Introduction

Navigating the complexities of disability pay can often feel like an uphill battle. We understand that understanding how payments are calculated can be overwhelming. With various programs like Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) available, each with its own eligibility criteria and benefits, the landscape can seem daunting.

This guide aims to demystify the calculation methods for disability payments. We want to provide you with essential insights and practical steps to secure the financial support you deserve. But what happens when the application process itself presents unexpected challenges? It's common to feel frustrated in these situations, but we're here to help you effectively overcome these hurdles.

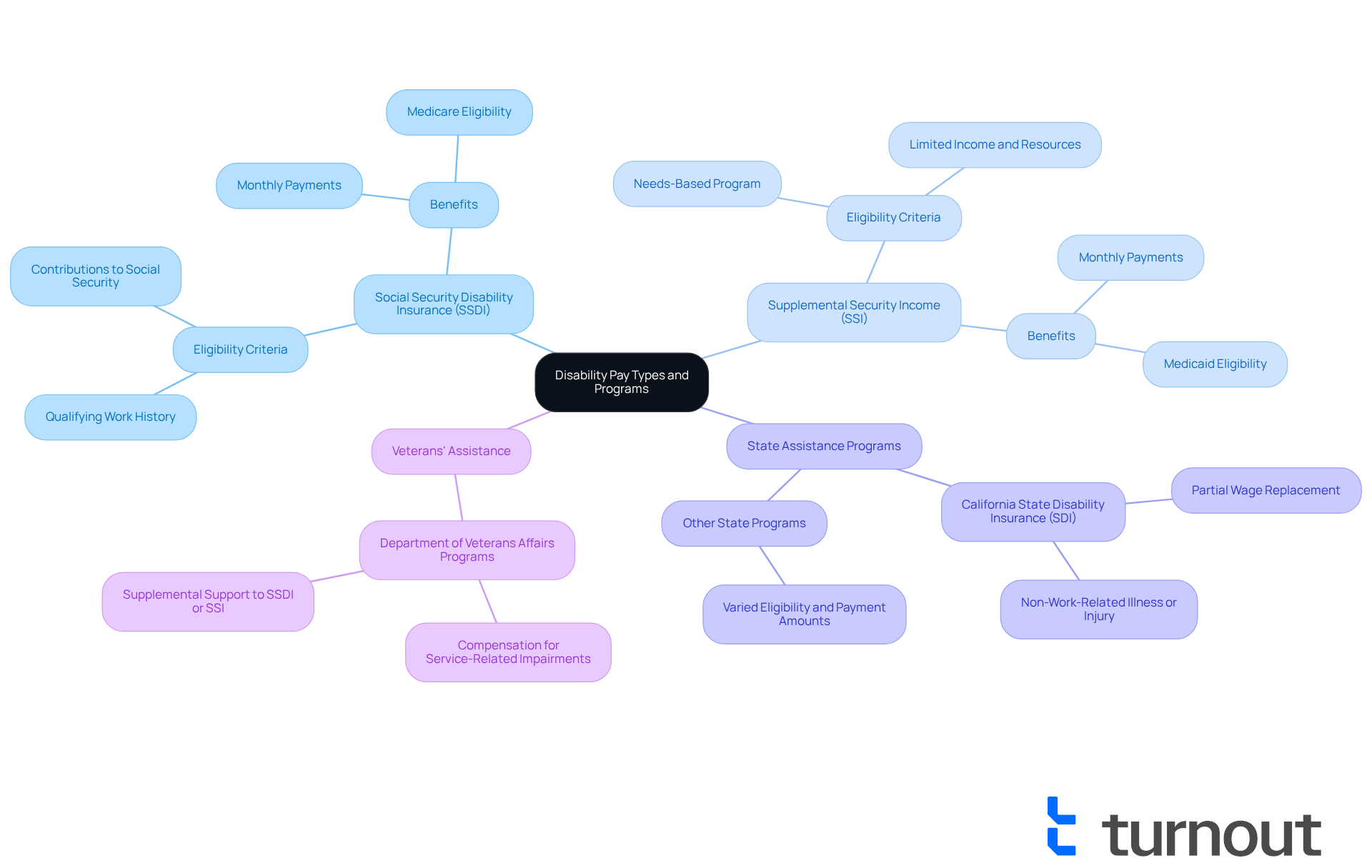

Define Disability Pay Types and Programs

Navigating the world of disability pay can feel overwhelming, especially when considering how disability pay is calculated, but understanding your options is the first step toward securing the support you need. Disability pay can come from several key programs, primarily Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

