Introduction

Navigating the complexities of garnishment can feel overwhelming, especially for those who depend on disability benefits to cover their essential needs. We understand that while federal laws offer important protections for Social Security Disability Insurance payments, there are exceptions that can leave recipients feeling vulnerable to financial strain.

How long can these benefits be garnished for a judgment? This question is crucial, as it can significantly impact the financial stability of individuals facing debt collection. By exploring the specific conditions and strategies to protect these vital payments, you can empower yourself to tackle the challenges of garnishment head-on. Remember, you are not alone in this journey, and we're here to help you secure your financial well-being.

Understand Garnishment and Its Legal Framework

Garnishment can be a daunting concept, especially when it comes to managing debts. It’s a legal mechanism that allows creditors to collect what they’re owed by seizing a portion of a debtor's income or assets. But here’s the good news: federal law offers substantial protections for those receiving Social Security Disability Insurance payments. Typically, these payments are shielded from most forms of debt collection, ensuring that you can rely on them for your essential needs.

However, it’s important to note that there are exceptions regarding how long can disability be garnished for a judgement. Responsibilities like child support, alimony, and federal tax debts may allow for withholding. In 2025, the legal framework surrounding disability support payments remains robust. The first $750 of monthly assistance is protected from seizure by government entities. Beyond that, the IRS can garnish up to 15% of disability payments for unpaid federal taxes, raising concerns about how long can disability be garnished for a judgement. Understanding these nuances is crucial, as they can significantly impact your financial stability.

Legal experts often recommend keeping your disability benefits in a separate bank account. This simple step can help protect your funds from potential seizure, especially if lenders attempt to freeze unprotected accounts after a court ruling. We understand that navigating these waters can be overwhelming, and it’s essential to know your rights.

Turnout does not provide legal counsel, but it’s vital for you to understand how long can disability be garnished for a judgment and the specific situations that may lead to your disability payments being garnished. By understanding your rights, you can better navigate the complexities of debt collection and safeguard your financial well-being. Remember, you are not alone in this journey, and there are resources available to help you through.

