Introduction

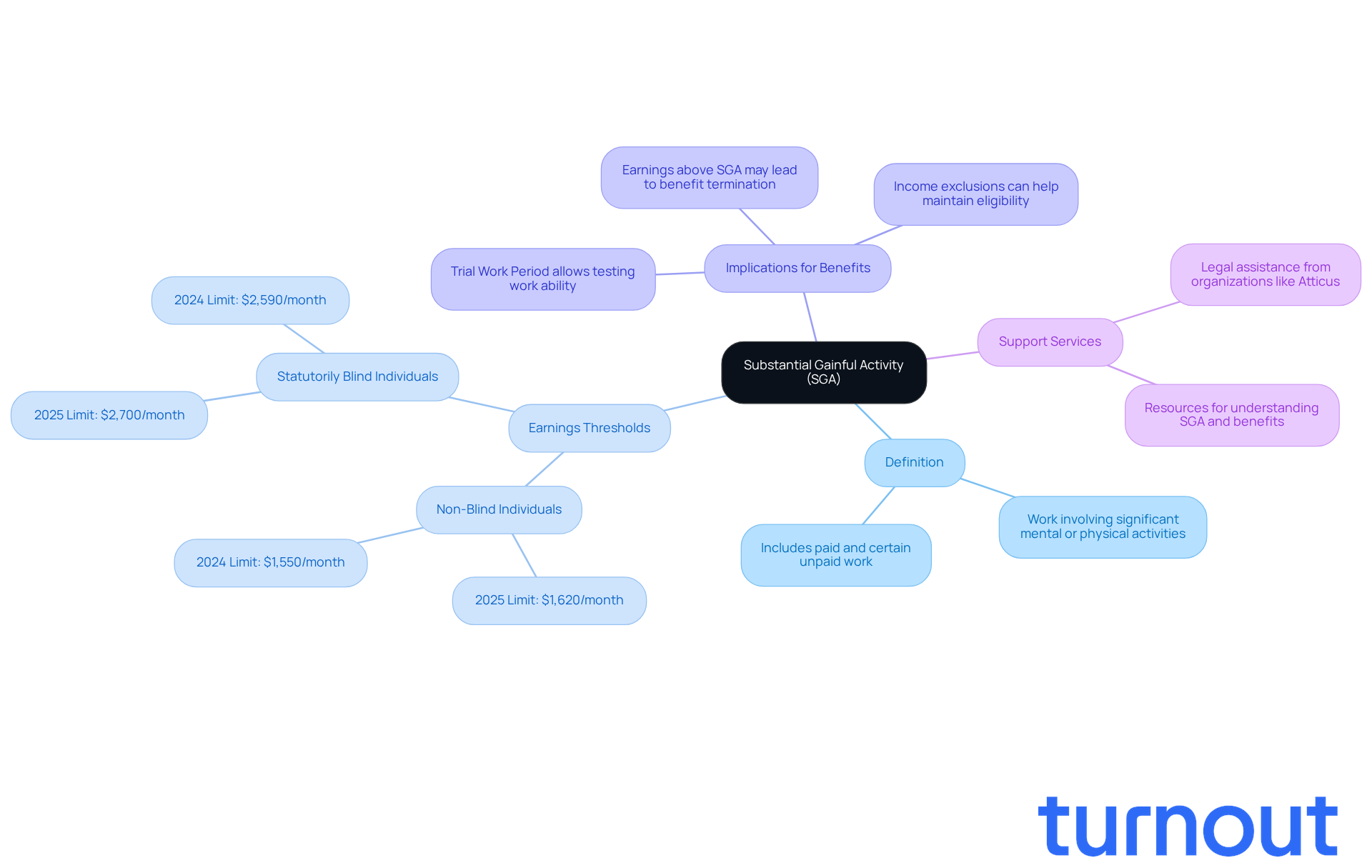

Navigating the complex landscape of disability benefits can be overwhelming, and understanding the nuances of Substantial Gainful Activity (SGA) is crucial. We know that the Social Security Administration sets specific income thresholds for 2025:

- $1,620 for non-blind individuals

- $2,700 for those who are blind

It’s essential for applicants to grasp how these figures impact their eligibility for Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

It’s common to feel confused about the calculation process. You might be wondering: how exactly is SGA calculated, and what common pitfalls should you be aware of? This guide is here to demystify the SGA calculation. We aim to provide essential insights and practical steps to empower you on your journey toward securing the benefits you deserve. Remember, you are not alone in this journey; we’re here to help.

