Introduction

Tax obligations can often feel like a daunting maze. We understand that the potential for severe consequences can loom large for those who struggle to comply. It’s crucial to grasp the complexities of tax evasion and the penalties that come with it. As you navigate these waters, you might wonder: how long can someone really go to jail for not paying taxes? The truth is, imprisonment usually stems from willful misconduct, not just a simple oversight.

What specific factors lead to criminal charges? And how can you protect yourself from the harshest penalties? These are important questions, and we’re here to help you find the answers. Remember, you are not alone in this journey. Seeking guidance can make all the difference.

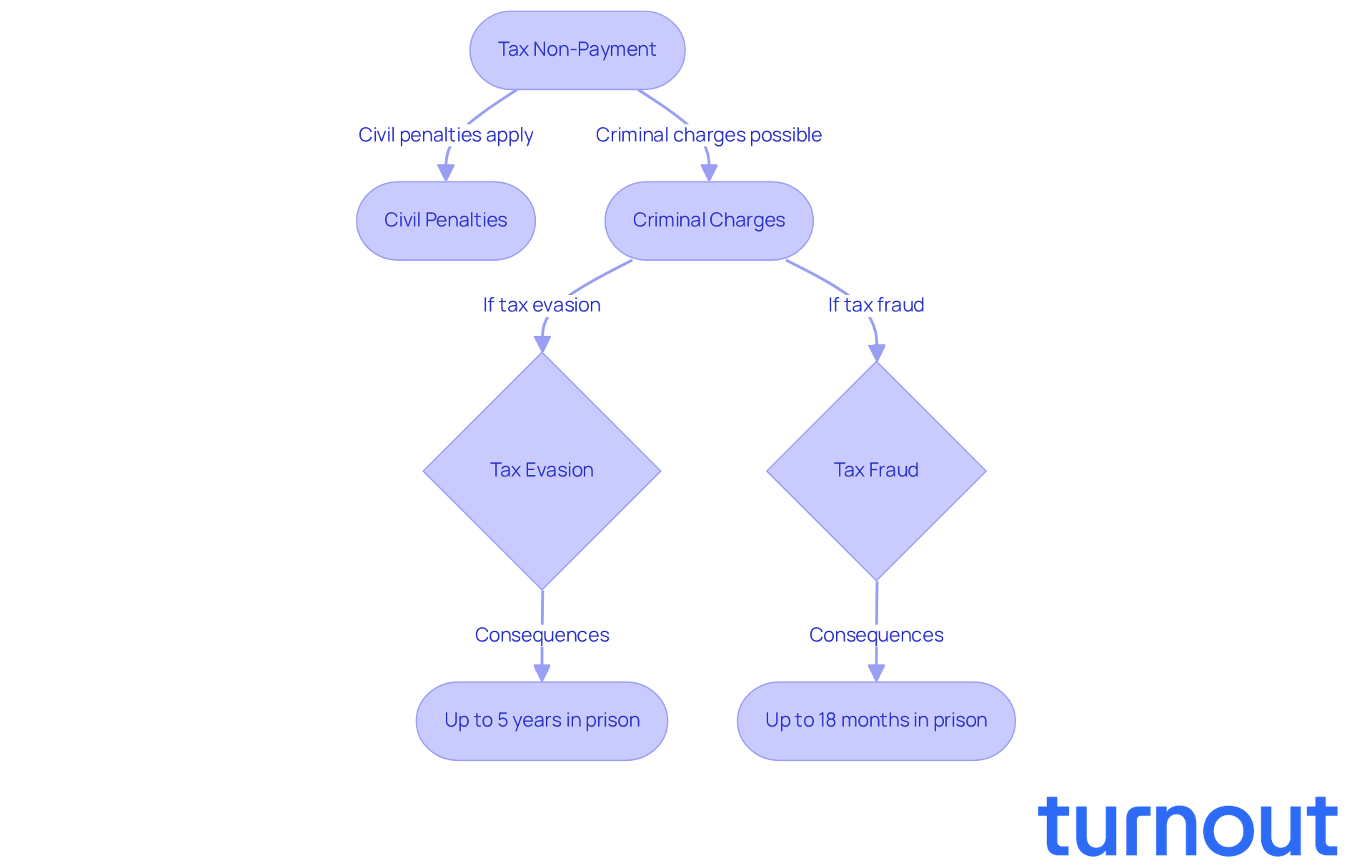

Define Jail Time for Tax Non-Payment

We understand that dealing with tax obligations can be overwhelming. When considering how long you can go to jail for not paying taxes, it's important to note that imprisonment often stems from serious criminal accusations rather than just simple non-payment of dues. Under U.S. law, not paying dues alone doesn’t automatically lead to imprisonment. However, if a taxpayer is found guilty of tax evasion or fraud, defined as willfully trying to evade tax obligations, they may face severe consequences, including how long can you go to jail for not paying taxes.

For instance, tax evasion under 26 U.S.C. § 7201 can result in a felony charge, which carries a maximum sentence of five years in prison, along with hefty fines. The average guideline minimum sentence for tax fraud has remained steady over the past five years, giving us insight into sentencing trends. It’s crucial to distinguish between civil penalties, like fines and interest on unpaid dues, and legal penalties, which may involve imprisonment.

The IRS generally prefers civil resolutions over legal charges due to cost and time factors. This makes it essential for individuals to fully understand their tax responsibilities. For instance, the serious repercussions of tax evasion are evident in the case of a business director who failed to pay employment taxes and faced up to ten years in prison, illustrating how long can you go to jail for not paying taxes. Additionally, a tax preparer who filed hundreds of false returns was sentenced to 18 months in prison, illustrating the legal system's strict stance on fraudulent tax activities.

Experts emphasize that the IRS typically pursues criminal charges when there’s a pattern of intentionally violating tax laws. A conviction for tax evasion can also lead to the loss of certain rights, such as voting and firearm ownership. This underscores the serious consequences of tax evasion. Remember, you are not alone in this journey, and understanding your obligations is the first step towards resolution.

