Overview

This article serves as a compassionate step-by-step guide for paying Pennsylvania taxes online. We understand that navigating tax payments can be challenging, and we detail the necessary preparations, how to access the payment portal, complete the transaction, and troubleshoot common issues. It's important to recognize the requirements for tax payments and to utilize available resources that can simplify this process, especially for disabled Americans who may face additional challenges.

We’re here to help you through this journey. By understanding your needs and providing clear instructions, we aim to alleviate some of the stress that comes with tax season. Remember, you are not alone in this process, and there are tools available to assist you.

Take a moment to reflect on your experiences with tax payments. Have you ever felt overwhelmed by the requirements? It's common to feel this way, but with the right guidance, you can navigate these challenges with confidence.

As you prepare to pay your taxes online, keep in mind that our goal is to support you every step of the way. Together, we can make this process smoother and more manageable.

Introduction

Navigating the world of tax payments can often feel daunting, especially for residents of Pennsylvania preparing to meet their obligations online. We understand that the increasing complexity of tax regulations and the rise of digital payment systems can be overwhelming. That's why understanding how to effectively pay PA taxes online is more crucial than ever. This guide offers a comprehensive walkthrough, empowering you with the knowledge and tools needed to tackle your tax payments confidently.

But what happens when unexpected issues arise during this seemingly straightforward process? How can you ensure you are fully prepared to navigate these challenges? You're not alone in this journey, and we're here to help.

