Introduction

Navigating the complexities of unfiled taxes can feel overwhelming, especially for those in Las Vegas who are facing mounting penalties and potential legal repercussions. We understand that this situation can weigh heavily on your mind. The implications of failing to file are significant; they can affect everything from your credit score to any potential refunds you might expect.

But there’s hope. With a variety of resources and professional assistance available, you can take meaningful steps to address your tax situation. It’s common to feel lost in this process, but you are not alone. Many have faced similar challenges and found their way back to financial stability.

So, how can you effectively tackle the daunting task of resolving unfiled taxes? Let’s explore the options together. Remember, reaching out for help is a sign of strength, and we’re here to support you every step of the way.

Understand Unfiled Taxes and Their Implications

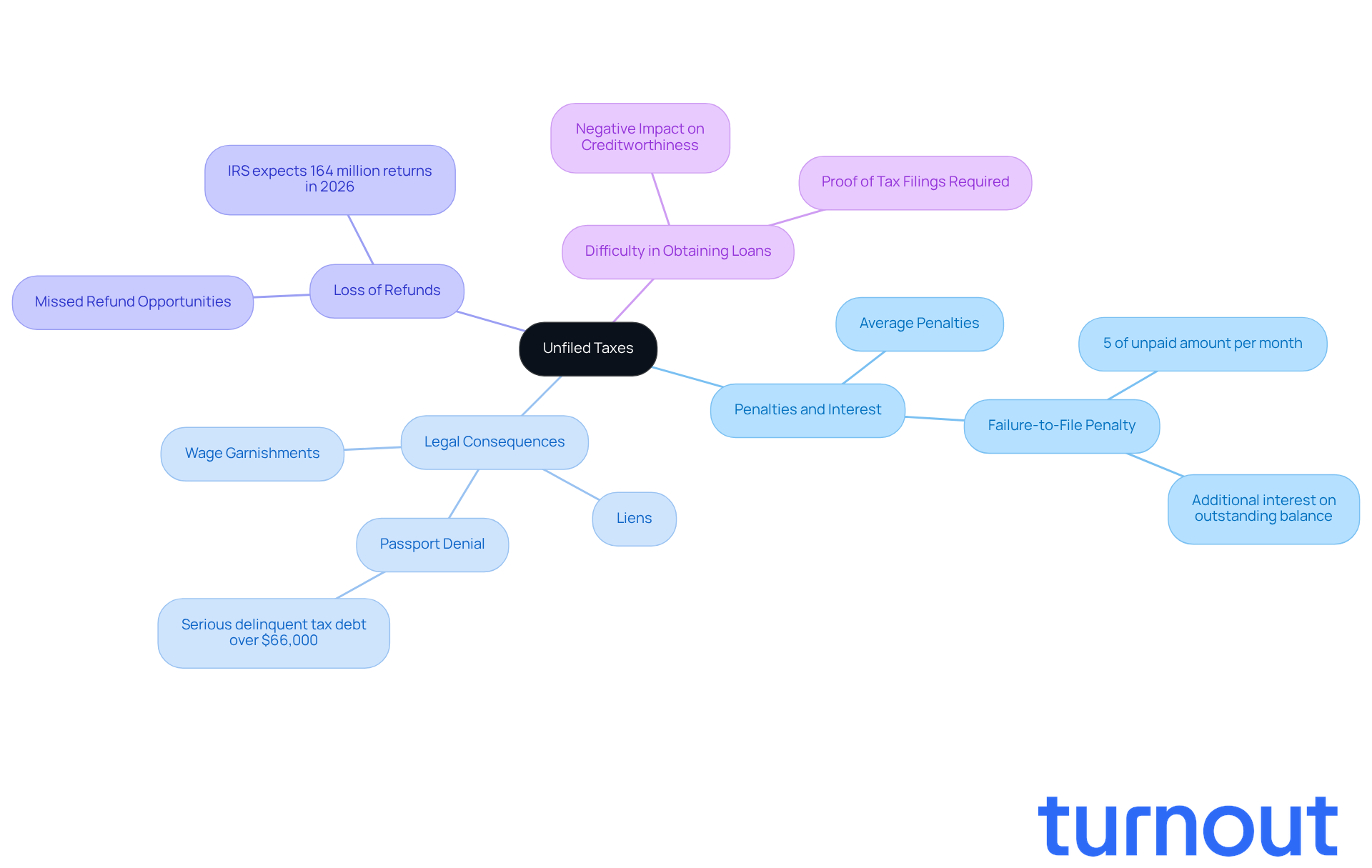

Unfiled taxes refer to income filings that haven’t been submitted to the IRS for one or more fiscal years. We understand that failing to file your taxes can lead to significant consequences, and it’s important to be aware of them:

