Introduction

Understanding tax allowances can feel overwhelming, and we get that. Yet, these allowances are crucial for optimizing your take-home pay and avoiding surprises come tax season. In this guide, we’ll explore the key factors that influence how many allowances you should claim. We aim to provide you with valuable insights into personal financial evaluations and IRS guidelines.

As tax regulations evolve, many taxpayers face the worry of unexpected tax bills. It’s common to feel uncertain about how to strike the right balance between maximizing your paycheck and meeting your tax obligations. Remember, you’re not alone in this journey. We’re here to help you navigate these complexities with confidence.

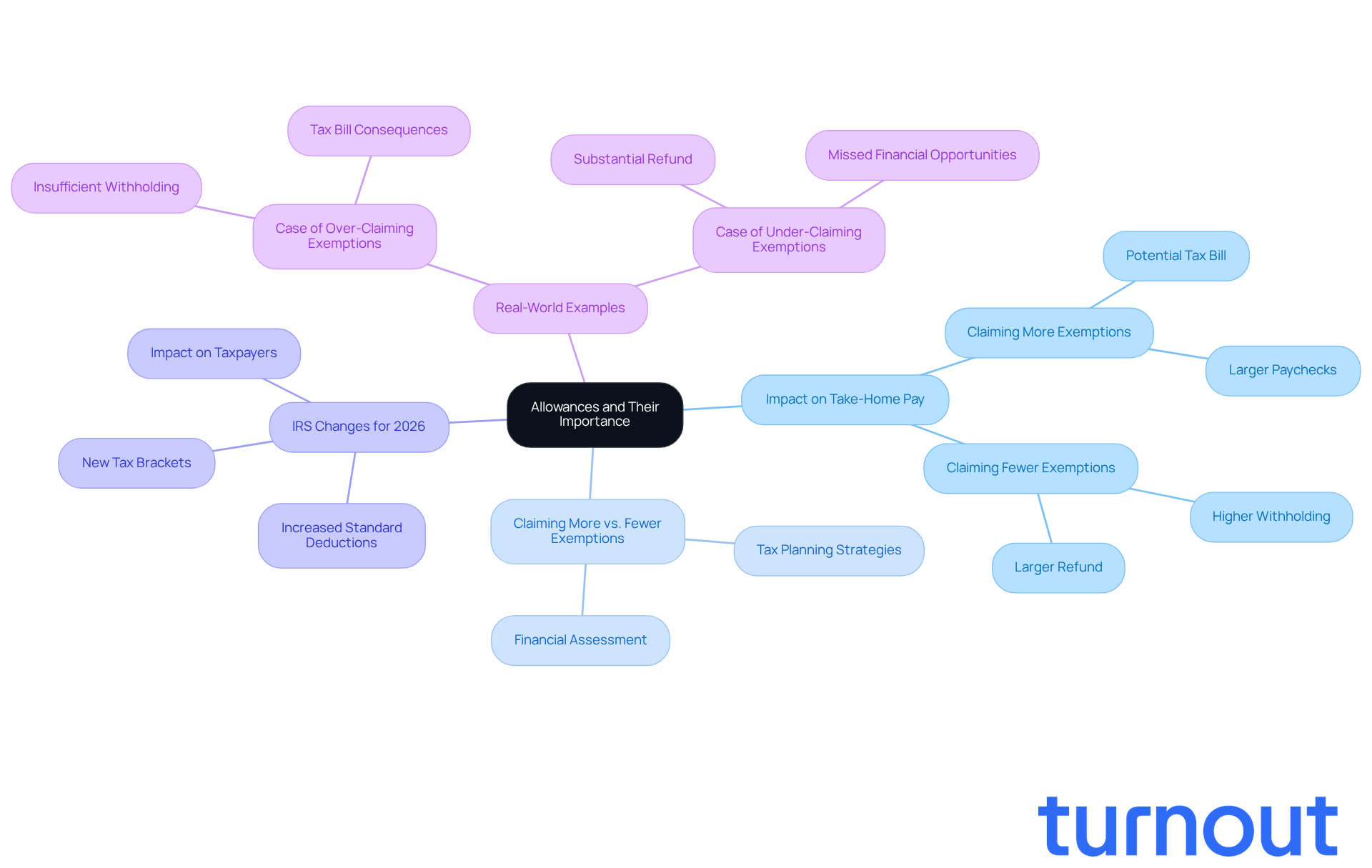

Understand Allowances and Their Importance

Allowances play a vital role in the tax deduction process, helping determine how much federal income tax is taken from your paycheck. Each deduction you claim reduces the amount of income subject to withholding, which can directly impact your take-home pay. We understand that grasping how deductions work is essential for effective tax planning. For instance, if you claim more exemptions, you might see less tax deducted, leading to a bigger paycheck. However, this could also mean a smaller refund or even a tax bill at the end of the year. Conversely, claiming fewer deductions means more tax is withheld, which might result in a larger refund. It's important to assess your financial situation and future tax responsibilities to determine how many allowances you are claiming.

As we approach the 2026 tax year, the IRS is making changes that could affect your tax situation. These updates include modifications to income tax withholding tables and higher standard deductions, which may influence how you evaluate your entitlements. According to tax expert Rocky Mengle, "Understanding the implications of tax policies is crucial for taxpayers to optimize their tax situations and comply with regulations."

Statistics show that taxpayers who accurately assess their benefits can significantly improve their financial outcomes. For example, a taxpayer earning $50,000 annually who claims two exemptions might notice a monthly take-home pay increase of about $150 compared to claiming just one exemption. This difference can add up over the year, highlighting the importance of understanding and managing your budgets strategically.

Real-world examples illustrate the impact of allowances on take-home pay. Imagine someone who claims too many exemptions and faces insufficient withholding. This could lead to a tax bill of several hundred dollars when filing, causing financial stress. On the flip side, an individual who claims too few deductions may receive a substantial refund, but this could mean they missed the chance to use that money throughout the year for savings or expenses.

Ultimately, evaluating your financial circumstances and future tax responsibilities is crucial when considering how many allowances you are claiming. By doing so, you can find a balance that maximizes your take-home pay while minimizing surprises during tax season. Remember, we're here to help you navigate this journey.

