Introduction

Navigating the complexities of the tax system can often feel like an uphill battle, filled with confusion and uncertainty. We understand that this journey can be overwhelming. Tax advocates are essential allies, offering expertise and support to individuals grappling with tax debts and disputes. But recognizing their importance is just the first step. How do you find the right advocate who can truly champion your interests?

It's common to feel lost in this process. The key qualities that distinguish an effective tax advocate can make all the difference. Look for someone who not only understands the intricacies of tax law but also genuinely cares about your situation. They should be able to listen to your concerns and provide tailored solutions that address your unique needs.

As you seek assistance, remember: you are not alone in this journey. Take the time to research and connect with potential advocates. Ask questions, seek testimonials, and trust your instincts. Finding the right support can ease your burden and empower you to tackle your tax challenges with confidence.

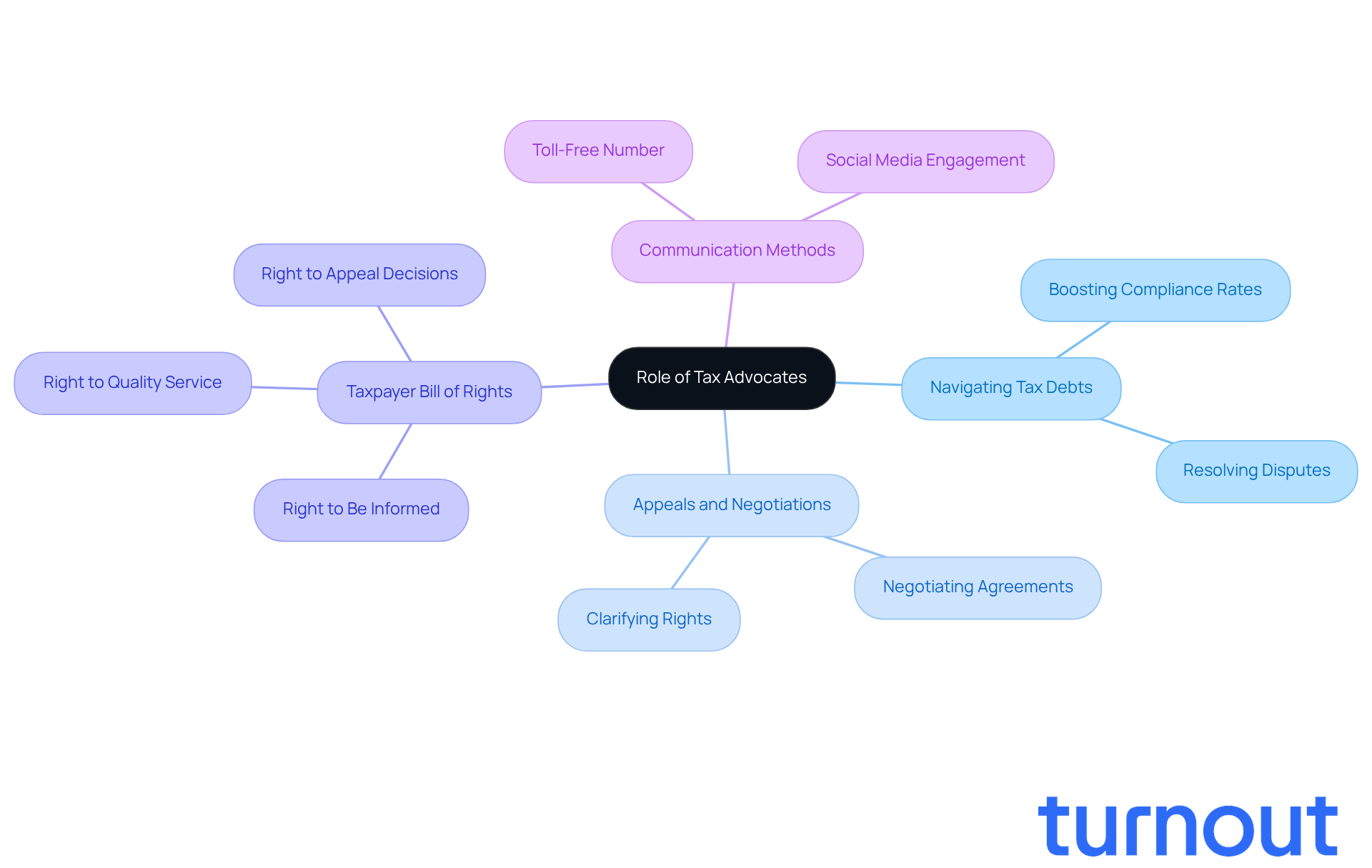

Understand the Role of Tax Advocates

Tax advocates near me play a crucial role in bridging the gap between individuals and tax authorities. They’re here to help you navigate the often overwhelming world of tax debts, disputes, compliance, and to connect you with tax advocates near me. With their deep understanding of tax laws, tax advocates near me guide you through the complexities of the tax system, ensuring you feel supported every step of the way.

Imagine having tax advocates near me to help with appeals, negotiate agreements, and clarify your rights as outlined in the Taxpayer Bill of Rights. This Bill is designed to protect you, fostering transparency and accountability in tax administration.

The primary goal of tax advocates near me is to champion your best interests, making the tax process less daunting and more manageable. Research shows that their successful interventions can significantly boost compliance rates, helping you understand your obligations and navigate the system with confidence. For instance, tax advocates near me, like the Taxpayer Advocate Service (TAS), offer free advocacy services to those facing financial hardships, ensuring you receive the support you need to tackle your challenges. They even use various communication methods, like a toll-free number and social media, to keep you informed and engaged.

Tax experts highlight the essential role of tax advocates near me in defending your rights and building trust in the IRS. Their efforts can lead to better outcomes for the public, as they work tirelessly to resolve disputes and clarify complex regulations. Additionally, TAS addresses systemic issues that affect many taxpayers, contributing to improvements in the overall tax system.

Ultimately, tax advocates near me are essential resources that empower you to take control of your tax situation and achieve favorable resolutions. Remember, you are not alone in this journey. We're here to help you every step of the way.