- Penalties and Interest: The IRS imposes substantial penalties for late filing, which can add up quickly. For 2026, the failure-to-file penalty is typically 5% of the unpaid amount for each month the return is delayed, with additional interest accumulating on the outstanding balance. It’s common to feel overwhelmed by the average penalties and interest for late tax submissions, which can significantly increase the total amount owed.

- Legal Consequences: Not filing your returns can lead to serious legal actions, such as wage garnishments and liens. For example, a serious delinquent tax debt-defined as any amount over $66,000-may even result in passport denial or revocation.

- Loss of Refunds: If you’re owed a refund, failing to file means you won’t receive it. The IRS expects to receive around 164 million individual income tax returns in 2026, and those who don’t file will miss out on potential refunds.

- Difficulty in Obtaining Loans: Unsubmitted financial obligations can negatively impact your creditworthiness, making it harder to secure loans or mortgages. Remember, lenders often require proof of tax filings as part of the loan application process.

As Erin M. Collins, the National Taxpayer Advocate, noted, "Taxpayers generally fared well in their dealings with the IRS in 2025, and most taxpayers are likely to have a smooth experience in 2026." Understanding these implications is essential for effectively managing your obligations, and unfiled taxes help las vegas. You are not alone in this journey, and taking the necessary actions to correct your situation can lead to peace of mind.