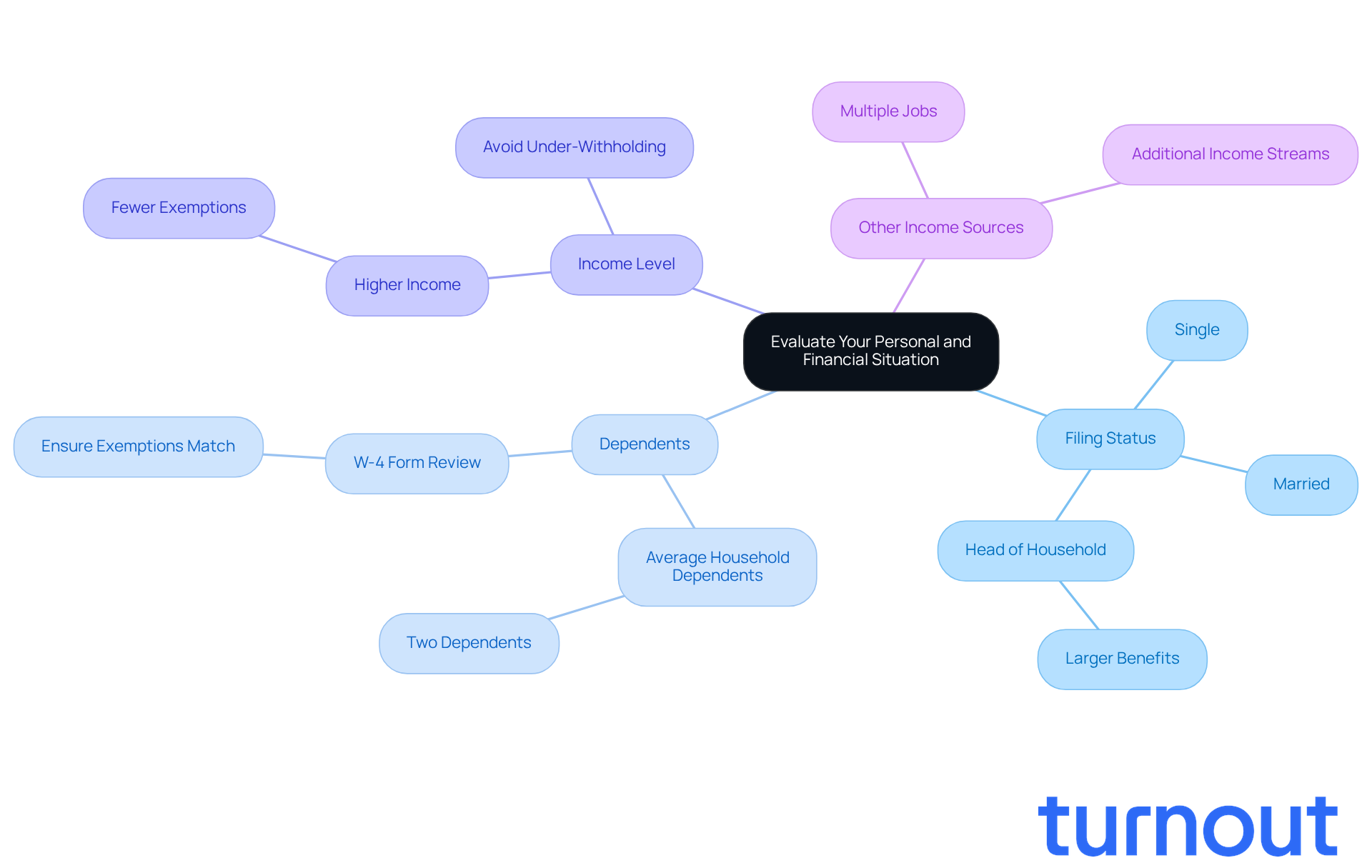

Evaluate Your Personal and Financial Situation

When it comes to figuring out how many claims to make, it’s important to take a close look at your personal and financial situation. We understand that this can feel overwhelming, but considering a few key factors can really help you make the best decision for your needs:

- Filing Status: Your classification - whether you’re single, married, or head of household - plays a significant role in how much you can claim. For instance, heads of household often qualify for larger benefits than single filers, which can make a big difference.

- Dependents: Each child or dependent you claim usually allows for an additional benefit. In 2026, the average American household has about two dependents, which can greatly influence your tax situation. It’s a good idea to regularly check your W-4 form to ensure your exemptions match your current circumstances.

- Income Level: If your income is on the higher side, you might need to claim fewer exemptions to avoid under-withholding. This can help you steer clear of unexpected tax bills when the year wraps up.

- Other Income Sources: If you have multiple jobs or additional income streams, these can affect your overall tax responsibility. It’s essential to factor these in when making your decisions.

We know it’s easy to overestimate your budget, but doing so can lead to underpayment penalties and added financial stress. By thoughtfully considering these factors, you can make a more informed choice about how many allowances you are claiming on your W-4 form. Remember, we’re here to help you optimize your tax withholding and enhance your financial planning.

