Overview

Navigating the process of getting short-term disability approved for anxiety and depression can feel overwhelming. It's essential to understand your insurance policy's definitions, eligibility criteria, and necessary documentation. We know that this journey can be challenging, and we're here to help you through it.

Start by obtaining a formal diagnosis from a qualified professional. This step is crucial as it validates your condition. Next, gather comprehensive medical records that support your claim. Remember, thorough preparation can significantly improve your chances of approval.

When submitting your claim, ensure it is well-documented. This means including all relevant information and presenting it clearly. It's common to feel anxious about this process, but taking these steps can empower you. You are not alone in this journey; many have successfully navigated these waters before you.

By understanding the requirements and preparing diligently, you can enhance your likelihood of receiving the support you need. Take a deep breath and know that with the right approach, you can move forward with confidence.

Introduction

Navigating the maze of short-term disability claims can feel particularly daunting, especially for those grappling with anxiety and depression. We understand that this financial safety net is crucial for individuals temporarily unable to work due to mental health challenges. However, securing approval often feels like an uphill battle. By familiarizing yourself with the eligibility criteria, necessary documentation, and common pitfalls, you can significantly enhance your chances of a successful claim.

But what happens when the process becomes overwhelming, and the fear of denial looms large? It's common to feel lost in this journey. Exploring effective strategies to overcome these obstacles can empower you to advocate for your mental health needs. Remember, you deserve the benefits that can support your well-being during this challenging time.

