Overview

Navigating the world of Social Security Disability Insurance (SSDI) can feel overwhelming. We understand that many individuals face challenges when trying to estimate their benefits. That’s why we’ve created a five-step process to help you through this journey.

- First, it’s crucial to grasp the eligibility criteria. Knowing whether you qualify can ease some of the stress.

- Next, calculating your Average Indexed Monthly Earnings (AIME) is essential. This figure plays a significant role in determining your benefits.

As you explore this process, consider the various factors that can affect your payment amounts. It’s common to feel uncertain about what documentation you’ll need. Rest assured, we provide detailed explanations to guide you through the necessary paperwork and calculations.

Our goal is to ensure you can accurately assess your potential benefits. Remember, you are not alone in this journey. We’re here to help you every step of the way, offering support as you complete your application. Together, we can navigate this process with confidence.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming, especially for those facing health challenges. We understand that understanding eligibility, benefit calculations, and the necessary documentation is crucial for securing the financial support SSDI offers. But what happens when the process feels daunting, and the stakes are high?

This guide is here to help. It breaks down the essential steps to estimate SSDI benefits, providing clarity and support for those seeking to understand their entitlements in a system that often seems complicated and inaccessible. Remember, you are not alone in this journey. We're here to guide you through it.

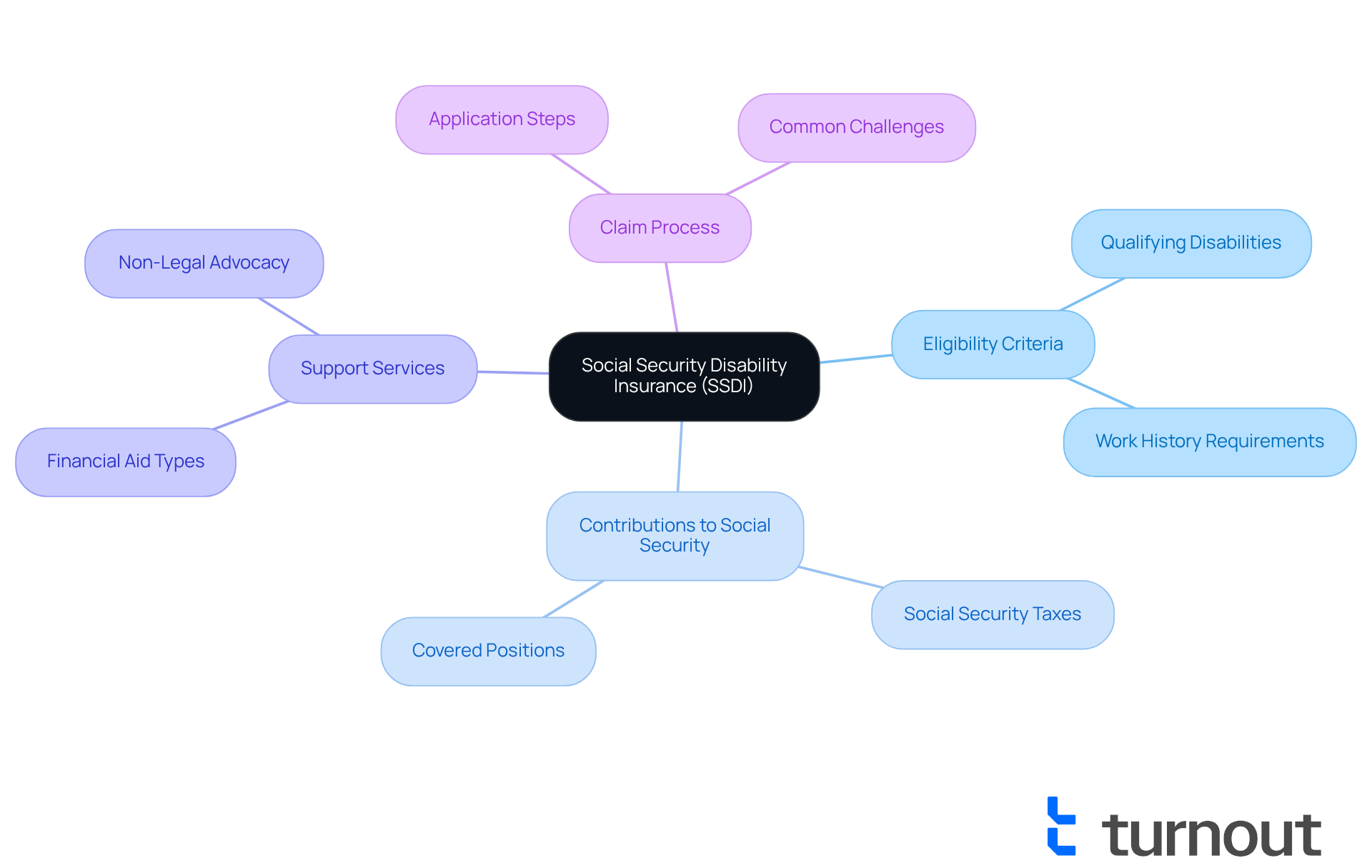

Understand Social Security Disability Insurance (SSDI)

Disability Insurance is a vital federal initiative designed to provide financial support for individuals who can’t work due to a qualifying disability. We understand that navigating this process can feel overwhelming, especially when health issues arise. To qualify for disability benefits, you need to have worked in positions covered by Social Security and contributed to Social Security taxes. This program is here to support those who have given to the system and now find themselves in need.

At our organization, we’re dedicated to streamlining your access to governmental assistance and financial aid. We’re here to help you manage the complexities of disability claims, ensuring you don’t have to face this journey alone. It’s important to remember that Turnout is not a law firm, and the information we provide isn’t legal advice. Understanding the basics of Social Security Disability Insurance, including eligibility criteria and benefits, is essential for obtaining a social security disability estimate of what you may be entitled to.

Our compassionate non-legal advocates are ready to assist you through the disability benefits process. We’re committed to ensuring you receive the support you deserve. You are not alone in this journey; we’re here to help every step of the way.

