Overview

This article gently explores the financial comparison between disability benefits and other income sources. We understand that navigating these options can be challenging. Disability assistance offers a sense of stability and structure, especially when contrasted with the variability of unemployment benefits, retirement income, and part-time work. While disability payments provide reliable support, it’s essential to consider how combining these benefits with other income sources can optimize your financial stability and long-term security. You're not alone in this journey, and understanding these implications can empower you to make informed decisions.

Introduction

Understanding the financial landscape for individuals unable to work due to disabilities is crucial. We recognize that navigating this terrain can be overwhelming, especially as various assistance programs evolve. This article delves into the intricacies of disability benefits, comparing them with alternative income sources such as:

- Unemployment benefits

- Retirement income

- Part-time employment

As you explore these options, it’s common to feel uncertain about which sources provide the most stability and potential for financial growth. How do disability benefits stack up against other income streams? What implications does this have for your long-term financial security? We're here to help you find clarity in this journey.

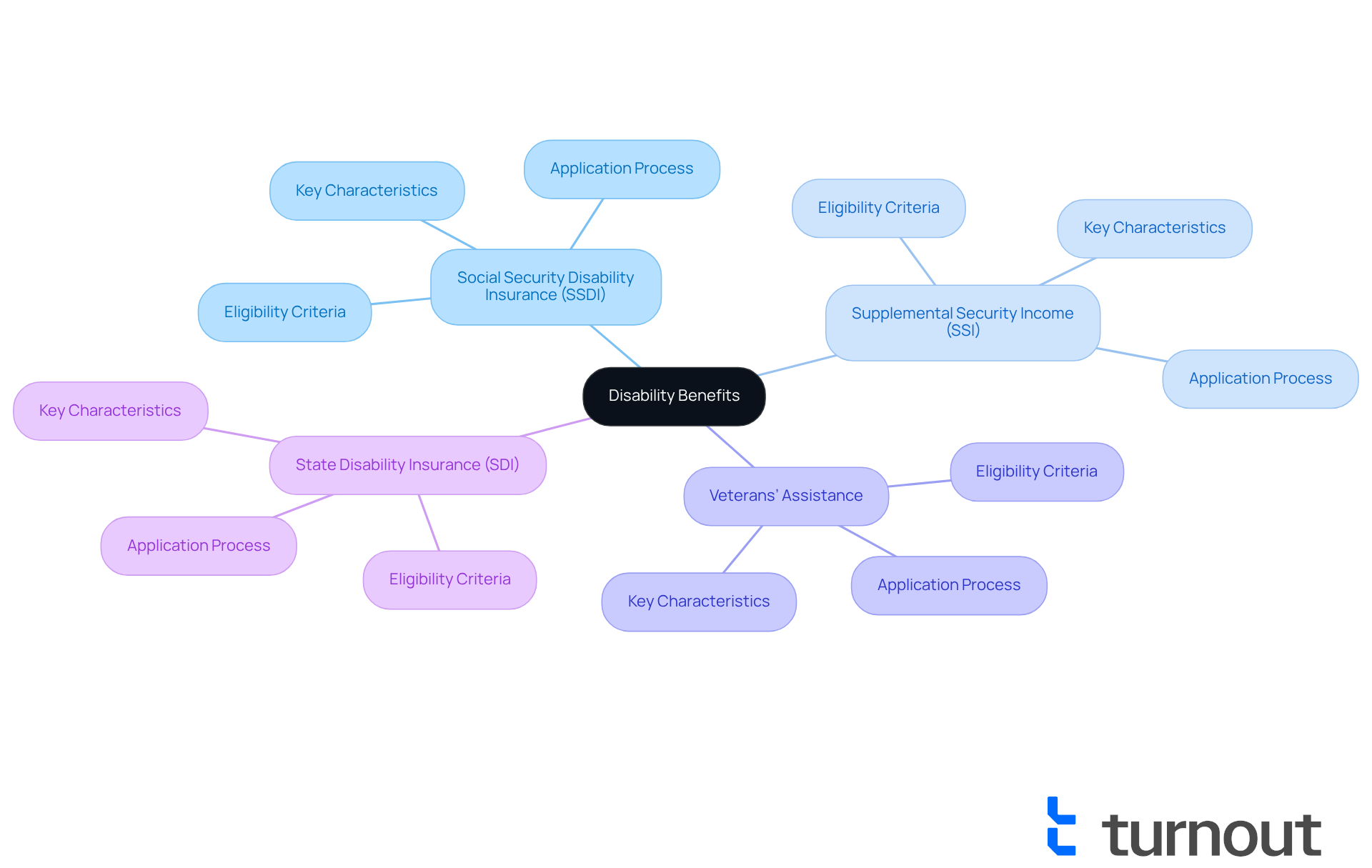

Understanding Disability Benefits: Definitions and Types

Disability assistance programs are essential financial support systems designed to aid those unable to work due to physical or mental limitations. Understanding these programs can be the first step towards regaining stability and peace of mind.