Define Substantial Gainful Activity (SGA) and Its Importance

Substantial Gainful Activity (SGA) is a term you might hear often when discussing how SGA is calculated for disability benefits. The Social Security Administration (SSA) defines how SGA is calculated in terms of the level of job activity and earnings that can affect your eligibility for these benefits. For 2025, the SGA limit is set at $1,620 per month for non-blind individuals and $2,700 for those who are statutorily blind, which raises the question of how is SGA calculated.

It is essential to understand how SGA is calculated. If you earn more than the SGA threshold, it may indicate how SGA is calculated in terms of your ability to engage in substantial work. This could lead to the denial of your disability claim, which raises concerns about how SGA is calculated. For example, if your monthly earnings exceed $1,620, you might be viewed as capable of gainful activity, which raises the question of how SGA is calculated and impacts your eligibility for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) benefits.

We understand that navigating the disability benefits application process can feel overwhelming. That’s why it’s crucial to understand how SGA is calculated. At Turnout, we’re here to help you through this journey. We offer a variety of tools and services designed to assist you in understanding and managing these complexities. Our trained nonlawyer advocates are committed to providing personalized guidance, ensuring you feel supported every step of the way.

You are not alone in this process. Let us help you make sense of it all.

Identify the Criteria for SGA Calculation

Understanding whether your earnings qualify as Substantial Gainful Activity (SGA) can feel overwhelming. We’re here to help you navigate this important process. The Social Security Administration (SSA) evaluates several key criteria to determine SGA:

-

Gross Earnings: This is your total income before any deductions. In 2025, if your gross earnings exceed $1,620 per month for non-blind individuals or $2,700 for blind individuals, you may be considered to be engaging in SGA.

-

Nature of Task: The SSA looks at whether the tasks you perform are substantial and gainful. This means they require significant physical or mental effort. It’s important to ensure that your work isn’t trivial or minimal in scope.

-

Hours Worked: The number of hours you work each week is also crucial. Typically, working more than 20 hours per week may indicate that you are engaging in SGA.

-

Self-Employment Considerations: If you’re self-employed, the SSA assesses your net income after business expenses. Specific formulas help determine how SGA is calculated to assess if your profits meet the threshold.

We understand that these criteria can be confusing, but knowing them is essential for your application. For example, if you earn $1,800 per month from a part-time job, your application for SSDI benefits might be at risk due to exceeding the SGA limit. On the other hand, if you work fewer hours or earn below the threshold, you may have a stronger case for receiving assistance.

By familiarizing yourself with these guidelines, you can better navigate the complexities of the application process. It’s also wise to check if your condition is listed in the latest SSA guidelines, as this can significantly impact your eligibility.

Remember, you’re not alone in this journey. Turnout offers valuable support to help you through these complexities. Our trained nonlawyer advocates are here to assist with SSD claims, and our IRS-licensed enrolled agents can help with tax debt relief. Seeking assistance from Turnout can make a difference in compiling the necessary documentation and understanding the application process.

