Introduction

Understanding tax withholding allowances can feel overwhelming. We get it - it’s a crucial part of managing your personal finances effectively. This guide aims to shed light on how many withholding allowances you should claim, highlighting the potential financial benefits of making informed choices.

With recent changes to the IRS Form W-4 and evolving tax regulations, it’s common to feel uncertain. How can you navigate these complexities to avoid overpaying or underpaying your taxes? You’re not alone in this journey, and we’re here to help you find clarity.

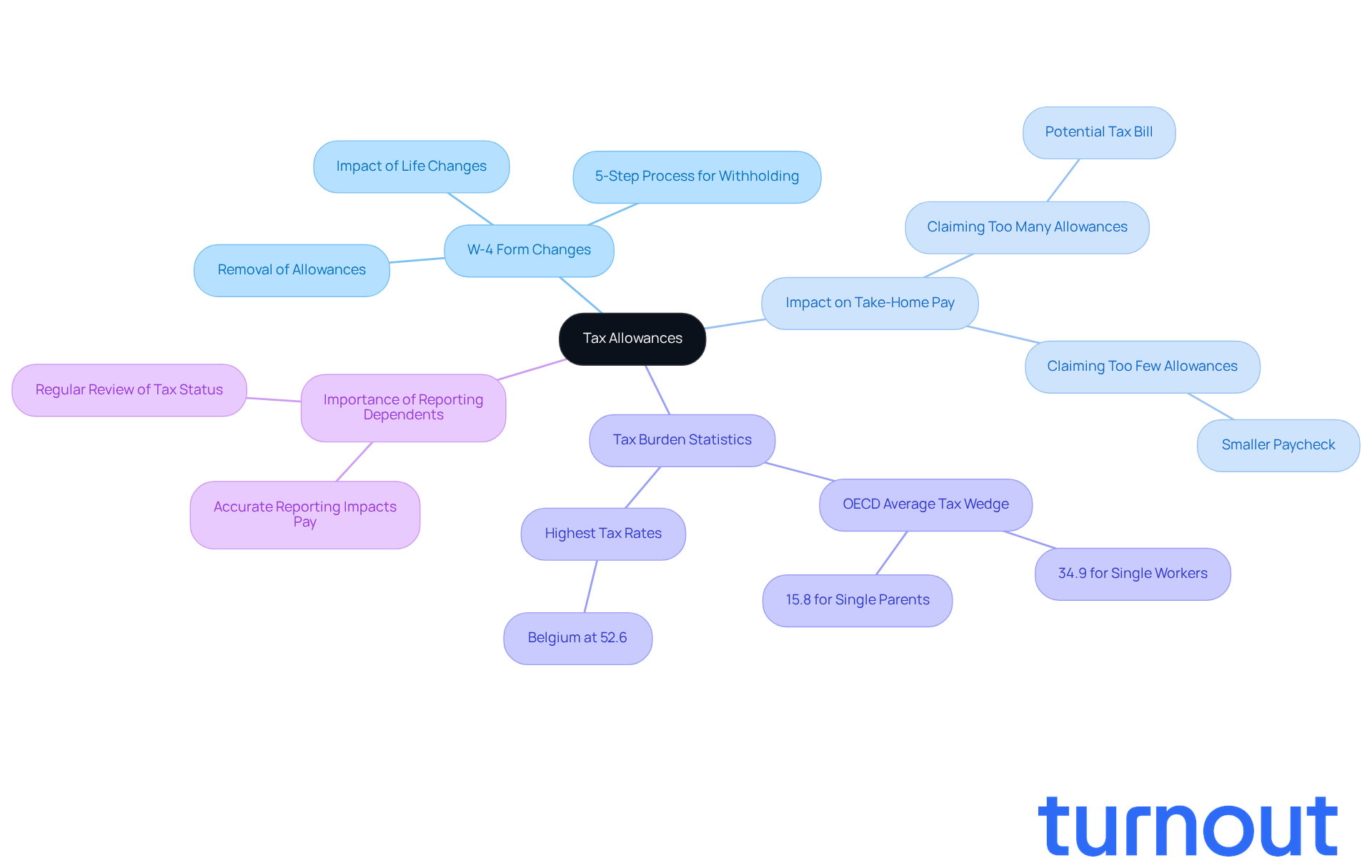

Understand Tax Allowances and Their Importance

Tax allowances are exemptions that can help reduce the amount of income tax withheld from your paycheck. We understand that navigating these allowances can feel overwhelming, but grasping how they work is essential for managing your tax liability effectively. In the past, employees used IRS Form W-4 to determine how many withholding allowances should I claim to indicate how much tax should be withheld based on personal circumstances, like marital status and number of dependents. However, recent changes to the W-4 form mean that allowances are no longer used in the same way. Now, the form focuses on providing information about dependents and other tax credits. Knowing how to navigate these changes is crucial for ensuring you don’t overpay or underpay your taxes.

For instance, if you are unsure about how many withholding allowances should I claim, claiming too many might lead you to face a tax bill at the end of the year. On the other hand, if I don't consider how many withholding allowances should I claim, it could lead to a smaller paycheck than necessary. It’s common to feel uncertain about how these decisions impact your financial planning. The OECD reported that the average tax wedge for an individual worker earning the average wage was 34.9% in 2024, highlighting the overall tax burden that affects tax strategies. Additionally, single parents earning 67% of the average wage faced a declining tax wedge of 15.8% in 2024, emphasizing the specific challenges they encounter.

Financial advisors stress the importance of accurately reporting dependents and expected deductions, as this can significantly impact your take-home pay. Regularly reviewing your tax status is essential to ensure that your paycheck reflects your financial needs accurately. Given the federal tax law changes commencing in 2025, it’s vital to stay updated on how these modifications may influence your deduction amounts. Remember, you are not alone in this journey; we’re here to help you navigate these complexities.

