Introduction

Filing taxes can feel overwhelming, especially if you haven’t submitted returns in years. We understand that this situation can be stressful, but addressing overdue taxes is essential for regaining your financial stability and avoiding hefty penalties. This guide offers a clear roadmap for anyone in this position, outlining the steps to file past due taxes and the benefits of taking action now.

But what if you continue to delay filing? The consequences might be more severe than you think, raising important questions about your financial health and future opportunities. Remember, you’re not alone in this journey, and we’re here to help you navigate through it.

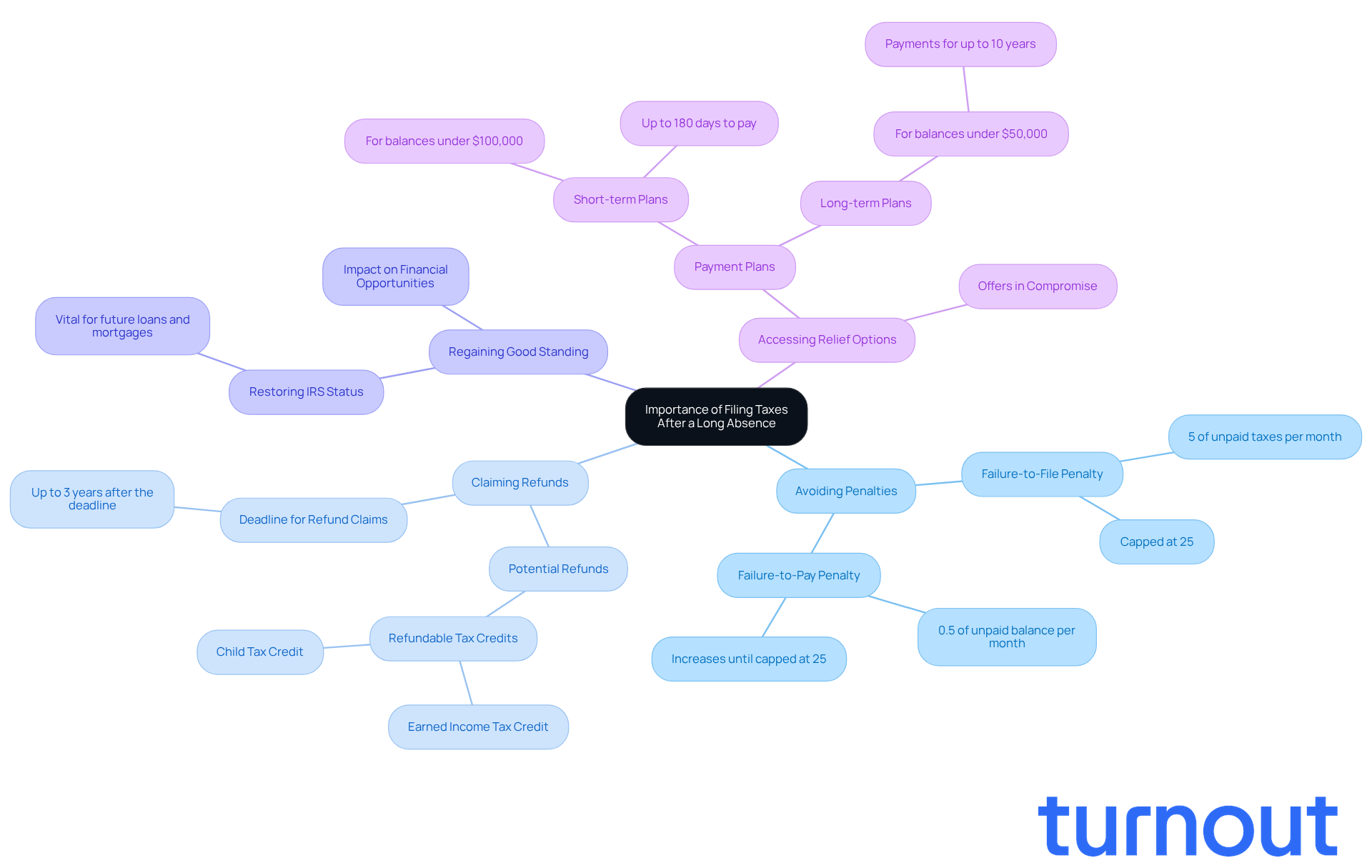

Understand the Importance of Filing Taxes After a Long Absence

Submitting your returns is crucial, especially if you haven't filed taxes in 4 years, as it isn’t just about meeting a legal requirement; it’s a vital step toward regaining your financial footing. We understand that this can feel overwhelming, but here are some important reasons to prioritize filing your overdue taxes:

- Avoiding Accumulating Penalties: The IRS can impose hefty penalties for late filing, and these can add up quickly. Did you know that the failure-to-file penalty is 5% of unpaid taxes for each month you’re overdue, capping at 25%? Understanding these penalties can motivate you to file sooner, particularly if you haven't filed taxes in 4 years, helping you avoid unnecessary financial strain.

- Claiming Potential Refunds: If you’re owed a refund, it’s essential to submit your request to receive it. The IRS allows taxpayers to claim refunds for up to three years after the deadline. Many miss out on valuable refundable tax credits, like the Earned Income Tax Credit, simply by not filing.

- Regaining good standing with the IRS is crucial, especially if you haven't filed taxes in 4 years, as filing your late returns can help restore that status, which is vital for future financial opportunities like loans and mortgages. Taking this proactive step can significantly enhance your financial prospects, particularly if you haven't filed taxes in 4 years.

- Accessing relief options is particularly important if you haven't filed taxes in 4 years, as filing can open doors to various solutions like payment plans or offers in compromise, which can ease your financial burden. For instance, if you owe less than $100,000, you can set up short-term payment plans, allowing manageable monthly payments for up to 180 days.

Turnout offers tools and services to help you navigate these complex financial systems, including assistance with tax debt relief. With trained nonlawyer advocates and IRS-licensed enrolled agents, Turnout is here to support you in addressing your tax situation without the need for legal representation. Recognizing these factors highlights the urgency of tackling your tax issues, especially if you haven't filed taxes in 4 years. By taking action now, you can pave the way for financial recovery and stability. Remember, you’re not alone in this journey; we’re here to help.