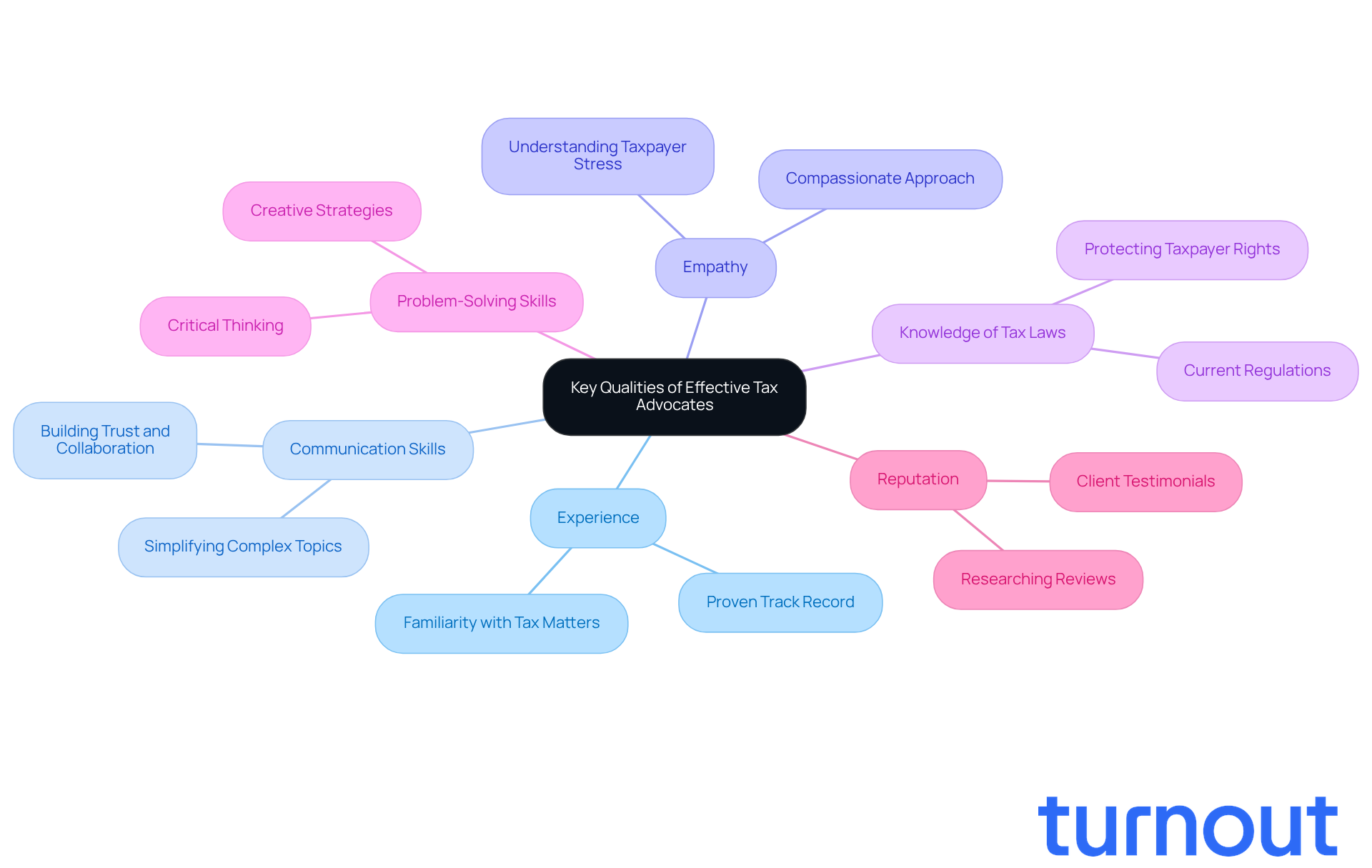

Identify Key Qualities of Effective Tax Advocates

When searching for a tax advocate, it’s important to consider a few key qualities that can make a real difference in your experience:

-

Experience: Look for advocates who have a proven track record in handling cases similar to yours. Their familiarity with specific tax matters can greatly influence the outcome of your situation. The Taxpayer Advocate Service (TAS) emphasizes that representatives should have a background in customer service and tax law, which is crucial for effective representation.

-

Communication Skills: It’s essential that your representative can explain complex tax topics in simple terms. Strong communication skills ensure you fully understand your situation and the steps needed to resolve it. Many successful tax advocates highlight that clear communication builds trust and collaboration, which are vital in navigating tax challenges.

-

Empathy: A good representative understands the stress that tax issues can bring and approaches each case with compassion. This quality is especially important given the difficulties many face when dealing with tax matters, as seen in the ongoing challenges at the Richmond TAS office.

-

Knowledge of Tax Laws: Make sure your advocate is well-versed in current tax laws and regulations. This expertise is key to effectively navigating the complexities of tax advocacy and ensuring your rights are protected.

-

Problem-Solving Skills: The ability to think critically and devise strategies to tackle challenges is essential. Advocates who can creatively address issues are more likely to achieve favorable outcomes, especially considering the systemic problems many taxpayers encounter.

-

Reputation: Take the time to research reviews and testimonials from past clients. A strong reputation often reflects a representative’s dedication to their clients and their ability to deliver results.

By focusing on these qualities, you can find tax advocates near me who will genuinely assist you in navigating your tax challenges. Remember, you’re not alone in this journey, and the right advocate can make all the difference.