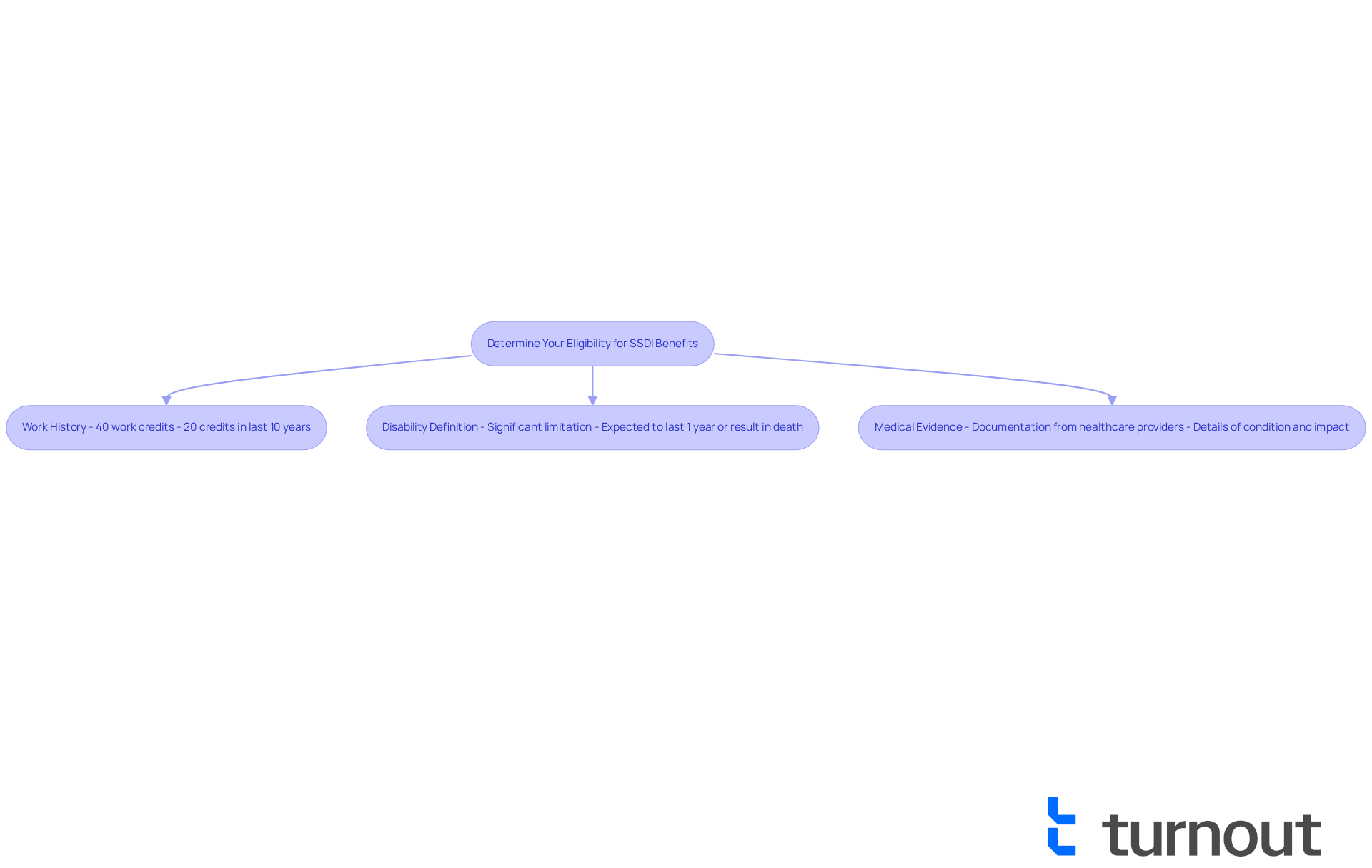

Determine Your Eligibility for SSDI Benefits

Determining your eligibility for a social security disability estimate can feel overwhelming, but we're here to help you navigate the process. To qualify, you need to meet several important criteria:

-

Work History: You should have worked a certain number of years in positions covered by Security. Typically, this means earning 40 work credits, with at least 20 of those credits earned in the last 10 years.

-

Disability Definition: Your condition must align with the Social Security Administration's definition of disability. This means it should significantly limit your ability to perform basic work activities and is expected to last at least one year or result in death.

-

Medical Evidence: It's essential to provide medical documentation that supports your claim of disability. This includes records from healthcare providers that detail your condition and its impact on your daily life.

We understand that navigating this process can be challenging. Our service is designed to streamline your access to these benefits, offering expert guidance and support during the SSD claims process. Our trained nonlawyer advocates are here to assist you in understanding the requirements and gathering the necessary documentation.

Please remember, Turnout is not a law firm, and the services we provide do not constitute legal advice. Evaluating these elements will help you determine your eligibility for the disability support you deserve, as well as your social security disability estimate. You are not alone in this journey; we’re here to support you every step of the way.