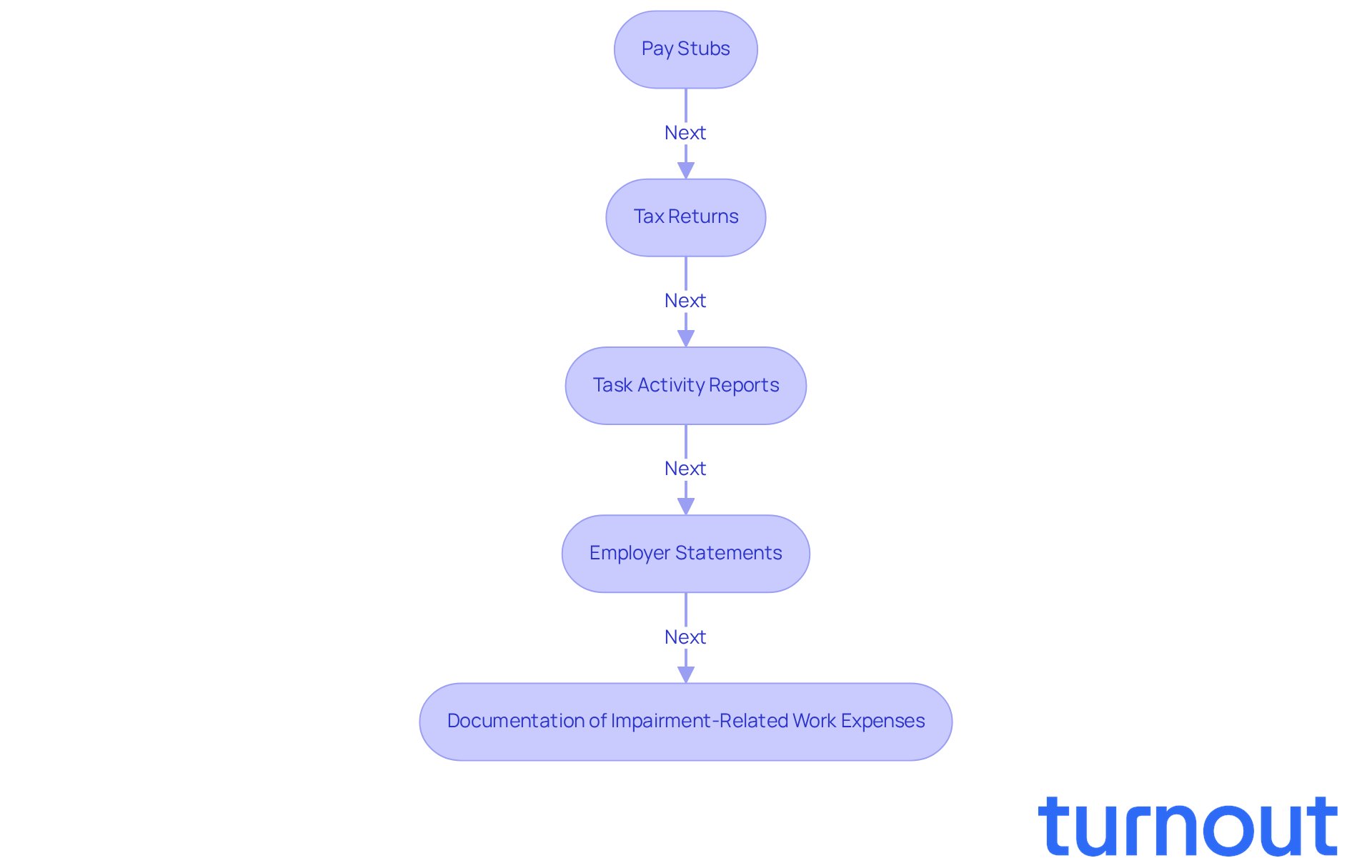

Gather Required Documentation for SGA Assessment

Navigating the SGA assessment can feel overwhelming, but you’re not alone in this journey. To make the process smoother, it’s essential to gather the right documentation. Here’s what you’ll need:

- Pay Stubs: Recent pay stubs that accurately reflect your gross income are crucial. They provide a snapshot of your revenue during the evaluation period.

- Tax Returns: Copies of your last two years of tax returns offer a comprehensive view of your overall income, which is vital for assessing your financial eligibility.

- Task Activity Reports: Completed forms like the SSA-821-BK (Task Activity Report - Employee) or SSA-820-BK (Task Activity Report - Self-Employment) are essential. They outline your employment history and income precisely.

- Employer Statements: Letters from your employers verifying your job responsibilities, hours worked, and income can support your claims and clarify your capacity for employment.

- Documentation of Impairment-Related Work Expenses (IRWEs): If applicable, include records of expenses incurred due to a disability that are necessary for your employment. These factors can influence how SGA is calculated.

Having these documents prepared can significantly enhance your chances of a successful application. Remember, Turnout's trained nonlawyer advocates are here to help you gather these documents and navigate the SSD claims process. You have the support you need, and legal representation isn’t necessary.