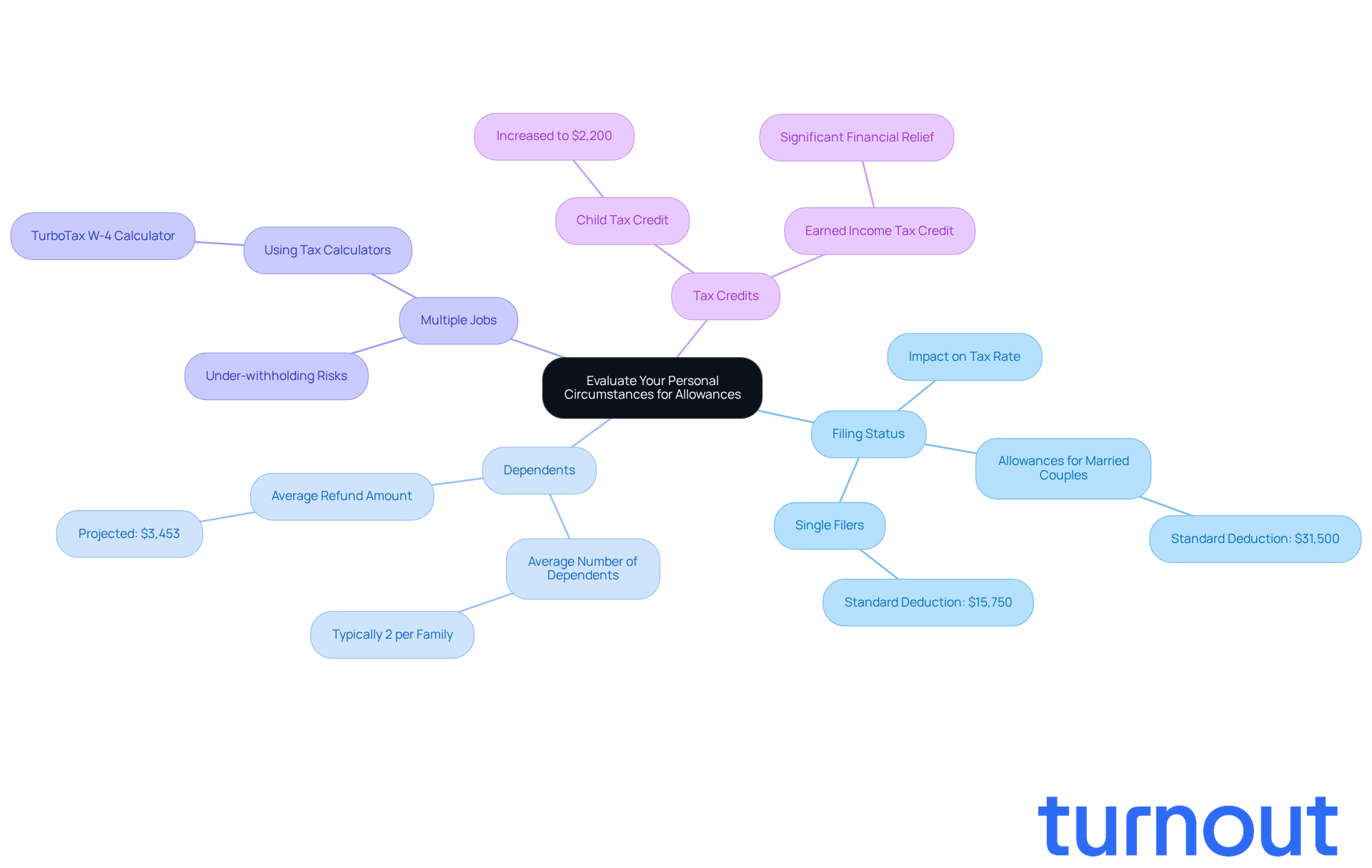

Evaluate Your Personal Circumstances for Allowances

Understanding how many withholding allowances should I claim can feel overwhelming, but we're here to help you navigate this important decision. Evaluating your personal circumstances is key, and here are some factors to consider:

-

Filing Status: Your filing status-whether single, married, or head of household-plays a significant role in determining your tax rate and the number of allowances you can claim. For example, married couples filing jointly often qualify for higher allowances than single filers, which can help lower their overall tax burden. For the 2025 tax year, the standard deduction for married couples filing jointly is $31,500, which can further influence your tax situation.

-

Dependents: If you have children or other dependents, you can claim additional allowances. On average, American families claim about two dependents, which can greatly reduce taxable income and increase potential refunds. In fact, the average refund amount for American taxpayers in the 2025 filing season is projected to be $3,453. This highlights the financial benefits of claiming dependents.

-

Multiple Jobs: If you hold more than one job, it’s crucial to consider all your income sources. Not accounting for multiple jobs can lead to under-withholding, resulting in a tax bill at the end of the year. Tools like TurboTax's W-4 tax deduction calculator can help you accurately assess your deduction needs based on your total income.

-

Tax Credits: Your eligibility for tax credits, such as the Child Tax Credit or Earned Income Tax Credit, can also shape your deduction strategy. These credits can provide significant financial relief, so it’s important to factor them into your calculations. According to the IRS, the Earned Income Tax Credit can substantially reduce your tax bill, making it essential to understand your eligibility.

By thoughtfully considering these factors, you can make informed choices about your tax deductions. Remember, you’re not alone in this journey; we’re here to support you in ensuring that you neither overpay nor underpay your taxes throughout the year.