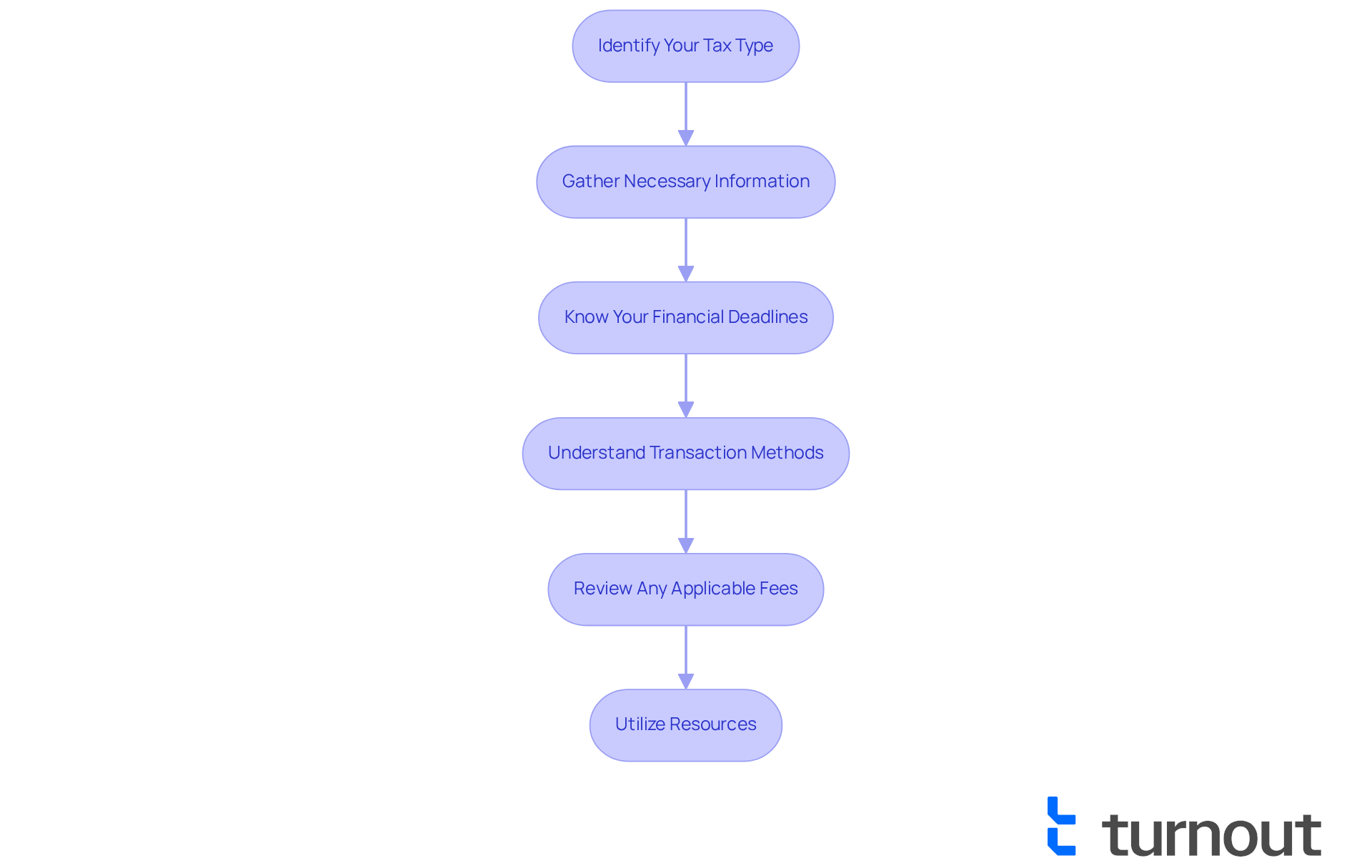

Understand Pennsylvania Tax Payment Requirements

Before you begin the process to pay pa taxes online, it's important to understand the specific requirements. We know this can feel overwhelming, so let's break it down together:

- Identify Your Tax Type: First, determine whether you are paying personal income tax, property tax, or business taxes. Each type may have different requirements, and we want to ensure you have everything you need.

- Gather Necessary Information: Next, collect your Social Security number, tax identification number, and any relevant tax forms or documents that may be necessary for your transaction. Having these ready can make the process smoother.

- Know Your Financial Deadlines: It's common to feel anxious about deadlines, so be aware of when your tax dues are due to avoid late fees. For 2025, if you owe $5,000 or more for the Business Income and Receipts Tax (BIRT), it's essential to pay pa taxes online. We recommend visiting the Pennsylvania Department of Revenue website for specific dates. Prompt remittances are crucial to evade penalties, which can include interest and extra charges.

- Understand Transaction Methods: Familiarize yourself with the accepted transaction methods, such as credit/debit cards, electronic checks, or bank transfers. Knowing your options will help you feel more in control of the transaction.

- Review Any Applicable Fees: Some transaction methods may come with extra charges. It's wise to examine these before completing your transaction to prevent any surprises.

We understand that managing tax payments can be particularly challenging for disabled Americans in the state. Many face difficulties due to complex systems and a lack of accessible resources, which can lead to missed deadlines and additional penalties. For instance, not settling dues promptly can result in the suspension of a Commercial Activity License, impacting your ability to operate your business.

However, understanding these requirements and utilizing available resources, including the Department of Revenue's commitment to assisting all taxpayers, can greatly simplify the process. Remember, you are not alone in this journey. Additionally, exploring tax credits applicable to BIRT, such as the Healthy Beverage Tax Credit and Community Development Credit, may provide opportunities to reduce your tax liability. We're here to help you navigate this path with confidence.

