Introduction

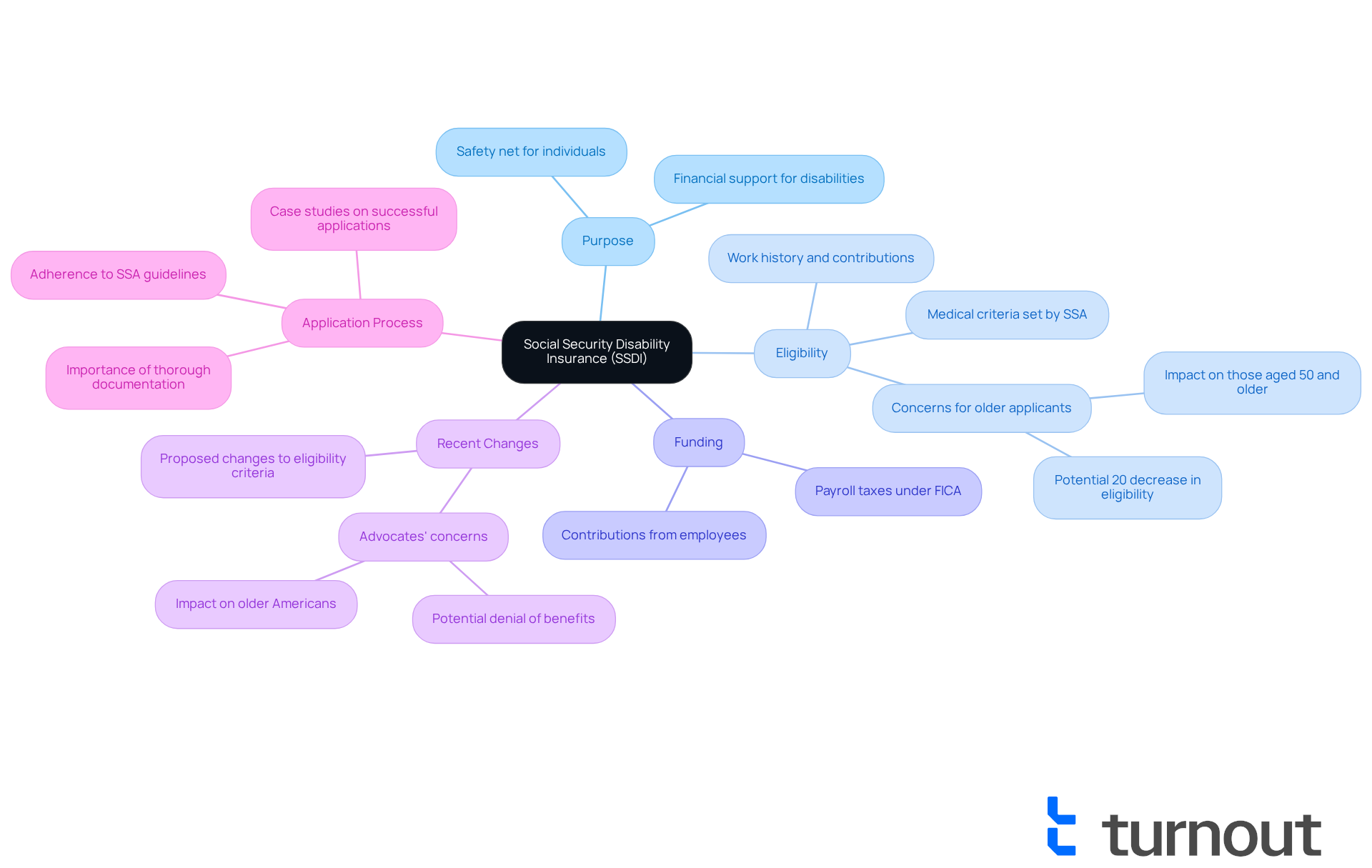

Understanding the complexities of Social Security Disability Insurance (SSDI) is crucial. Millions rely on it for financial stability during tough times. This essential program offers a safety net for those unable to work due to severe disabilities. However, it also faces changing eligibility criteria that could impact future beneficiaries.

