Introduction

Navigating the challenges of a disability can be overwhelming, and understanding the intricacies of Social Security Disability Insurance (SSDI) is crucial. This federal program offers essential financial support, but it also raises important questions about eligibility, payment amounts, and the factors that influence these benefits.

We understand that many individuals are seeking clarity on how much they can expect to receive each month. It’s common to feel confused by the complexities of calculations, earning limits, and potential back pay. What are the key elements that determine SSDI payments? How can you maximize your understanding of this vital resource?

By addressing these questions, we aim to provide you with the information you need to navigate this journey with confidence. Remember, you are not alone in this process, and we’re here to help you every step of the way.

Explore the Basics of Social Security Disability Insurance (SSDI)

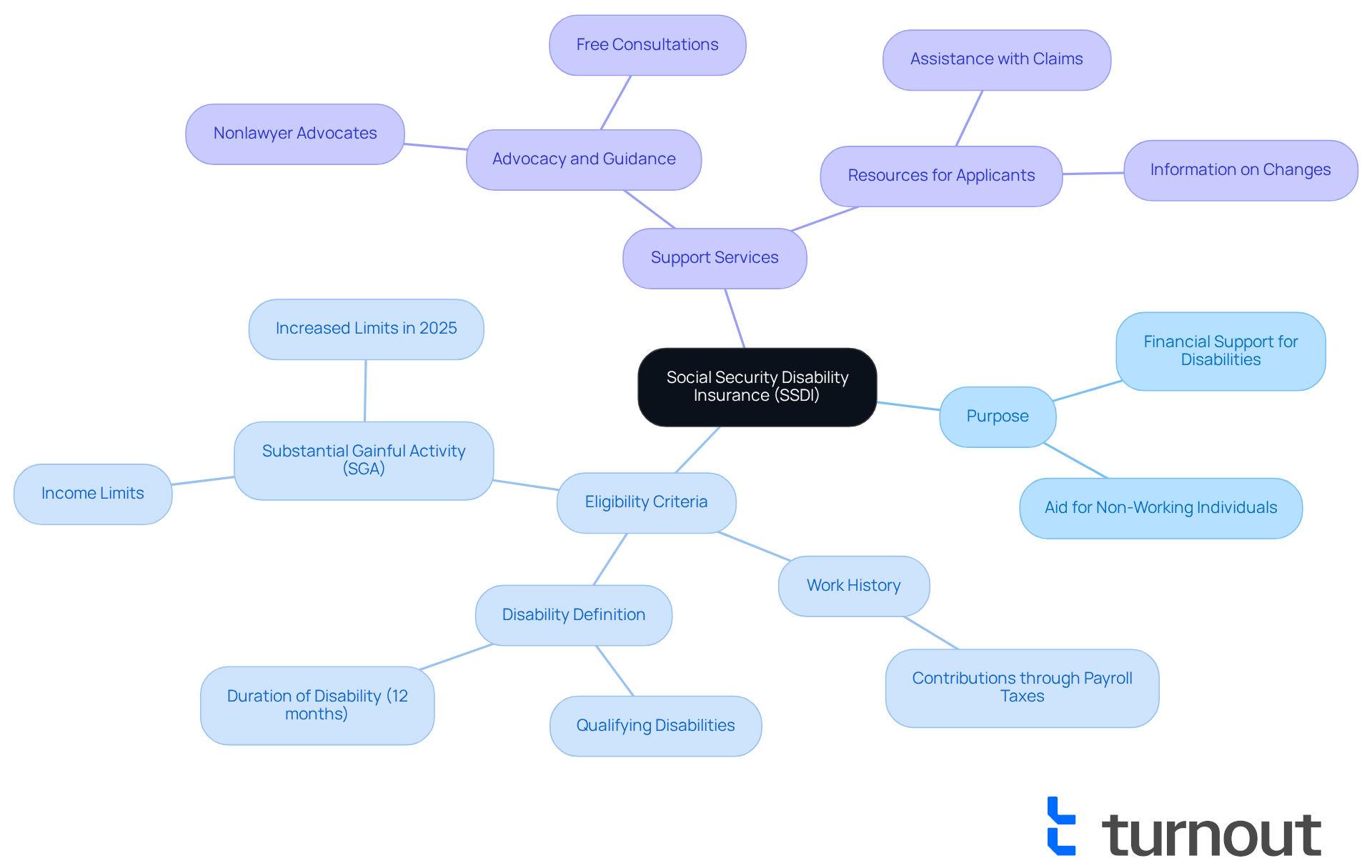

Social Security Disability Insurance is a vital federal program designed to provide financial support to those who can’t work due to a qualifying disability. We understand that navigating this process can be overwhelming, especially when you’re facing such significant challenges. To qualify for Social Security Disability Insurance, applicants need a work history that shows contributions to the Social Security system through payroll taxes.