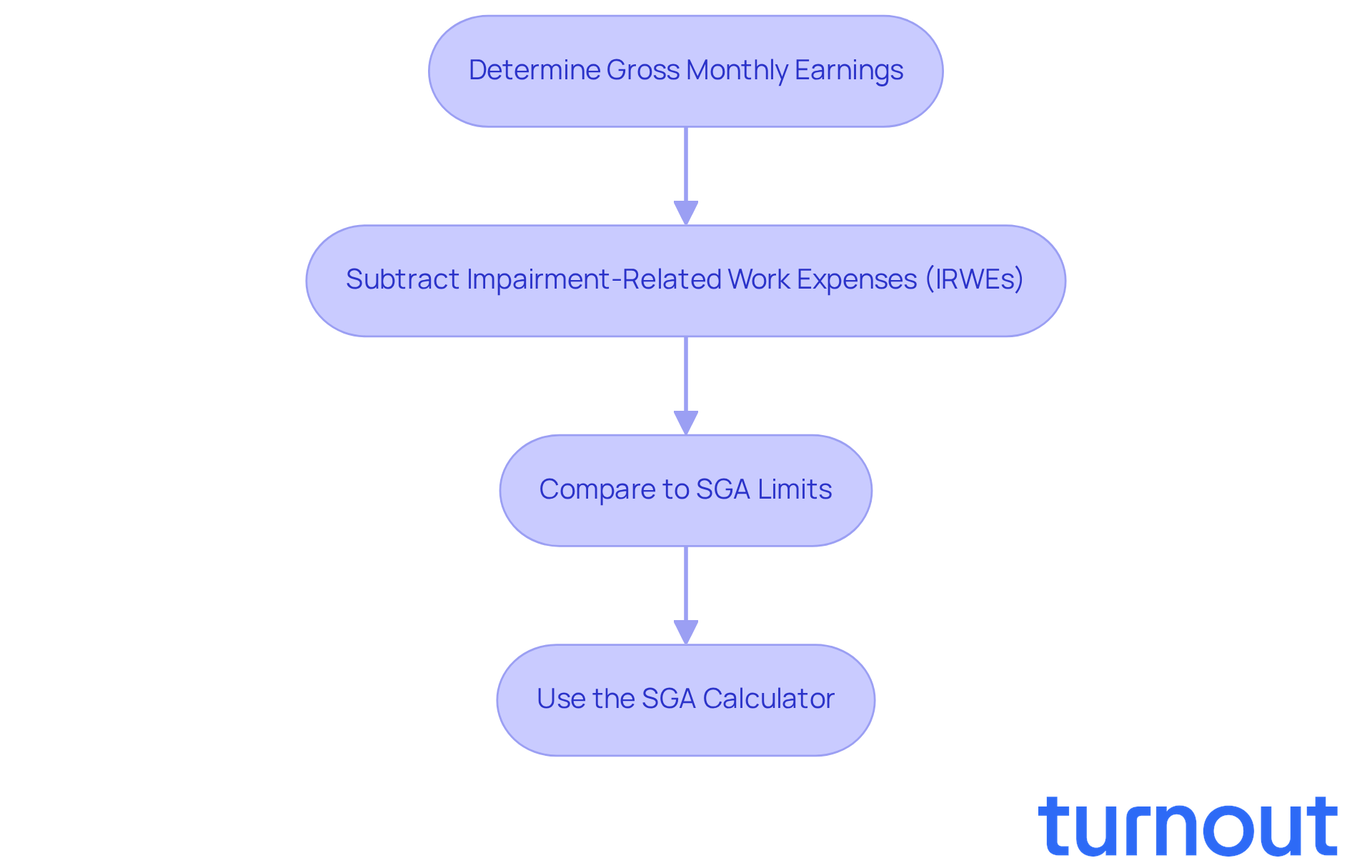

Calculate Your SGA Based on Income and Documentation

Calculating your SGA can feel overwhelming, but we're here to help you understand how SGA is calculated. Follow these simple steps to gain clarity:

-

Determine Gross Monthly Earnings: Start by summing all your income sources, including wages, bonuses, and any self-employment earnings. This gives you a clear picture of your financial situation.

-

Subtract Impairment-Related Work Expenses (IRWEs): Next, deduct any expenses related to your disability that help you work from your gross income. This step is crucial for understanding your adjusted earnings.

-

Compare to SGA Limits: For 2025, if your adjusted income exceeds $1,620 (or $2,700 if you’re visually impaired), you may be participating in SGA. It’s common to feel uncertain about these limits, but knowing them is key.

-

Use the SGA Calculator: To simplify the process, utilize online tools like the SGA Limit Calculator from Turnout. Just input your hourly rate and hours worked to see if you meet the SGA criteria.

