Overview

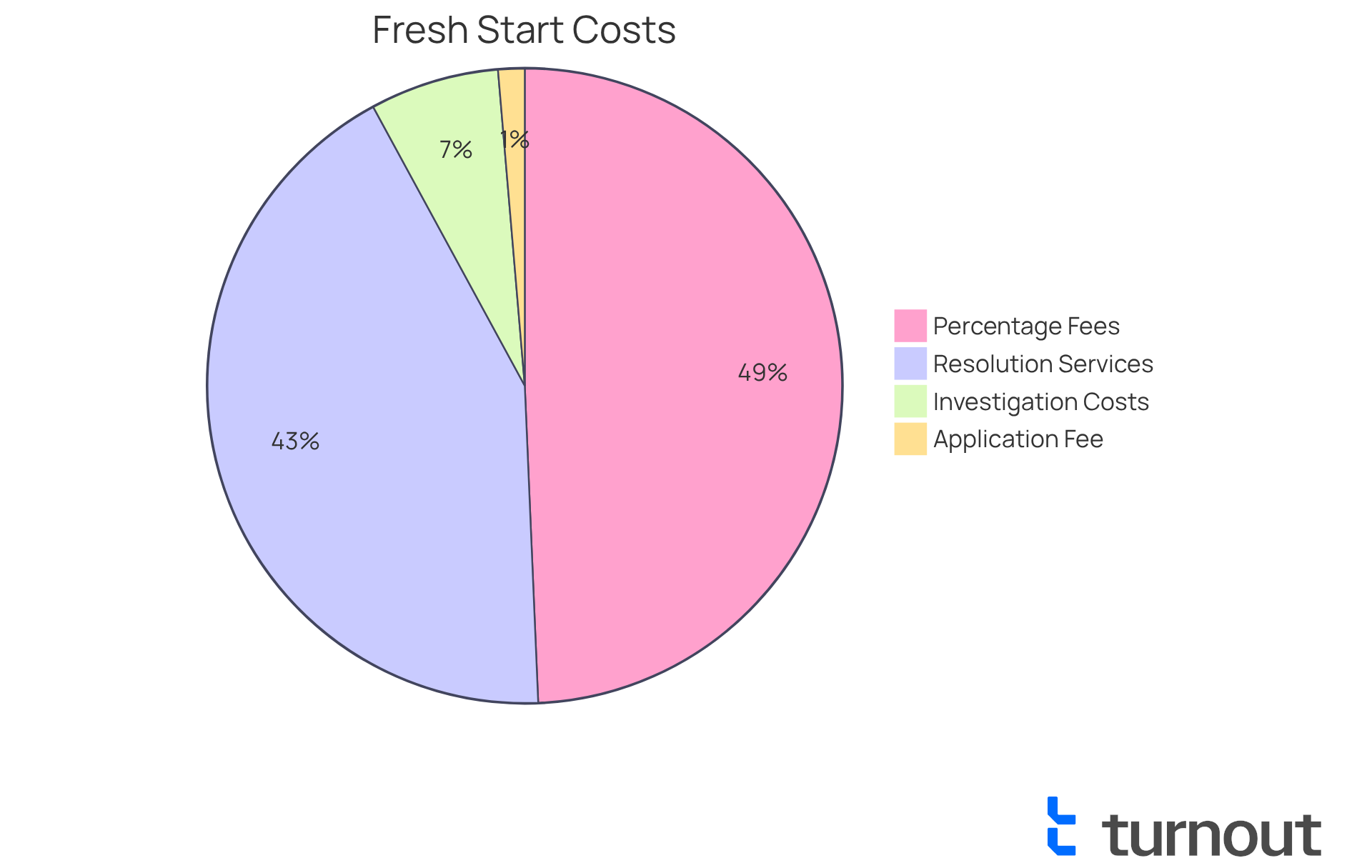

Navigating the costs of the Fresh Start Program can feel overwhelming, and we understand that each taxpayer's situation is unique. Various factors contribute to these costs, including:

- Application fees

- Service fees for tax relief assistance

- Additional expenses related to filing or documentation

For instance, the non-refundable application fee for an Offer in Compromise is $205. Full resolution services can range from $5,000 to $7,500. It's essential to grasp these financial commitments before moving forward, as this knowledge empowers you to make informed decisions. Remember, you're not alone in this journey; we're here to help you through every step.

