Introduction

Understanding tax obligations can feel overwhelming, especially when it comes to the IRS's collection timeline. We understand that many people worry about how long the IRS has to collect owed taxes. Typically, this period spans a decade, but various factors can influence it, including actions taken by the taxpayer. As the deadline approaches, it’s common to have questions about how far back the IRS can go and what rights you have in this complex process.

What happens when the clock runs out? How can you navigate the intricacies of tax collection effectively? You're not alone in this journey. Many individuals face similar challenges, and we're here to help you understand your options and rights. Let’s explore this together, so you can feel more confident and informed.

Understand the IRS Collection Timeline

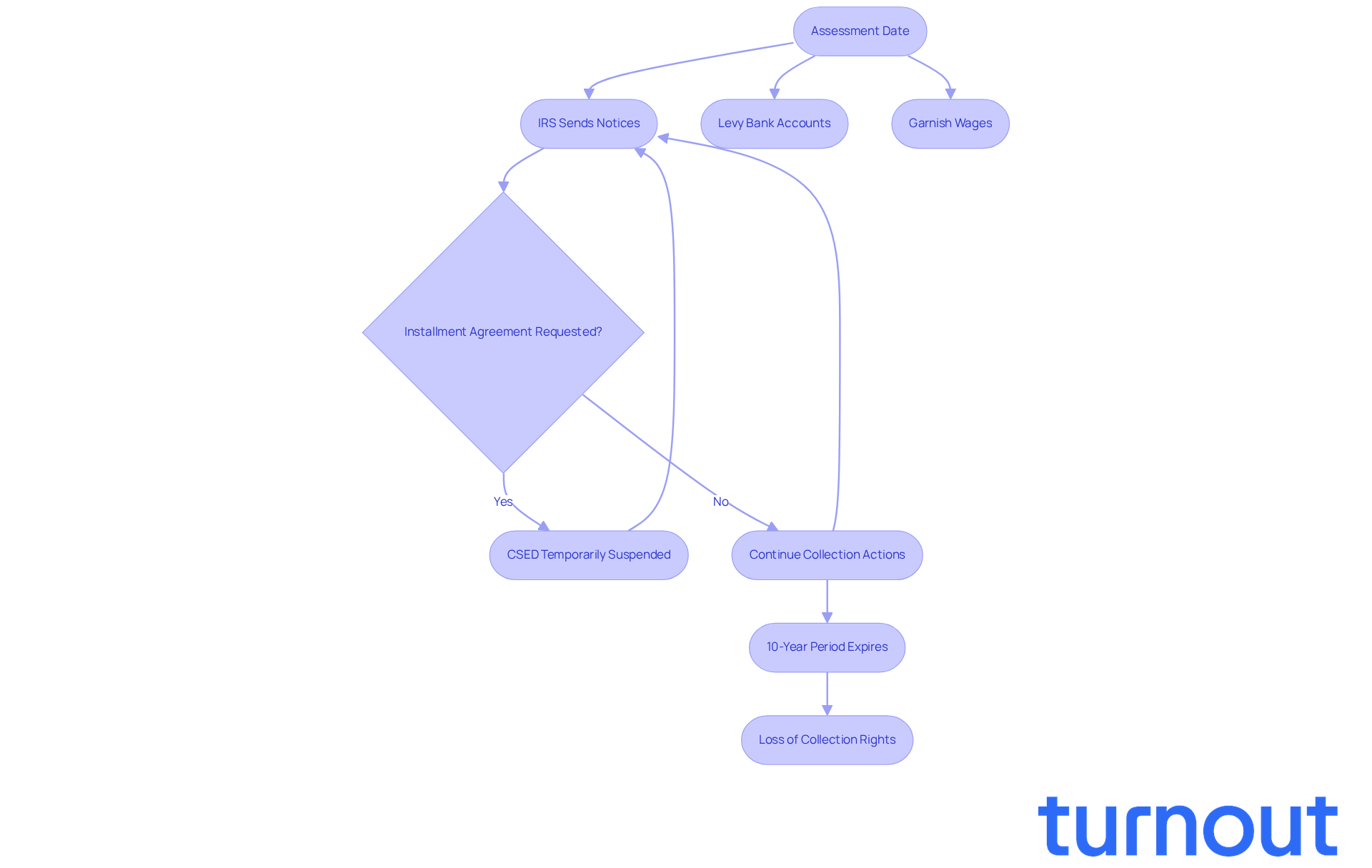

Understanding your tax obligations can feel overwhelming, especially when it comes to the IRS timeline. Did you know how far back can the IRS collect taxes, given that they have a 10-year window from the date your tax was assessed? This period begins when the IRS determines you owe taxes, leading to inquiries about how far back can IRS collect taxes, typically coinciding with your tax return submission. During these ten years, the IRS can take various actions to recover owed taxes, such as sending notices, levying bank accounts, or garnishing wages.

Here are some key points to keep in mind:

- Assessment Date: The countdown starts on the assessment date, marking when the IRS can begin collecting.

- Collection Actions: The IRS can initiate enforcement measures at any time during this decade. It’s crucial to address any outstanding debts promptly. Ignoring IRS notices can lead to serious consequences, including liens and garnishments.

- Finality indicates that once the 10-year period expires, the IRS loses the legal right to collect the debt, raising the question of how far back can IRS collect taxes, unless specific exceptions apply, known as the Collection Statute Expiration Date (CSED).

- Installment Agreements: If you request an installment agreement, it can temporarily suspend the CSED while under review, giving you more time to manage your obligations.

As we approach 2026, understanding these timelines is more important than ever. The IRS has enhanced its enforcement capabilities and expanded taxpayer assistance programs. We encourage you to take proactive steps in managing your tax obligations. Remember, you are not alone in this journey. Engaging with a tax professional can provide valuable guidance and help you navigate these complexities, leading to more favorable outcomes.

We understand that dealing with taxes can be stressful, but taking action now can make a significant difference.