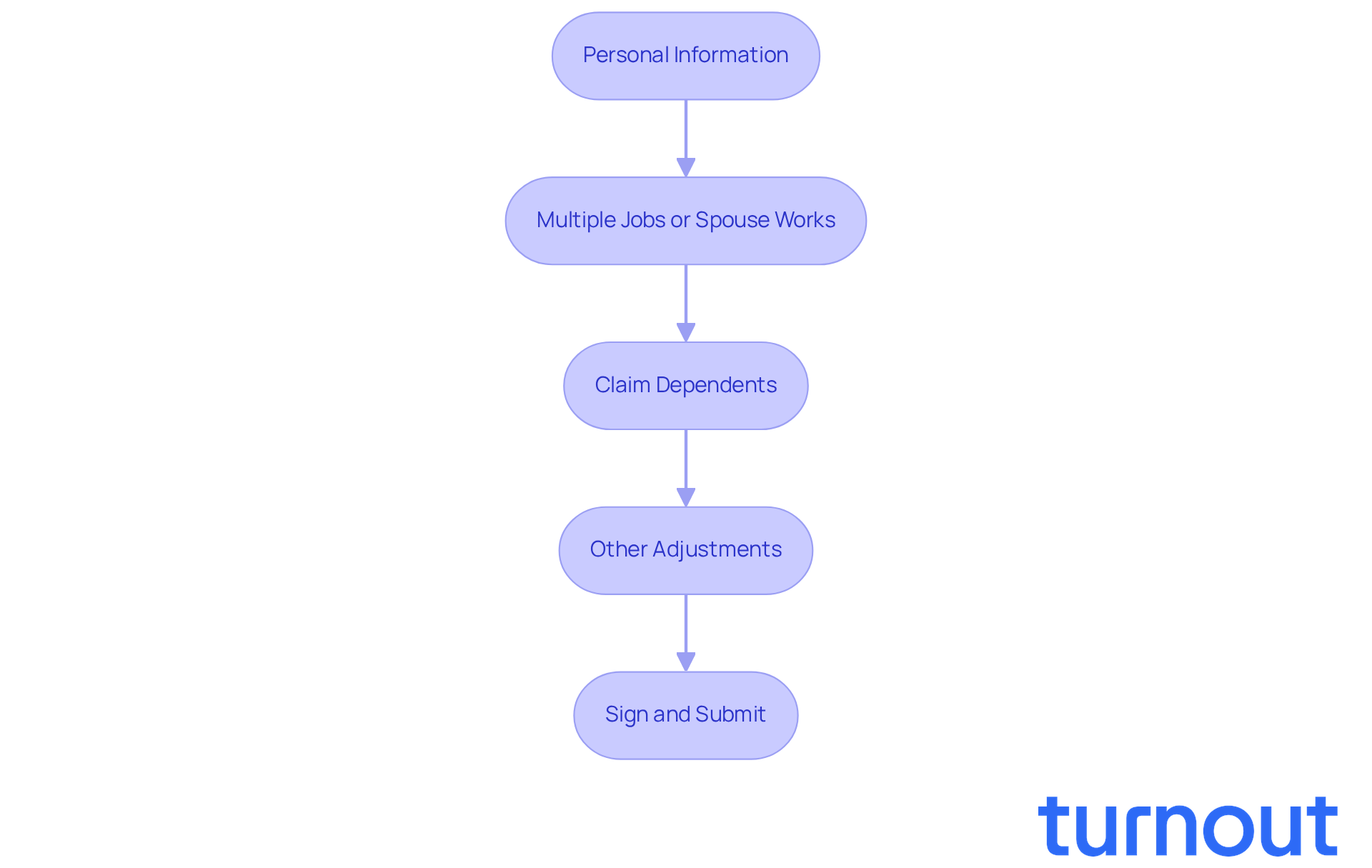

Complete IRS Form W-4 to Claim Your Allowances

Filling out the IRS Form W-4 can feel overwhelming, but we're here to help you navigate it step by step. Ensuring accurate tax withholding is essential for your financial peace of mind.

-

Personal Information: Start by entering your name, address, Social Security number, and filing status at the top of the form. This information is crucial for proper identification and helps avoid any confusion later on.

-

Multiple Jobs or Spouse Works: If you have more than one job or your spouse is employed, don’t worry! Use the Multiple Jobs Worksheet included in the form. This handy tool will guide you in determining the right deduction amount based on your total income.

-

Claim Dependents: In Step 3, specify the number of dependents you have and any tax credits for which you qualify. This step is vital as it directly impacts your deduction amount. For example, if you're a single taxpayer earning under $200,000 or a married couple making under $400,000, you can claim the Child Tax Credit, which can significantly lighten your tax burden.

-

Other Adjustments: Step 4 allows you to make further modifications for other income, deductions, or extra deductions if needed. This flexibility helps you tailor your deductions to fit your unique financial situation.

-

Sign and Submit: Finally, don’t forget to sign and date the form before handing it over to your employer. Keeping a copy for your records is also a good idea, as it will be important for future reference.

Tax professionals emphasize the importance of understanding how many withholding allowances should I claim when filling out the W-4 accurately to avoid surprises at tax time. Caleb Newquist suggests that using the IRS Tax Estimator is one of the most reliable ways to calculate your deduction amount. This can help you prevent an unexpected tax bill or a large refund when you file your return.

Common mistakes include not completing Step 1, which can lead to deductions being assessed at the higher 'Single' rate, and forgetting to update the form after significant life changes. By following these steps and utilizing available resources, you can determine how many withholding allowances should I claim to ensure that your tax deductions align with your financial needs.