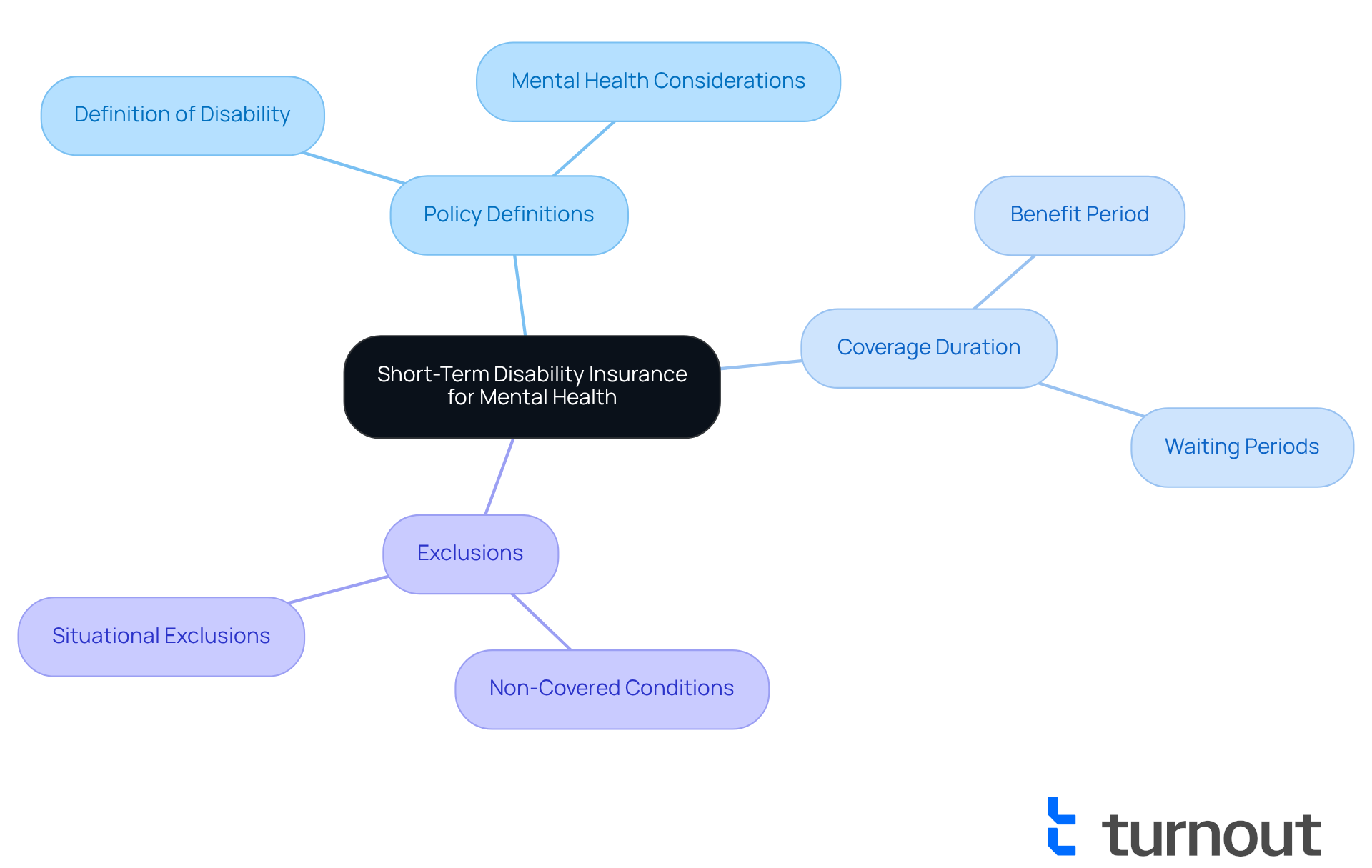

Understand Short-Term Disability Insurance for Mental Health

Short-term disability coverage is designed to provide financial support for individuals who are temporarily unable to work due to medical conditions, and it is important to know how to get short-term disability approved for anxiety and depression. This coverage typically offers a portion of your salary for a limited time, usually from a few weeks to several months. Understanding how to get short-term disability approved for anxiety and depression is essential, as the specific terms of your policy can vary significantly among providers. Here are some key points to consider:

- Policy Definitions: It’s important to know how your insurance provider defines 'disability' in relation to mental health.

- Coverage Duration: Be aware of how long you can receive benefits and any waiting periods that may apply.

- Exclusions: Familiarize yourself with any conditions or situations that might not be covered under your policy.

By grasping these elements, you can feel more prepared for the next steps in the claims process. Remember, you're not alone in this journey, and we're here to help you navigate through it.