Social Security Disability Insurance (SSDI) offers benefits to individuals who have contributed to Social Security taxes but can no longer work due to a disabling condition. Eligibility is determined by work history and the severity of the disability. We understand that navigating the SSDI application process can be overwhelming. That’s why Turnout provides tools and services, employing trained nonlawyer advocates to help clients understand their rights and options. Remember, Turnout is not a law firm, and the information provided is not legal advice.

Supplemental Security Income (SSI) is different; it’s need-based and provides financial support to individuals with limited income and resources, regardless of their work history. This assistance is available not only to disabled individuals but also to the elderly and those with certain medical conditions. Turnout can simplify the SSI application process, ensuring you receive the support you need.

Veterans’ Assistance is specifically tailored for veterans with service-related disabilities. The Department of Veterans Affairs (VA) has various programs to help veterans secure their entitled benefits. Turnout is here to assist veterans in navigating these complexities, ensuring they can access the resources they deserve.

State Disability Insurance (SDI) is another option, as some states offer their own insurance programs that provide temporary assistance for those unable to work due to non-work-related injuries or illnesses. Turnout’s services can help you understand your state’s specific programs and eligibility criteria.

Alongside disability support, Turnout also offers tax debt relief services, helping clients manage their economic challenges. Understanding how much do you make on disability and these categories of assistance is crucial for anyone navigating the intricate world of financial support. Each program has distinct eligibility criteria, application procedures, and assistance amounts, ultimately affecting how much do you make on disability. With Turnout's expert guidance, you can more easily obtain the support you deserve. Remember, you are not alone in this journey; we’re here to help.