Introduction

We understand that navigating tax obligations can feel overwhelming, particularly for those facing financial challenges. The IRS Fresh Start Program shines as a beacon of hope, offering a variety of options for taxpayers who are struggling to meet their obligations. In this guide, we will explore the costs associated with the program, outlining essential steps and resources designed to help you manage your financial responsibilities.

It's common to feel uncertain about potential hidden fees and varying service costs. So, how can you accurately assess the true financial impact of seeking relief through this initiative? We're here to help you find clarity and support.

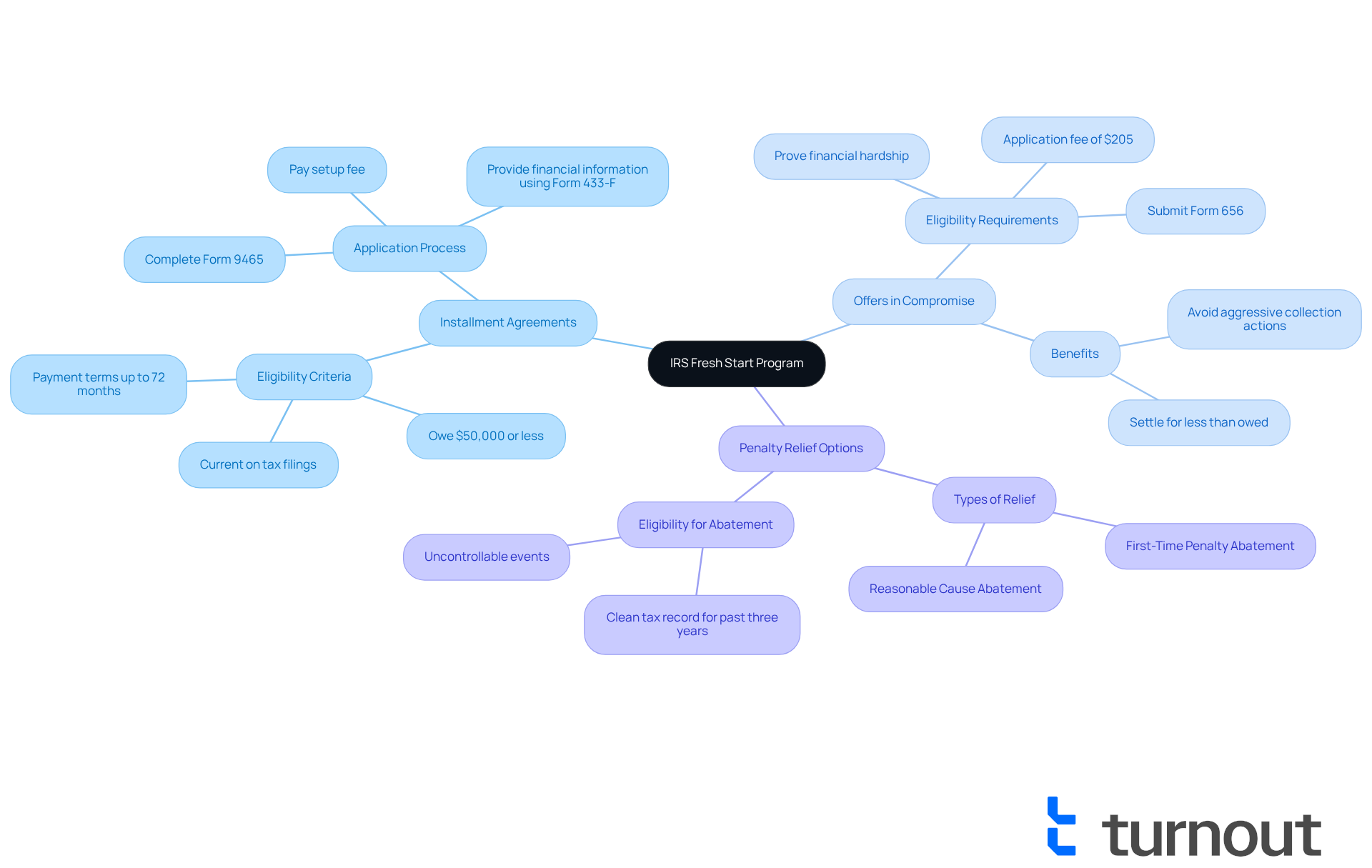

Understand the IRS Fresh Start Program

The IRS Fresh Start Program is a vital initiative aimed at assisting taxpayers who are facing challenges with their tax obligations. This program is especially beneficial for individuals who owe $50,000 or less, as it offers simplified installment agreements. For those with greater amounts, up to $250,000, there are additional alternatives available, making it more achievable for anyone experiencing financial difficulties.

Key features of the program include:

- Installment agreements, allowing taxpayers to pay off their obligations in manageable monthly installments over a period of up to 72 months.

- Offers in compromise enable eligible individuals to settle their tax liabilities for less than the total amount owed.

- Penalty relief options, such as penalty abatement, which can help reduce or eliminate penalties for late payments or filings, provided that taxpayers have maintained a clean tax record for the past three years or have faced uncontrollable events.

To qualify for the New Beginnings Program, taxpayers must be current on all tax submissions and demonstrate an inability to fully settle their tax obligation. Recent updates to the program have made it more accessible, with increased financial thresholds and simplified application processes. For instance, individuals like Dana, who faced nearly $50,000 in tax obligations, successfully enrolled in a simplified program and received a First-Time Penalty Abatement. This greatly reduced her overall debt, allowing her to manage payments without the burden of public liens.

