Introduction

Navigating the complexities of lump sum settlements can feel overwhelming. We understand that these one-time payments, often pursued in legal claims like personal injury or workers' compensation, can offer immediate financial relief. However, they may also complicate your long-term financial planning, especially regarding Social Security retirement benefits.

How do these settlements affect your eligibility for Social Security programs? It's common to feel uncertain about the implications of accepting a lump sum payment. Understanding these dynamics is crucial for anyone facing this decision, as it can significantly impact your future financial stability and access to essential support.

You are not alone in this journey. Many individuals grapple with similar concerns, and there are strategies you can employ to protect your benefits. By exploring your options and seeking guidance, you can make informed choices that align with your financial goals. Remember, we're here to help you navigate this process.

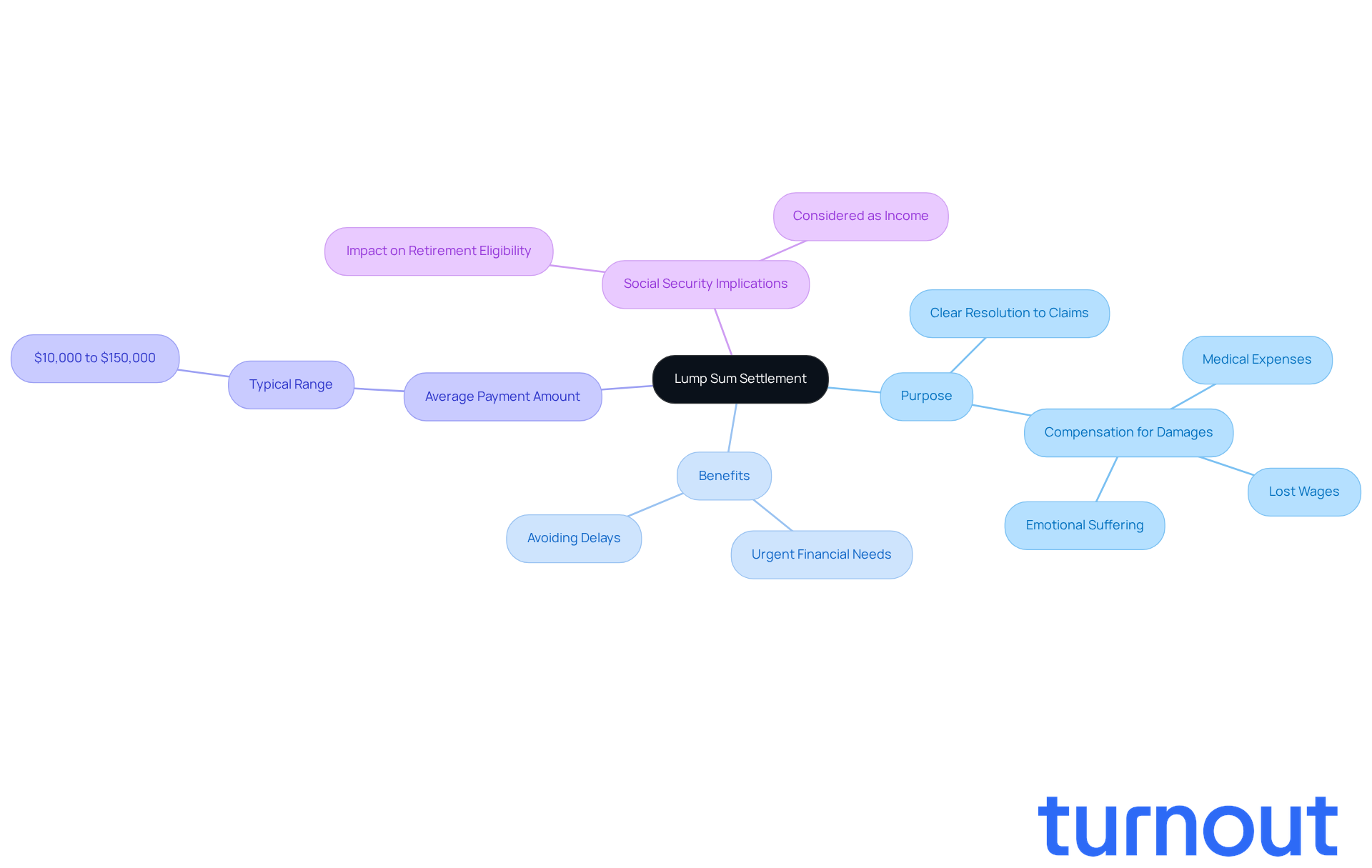

Define Lump Sum Settlement and Its Purpose

A single payment can be a lifeline for those facing legal claims, like personal injury or workers' compensation. Imagine receiving the full compensation amount in one go, rather than waiting for regular distributions. This straightforward approach often appeals to individuals who need to address urgent financial needs without delay.

The primary goal of a one-time payment is to provide a clear resolution to a claim, compensating the injured person for various damages, including medical expenses, lost wages, and emotional suffering. For instance, in workers' compensation cases, the average one-time payment can vary significantly, typically ranging from $10,000 to $150,000, depending on the severity of the injury and associated costs.

We understand that navigating the implications of a one-time payment can be daunting, especially when considering how does a lump sum settlement affect social security retirement benefits. It's important to understand how does a lump sum settlement affect social security retirement eligibility, as it might be seen as income and could potentially impact the financial support available to you. It's common to feel overwhelmed by these choices, which is why it's essential to carefully evaluate how a one-time payment aligns with your long-term financial goals.

At Turnout, we’re here to help you through these complexities, particularly if you're dealing with SSD claims. Our tools and services are designed to ensure you understand the implications of your decisions, all while providing the support you need. Remember, you are not alone in this journey.