Understanding how SGA is calculated is vital for securing the benefits you deserve. For instance, if you earn $1,800 monthly and have $300 in IRWEs, your adjusted income would be $1,500, which is below the SGA limit for non-blind individuals.

At Turnout, we’re committed to providing you with the tools and services you need to navigate these calculations. Our trained nonlawyer advocates are here to assist with SSD claims, and our IRS-licensed enrolled agents can help with tax debt relief. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

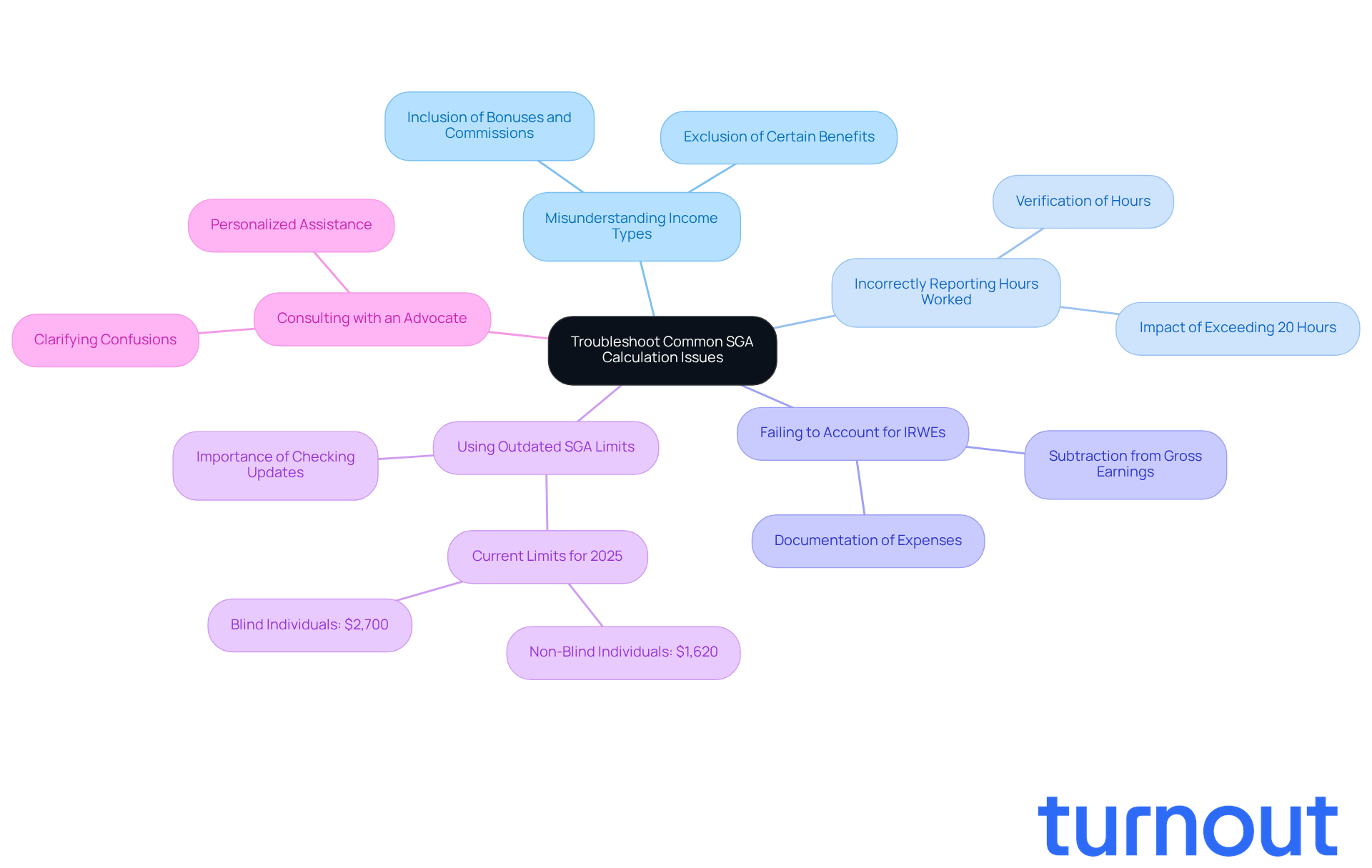

Troubleshoot Common SGA Calculation Issues

When discussing how SGA is calculated, it’s common to face a few challenges. We understand that navigating this process can feel overwhelming, but you’re not alone. Here are some common issues you might encounter:

-

Misunderstanding Income Types: It’s essential to know which income types count towards SGA. For example, bonuses and commissions are included, while some benefits may not be.

