Overview

Navigating the world of Social Security Disability Insurance (SSDI) can be overwhelming, especially when it comes to understanding how much assistance you may receive. The amount SSDI pays varies based on your unique earnings history. In 2025, the maximum benefit is set at $4,018 per month, while the average payment is around $1,580.

We understand that these figures can feel daunting. They are determined by important factors like:

- Average Indexed Monthly Earnings (AIME)

- Primary Insurance Amount (PIA)

These elements reflect your contributions to the Social Security system and are adjusted for inflation through Cost-of-Living Adjustments (COLA).

It’s common to feel uncertain about how these calculations impact your financial future. Remember, you are not alone in this journey. We're here to help you navigate these complexities and ensure you receive the benefits you deserve.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming, especially for those facing the financial challenges that come with a disability. Millions of Americans depend on this vital program for support, making it essential to understand how much SSDI pays and the factors that influence benefit amounts.

We understand that applicants encounter numerous challenges in securing the benefits they deserve. How can you ensure that you are maximizing your potential support? This article explores the intricacies of SSDI payments, offering insights designed to empower you to navigate this essential system with confidence.

Explore the Basics of Social Security Disability Insurance (SSDI)

Social Security Disability Insurance is a vital federal initiative that offers financial assistance to individuals who find it challenging to perform daily tasks due to qualifying disabilities. We understand that navigating this process can feel overwhelming. To be eligible for disability benefits, applicants must have a work history that includes contributions to Social Security taxes and must demonstrate that their disability prevents them from engaging in substantial gainful activity (SGA). Financed through payroll taxes collected under the Federal Insurance Contributions Act (FICA), disability benefits raise the question of how much does SSDI pay to replace a portion of lost earnings, helping individuals maintain a basic standard of living during difficult times.

Key points to remember include:

- SSDI is available to those who have contributed to the Social Security system through their employment.

- The definition of disability under Social Security Disability Insurance is strict; it must be a condition expected to last at least 12 months or result in death.

- The calculation of benefits, which raises the question of how much does SSDI pay, is based on the applicant's average lifetime earnings and uses a formula that considers their highest-earning years.

As of 2025, approximately 10 million Americans are expected to receive SSDI support, highlighting the program's significance in providing essential financial aid. Recent updates indicate that eligibility criteria may change, including potential increases in the SGA income threshold. This anticipated adjustment would allow recipients to earn more while still qualifying for assistance, reflecting ongoing efforts to support individuals with disabilities as they navigate the complexities of the system.

Turnout plays a crucial role in this process by offering tools and services that facilitate access to disability support. With the help of skilled non-professional advocates, Turnout assists applicants in understanding the requirements and gathering the necessary medical evidence for a successful disability claim. We want you to know that you are not alone in this journey; we are here to help. It's important to remember that Turnout t is not a law firm and does not provide legal advice. The significance of medical evidence for a successful disability claim cannot be overstated, as it is a critical component of the approval process.