Looking ahead to the 2025 tax year, the standard deduction amounts are $30,000 for married filing jointly, $15,000 for single or married filing separately, and $22,500 for head of household. It's also worth noting that the 2026 Form W-4 will expand to five pages, reflecting the growing complexity of tax forms and the importance of careful completion. Remember, you are not alone in this journey; we're here to support you every step of the way.

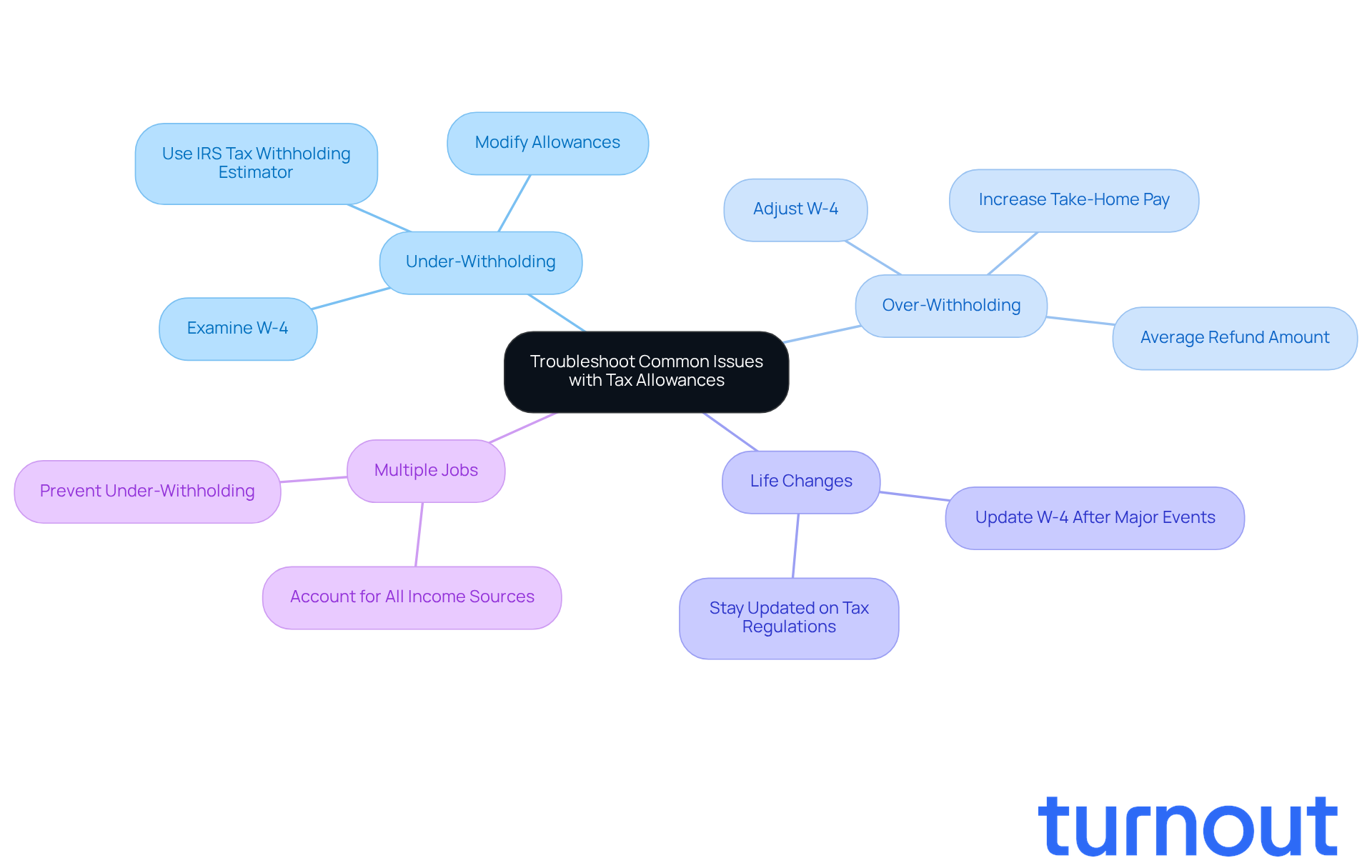

Troubleshoot Common Issues with Tax Allowances

Managing your tax withholding can feel overwhelming at times, and it’s completely normal to encounter a few bumps along the way. Let’s explore some common issues you might face and how to address them with care.