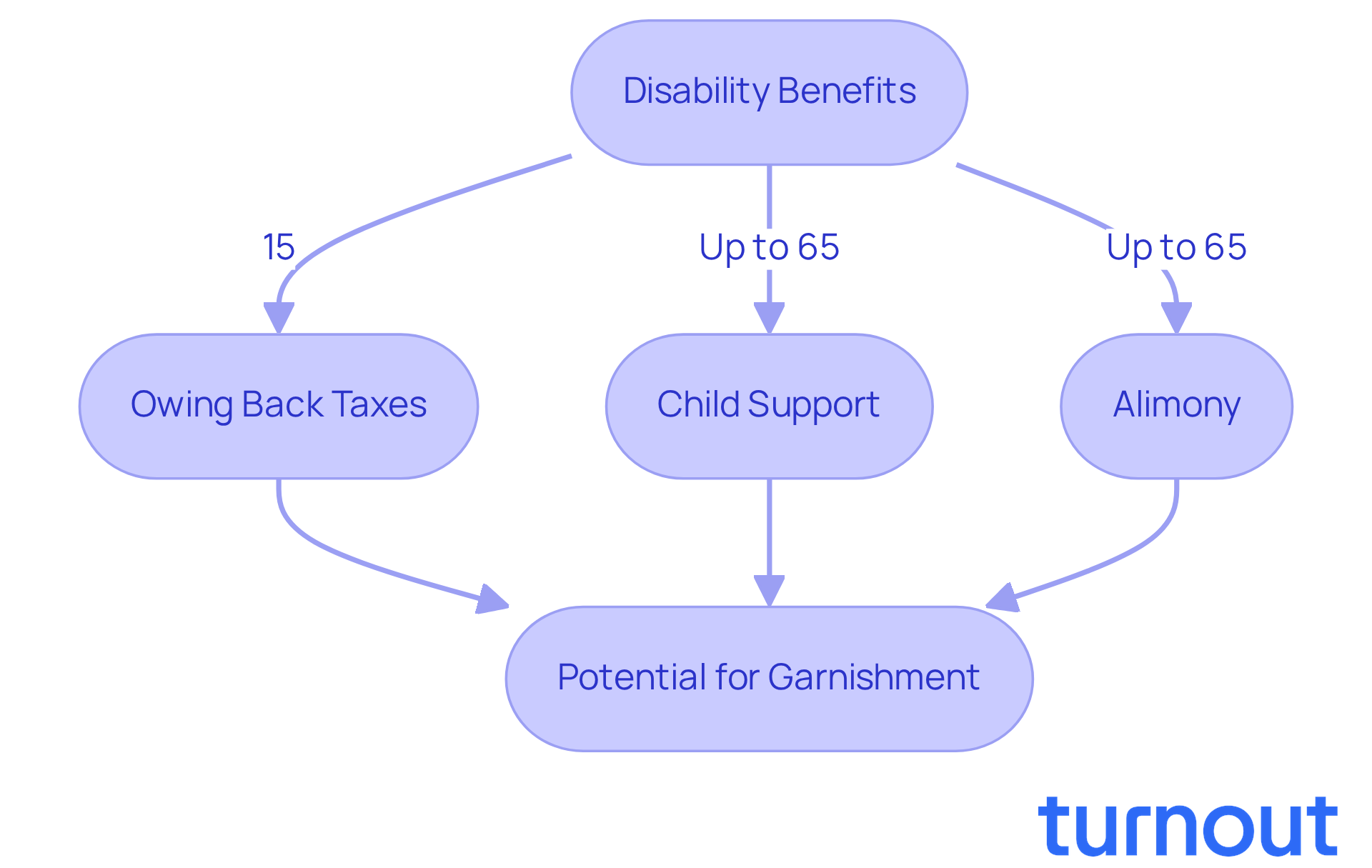

Identify Conditions for Garnishment of Disability Benefits

While disability payments are generally protected from seizure, it is crucial to know how long can disability be garnished for a judgement in certain situations that can lead to exceptions. For instance, if you find yourself owing back taxes, you may wonder how long can disability be garnished for a judgement, as the IRS can take a portion - typically around 15% - of your disability payments to settle federal tax debts. Similarly, obligations like child support and alimony can lead to deductions, prompting the inquiry of how long can disability be garnished for a judgement, with courts allowing up to 65% of SSDI payments to be withheld. Understanding whether you fall into any of these categories is crucial, as it can affect your exposure to wage deductions.

It's common to feel overwhelmed by these financial complexities. Recognizing the specific debts that might lead to wage withholding can help you prepare and protect your benefits effectively. That’s where Turnout comes in. They offer tools and services designed to assist you in navigating these challenging financial systems, including support for SSD claims and tax debt relief.

Importantly, Turnout is not a law firm and does not provide legal advice. Instead, they employ trained nonlawyer advocates and IRS-licensed enrolled agents who are here to guide you through these processes. This means you can receive the help you need without the formalities of an attorney-client relationship.

If you experience improper withholding, remember that you can seek reimbursement for any bank fees incurred due to these actions. You are not alone in this journey; we’re here to help you find the support you deserve.

