Overview

We understand that navigating tax responsibilities can be overwhelming, especially when using platforms like Zelle. It's important to know that Zelle does not send 1099 forms for reporting transactions. This means the responsibility falls on you to declare any taxable income you receive through the platform.

While Zelle makes it easy to transfer money directly between bank accounts, it doesn’t act as a third-party payment processor. Therefore, it’s crucial to keep detailed records of your transactions. If you earn money from goods or services, you must report those earnings to the IRS, even if you don’t receive a 1099-K.

You are not alone in this journey. Many people share similar concerns about managing their finances and tax obligations. We’re here to help you navigate these responsibilities with confidence. Remember, staying organized and informed is key to ensuring you meet your tax obligations without stress.

Introduction

Understanding the complexities of digital payment platforms like Zelle is crucial, especially as their popularity continues to grow. Millions of users are engaging in peer-to-peer transactions, and while this service offers remarkable convenience, it also brings up important questions about tax responsibilities. You might be wondering about the issuance of 1099 forms and how to navigate the reporting of income received through Zelle.

We understand that it can be overwhelming to ensure compliance with IRS regulations, especially without the typical documentation that other services provide. This article aims to delve into the nuances of Zelle's tax obligations, providing you with the information you need to manage your financial responsibilities effectively. Remember, you are not alone in this journey, and we're here to help you every step of the way.

Explore Zelle: How It Works and Its Unique Payment Model

We understand that navigating financial transactions can be overwhelming, especially when it comes to managing your tax responsibilities. This peer-to-peer service offers a solution, allowing you to transfer and receive funds directly from your bank accounts, often within minutes. Unlike traditional transaction platforms, this service doesn’t hold or process funds; it facilitates direct transactions between banks. Recognizing this difference is crucial for users like you, as it can significantly impact how you handle your taxes.

Integrated into many banking applications, this service prioritizes accessibility and convenience. When you send money, it goes straight from your bank account to the recipient's account, eliminating the need for a third-party intermediary. This direct transfer model not only simplifies your transactions but also leads to questions about whether Zelle sends 1099 for tax reporting practices. It’s essential to grasp your responsibilities regarding income reporting to avoid any surprises.

As of 2025, approximately 151 million users have enrolled in this service, showcasing a remarkable increase in adoption. This growth underscores the importance of understanding how these platforms operate and their implications for tax reporting, particularly regarding the question of whether Zelle does send 1099 as peer-to-peer transfer systems continue to evolve. In 2024 alone, the service managed $1 trillion in transactions, marking a record high for peer-to-peer applications. Furthermore, it’s projected to account for around 54.6% of U.S. mobile peer-to-peer transaction value in 2025, solidifying its leading position in the market.

Letitia James has emphasized the need for justice for consumers affected by the platform's security issues. Remember, you are not alone in this journey. We’re here to help you navigate these complexities and ensure you understand your responsibilities.

Determine Zelle's Reporting Obligations to the IRS

We understand that navigating tax obligations can be overwhelming, particularly when you are uncertain about whether does Zelle send 1099 for reporting your earnings. The service you’re using isn’t classified as a third-party transaction processor, which means it doesn’t have to report your transactions to the IRS. Starting in 2025, you won’t receive Form 1099-K, leading to inquiries about how does Zelle send 1099 for reporting income from goods and services. This places the responsibility on you to declare any taxable earnings you receive through the platform, raising the question of whether does Zelle send 1099.

It’s crucial to recognize that even without a 1099-K, you still need to keep an eye on your earnings and accurately report them on your tax returns, especially in light of the question: does Zelle send 1099? For instance, if you receive funds for products or services through the app, it’s your responsibility to declare that income, and you might be asking, does Zelle send 1099 for this, regardless of whether you get a tax document from the service.