We understand that many are concerned about how long SSDI benefits last. It’s common to wonder what factors influence this duration and how changes in health or age might affect your support. Exploring these aspects can empower you to navigate your SSDI journey with greater confidence and clarity. Remember, you are not alone in this journey; we’re here to help.

Explore the Basics of Social Security Disability Insurance (SSDI)

Social Security Disability Insurance is a crucial federal program that offers financial support to those unable to work due to severe disabilities. We understand that navigating this process can be overwhelming, especially when facing significant challenges. In 2025, around 8.5 million individuals are expected to qualify for this essential program, underscoring its role as a safety net for those in need.

To be eligible, applicants must show a work history that includes contributions to Social Security through payroll taxes, along with meeting strict medical criteria set by the Social Security Administration (SSA). This program is designed to assist individuals whose impairments make it difficult to secure gainful employment, ensuring they have the resources they need during tough times.

Funding for Social Security Disability Insurance comes from payroll taxes collected under the Federal Insurance Contributions Act (FICA). This highlights how the program is built on the contributions made by employees throughout their careers.

However, recent changes to the eligibility criteria have raised concerns among advocates. Many worry that older applicants may face a decrease in eligibility. Proposals suggest that overall eligibility for disability benefits could drop by as much as 20 percent, with even more significant impacts for those aged 50 and older. Disability advocates are voicing their concerns, emphasizing that these changes could deny benefits to hundreds of thousands, particularly older Americans who depend on this vital support.

Successful requests for disability benefits often hinge on thorough documentation and adherence to the SSA's guidelines. For example, case studies show that applicants who provide detailed medical evidence and illustrate how their disabilities affect daily life are more likely to gain approval. This underscores the importance of understanding the application process and the standards the SSA uses to evaluate claims.

Ultimately, Social Security Disability Insurance remains a lifeline for millions. It ensures that individuals with disabilities can face their financial challenges with a sense of security. Remember, you are not alone in this journey, and there are resources available to help you every step of the way.

