Introduction

Navigating the world of tax preparation services can feel overwhelming for small business owners. We understand that the complexities of tax regulations and the multitude of options available can create confusion and stress. This article aims to shed light on the essential criteria for evaluating these services, emphasizing the benefits that can significantly impact your business's financial health.

As the stakes rise, it’s common to wonder: how can you ensure that you select the right tax preparation service? One that not only meets your immediate needs but also supports your long-term growth? We're here to help you explore these important considerations, so you can make an informed decision that feels right for you.

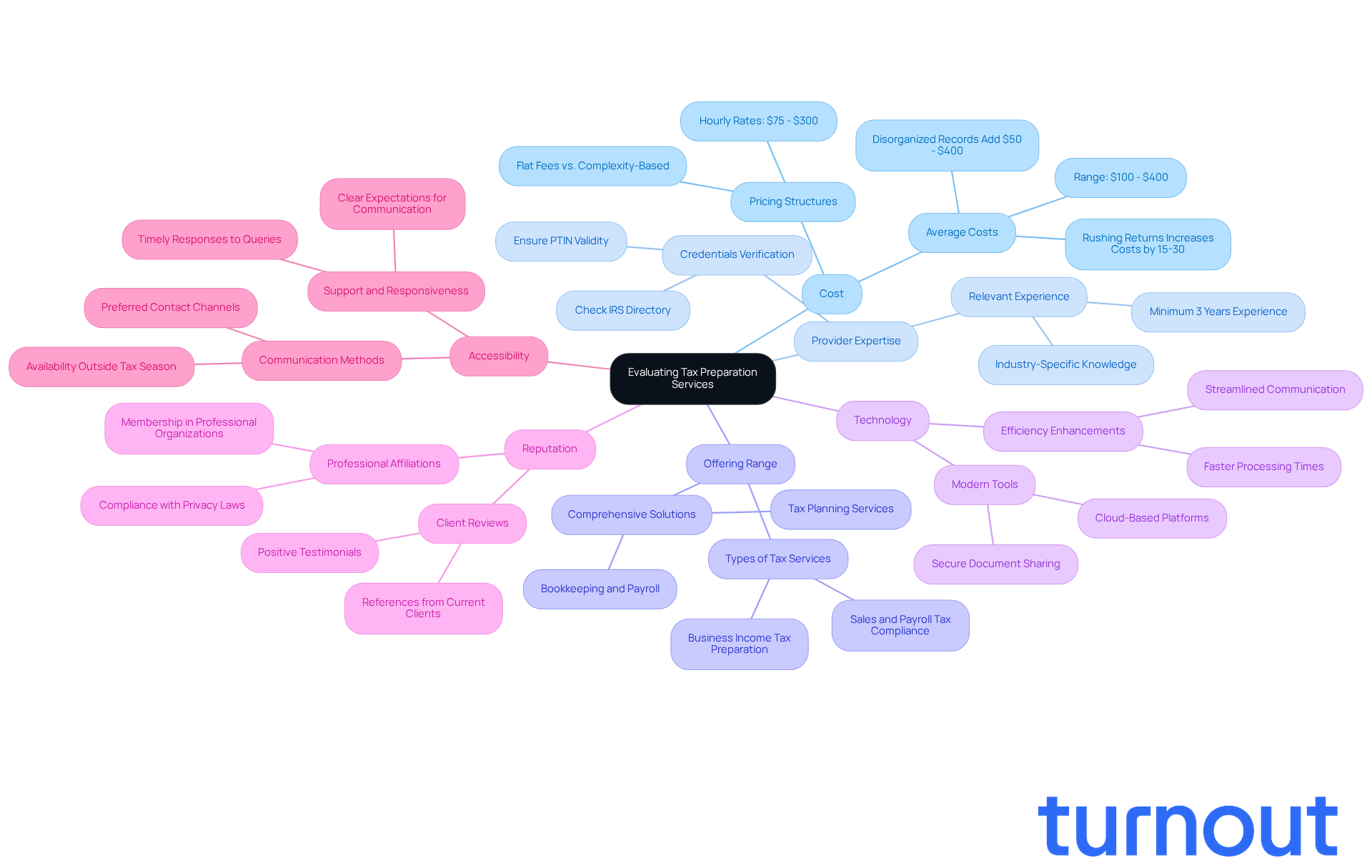

Key Criteria for Evaluating Tax Preparation Services

We understand that finding the right tax preparation services for small business can feel overwhelming. You want to make sure you’re making the best choice for your financial well-being. Here are some key criteria to consider:

-

Cost: Understanding the pricing structure is crucial. Services may charge flat fees or base their rates on the complexity of the return, with average costs ranging from $100 to $400. It’s important to note that rushing a return in the last 30 days can increase costs by 15-30%. Additionally, many small business clients end up paying an extra $50 to $400 due to disorganized recordkeeping. Keeping your financial documents orderly can save you money and stress.

-

Look for providers who offer tax preparation services for small business. They should be well-versed in relevant deductions and credits, as well as industry-specific tax considerations that can significantly impact your tax liability. A qualified tax expert can also represent your business if the IRS reaches out regarding a tax issue, adding an extra layer of reassurance.

-

Offering Range: Assess whether the service includes comprehensive solutions, such as bookkeeping, payroll, and tax planning. Tax preparers typically offer a variety of options, including business income tax preparation, sales tax filings, and payroll tax compliance. These services can help you optimize your financial management and ensure you’re adhering to tax regulations.

-

Technology: Consider if the service utilizes modern technology for efficiency. Cloud-based platforms can make it easier to access documents and enhance communication, streamlining the tax preparation process.

-

Reputation: Investigate reviews and testimonials to gauge the reliability and effectiveness of the service. A skilled tax preparer should have a strong track record, with many clients expressing satisfaction. It’s also wise to check the IRS Directory of Preparers to verify the credentials of qualified tax professionals.

-

Accessibility: Ensure that the service is easily reachable for any questions or support throughout the tax preparation process. Effective communication is vital for a smooth tax season and informed decision-making. Different preparers have varying preferred communication methods, which can impact your overall satisfaction.

Remember, you’re not alone in this journey. Finding the right tax preparation services for small business can make a significant difference in your business’s financial health. We’re here to help you navigate this process with confidence.