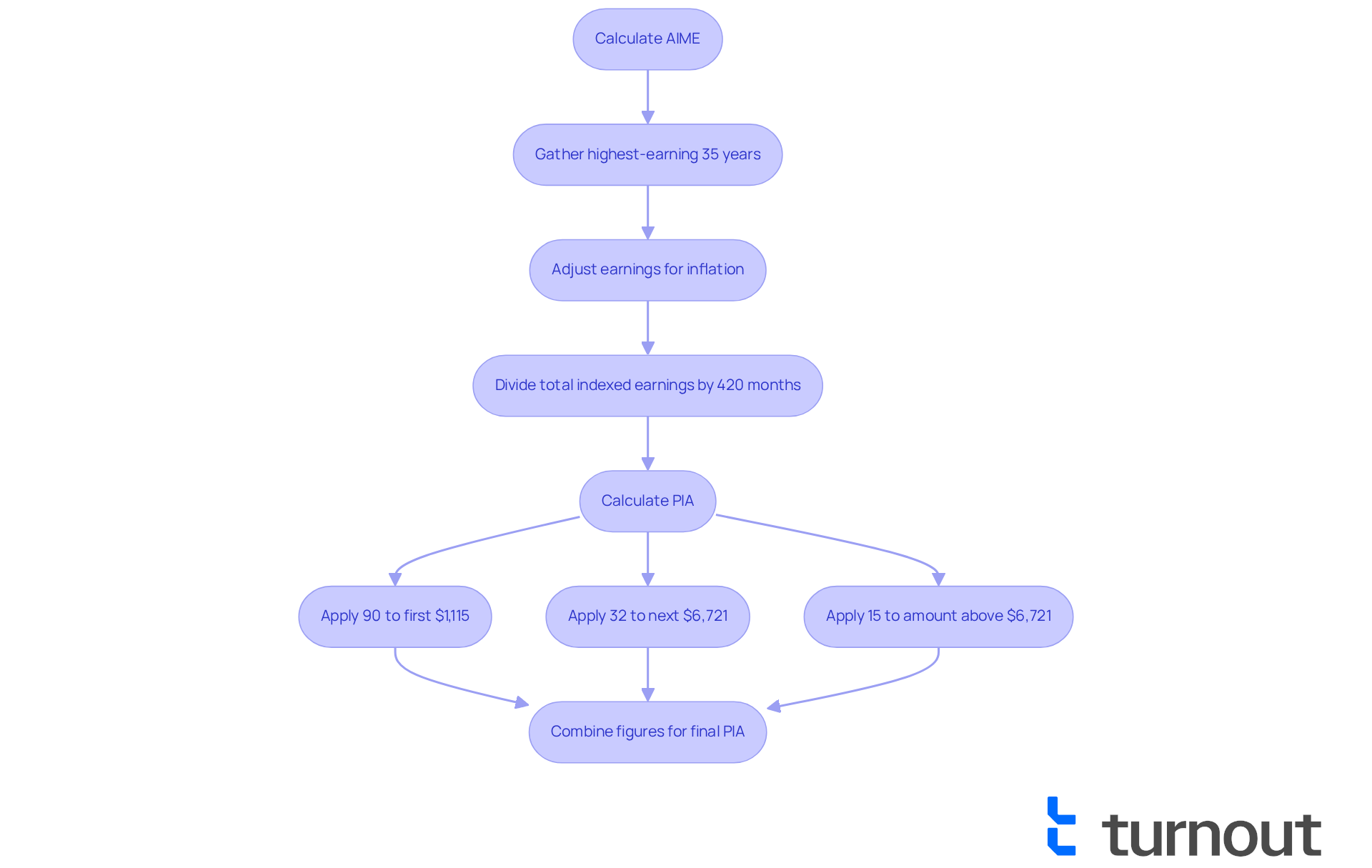

Calculate Your SSDI Benefits Using the AIME and PIA Formulas

Estimating your social security disability estimate can feel overwhelming, but we're here to help you navigate through it. Understanding how to calculate your Average Indexed Monthly Earnings (AIME) and your Primary Insurance Amount (PIA) is essential, and this service aims to simplify the process of obtaining your social security disability estimate for you. Remember, you don’t have to navigate this journey alone; our guidance is designed to assist you without needing legal representation. Just a quick note: Turnout is not a law firm and doesn’t provide legal advice. Here’s how to get started:

-

Calculate AIME:

- First, gather your highest-earning 35 years of work history.

- Next, adjust these earnings for inflation using the Social Security Administration's indexing factors.

- Finally, divide the total indexed earnings by the number of months in those years (420 months for 35 years) to find your AIME.

-

Calculate PIA:

- The PIA is determined using a formula that applies different percentages to portions of your AIME. For instance, the first $1,115 of your AIME is multiplied by 90%, the next $6,721 by 32%, and any amount above that by 15%.

- Combine these figures to find your PIA, which represents the monthly payment you can expect to receive.