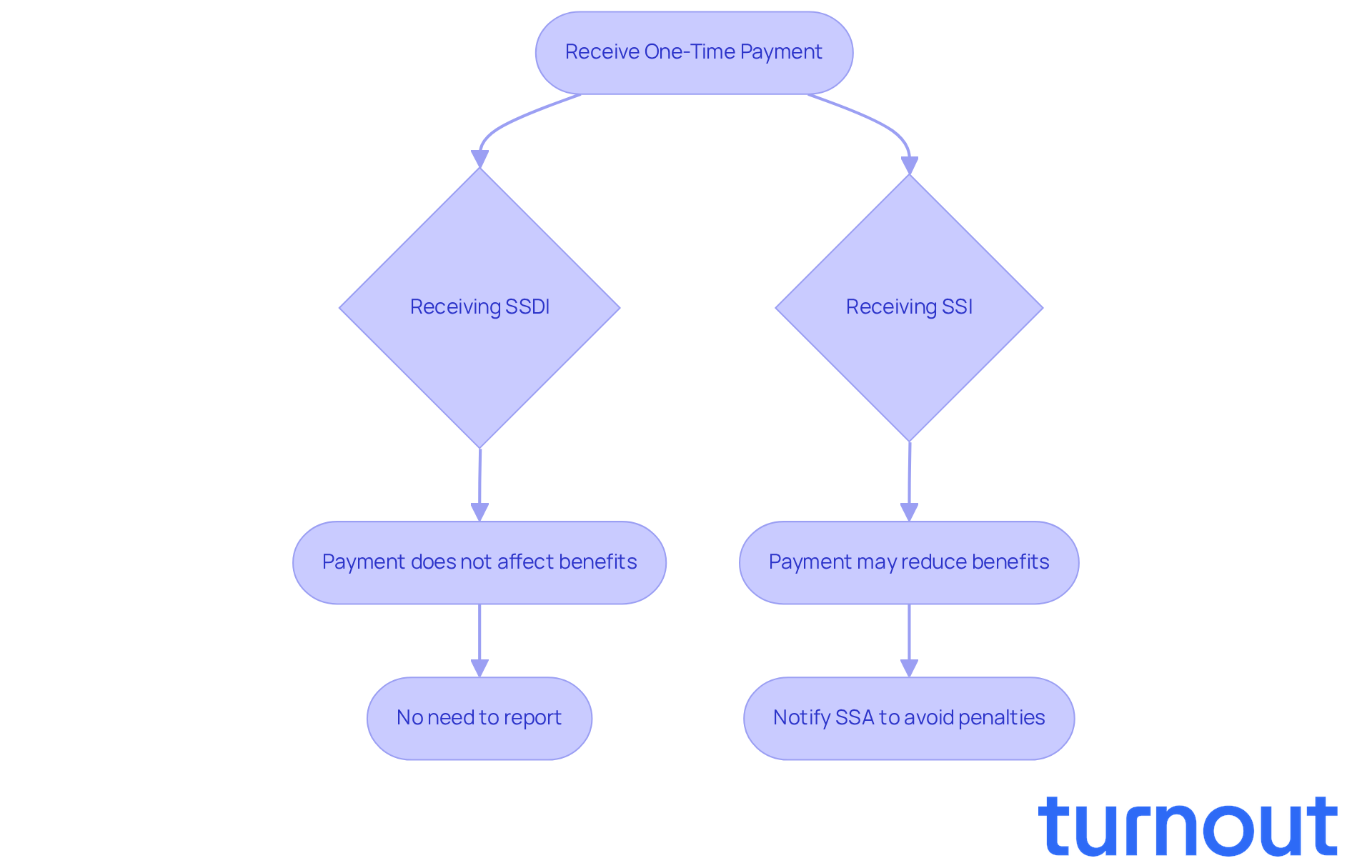

Examine the Impact on Social Security Retirement Benefits

Navigating the world of Social Security retirement entitlements can feel overwhelming, especially when it comes to one-time payments. We understand that many individuals face unique challenges, and it’s important to know how does a lump sum settlement affect social security retirement benefits.

For those receiving Social Security Disability Insurance (SSDI), a one-time payment typically doesn’t affect monthly benefits. This is because SSDI is based on your work history and disability status. Importantly, if you’re receiving SSDI, you don’t have to report personal injury compensation to the Social Security Administration (SSA).

However, if you’re on Supplemental Security Income (SSI), you may wonder how does a lump sum settlement affect social security retirement, as the rules change. SSI is needs-based, meaning a one-time payment can be seen as an increase in your financial resources. This could lead to a decrease or even a loss of benefits, which raises the question of how does a lump sum settlement affect social security retirement. For instance, if you receive a $100,000 workers' compensation award, it might reduce your monthly SSDI by about $412 if spread over 30 years.

Additionally, keep in mind that Medicaid eligibility could be affected if this one-time payment raises your monthly income or total assets beyond the allowed limits. It’s essential to notify the SSA about any one-time payments to avoid penalties or overpayments.

The SSA may also look into whether your workers' compensation payments came from a public agreement, which can further influence your SSDI entitlements. Understanding how does a lump sum settlement affect social security retirement is crucial for effectively managing your financial landscape.

At Turnout, we’re here to help you navigate these complex financial and governmental systems. Our tools and services are designed to empower you to make informed decisions regarding your SSD claims and tax relief, all without the need for legal representation. Remember, you’re not alone in this journey.