As we look ahead to 2025, the IRS estimates that millions of taxpayers may qualify for the New Beginnings Program. This highlights their ongoing commitment to providing support for individuals in financial hardship. Understanding these components is essential for determining which option may best suit your financial situation, empowering you to regain control over your tax obligations.

We encourage you to consult a tax professional to enhance your chances of approval for tax relief applications. Remember, you are not alone in this journey, and we’re here to help you navigate the process effectively.

Identify Costs Involved in the Fresh Start Program

Navigating the IRS New Beginning Program can feel overwhelming, and it's important to recognize how much does fresh start cost, along with the various expenses involved. To qualify for this program, your tax obligation typically needs to be below $50,000. If you’re considering an Offer in Compromise, be aware that there is a non-refundable application fee of $205 as of 2025.

If you decide to seek help from a tax relief service, it's essential to understand how much does fresh start cost, as fees can vary widely based on the complexity of your situation. Initial investigations might cost a few hundred dollars, but they can also exceed $1,500. For full resolution services, it's important to consider how much does fresh start cost, as expenses may rise to between $5,000 and $7,500, especially for more intricate cases. Additionally, some tax relief services charge fees as a percentage of your tax obligation, usually ranging from 10% to 15%.

Before moving forward, take the time to thoroughly review how much does fresh start cost and all potential expenses. This includes any additional costs that might arise from filing fees, transcript fees, or appeals during the investigation. It’s crucial to ensure that you can manage these costs without adding to your financial burden.

We understand that the process of applying for an Offer in Compromise can be lengthy and stressful. Remember, any payments made during this time are non-refundable. You are not alone in this journey, and we’re here to help you navigate these challenges with compassion and understanding.