- SSDI is designed for individuals who have a qualifying work history and have contributed to Social Security through payroll taxes.

- On the other hand, SSI is a needs-based program aimed at individuals with limited income and resources, regardless of their work history.

We understand that every situation is unique, and alongside these federal initiatives, many states offer their own assistance for individuals with disabilities. These programs can vary significantly in terms of eligibility and payment amounts. As of 2025, there are over 30 state assistance programs available across the United States, each tailored to meet the specific needs of residents.

- For example, California's State Disability Insurance (SDI) program provides partial wage replacement for eligible workers unable to work due to a non-work-related illness or injury.

Additionally, veterans' assistance plays a crucial role for those with service-related impairments. The Department of Veterans Affairs offers various compensation programs that can supplement SSDI or SSI, providing extra financial support to veterans in need.

Grasping these differences is essential for understanding how disability pay is calculated, which will help determine which program you may be eligible for and the benefits you can expect. Advocates for individuals with impairments emphasize the importance of being informed about these payment types. Managing the intricacies of assistance programs can significantly impact your financial security.

Remember, getting to know SSDI, SSI, state programs, and veterans' assistance is the initial step in effectively navigating the disability support landscape. You're not alone in this journey, and we're here to help.

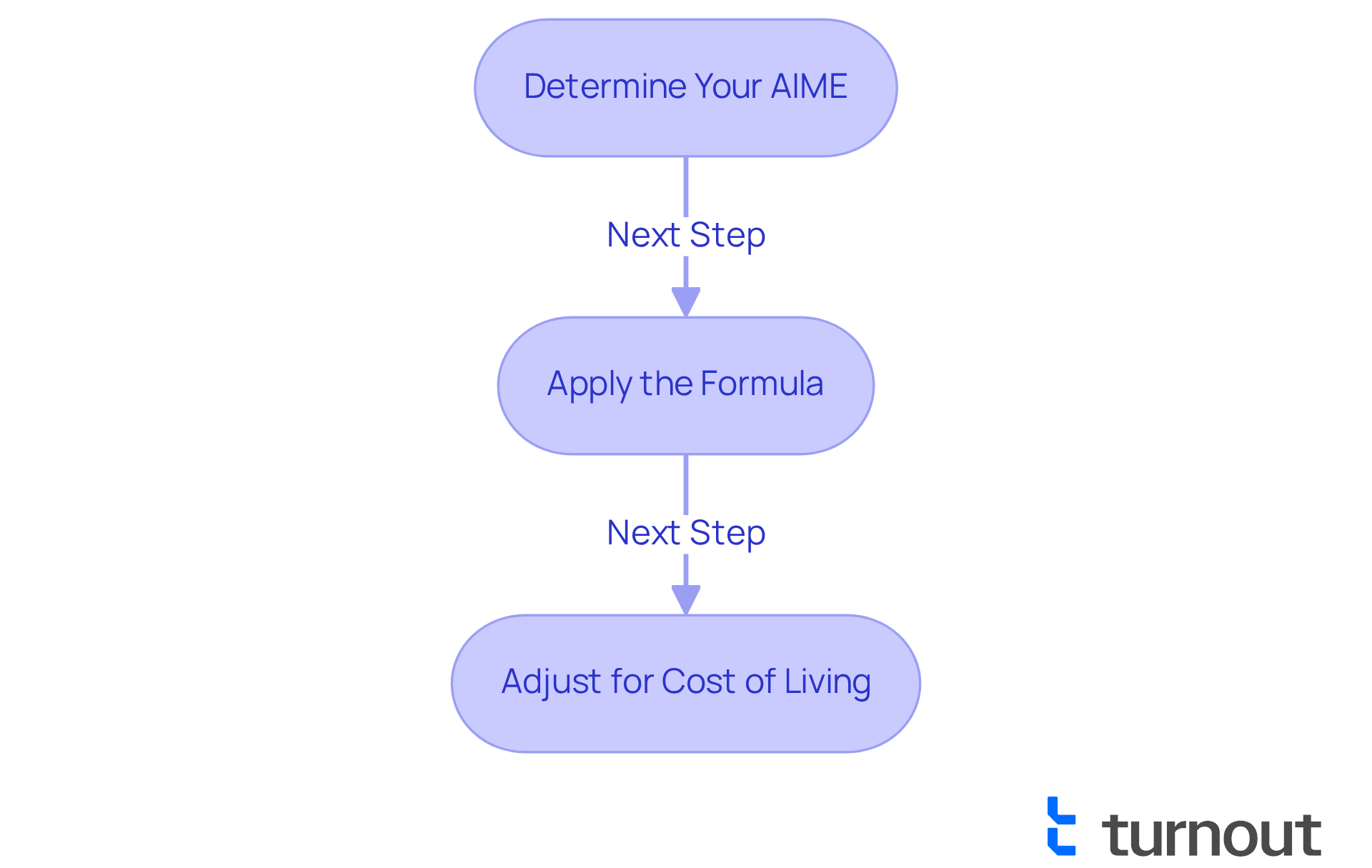

Explore Calculation Methods for Disability Payments

Navigating disability payments can feel overwhelming, but understanding the process is the first step toward securing the support you need. Let’s break it down together:

-