This program primarily supports individuals who have developed a disability that prevents them from engaging in substantial gainful activity (SGA) for at least 12 months. Understanding the Social Security Disability Insurance program is the first step in navigating the complexities of disability benefits. It lays the groundwork for knowing what to expect regarding payments and eligibility criteria.

At Turnout, we’re here to help you through this journey. Our trained nonlawyer advocates offer compassionate support throughout the SSD claims process. You don’t have to face this alone; we ensure you receive the guidance you need without the requirement of legal representation. Remember, you are not alone in this journey.

Understand How SSDI Payment Amounts Are Calculated

Navigating disability payments can feel overwhelming, but understanding how much does someone make on disability is the first step toward securing the support you need. The Average Indexed Monthly Earnings (AIME) fundamentally determines how much does someone make on disability, reflecting their earnings throughout their working life. The Social Security Administration (SSA) uses a specific formula to calculate how much does someone make on disability, which indicates the monthly payment you’re entitled to receive. In 2025, how much does someone make on disability varies, with the highest payment reaching $4,018 per month, while the average amount typically falls between $1,300 and $1,600.

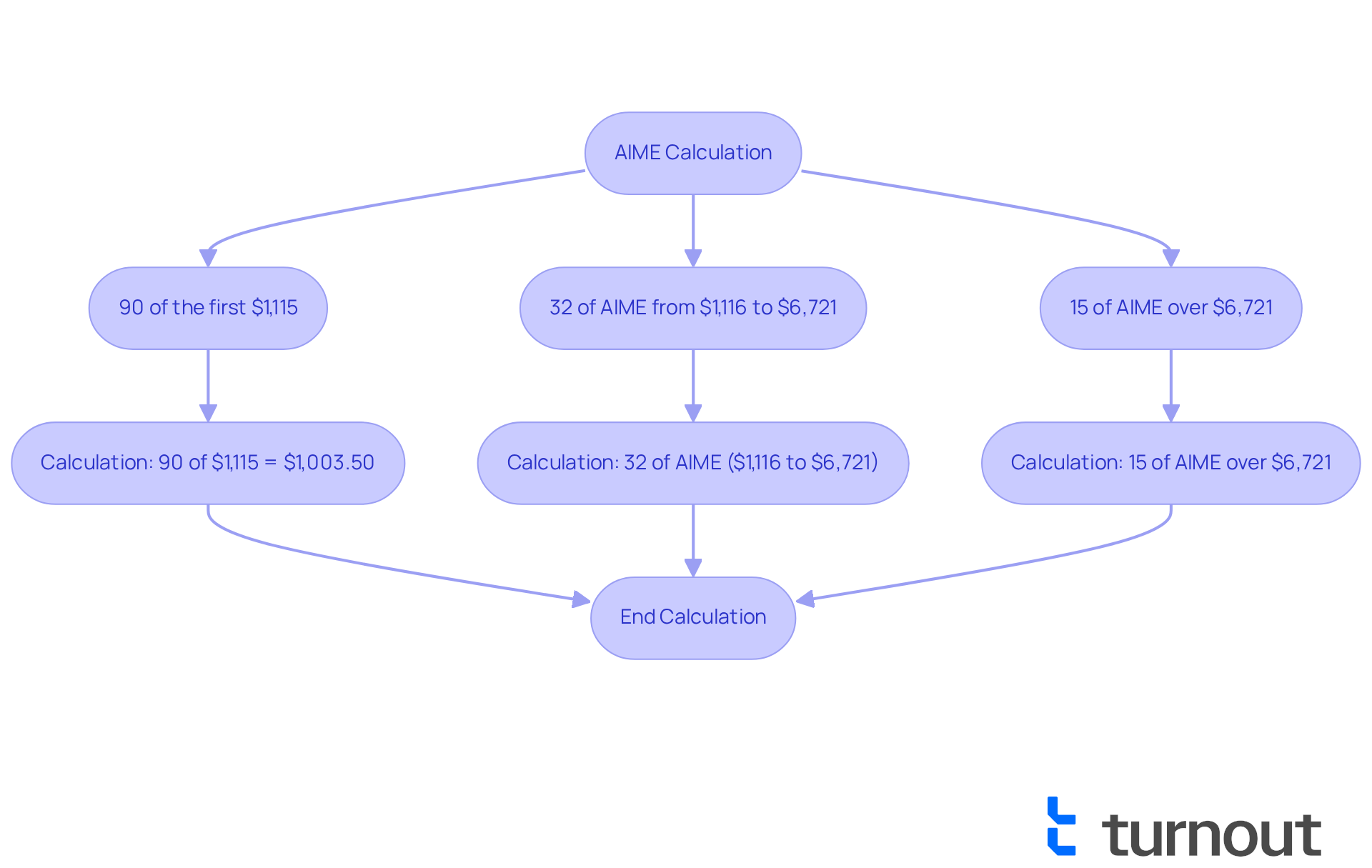

To illustrate how AIME impacts disability payments, let’s break down the formula for PIA. It incorporates:

- 90% of the initial $1,115 of AIME

- 32% of AIME ranging from $1,116 to $6,721

- 15% of AIME exceeding $6,721

For example, if your AIME is determined at $3,000, your PIA would be approximately $1,605.90. This is the amount you would receive monthly, though it may be adjusted based on additional entitlements.

If you’re looking to find out how much does someone make on disability, the SSA offers an online benefits calculator. This tool requires you to enter your work history and earnings information, providing a personalized estimate based on your unique situation. We understand that comprehending these calculations is vital for you as you navigate the disability benefits system. It directly influences your financial assistance during challenging times.

Remember, you’re not alone in this journey. We’re here to help you understand your options and ensure you receive the support you deserve.