Assess Your Tax Situation and Gather Necessary Documents

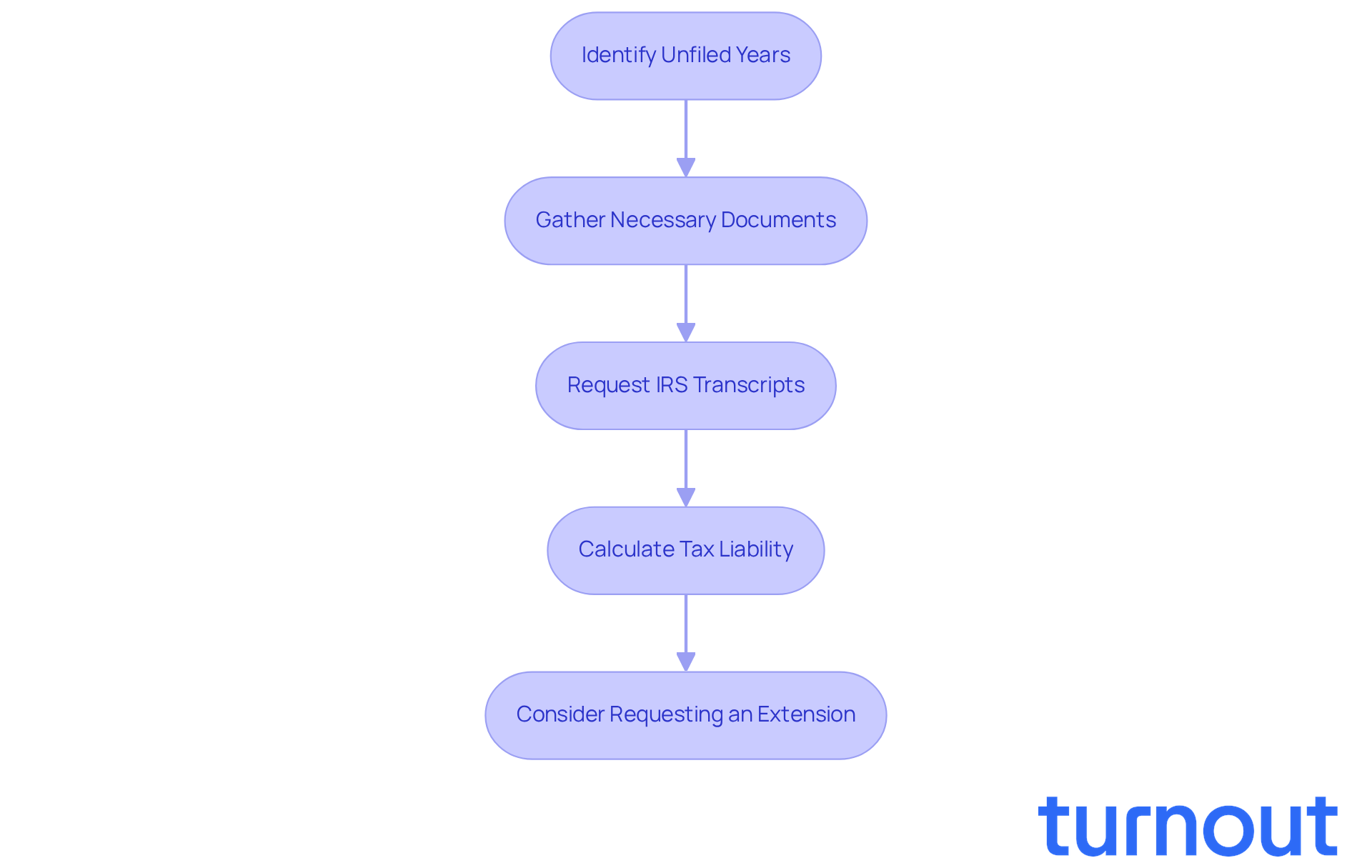

To effectively address your situation regarding unfiled taxes help Las Vegas, it’s important to start by assessing your tax situation. We understand that this can feel overwhelming, but taking it step by step can make a big difference.

-

Identify the Years You Haven't Submitted: First, determine which tax years you haven’t submitted documents for. This will clarify the scope of your situation and help you prioritize your efforts.

-

Gather Necessary Documents: Next, collect all relevant financial documents. This includes:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Bank statements and other income records

- Previous tax returns, if available

-

Request Transcripts from the IRS: If you’re missing documents, don’t hesitate to request wage and income transcripts from the IRS. This can aid in rebuilding your financial history and ensuring precision in your submissions.

-

Calculate Your Tax Liability: It’s crucial to estimate how much you owe for each unfiled year, including any penalties and interest that may have accrued. The average financial obligation for unreported dues in 2026 is anticipated to be substantial, highlighting how unfiled taxes help Las Vegas in addressing these matters swiftly. Remember, the failure-to-submit penalty is ten times greater than the failure-to-pay penalty, highlighting the urgency of submitting your taxes.

-

Consider Requesting an Extension: If you can’t meet the submission deadline, apply for an extension using IRS Form 4868 to avoid late penalties. This extension gives you additional time to gather your documents and file your return.

Arranging this information will simplify the documentation process and help you prevent additional complications. As tax advisor Michele Cagan emphasizes, completing a tax organizer provided by your preparer ensures all relevant information is included, maximizing available deductions and minimizing potential liabilities. Additionally, maintain communication with your tax preparer to ensure all information is accurate and complete. Remember, you’re not alone in this journey; utilize IRS resources to help identify necessary documents for filing.

