Overview

Navigating the complexities of IRS back taxes can feel overwhelming, and we understand that you may be experiencing a range of emotions. This article serves as a compassionate guide to help you seek relief. It emphasizes the importance of:

- Assessing your tax situation

- Gathering necessary documentation

- Exploring payment options

Initiating contact with the IRS and adhering to a payment plan are crucial steps on this journey.

To support you, we’ll detail specific actions you can take, such as:

- Submitting forms for installment agreements

- Offers in compromise

Thorough preparation and open communication with the IRS can significantly improve your chances of achieving favorable outcomes. Remember, you are not alone in this process; we’re here to help you every step of the way.

As you embark on this path, take a moment to reflect on your situation. What are your concerns? By acknowledging your struggles, you can move toward finding effective solutions. Together, we can explore the options available to you and create a plan that works for your unique circumstances.

In conclusion, seeking relief from IRS back taxes is a journey that requires patience and understanding. With the right information and support, you can navigate this process successfully. We encourage you to take action today—reach out to the IRS, gather your documents, and take the first step toward regaining your peace of mind.

Introduction

Navigating the complexities of IRS back taxes can feel overwhelming, and you’re not alone in this journey. Many taxpayers are grappling with rising average debts, and understanding how to assess your tax situation is crucial for regaining financial stability. It’s common to feel uncertain about the steps to take and the relief options available.

This guide offers a comprehensive roadmap designed to help you tackle your IRS back taxes with confidence and clarity. We’re here to help you every step of the way.

Assess Your Tax Situation and Gather Documentation

Begin by reviewing your tax returns from the past few years to determine the total amount owed to the IRS, as this is essential for tax help with IRS back taxes. We understand that this can be a daunting task, but gathering all relevant documents is a crucial first step. Consider collecting the following:

- W-2s and 1099s: These forms report your income and are essential for verifying your earnings. Financial advisors emphasize that having these documents prepared is vital for accurate tax reduction applications.

- Previous Tax Returns: Keeping copies of your past returns can help you understand your tax history and identify any discrepancies.

- IRS Notices: Collect any correspondence from the IRS regarding your tax debt. These documents will provide specific details about what you owe and any penalties applied.

- Financial Records: Compile bank statements, pay stubs, and any other financial documents that reflect your current financial situation. This information will be essential when discussing financial options or assistance programs.

Once you have gathered all necessary documentation, create a summary of your tax situation. Include the total amount owed, any penalties, and your current financial status. This summary will serve as a helpful reference point as you move forward in this process.

As of 2025, the average amount owed to the IRS by taxpayers has been reported to be significant. This highlights the urgency of addressing tax debts promptly, particularly with tax help IRS back taxes. Real-world examples show how individuals have successfully collected their W-2s and 1099s to aid their tax assistance efforts. This demonstrates the effectiveness of thorough preparation in achieving favorable outcomes.

Remember, the Collection Statute Expiration Date (CSED) is typically 10 years from the date the debt was assessed. This marks the deadline for IRS collection actions. If you encounter difficulties navigating your tax issues, consider reaching out for tax help with IRS back taxes from the Taxpayer Advocate Service (TAS). You're not alone in this journey, and support is available.

Explore Payment Options and Relief Programs

Once you have assessed your situation, we understand that exploring payment options and relief programs can feel overwhelming. Here are some supportive avenues to consider:

-

Installment Agreements: This option allows you to pay your tax debt in manageable monthly installments. You can easily apply for tax help with IRS back taxes directly through the IRS website or by submitting Form 9465. Most individual taxpayers can receive tax help for IRS back taxes by qualifying for a payment plan that can be set up quickly online, providing a sense of relief.

-

Offer in Compromise: If paying your full tax liability feels impossible, you may qualify for an Offer in Compromise, a type of tax help for IRS back taxes. This program offers tax help for IRS back taxes, enabling you to settle your tax debt for less than the total amount owed. In 2025, the acceptance rate for OIC applications was around 42.1%, highlighting the potential for assistance. We encourage you to use the IRS's pre-qualifier tool to determine your eligibility.

-

Financial Hardship: If you are experiencing financial hardship, you can request tax help for IRS back taxes to temporarily delay collection efforts until your situation improves. This status can provide essential breathing room, allowing you to focus on stabilizing your finances while obtaining tax help for IRS back taxes without the added pressure of immediate collection.