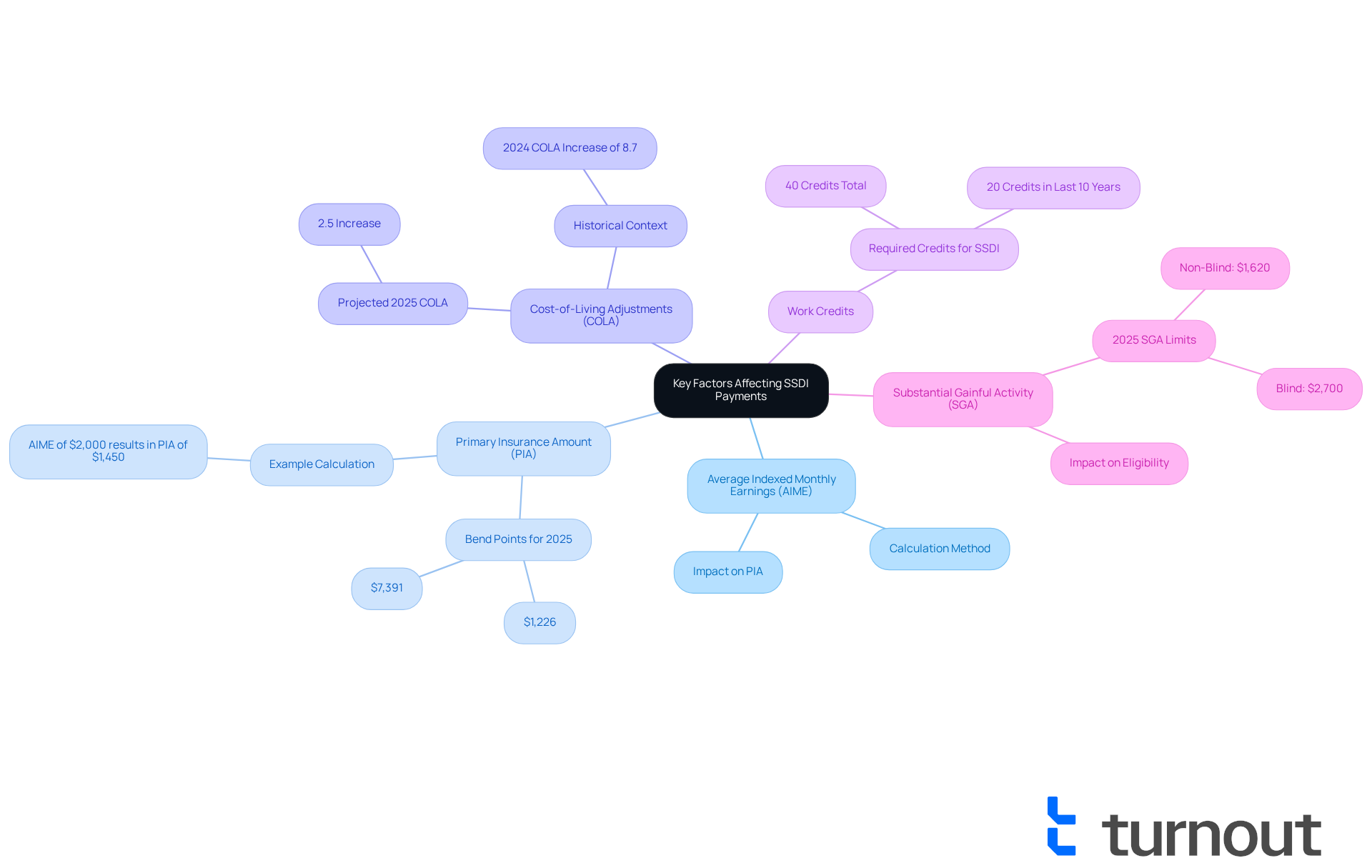

Identify Key Factors Affecting SSDI Payment Amounts

Navigating the world of SSDI benefits can feel overwhelming, but understanding how much does SSDI pay and the key factors that determine the amount you may receive can help ease your concerns. Here are several important elements to consider:

-

Average Indexed Monthly Earnings (AIME): This figure is calculated based on your highest-earning years, adjusted for inflation. AIME is crucial in determining your Primary Insurance Amount (PIA).

-

The Primary Insurance Amount (PIA) shows how much does SSDI pay in monthly payments you are eligible to receive at full retirement age. It is calculated using a formula that applies bend points to your AIME, which for 2025 are set at $1,226 and $7,391.

-

Cost-of-Living Adjustments (COLA): Your disability benefits may be adjusted annually based on inflation, helping to increase your benefit amount over time. For 2025, the COLA is projected at 2.5%, offering financial relief to all beneficiaries.

-

Work Credits: To qualify for SSDI, you must have earned a specific number of work credits based on your work history and earnings. Typically, you will need 40 credits, with at least 20 obtained in the past 10 years.

-

Substantial Gainful Activity (SGA): For 2025, the SGA limit is set at $1,620 per month for non-blind individuals and $2,700 for blind individuals. Earnings above these limits may impact your eligibility for assistance.

We understand that deciphering how AIME and PIA are calculated can be daunting. For example, if your AIME is $2,000, your PIA might be calculated to provide a monthly payment of approximately $1,450 in 2025. This illustrates how your earnings history directly influences how much does SSDI pay, emphasizing the importance of accurate reporting and documentation during the application process.