Determine Your AIME: Your Average Indexed Monthly Earnings (AIME) is calculated based on your highest-earning years-typically the 35 years where you earned the most. This amount is adjusted for inflation, ensuring your earnings reflect current economic conditions. We understand that how disability pay is calculated can be a complex process, but it’s crucial for determining your benefits.

-

Apply the Formula: The Social Security Administration (SSA) uses a specific formula to convert your AIME into your Primary Insurance Amount (PIA). For 2025, this involves applying different percentages to segments of your AIME: 90% of the first $1,115, 32% of the next $6,721, and 15% of any amount exceeding that. This tiered approach means that while higher earnings can yield benefits, the percentage returns diminish as income increases. It’s common to feel confused by these numbers, but we’re here to help clarify.

-

Adjust for Cost of Living: Payments are adjusted annually based on cost-of-living increases (COLA). For 2025, a 2.5% COLA has been implemented, impacting both SSDI and SSI payment amounts. This adjustment is designed to help you keep pace with rising living costs.

For instance, if your AIME is determined at $3,000, your PIA would be around $1,605.90, though this may change based on any other payments you receive. It’s important to note that the highest SSDI payment for 2025 is $4,018 monthly, while those newly qualified in 2025 can expect around $3,822 each month.

Participating in this process gives you access to trained nonlawyer advocates who can guide you through these calculations and help you understand your potential benefits. Remember, this organization is not a law firm and does not provide legal advice. Using online calculators from the SSA can give you a preliminary estimate of how disability pay is calculated based on your earnings history. For a more personalized assessment, reaching out to a support representative can be essential. You are not alone in this journey, and we’re here to help you optimize your potential payments.