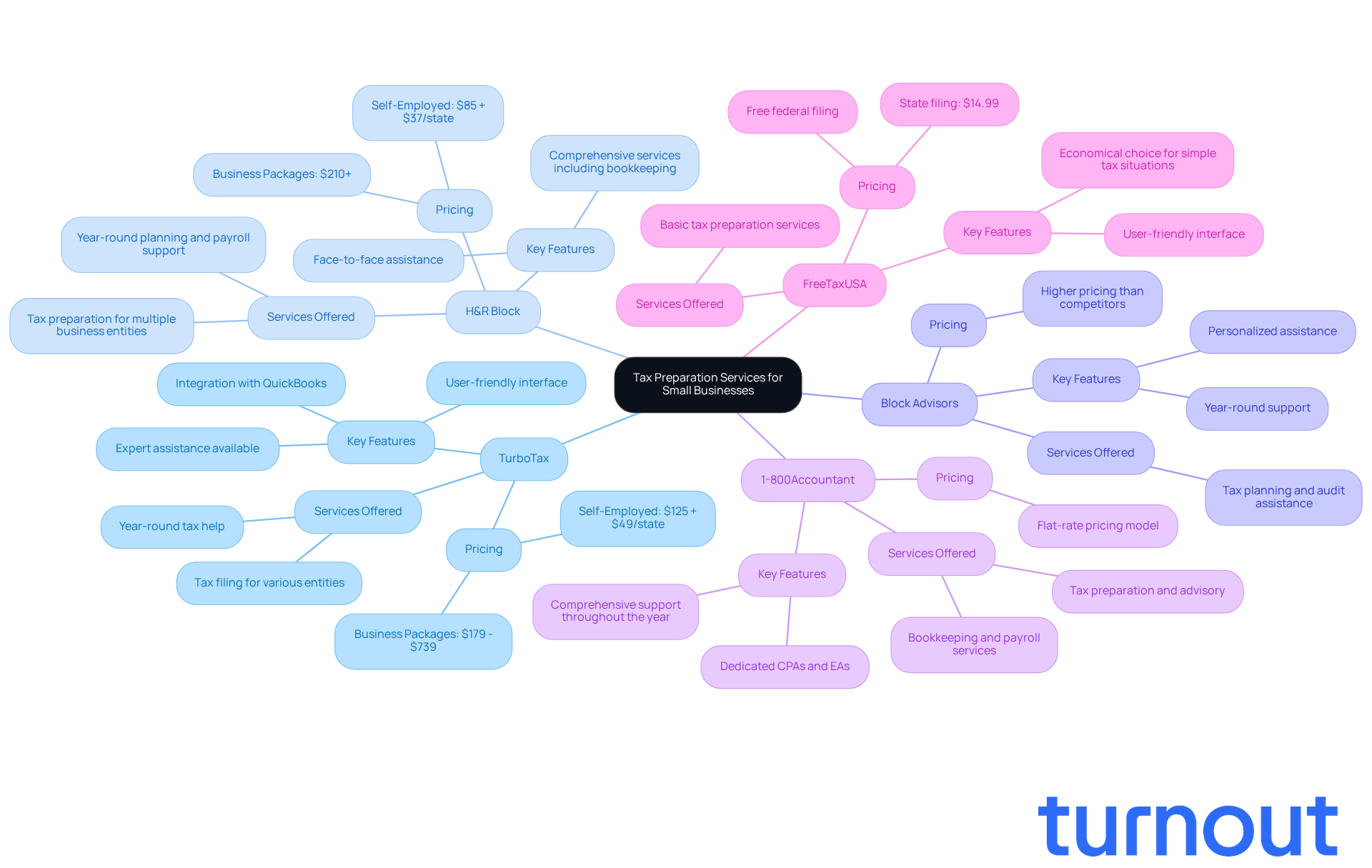

Service Offerings: What Each Provider Brings to the Table

Navigating tax preparation services for small business can feel overwhelming, especially for small business owners. Here’s a comparison of some leading tax preparation providers that can help lighten your load:

-

TurboTax: This user-friendly platform offers various tiers tailored to different business needs, including options for self-employed individuals and small businesses. With pricing ranging from $219 to $739, TurboTax provides extensive resources to help maximize your deductions. It’s no wonder many entrepreneurs choose TurboTax for their tax needs.

-

H&R Block: Known for its face-to-face assistance, H&R Block also offers online solutions. They offer tax preparation services for small business, going beyond that by providing bookkeeping and payroll services, making them a comprehensive option for small enterprises. Starting at $210, H&R Block has been recognized as the top overall tax software for businesses, ensuring you have the support you need.

If you’re looking for personalized assistance, Block Advisors focuses on providing tax preparation services for small business. They offer year-round support, including tax planning and audit assistance, helping you navigate complex tax situations with confidence.

-

1-800Accountant: This provider offers a full range of services, including bookkeeping, payroll, and tax preparation, specifically designed for small businesses. Their dedicated approach ensures you receive comprehensive support throughout the year, including tax preparation services for small business, so you’re never alone in this journey.

-

FreeTaxUSA: For those seeking an economical choice, FreeTaxUSA provides free federal filing and an easy-to-use interface, perfect for small businesses with straightforward tax situations.

Upcoming Tax Deadlines: It’s important to stay informed about key tax deadlines. Small business owners should mark their calendars for September 15, 2025, for Q3 quarterly tax estimates, and October 15, 2025, for extended filing deadlines. Being aware of these dates is crucial for timely tax preparation and compliance.

Remember, you’re not alone in this process. We’re here to help you navigate your tax preparation with ease.