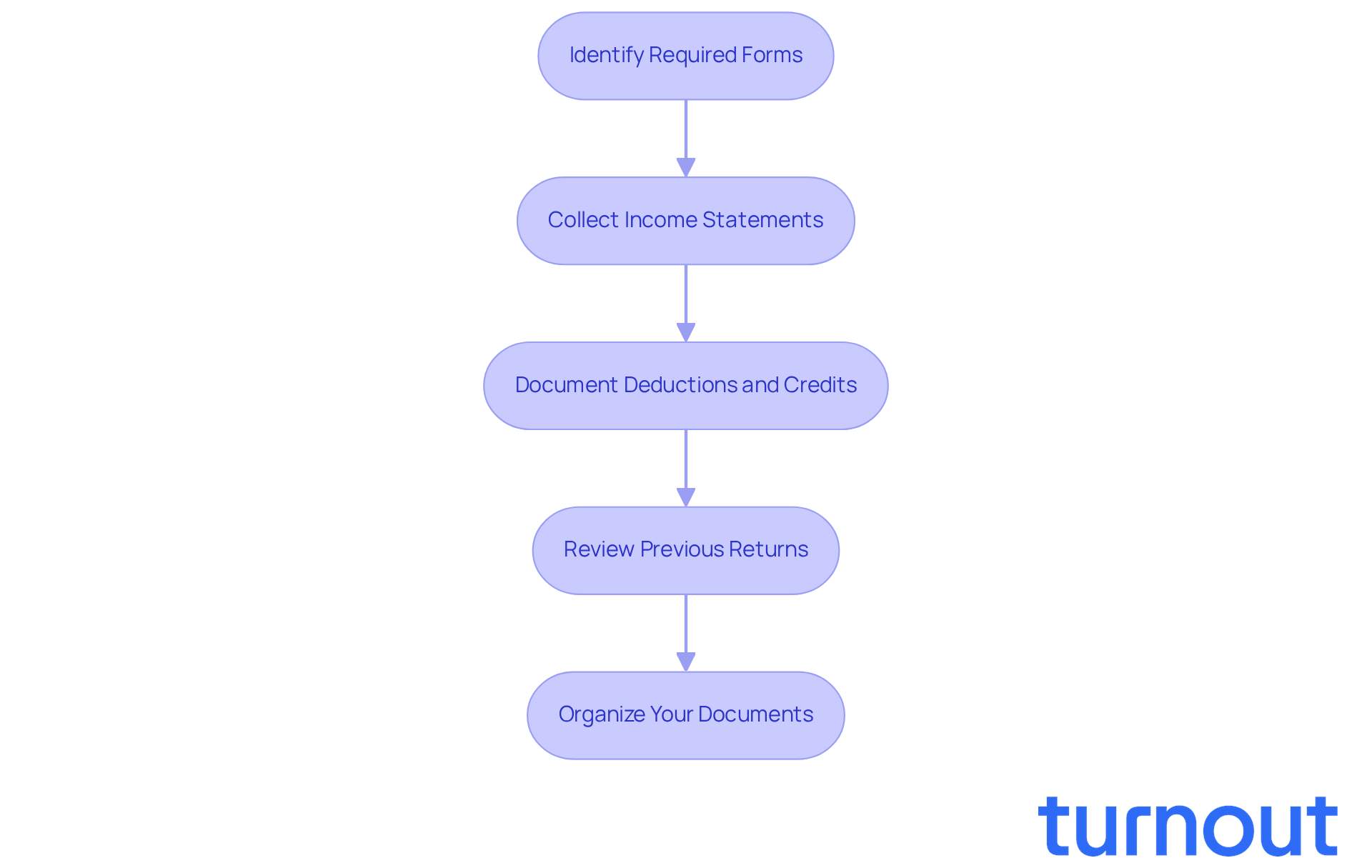

Gather Necessary Documentation and Understand Requirements

Before you can file your overdue taxes, it’s important to gather the necessary documentation. We understand that this can feel overwhelming, but we’re here to help you through it. Here’s how to get started:

-

Identify Required Forms: Typically, you’ll need Form 1040 for individual income tax returns. If you’ve earned income from self-employment, don’t forget about Schedule C. Keep in mind that there are updates to Form 1040 for 2025, so make sure you have the correct version.

-

Collect Income Statements: Gather all your W-2s and 1099s from employers or clients for the years you missed. If you can’t find these documents, it’s okay! You can request a wage and income transcript from the IRS using Form 4506-T.

-

Document Deductions and Credits: Compile your receipts and records for any deductions or credits you plan to claim. This might include medical expenses, mortgage interest, or education credits. For 2025, the standard deduction is $15,750 for single filers and $31,500 for married couples filing jointly. This could significantly lower your tax obligation. Plus, the Child Tax Credit has increased to $2,200 per qualifying child, which is great news for families.

-

Review Previous Returns: If you’ve filed in the past, take a moment to examine your earlier returns. This can help you understand your history and any carryover items that might apply.

-

Organize Your Documents: Keep all your documents in one place to make sorting easier. Consider using a checklist to ensure you have everything you need.

Remember, the tax filing deadline is April 15, 2025. It’s crucial to act promptly. By following these steps, you’ll be well-prepared to submit your late payments correctly. You’re not alone in this journey, and taking these steps can make a big difference.