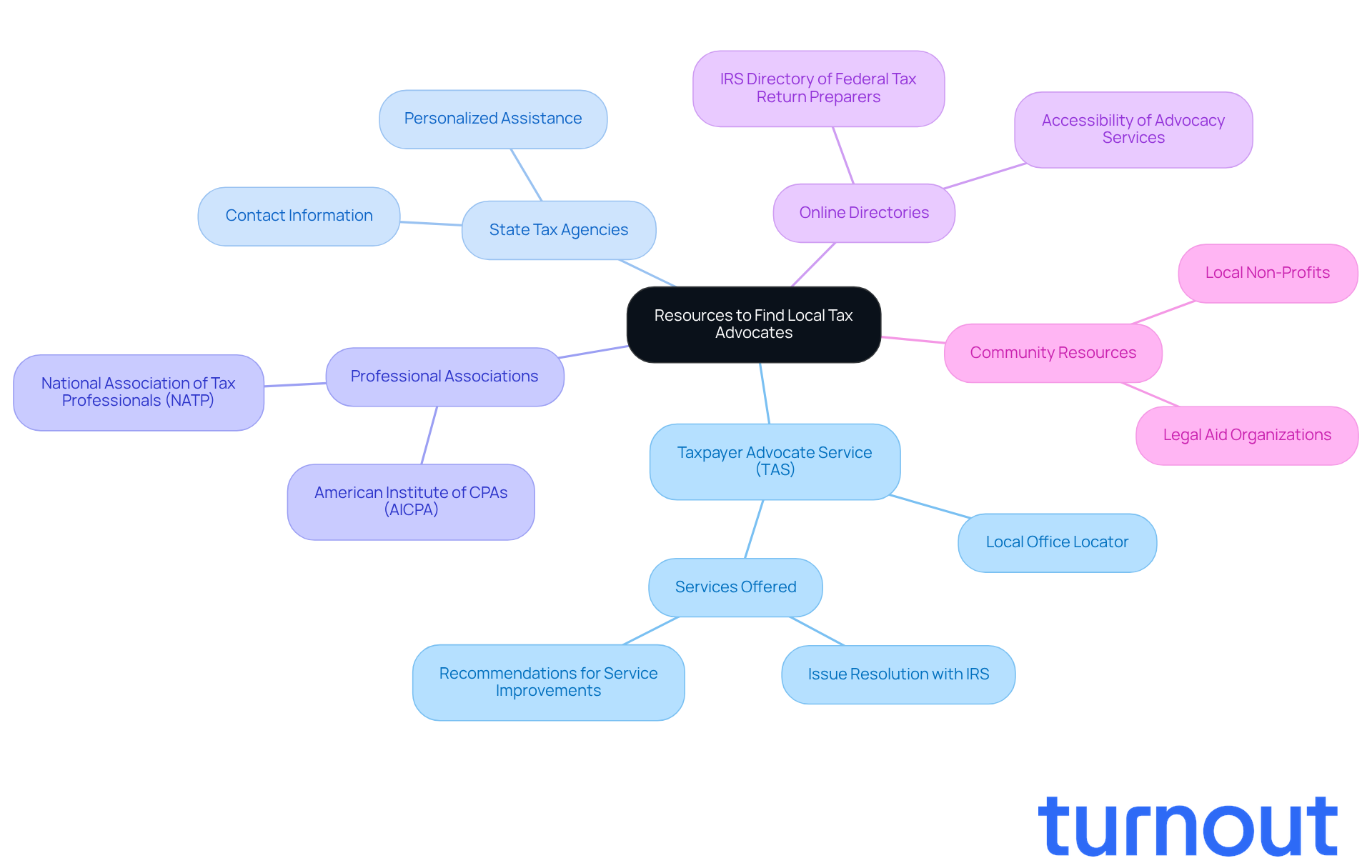

Explore Resources to Find Local Tax Advocates

Finding tax advocates near me can feel overwhelming, but you’re not alone in this journey. Here are some resources that can help you navigate your tax concerns with care and support:

-

Taxpayer Advocate Service (TAS): Visit the TAS website to find a nearby office. They offer a range of services designed to assist you in managing complicated tax matters. As Grant A. Driessen notes, TAS's mission is to help individuals resolve issues with the IRS and recommend improvements to enhance services for taxpayers like you.

-

State Tax Agencies: Many states have dedicated support offices for taxpayers. Check your state’s department of revenue website for contact information and details on available services. Research shows that these state taxpayer support offices can significantly impact tax resolution by providing personalized assistance tailored to your needs.