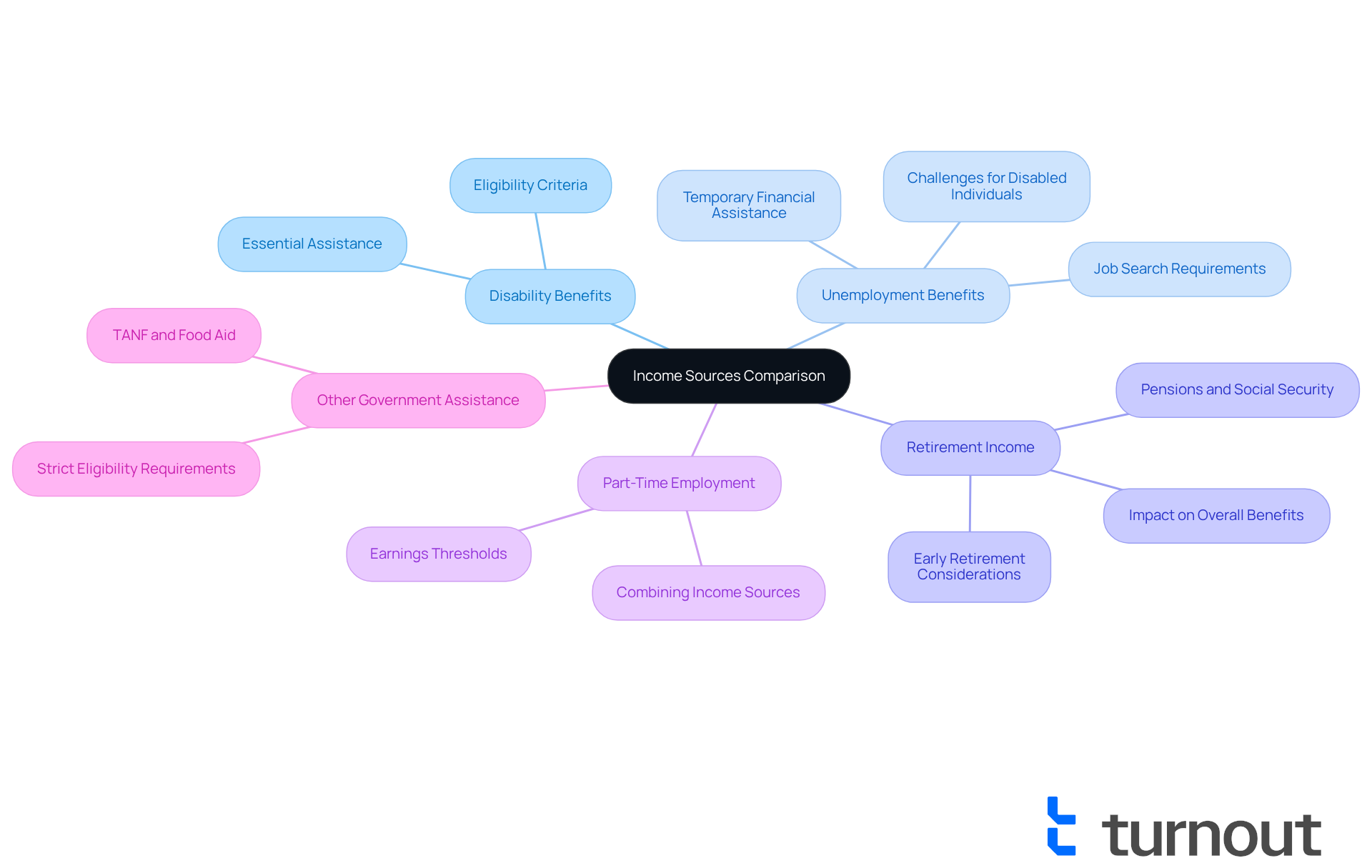

Comparing Disability Benefits with Other Income Sources

When comparing how much do you make on disability with other income sources, it's important to consider several factors, especially for those navigating the complexities of government assistance. We understand that this can be a challenging journey.

-

Unemployment Benefits: These programs provide temporary financial assistance for individuals who have lost their jobs through no fault of their own. Unlike assistance for individuals with impairments, unemployment benefits require recipients to actively search for employment. This can be impractical for those unable to work due to a condition, and it's common to feel overwhelmed by these requirements.

-

Retirement Income: This includes pensions, Social Security retirement payments, and personal savings. While designed for those who have reached retirement age, some may choose to retire early due to health issues. However, it's important to note that early retirement can reduce the overall benefits received, which can be a difficult decision to make.

-

Part-Time Employment: Some individuals may opt to work part-time while receiving assistance. However, earning above a certain threshold can affect the amount of assistance received. Understanding the implications of combining income sources is essential, and we encourage you to reflect on your own situation.

-

Other Government Assistance Programs: Programs like Temporary Assistance for Needy Families (TANF) or food aid can supplement income. However, these may have strict eligibility requirements that differ from disability support. Navigating these options can feel daunting, but you're not alone in this process.

Turnout offers valuable tools and services to assist people in navigating these options, particularly for SSD claims and tax debt relief. By employing trained nonlegal advocates, Turnout helps streamline the process of obtaining these resources. This ensures that disabled individuals can effectively manage their support without the need for professional representation.

In summary, while support payments provide essential assistance for those unable to work due to health issues, understanding how much do you make on disability compared to other income sources may reveal different benefits, such as higher potential earnings or more flexible eligibility criteria. Remember, Turnout's guidance can help you make informed choices regarding your economic future. We're here to help you every step of the way.