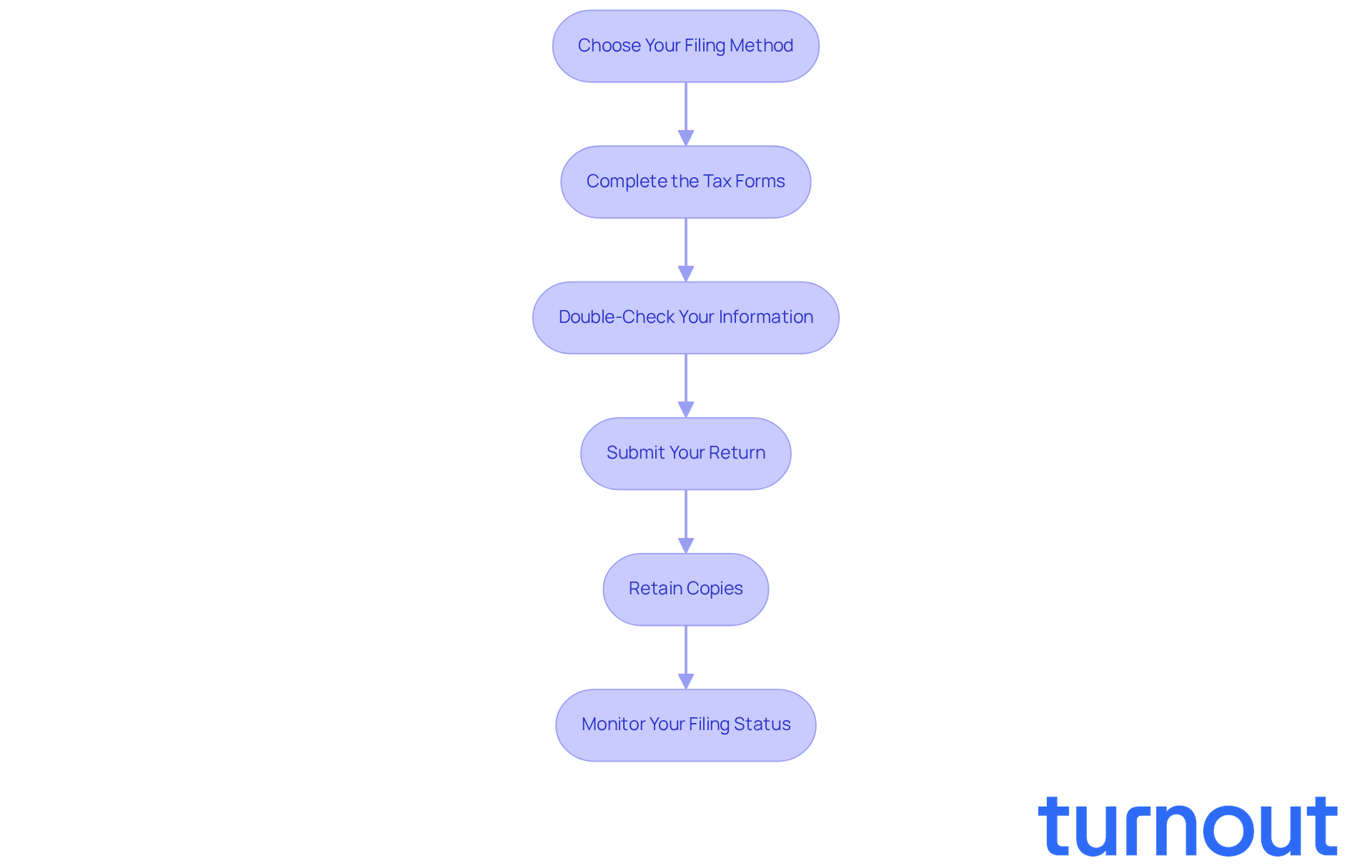

File Your Overdue Taxes: Step-by-Step Instructions

If you haven't filed taxes in 4 years, it can feel overwhelming, but breaking the process down into manageable steps can make it easier. We understand that this process can be stressful, so here’s how to file:

- Choose Your Filing Method: Decide whether you’d prefer to file online using tax software or by mail. Keep in mind that e-filing for prior years might not be available, so you may need to print and mail your returns.

- Complete the Tax Forms: Take your time to fill out the necessary forms accurately. It’s important to report all income and claim any deductions or credits you qualify for.

- Double-Check Your Information: Before submitting, review your completed forms for accuracy. Mistakes can lead to delays or additional penalties, which can be significant. Remember, the failure-to-file penalty is 5% of the unpaid tax bill, increasing by 5% each month, up to a maximum of 25%.