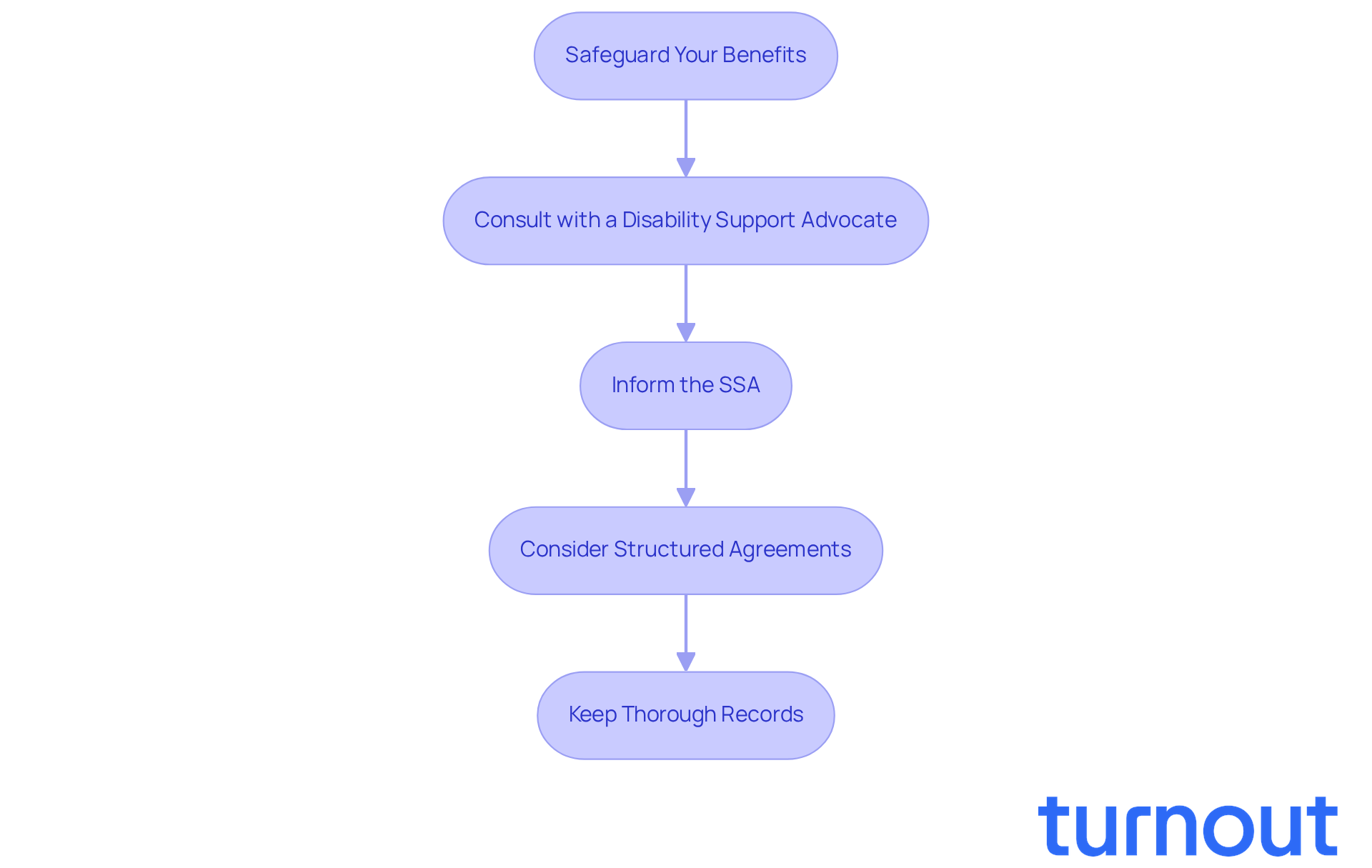

Explore Strategies to Safeguard Your Benefits

Navigating the complexities of Social Security can be overwhelming, especially when trying to understand how does a lump sum settlement affect social security retirement. We understand that you might have concerns about how does a lump sum settlement affect social security retirement benefits. That’s why it’s crucial to take proactive steps to protect your Social Security advantages.

First and foremost, consulting with a qualified disability support advocate can make a world of difference. Organizations like Turnout offer personalized guidance tailored to your unique situation. Just a reminder: Turnout isn’t a law firm and doesn’t have ties to any law firm or government agency, but their expertise can help you understand how does a lump sum settlement affect social security retirement and the implications of your agreement on both SSDI and SSI assistance.

It’s essential to inform the SSA about your agreement as soon as possible. Have you considered how to structure it while thinking about how does a lump sum settlement affect social security retirement in order to minimize its impact on your benefits? For example, negotiating a structured agreement instead of a lump sum can help maintain your SSI eligibility, which raises the question of how does a lump sum settlement affect social security retirement by spreading payments over time.

