help you navigate through it.

Identify Conditions for IRS Interest Payments

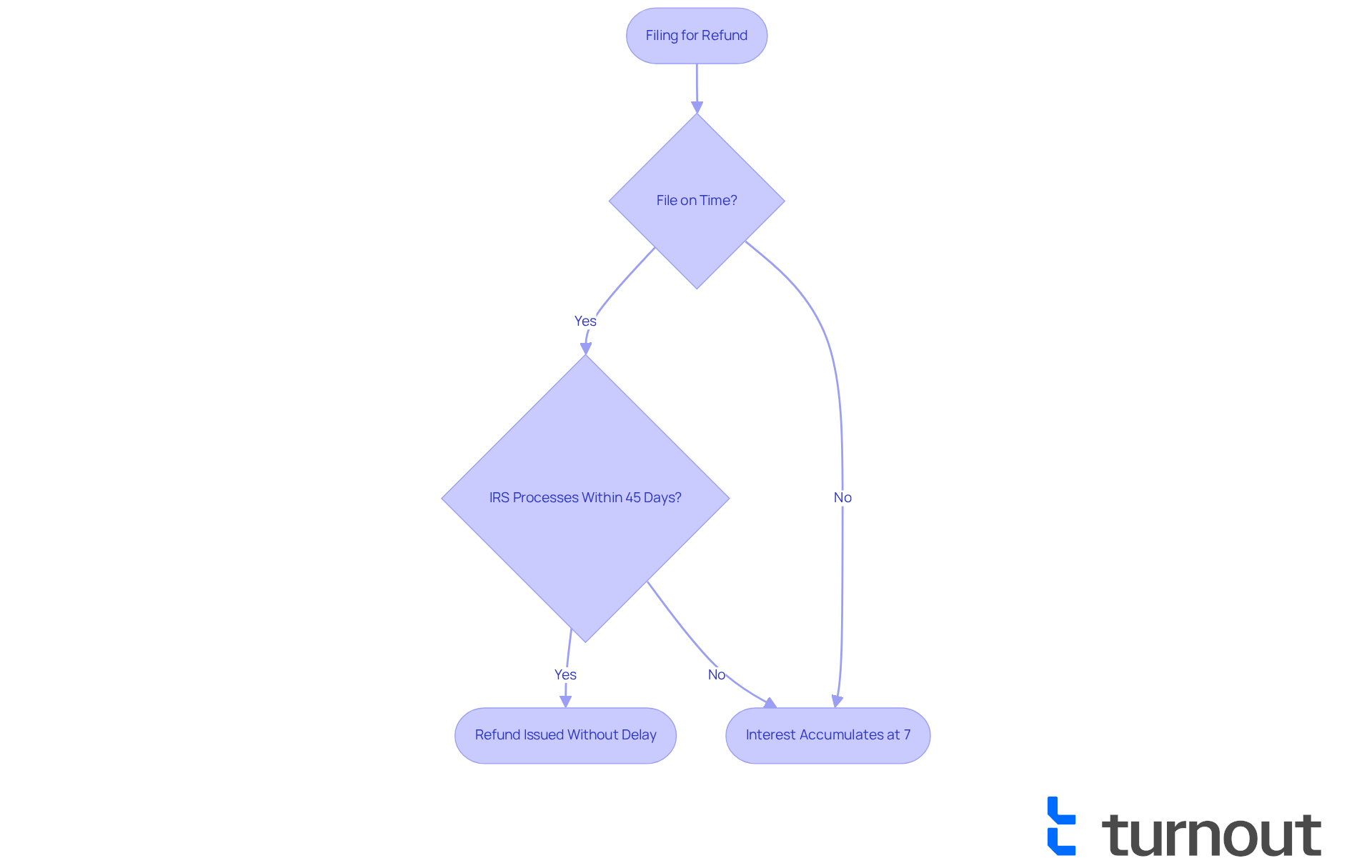

Understanding how much interest does the pay on can feel overwhelming, but we’re here to help you navigate this process. Several key conditions determine whether you will receive interest on your tax payments:

- : It’s crucial to file your returns on time to qualify for interest payments.

- : The IRS must process reimbursements within 45 days. If it takes longer, .

- Type of Refund: Interest is paid on overpayments, including those from amended returns.