-

State-Specific Programs: Don't forget to explore state-specific programs that provide tax help for IRS back taxes and may offer additional support. Many states have tailored programs designed to offer tax help for IRS back taxes, helping residents manage their tax debt effectively.

As you compile a list of the options that seem most applicable to your situation, gather any additional documentation required for each program. Successful cases have shown that thorough preparation and accurate financial documentation significantly improve the chances of acceptance for an Offer in Compromise. For instance, one significant case involved a taxpayer who resolved a $700,000 tax obligation for slightly more than $100, showcasing the possibility for considerable assistance when navigating these options with care and efficiency. Remember, you're not alone in this journey, and we're here to help you find the best path forward.

Initiate Contact with the IRS and Submit Required Forms

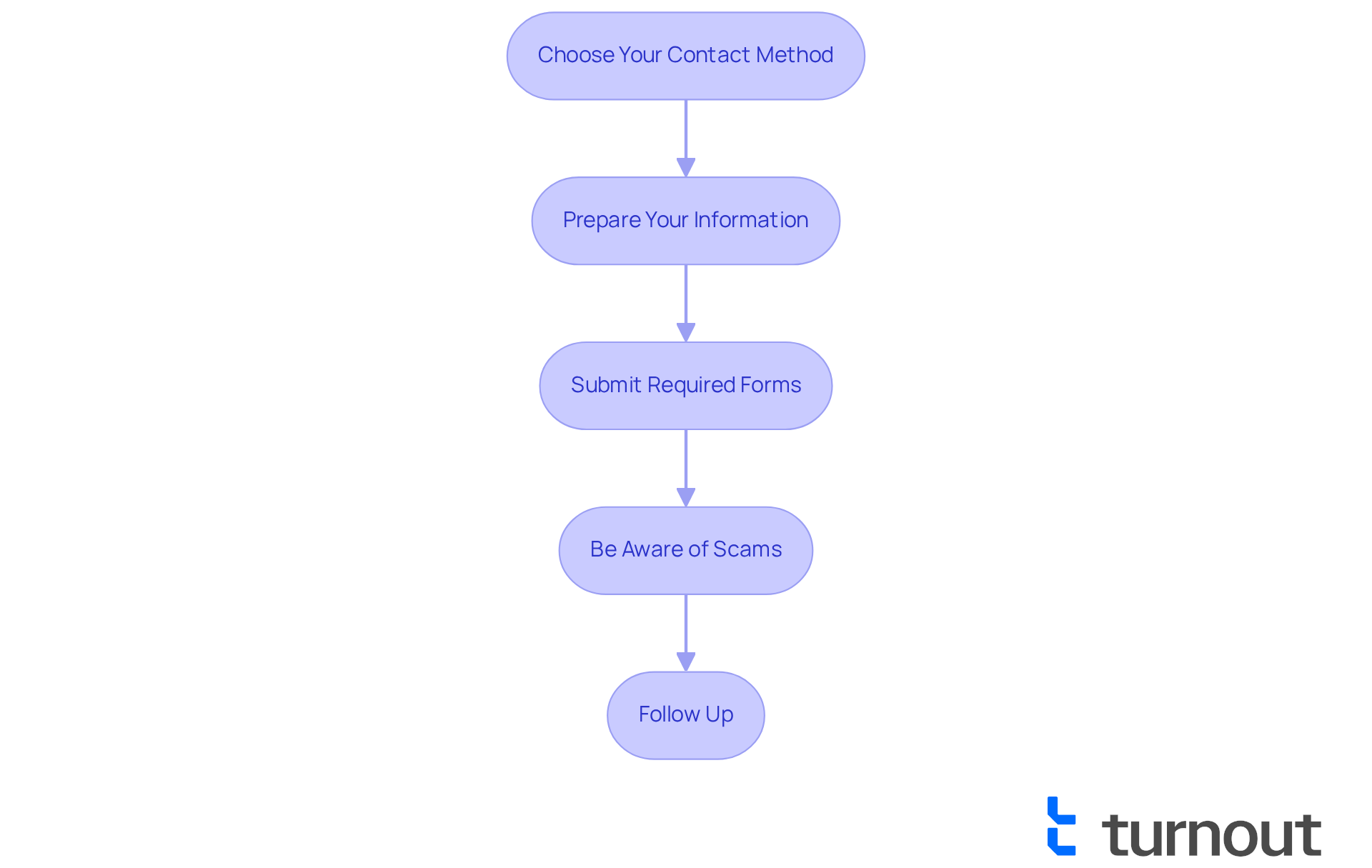

After identifying the suitable assistance options, we understand that reaching out to the IRS can feel daunting. Here are some steps to guide you through this process:

- Choose Your Contact Method: You can reach the IRS by phone, mail, or through their online portal. For immediate assistance, calling the IRS at 1-800-829-1040 is often the best option.