Learn About Earning Limits and Their Impact on SSDI Benefits

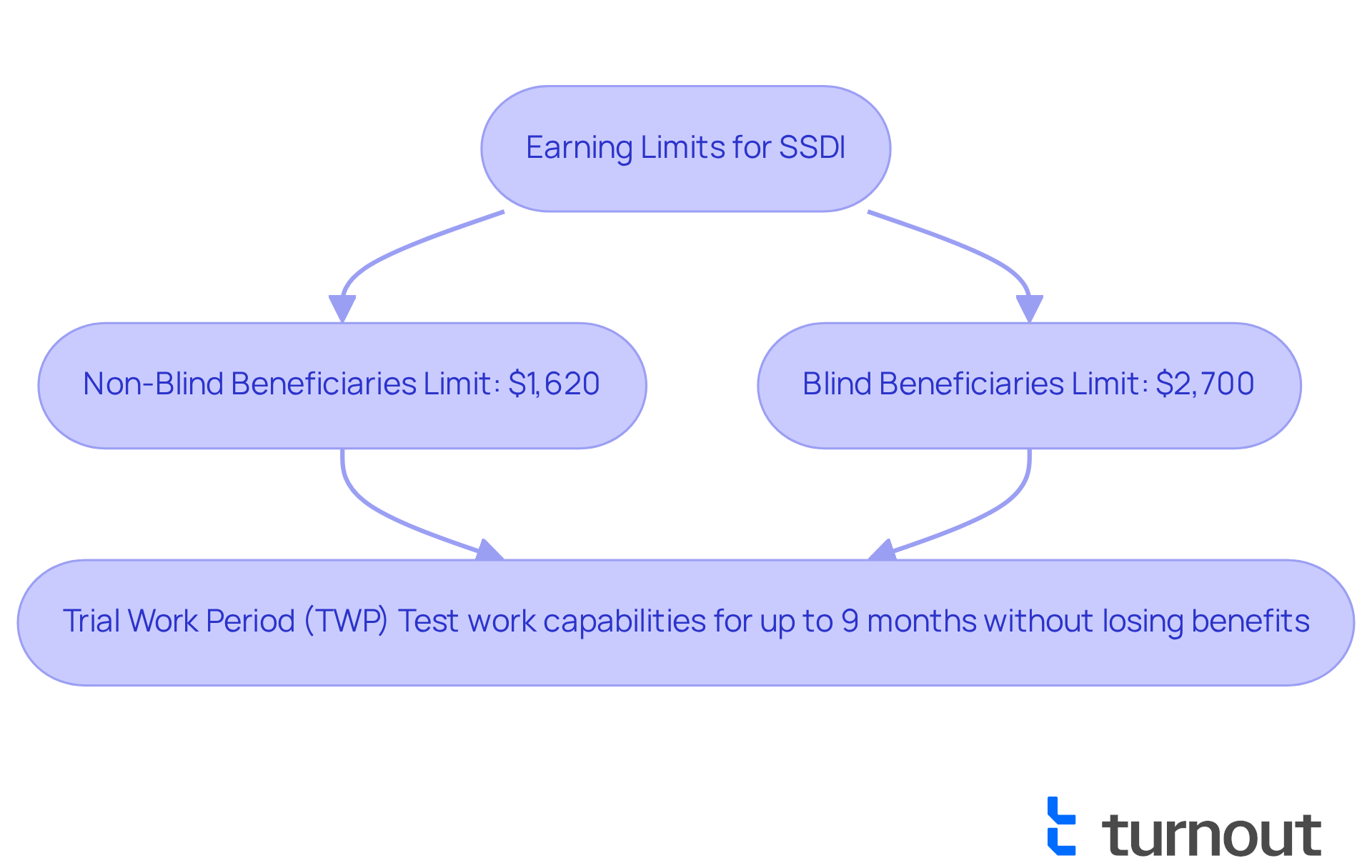

In 2025, the Substantial Gainful Activity (SGA) limit for non-blind disability beneficiaries is set at $1,620 monthly, up from $1,550 in 2024. For blind individuals, this limit rises to $2,700. Surpassing these limits can jeopardize disability assistance, making it crucial for recipients to manage their earnings carefully.

We understand that navigating these limits can be challenging. Fortunately, the Social Security Administration (SSA) offers a trial work period (TWP). This allows beneficiaries to test their work capabilities for up to nine months without losing their benefits, no matter their earnings during this time. This provision is vital for those looking to reintegrate into the workforce while still relying on disability support.

Disability advocates emphasize that the TWP not only provides a safety net but also encourages beneficiaries to explore employment opportunities without the immediate worry of losing financial support. For instance, individuals who successfully navigate the TWP can gain valuable work experience and potentially increase their earnings, all while keeping their disability benefits intact during this trial phase.

Turnout utilizes trained nonlawyer advocates to help clients understand these processes, ensuring they are well-informed about their options. It's important to note that Turnout is not a law firm and does not provide legal advice.

For beneficiaries, it is essential to understand how much does someone make on disability, including the earning limits and the TWP. It empowers them to make informed choices about their employment and financial futures. Remember, you are not alone in this journey. The SGA limits are expected to rise in 2026, further enhancing opportunities for those receiving Social Security Disability Insurance.