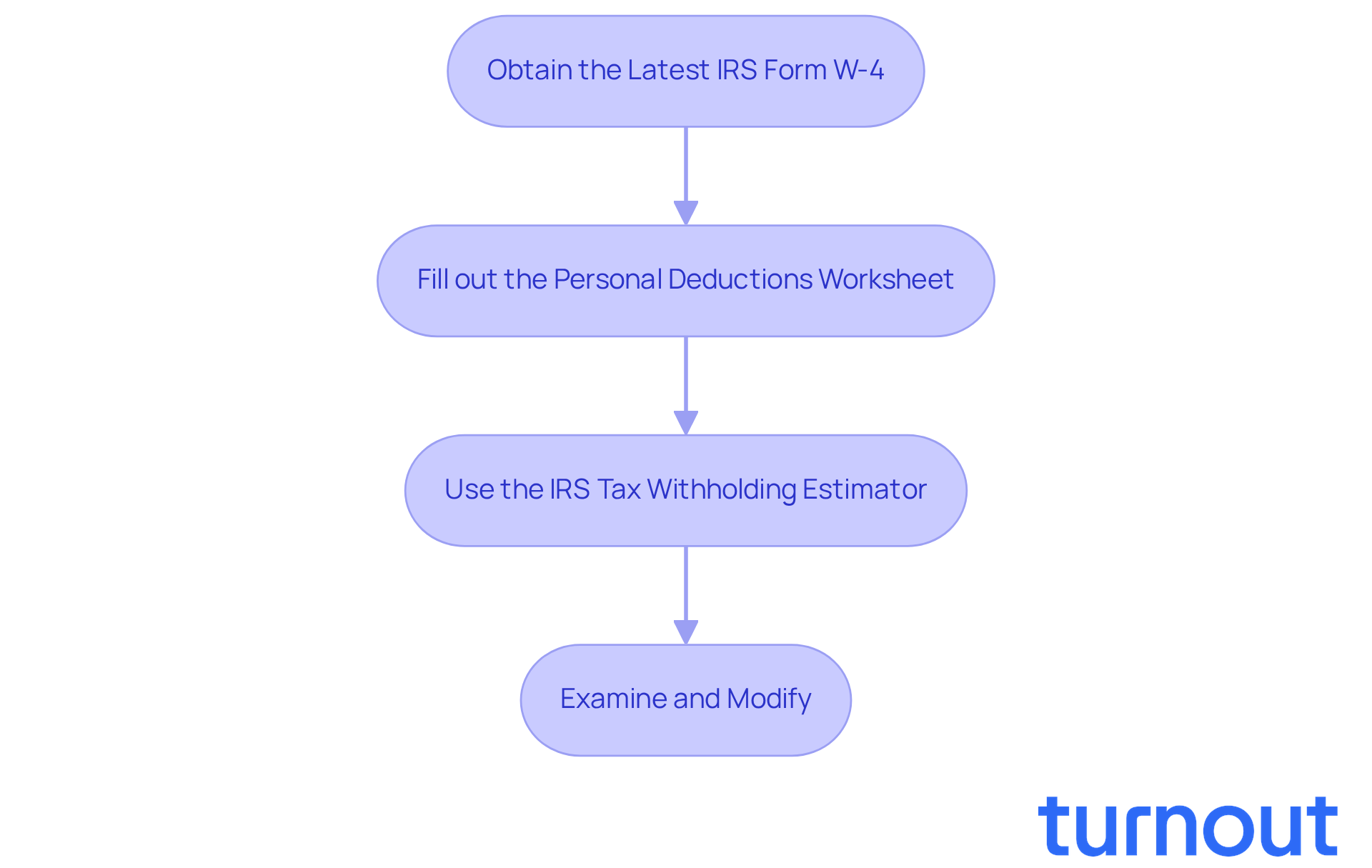

Calculate Your Allowances Using the IRS Guidelines

Calculating your tax allowances can feel overwhelming, but we're here to help you through it. Follow these steps to make the process smoother:

-

Obtain the Latest IRS Form W-4: Start by downloading the current version of the W-4 form from the IRS website. Having the most up-to-date information is essential for accurate calculations.

-

Fill out the Personal Deductions Worksheet: This worksheet is crucial for determining the number of exemptions based on your unique situation. Consider your filing status, number of dependents, and any additional income you may have. It’s common to feel uncertain about how these factors play into your tax situation.

-

Use the IRS Tax Withholding Estimator: Head over to the IRS website and try out the Tax Withholding Estimator tool. This resource provides a personalized estimate based on your financial details, helping you avoid surprises come tax time. Many taxpayers have found success using this tool to align their withholding with their actual tax liability, ensuring they neither owe a large sum nor receive an excessive refund. Just keep in mind that the estimator hasn’t yet been updated to reflect the provisions of the One Big Beautiful Act, which could impact your calculations.

-

Examine and Modify: After calculating your allocations, take a moment to assess them. Do they align with your financial goals? If not, consider adjusting the number of exemptions to better fit your tax situation. Tax experts suggest revisiting your W-4 form regularly, especially after significant life changes or income fluctuations. For example, the standard deduction for single taxpayers in 2026 will be $16,100, and for married couples filing jointly, it will be $32,200. Understanding these changes is crucial for navigating your tax landscape.