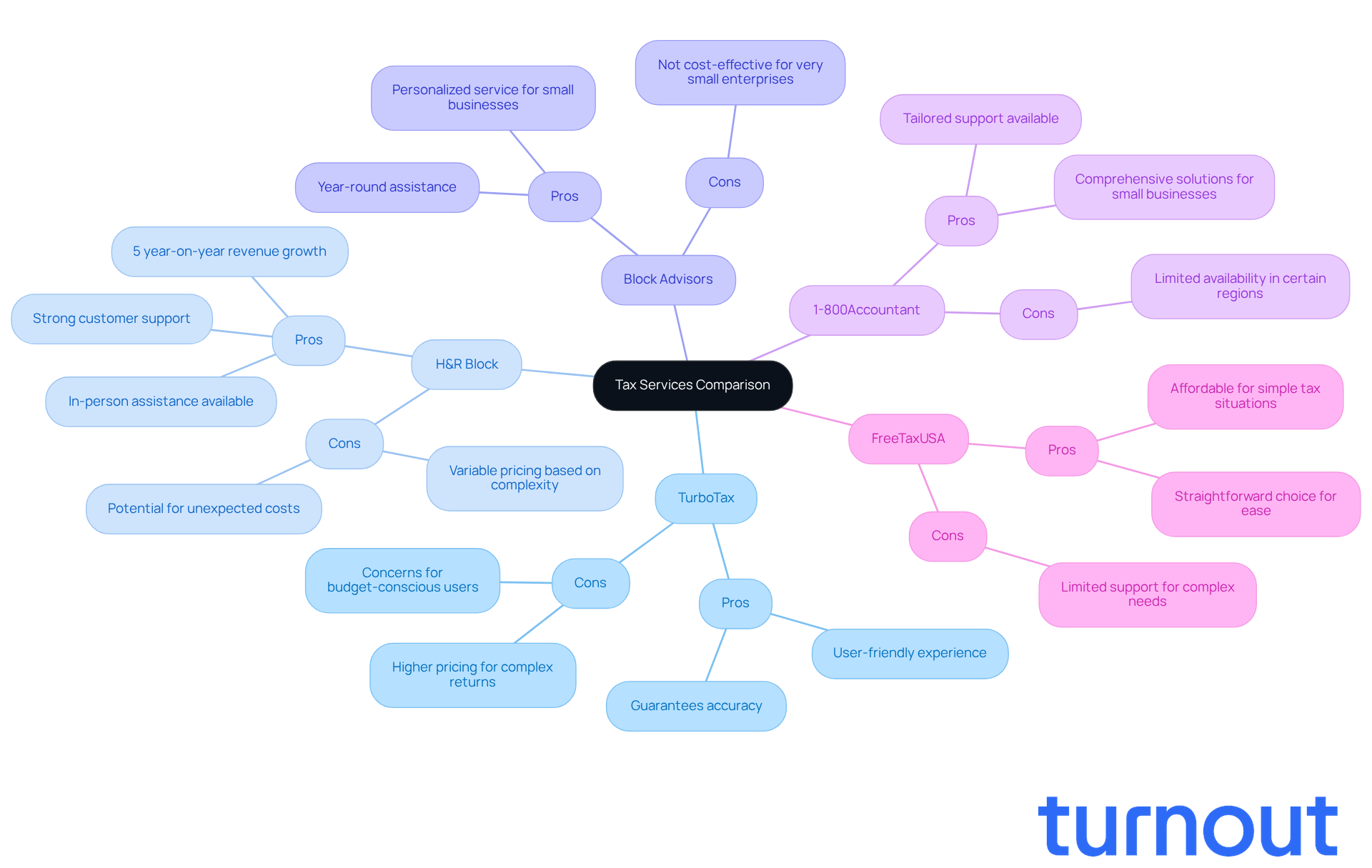

Pros and Cons: Weighing the Strengths and Weaknesses of Each Service

TurboTax:

- Pros: If you’re looking for a user-friendly experience, TurboTax shines with its intuitive interface and extensive resources. It guarantees accuracy, making it a comforting choice for many individuals navigating tax season.