Identify the 10-Year Statute of Limitations

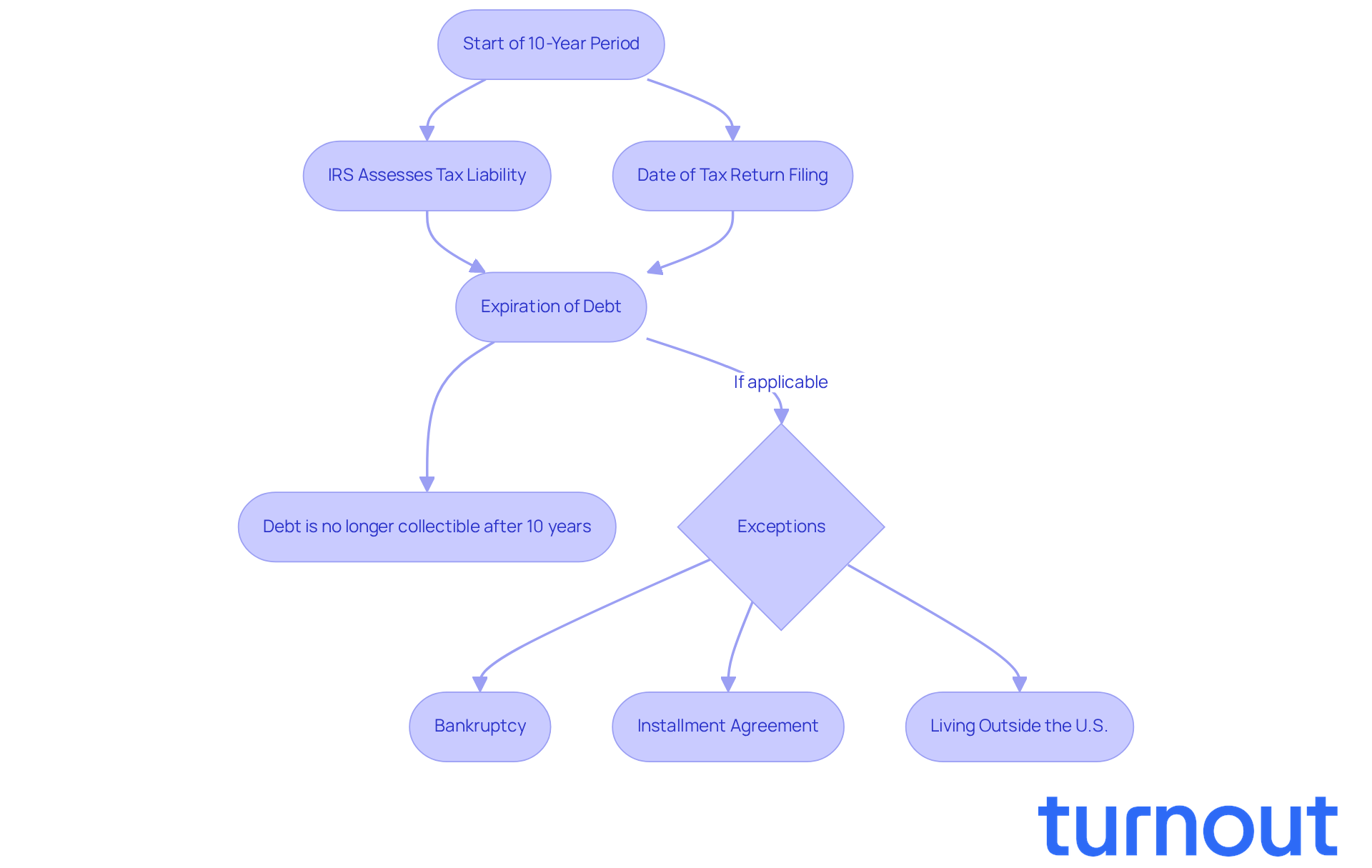

It is essential for anyone navigating tax responsibilities to understand how far back the IRS can collect taxes, particularly under the 10-year statute of limitations. This law dictates how far back the IRS can collect taxes, making it important to understand its implications. Here’s what you should know:

- Start of the Period: The 10-year countdown begins when the IRS assesses your tax liability. This often coincides with the date you filed your return or when the IRS processed it.

- Expiration of Debt: If the IRS doesn’t collect the debt within this timeframe, it raises the question of how far back can IRS collect taxes before your tax liability expires. You won’t be responsible for paying it anymore. However, keep in mind that the IRS can still collect overdue payments after 10 years, which raises the question of how far back can IRS collect taxes if certain events initiated by you paused or extended the original timeframe.

- Exceptions: There are actions that can prolong this period, like filing for bankruptcy, entering into an installment agreement, or being outside the U.S. for an extended time. The Collection Statute Expiration Date (CSED) is also suspended during military service and while living abroad. Recognizing these exceptions is crucial for managing your tax responsibilities effectively. If you’re nearing the CSED, we encourage you to consult with a tax professional. This way, you can make informed decisions about your situation.

By understanding the 10-year statute, you can navigate your tax situation more effectively. Remember, you have rights and obligations, and we’re here to help you through this journey.