- Submit Your Return: If you’re mailing your forms, send them to the appropriate IRS address based on your state. If you’re filing electronically, just follow the software instructions to submit your return.

- Retain Copies: After you submit, keep copies of your forms and any supporting documentation. This is crucial for future reference, especially if you need to claim a refund.

- Monitor Your Filing Status: If you expect a refund, use the IRS 'Where's My Refund?' tool to check the status of your return. This tool is essential for tracking your refund progress and ensuring you receive any money owed to you.

If you’re feeling stuck during the filing process, consider reaching out to programs like the Volunteer Income Tax Assistance (VITA) or MilTax. They offer free tax help to eligible individuals. By following these steps and utilizing available resources, you can successfully submit your late payments, even if you haven't filed taxes in 4 years, and move forward with peace of mind. Remember, you’re not alone in this journey, and we’re here to help.

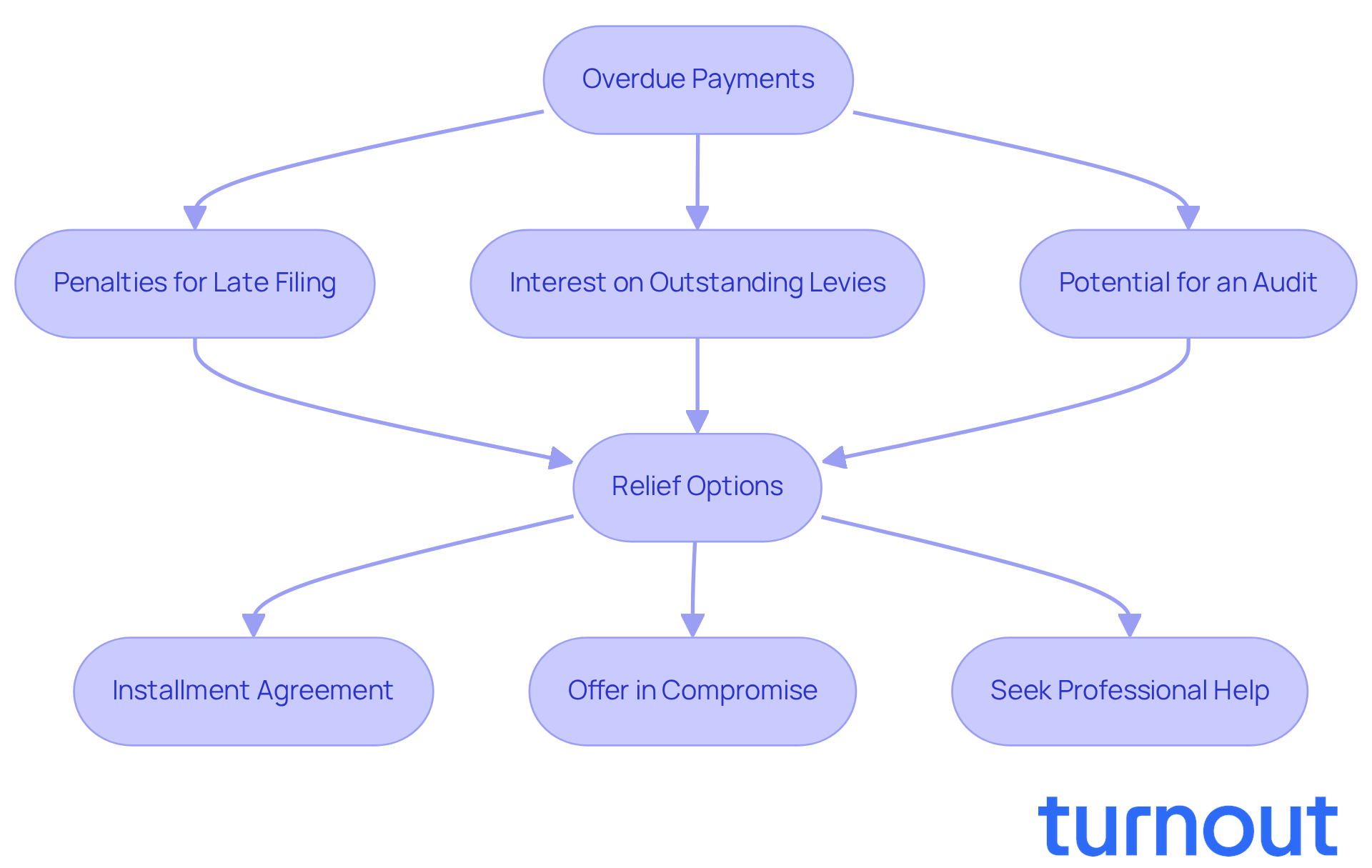

Address Potential Consequences and Explore Relief Options

We understand that submitting overdue payments can be stressful, but knowing what to expect can help you navigate this process more smoothly. Here’s what you should keep in mind:

- Penalties for Late Filing: The IRS imposes a failure-to-file penalty, which is usually 5% of the unpaid tax for each month your return is late, up to a maximum of 25%. This can add up quickly, so it’s important to act.

- Interest on Outstanding Levies: Alongside penalties, interest accumulates on any unpaid dues, which can increase your overall obligation over time. It’s common to feel overwhelmed by this.

- Potential for an Audit: Filing overdue returns may raise your chances of being audited, especially if there are discrepancies in your reported income. This can be daunting, but you’re not alone in facing this concern.

- Relief Options: If you owe taxes and can’t pay, consider applying for an installment agreement or an offer in compromise. These options allow you to settle your tax debt for less than the full amount owed, providing some relief.

- Seek Professional Help: If you’re feeling lost, consulting a tax professional can offer personalized guidance and help you explore all available options. Remember, reaching out for help is a strong step forward.

By being aware of these consequences and relief options, you can approach your tax situation with confidence. Remember, you are not alone in this journey, and there are steps you can take to resolve it.

Conclusion