- Cons: However, it’s important to note that pricing can be higher than some competitors, especially for more complex returns. This might be a concern for those on a tighter budget.

H&R Block:

- Pros: H&R Block is well-known for its strong customer support and the option for in-person assistance. They offer a comprehensive range of services tailored to various needs. Recently, they reported a Q3 CY2025 revenue of $203.6 million, reflecting a 5% year-on-year growth. This shows their solid market position. Management is committed to investing in AI-powered solutions and focusing on higher-value clients, which enhances their competitive edge.

- Cons: On the flip side, pricing can vary significantly based on the complexity of your return, which might lead to unexpected costs for some clients. It’s common to feel uncertain about these fluctuations.

Block Advisors:

- Pros: For small business owners seeking ongoing support, Block Advisors offers personalized service and year-round assistance. This can be a real relief when you need consistent help.

- Cons: However, it may not be the most cost-effective option for very small enterprises, which could limit its appeal for those just starting out.

1-800Accountant:

- Pros: This service provides comprehensive solutions specifically designed for small businesses, ensuring that your unique needs are met. It’s reassuring to know that tailored support is available.

- Cons: That said, availability might be limited in certain regions, which could restrict access for some potential clients. We understand how frustrating that can be.

FreeTaxUSA:

- Pros: If you have a simple tax situation, FreeTaxUSA is an affordable and straightforward choice. It’s a great option for individuals looking for ease and simplicity.

- Cons: However, it does offer limited support for more complex tax needs, which may not meet everyone’s requirements. You’re not alone if you find yourself needing more assistance.