- Prepare Your Information: It’s helpful to have your tax identification number, relevant documents, and a summary of your tax situation ready before contacting the IRS. This preparation can streamline the conversation and ensure you provide all necessary details.

- Submit Required Forms: Depending on the relief option you choose, you may need to submit specific forms. For an Installment Agreement, complete Form 9465. For an Offer in Compromise, fill out Form 656 and Form 433-A (OIC) or Form 433-B (OIC) as applicable. In 2025, the success rate for Offer in Compromise submissions has shown improvement, with approximately 30% of applicants receiving approval. This highlights the importance of accurate and complete submissions.

- Be Aware of Scams: It's common to feel uncertain about communications claiming to be from the IRS. Always verify these messages. The IRS does not initiate contact through phone, text, or social media to request funds. If you receive suspicious messages, please report them to the appropriate authorities.

- Follow Up: After submitting your forms, keep a record of your submission and any correspondence with the IRS. If you do not receive a response within a reasonable timeframe, typically around 30 days, it's important to follow up to ensure your application is being processed. Utilizing the IRS's online tools can also provide updates on your submission status. Additionally, the IRS provides tax help for those facing back taxes, which can be beneficial for struggling taxpayers during this process. Remember, you are not alone in this journey; we're here to help.

Follow Up and Adhere to Your Payment Plan

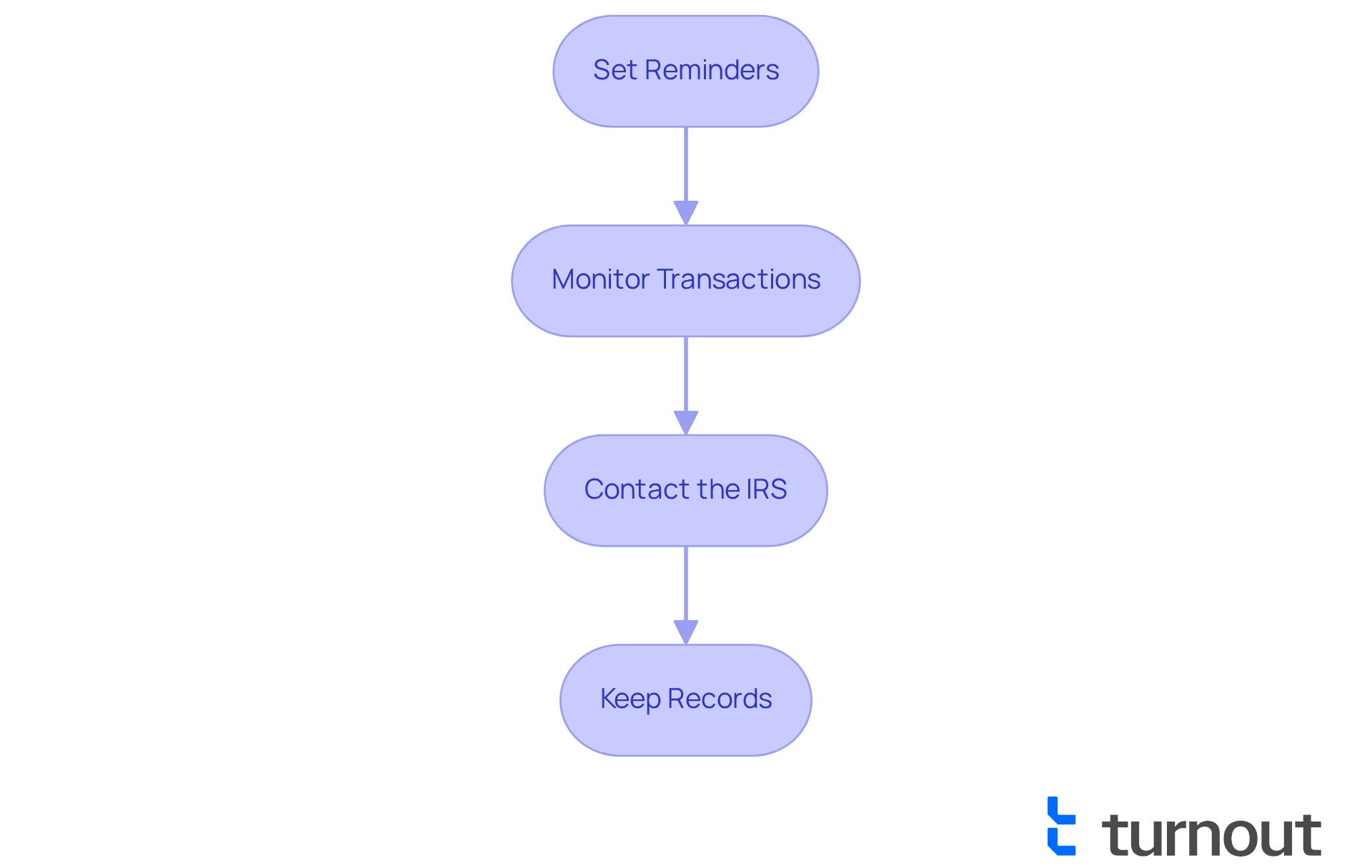

Once your payment plan is established, it's crucial to stay on track to manage your tax obligations effectively. We understand that this can feel overwhelming, but you are not alone in this journey. Here are some steps to help you navigate this process with confidence:

- Set Reminders: Consider using a calendar or reminder app to track your payment due dates and any necessary follow-up actions. This simple step can help ensure that you never overlook a financial obligation, which is essential for upholding your agreement.

- Monitor Your Transactions: Regularly reviewing your bank statements can confirm that transactions are processed correctly and on time. Keeping an eye on your transactions helps you catch any discrepancies early, easing your worries.

- Contact the IRS: If you encounter any problems with your plan or if your financial circumstances change, please reach out to the IRS right away. They may be able to adjust your plan based on your current situation, providing you with the flexibility you need.

- Keep Records: It's wise to maintain copies of all correspondence with the IRS, transaction confirmations, and any other relevant documents. This documentation is essential in case of disputes or questions regarding your account.