Determine the Duration of SSDI Benefits: Key Factors and Guidelines

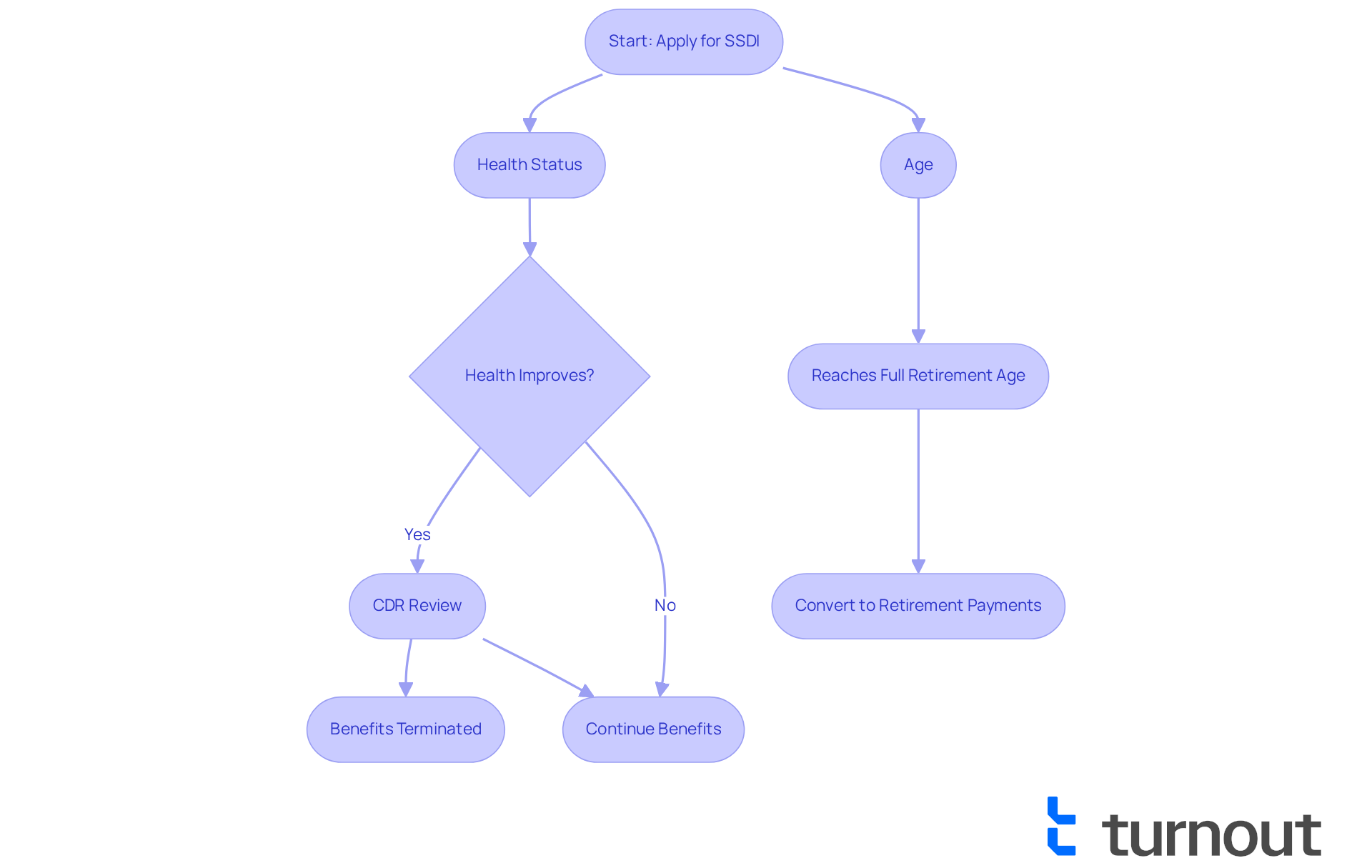

Navigating disability assistance can be challenging, and we understand that your health status and age play significant roles in this journey. Typically, assistance continues as long as you are considered disabled by the SSA, leading to inquiries about how long does SSDI last. However, once you reach full retirement age-currently between 66 and 67-you might ask how long does SSDI last, as your SSDI payments will automatically convert to retirement payments.

It's also important to know that if your health improves, you may face a Continuing Disability Review (CDR). This review can lead to the termination of support if you are deemed no longer disabled. Staying informed about your health status and any changes in SSA policies is essential, as these can impact your benefits.

At Turnout, we're here to help. Our trained nonlawyer advocates are dedicated to guiding you through the complexities of SSD claims. We ensure you understand your rights and options, all without the need for legal representation. Remember, you are not alone in this journey; we are here to support you every step of the way.