Let’s take a moment to reflect on a real-life example. A 55-year-old man with gout received support after demonstrating that he would miss significant workdays due to flare-ups. This case highlights the importance of seeking expert guidance in your journey.

Additionally, keeping thorough records of all communications and documents related to your agreement is vital. This ensures you meet SSA requirements and protects your benefits. Remember, neglecting this step could jeopardize what you’ve worked hard to secure.

You’re not alone in this journey. We’re here to help you navigate these challenges and ensure you receive the support you deserve.

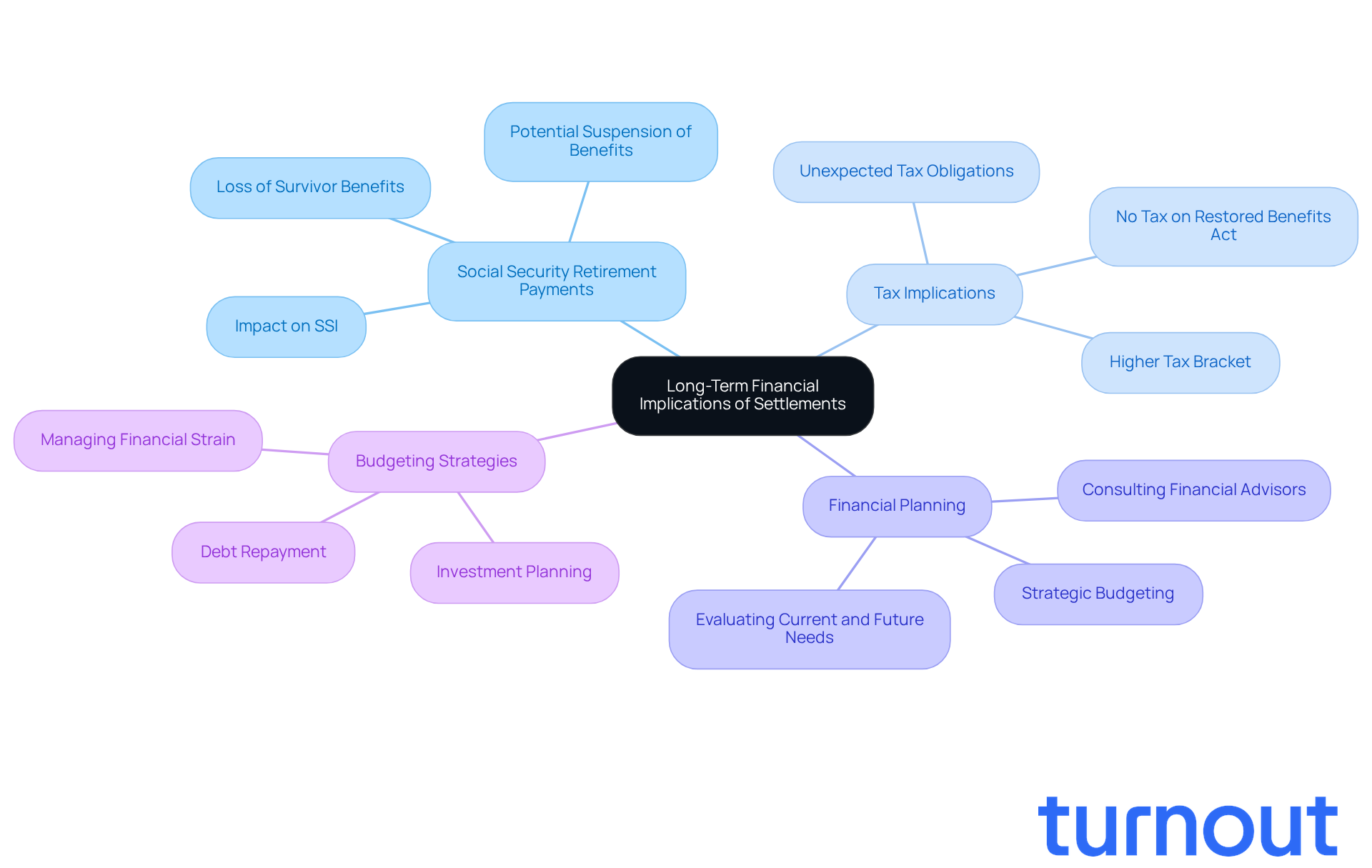

Understand Long-Term Financial Implications of Settlements

Agreeing to a single payment settlement raises questions about how a lump sum settlement affects social security retirement payments, particularly if you're depending on them for long-term financial security. While the immediate cash influx might seem appealing, it’s essential to consider how a lump sum settlement affects social security retirement and your future income along with eligibility for assistance programs. For those receiving Supplemental Security Income (SSI), a one-time payment could lead to a temporary suspension of benefits, which might create financial strain if not managed wisely.

We understand that navigating these decisions can be overwhelming. The tax implications of receiving a lump sum can also be considerable. It may push you into a higher tax bracket, affecting your overall financial situation. Many individuals who receive large payments find themselves facing unexpected tax obligations, complicating their financial planning.

That’s why long-term financial planning is so crucial. It’s important to evaluate both your current and future needs carefully. Consulting with financial advisors can provide you with valuable insights, ensuring that your settlement aligns with your financial goals and doesn’t jeopardize your access to essential benefits.

For instance, some SSI recipients have successfully managed their financial challenges after receiving lump sums by implementing strategic budgeting and investment plans. This highlights the importance of informed decision-making in these situations. Remember, you’re not alone in this journey; we’re here to help you navigate these complexities.

Conclusion

Understanding the implications of a lump sum settlement on Social Security retirement benefits is crucial for anyone considering this financial option. We know that a lump sum can offer immediate relief, but it also comes with potential risks that could impact your long-term benefits and financial stability. Recognizing the differences between Social Security benefits - like SSDI and SSI - can significantly influence how a one-time payment affects your overall financial health.