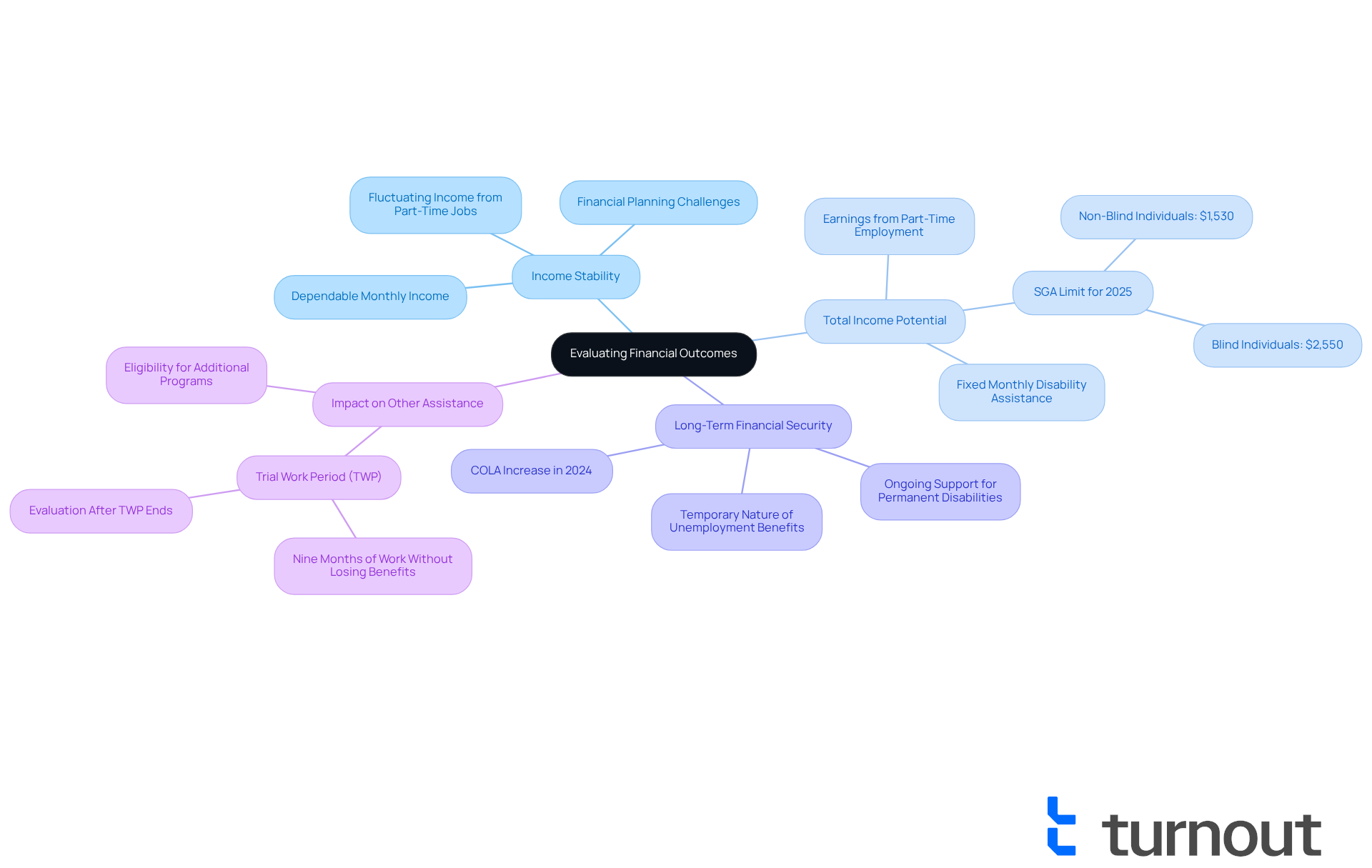

Evaluating Financial Outcomes: Disability Benefits vs. Alternative Income

Evaluating the financial outcomes of disability benefits versus alternative income sources involves several key considerations that we understand can be challenging:

-

Income Stability: Disability support typically offers a dependable monthly income, which is crucial for effective budgeting and financial planning. In contrast, income from part-time jobs or unemployment assistance can fluctuate significantly, potentially leading to financial instability. We recognize how unsettling this can be.