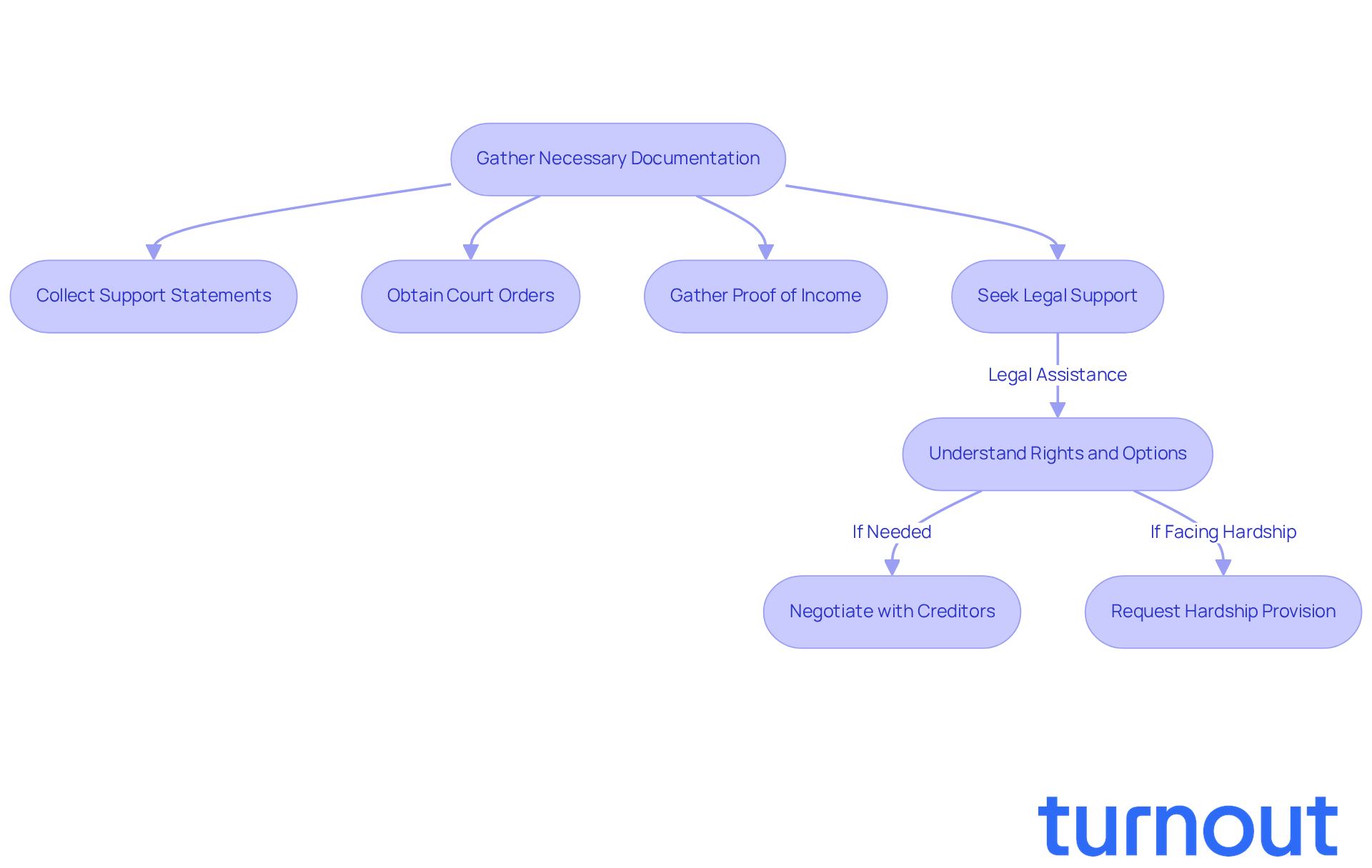

Gather Necessary Documentation and Seek Legal Support

If you're concerned about how long can disability be garnished for a judgement, you're not alone. It’s important to gather all the necessary documentation, including your support statements, any court orders related to debts, and proof of income. Seeking help is crucial. A lawyer or representative who specializes in disability benefits can provide you with personalized advice tailored to your situation. They can help you understand your rights and may assist in negotiating with creditors or challenging wage withholding orders.

Many individuals find that legal assistance leads to better outcomes. With the right support, you can effectively contest illegal deductions. Remember, up to 50-65% of SSDI payments can be withheld for child support or spousal support obligations, leading to inquiries about how long can disability be garnished for a judgement. However, there’s a hardship provision that allows you to request a reduction or pause in wage deductions if they’re causing serious financial trouble.