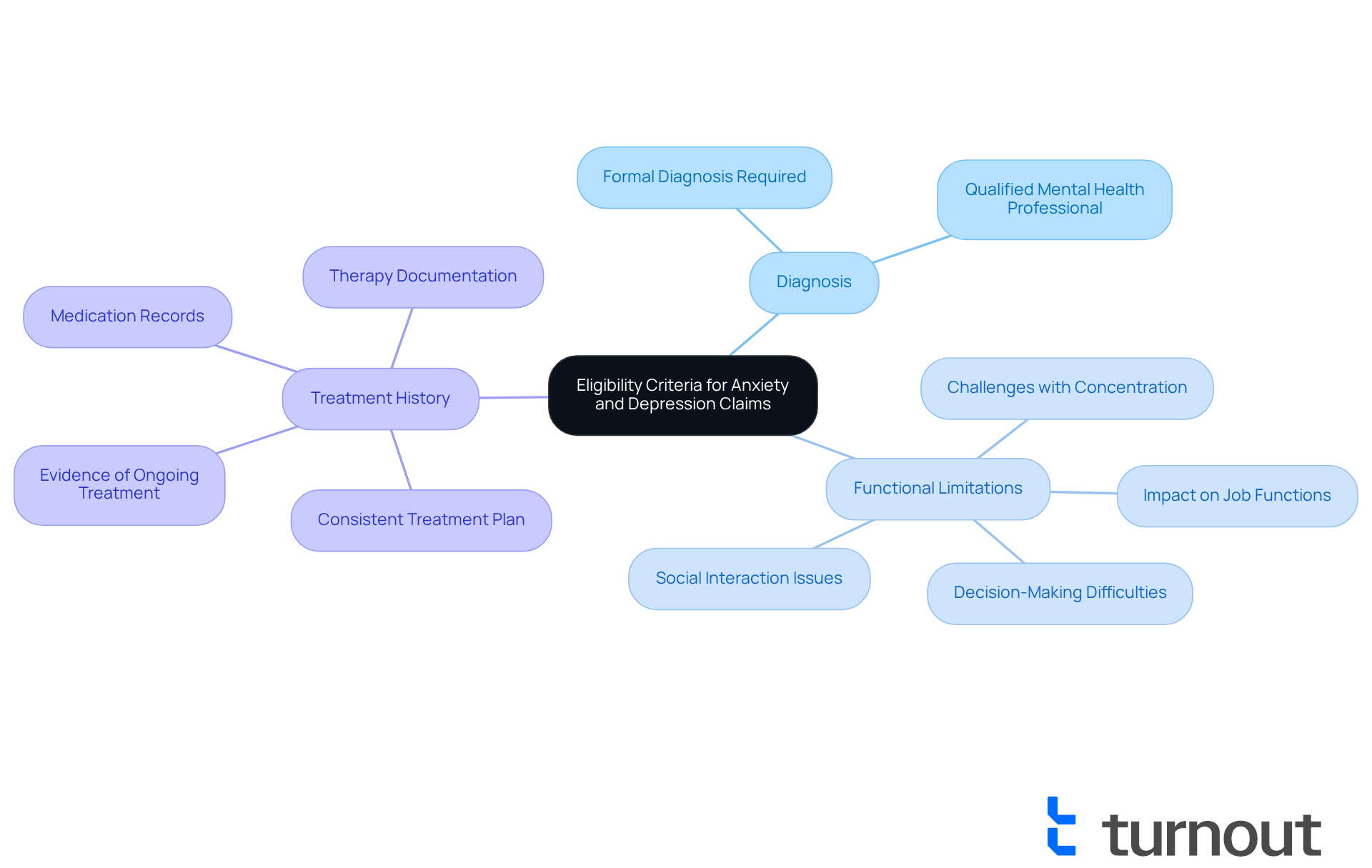

Determine Eligibility Criteria for Anxiety and Depression Claims

Navigating how to get short-term disability approved for anxiety and depression can feel overwhelming. We understand that seeking help is a significant step, and it's important to know how to get short-term disability approved for anxiety and depression and the specific eligibility criteria set by your insurance provider. Here are some common requirements to consider:

- Diagnosis: A formal diagnosis from a qualified mental health professional is often necessary. Be sure that your health status is accurately recorded in your medical files.

- Functional Limitations: You’ll need to show how your mental health condition affects your ability to perform essential job functions. This may include challenges with concentration, decision-making, or social interactions.

- Treatment History: Providing evidence of ongoing treatment, such as therapy or medication, can strengthen your case. Insurance companies typically look for a consistent treatment plan.

It's also wise to examine your policy for any additional criteria. Remember, consulting with your healthcare professional can provide guidance on how to get short-term disability approved for anxiety and depression. You're not alone in this journey, and we're here to help you every step of the way.