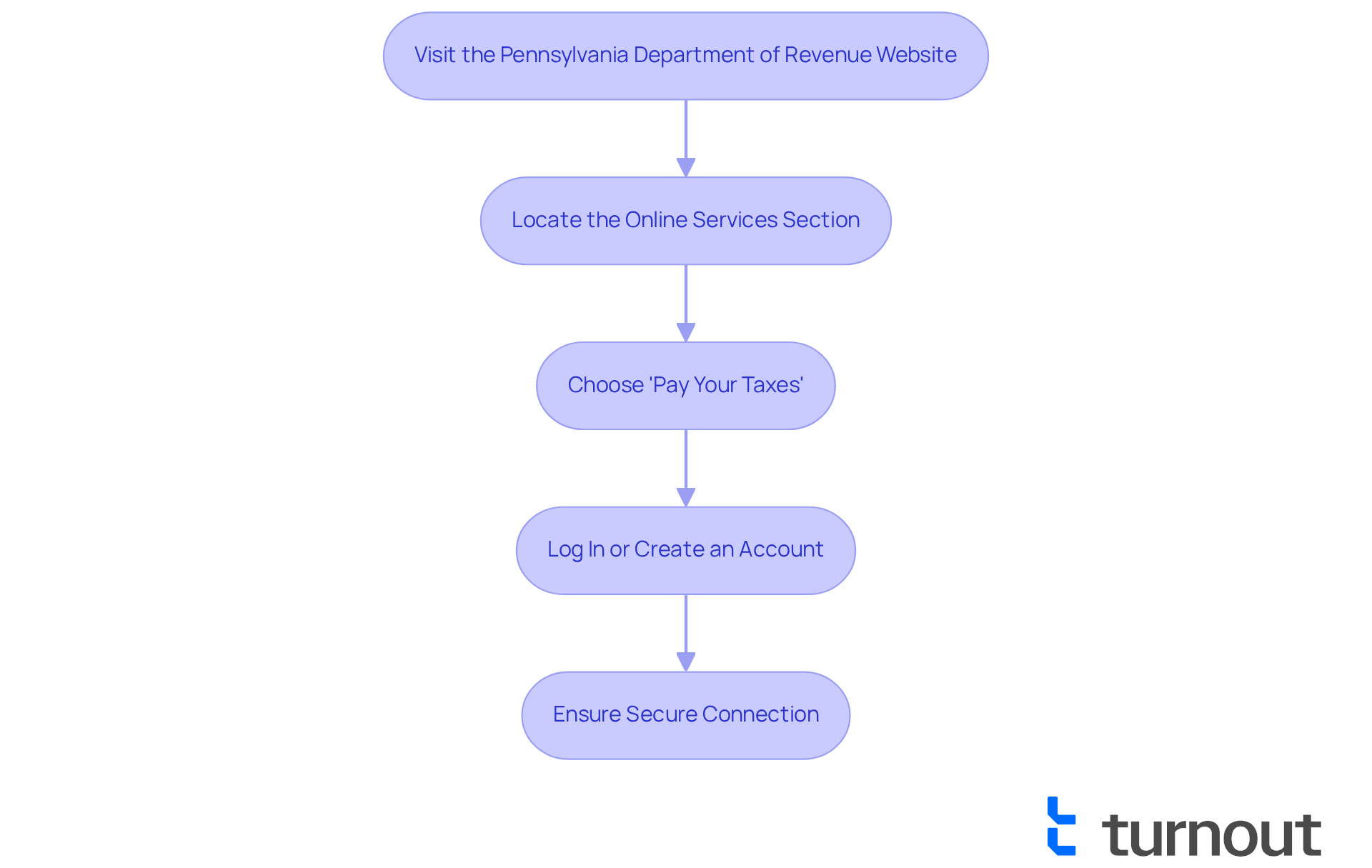

Access the Online Tax Payment Portal

We understand that managing taxes can be overwhelming, but we're here to help you navigate the process to pay pa taxes online. Follow these straightforward steps to access the official tax payment portal with ease:

- Visit the Pennsylvania Department of Revenue Website: Open your web browser and navigate to www.revenue.pa.gov.

- Locate the Online Services Section: On the homepage, find the 'Online Services' tab, typically located in the main navigation menu.

- Choose 'Pay Your Taxes': Click on the option that enables you to settle your taxes via the web, guiding you to the processing portal.

- Log In or Create an Account: If you have previously registered, log in using your credentials. New users should follow the prompts to create an account, which may involve verifying your identity.

- Ensure Secure Connection: Before entering any personal information, confirm that the website URL begins with 'https://' to guarantee a secure connection.

It's common to feel uncertain about online transactions, but rest assured, in 2025, the myPATH portal has gained significant popularity, with millions of users accessing it around the clock to pay pa taxes online for their tax settlement needs. This user-friendly platform has substituted numerous services previously offered by the Department of Revenue, making it compatible with any device and most browsers. You can manage your tax obligations with ease and confidence, knowing that you are not alone in this journey.