Discover SSDI Back Pay and Benefit Adjustments

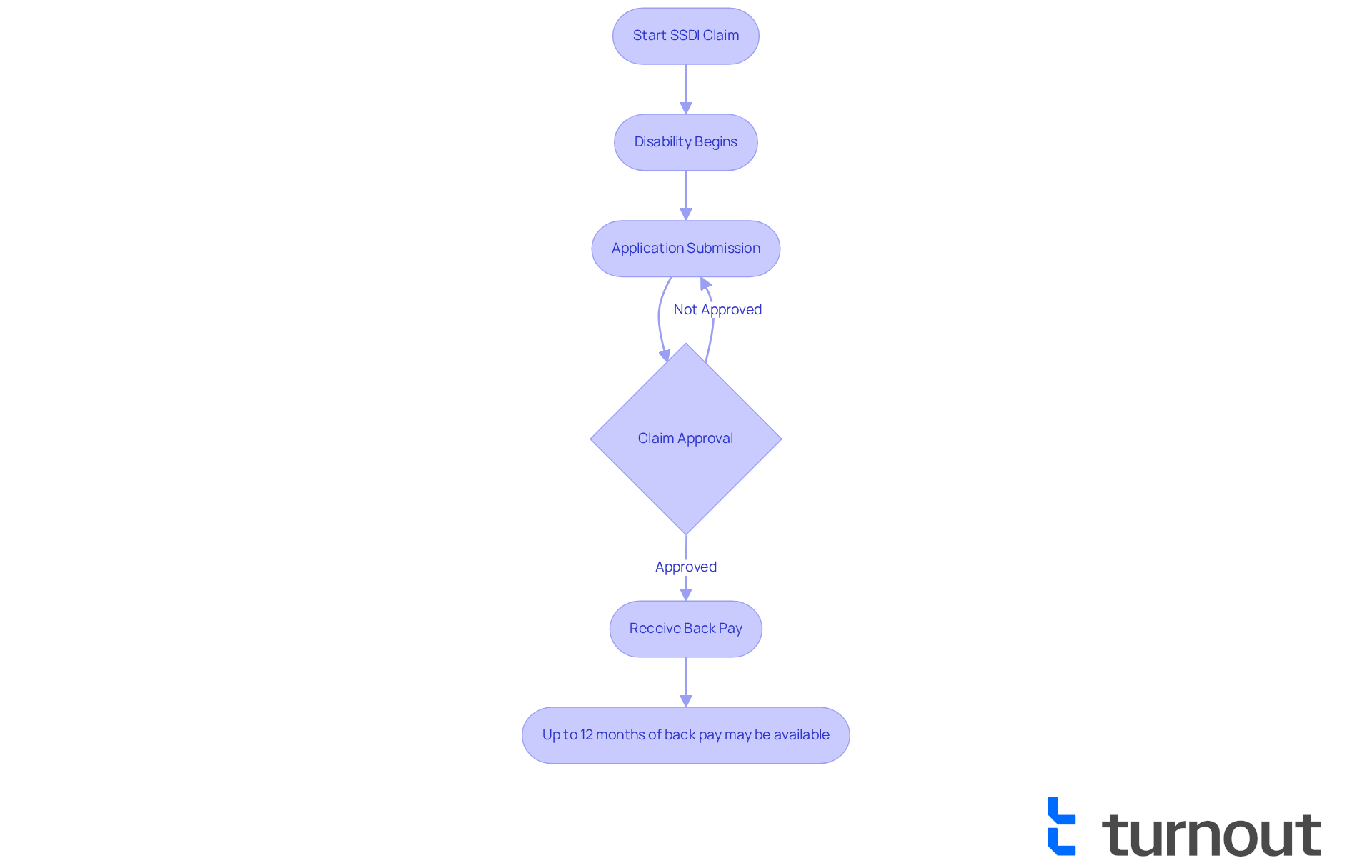

Back pay is the money owed to you for the time between when your disability began and when your claim was approved. We understand that navigating this process can be overwhelming. Typically, beneficiaries can receive up to 12 months of back pay, depending on eligibility and when they submitted their application.

Additionally, SSDI payments are adjusted each year based on the Cost-of-Living Adjustment (COLA). For 2025, this adjustment is set at 2.5%. This means you might see an increase in your monthly payments, helping to keep pace with the rising cost of living and inflation.

At Turnout, we’re here to help you access these benefits. Our trained nonlawyer advocates provide expert guidance and support throughout the SSD claims process. You don’t have to navigate the complexities of government systems alone. We’re dedicated to making this journey easier for you.

Conclusion

Understanding the intricacies of Social Security Disability Insurance (SSDI) is crucial for those seeking financial support during challenging times. We understand that navigating this system can feel overwhelming. This program not only provides essential benefits but also offers a framework for managing the complexities of disability payments and eligibility. By grasping the details surrounding SSDI, you can better equip yourself to secure the assistance you need.

Key insights discussed throughout the article include:

- The calculation of SSDI payment amounts

- The importance of Average Indexed Monthly Earnings (AIME)

- The impact of Substantial Gainful Activity (SGA) limits

It's common to feel uncertain about these terms, but understanding them can empower you. Additionally, the article highlights the significance of back pay and annual benefit adjustments, emphasizing that beneficiaries have access to various resources, including trial work periods that allow you to explore employment without jeopardizing your benefits.

Ultimately, it is vital for you to take proactive steps in understanding your SSDI options and rights. By doing so, you can navigate the complexities of the application process and make informed decisions about your financial future. Remember, reaching out for support from trained advocates can provide the necessary guidance. You are not alone in this journey; we're here to help.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

Social Security Disability Insurance is a federal program that provides financial support to individuals who cannot work due to a qualifying disability.

Who is eligible for SSDI?

To qualify for SSDI, applicants must have a work history that demonstrates contributions to the Social Security system through payroll taxes and must have a disability that prevents them from engaging in substantial gainful activity (SGA) for at least 12 months.

What does "substantial gainful activity" (SGA) mean?

Substantial gainful activity refers to work that earns above a certain threshold, indicating that an individual can engage in significant work despite their disability.

How long must a disability last to qualify for SSDI?

The disability must last for at least 12 months to qualify for SSDI.

What kind of support does Turnout offer for SSDI applicants?

Turnout provides trained nonlawyer advocates who offer compassionate support throughout the SSD claims process, helping individuals navigate the complexities of disability benefits without requiring legal representation.

Is legal representation necessary to apply for SSDI?

No, legal representation is not required to apply for SSDI, and Turnout offers guidance without the need for legal assistance.