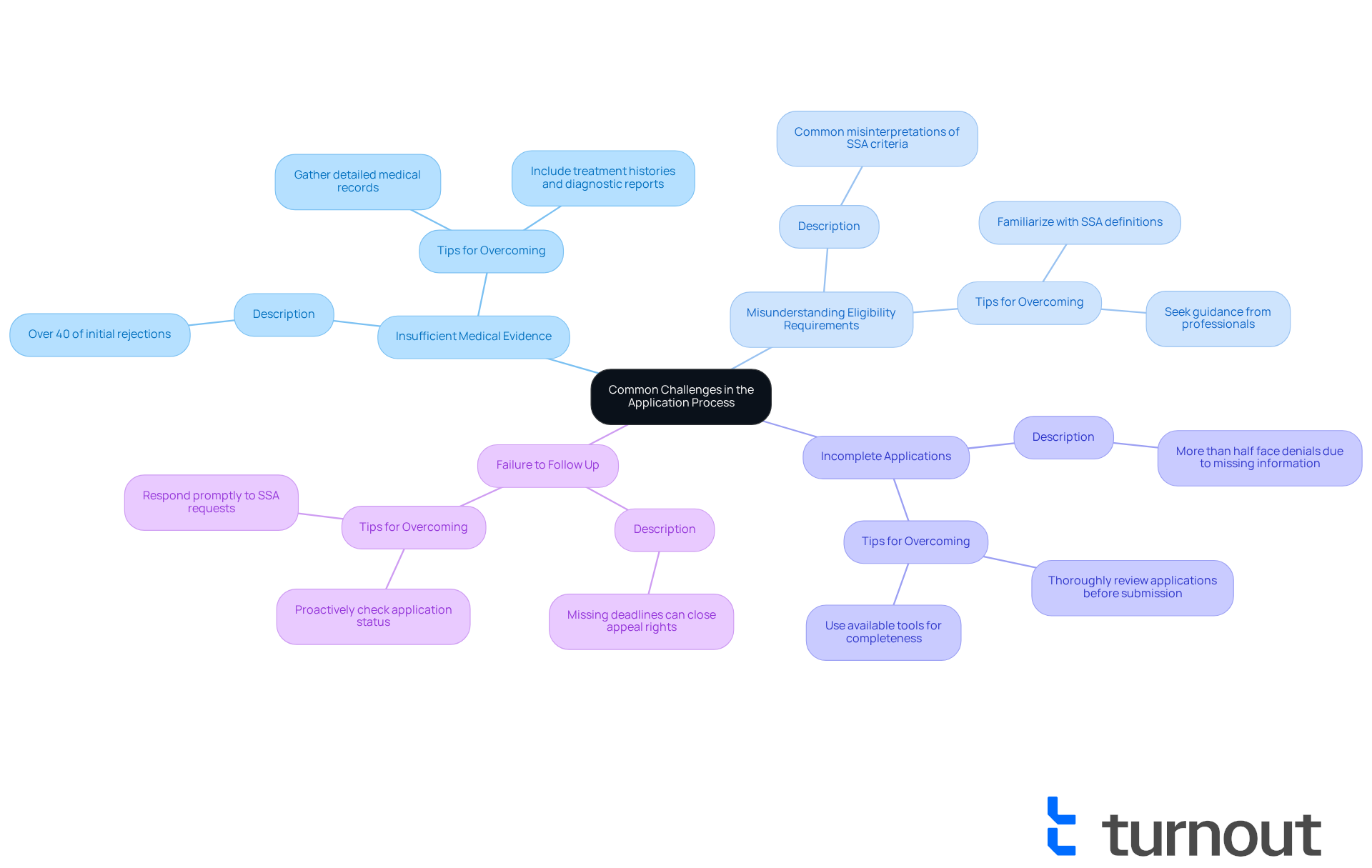

Identify Common Challenges in the Application Process

Navigating the procedure for disability benefits can feel overwhelming, but we’re here to help simplify your journey. Many applicants face notable obstacles, and understanding these challenges is the first step toward overcoming them. Here are some common issues you might encounter:

- Insufficient Medical Evidence: Did you know that insufficient medical documentation accounts for over 40% of initial rejections? This is a primary reason for application denials. To strengthen your claim, gather detailed records from your healthcare providers, including treatment histories and diagnostic reports. Our trained nonlawyer advocates are here to help you understand what documentation is necessary.

- Misunderstanding Eligibility Requirements: It’s common to misinterpret the criteria for qualifying disabilities. Familiarizing yourself with the Social Security Administration's (SSA) definitions and requirements can ensure your condition meets the necessary standards. Turnout provides guidance to help clarify these requirements, so you don’t have to navigate this alone.