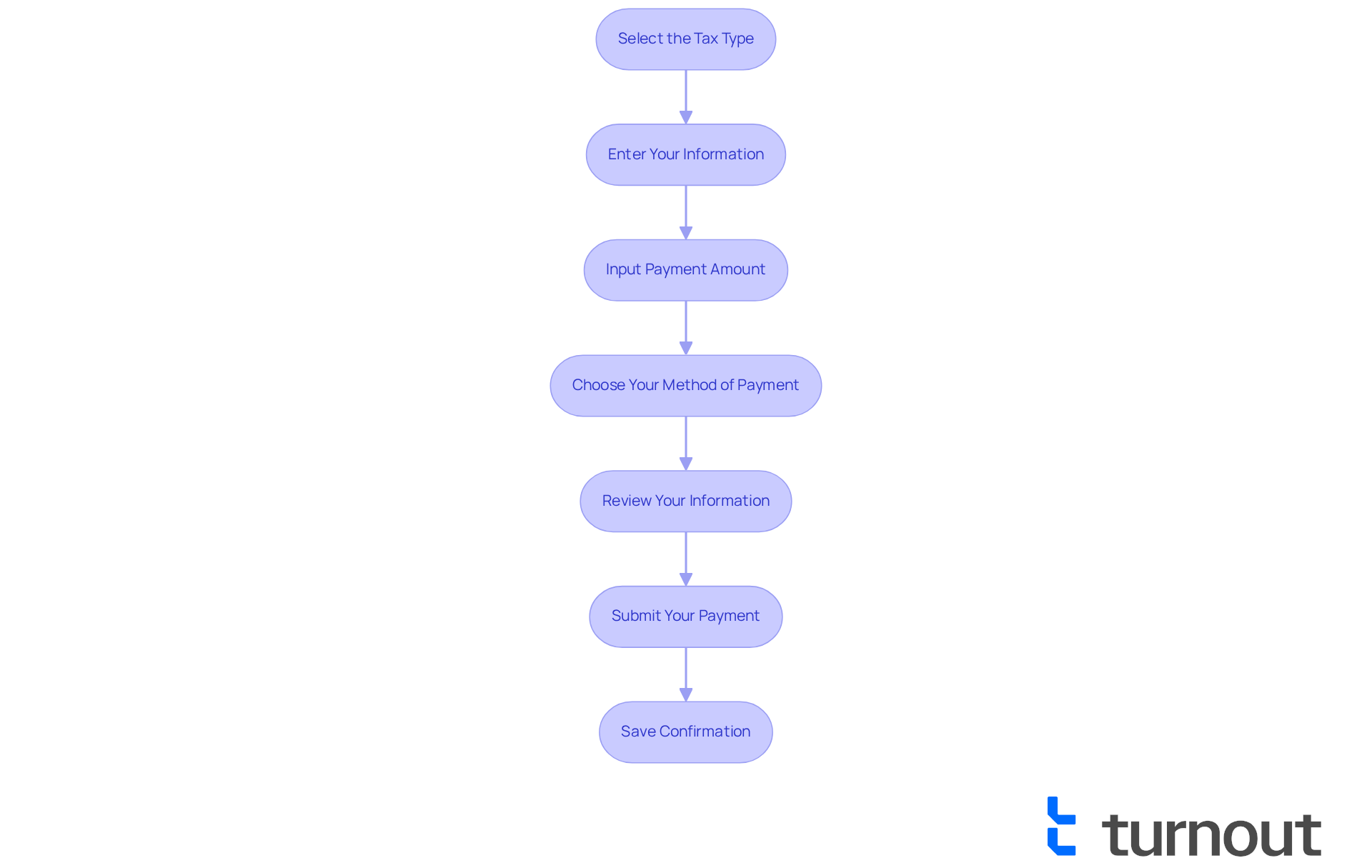

Complete Your Tax Payment Online

While it may feel daunting to pay pa taxes online in Pennsylvania, we're here to guide you through the process with ease. Follow these straightforward steps:

- Select the Tax Type: Begin by choosing the specific tax you are paying from the available options.

- Enter Your Information: Fill in the required fields with your personal details, including your Social Security number and any other requested information.

- Input Payment Amount: Specify the amount you wish to pay, ensuring it aligns with your tax liability to avoid discrepancies.

- Choose Your Method of Payment: Select your preferred method, such as credit/debit card or electronic check. If using a card, enter the necessary card details.

- Review Your Information: Before submitting, double-check all entered details for correctness to prevent any issues with your transaction.

- Submit Your Payment: Click the 'Submit' button to complete your transaction. A confirmation message should appear on your screen.

- Save Confirmation: After the transaction, save or print the confirmation page for your records. This serves as evidence of the transaction for any future inquiries.

We understand that navigating tax payments can be challenging, especially with the changes coming in 2025. The Pennsylvania digital tax submission process has been optimized to enhance accessibility for everyone, including disabled Americans. For instance, the Philadelphia Tax Center allows users to make transactions without needing to set up an account, which greatly simplifies the process.