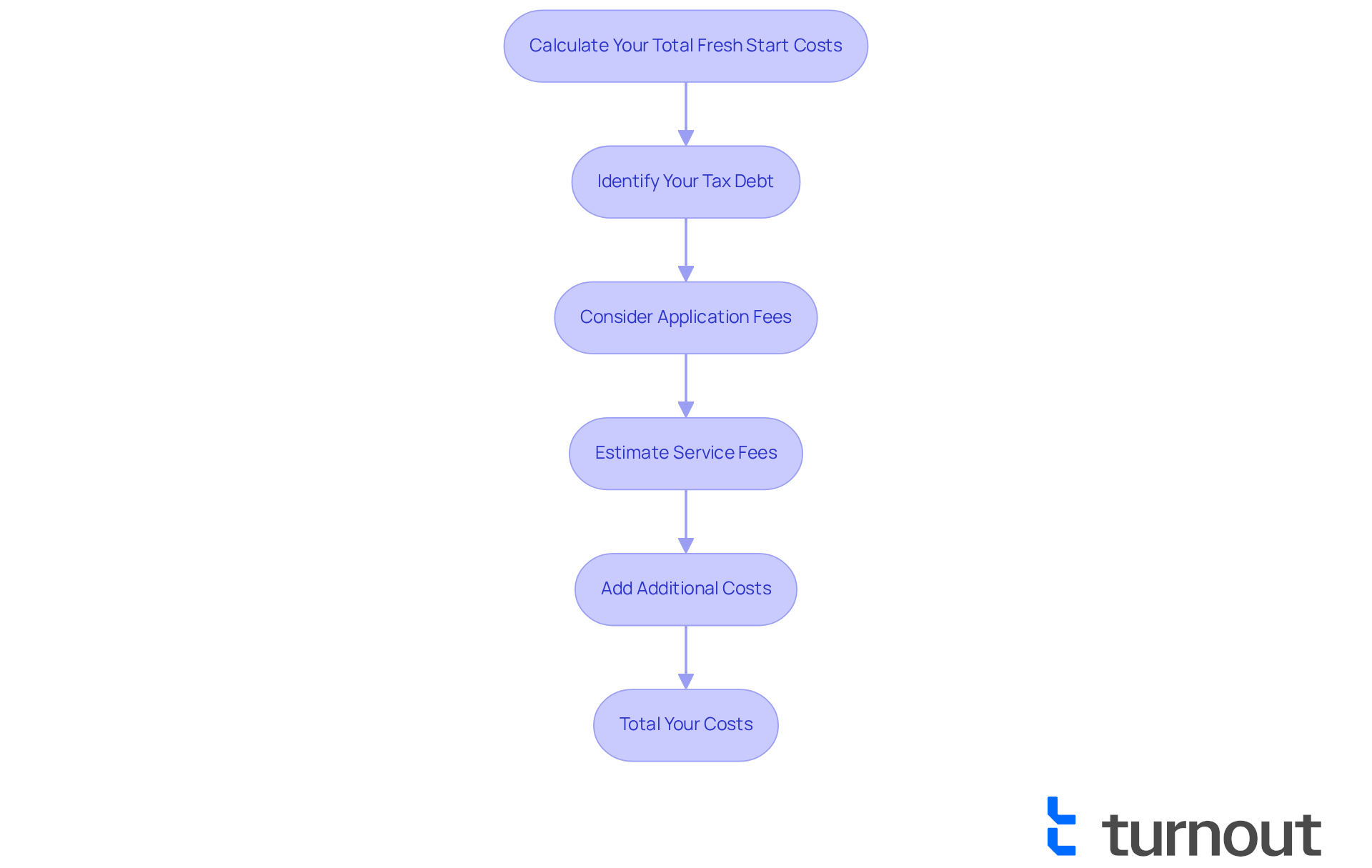

Calculate Your Total Fresh Start Costs Step-by-Step

Calculating how much does fresh start cost in association with the Fresh Start Program can feel overwhelming, but we're here to help you through it. Follow these steps to gain clarity on your financial commitments:

- Identify Your Tax Debt: Start by determining the total amount of tax debt you owe to the IRS. This is the foundation for understanding your financial obligations and can help alleviate some of your concerns.

- Consider Application Fees: If you're applying for an Offer in Compromise, remember to include the $205 application fee. However, if you qualify as a low-income taxpayer, you may not have to pay this fee, which can ease your financial burden.

- Estimate Service Fees: Planning to hire a tax relief service? Research their fees to get an accurate picture of your costs. For instance, if a service charges around $1,000, add this to your total. Keep in mind that fees can vary significantly based on the complexity of your case.

- Add Additional Costs: Don't forget to consider any other potential costs, such as fees for financial documentation or related expenses. This can include costs for obtaining tax transcripts or filing fees, as well as any issues that may arise during the investigation.