- Incomplete Applications: Missing forms or information can lead to delays or outright denials. In fact, more than half of all SSD candidates face denials at some point during the process, often due to incomplete submissions. Before sending in your application, thoroughly review it for completeness. Our available tools can assist you in ensuring you have all the required information.

- Failure to Follow Up: After submitting your application, it’s essential to follow up with the SSA to check on the status and respond promptly to any requests for additional information. Missing deadlines can permanently close your right to appeal a denial, especially since initial denial rates exceed 65%. Proactive communication is key, and we encourage you to stay on track.

Remember, this organization is not a law firm and does not provide legal representation. By understanding these common obstacles, you can enhance your readiness to manage the enrollment process. You are not alone in this journey; with Turnout's expert assistance, you can increase your prospects of obtaining the support you need.

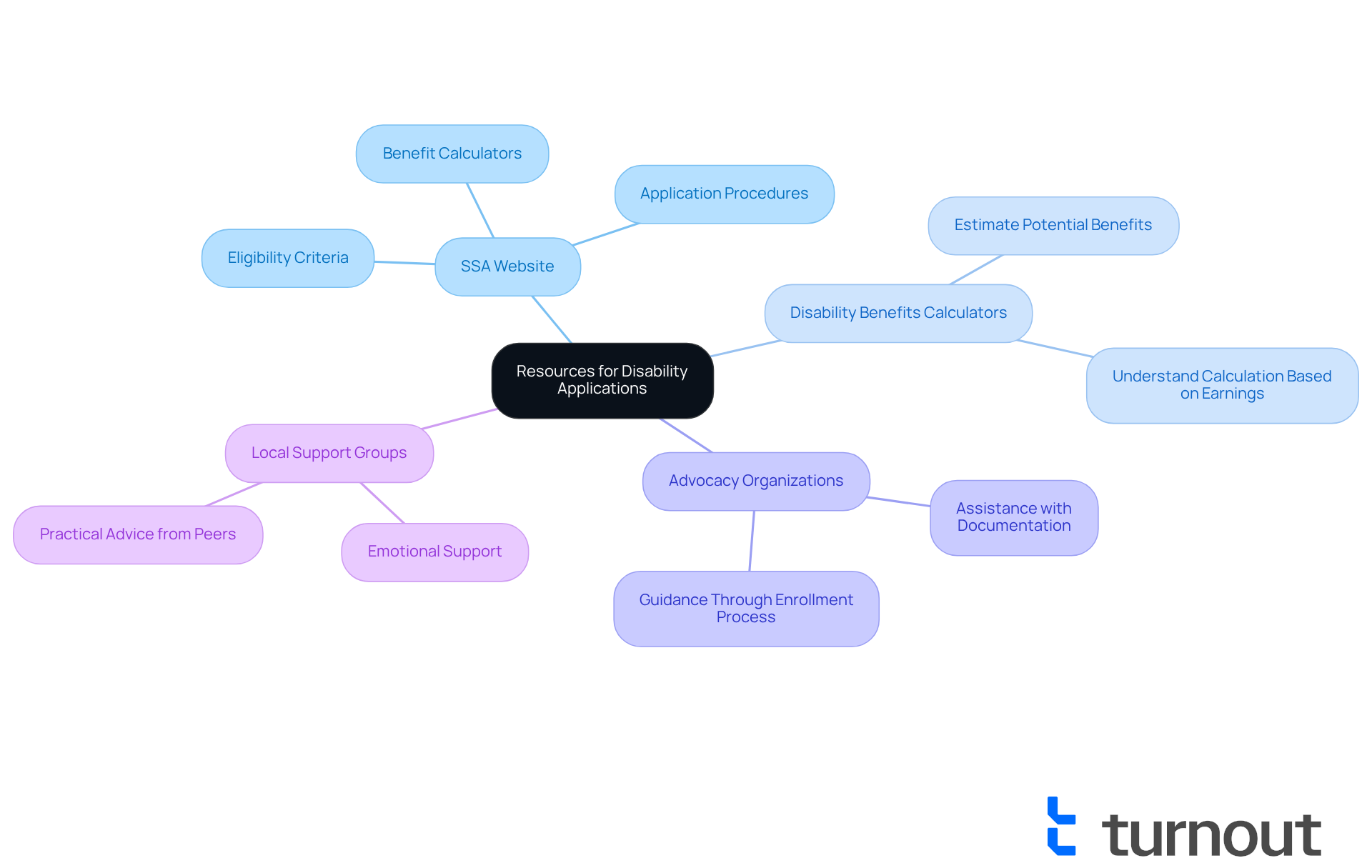

Utilize Resources and Tools for Successful Applications

If you're feeling overwhelmed by the process of applying for disability benefits, you're not alone. Many people face similar challenges, and there are resources available to help you navigate this journey with confidence.

- Social Security Administration (SSA) Website: Start here! The SSA provides a wealth of information on how disability pay is calculated, including eligibility criteria, application procedures, and benefit calculators. This is a vital resource for anyone looking to understand their options.

- Disability Benefits Calculators: Have you ever wondered what your potential benefits might be? Online calculators from organizations like Allsup and the SSA can help you estimate your benefits and understand how disability pay is calculated based on your earnings history, giving you a clearer picture of what to expect.

- Advocacy Organizations: Organizations like Turnout are here for you. They offer crucial assistance and guidance throughout the enrollment process, helping you gather necessary documentation and navigate the often complex requirements. This support can significantly improve your chances of approval.

- Local Support Groups: Connecting with local disability support groups can provide not just emotional support but also practical advice from individuals who have successfully navigated the process themselves. Sharing experiences can be incredibly reassuring.

By effectively utilizing these resources, you can streamline your application process and significantly increase your likelihood of receiving the benefits you deserve. Remember, we're here to help you every step of the way.

Conclusion