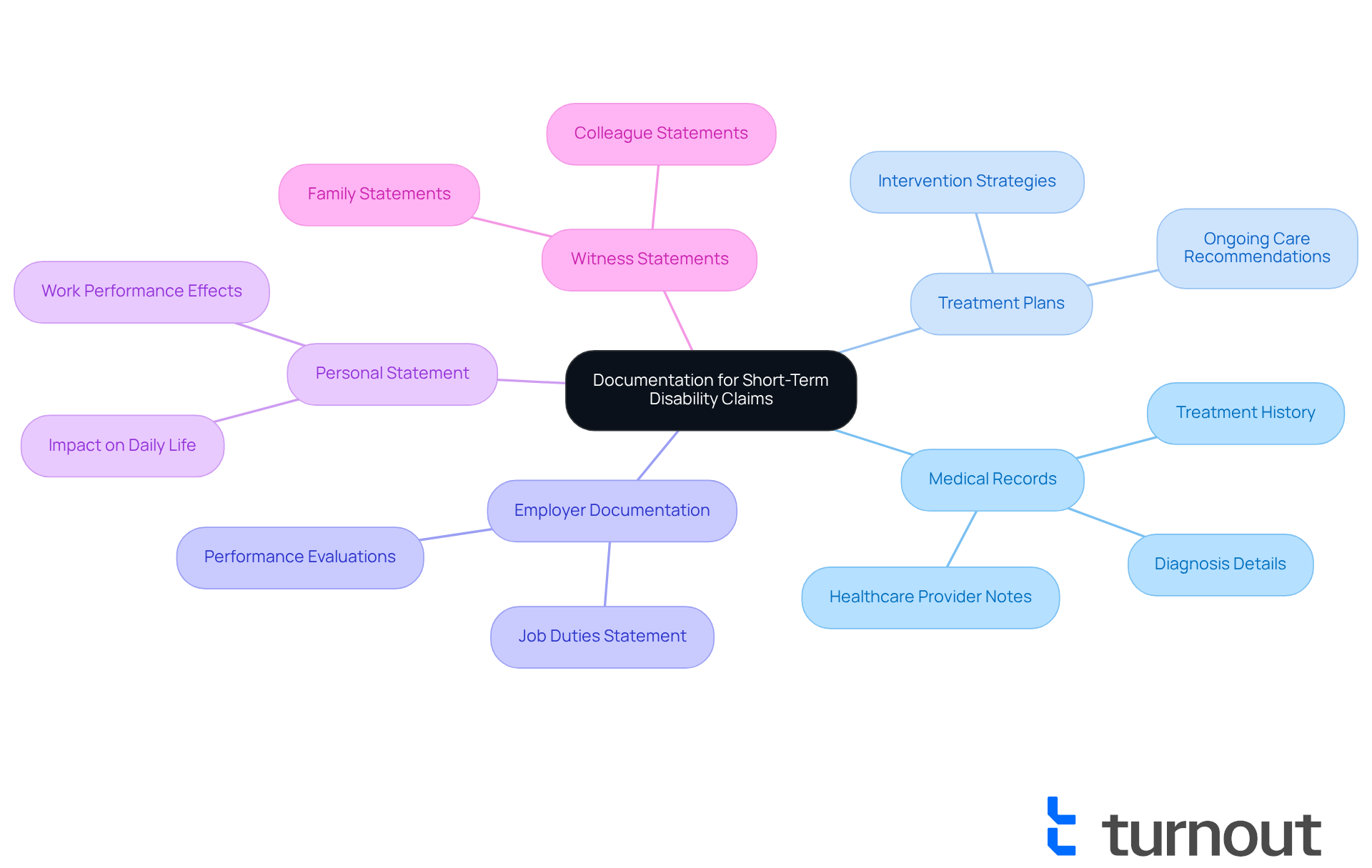

Gather Necessary Documentation for Your Claim

Collecting the necessary documentation is a vital step in understanding how to get short-term disability approved for anxiety and depression. We understand that this process can feel overwhelming, but having the right documents can make a significant difference. Essential documents typically include:

- Medical Records: Obtain copies of your medical records that detail your diagnosis, treatment history, and any relevant notes from your healthcare provider. Thorough medical documentation is crucial, as claims lacking comprehensive evidence are often denied or delayed.

- Treatment Plans: Include any treatment plans or recommendations from your mental health professional that outline your ongoing care. This documentation should clearly explain the nature of your situation and the recommended interventions.

- Employer Documentation: Your employer may require specific forms to be filled out, such as a statement of your job duties and how your condition affects your work. Accurate employment records, including job descriptions and performance evaluations, are essential to illustrate the impact of your disability on job performance.

- Personal Statement: Consider writing a personal statement that describes how anxiety and depression impact your daily life and work performance. This narrative can offer context to your assertion and help communicate how to get short-term disability approved for anxiety and depression.

- Witness Statements: Including statements from family, friends, or colleagues can corroborate your account of the disability and its effects, further enhancing your case.

Ensure all documents are complete and accurate, as discrepancies can lead to delays in processing your request. It’s common to feel anxious about how to get short-term disability approved for anxiety and depression, but remember that statistics show many requests for mental health conditions are rejected due to insufficient documentation. This highlights the significance of careful record-keeping. Advocates stress that well-organized evidence greatly enhances the likelihood of a successful outcome. Therefore, it’s essential to collect and provide all necessary information without delay.

Additionally, understanding the potential duration of short-term disability benefits, which typically lasts from 9 to 52 weeks, can help you plan your recovery and financial needs effectively. Remember, you are not alone in this journey; we're here to help you every step of the way.