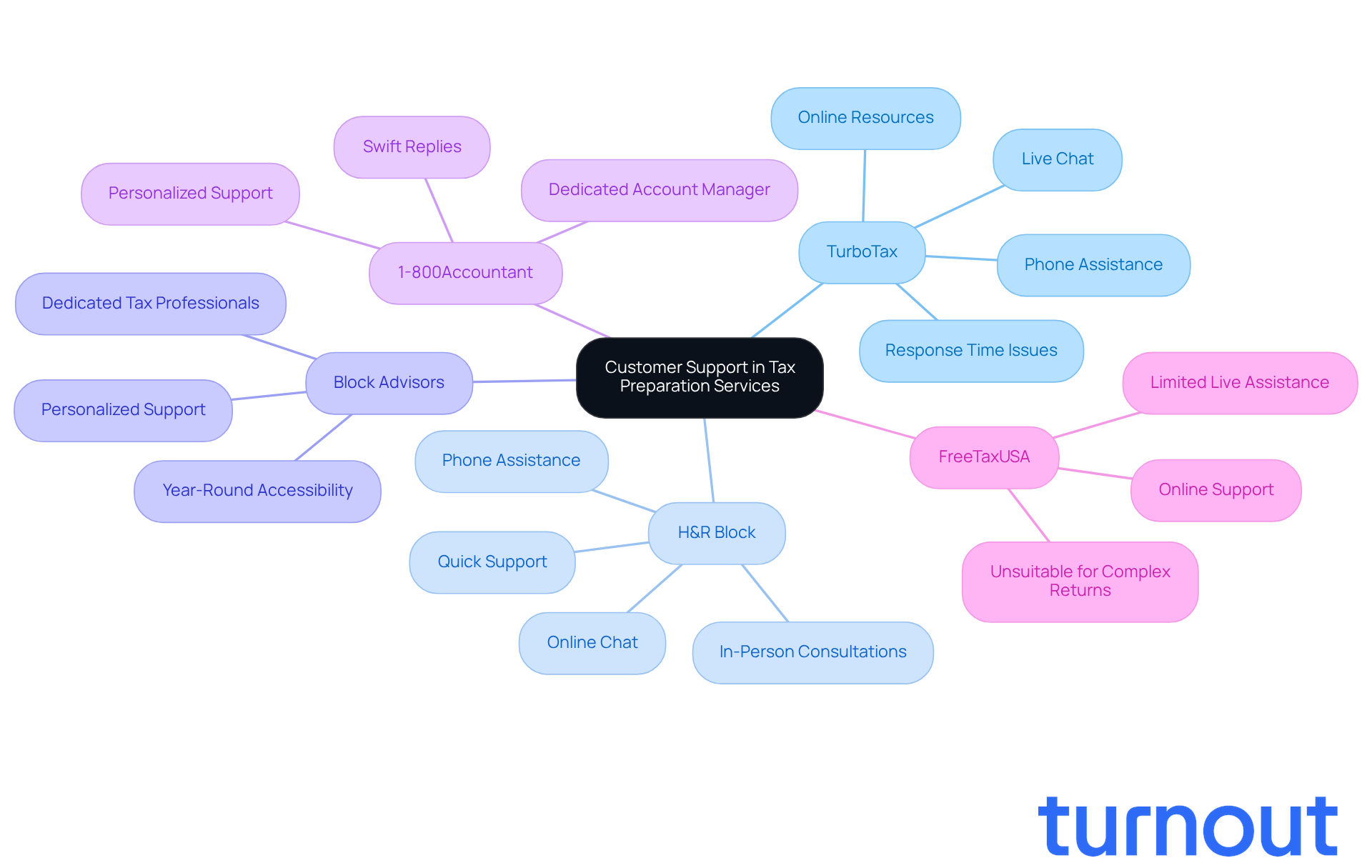

Customer Support and Accessibility: Evaluating Client Assistance

Evaluating customer support and accessibility in tax preparation services for small business is essential for small enterprises navigating the complexities of tax systems. We understand that 47% of Americans find the tax system frustratingly complex, and that can feel overwhelming.

- TurboTax: Known for its extensive online resources, TurboTax offers live chat support and phone assistance. However, during peak seasons, response times can fluctuate, which may lead to delays in resolving issues. It's common to feel anxious when waiting for help.

- H&R Block: This organization stands out for its robust customer support, providing in-person consultations, online chat, and phone assistance. Customers often praise H&R Block for its quick support, which is crucial for timely assistance when you need it most.

- Block Advisors: Focused on personalized support, Block Advisors assigns dedicated tax professionals to clients, ensuring accessibility year-round. This fosters a strong client-advisor relationship, making you feel valued and understood.

- 1-800Accountant: This solution enhances the client experience by offering a dedicated account manager for each client, ensuring personalized support and swift replies to inquiries. You deserve that level of attention.

- FreeTaxUSA: While it offers primarily online support, the limited live assistance may not meet the needs of clients requiring more hands-on help. If you're unfamiliar with tax processes, this might not be the best fit for you.

Furthermore, the IRS has made notable enhancements in client support and operations since 2022, thanks to funding from President Biden’s Inflation Reduction Act. This improvement aims to enhance the overall customer experience in tax preparation offerings. When assessing these options, it's crucial to consider how effectively they address your needs, especially regarding accessibility and responsiveness, including the availability of tax preparation services for small business. These elements greatly influence your overall experience with tax preparation services for small business.

The tax preparation services for small business industry in the US has experienced a growth rate of 2.9% CAGR over the past five years, leading to an estimated revenue of $14.5 billion by 2025. This indicates a competitive landscape where you have choices. Resources like the Volunteer Income Tax Assistance (VITA) program, which offers free tax help to individuals making $64,000 or less, persons with disabilities, and taxpayers with limited English proficiency, are also available to assist those in need. Remember, you are not alone in this journey.

Significantly, taxpayers waited an average of just over three minutes for assistance on the IRS main phone lines, reflecting enhancements in customer support. We're here to help you navigate these options and find the support you need.