When these conditions are met, you can expect compensation for any delays in receiving your funds. For instance, if you file your return by the April 15 deadline, the IRS has until May 30 to process your repayment without incurring extra charges. If your refund is delayed beyond this date, you might be curious about , as a fee will start accumulating at the current rate of 7% for the first two quarters of 2025, compounded daily. This ensures that you are compensated for the time you are without your money.

begins from the later of the submission deadline, the date the return is processed, or when the payment was made, and this process may also involve considerations about how much interest does the IRS pay on delayed refunds. It’s important to remember that exceptions may apply, such as delays caused by identity theft investigations or math errors on your return, during which charges may not accumulate.

Additionally, any earnings from a postponed reimbursement must be reported as on your next year's tax return. We understand that grasping these circumstances is essential for managing your payment expectations and any potential additional charges. You are not alone in this journey, and knowing these details can empower you to take control of your financial situation.

Understand IRS Interest Calculation Methods

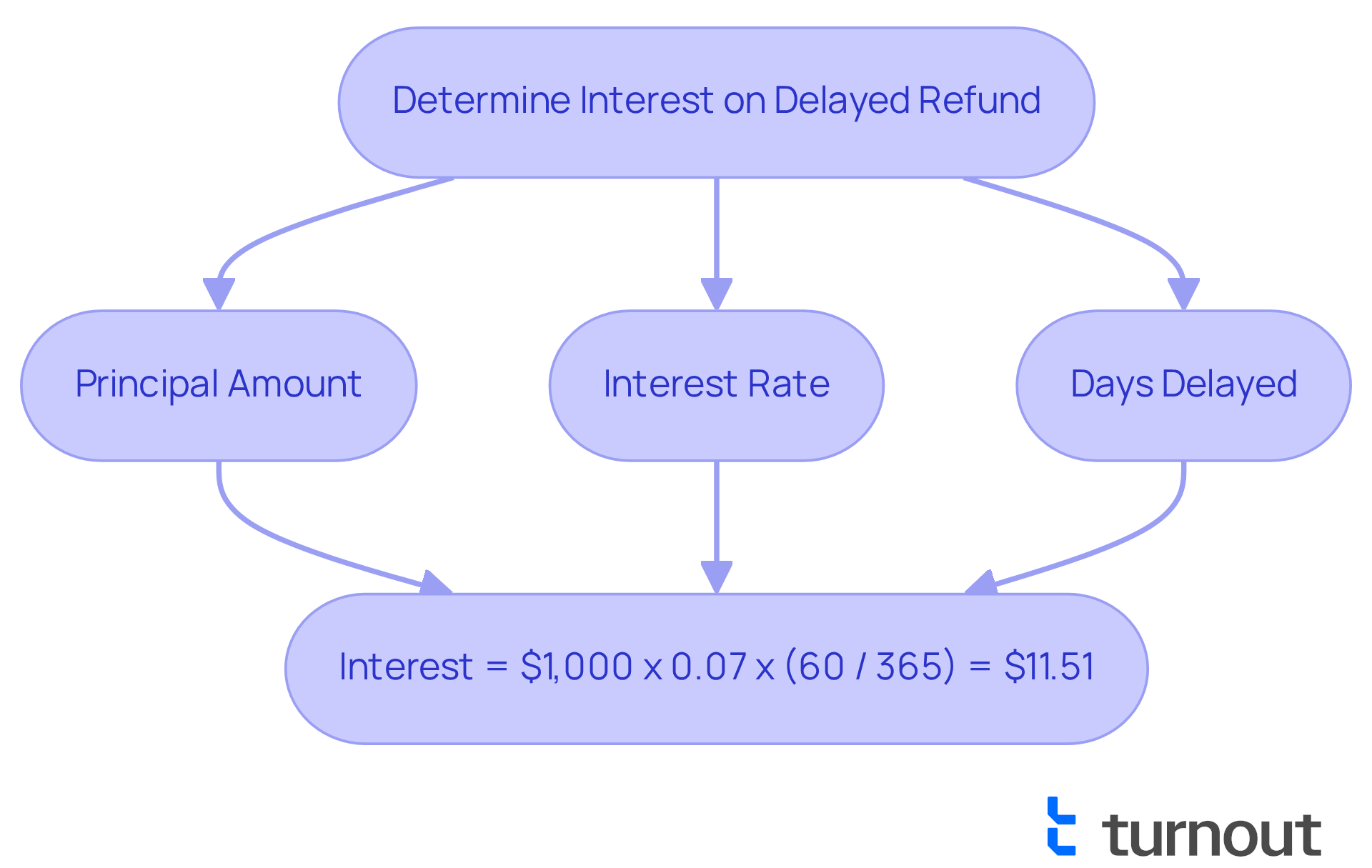

We understand that can be stressful. The IRS determines through a daily compounding technique. The formula for determining interest is straightforward:

Interest = Principal Amount x Interest Rate x (Number of Days Delayed / 365).