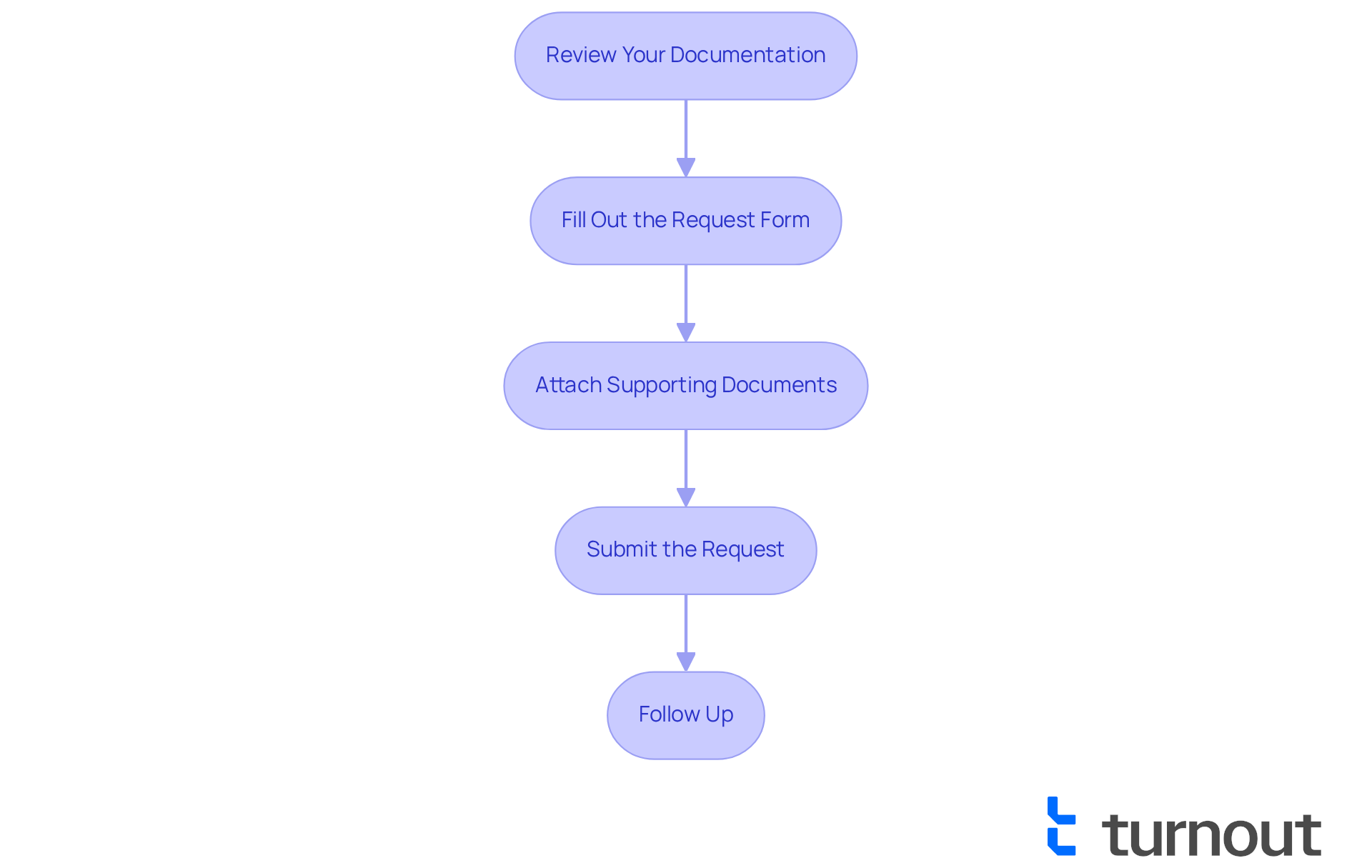

Submit Your Short-Term Disability Claim Effectively

Submitting your short-term disability claim can feel overwhelming, but we're here to help you through it. By following these steps on how to get short-term disability approved for anxiety and depression, you can simplify the process and enhance your chances of achieving a successful outcome.

- Review Your Documentation: Start by ensuring that all required documents are complete and accurate. It’s common to overlook details, so take a moment to double-check for any missing information.

- Fill Out the Request Form: Next, complete the request form provided by your coverage provider. Be thorough and honest in your responses; this is your opportunity to share your story.