You're not alone in this journey. Turnout is here to assist you through these complex calculations and processes. Our trained advocates are dedicated to helping clients like you navigate the SSDI benefits system, ensuring you receive the support you need to optimize your advantages. Remember, Turnout is not a law firm and does not provide legal advice, but we are here to help you every step of the way.

Clarify Common Questions About SSDI Payments

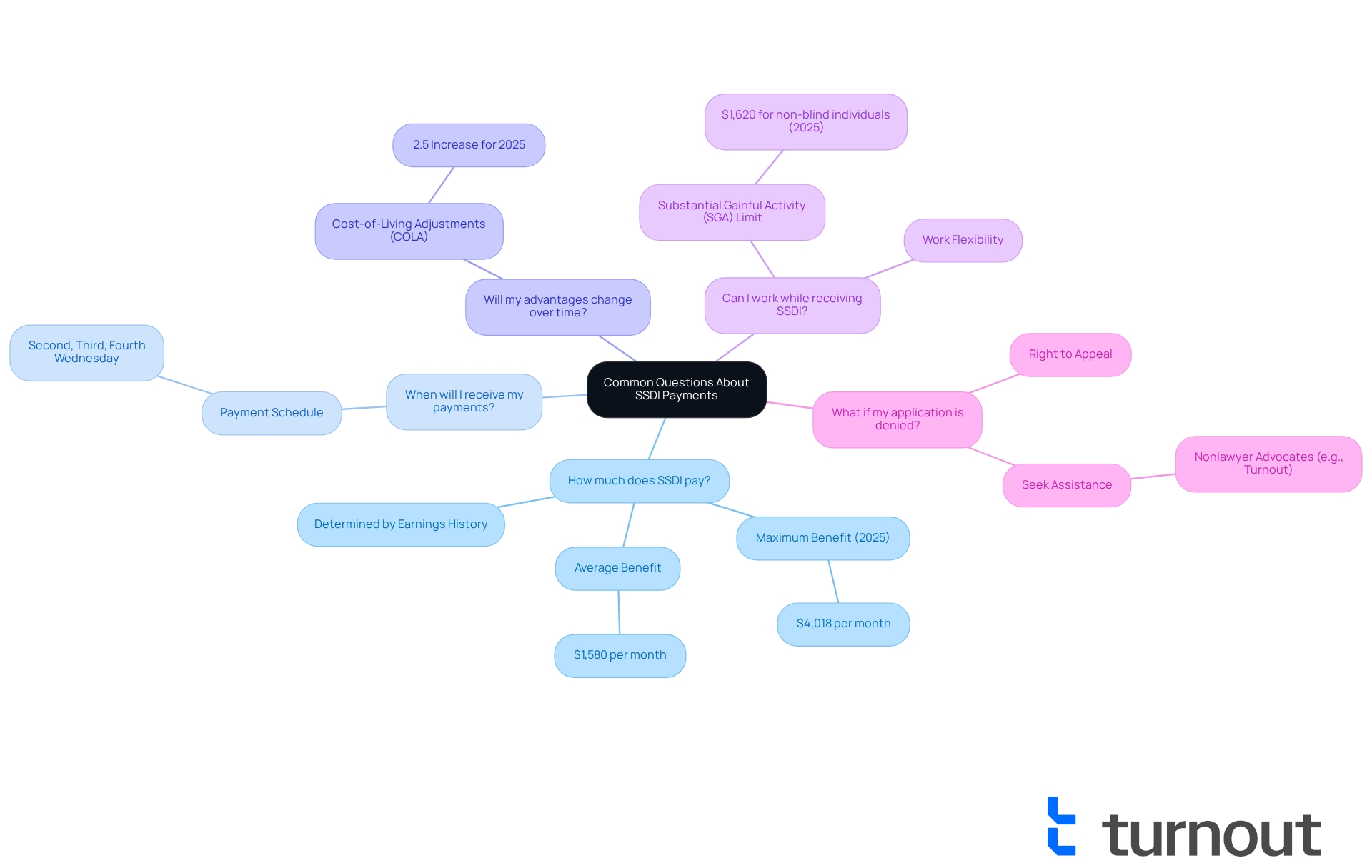

Here are some common questions regarding SSDI payments:

-

I am curious about how much does SSDI pay in benefits that I can expect to receive?