Understanding how disability pay is calculated is crucial for anyone seeking financial support due to disabilities. We understand that navigating this process can feel overwhelming. By familiarizing yourself with various programs available, such as SSDI and SSI, you can better explore your options and ensure you receive the assistance you deserve. Each program has distinct eligibility requirements and benefits, making it essential to comprehend these differences to make informed decisions.

This article outlines the step-by-step process of calculating disability payments, from determining Average Indexed Monthly Earnings (AIME) to applying the Social Security Administration's formula for Primary Insurance Amount (PIA). It's common to face challenges during the application process, such as insufficient medical evidence and misunderstanding eligibility criteria. By recognizing these hurdles and utilizing available resources, you can significantly enhance your chances of success.

Ultimately, the journey toward securing disability benefits may seem daunting, but remember, support is available. Utilizing resources like the SSA website, online calculators, and advocacy organizations can empower you to navigate the complexities of the application process with confidence. Taking proactive steps and seeking assistance can lead to a smoother experience and a better understanding of how to achieve the financial support you need. You're not alone in this journey; we're here to help.

Frequently Asked Questions

What are the main types of disability pay programs?

The main types of disability pay programs are Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

Who qualifies for Social Security Disability Insurance (SSDI)?

SSDI is designed for individuals who have a qualifying work history and have contributed to Social Security through payroll taxes.

What is Supplemental Security Income (SSI)?

SSI is a needs-based program aimed at individuals with limited income and resources, regardless of their work history.

Are there state-specific disability assistance programs?

Yes, many states offer their own assistance programs for individuals with disabilities, which can vary significantly in terms of eligibility and payment amounts.

Can you provide an example of a state disability program?

California's State Disability Insurance (SDI) program provides partial wage replacement for eligible workers unable to work due to a non-work-related illness or injury.

How does veterans' assistance relate to disability pay?

The Department of Veterans Affairs offers various compensation programs for veterans with service-related impairments, which can supplement SSDI or SSI, providing extra financial support.

Why is it important to understand disability pay types?

Understanding the differences between SSDI, SSI, state programs, and veterans' assistance is essential for determining eligibility and the benefits one can expect, which can significantly impact financial security.