Navigate the SSDI Application Process: Steps and Documentation Needed

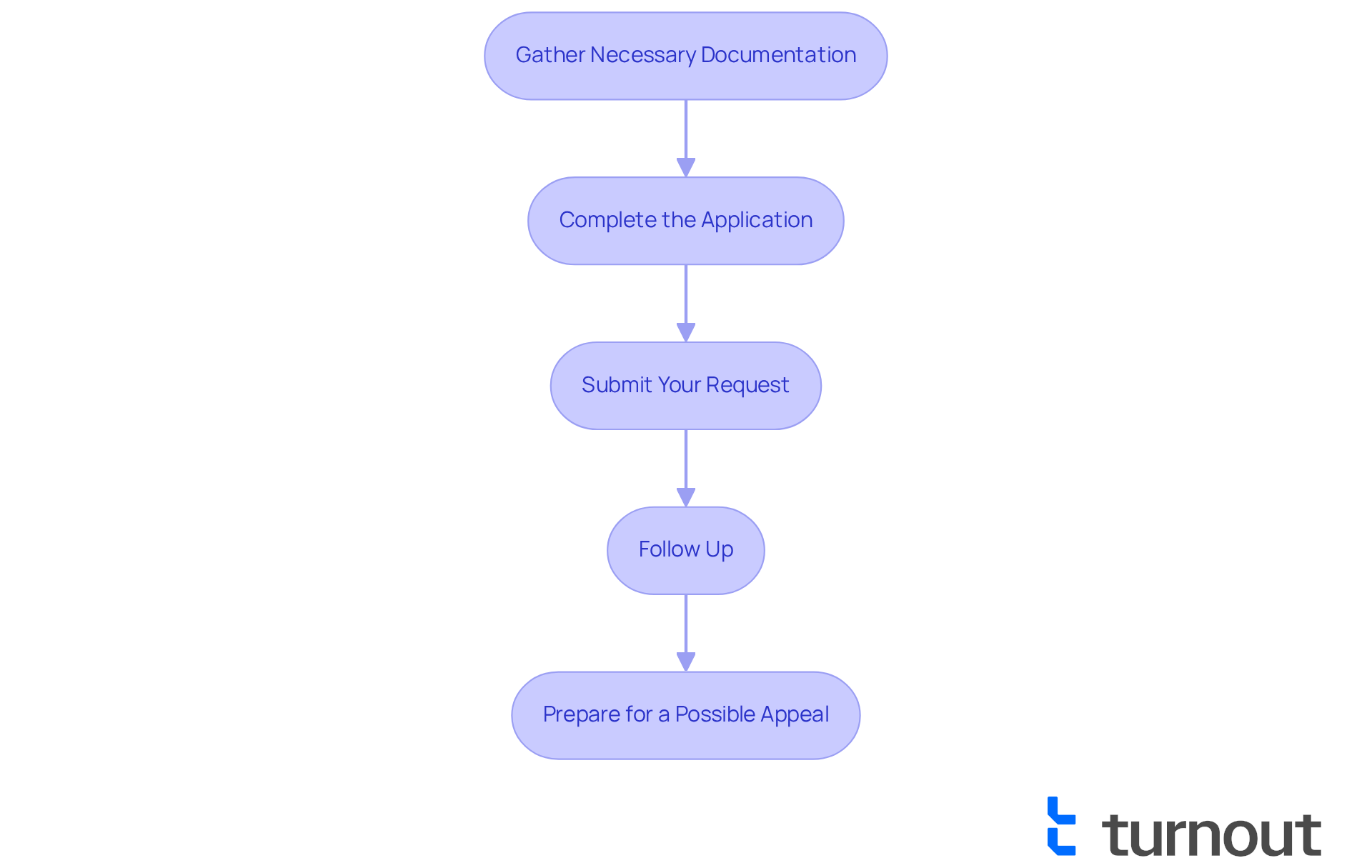

Applying for SSDI can feel overwhelming, but we're here to help you through it. Follow these essential steps to make the process smoother:

-

Gather Necessary Documentation: Start by collecting vital documents like health records, a comprehensive work history covering the last 15 years, and personal identification. Key documents include proof of age (like a birth certificate), your Social Security number, and detailed medical evidence of your disability. A well-organized file can speed up the decision-making process and demonstrate your commitment.

-

Complete the Application: You can apply online at the SSA website, by phone, or in person at your local SSA office. Make sure to fill out all fields correctly to avoid common mistakes. Remember, even one missing document can lead to significant delays or rejection.

-

Submit Your Request: Once you've completed your request, send it along with all necessary documentation. If you're missing some documents, don’t hesitate to submit your request anyway; you can always provide the remaining documents later.

-

Follow Up: Keep an eye on your application status and respond quickly to any inquiries from the SSA. The initial decision on a disability benefits request typically takes three to six months, so staying informed is crucial.

-

Prepare for a Possible Appeal: If your application is denied, don’t lose hope. Be ready to appeal the decision. Gather additional evidence and consider seeking legal assistance. An experienced advocate can help identify reasons for denial and strategize for a successful appeal. Remember, many disability claims face initial rejections due to technical mistakes, so careful preparation is key.

