Introduction

Navigating tax liabilities can feel overwhelming, especially when it comes to managing IRS payment plans. We understand that with over 90% of individual filers expected to qualify for a Simple Payment Plan by 2025, knowing how to modify these arrangements is more important than ever. Yet, it’s common for many taxpayers to feel uncertain about the steps to take or the options available to them.

How can you effectively adjust your IRS payment plans to better fit your financial situation and ease the burden of tax debt?

You are not alone in this journey. Many individuals face similar challenges, and there are solutions available to help you regain control. Let’s explore how you can navigate these options with confidence.

Understand IRS Payment Plans

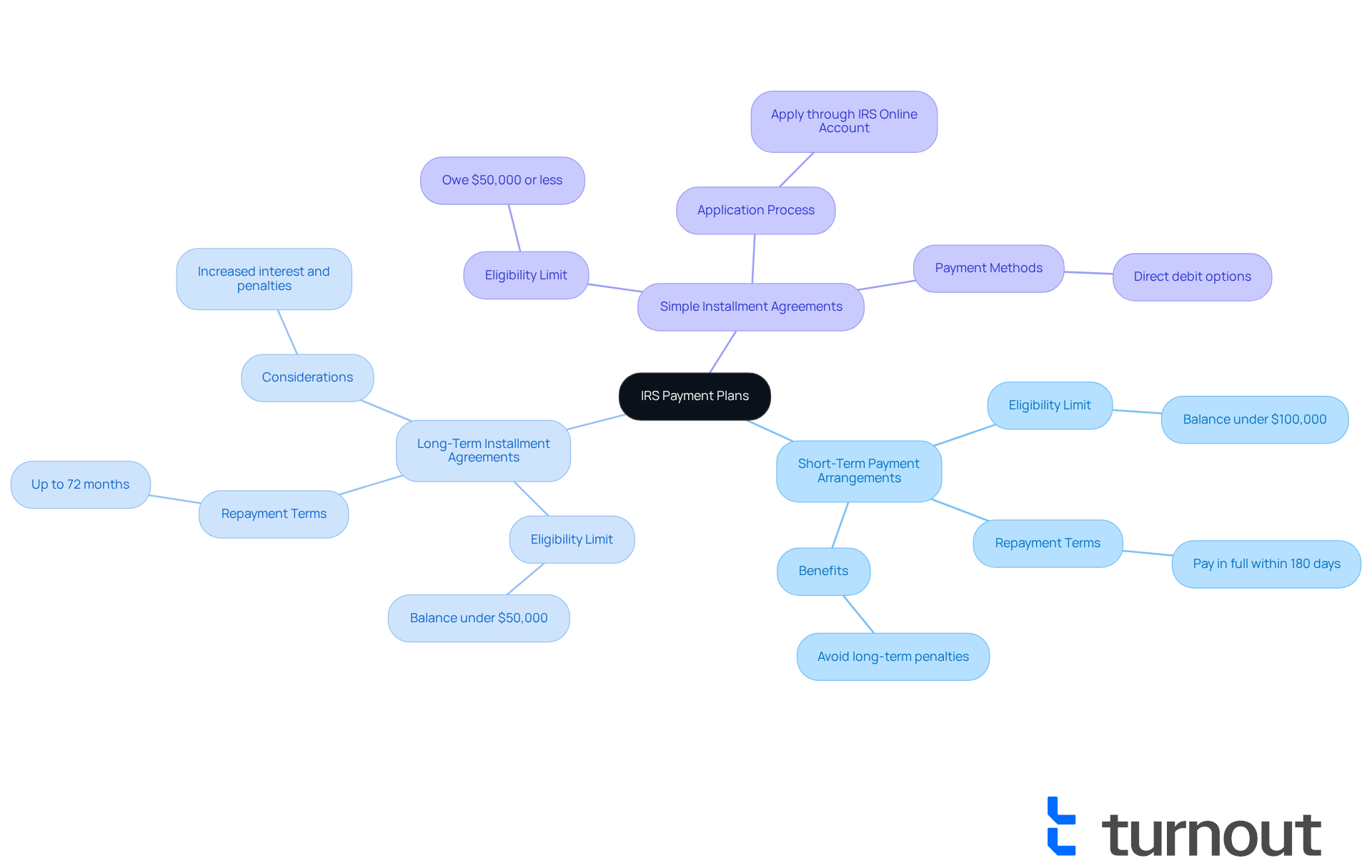

Dealing with tax liabilities can feel overwhelming, but you can change IRS payment plan options, often known as installment agreements, to manage these responsibilities gradually. In fact, in 2025, over 90% of individual filers with a balance due will qualify for a Simple Payment Plan. This reflects the growing importance of these options in managing tax debt.

Short-Term Payment Arrangements are designed for obligations under $100,000, allowing individuals to settle their balance within 180 days. If you can manage a quick repayment, this option can help you avoid long-term penalties.

For those with debts under $50,000, Long-Term Installment Agreements extend repayment over a period of up to 72 months. This flexibility can ease your financial burden while you gradually address your tax responsibilities. Just keep in mind that extending the repayment period may increase interest, penalties, and fees.

Simple Installment Agreements, introduced in 2025, cater to taxpayers owing $50,000 or less. These agreements offer more accessible and flexible terms. You can apply for a Simple Payment Plan through your IRS Online Account, where you can set up direct debit or other payment methods without needing to contact the IRS.

Understanding these options is crucial for determining how to change IRS payment plan according to your financial situation. Many individuals with an outstanding balance can qualify for a Simple Payment Plan, which simplifies the process and alleviates the stress of tax debt. If you've tried to comply with tax regulations but faced challenges beyond your control, you may also be eligible for penalty relief.

It's essential to stay current with your tax returns to qualify for a Simple Payment Plan. By choosing the right financial arrangement, you can effectively manage your obligations and change IRS payment plan to minimize extra expenses related to interest and penalties. Remember, you are not alone in this journey; we're here to help you navigate your options.

Request Changes to Your IRS Payment Plan

If you're looking to change your IRS payment plan, we understand that navigating this process can feel overwhelming. But don’t worry; we’re here to help! Just follow these simple steps:

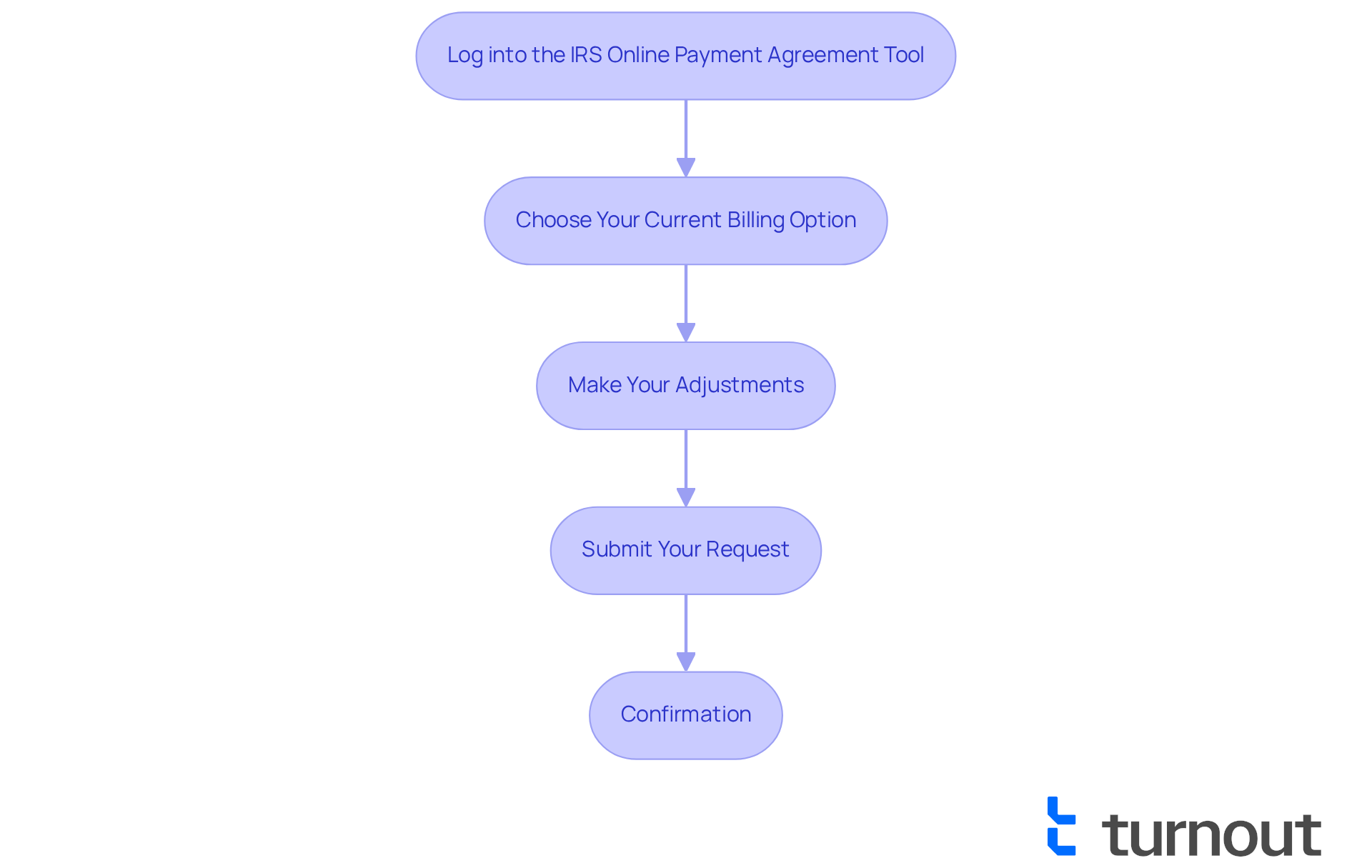

- Log into the IRS Online Payment Agreement Tool: This is the quickest way to make changes. You can access it directly on the IRS website.

- Choose Your Current Billing Option: After logging in, select the billing option you wish to modify.

- Make Your Adjustments: You can change your IRS payment plan by adjusting the amount owed, due date, or even adding new tax liability to your current arrangement.

- Submit Your Request: Once you've made the necessary adjustments, submit your request. Just a heads up, there may be a $10 fee for online modifications.

- Confirmation: You will receive confirmation of your changes via email or through your IRS account.

Looking ahead, in 2025, updates to the IRS Online Payment Agreement Tool will enhance your experience by streamlining the process to change IRS payment plan and providing clearer guidance. It’s common to feel uncertain about these changes, but expert opinions suggest that around 70% of individuals successfully adjust their financial plans using this tool. For instance, one individual who initially faced a monthly charge of $600 was able to lower it to $400 after using the tool, significantly easing their financial burden.

By utilizing the IRS Online Payment Agreement Tool effectively, you can enjoy smoother interactions with the IRS and improved financial outcomes. Remember, with the electronic transaction mandate set to take effect on September 30, 2025, it’s essential to stay informed about your options and any necessary changes. You are not alone in this journey; we’re here to support you every step of the way.