With Turnout's expert guidance and the support of trained non-professional advocates, you can confidently navigate the SSD claims process. You deserve to assess your entitlements accurately, including your social security disability estimate, and we’re here to ensure you feel supported every step of the way.

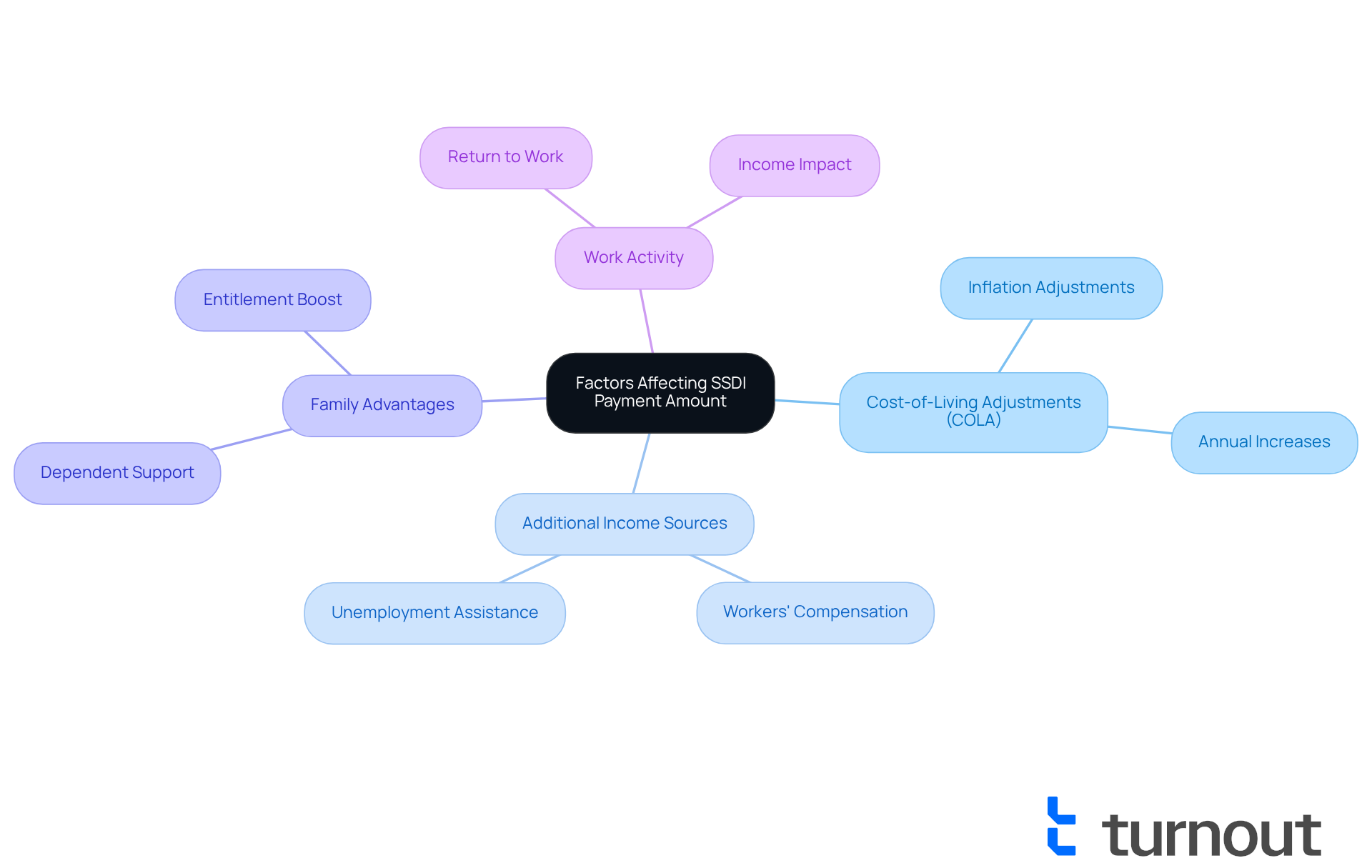

Identify Factors That Affect Your SSDI Payment Amount

Understanding your social security disability estimate can feel overwhelming, but you’re not alone in this journey. Several factors can influence the amount you receive:

- Cost-of-Living Adjustments (COLA): Each year, your disability payments may be adjusted for inflation, potentially increasing your payment over time.