-

Under-Withholding: Have you found yourself owing taxes at the end of the year? This could be due to under-withholding. Take a moment to examine your W-4. Consider modifying your allowances by determining how many withholding allowances should I claim or adding extra deductions. The IRS Tax Withholding Estimator is a helpful tool that can guide you in determining how many withholding allowances should I claim based on your current financial situation.

-

Over-Withholding: On the flip side, if you’re receiving a large tax refund, you might be over-withholding. This essentially means you’re giving the government an interest-free loan. Adjusting your W-4 can increase your take-home pay, allowing you to utilize those funds throughout the year. Did you know that, on average, American taxpayers receive a refund of around $3,000? That’s a significant amount that could be better used in your daily life.

-

Life Changes: Major life events-like marriage, divorce, or welcoming a child-can significantly impact your tax situation. It’s crucial to update your W-4 to reflect how many withholding allowances should I claim after such changes to match your current circumstances. With tax regulations evolving, especially with substantial alterations anticipated in 2026, staying updated is more important than ever.

-

Multiple Jobs: If you’re juggling multiple jobs, make sure you account for all income sources on your W-4. This comprehensive approach helps prevent under-withholding and ensures that your tax obligations are met.

For personalized guidance, consider reaching out to a tax professional. They can provide tailored advice and help you navigate these issues effectively. Remember, you’re not alone in this journey. Tax professionals often emphasize the importance of regularly reviewing how many withholding allowances should I claim to avoid surprises at tax time. We’re here to help you every step of the way.

Conclusion

Understanding how many withholding allowances to claim is crucial for effective financial management and tax planning. We understand that navigating tax regulations can feel overwhelming, especially with the recent changes to the IRS Form W-4. It’s important to accurately report your personal circumstances, dependents, and tax credits to avoid the stress of overpaying or underpaying taxes. By thoughtfully navigating this process, you can ensure your tax withholding aligns with your financial needs throughout the year.

Key arguments presented in the article emphasize the significance of evaluating your personal circumstances, such as:

- Filing status

- Number of dependents

- Eligibility for tax credits

Tools like the IRS Tax Withholding Estimator and the Multiple Jobs Worksheet can aid you in making informed decisions. Staying updated on federal tax law changes is essential for adjusting your withholding allowances effectively. Remember, you are not alone in this journey; many people share similar concerns.

In conclusion, taking the time to understand and accurately report your withholding allowances can lead to improved financial outcomes and peace of mind. As tax regulations evolve, it’s common to feel uncertain, but remaining proactive in reviewing and adjusting your withholding strategies is vital. Embracing this knowledge empowers you to take control of your tax situation, ensuring you maximize your take-home pay while minimizing surprises at tax time. We're here to help you every step of the way.

Frequently Asked Questions

What are tax allowances?

Tax allowances are exemptions that help reduce the amount of income tax withheld from your paycheck.

Why are tax allowances important?

Understanding tax allowances is essential for managing your tax liability effectively and ensuring you don’t overpay or underpay your taxes.

How did the IRS Form W-4 change regarding tax allowances?

The recent changes to the W-4 form mean that allowances are no longer used in the same way; the form now focuses on providing information about dependents and other tax credits.

What could happen if I claim too many withholding allowances?

Claiming too many allowances might result in a tax bill at the end of the year.

What could happen if I don't consider how many withholding allowances to claim?

Not considering the number of allowances could lead to a smaller paycheck than necessary.

What is the average tax wedge for an individual worker in 2024?

The OECD reported that the average tax wedge for an individual worker earning the average wage was 34.9% in 2024.

What challenges do single parents face regarding tax wedges?

Single parents earning 67% of the average wage faced a declining tax wedge of 15.8% in 2024, highlighting specific challenges in their tax strategies.

How can I ensure my paycheck reflects my financial needs accurately?

It is important to accurately report dependents and expected deductions, and regularly review your tax status.

Why is it important to stay updated on tax law changes?

Given the federal tax law changes commencing in 2025, staying updated is vital as these modifications may influence your deduction amounts.

Where can I find help with navigating tax allowances?

You can seek assistance from financial advisors or resources that specialize in tax planning to help you navigate these complexities.