-

Professional Associations: Organizations such as the National Association of Tax Professionals (NATP) and the American Institute of CPAs (AICPA) maintain directories of qualified tax professionals. These experts can serve as tax advocates near me, providing the advocacy and support you need while ensuring you connect with certified professionals who understand the complexities of tax issues.

-

Online Directories: The IRS's Directory of Federal Tax Return Preparers is a valuable tool for finding tax advocates near me and other tax preparers in my area. This resource helps ensure you connect with certified professionals. A study on taxpayer opinions of IRS online accounts highlights how accessible advocacy services can make navigating tax complexities easier.

-

Community Resources: Local non-profits and legal aid organizations often run tax assistance programs or can refer you to trustworthy representatives. They provide additional support as you work through your tax resolution journey.

Remember, seeking help is a strong step forward. You deserve support, and these resources are here to guide you.

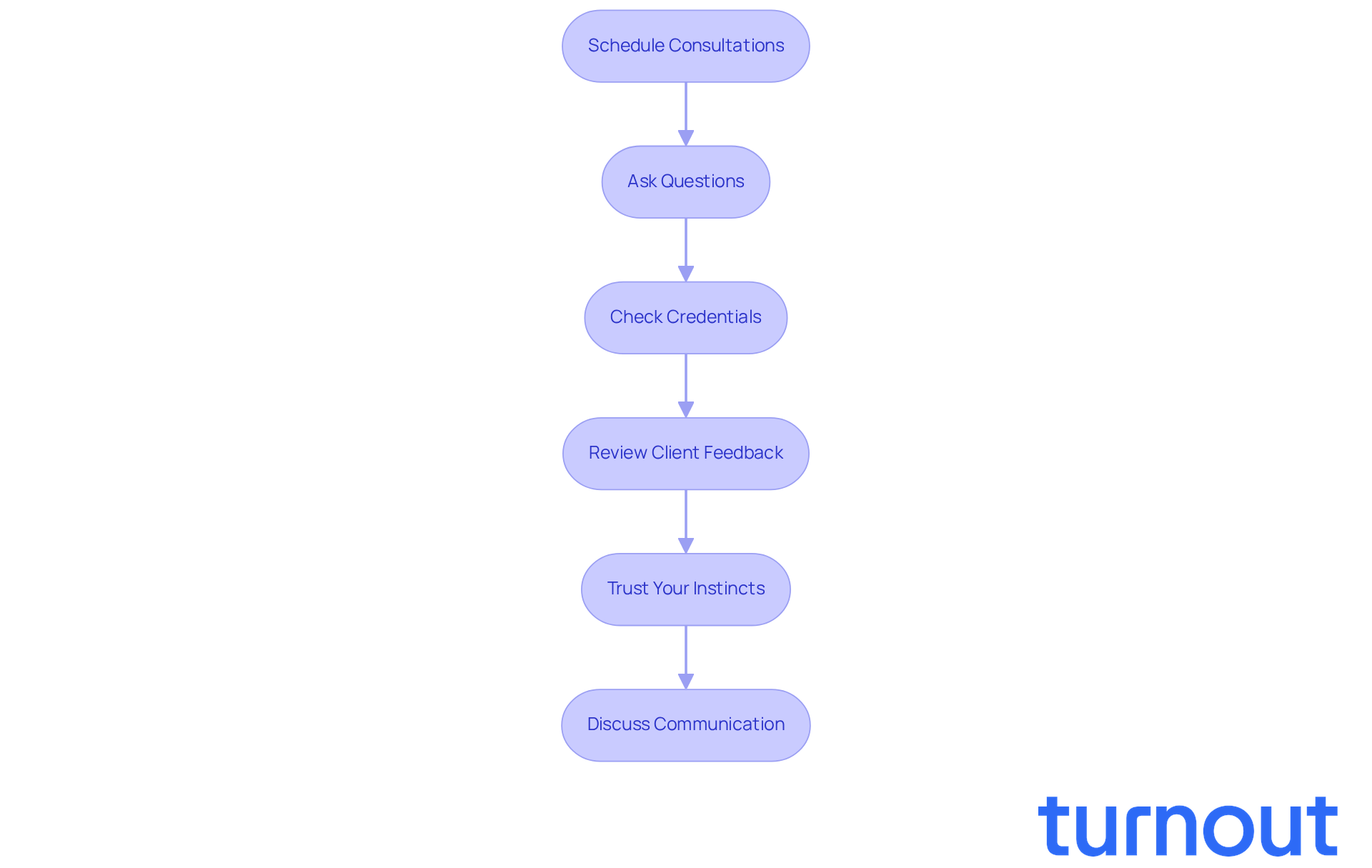

Evaluate and Choose the Right Tax Advocate

Finding tax advocates near me can feel overwhelming, but you’re not alone in this journey. Here’s how to evaluate potential supporters with care:

-

Schedule Consultations: Many representatives offer free initial consultations. This is a great chance to discuss your case and see how they approach your needs.

-

Ask Questions: Don’t hesitate to inquire about their experience with cases like yours, their success rates, and how they structure their fees. It’s important to feel informed.

-

Check Credentials: Verify their qualifications. For instance, Turnout employs trained nonlawyer representatives for SSD claims and IRS-licensed enrolled agents for tax debt relief. Remember, Turnout isn’t a law firm and doesn’t provide legal representation.

-

Review Client Feedback: Look for reviews or testimonials from previous clients. Their experiences can give you insight into what to expect.

-

Trust Your Instincts: Choose a supporter you feel comfortable with. Your comfort is key in this process.

-

Discuss Communication: Ensure your advocate is committed to keeping you informed throughout the process and is accessible for any questions you may have.

We understand that seeking help can be daunting, but taking these steps can lead you to tax advocates near me for the right support. Remember, you deserve to feel confident and supported every step of the way.

Conclusion