- Additional Income Sources: If you receive other forms of income, like workers' compensation or unemployment assistance, it might lower your disability payments.

- Family Advantages: If you have dependents, they could qualify for extra support based on your Social Security Disability Insurance entitlement, which can boost the total amount you receive.

- Work Activity: If you decide to return to work while receiving disability benefits, your income may affect your assistance.

We understand that navigating these factors can be challenging. Comprehending these elements will assist you in calculating your social security disability estimate more accurately. At Turnout, we’re here to help. We offer various tools and services, including personalized calculators and expert guidance from trained non-professional advocates. Our goal is to assist you in optimizing your benefits while ensuring you have the support you need. Remember, you’re not alone in this process.

Gather Required Documentation and Resources for Your Application

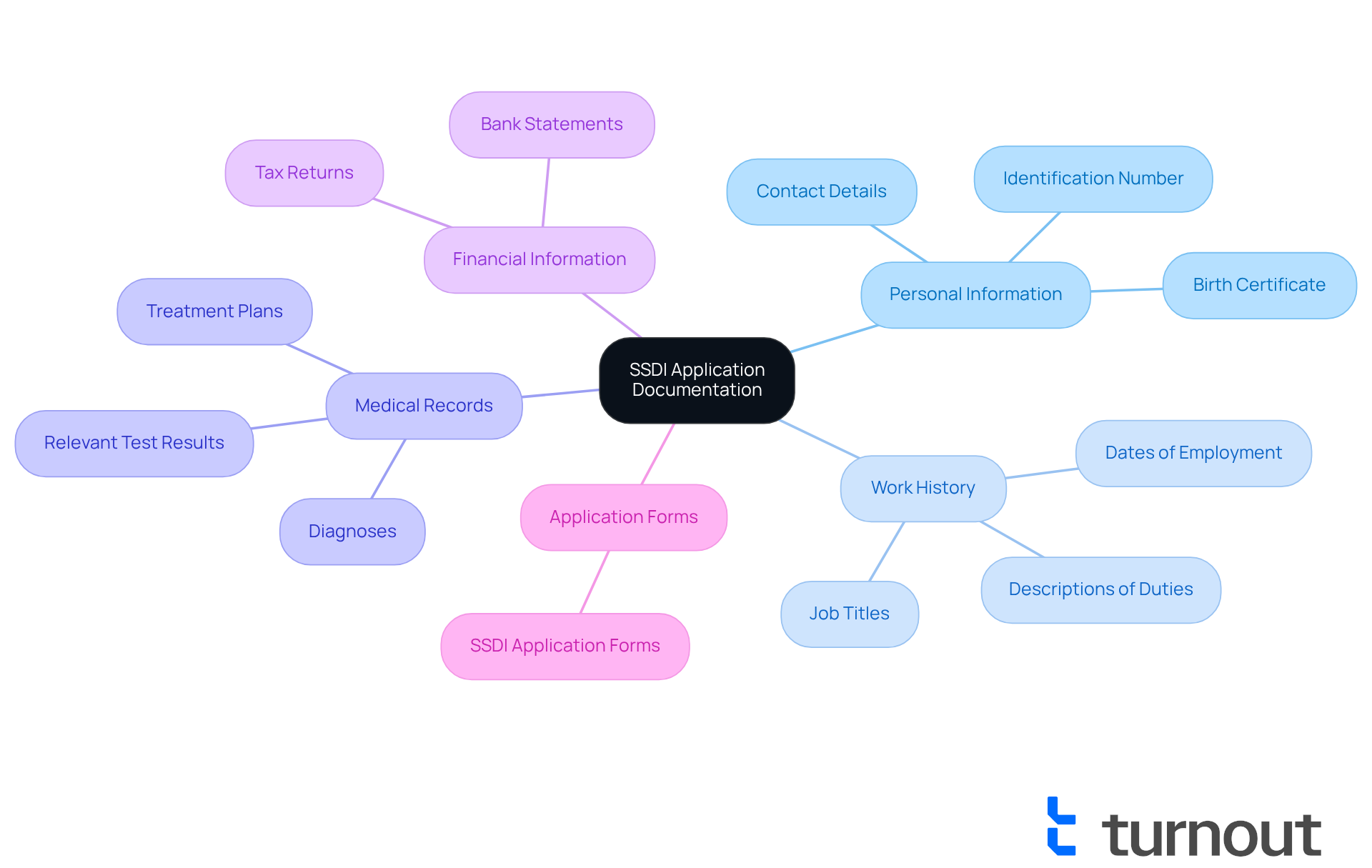

Applying for SSDI benefits can feel overwhelming, but you’re not alone in this journey. We understand that gathering the right documents is crucial for a successful application. Here’s a helpful list to guide you:

- Personal Information: Make sure to have your identification number, birth certificate, and contact details ready.

- Work History: Prepare a detailed work history, including job titles, dates of employment, and descriptions of your duties.

- Medical Records: Collect comprehensive medical documentation from your healthcare providers. This should include diagnoses, treatment plans, and any relevant test results.

- Financial Information: Gather documentation of your income and assets, such as bank statements and tax returns.

- Application Forms: Don’t forget to complete the SSDI application forms, which you can find on the Social Security Administration's website.

Having these documents organized will not only streamline your application process but also improve your chances of approval. Remember, Turnout is here to assist you every step of the way. Our trained nonlawyer advocates can help you navigate the complexities of SSD claims, ensuring you feel supported and informed. You deserve this assistance, and we’re here to help.

Conclusion

Estimating Social Security Disability benefits can feel overwhelming. We understand that many rely on this support during tough times. This article has laid out a clear path to help you navigate the complexities of Social Security Disability Insurance (SSDI). It’s essential to grasp the importance of eligibility, calculation methods, and the necessary documentation.