You are not alone in this journey, and with the right steps, you can navigate the SSDI application process with confidence.

Address Common Challenges in Securing SSDI Benefits: Strategies for Success

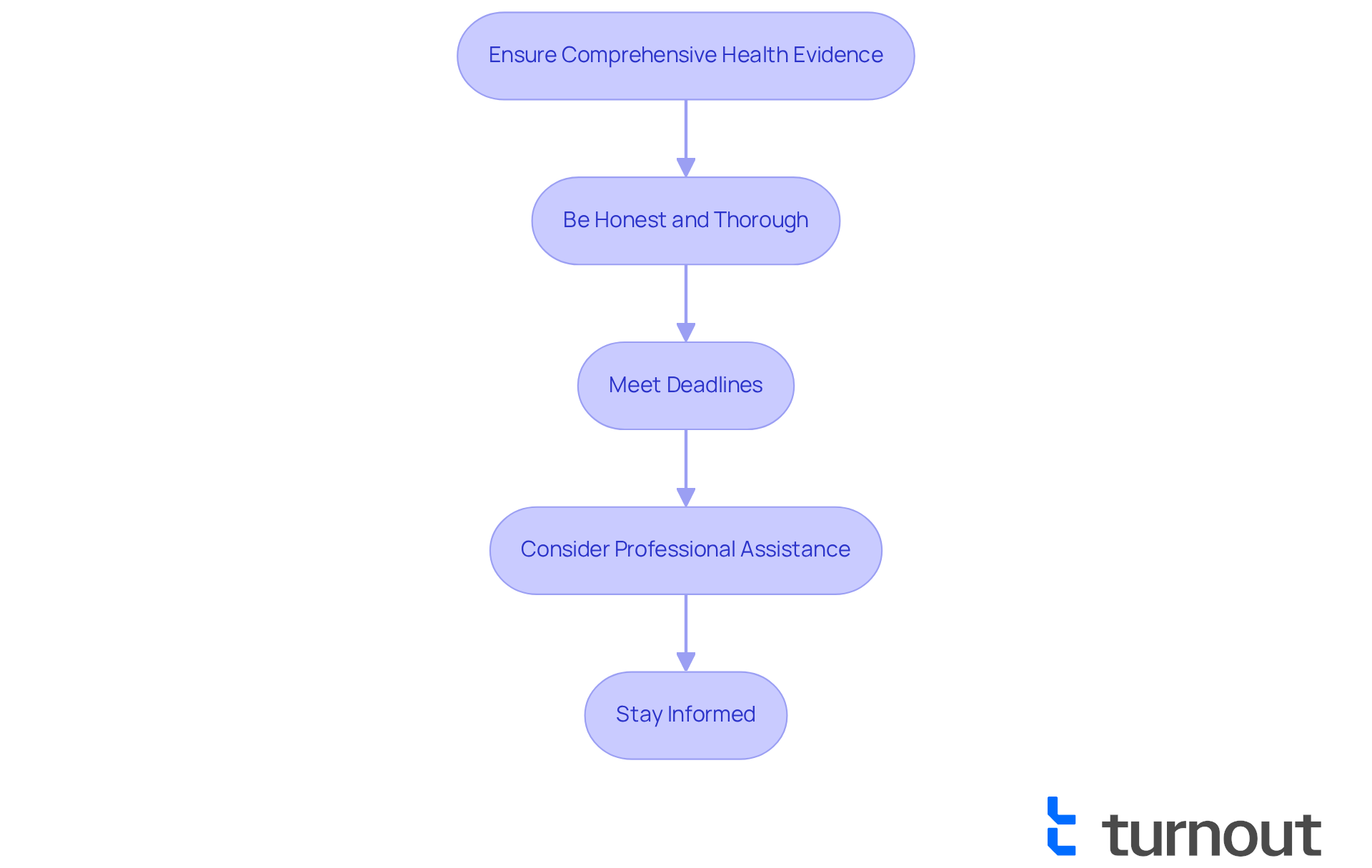

Securing SSDI benefits can feel overwhelming, but with the right strategies, you can significantly boost your chances of success. Let’s explore some key approaches that can help you on this journey:

-

Ensure Comprehensive Health Evidence: Providing detailed health records is crucial. These documents should clearly outline your disability and how it impacts your ability to work. Research shows that submissions with thorough medical documentation have a higher likelihood of approval.