Explore Exceptions to the Collection Period

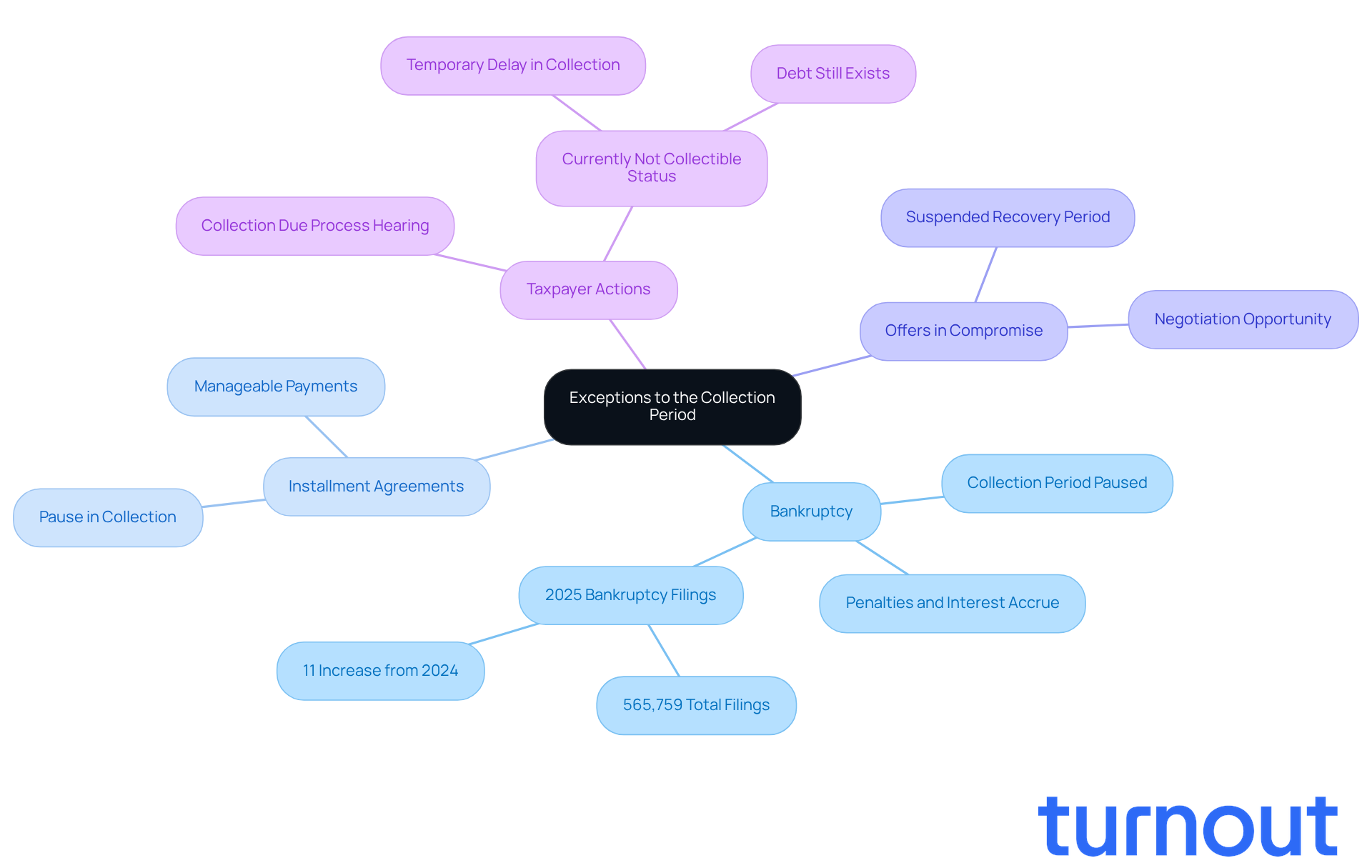

Dealing with taxes can be overwhelming, and we understand that many people face challenges in this area. While the IRS generally has 10 years to collect taxes, it is essential to consider how far back can IRS collect taxes, as there are several exceptions that can extend this period, offering you some relief.

-

Bankruptcy: If you find yourself needing to file for bankruptcy, know that the collection period is paused during the proceedings and for an additional six months afterward. However, it’s important to remember that penalties and interest will continue to accrue on your tax debt during this time. In CY2025, there were 565,759 bankruptcy filings, which is an 11% increase from 508,953 in CY2024. This trend may affect many consumers facing tax issues. Consulting a credit counselor before filing for bankruptcy is essential to explore all available debt relief options.

-

Installment Agreements: Engaging in an installment agreement can also pause the retrieval timeframe until the agreement is settled. This allows you to manage your payments without the stress of immediate collection efforts.

-

Offers in Compromise: If you submit an Offer in Compromise (OIC), the recovery period is suspended while the IRS assesses your offer. This gives you valuable time to negotiate a potentially reduced tax liability.

-

Taxpayer Actions: Certain actions, like requesting a Collection Due Process hearing, can extend the timeline as well. If the IRS designates your account as 'currently not collectible,' it acknowledges your financial difficulties and temporarily postpones recovery efforts. However, keep in mind that the debt still exists and continues to accumulate penalties and interest.