It's common to feel overwhelmed by the digital tax submission process. Financial consultants often highlight typical errors, such as not confirming transaction amounts or forgetting to save confirmation receipts. These oversights can lead to issues later on. A recent study shows that nearly 30% of internet tax transaction mistakes arise from incorrect amounts, underscoring the importance of careful examination.

By following these steps and keeping these suggestions in mind, you can approach the process to pay pa taxes online with confidence. Remember, you are not alone in this journey; we’re here to help you every step of the way.

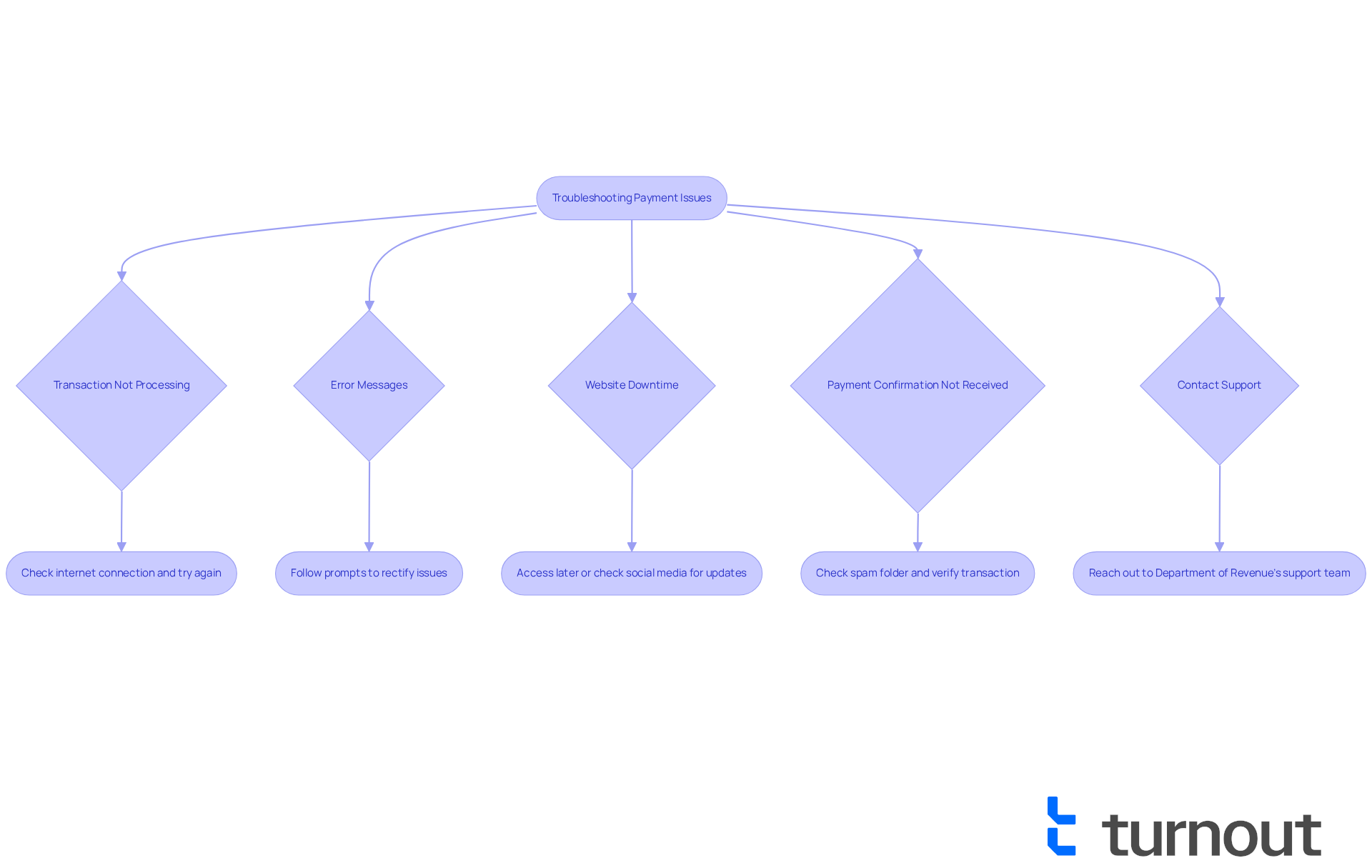

Troubleshoot Common Payment Issues

Even with thorough preparation, we understand that issues can still arise when you pay pa taxes online during the transaction process in Pennsylvania. Here are some common problems you might encounter, along with effective troubleshooting steps:

- Transaction Not Processing: If your transaction fails to process, first check your internet connection and try again. Ensure that all entered information is correct, including your bank details and total amount.