Explore Options for Modifying Payment Amounts and Terms

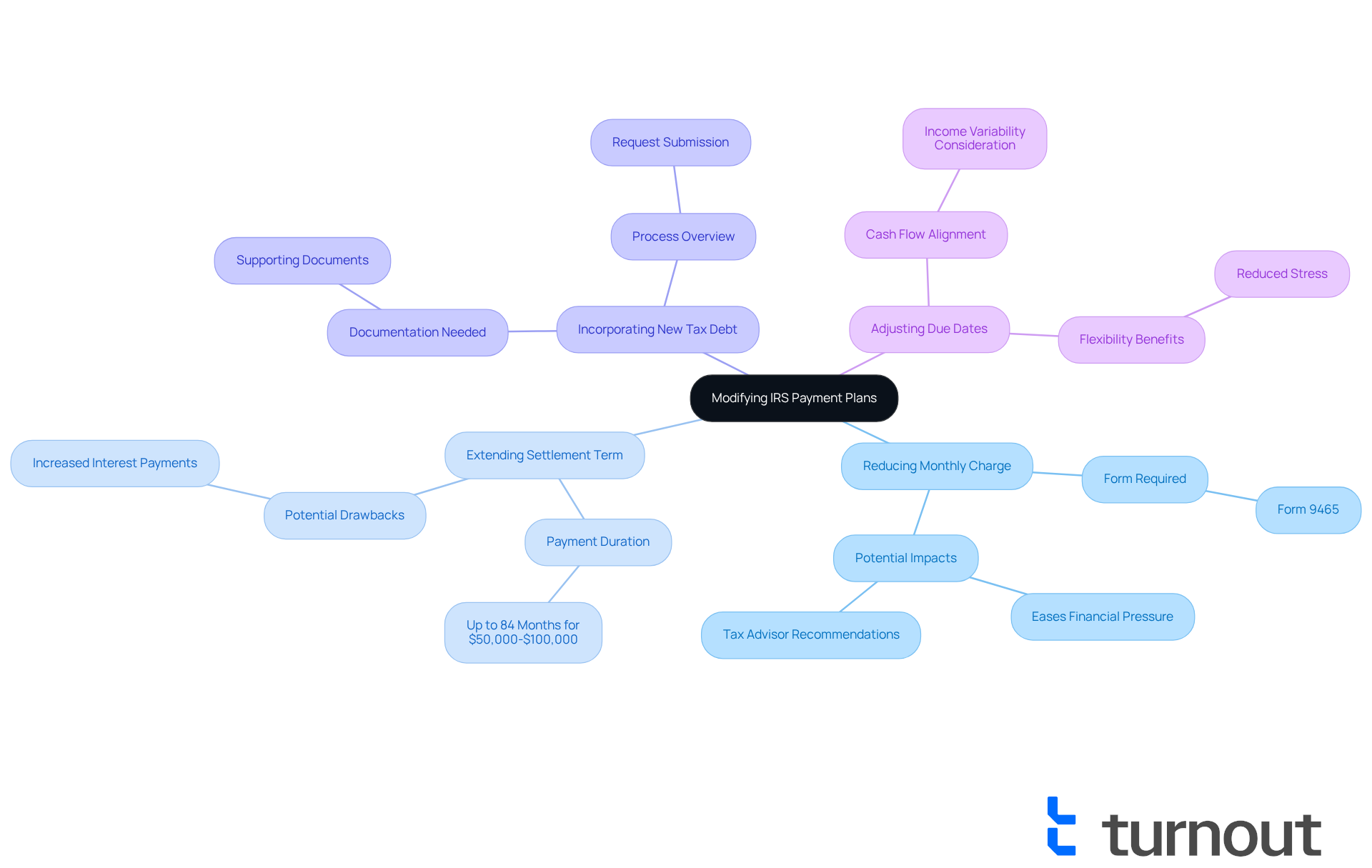

When it comes to how to change your IRS payment plan, we understand that navigating your financial situation can be overwhelming. You have several options to tailor your plan to better fit your needs:

-

Reducing Your Monthly Charge: If your financial circumstances have changed, you can request a lower monthly payment. This might involve submitting Form 9465 if online changes aren’t possible. Many tax advisors recommend this approach to help ease financial pressure. As one tax consultant noted, "Renegotiating your terms of settlement can offer considerable relief and assist you in managing your finances more effectively."

-

Extending the Settlement Term: If you need more time to pay off your debt, consider asking for an extension of your payment plan. This adjustment can lower your monthly payments, although it may result in paying more interest over time. For instance, individuals with debts between $50,000 and $100,000 can extend their terms to 84 months, providing significant relief. Remember, 88% of individual taxpayers owe less than $25,000 to the IRS, making streamlined installment agreements (SLIAs) a popular choice for many.