-

Incorrectly Reporting Hours Worked: Make sure to verify the number of hours you’ve worked. If you exceed 20 hours per week, you may be classified as engaging in SGA.

-

Failing to Account for IRWEs: Don’t forget to document and subtract any impairment-related work expenses (IRWEs) from your gross earnings. This step is crucial for accurate calculations.

-

Using Outdated SGA Limits: Always check the current SGA limits for the year of your application. For 2025, the limits are set at $1,620 for non-blind individuals and $2,700 for blind individuals.

-

Consulting with an Advocate: If you’re facing ongoing challenges, consider reaching out to Turnout’s trained nonlawyer advocates. They’re here to provide personalized assistance, clarify any confusion, and help ensure your application is accurate. Turnout offers various tools and services designed to help you navigate complex financial and governmental systems, especially in SSD claims and tax debt relief, without needing legal representation.

Understanding these common pitfalls is vital. Did you know that approximately 64 percent of initial SSD claims are denied? Often, this is due to miscalculations or misunderstandings regarding SGA criteria. That’s why being thorough and accurate in understanding how SGA is calculated is so important.

Additionally, with potential changes in the disability determination process in 2025-especially affecting applicants with mental health conditions or non-visible disabilities-staying informed is crucial. The Social Security Administration emphasizes that understanding SGA limits is essential for maintaining eligibility and ensuring a successful application. Remember, we’re here to help you through this journey.

Conclusion

Understanding how Substantial Gainful Activity (SGA) is calculated is crucial for anyone navigating the complexities of disability benefits. We know this can be overwhelming, but you’re not alone. This guide has outlined the essential components involved in determining SGA, emphasizing the importance of knowing your income limits, the criteria set by the Social Security Administration, and the necessary documentation required for a successful application.

Key insights covered include:

- The significance of gross earnings

- The nature of tasks performed

- The hours worked

These factors play a pivotal role in assessing your eligibility. It’s common to feel uncertain about these details, but being informed can make a significant difference. Additionally, we’ve highlighted common pitfalls, such as misreporting income types or failing to account for impairment-related work expenses. Accuracy in your application process is vital, and we’re here to help you navigate these challenges.

As you prepare to tackle the SGA assessment, remember that support is available. Utilizing resources like Turnout can provide you with personalized guidance and assistance. You deserve the tools necessary to manage your application successfully. Staying informed and meticulous about your SGA calculations can significantly impact your eligibility for Social Security benefits. Approach this process with care and confidence, knowing that you have the support you need.

Frequently Asked Questions

What is Substantial Gainful Activity (SGA)?

Substantial Gainful Activity (SGA) refers to the level of job activity and earnings that can affect an individual's eligibility for disability benefits as defined by the Social Security Administration (SSA).

What are the SGA limits for 2025?

For 2025, the SGA limit is set at $1,620 per month for non-blind individuals and $2,700 for those who are statutorily blind.

How does exceeding the SGA limit affect disability benefits?

If an individual earns more than the SGA threshold, it may indicate their ability to engage in substantial work, potentially leading to the denial of their disability claim for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) benefits.

What criteria does the SSA use to evaluate SGA?

The SSA evaluates several key criteria to determine SGA, including: - Gross Earnings: Total income before deductions, with limits of $1,620 for non-blind and $2,700 for blind individuals. - Nature of Task: The tasks performed must require significant physical or mental effort. - Hours Worked: Typically, working more than 20 hours per week may indicate engagement in SGA. - Self-Employment Considerations: For self-employed individuals, the SSA assesses net income after business expenses.

How can understanding SGA criteria help with the application process?

Familiarizing oneself with SGA criteria can help individuals navigate the complexities of the application process, as exceeding the SGA limit may jeopardize their SSDI benefits, while staying below the threshold can strengthen their case for assistance.

What support does Turnout offer for navigating SGA and disability claims?

Turnout provides various tools and services, including personalized guidance from trained nonlawyer advocates to help individuals understand and manage the complexities of the disability benefits application process.