Overview

This article serves as a compassionate guide to help you pay your IRS installment online with ease. We understand that navigating financial obligations can be overwhelming, and we're here to support you every step of the way. From selecting a suitable payment plan to submitting your application, we've detailed each necessary step to ensure a smooth process.

You'll find various IRS payment options outlined, each designed to cater to different needs. It's crucial to provide accurate financial information, as this will facilitate your payment process. If you encounter any common issues during setup, don't worry—we've included helpful troubleshooting tips to guide you.

We want you to feel empowered in this journey. Remember, you are not alone, and taking these steps can lead you to a more manageable financial situation. Let's work together to make this process as straightforward as possible.

Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially when it comes to managing payments to the IRS. We understand that the options available can sometimes add to the confusion rather than ease it.

However, various installment plans exist to help lighten your financial load and provide a structured path toward compliance. It’s common to feel uncertain about how to effectively set up and manage these online payment plans.

What steps can you take to ensure a smooth process, and what challenges might arise along the way? This guide is here to demystify the process of paying IRS installments online, offering clear, actionable steps to empower you on your financial journey.

Remember, you're not alone in this process—we're here to help.

Understand IRS Payment Plans

Before we dive into the setup process, it's important to recognize the various IRS payment plans available to you. We understand that navigating tax obligations can be challenging, and we're here to help you find the right solution.

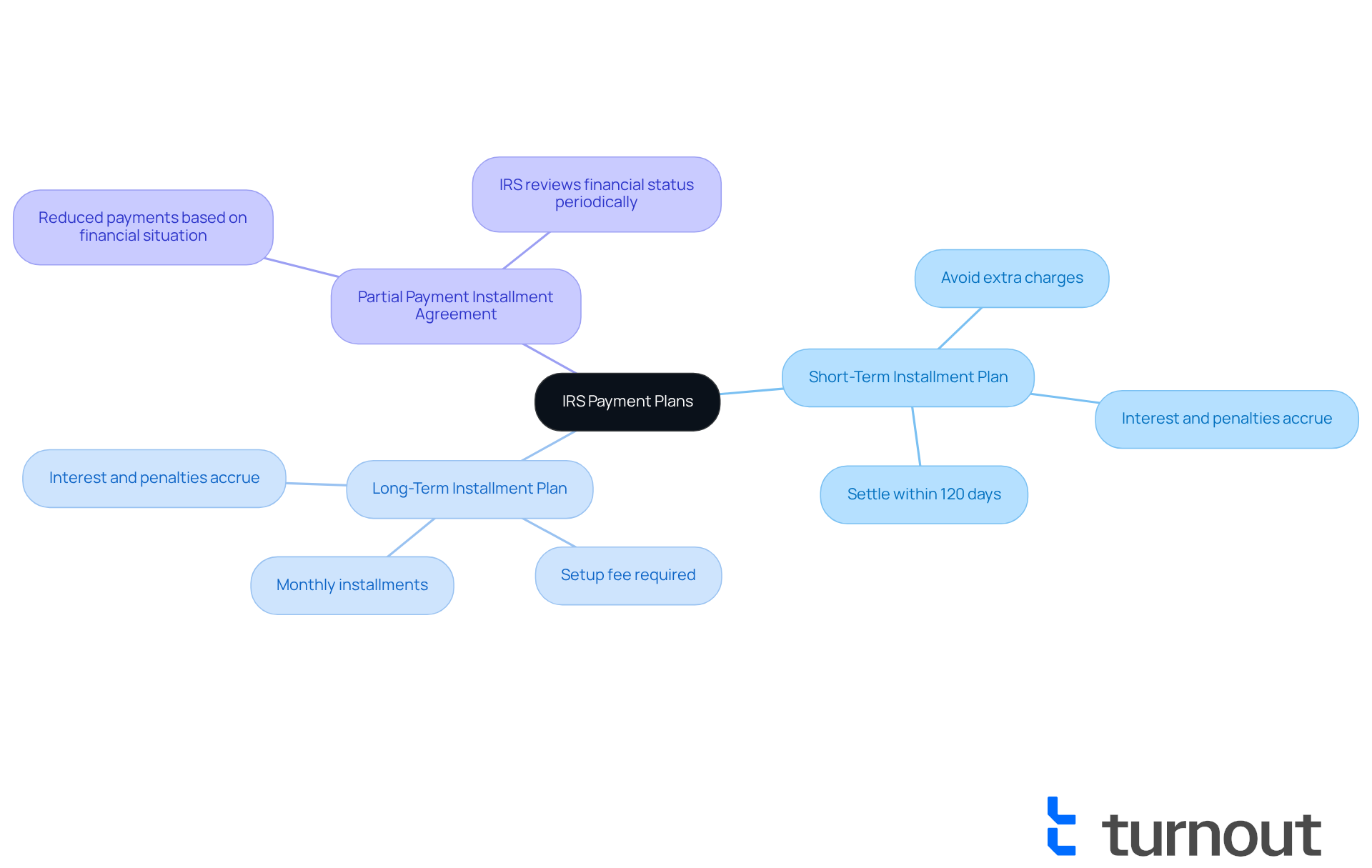

-

Short-Term Installment Plan: If you can settle your tax bill in full within 120 days, this option allows you to avoid extra charges. However, it's good to keep in mind that interest and penalties will still accrue until the balance is fully paid.