-

Incorporating New Tax Debt: If you find yourself with additional tax debt, you can request to include it in your current repayment plan. Be ready with all necessary documentation to support your request, as this can help make the process smoother.

-

Adjusting Due Dates: If your income varies, you can change the due date of your payments to better align with your cash flow. This flexibility can help you meet your obligations without added stress.

By understanding these options, you can take control of your IRS financial arrangement and change the IRS payment plan to suit your changing economic needs. Remember, you’re not alone in this journey, and we’re here to help you every step of the way.

Utilize Resources and Best Practices for Payment Plan Management

Changing your IRS payment plan can feel overwhelming, but you’re not alone in this journey. We understand that navigating financial obligations can be stressful, and we’re here to help. Here are some resources and best practices to support you:

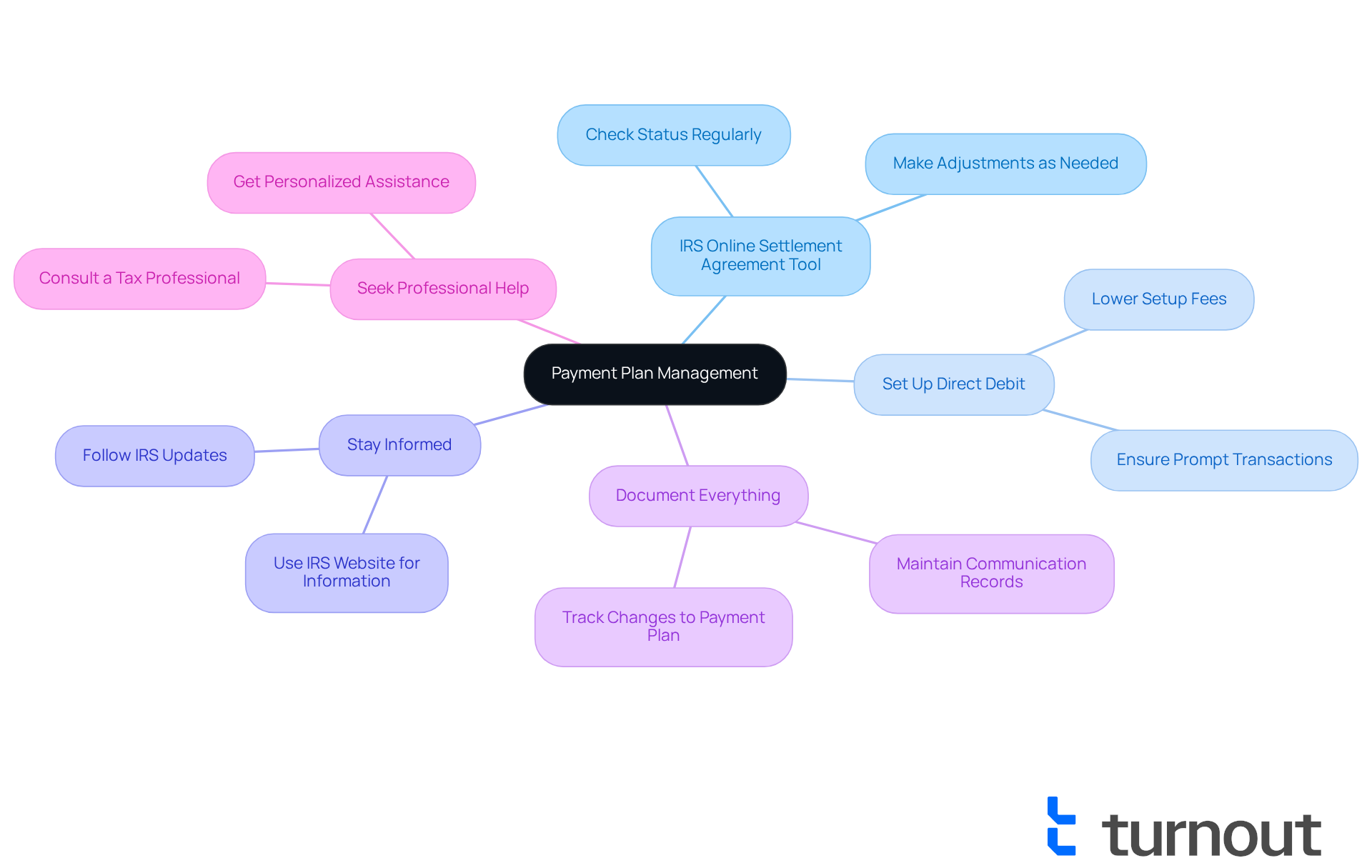

- IRS Online Settlement Agreement Tool: Regularly check your status and make adjustments as needed through this helpful tool. Staying informed can ease your worries.

- Set Up Direct Debit: Enrolling in direct debit can ensure prompt transactions and may even lower your setup fees. It’s a simple step that can make a big difference.

- Stay Informed: Keep up with IRS updates regarding financial arrangements, as policies can change. The IRS website is a reliable source for the latest information, helping you stay ahead.

- Document Everything: Maintain records of all communications with the IRS and any changes you may need to make to change your IRS payment plan. This can provide peace of mind and clarity.

- Seek Professional Help: If you encounter difficulties, consider consulting a tax professional or an advocate who can provide personalized assistance. You deserve support tailored to your needs.

Remember, taking these steps can empower you to manage your payment plan effectively. You’re taking a positive step forward!

Conclusion

Navigating the complexities of IRS payment plans can feel overwhelming, but you’re not alone in this journey. Understanding the various options available - like Short-Term Payment Arrangements, Long-Term Installment Agreements, and the newly introduced Simple Installment Agreements - can empower you to tailor your repayment strategies to fit your unique financial situation. This flexibility not only alleviates stress but also helps minimize additional costs associated with interest and penalties.