Having the right documentation and legal support can significantly enhance your ability to protect your essential benefits. As Amir Boroumand, a managing attorney, wisely advises:

- "Keep copies of all notices,

- show proof that your income comes from Social Security,

- and if needed, ask a qualified attorney for help."

You're taking a vital step by seeking assistance, and we're here to help you navigate this journey.

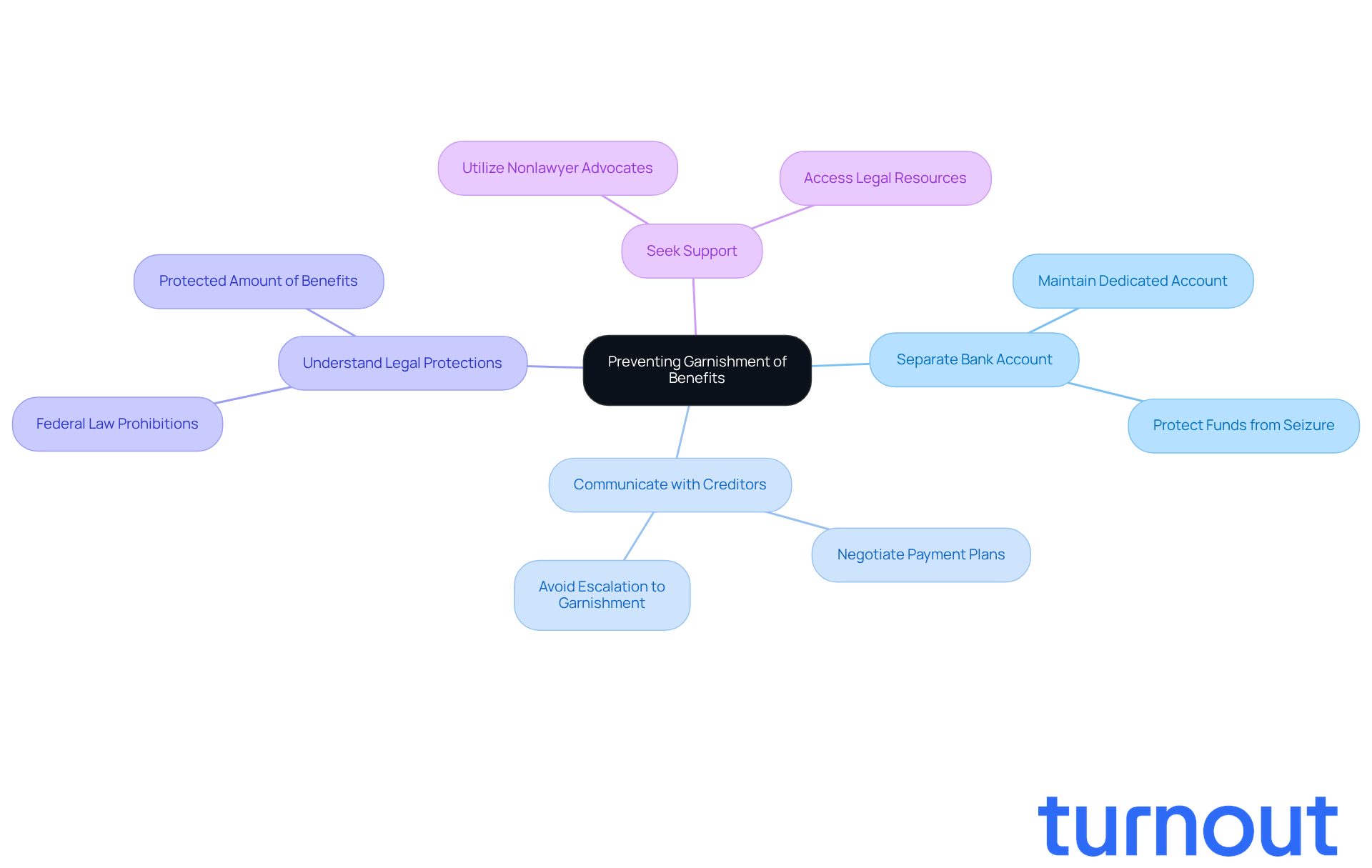

Implement Strategies to Prevent Garnishment of Benefits

To protect your disability entitlements from seizure, it’s important to consider a few effective strategies. First, think about maintaining a separate bank account just for your disability payments. This simple practice not only helps you clearly differentiate these funds from other income but also strengthens their protection under federal law. When kept in a dedicated account, these funds are secured from seizure. In 2023, over 8.7 million disabled recipients received payments, averaging $1,537.13 a month. Yet, many may not realize how crucial this separation is.

If you find yourself facing financial difficulties, it’s important to understand how long can disability be garnished for a judgement, as you’re not alone in this situation. It’s common to feel overwhelmed, but proactively communicating with creditors can make a difference. By negotiating payment plans or settlements, you can prevent escalation to garnishment actions and avoid concerns about how long can disability be garnished for a judgement. Federal law, as outlined in the Social Security Act, specifically prohibits most creditors from garnishing Social Security Disability Insurance (SSDI) payments, leading to inquiries about how long can disability be garnished for a judgement. Maintaining your financial stability is essential, particularly in understanding how long can disability be garnished for a judgement. Plus, the first $750 of your Social Security benefit is safeguarded from government agency claims, providing a vital safety net.

Staying informed about your rights is crucial. For instance, if a withholding order is issued against you, understanding how long can disability be garnished for a judgement can empower you to take appropriate action. Regularly reviewing your financial situation and seeking help when needed can further assist you in avoiding garnishment traps. Turnout, which is not a law firm and does not provide legal advice, offers support through trained nonlawyer advocates. They can guide you in navigating these processes effectively, ensuring you can manage your disability payments without undue stress from creditors. Remember, you are not alone in this journey.

Conclusion