Filing taxes after a long absence isn’t just a legal obligation; it’s a vital step toward regaining your financial stability. If you haven’t filed taxes in four years, understanding the importance of this process is crucial. By addressing overdue returns, you can avoid accumulating penalties, claim potential refunds, restore good standing with the IRS, and access various relief options that can ease your financial burden.

We understand that this can feel overwhelming. Throughout this guide, we’ve highlighted key steps, including:

- Gathering necessary documentation

- Understanding filing requirements

- Navigating the submission process

It’s also important to recognize the potential consequences of not filing, such as hefty penalties and interest. Exploring relief options, like installment agreements, can provide much-needed support for those struggling with tax debt.

Taking action now can pave the way for a brighter financial future. Remember, resources and assistance are available to help you navigate this complex journey. By prioritizing tax filing, you can reclaim control over your financial life and open doors to future opportunities. Embrace the steps outlined in this guide, and take the first step toward resolving your overdue tax issues today. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

Why is it important to file taxes after a long absence?

Filing taxes after a long absence is crucial for regaining financial footing, avoiding penalties, claiming potential refunds, and restoring good standing with the IRS.

What penalties can I face for not filing taxes?

The IRS can impose a failure-to-file penalty of 5% of unpaid taxes for each month you’re overdue, capping at 25%. These penalties can accumulate quickly, making it important to file sooner.

How long do I have to claim a tax refund?

Taxpayers can claim refunds for up to three years after the deadline. Filing your taxes is essential to receive any refunds you may be owed.

How does filing taxes affect my standing with the IRS?

Filing late returns can help restore your good standing with the IRS, which is important for future financial opportunities, such as obtaining loans and mortgages.

What relief options are available if I haven’t filed taxes in several years?

Filing can open doors to various relief options, such as payment plans or offers in compromise. For example, if you owe less than $100,000, you can set up short-term payment plans with manageable monthly payments for up to 180 days.

How can Turnout assist with tax issues?

Turnout offers tools and services to help navigate tax situations, including assistance with tax debt relief. They provide support through trained nonlawyer advocates and IRS-licensed enrolled agents without the need for legal representation.