We understand that modifying an IRS payment plan can be daunting. That’s why utilizing the IRS Online Payment Agreement Tool is so important for making seamless adjustments. Whether you need to reduce monthly payments, extend settlement terms, or change due dates, these options allow you to take control of your financial obligations. Additionally, resources like direct debit enrollment and professional assistance can further enhance your management of these plans, ensuring you stay informed and prepared.

Ultimately, grasping and effectively managing IRS payment plans is crucial for achieving financial stability. By taking proactive steps and utilizing the resources available, you can navigate your tax obligations with confidence. Remember, it’s vital to remain engaged and informed about your options, as doing so can lead to a more manageable and less stressful financial future. We’re here to help you every step of the way.

Frequently Asked Questions

What are IRS payment plans?

IRS payment plans, also known as installment agreements, allow individuals to manage their tax liabilities gradually, alleviating the stress of paying a lump sum.

What is the Simple Payment Plan introduced in 2025?

The Simple Payment Plan is designed for individual filers with a balance due of $50,000 or less, offering more accessible and flexible terms for repayment.

Who qualifies for a Simple Payment Plan?

In 2025, over 90% of individual filers with a balance due will qualify for a Simple Payment Plan, particularly those with outstanding balances of $50,000 or less.

What are Short-Term Payment Arrangements?

Short-Term Payment Arrangements are for tax obligations under $100,000, allowing individuals to settle their balance within 180 days to avoid long-term penalties.

What are Long-Term Installment Agreements?

Long-Term Installment Agreements are available for debts under $50,000 and extend the repayment period up to 72 months, providing flexibility but potentially increasing interest, penalties, and fees.

How can I apply for a Simple Payment Plan?

You can apply for a Simple Payment Plan through your IRS Online Account, where you can set up direct debit or other payment methods without needing to contact the IRS.

What should I do to qualify for a Simple Payment Plan?

To qualify for a Simple Payment Plan, it is essential to stay current with your tax returns and demonstrate a willingness to manage your tax obligations.

Is there any relief available for penalties?

If you have tried to comply with tax regulations but faced challenges beyond your control, you may be eligible for penalty relief.