By following these steps and remaining proactive, you can effectively manage your tax debt with tax help for IRS back taxes and work towards achieving financial stability. Experts emphasize that consistent monitoring and open communication with the IRS are key components of successful payment plan adherence. Remember, you have the tools and support to navigate your obligations with confidence.

Conclusion

Navigating the complexities of IRS back taxes can feel overwhelming. We understand that seeking relief is crucial for your financial stability. This guide highlights the importance of:

- Assessing your tax situation

- Gathering necessary documentation

- Exploring available payment options and relief programs

By taking these proactive measures, you can effectively address your tax obligations and work towards a resolution.

Thorough preparation is key. Collecting W-2s, previous tax returns, and IRS correspondence is essential for any relief application. From installment agreements to offers in compromise, various pathways exist to ease your burdens. Establishing a payment plan and maintaining communication with the IRS are also vital for managing your tax debts successfully.

Ultimately, addressing IRS back taxes is not only about compliance but about reclaiming your financial peace of mind. We encourage you to take the first step by assessing your situation and seeking appropriate assistance. By doing so, you can transform a daunting challenge into a manageable process, ensuring you are not alone on this journey toward tax relief.

Frequently Asked Questions

What is the first step to take when dealing with IRS back taxes?

The first step is to assess your tax situation by reviewing your tax returns from the past few years to determine the total amount owed to the IRS.

What documents should I gather to address my tax situation?

You should gather W-2s and 1099s, previous tax returns, IRS notices, and financial records such as bank statements and pay stubs.

Why are W-2s and 1099s important for tax help?

W-2s and 1099s report your income and are essential for verifying your earnings, which is vital for accurate tax reduction applications.

How can previous tax returns assist me?

Keeping copies of your past returns helps you understand your tax history and identify any discrepancies.

What information do IRS notices provide?

IRS notices provide specific details about what you owe, including any penalties applied to your tax debt.

How should I summarize my tax situation?

Create a summary that includes the total amount owed, any penalties, and your current financial status to use as a reference point moving forward.

What is the significance of the Collection Statute Expiration Date (CSED)?

The CSED is typically 10 years from the date the debt was assessed and marks the deadline for IRS collection actions.

What should I do if I encounter difficulties with my tax issues?

If you face difficulties, consider reaching out for tax help with IRS back taxes from the Taxpayer Advocate Service (TAS) for support.