- Total Your Costs: Now, add all specified expenses to determine your overall initial costs. This total will give you a clear picture of how much does fresh start cost, assisting you in planning effectively.

Additionally, it's beneficial to utilize the IRS pre-qualifier tool to check your eligibility for offers in compromise. This can aid in your financial planning and provide peace of mind. By following these steps, you can achieve a thorough understanding of the financial implications of participating in the New Beginnings Program, facilitating improved financial planning and decision-making. Remember, maintaining compliance with payment terms is crucial for facilitating tax lien withdrawal. You are not alone in this journey; we are here to support you every step of the way.

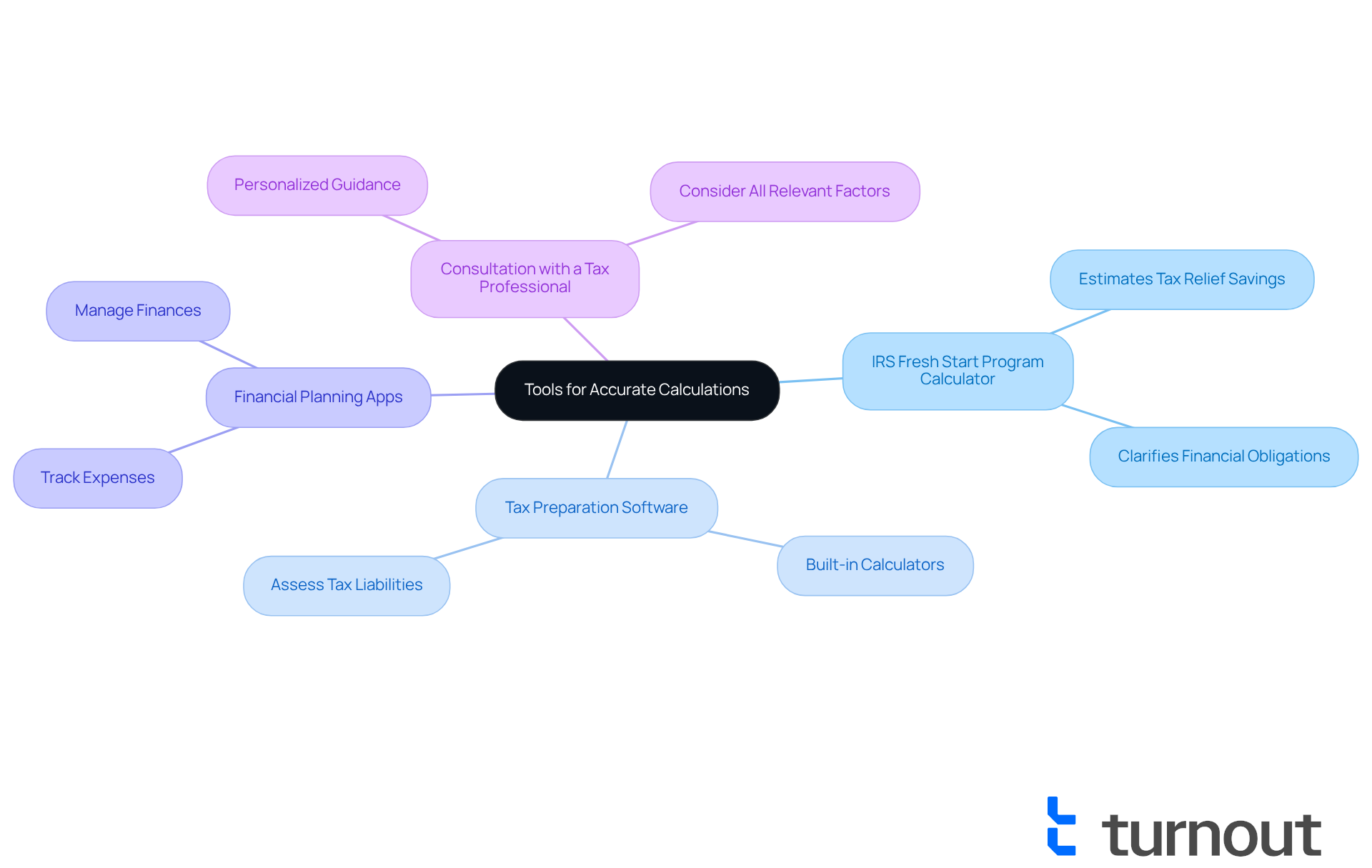

Utilize Tools and Resources for Accurate Calculations

To ensure accurate calculations of your costs, we understand how much does Fresh Start cost and how overwhelming this process can be. Consider utilizing the following tools and resources to ease your journey:

- IRS Fresh Start Program Calculator: This online tool estimates your potential tax relief savings, offering a clearer picture of your financial obligations.

- Tax Preparation Software: Many tax software programs feature built-in calculators that help you assess your tax liabilities and explore potential relief options.

- Financial Planning Apps: Use budgeting and financial planning applications to effectively track your expenses and manage your finances.

- Consultation with a Tax Professional: Engaging with a knowledgeable tax professional can provide personalized guidance, ensuring you consider all relevant factors in your calculations.

It's common to feel uncertain about your tax situation, but the IRS New Beginnings Program offers additional opportunities for taxpayers to settle IRS obligations through payment plans or Offers in Compromise (OIC). In 2025, over 90% of individual taxpayers with tax debt will qualify for the newly introduced Simple Payment Plans. These plans allow you to set up long-term payment arrangements lasting up to 72 months for debts up to $50,000. Remember, individuals must not be in an active bankruptcy proceeding and must have filed all required tax returns to qualify for the Fresh Start program, which raises the question of how much does fresh start cost.

Utilizing these tools can help you navigate the complexities of the program and maximize your potential savings. You're not alone in this journey; we're here to help you every step of the way.

Conclusion

Understanding the costs associated with the IRS Fresh Start Program is vital for taxpayers seeking relief from their tax obligations. This program offers a lifeline for individuals facing financial difficulties, allowing them to manage their debts through:

- installment agreements

- offers in compromise

- penalty relief options

By grasping the financial implications and potential expenses involved, you can make informed decisions that lead to a more manageable financial future.

Throughout this guide, we’ve highlighted key aspects of the Fresh Start Program, including the various costs that may arise, such as:

- application fees

- service fees

- additional expenses related to documentation and filing

Our step-by-step approach empowers you to calculate your total costs accurately, ensuring you are well-prepared for the financial commitments ahead. Utilizing available tools and resources can further enhance your understanding and facilitate the process of navigating this program.

Ultimately, the IRS Fresh Start Program represents a significant opportunity for you to regain control over your financial situation. By taking proactive steps, seeking professional advice, and utilizing available resources, you can effectively manage your tax obligations and work towards a brighter financial future. Engaging with the program not only alleviates immediate financial pressures but also sets the stage for long-term stability and compliance. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What is the IRS Fresh Start Program?

The IRS Fresh Start Program is an initiative designed to assist taxpayers who are struggling with their tax obligations, particularly those who owe $50,000 or less.

What are the key features of the IRS Fresh Start Program?

Key features include installment agreements for manageable monthly payments over up to 72 months, offers in compromise to settle tax liabilities for less than owed, and penalty relief options like penalty abatement for eligible taxpayers.

Who qualifies for the New Beginnings Program?

Taxpayers must be current on all tax submissions and demonstrate an inability to fully settle their tax obligations to qualify for the New Beginnings Program.

What recent updates have been made to the IRS Fresh Start Program?

Recent updates have increased financial thresholds and simplified application processes, making the program more accessible to taxpayers.

Can you provide an example of someone who benefited from the program?

An example is Dana, who had nearly $50,000 in tax obligations and successfully enrolled in a simplified program, receiving a First-Time Penalty Abatement that reduced her overall debt.

How many taxpayers are estimated to qualify for the New Beginnings Program by 2025?

The IRS estimates that millions of taxpayers may qualify for the New Beginnings Program by 2025.

What should taxpayers do to improve their chances of approval for tax relief applications?

It is encouraged to consult a tax professional to enhance the chances of approval for tax relief applications.