-

Be Honest and Thorough: Transparency is essential when finalizing your submission. Inconsistencies in your reported condition and limitations can lead to denials. It’s important to provide specific and detailed answers about how your disability affects your daily activities and work tasks.

-

Meet Deadlines: We understand that managing timelines can be stressful. Adhering to all deadlines for submitting documents and appeals is critical. Missing a deadline can jeopardize your claim, so be proactive. Remember, you have 60 days to request reconsideration after a denial.

-

Consider Professional Assistance: Navigating the disability benefits process can be complex, especially after a denial. Consulting a disability advocate or utilizing services like those offered by Turnout, which employs trained nonlawyer advocates (not attorneys), can provide valuable guidance and support. Research indicates that having professional representation can significantly improve your chances of success.

-

Stay Informed: It’s common to feel lost with changing policies. Keeping abreast of any changes in disability benefits policies or regulations is essential. Understanding the current landscape can help you navigate the system more effectively and ensure that you meet all eligibility requirements.

By following these strategies, you can improve your chances of successfully securing SSDI benefits. Remember, you are not alone in this journey, and we’re here to help you navigate the complexities of the application process.

Conclusion

Understanding the duration of Social Security Disability Insurance (SSDI) benefits is crucial for anyone navigating the complexities of disability support. This program serves as a vital financial lifeline for those unable to work due to severe disabilities. Benefits typically last as long as the individual remains disabled or until they reach retirement age. It's important to be aware of eligibility criteria, documentation requirements, and the potential for ongoing reviews to maintain these benefits.

We understand that the application process can feel overwhelming. Key insights highlight the importance of:

- Thorough documentation

- Following application guidelines

- Making timely follow-ups

Successful applicants often provide comprehensive medical evidence and clearly demonstrate how their disabilities impact daily life. Staying informed about policy changes and seeking professional assistance when needed can significantly enhance your chances of approval.

Ultimately, SSDI is more than just a financial support system; it represents a commitment to ensuring that individuals with disabilities can maintain a sense of security during challenging times. By understanding the nuances of the SSDI process and actively engaging with available resources, you can empower yourself to navigate this journey with confidence. Taking proactive steps today can lead to a more secure tomorrow. Remember, advocating for your rights and staying informed about your benefits is essential. You're not alone in this journey; we're here to help.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

Social Security Disability Insurance is a federal program that provides financial support to individuals who are unable to work due to severe disabilities.

Who is eligible for SSDI?

Applicants must have a work history that includes contributions to Social Security through payroll taxes and must meet strict medical criteria set by the Social Security Administration (SSA).

How many people are expected to qualify for SSDI in 2025?

Around 8.5 million individuals are expected to qualify for SSDI in 2025.

How is SSDI funded?

SSDI is funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA).

What recent changes have raised concerns among disability advocates regarding SSDI?

Recent changes to the eligibility criteria may decrease eligibility for older applicants, with proposals suggesting that overall eligibility for disability benefits could drop by as much as 20 percent, significantly affecting those aged 50 and older.

What factors contribute to a successful application for SSDI?

Successful applications often depend on thorough documentation and adherence to SSA guidelines, with detailed medical evidence and explanations of how disabilities affect daily life being crucial for approval.

Why is SSDI considered a lifeline for many individuals?

SSDI provides essential financial support to individuals with disabilities, helping them manage their financial challenges and ensuring they have resources during difficult times.