Navigating the complexities of the tax system can feel overwhelming, but you don’t have to face it alone. Tax advocates are here to serve as your essential allies, offering invaluable support when you encounter challenges with tax debts, disputes, or compliance issues. Their expertise not only helps to demystify tax laws but also empowers you to assert your rights and achieve favorable outcomes. With the right tax advocate by your side, the daunting journey through tax issues becomes significantly more manageable.

We understand that finding the right support can be daunting. Key qualities of effective tax advocates include:

- Experience

- Strong communication skills

- Empathy

- Problem-solving abilities

These attributes are crucial in ensuring that you receive personalized assistance tailored to your unique situation. Additionally, various resources, such as the Taxpayer Advocate Service, state tax agencies, and professional associations, can guide you in finding qualified advocates who can provide the necessary support.

Ultimately, seeking the help of a tax advocate is a proactive step toward regaining control over your tax situation. By utilizing the resources mentioned and focusing on the essential qualities of a good advocate, you can confidently navigate your tax challenges. Remember, assistance is available, and taking the initiative to find the right advocate can lead to a smoother, more informed experience in managing your tax matters. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is the role of tax advocates?

Tax advocates play a crucial role in helping individuals navigate tax debts, disputes, and compliance issues, providing support and guidance through the complexities of the tax system.

How do tax advocates assist with tax disputes?

Tax advocates assist by helping with appeals, negotiating agreements, and clarifying taxpayers' rights as outlined in the Taxpayer Bill of Rights.

What is the Taxpayer Bill of Rights?

The Taxpayer Bill of Rights is designed to protect taxpayers, fostering transparency and accountability in tax administration.

What are the benefits of working with tax advocates?

Tax advocates can significantly boost compliance rates, help individuals understand their obligations, and make the tax process less daunting and more manageable.

Who provides free advocacy services?

The Taxpayer Advocate Service (TAS) offers free advocacy services to individuals facing financial hardships.

How can taxpayers contact tax advocates?

Tax advocates, such as TAS, use various communication methods, including a toll-free number and social media, to keep taxpayers informed and engaged.

What systemic issues do tax advocates address?

Tax advocates address systemic issues affecting many taxpayers, contributing to improvements in the overall tax system.

Why are tax advocates important for taxpayers?

Tax advocates are essential resources that empower taxpayers to take control of their tax situations and achieve favorable resolutions, ensuring they do not feel alone in the process.