- Error Messages: Pay close attention to any error messages you receive. These often indicate missing or incorrect information. Follow the prompts to rectify any issues.

- Website Downtime: It’s common to feel frustrated during portal downtime. If this happens, attempt to access it later. For real-time updates, check the Department of Revenue's social media channels or official website.

- Payment Confirmation Not Received: If you do not receive a confirmation email, check your spam folder. If it’s not there, log back into the portal to verify whether your transaction was processed.

- Contact Support: Should you face persistent issues, please reach out to the Department of Revenue’s support team. They are here to provide guidance and assist in resolving any problems.

In 2025, statistics revealed that nearly 15% of online tax transactions in Pennsylvania encountered processing failures. This highlights the importance of understanding these prevalent issues. Disabled Americans, in particular, may face unique challenges when navigating these systems. Turnout's support services, including assistance with SSD claims and tax debt relief, have proven crucial in helping individuals address their tax obligations, ensuring they receive the benefits they deserve.

Clear communication and prompt action are vital when dealing with problems related to how to pay pa taxes online. Turnout advocates for accessible resources to assist those in need. For example, Turnout utilizes trained nonlawyer advocates to guide clients through complex tax issues, showcasing the value of professional support in overcoming bureaucratic hurdles. Remember, you are not alone in this journey; we’re here to help.

Conclusion

Understanding how to pay Pennsylvania taxes online can transform a daunting task into a manageable one. We understand that navigating tax obligations can feel overwhelming. By breaking down the process into clear, actionable steps, you can approach your responsibilities with greater ease and confidence. Preparation is key—gathering necessary information and familiarizing yourself with transaction methods is crucial for staying organized and informed.

Key insights shared throughout this article highlight the necessity of knowing specific tax types, deadlines, and potential fees. It's common to feel uncertain about these details. The introduction of the myPATH portal offers a user-friendly solution for online payments, ensuring accessibility for everyone, including disabled Americans. By addressing common issues and providing troubleshooting tips, we aim to empower you to tackle your tax responsibilities with assurance.

Ultimately, effectively managing tax payments online is not just about compliance; it’s about taking control of your financial responsibilities. Engaging with available resources, understanding the digital landscape, and seeking assistance when needed can lead to a smoother tax experience. Remember, you are not alone in this journey. Embracing these tools and knowledge is crucial for staying on top of your tax obligations and avoiding unnecessary penalties. We're here to help you every step of the way.

Frequently Asked Questions

What should I do before paying Pennsylvania taxes online?

Before paying Pennsylvania taxes online, you should identify your tax type (personal income tax, property tax, or business taxes), gather necessary information such as your Social Security number and tax identification number, and be aware of financial deadlines.

What information do I need to gather to pay my taxes?

You need to collect your Social Security number, tax identification number, and any relevant tax forms or documents that may be necessary for your transaction.

Why is it important to know my financial deadlines?

Knowing your financial deadlines is important to avoid late fees. For example, if you owe $5,000 or more for the Business Income and Receipts Tax (BIRT) in 2025, you must pay your taxes online to avoid penalties, including interest and extra charges.

What transaction methods can I use to pay my Pennsylvania taxes?

You can use various transaction methods to pay your Pennsylvania taxes, including credit/debit cards, electronic checks, or bank transfers.

Are there any fees associated with tax payment methods?

Yes, some transaction methods may have additional charges. It is advisable to review these fees before completing your transaction to avoid surprises.

What challenges do disabled Americans face regarding tax payments in Pennsylvania?

Disabled Americans may face challenges due to complex systems and a lack of accessible resources, which can lead to missed deadlines and additional penalties, such as the suspension of a Commercial Activity License.

What resources are available to help with tax payments in Pennsylvania?

The Pennsylvania Department of Revenue provides resources and assistance to all taxpayers, which can help simplify the tax payment process.

Are there any tax credits available that can reduce my tax liability?

Yes, there are tax credits applicable to the Business Income and Receipts Tax (BIRT), such as the Healthy Beverage Tax Credit and Community Development Credit, which may provide opportunities to reduce your tax liability.