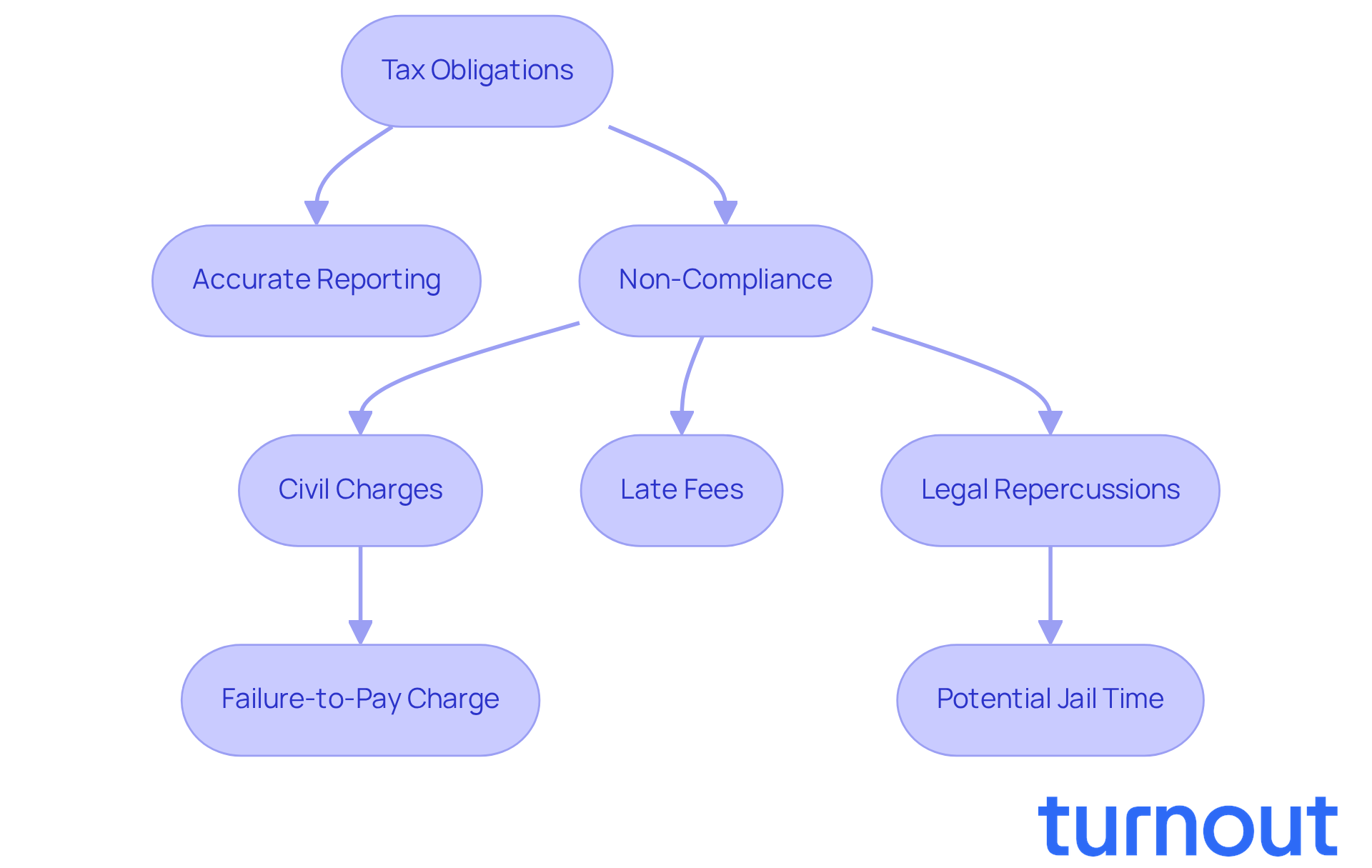

Context of Tax Obligations and Consequences

In the United States, tax obligations can feel overwhelming, as they are dictated by both federal and state laws. It’s essential for individuals to accurately report their income and fulfill their tax responsibilities. We understand that non-compliance can lead to various repercussions, starting with civil charges like late fees and interest on overdue amounts. For instance, the IRS imposes a failure-to-pay charge of 0.5% per month on any unpaid tax, which can accumulate to a maximum of 25%. If you owe $1,000 and miss the payment deadline, you might incur a fee of $5 for the first month. If it remains unpaid for five months, that fee could escalate to $25, ultimately reaching a cap of $250. And if you submit your return over 60 days late, the minimum charge rises to $510 or 100% of the unpaid tax, whichever is lower.

It's common to feel anxious about these penalties, especially if the IRS suspects deliberate intent to evade taxes. Individuals who neglect to file tax returns or misrepresent their income may face serious charges under 26 U.S.C., leading to questions about how long can you go to jail for not paying taxes. According to § 7203, the question of how long can you go to jail for not paying taxes arises, as it can lead to up to one year in prison for each year of non-filing. Tax experts emphasize that the civil consequences for late payments are generally less severe than legal repercussions, including hefty fines and the possibility of incarceration, raising concerns about how long can you go to jail for not paying taxes. However, there’s hope! If you acted in good faith and can show reasonable cause for not meeting your tax obligations, penalties may be removed or reduced.

Understanding these layers of consequences is crucial for navigating your obligations and avoiding severe repercussions. Remember, you’re not alone in this journey. For those worried about their refund status, the IRS offers a helpful tool called 'Where’s My Refund?' This resource can be invaluable during tax season, providing peace of mind as you check the status of your federal refunds. We're here to help you through this process.