Final Thoughts: Choosing the Right Tax Preparation Service for Your Business

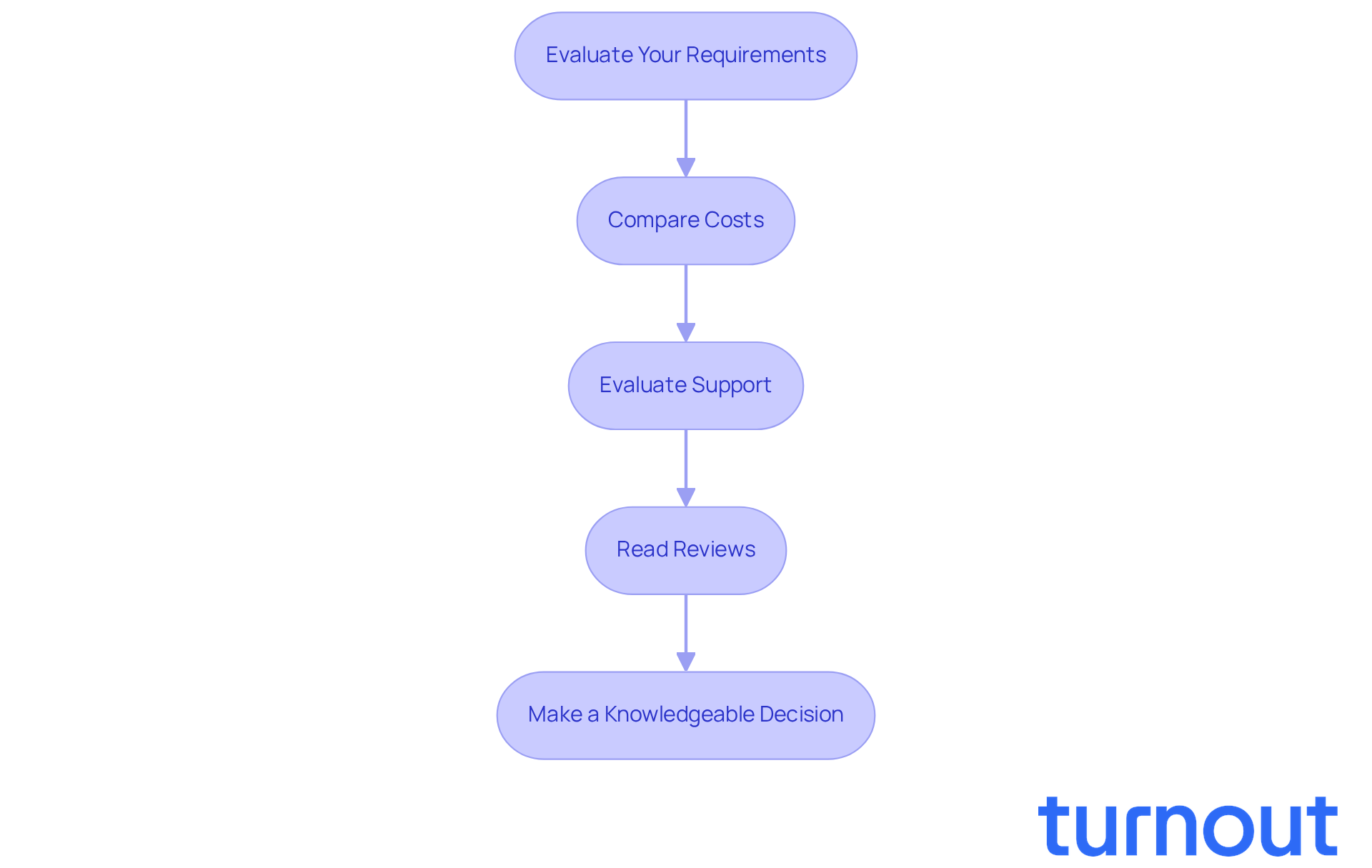

Choosing the right tax preparation services for small business can feel overwhelming, but you’re not alone in this journey. Let’s break it down together:

-

Evaluate Your Requirements: Start by understanding the complexity of your tax situation and the help you truly need. With more Americans juggling multiple income streams, it’s essential to pinpoint your specific needs. We understand that this can be a daunting task, but clarity will guide you.