By following these steps, you can confidently determine how many allowances you are claiming, which will ensure your tax withholding aligns with your financial needs and objectives. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

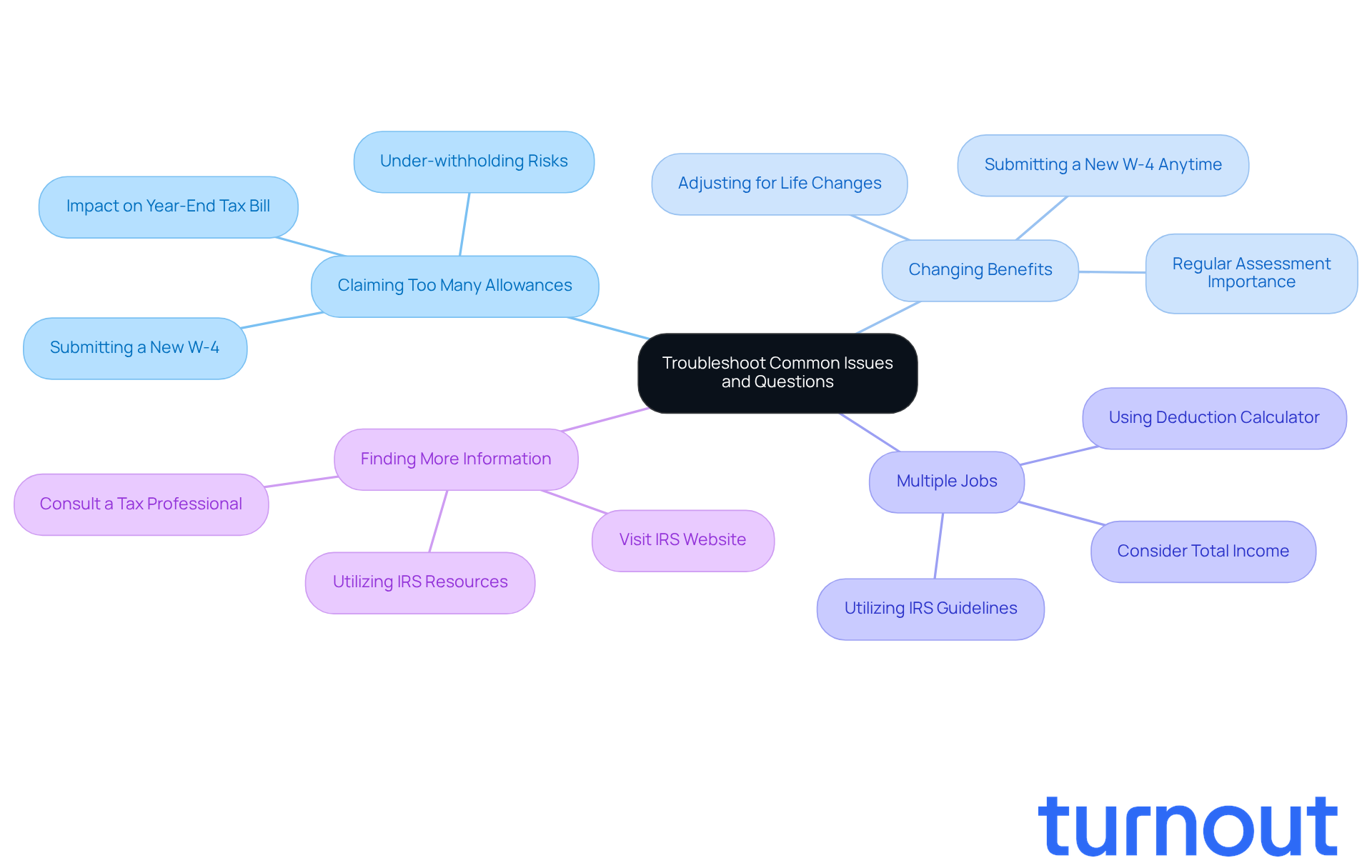

Troubleshoot Common Issues and Questions

Navigating the process of determining your entitlements can feel overwhelming at times. We understand that you might encounter some common issues along the way. Here are some solutions to frequently asked questions that can help you feel more confident:

-

What if I claim too many allowances? Claiming more exemptions than you qualify for can lead to under-withholding, which may result in unexpected tax bills or penalties. If you notice this error, don’t worry! Just submit a new W-4 form with the correct number of exemptions to your employer as soon as possible. Remember, the amount of tax you owe at the end of the year can be significantly impacted by how many allowances you are claiming.