For example, if you are owed a refund of $1,000 and it is delayed by 60 days, the :

- Principal Amount: $1,000

- Interest Rate: 7% (0.07)

- Days Delayed: 60

Interest = $1,000 x 0.07 x (60 / 365) = $11.51.

In this case, you would receive an additional $11.51 along with your reimbursement. This method ensures that taxpayers are compensated fairly for any delays in receiving their payments.

It's important to remember that any earnings from a must be reported as taxable income on your . Additionally, most payment distributions will be sent separately from tax returns, as required by the established 45-day rule. As the Internal Revenue Service states, 'If you haven't received your payment within 45 days of the tax deadline, the IRS provides , raising the question of how much interest does the IRS pay on delayed refunds, with compensation accumulating daily.'

We’re here to help you navigate these processes, and you are not alone in this journey.

Examine Scenarios and Exceptions Affecting Interest Payments

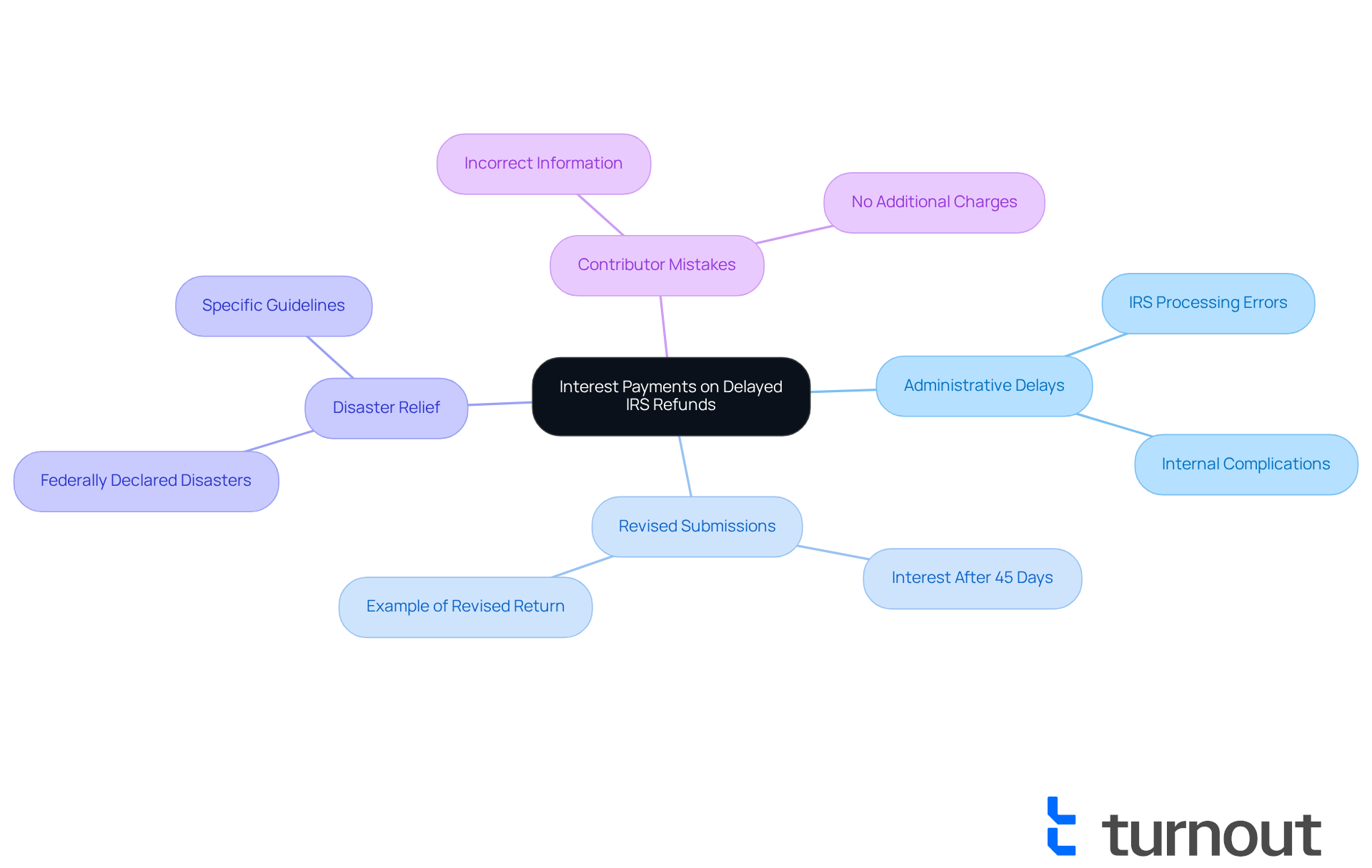

We understand that dealing with can be frustrating and confusing, especially when you wonder . While the IRS typically pays interest on these delays, there are several exceptions that you should be aware of:

- Administrative Delays: If your refund is delayed due to , interest may not be paid. This can happen when the IRS faces processing errors or other internal complications. Many postponed refunds are linked to these issues, highlighting the importance of being attentive during the filing process.

- Revised Submissions: Did you submit a revised return? is only applicable if the payment is issued more than 45 days after the filing date. For example, if you file a revised return on August 1, the IRS must process your refund by September 15 to avoid penalties.

- Disaster Relief: In the case of , different regulations may apply regarding payment obligations. It's crucial to check the specific guidelines that relate to your situation.

- Contributor Mistakes: If the delay is due to mistakes made by you, such as providing incorrect information, additional charges may not apply. This underscores the importance of accuracy when filing your returns.

The IRS is required to provide after the tax return is due or the date the return was submitted, whichever is later. Understanding these exceptions is vital as you manage your expectations regarding how much interest does the IRS pay on delayed refunds. Remember, the IRS automatically monitors amounts due on postponed refunds, so you don't have to request payment from them. Standard non-corporate overpayments earn interest at the federal short-term rate plus 3 percentage points, which shows the financial implications for you as a taxpayer.

You're not alone in this journey, and we're here to help you navigate these complexities.

Conclusion

Understanding the intricacies of IRS interest payments on delayed refunds is essential for taxpayers navigating the often stressful world of tax returns. We understand that dealing with tax issues can be overwhelming. The IRS has established clear guidelines that dictate when and how much interest is paid on refunds that are not processed within the stipulated timeframe. By knowing that interest accrues daily at the federal short-term rate plus an additional 3%, you can better manage your expectations and financial planning.

Throughout this discussion, we highlighted key points, including:

- The conditions that must be met for interest payments to apply

- The method of calculating these payments

- The various scenarios that may affect eligibility

It's crucial to recognize that timely filing and awareness of exceptions—such as administrative delays or errors on your part—play a significant role in understanding potential compensation. The IRS automatically monitors these situations, relieving you from the burden of having to request payments yourself.

In conclusion, being aware of IRS policies regarding interest payments on delayed refunds empowers you to take control of your financial situation. By staying informed about current interest rates, understanding the calculation methods, and recognizing the conditions that affect eligibility, you can navigate the complexities of tax refunds with confidence. This knowledge not only alleviates stress but also ensures that you are adequately compensated for any delays you may encounter. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What does the IRS do for delayed tax refunds?

The IRS reimburses taxpayers for delayed tax refunds by providing interest on the amounts due when a refund isn't processed within 45 days of the tax deadline or the date the return was submitted.

How is the interest on delayed refunds calculated?

The interest is calculated based on the federal short-term rate plus an additional 3%. For the fourth quarter of 2025, this rate is set at 7% annually, compounded daily.

What happens if a refund is delayed beyond 45 days?

If a refund is delayed beyond the 45-day period, the IRS owes compensation for each day of delay, which can accumulate significantly over time.

Can you provide an example of how this interest works?

For instance, if you submit a revised return on August 1 for an additional payment of $1,000, the IRS must provide that payment by September 15 to avoid additional charges. If delayed beyond this, you will receive interest on the remaining amount.

Do taxpayers need to take action to claim the interest on delayed refunds?

No, the process is automatically monitored by the IRS, so taxpayers do not need to take further action to claim this compensation.

What is the average payment taxpayers can expect from the IRS for delayed refunds?

Most taxpayers can expect an average payment of about $18, which is typically directly deposited or sent as checks labeled 'INT Amount'.

Are the interest payments from delayed refunds taxable?

Yes, any earnings from postponed reimbursements are taxable and must be reported on the following year's tax return.

Are there situations where the IRS may not provide compensation for delayed payments?

Yes, the IRS may not provide compensation for delayed payments in cases of mathematical errors on the tax return or during inquiries related to fraud or identity theft.