We understand that financial security is a major concern. In 2025, the maximum SSDI benefit is $4,018 per month, while the average benefit is approximately $1,580. The exact amount, or how much does SSDI pay, varies based on your individual earnings history and contributions through FICA taxes. -

When will I receive my payments?

It's common to wonder about payment schedules. SSDI payments are typically issued on the second, third, and fourth Wednesday of each month, depending on your birth date. -

Will my advantages change over time?

Yes, benefits may increase due to Cost-of-Living Adjustments (COLA), which are designed to help you cope with inflation. For 2025, the COLA increase is set at 2.5%, providing some financial relief. -

Is it possible for me to engage in employment while receiving SSDI?

Yes, you can work, but there are limits on how much you can earn without affecting your benefits. For 2025, the Substantial Gainful Activity (SGA) limit is $1,620 for non-blind individuals, allowing some flexibility for those looking to test their work capacity. -

What happens if my application is denied?

If your SSDI application is denied, it's important to know that you have the right to appeal the decision. The appeals process can be complex, so seeking assistance from trained nonlawyer advocates, like those at Turnout, may be beneficial. While Turnout is not a law firm and does not provide legal representation, our advocates are here to help you navigate the necessary steps effectively. Understanding the intricacies of the appeals process can significantly impact your chances of success. Additionally, Turnout offers various tools and services to support you throughout your SSDI journey.

Conclusion

Social Security Disability Insurance (SSDI) is a crucial program designed to provide financial support for individuals unable to work due to qualifying disabilities. We understand that navigating this system can be overwhelming, and knowing how much SSDI pays, along with the various factors influencing payment amounts, is essential. The interplay between your work history, average indexed monthly earnings, and the strict criteria for defining disability shapes the benefits you can expect to receive.

Key insights from the article highlight the importance of average indexed monthly earnings (AIME) and the primary insurance amount (PIA) in determining SSDI payments. Additionally, factors such as cost-of-living adjustments and substantial gainful activity limits play a significant role in shaping the benefits landscape. With projections indicating that approximately 10 million Americans will rely on SSDI support by 2025, it is evident that this program is vital for ensuring a basic standard of living for many.

Reflecting on the complexities of SSDI, it becomes clear that understanding the nuances of eligibility and payment calculations is paramount. For those seeking assistance, resources like Turnout offer invaluable support in navigating the application process and addressing common concerns, such as payment timelines and appeals. Remember, empowering yourself with knowledge and seeking assistance is essential in ensuring you receive the support you deserve. You are not alone in this journey, and SSDI plays a significant role in the lives of millions.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a federal initiative that provides financial assistance to individuals who struggle to perform daily tasks due to qualifying disabilities.

Who is eligible for SSDI benefits?

To be eligible for SSDI benefits, applicants must have a work history that includes contributions to Social Security taxes and must demonstrate that their disability prevents them from engaging in substantial gainful activity (SGA).

How is SSDI funded?

SSDI is financed through payroll taxes collected under the Federal Insurance Contributions Act (FICA).

How much does SSDI pay to beneficiaries?

The amount paid by SSDI is based on the applicant's average lifetime earnings and uses a formula that considers their highest-earning years.

What qualifies as a disability under SSDI?

A disability under SSDI must be a condition expected to last at least 12 months or result in death.

How many Americans are expected to receive SSDI support in 2025?

Approximately 10 million Americans are expected to receive SSDI support in 2025.

Are there any recent updates to SSDI eligibility criteria?

Yes, recent updates indicate that eligibility criteria may change, including potential increases in the SGA income threshold, allowing recipients to earn more while still qualifying for assistance.

What role does Turnout play in the SSDI application process?

Turnout offers tools and services that help applicants understand the requirements and gather necessary medical evidence for a successful disability claim.

Does Turnout provide legal advice for SSDI claims?

No, Turnout is not a law firm and does not provide legal advice.

Why is medical evidence important for SSDI claims?

Medical evidence is critical for the approval process of a disability claim, as it supports the applicant's case for receiving benefits.