It’s crucial to be aware of how far back can IRS collect taxes to prevent unexpected collection actions. Remember, you are not alone in this journey, and there are options available to help you navigate these challenges.

Take Action: What to Do If Collections Extend

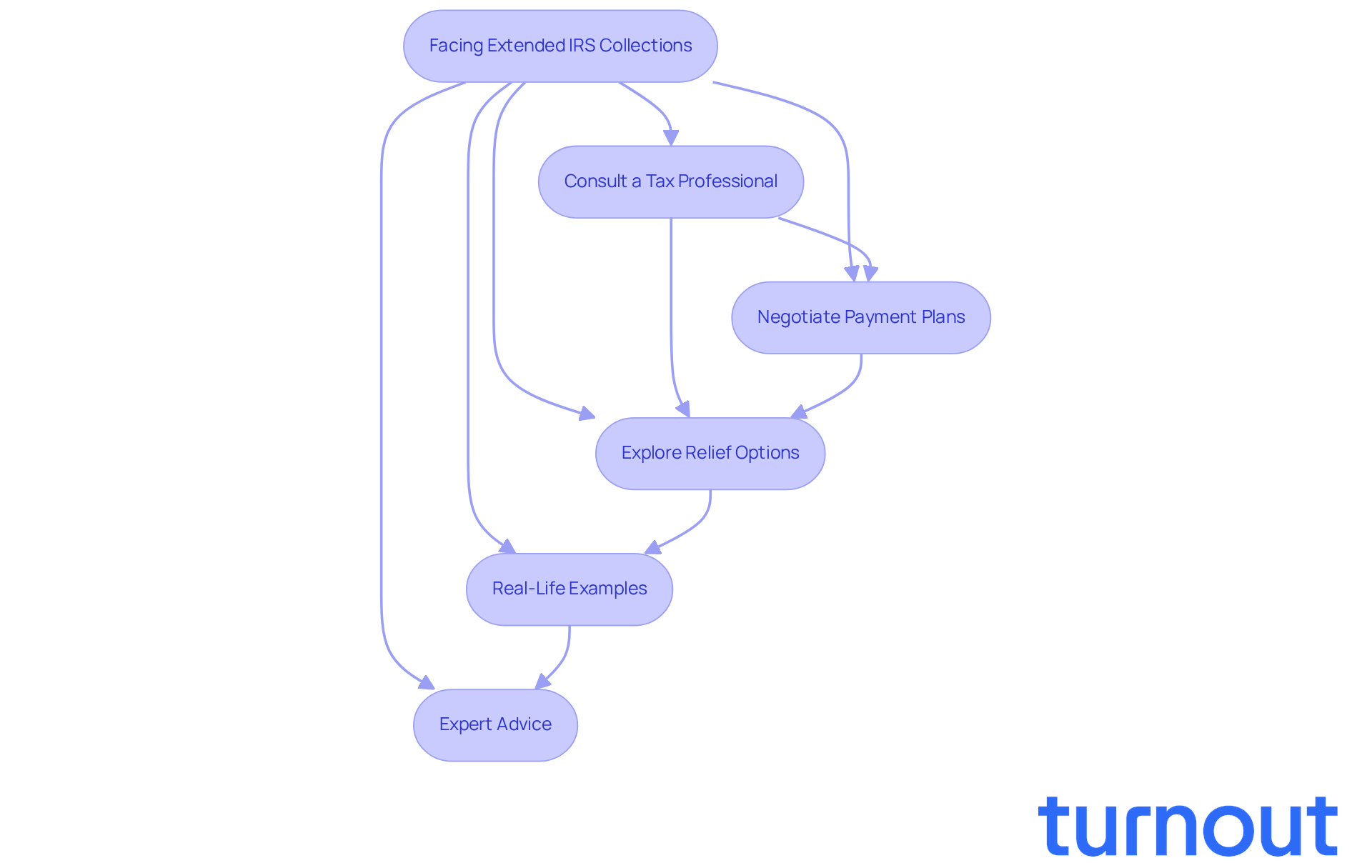

If you find that the IRS is extending its collection efforts beyond the typical 10-year period, you might be concerned about how far back the IRS can collect taxes, which is understandable. Here are some supportive actions you can take:

-

Consult a Tax Professional: Engaging with a tax advocate or attorney can provide personalized guidance tailored to your situation. Tax professionals understand IRS procedures and can help you navigate complex regulations, ensuring you know your rights and options. It's wise to inquire with the IRS for documentation concerning the assessment and any actions taken to understand how far back the IRS can collect taxes. This can clarify your standing and help identify any discrepancies in the IRS's claims.

-

Negotiate Payment Plans: If you owe taxes, negotiating a payment plan can help manage your debt while ensuring compliance with IRS requirements. In 2026, installment agreements offer more adaptable terms than they did two years ago, allowing you to establish terms that reflect your financial situation instead of strict recovery standards. This flexibility can prevent undue financial strain.

-

Explore Relief Options: Investigate options like Offers in Compromise or Currently Not Collectible status if you’re unable to pay your tax debt. These programs can provide substantial relief, potentially stopping recovery actions and enabling you to focus on recuperation. For instance, CoastOne Tax Group has successfully negotiated reductions of tax debt by up to 90% through these avenues, showing the potential benefits of professional representation.

-

Real-Life Examples: Many individuals have successfully navigated IRS demands by consulting tax professionals. For example, a government contractor faced collection notices due to an ERC reclamation action but resolved the issue after professional intervention, recovering nearly $1 million in contracts. Such cases highlight the importance of timely engagement with tax experts to avoid severe consequences.

-

Expert Advice: Remember, "the moment a levy hits your bank account or your wages get garnished, your negotiating position collapses entirely." Engaging with a tax professional early can help you avoid these pitfalls and secure a more favorable outcome.

We understand that facing the IRS can be daunting, but you are not alone in this journey. We're here to help you navigate these challenges.

Conclusion

Understanding the complexities of IRS tax collection can truly empower you to take charge of your financial responsibilities. It’s important to recognize the significance of the 10-year statute of limitations on tax collection, which starts from the assessment date. During this period, the IRS can pursue various collection actions. That’s why it’s essential to be proactive in addressing your obligations.

We understand that navigating this landscape can be overwhelming. Recognizing when the collection period begins, knowing about exceptions that might extend this timeline, and engaging with tax professionals for personalized guidance are all crucial steps. Taking timely action - whether through negotiating payment plans or exploring relief options - can significantly impact your financial situation and overall peace of mind.

Ultimately, managing IRS tax collection requires awareness and informed decision-making. By understanding your rights and obligations, and seeking assistance when needed, you can effectively handle your tax responsibilities and avoid the stress of prolonged collection efforts. Remember, you’re not alone in this journey. Engaging with a tax professional can provide invaluable support, ensuring you’re equipped to make the best choices for your financial future.

Frequently Asked Questions

How long does the IRS have to collect taxes owed?

The IRS has a 10-year window from the date your tax was assessed to collect taxes owed.

When does the 10-year collection period begin?

The 10-year collection period begins on the assessment date, which is when the IRS determines you owe taxes.

What actions can the IRS take during the 10-year collection period?

During this period, the IRS can take various actions to recover owed taxes, such as sending notices, levying bank accounts, or garnishing wages.

What happens when the 10-year period expires?

Once the 10-year period expires, the IRS loses the legal right to collect the debt, unless specific exceptions apply, known as the Collection Statute Expiration Date (CSED).

What is the impact of requesting an installment agreement?

Requesting an installment agreement can temporarily suspend the CSED while under review, giving you more time to manage your tax obligations.

Why is it important to understand the IRS collection timeline?

Understanding the IRS collection timeline is important because the IRS has enhanced its enforcement capabilities and expanded taxpayer assistance programs, making it crucial to address outstanding debts promptly.

What should I do if I have outstanding tax obligations?

It is advisable to take proactive steps in managing your tax obligations, such as engaging with a tax professional for guidance and support.