-

Long-Term Installment Plan (Installment Agreement): For those who need a bit more time, this plan enables you to pay your tax obligation in monthly installments over a period exceeding 120 days. While there is a setup fee, remember that interest and penalties will continue to accrue until your debt is completely settled.

-

Partial Payment Installment Agreement: This option is designed for individuals who cannot pay their full tax liability. It allows for reduced monthly payments based on your financial situation, but be aware that the IRS may review your financial status periodically.

Understanding these options can empower you to choose the most suitable strategy for your financial circumstances. You are not alone in this journey, and we encourage you to take the next steps with confidence.

Set Up Your IRS Online Payment Plan

Setting up your plan to pay installment IRS online can feel overwhelming, but we're here to help. By following these simple steps, you can confidently pay installment IRS online with ease.

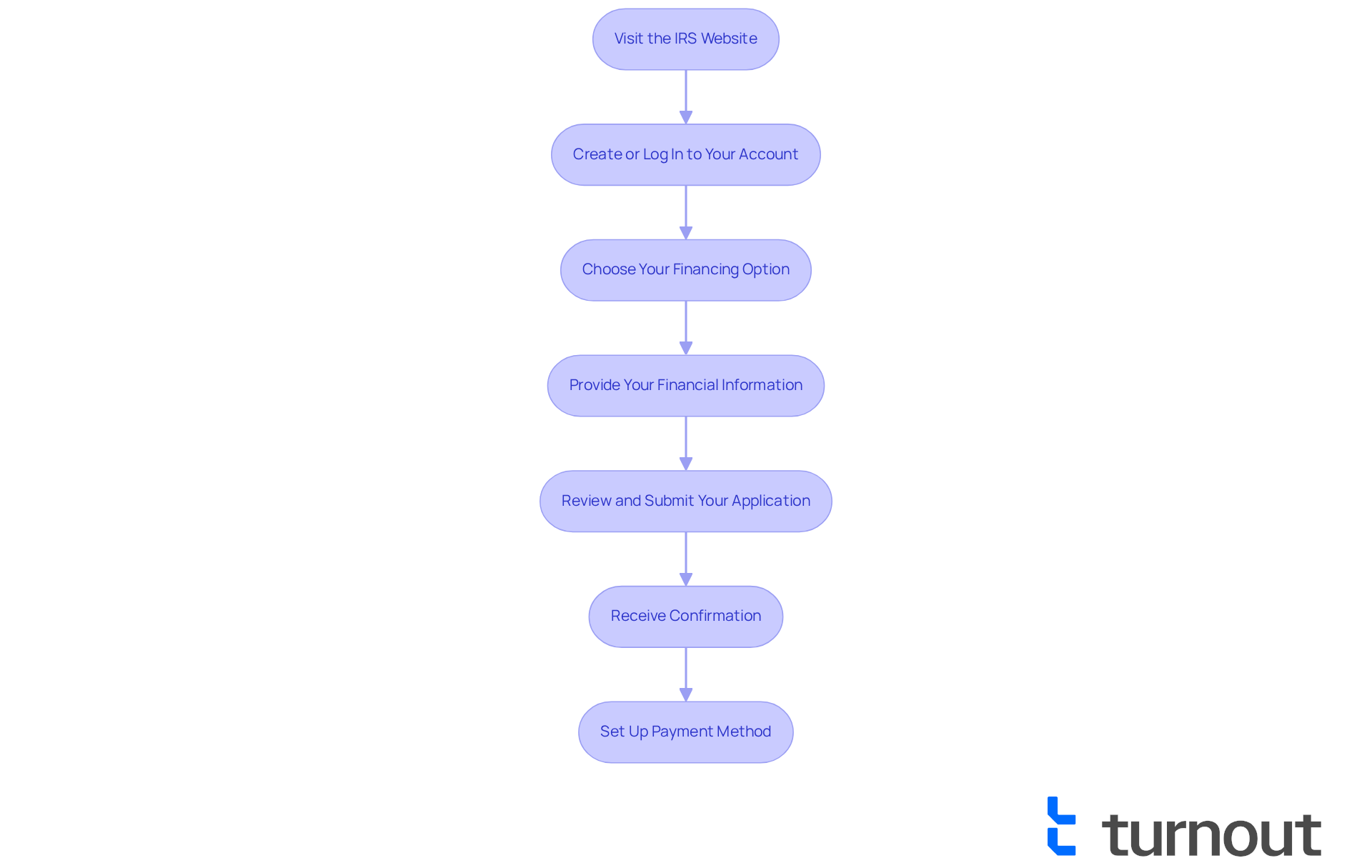

-

Visit the IRS Website: Start by going to the official IRS website. Look for the 'Payment Plans' section to find the information you need.