Understanding how long disability benefits can be garnished for a judgment is crucial for protecting your financial stability. We know that navigating these waters can be overwhelming. While federal laws offer strong protections for Social Security Disability Insurance payments, there are exceptions that may lead to garnishment, especially for obligations like child support, alimony, and federal tax debts. Grasping these nuances is essential to effectively manage the challenges of debt collection.

One key insight is the importance of keeping separate bank accounts for your disability payments. This simple step can help shield your funds from creditors. Recognizing the specific conditions under which garnishment can happen empowers you to take proactive measures. Gathering necessary documentation and seeking legal support are vital actions that can significantly enhance your ability to contest improper deductions and protect your essential benefits.

Ultimately, staying informed about your rights and available resources is paramount in preventing garnishment. By understanding how to navigate these complexities and implementing protective strategies, you can ensure your disability benefits remain secure. Remember, taking the time to educate yourself and seek assistance when needed can make a substantial difference in maintaining your financial well-being amidst potential garnishment challenges. You're not alone in this journey, and we're here to help.

Frequently Asked Questions

What is garnishment?

Garnishment is a legal mechanism that allows creditors to collect debts by seizing a portion of a debtor's income or assets.

Are Social Security Disability Insurance payments protected from garnishment?

Yes, federal law provides substantial protections for Social Security Disability Insurance payments, typically shielding them from most forms of debt collection.

What are the exceptions to the protection of disability payments from garnishment?

Exceptions include responsibilities like child support, alimony, and federal tax debts, which may allow for withholding of disability payments.

How much of a disability payment is protected from seizure?

The first $750 of monthly assistance is protected from seizure by government entities.

Can the IRS garnish disability payments?

Yes, the IRS can garnish up to 15% of disability payments for unpaid federal taxes.

What should I do to protect my disability benefits from garnishment?

It is recommended to keep your disability benefits in a separate bank account to help protect your funds from potential seizure.

How can I navigate the complexities of debt collection related to disability payments?

Understanding your rights and the specific situations that may lead to garnishment can help you better navigate debt collection and safeguard your financial well-being.