Explore Available Resources and Professional Help

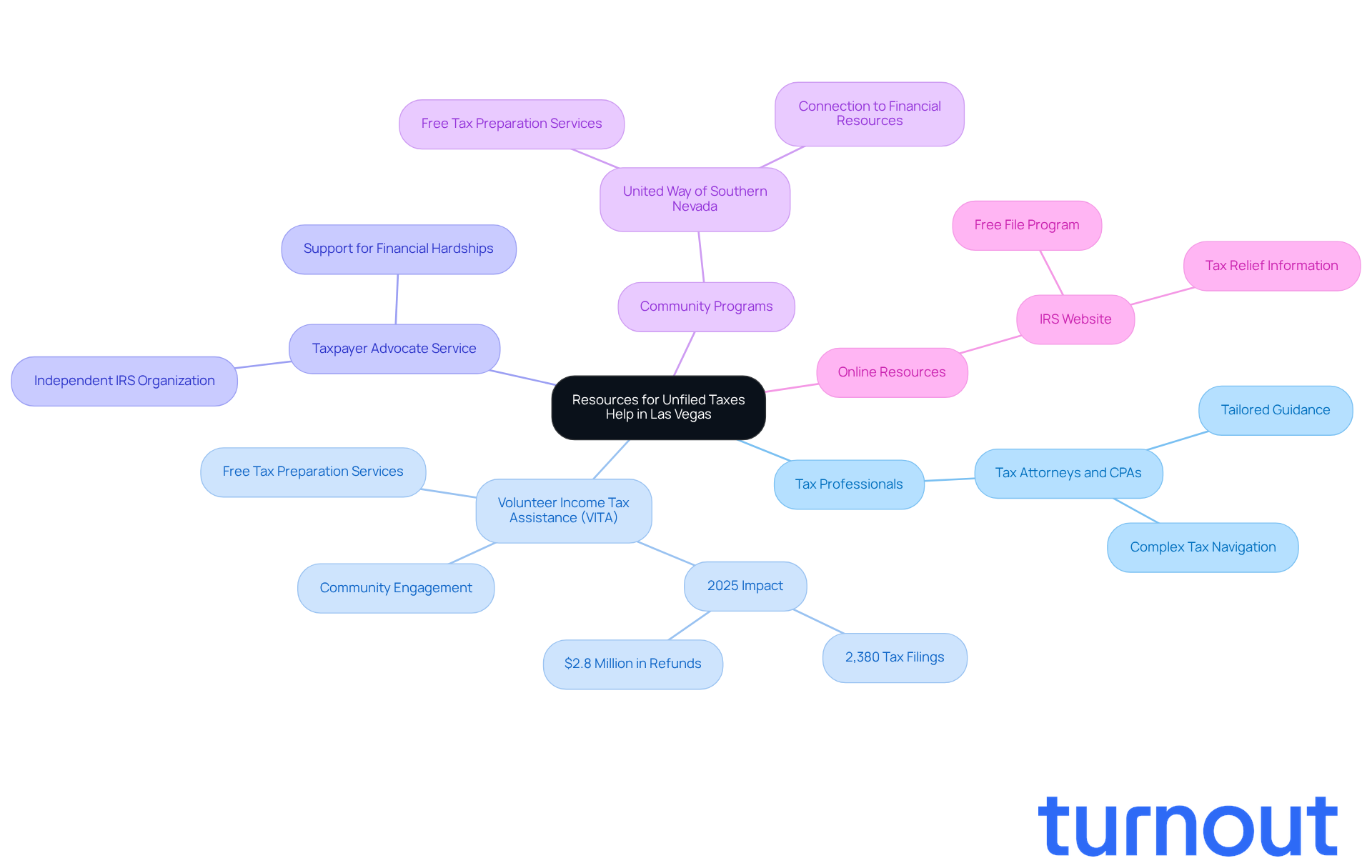

When seeking unfiled taxes help Las Vegas, it’s completely understandable to feel overwhelmed. But remember, you’re not alone in this journey. There are several valuable resources available to help you navigate these challenges:

-

Tax Professionals: Engaging a tax attorney or certified public accountant (CPA) can provide you with tailored guidance. They can help you effectively navigate the complexities of your tax situation, ensuring you feel supported every step of the way.

-

Volunteer Income Tax Assistance (VITA): This IRS-sponsored program offers free tax preparation services to low-income individuals and families. In Las Vegas, numerous VITA sites are available, making help accessible. For instance, in 2025, VITA successfully completed 2,380 tax filings, leading to over $2.8 million in federal tax refunds for the community. This shows just how impactful VITA can be for those in need.

-

Taxpayer Advocate Service: This independent IRS organization is dedicated to assisting taxpayers in resolving issues. They offer support for those facing financial hardships, ensuring that every taxpayer is treated fairly. As a representative from the Taxpayer Advocate Service puts it, "We’re here to ensure that every taxpayer is treated fairly and that you know and understand your rights."

-

Community Programs: Local organizations, like the United Way of Southern Nevada, provide free tax preparation services and can connect you with additional financial resources. In 2026, several VITA sites will continue to operate in Las Vegas, making it even easier for individuals to access these services.