-

Create or Log In to Your Account: If you don’t have an account yet, don’t worry! Creating one is straightforward. You’ll need to provide some personal information, such as your Social Security number, date of birth, and filing status. If you already have an account, simply log in and you’re one step closer.

-

Choose Your Financing Option: Take a moment to consider your financial situation. You can select between a short-term financing arrangement or a long-term installment agreement if you want to pay installment IRS online that best suits your needs.

-

Provide Your Financial Information: This step involves filling out your financial details, including your income, expenses, and assets. We understand that sharing this information can be daunting, but it’s crucial for the IRS to assess your eligibility for the program.

-

Review and Submit Your Application: Before you hit submit, carefully review all the information you’ve provided. Ensuring accuracy is essential, and once you’re confident, go ahead and submit your application.

-

Receive Confirmation: After submitting, you’ll receive a confirmation of your application. Keep this document safe, as it contains important information about your financial arrangement.

-

Set Up Payment Method: Finally, choose how you’d like to make your payments—whether through direct debit, credit card, or check. Many find that setting up direct debit is the easiest way to ensure timely payments.

By following these steps, you’re taking a significant step towards managing your financial obligations, including how to pay installment IRS online. Remember, you are not alone in this journey, and we’re here to support you every step of the way.

Troubleshoot Common Payment Issues

If you encounter issues while setting up or managing your IRS payment plan, we understand how challenging this can be. Here are some helpful troubleshooting tips to guide you:

-

Login Issues: Ensure you are using the correct username and password when logging into your IRS account. If you’ve forgotten your password, don’t worry—just utilize the 'Forgot Password' feature to reset it. If login attempts fail, consider trying again outside of business hours to avoid potential website overload. Additionally, make sure that the Company Name you are entering matches IRS records exactly, as discrepancies can lead to login failures. For persistent login issues, we're here to help. You can contact the IRS Technical Services Operation help desk at 866-455-7438 for assistance.

-

Application Rejected: If your request for a financial arrangement is denied, it’s important to thoroughly examine the explanations given by the IRS. Common issues include insufficient income documentation or failure to meet eligibility criteria. In 2025, around 30% of IRS application submissions are rejected, which highlights the necessity of ensuring all documentation is precise and thorough. You might need to provide extra details or consider different financing options, but remember, you are not alone in this journey.

-

Transaction Not Completed: If a transaction fails to process, first verify your bank account to ensure that adequate funds are accessible. If the problem persists, please reach out to the IRS directly for assistance; they are there to support you.

-

Adjusting Payment Amounts: If your financial circumstances shift and you need to modify your payment amount, simply log into your IRS account and submit a request for a change to your arrangement. It’s important that your plan reflects your current situation.

-

Missed Installments: If you fail to make a contribution, don’t hesitate to reach out to the IRS promptly to discuss your alternatives. They may permit you to restore your strategy or provide options based on your situation.

By following these troubleshooting tips, you can effectively manage your IRS payment plan and pay installment IRS online to resolve any issues that arise. Remember, we’re here to help you through this process.

Conclusion

Navigating the complexities of IRS payment plans can feel overwhelming. We understand that the thought of managing these obligations may cause anxiety. However, recognizing the available options and the steps to set them up can significantly lighten the load. This guide has provided a comprehensive overview of how to effectively pay your IRS installment online, ensuring you feel equipped to manage your tax responsibilities with confidence.

Key points discussed include the different types of IRS payment plans:

- Short-term

- Long-term

- Partial payment agreements

Each designed to accommodate various financial situations. The step-by-step process for setting up your online payment plan emphasizes the importance of careful preparation and accurate information submission. Additionally, we offer troubleshooting tips for common issues, helping you stay on track with your payments, even when challenges arise.

Ultimately, taking control of your IRS payments is not just about fulfilling a financial obligation; it’s about regaining peace of mind and empowering yourself in the face of tax responsibilities. By utilizing the resources and strategies outlined in this guide, you can approach your tax payments with clarity and assurance. Remember, support is available throughout this process, and taking proactive steps can lead to a more manageable and less stressful experience. You are not alone in this journey, and we're here to help.

Frequently Asked Questions

What are the main IRS payment plans available?

The main IRS payment plans include the Short-Term Installment Plan, Long-Term Installment Plan (Installment Agreement), and Partial Payment Installment Agreement.

What is the Short-Term Installment Plan?

The Short-Term Installment Plan allows you to pay your tax bill in full within 120 days, helping you avoid extra charges. However, interest and penalties will still accrue until the balance is fully paid.

How does the Long-Term Installment Plan work?

The Long-Term Installment Plan enables you to pay your tax obligation in monthly installments over a period exceeding 120 days. There is a setup fee, and interest and penalties will continue to accrue until your debt is fully settled.

What is the Partial Payment Installment Agreement?

The Partial Payment Installment Agreement is for individuals who cannot pay their full tax liability. It allows for reduced monthly payments based on your financial situation, and the IRS may review your financial status periodically.

What should I consider when choosing an IRS payment plan?

When choosing an IRS payment plan, consider your ability to pay the tax bill in full, the time you need for repayment, and your current financial situation to select the most suitable option.