Key insights include:

- Determining your eligibility based on work history and medical evidence.

- Learning how to calculate benefits using the AIME and PIA formulas.

- Recognizing the factors that can influence payment amounts.

- Gathering the right documentation is crucial for a successful application, ensuring you’re well-prepared to present your case.

Ultimately, the journey to secure SSDI benefits requires careful attention and support. By taking the time to understand the steps involved and utilizing available resources, you can empower yourself to navigate this process more effectively. Remember, assistance is available, and seeking help can make a significant difference in obtaining the benefits you deserve. You are not alone in this journey.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a federal initiative that provides financial support to individuals who cannot work due to a qualifying disability. It is designed to assist those who have worked in positions covered by Social Security and contributed to Social Security taxes.

What are the eligibility criteria for SSDI benefits?

To qualify for SSDI benefits, you must meet several criteria: 1. Work History: You should have earned 40 work credits, with at least 20 credits earned in the last 10 years. 2. Disability Definition: Your condition must significantly limit your ability to perform basic work activities and is expected to last at least one year or result in death. 3. Medical Evidence: You need to provide medical documentation from healthcare providers that supports your claim of disability.

How can I determine my eligibility for SSDI benefits?

To determine your eligibility, evaluate your work history, ensure your condition meets the Social Security Administration's definition of disability, and gather necessary medical documentation to support your claim.

What kind of assistance does Turnout provide for SSDI claims?

Turnout offers guidance and support to help individuals navigate the SSDI claims process, including understanding eligibility requirements and gathering necessary documentation. They provide assistance through compassionate non-legal advocates.

Is Turnout a law firm and do they provide legal advice?

No, Turnout is not a law firm, and the information they provide does not constitute legal advice. Their focus is on helping individuals access governmental assistance and financial aid related to disability claims.

What should I do if I feel overwhelmed by the SSDI process?

If you feel overwhelmed, you can reach out to Turnout for support. Their trained non-lawyer advocates are ready to assist you through the disability benefits process, ensuring you do not have to face it alone.