- Attach Supporting Documents: Don’t forget to include all necessary documentation, such as medical records and treatment plans, as attachments to your submission form. These documents can greatly support your understanding of how to get short-term disability approved for anxiety and depression.

- Submit the Request: When you're ready, send your request using the method specified by your coverage provider—whether online, by mail, or fax. Remember to keep copies of everything you submit for your records.

- Follow Up: After submitting your claim, reach out to your insurance company to confirm receipt of your request. It’s perfectly normal to want to inquire about the timeline for processing; staying informed can ease your concerns.

By following these steps, you can navigate this process with confidence, knowing that you are taking the right actions to secure the support you need.

Navigate Challenges and Common Pitfalls in the Approval Process

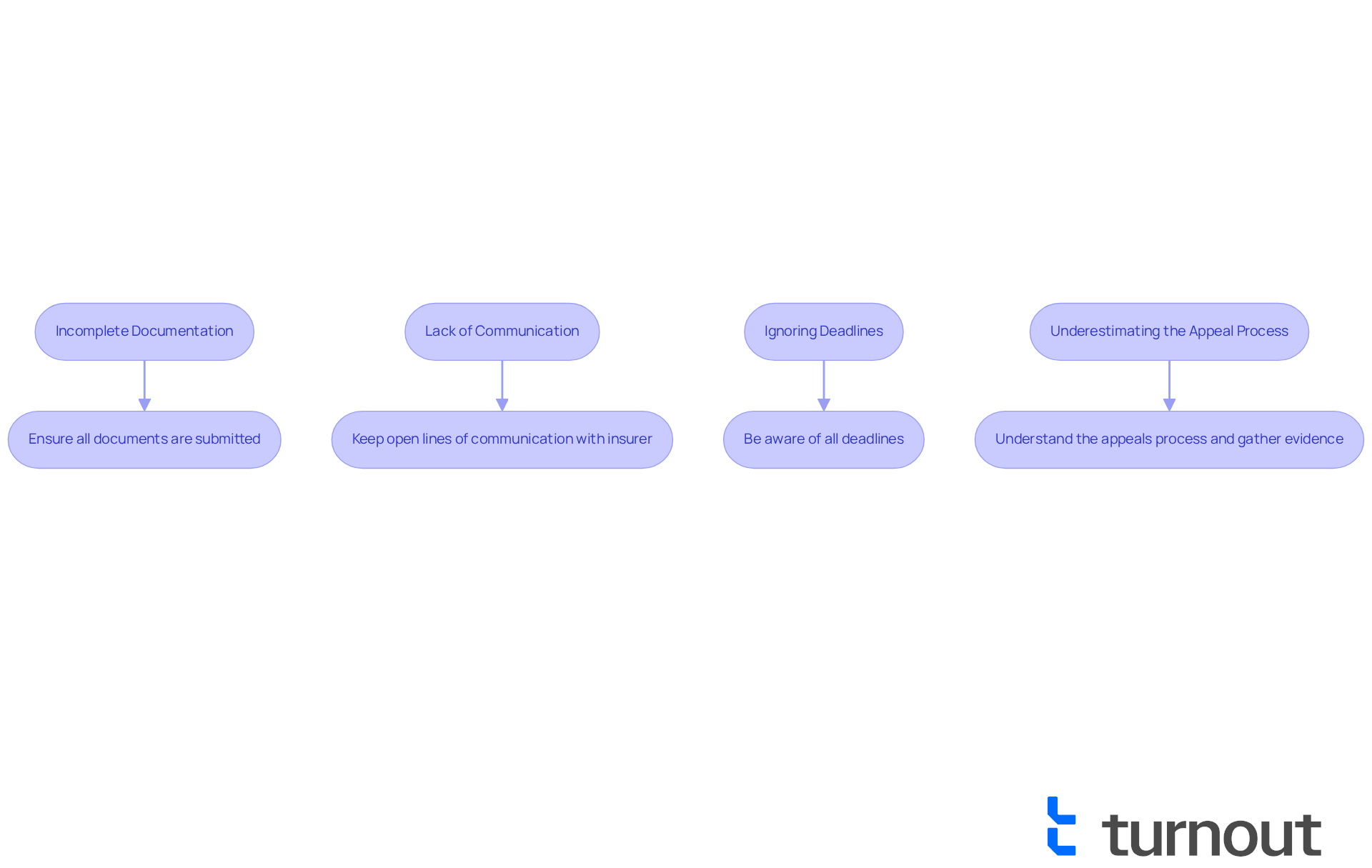

We understand that navigating how to get short-term disability approved for anxiety and depression can be challenging, and this journey may feel overwhelming at times. Here are some common pitfalls and strategies to help you avoid them:

- Incomplete Documentation: It’s vital to ensure that all required documents are submitted in full. Incomplete submissions can lead to delays or denials. By maintaining comprehensive medical records and documentation from your healthcare professionals, you can effectively demonstrate how to get short-term disability approved for anxiety and depression.

- Lack of Communication: Keeping open lines of communication with your insurance provider is essential. If you have questions or concerns, don’t hesitate to reach out. Frequent updates and proactive inquiries can help keep your request on track.

- Ignoring Deadlines: Being aware of all deadlines related to your request, including submission dates and follow-up inquiries, is crucial. Missing deadlines can jeopardize your request, so it’s important to remain organized and alert.

- Underestimating the Appeal Process: If your request is denied, try not to feel discouraged. Understanding how to get short-term disability approved for anxiety and depression involves knowing the appeals process and gathering additional documentation to support your case. Many claims are initially denied due to insufficient evidence, so presenting clinical evidence can significantly strengthen your appeal.

By being proactive and informed, you can navigate these challenges more effectively. Remember, you are not alone in this journey, and we’re here to help you improve your chances of obtaining the benefits you deserve.

Conclusion

Understanding how to secure short-term disability benefits for anxiety and depression is crucial for those facing mental health challenges. This guide highlights the essential steps and considerations needed to successfully navigate the approval process, empowering you to advocate for your rights and well-being.

Key points include:

- The importance of understanding policy definitions

- Determining eligibility criteria

- Gathering necessary documentation

- Effectively submitting claims

Each of these elements plays a pivotal role in ensuring that claims are submitted and approved, providing much-needed financial support during difficult times. By being aware of common pitfalls and maintaining open communication with insurance providers, you can enhance your chances of a successful outcome.

We understand that the journey to obtaining short-term disability benefits for mental health conditions can be daunting, but it is a vital step toward recovery and stability. It's essential to approach this process with diligence and persistence. For those grappling with anxiety and depression, taking proactive measures in understanding and preparing for the claims process is not just beneficial—it's necessary. Remember, the support is out there, and with the right knowledge and preparation, you can secure the assistance you deserve.

Frequently Asked Questions

What is short-term disability insurance for mental health?

Short-term disability insurance provides financial support for individuals temporarily unable to work due to medical conditions, including mental health issues like anxiety and depression. It typically offers a portion of your salary for a limited time, usually from a few weeks to several months.

How can I get short-term disability approved for anxiety and depression?

To get short-term disability approved for anxiety and depression, you need to understand your insurance policy's definitions of 'disability,' coverage duration, and any exclusions. Additionally, meeting specific eligibility criteria set by your provider is essential.

What are the eligibility criteria for anxiety and depression claims?

Common eligibility criteria include having a formal diagnosis from a qualified mental health professional, demonstrating how your condition affects your ability to perform essential job functions, and providing evidence of ongoing treatment, such as therapy or medication.

Why is a formal diagnosis important for short-term disability claims?

A formal diagnosis from a qualified mental health professional is often necessary to validate your claim and ensure that your health status is accurately recorded in your medical files.

What should I provide to show functional limitations due to my mental health condition?

You need to demonstrate how your mental health condition affects your ability to perform essential job functions, which may include challenges with concentration, decision-making, or social interactions.

How can treatment history impact my short-term disability claim?

Providing evidence of ongoing treatment, such as therapy or medication, can strengthen your case, as insurance companies typically look for a consistent treatment plan when evaluating claims.

Are there exclusions I should be aware of in my policy?

Yes, it is important to familiarize yourself with any conditions or situations that might not be covered under your specific insurance policy, as these can vary among providers.