-

Online Resources: Websites such as the IRS and various tax relief organizations offer valuable information and tools to help you understand your options and obligations. The IRS Free File Program, for example, allows qualifying taxpayers to file their returns at no cost.

Utilizing these resources can significantly relieve the stress related to unfiled taxes help Las Vegas. Remember, you have the power to take control of your financial situation, and there’s support available to help you along the way.

Take Action to Resolve Your Unfiled Taxes

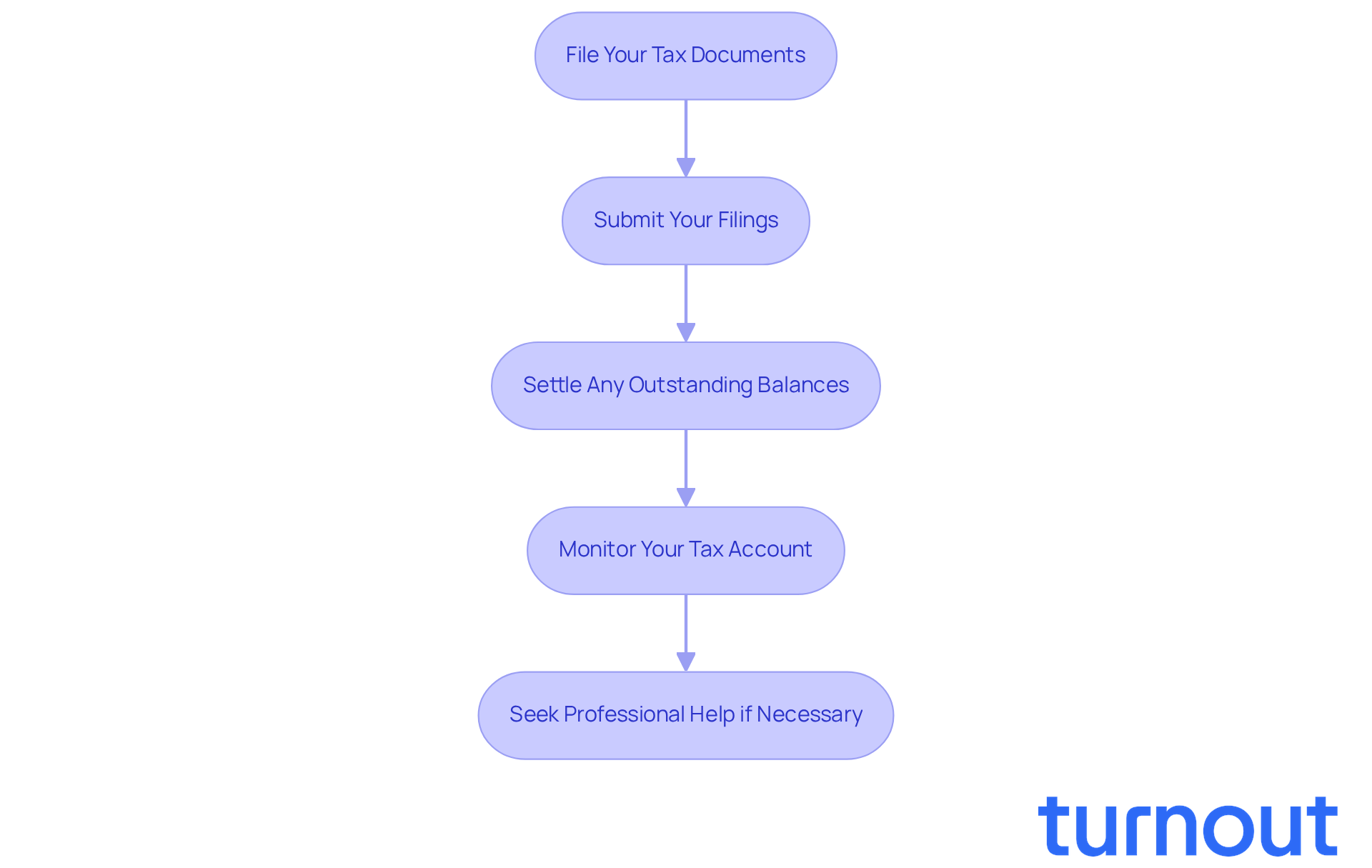

If you're feeling overwhelmed by unfiled taxes, remember that unfiled taxes help Las Vegas can provide the support you need. Here are some essential steps to help you navigate this process with care and support:

-

File Your Tax Documents: Start by using the documents you've gathered to complete your tax submissions for each unfiled year. The IRS usually requires individuals to submit at least the last six years of unfiled tax documents. Remember, accuracy is key to avoid any additional issues, as the IRS can impose penalties, attach liens, or garnish wages for unfiled tax documents.