-

How do I change my benefits? You can modify your deductions anytime by submitting a new W-4 form. It’s a good idea to do this whenever your financial situation changes - like starting a new job, getting married, or welcoming a child. Regularly assessing and adjusting your tax exemptions is crucial to ensure they reflect your current circumstances.

-

What if I have multiple jobs? If you hold more than one job, it’s important to consider the total income from all sources when calculating your benefits. We recommend utilizing IRS guidelines, including the deduction calculator available on their website, to ensure you’re retaining enough tax across your combined earnings.

-

Where can I find more information? For further inquiries, feel free to visit the IRS website or consult a tax professional for personalized advice. Utilizing IRS resources can clarify the deduction allowance process and help you make informed decisions.

By addressing these common issues, you can navigate the process more effectively. Remember, we’re here to help you ensure your tax withholding aligns with your financial situation. You are not alone in this journey!

Conclusion

Understanding how many allowances to claim is crucial for optimizing your tax situation and ensuring your financial health. We know that navigating this can feel overwhelming, but by accurately assessing your personal and financial circumstances, you can find a balance between your take-home pay and tax obligations. This balance can lead to a more manageable financial year.

This article highlights the importance of allowances and how they directly affect your paycheck and tax refunds. Key factors like your filing status, dependents, income level, and additional income sources play a vital role in determining the right number of allowances. By utilizing IRS guidelines, including the W-4 form and the Tax Withholding Estimator, you can make informed decisions that align with your unique financial situation.

Taking the time to evaluate and adjust your allowances can significantly impact your overall financial well-being. It's common to feel uncertain, especially after significant life changes. That's why it's crucial to remain proactive and revisit your claims regularly. By doing so, you can avoid unexpected tax bills and make the most of your hard-earned money throughout the year.

Embrace this opportunity to optimize your tax planning. Remember, you're not alone in this journey. We're here to help you ensure a smoother tax season ahead.

Frequently Asked Questions

What are allowances in the context of taxes?

Allowances are deductions that help determine how much federal income tax is withheld from your paycheck. Each allowance you claim reduces the amount of income subject to withholding, impacting your take-home pay.

How do allowances affect my take-home pay?

Claiming more allowances can lead to less tax being deducted from your paycheck, resulting in a larger take-home pay. However, this may also mean a smaller tax refund or a potential tax bill at the end of the year. Conversely, claiming fewer allowances results in more tax withheld, which could lead to a larger refund.

Why is it important to understand how deductions work?

Understanding deductions is essential for effective tax planning, as it helps you assess your financial situation and future tax responsibilities, allowing you to determine the appropriate number of allowances to claim.

What changes are expected in the 2026 tax year that may affect allowances?

The IRS is making changes to income tax withholding tables and increasing standard deductions, which may influence how taxpayers evaluate their allowances and entitlements.

How can accurately assessing allowances improve financial outcomes?

Taxpayers who accurately assess their allowances can significantly improve their financial outcomes. For example, a taxpayer earning $50,000 annually who claims two exemptions could see an increase of about $150 in monthly take-home pay compared to claiming just one exemption.

What are the potential consequences of claiming too many or too few exemptions?

Claiming too many exemptions can lead to insufficient withholding and result in a tax bill when filing, causing financial stress. Conversely, claiming too few exemptions may yield a substantial refund but could mean missing opportunities to use that money throughout the year.

How can I find a balance in claiming allowances?

Evaluating your financial circumstances and future tax responsibilities is crucial when determining how many allowances to claim. This balance can help maximize your take-home pay while minimizing surprises during tax season.