-

Total Income Potential: While disability assistance provides a fixed monthly amount, other income sources, like part-time employment, can offer greater earnings. However, this comes with the risk of exceeding income thresholds, which could jeopardize benefits for individuals with disabilities. For example, in 2025, the anticipated Substantial Gainful Activity (SGA) limit for non-blind individuals is projected to be around $1,530 per month. This allows some flexibility for those considering part-time work, but it’s important to weigh your options carefully.

-

Long-Term Financial Security: Disability assistance is designed to provide ongoing support, especially for those with permanent disabilities. This long-term aid is different from unemployment benefits, which are temporary, and retirement income, which may not be accessible until a certain age. The financial support from a Cost-of-Living Adjustment (COLA) increase in 2024, the largest in decades, highlights the importance of these benefits for long-term stability.

-

Impact on Other Assistance: Receiving disability support can influence eligibility for additional assistance programs. Understanding how various income sources interact is essential for maximizing your overall financial support. For instance, SSDI recipients can work during the Trial Work Period (TWP) for nine months without losing their benefits. This allows them to evaluate their ability to return to work while maintaining economic stability.

In summary, while disability benefits provide essential support for those unable to work, it is crucial to evaluate how much do you make on disability in comparison to alternative income sources. We encourage you to consider these factors carefully to optimize your financial situation. Remember, you are not alone in this journey, and we’re here to help.

Conclusion

Understanding the financial landscape of disability benefits in relation to other income sources can feel overwhelming. You're not alone in this journey. The various types of disability assistance—such as SSDI, SSI, Veterans’ Assistance, and state programs—offer essential support for those unable to work due to health conditions. Each program has unique eligibility criteria and benefits, which highlights the importance of making informed decisions to maximize your financial stability.

While disability benefits provide reliable monthly income, alternative sources like unemployment benefits, retirement income, and part-time employment present different opportunities and challenges. It’s common to feel uncertain about factors such as income stability and long-term financial security. Evaluating these aspects carefully can help you make the best choices for your unique circumstances. Remember, the interactions between these income sources can significantly impact your overall financial health.

The journey toward financial stability may seem daunting, but support is available. By exploring the nuances of disability benefits alongside other income sources, you can empower yourself to make informed choices. Seeking guidance and assistance, such as that offered by Turnout, can facilitate this process and ensure that you receive the support you deserve. Taking proactive steps today can lead to a more secure financial future. You are not alone in this journey, and we’re here to help you every step of the way.

Frequently Asked Questions

What are disability assistance programs?

Disability assistance programs are financial support systems designed to aid individuals who are unable to work due to physical or mental limitations.

What is Social Security Disability Insurance (SSDI)?

SSDI provides benefits to individuals who have contributed to Social Security taxes and can no longer work due to a disabling condition. Eligibility is based on work history and the severity of the disability.

How can Turnout assist with the SSDI application process?

Turnout offers tools and services, employing trained nonlawyer advocates to help clients understand their rights and options regarding the SSDI application process.

What is Supplemental Security Income (SSI)?

SSI is a need-based program that provides financial support to individuals with limited income and resources, regardless of their work history. It assists disabled individuals, the elderly, and those with certain medical conditions.

How does Turnout help with the SSI application process?

Turnout simplifies the SSI application process, ensuring individuals receive the support they need.

What is Veterans’ Assistance?

Veterans’ Assistance is tailored for veterans with service-related disabilities, providing various programs through the Department of Veterans Affairs (VA) to help them secure entitled benefits.

How does Turnout assist veterans?

Turnout helps veterans navigate the complexities of securing their entitled benefits and accessing available resources.

What is State Disability Insurance (SDI)?

SDI refers to state-specific insurance programs that provide temporary assistance for individuals unable to work due to non-work-related injuries or illnesses.

How can Turnout assist with State Disability Insurance?

Turnout can help individuals understand their state’s specific programs and eligibility criteria for State Disability Insurance.

What additional services does Turnout offer?

In addition to disability support, Turnout offers tax debt relief services to help clients manage their economic challenges.

Why is it important to understand the different types of disability assistance?

Each program has distinct eligibility criteria, application procedures, and assistance amounts, which can impact the financial support individuals receive while navigating disability benefits.