-

Submit Your Filings: Depending on what feels right for you and the IRS guidelines for the specific tax years, you can file your documents electronically or by mail. Choose the method that makes you feel most comfortable.

-

Settle Any Outstanding Balances: If you owe taxes, consider setting up a payment plan with the IRS. If your total debt is below a certain threshold, you can easily apply for an installment agreement online. This can help ease the burden.

-

Monitor Your Tax Account: After you've submitted your filings, it’s a good idea to regularly check your IRS account. This way, you can confirm that your returns are processed and any payments are applied correctly. The IRS's 'Where’s My Refund?' tool updates once per day, usually overnight, and can provide you with updates on your refund status.

-

Seek Professional Help if Necessary: If you run into difficulties during the submission process or have questions about your tax situation, don’t hesitate to reach out to a tax expert. Their knowledge can guide you through the complexities and help manage any outstanding balances effectively.

By taking these proactive steps, including submitting within three years of the original deadline to claim any potential refunds, you can restore compliance with the IRS and alleviate the stress that comes with unfiled taxes help Las Vegas. Plus, keep in mind that larger refunds are expected in 2026 due to the One Big Beautiful Bill Act (OBBBA), which could provide even more motivation to file your taxes promptly. Remember, we're here to help you through this journey.

Conclusion

Navigating the complexities of unfiled taxes can feel overwhelming. We understand that the implications can be daunting, but knowing where to seek help can significantly lighten this load. Unfiled taxes can lead to severe penalties and legal consequences, and they may even impact your ability to secure loans. That’s why it’s so important to address this issue promptly.

Taking proactive steps to file overdue returns not only restores compliance but also opens the door to potential refunds and financial peace of mind. Imagine regaining control over your tax obligations and feeling secure again.

Key insights from our discussion include critical steps to:

- Assess your tax situation

- Gather necessary documents

- Explore available resources for assistance

Engaging with tax professionals, utilizing community programs like VITA, and leveraging online tools can provide invaluable support in managing unfiled taxes. Remember, maintaining communication with tax preparers and the IRS is essential for ensuring accurate submissions and compliance.

Ultimately, taking action to resolve unfiled taxes is vital for your financial stability and peace of mind. By understanding the consequences of non-filing and utilizing available resources, you can regain control over your tax obligations. Embrace the support offered by professionals and community programs; you are not alone in this journey.

Taking that first step towards filing your taxes can lead to a brighter financial future and a renewed sense of security. We’re here to help you every step of the way.

Frequently Asked Questions

What are unfiled taxes?

Unfiled taxes refer to income filings that have not been submitted to the IRS for one or more fiscal years.

What are the penalties for not filing taxes?

The IRS imposes substantial penalties for late filing, typically 5% of the unpaid amount for each month the return is delayed, along with additional interest on the outstanding balance.

What legal consequences can arise from unfiled taxes?

Not filing tax returns can lead to serious legal actions, such as wage garnishments and liens. A serious delinquent tax debt, defined as any amount over $66,000, may also result in passport denial or revocation.

Will I miss out on refunds if I don’t file my taxes?

Yes, if you are owed a refund and do not file your tax return, you will not receive that refund.

How can unfiled taxes affect my ability to obtain loans?

Unsubmitted financial obligations can negatively impact your creditworthiness, making it more difficult to secure loans or mortgages, as lenders often require proof of tax filings during the loan application process.

What is the expected number of individual income tax returns the IRS anticipates for 2026?

The IRS expects to receive around 164 million individual income tax returns in 2026.

Is it common for taxpayers to have a smooth experience with the IRS?

According to Erin M. Collins, the National Taxpayer Advocate, taxpayers generally fared well in their dealings with the IRS in 2025, and most are likely to have a smooth experience in 2026.