It's important to consider key factors. For instance:

- SSDI recipients typically don’t need to report lump sum settlements.

- SSI recipients might see reductions in benefits due to increased financial resources.

Consulting with financial advisors and disability support advocates can be invaluable. They can provide personalized strategies to help safeguard your benefits and ensure compliance with Social Security regulations. Additionally, thorough documentation and proactive communication with the SSA are essential to avoid any potential pitfalls.

Navigating the complexities of a lump sum settlement requires careful planning and informed decision-making. By understanding how a lump sum settlement affects your Social Security retirement benefits and taking strategic steps to protect those benefits, you can better position yourself for financial security in the future. Remember, engaging with experts and staying vigilant in your financial planning empowers you to make choices that align with your long-term goals. You are not alone in this journey; we’re here to help you ensure that immediate gains do not compromise your future stability.

Frequently Asked Questions

What is a lump sum settlement?

A lump sum settlement is a single payment made to resolve legal claims, such as personal injury or workers' compensation, providing the full compensation amount at once rather than through regular distributions.

What is the purpose of a lump sum settlement?

The primary purpose of a lump sum settlement is to provide a clear resolution to a claim, compensating the injured person for various damages, including medical expenses, lost wages, and emotional suffering.

How much can a lump sum settlement amount to in workers' compensation cases?

In workers' compensation cases, the average lump sum settlement can vary significantly, typically ranging from $10,000 to $150,000, depending on the severity of the injury and associated costs.

How does a lump sum settlement affect social security retirement benefits?

A lump sum settlement may be considered income and could potentially impact the eligibility for social security retirement benefits, affecting the financial support available to the individual.

What should individuals consider when evaluating a lump sum settlement?

Individuals should carefully evaluate how a lump sum settlement aligns with their long-term financial goals and consider the implications it may have on their overall financial situation.

How can Turnout assist individuals navigating lump sum settlements?

Turnout offers tools and services to help individuals understand the implications of their decisions regarding lump sum settlements, particularly for those dealing with SSD claims, ensuring they receive the support they need.