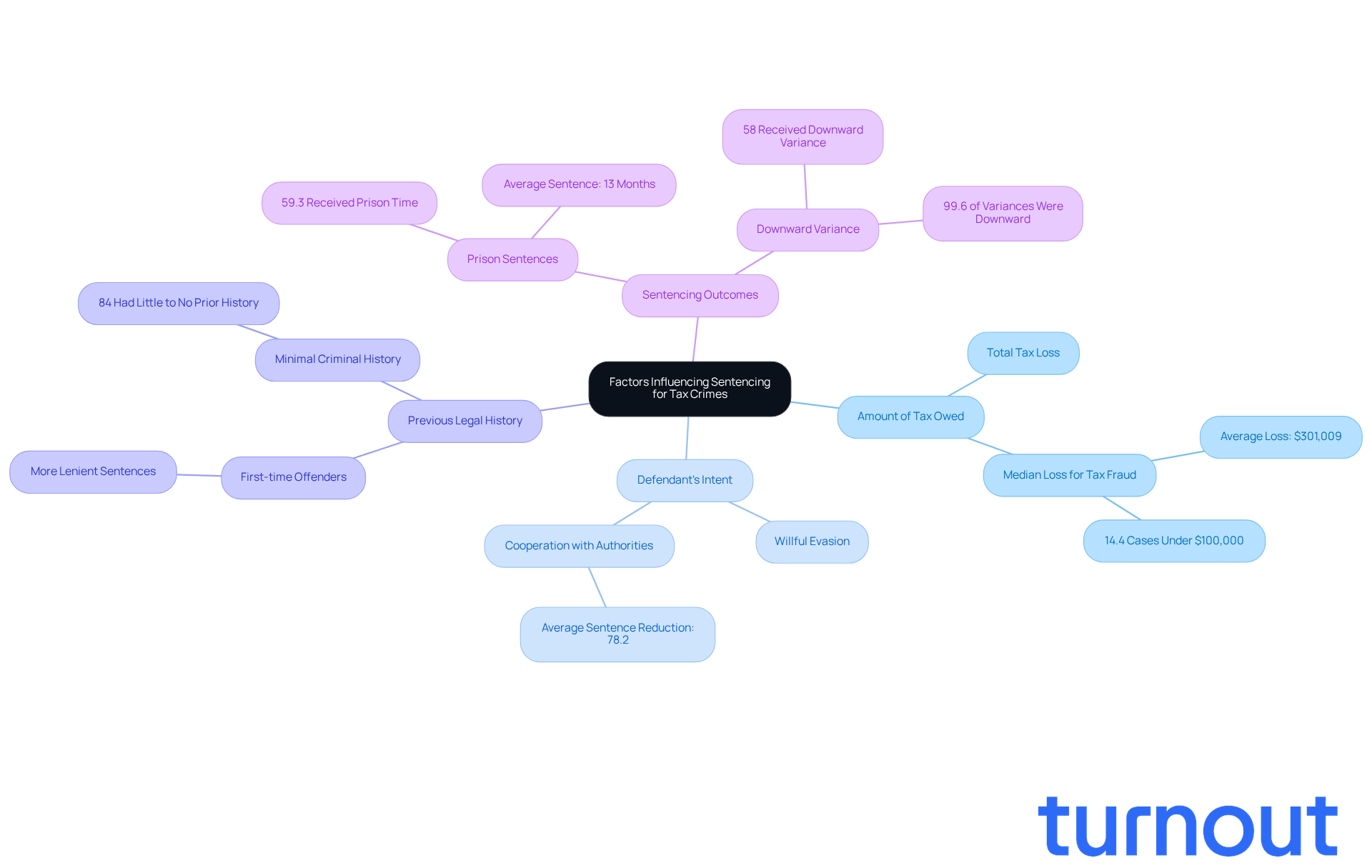

Factors Influencing Sentencing for Tax Crimes

Facing tax offenses can be overwhelming, and it’s important to understand the factors that influence sentencing. Key elements include:

- The amount of tax owed

- The defendant's intent

- Their previous legal history

Courts look closely at whether the taxpayer willfully tried to evade taxes, which can lead to harsher penalties.

For instance, first-time offenders who cooperate with the IRS often receive more lenient sentences compared to those with prior offenses. The complexity of the fraud and the total tax loss also play crucial roles in determining outcomes. Recent data from the U.S. Sentencing Commission shows that 59.3% of individuals convicted of tax fraud received prison sentences, averaging around 13 months. Interestingly, 84% of these individuals had minimal to no previous legal history, challenging the notion that incarceration is unlikely for tax fraud.