-

Compare Costs: Take a close look at the pricing structures of different providers and what services they include. As competition grows, especially with the rise of electronic filing options, it’s vital to ensure you’re getting good value for your investment. Remember, it’s okay to ask questions about what you’re paying for.

-

Evaluate Support: Think about the level of customer support you might require during tax season. A responsive support system can ease the stress, especially for small business owners who have shown incredible resilience in tough times. You deserve to feel supported throughout this process.

-

Read Reviews: Look into customer experiences to gauge the reliability and effectiveness of each service. Positive feedback can be a reassuring sign that a provider can meet your needs. Did you know that 96% of individuals who work with a tax professional feel more confident about filing their taxes? That’s a comforting statistic!

-

Make a Knowledgeable Decision: Use the insights you’ve gathered to select an option that aligns with your goals and offers the support you need. Keep in mind that the Southeast region is a hub for tax preparation, which might influence your choices based on where you’re located.

By considering these factors, you can confidently choose tax preparation services for small business that not only address your immediate needs but also support your long-term business aspirations. Remember, we’re here to help you every step of the way.

Conclusion

Choosing the right tax preparation service for your small business is a crucial decision that can greatly impact your financial health and compliance. We understand that this process can feel overwhelming, but by considering key factors like cost, range of services, technology use, and customer support, you can make informed choices that truly align with your needs. This thoughtful approach not only eases the stress of tax season but also fosters a supportive partnership that benefits your business throughout the year.

Key insights from this evaluation highlight the importance of:

- Understanding pricing structures

- Assessing the qualifications of tax professionals

- Reviewing the reputation of service providers

We’ve looked at several prominent options, including:

- TurboTax

- H&R Block

- Block Advisors

- 1-800Accountant

- FreeTaxUSA

Each of these services offers unique advantages and limitations. By comparing these options, you can find a solution that meets your immediate tax preparation needs while also supporting your long-term financial goals.

Ultimately, the significance of choosing the right tax preparation service cannot be overstated. It’s essential to approach this decision with care and clarity, ensuring that your business receives the best possible support. As the landscape of tax preparation services continues to evolve, staying informed about trends and available options will empower you to navigate your tax responsibilities with confidence and ease. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What are the key criteria for evaluating tax preparation services for small businesses?

Key criteria include cost, provider expertise in small business tax issues, offering range (like bookkeeping and payroll), use of modern technology, reputation, and accessibility for communication.

How much do tax preparation services typically cost?

Costs generally range from $100 to $400, depending on the complexity of the return. Rushing a return in the last 30 days can increase costs by 15-30%, and disorganized recordkeeping may add an extra $50 to $400.

Why is it important to choose a provider knowledgeable about small business taxes?

A knowledgeable provider can help identify relevant deductions and credits, address industry-specific tax considerations, and represent your business in case of IRS inquiries.

What types of services should I look for in a tax preparation provider?

Look for providers offering comprehensive solutions, including business income tax preparation, sales tax filings, payroll tax compliance, bookkeeping, and tax planning.

How does technology play a role in tax preparation services?

Utilizing modern technology, such as cloud-based platforms, enhances efficiency by making document access easier and improving communication during the tax preparation process.

How can I assess the reputation of a tax preparation service?

Investigate reviews and testimonials from clients, check the IRS Directory of Preparers for credentials, and look for a strong track record of client satisfaction.

Why is accessibility important when choosing a tax preparation service?

Effective communication and easy access to support are vital for a smooth tax preparation process and for making informed decisions throughout the tax season.

What are some notable tax preparation providers for small businesses?

Notable providers include TurboTax, H&R Block, Block Advisors, 1-800Accountant, and FreeTaxUSA, each offering various services and pricing options.

What are the price ranges for some popular tax preparation services?

TurboTax ranges from $219 to $739, H&R Block starts at $210, and FreeTaxUSA offers free federal filing for straightforward tax situations.

What are the upcoming tax deadlines for small businesses?

Key deadlines include September 15, 2025, for Q3 quarterly tax estimates and October 15, 2025, for extended filing deadlines.