Moreover, 58% of offenders experienced a downward variance in sentencing, highlighting the potential for leniency. Understanding these factors is essential for anyone facing tax-related charges, as they can significantly impact legal outcomes, including how long can you go to jail for not paying taxes.

Cooperation with authorities can lead to substantial sentence reductions. Offenders who assist in investigations see average reductions of 78.2%. This underscores the importance of hiring an experienced federal criminal defense attorney. With skilled legal representation, you can navigate this challenging situation more effectively. Remember, you are not alone in this journey, and we’re here to help.

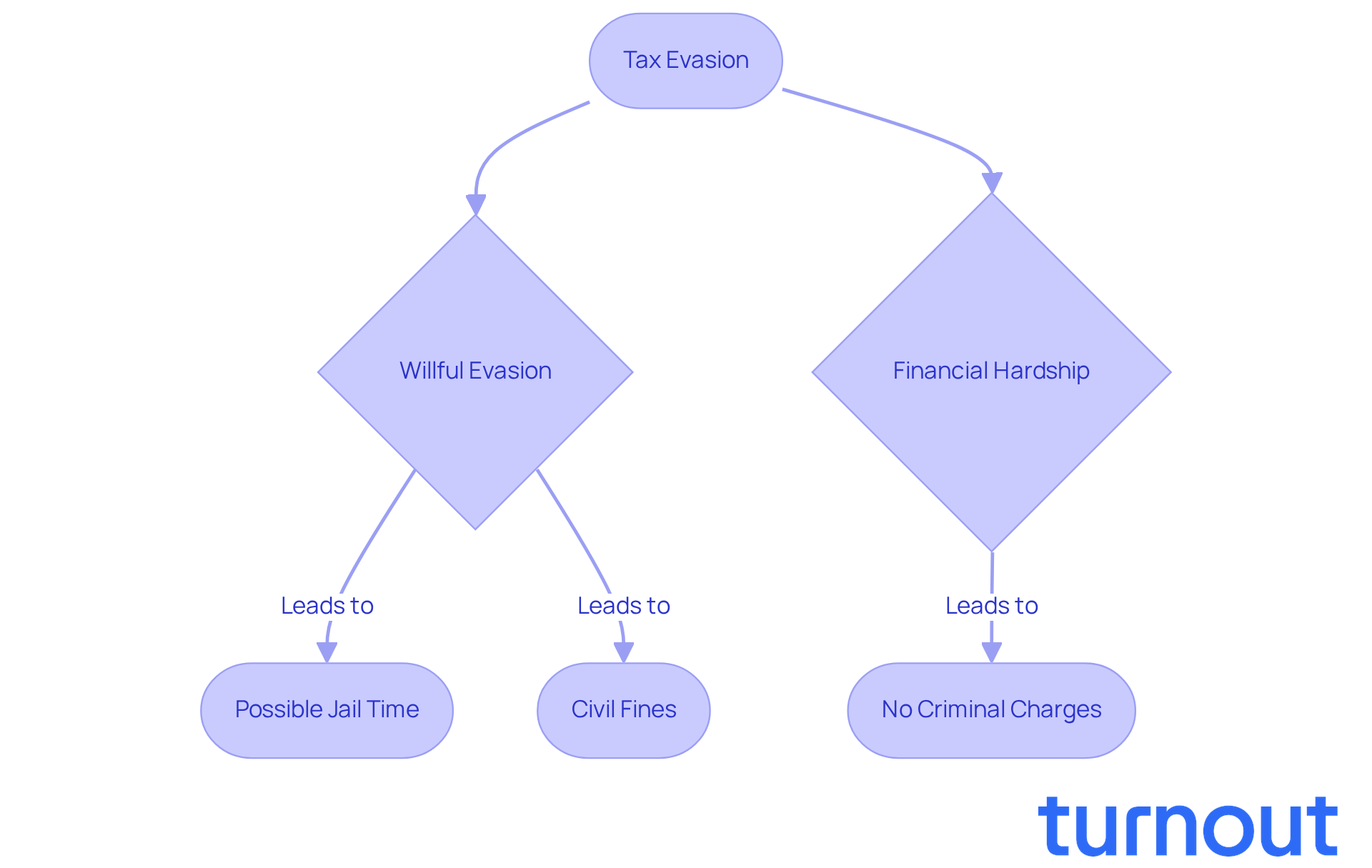

Debunking Myths About Tax Evasion and Jail Time

Many myths surround tax evasion and the fear of imprisonment. It’s common to feel anxious about the consequences of failing to pay taxes, particularly about how long can you go to jail for not paying taxes, but let’s clarify this misconception: jail time usually applies only to cases of willful tax evasion or fraud. Financial hardship alone doesn’t make someone a criminal; many individuals facing real challenges aren’t prosecuted.

It’s important to understand that not every case of tax evasion leads to severe consequences. In fact, while 63.6% of tax fraud offenders do receive prison sentences, many others face civil fines instead of jail time. This knowledge can help ease the worries of taxpayers, allowing them to manage their responsibilities without the constant fear of legal action for non-payment alone.

On average, the sentence for tax fraud is about 15 months, which raises the question of how long can you go to jail for not paying taxes, underscoring the seriousness of the issue for those who do face criminal charges. Consider the case of John Doe, who faced significant repercussions for failing to report income accurately. After an audit revealed unreported earnings from his plumbing side business, he encountered jail time and hefty financial penalties. This serves as a powerful reminder of the importance of accurate reporting and compliance.

If you’re feeling overwhelmed, remember: you’re not alone in this journey. We’re here to help you navigate these challenges and ensure you understand your responsibilities.

Conclusion

Understanding the potential consequences of failing to pay taxes is crucial for anyone navigating their financial responsibilities. We understand that the fear of imprisonment can feel overwhelming. However, it’s important to recognize that jail time is typically reserved for serious offenses like tax evasion or fraud, rather than mere non-payment. The legal landscape surrounding tax obligations highlights the significance of compliance and the potential repercussions of willful neglect.

Throughout this discussion, key insights reveal that tax evasion can lead to severe penalties, including felony charges and substantial prison sentences. Factors such as the amount owed, intent, and previous legal history play a significant role. The IRS generally prefers civil resolutions, emphasizing that individuals facing tax issues should seek to understand their obligations and the potential consequences of their actions. It’s common to feel anxious about myths surrounding tax evasion, but it’s essential to clarify that financial hardship alone does not equate to criminal behavior.

Ultimately, we encourage you to stay informed and proactive about your tax responsibilities. Engaging with tax professionals and understanding the nuances of tax law can mitigate risks and promote compliance. By taking these steps, you can navigate the complexities of tax obligations with confidence. Remember, you’re not alone in this journey. Together, we can ensure that you avoid the pitfalls of legal repercussions while securing your financial future.

Frequently Asked Questions

What leads to jail time for not paying taxes?

Jail time for not paying taxes typically results from serious criminal accusations, such as tax evasion or fraud, rather than simple non-payment of dues.

What is tax evasion under U.S. law?

Tax evasion, defined under 26 U.S.C. § 7201, involves willfully trying to evade tax obligations and can result in felony charges.

What are the potential consequences of tax evasion?

A conviction for tax evasion can lead to a maximum sentence of five years in prison and hefty fines, along with the possibility of losing certain rights.

How does the IRS handle tax non-payment cases?

The IRS generally prefers civil resolutions over criminal charges due to cost and time factors, focusing on resolving unpaid dues through fines and interest rather than imprisonment.

Can you provide an example of a severe consequence for tax evasion?

Yes, a business director who failed to pay employment taxes faced up to ten years in prison, highlighting the serious repercussions of tax evasion.

What is the average guideline minimum sentence for tax fraud?

The average guideline minimum sentence for tax fraud has remained steady over the past five years, indicating consistent sentencing trends.

What happens to tax preparers who commit fraud?

Tax preparers who file false returns can face significant prison sentences; for example, one was sentenced to 18 months in prison for filing hundreds of false returns.

What rights may be lost due to a conviction for tax evasion?

A conviction for tax evasion can lead to the loss of certain rights, including the right to vote and firearm ownership.