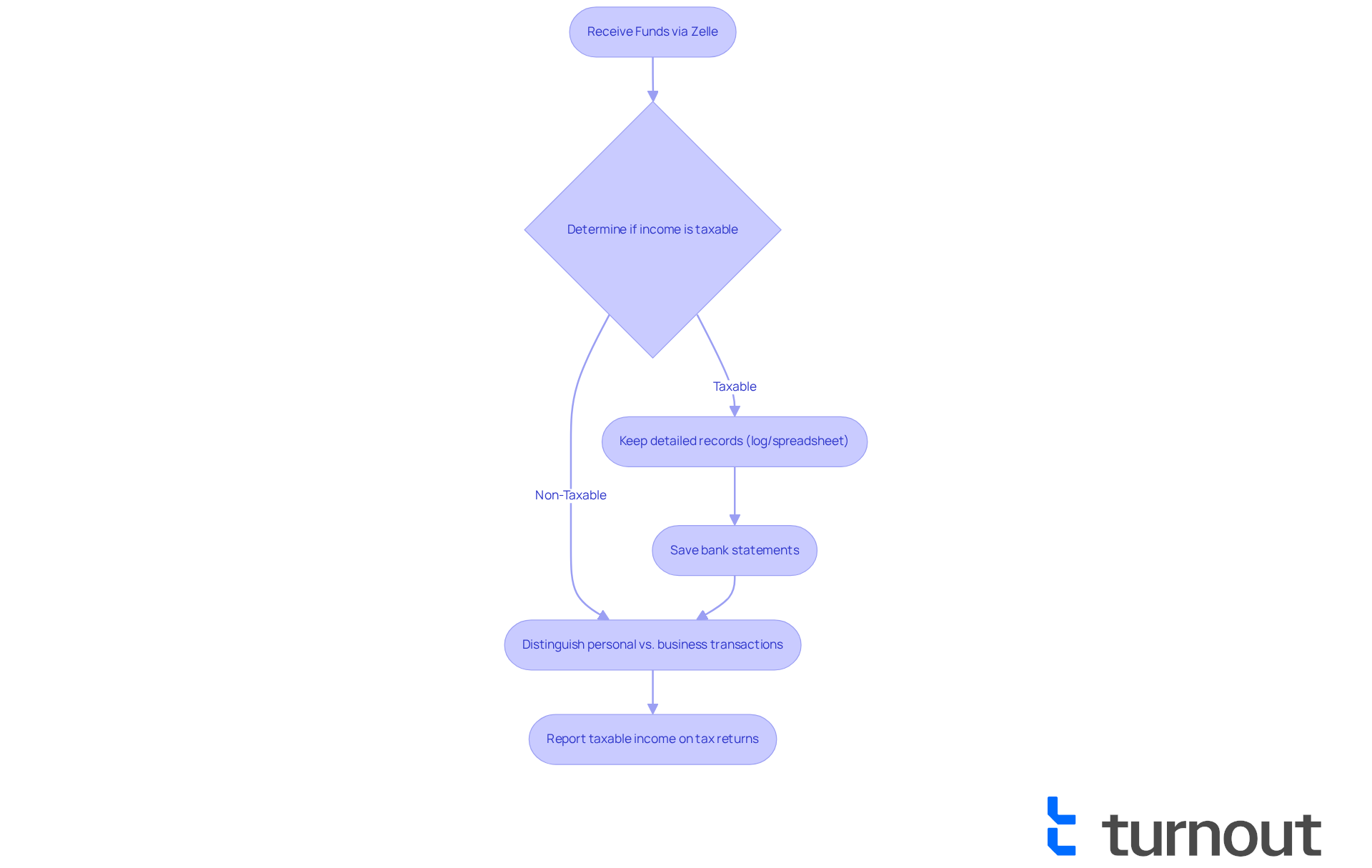

To help you stay compliant, we recommend keeping detailed records of your transactions. This means:

- Maintaining a log or spreadsheet of the funds you receive

- Saving bank statements that show these deposits

- Clearly distinguishing between personal transfers and business transactions

Additionally, using a separate bank account for business-related Zelle transfers can make it easier to track your income accurately and comply with tax regulations.

It’s also important to remember that personal transfers, like gifts, are non-taxable and don’t need to be reported. However, neglecting to report taxable earnings, such as those received via Zelle, raises the question: does Zelle send 1099, and this can lead to serious penalties from the IRS. By diligently tracking your income and keeping proper documentation, you can substantiate your earnings during tax filing and avoid potential issues with the IRS. Remember, you’re not alone in this journey; we’re here to help you navigate these responsibilities with confidence.

Understand the 1099-K Form: When and Why It Matters for Zelle Users

The 1099-K form plays a crucial role for transaction processors, as it reports amounts disbursed to individuals or businesses for goods and services. Typically, you’ll receive this form if you earn over $20,000 and have more than 200 transactions in a calendar year. However, it’s important to note that some services, like Zelle, don’t issue 1099-K forms, which raises the question: does Zelle send 1099? Instead, they act as transfer services between bank accounts. This means it’s up to you to keep an eye on your earnings.

If you’re using Zelle for business transactions and find yourself exceeding those reporting thresholds, you may wonder, does Zelle send 1099 for declaring those earnings on your tax return? This involves careful documentation of all your transactions, including the amounts received and the reasons for each transfer. As Mark Steber, chief tax information officer for Jackson Hewitt, wisely points out, "If you received earnings from goods, services, or property, you must report it to the IRS — regardless of the amount, the method of compensation, or whether you received a 1099-K or not." Understanding the implications of the 1099-K form is vital for staying compliant with IRS regulations, even if you don’t receive a form from your payment service.

Tax experts emphasize the importance of maintaining thorough records. Income obtained through electronic transfers is treated similarly to cash transactions, so it’s essential to document all business-related exchanges accurately. For instance, businesses using electronic funds transfer services must declare their income, regardless of whether they receive a 1099-K. It’s also crucial to remember that transfers from friends and family shouldn’t be reported on Form 1099-K, which is a key distinction for understanding your reporting responsibilities.

To effectively monitor your digital payments, consider these methods:

- Review your bank statements regularly.

- Utilize accounting software to track your transactions.

- Keep separate accounts for personal and business transactions to avoid confusion.

If you have questions about reporting electronic payment transactions, seeking guidance from a tax expert is a wise step. Neglecting to declare income can lead to serious legal repercussions, including fines for underreported earnings. While the payment service doesn’t charge fees for transferring and receiving funds, making it an appealing option for business dealings, it’s essential to stay vigilant in your record-keeping to ensure you meet your tax responsibilities. Remember, you’re not alone in this journey — we’re here to help!

![]()

Navigate Tax Responsibilities: Reporting Zelle Payments and Avoiding Common Mistakes

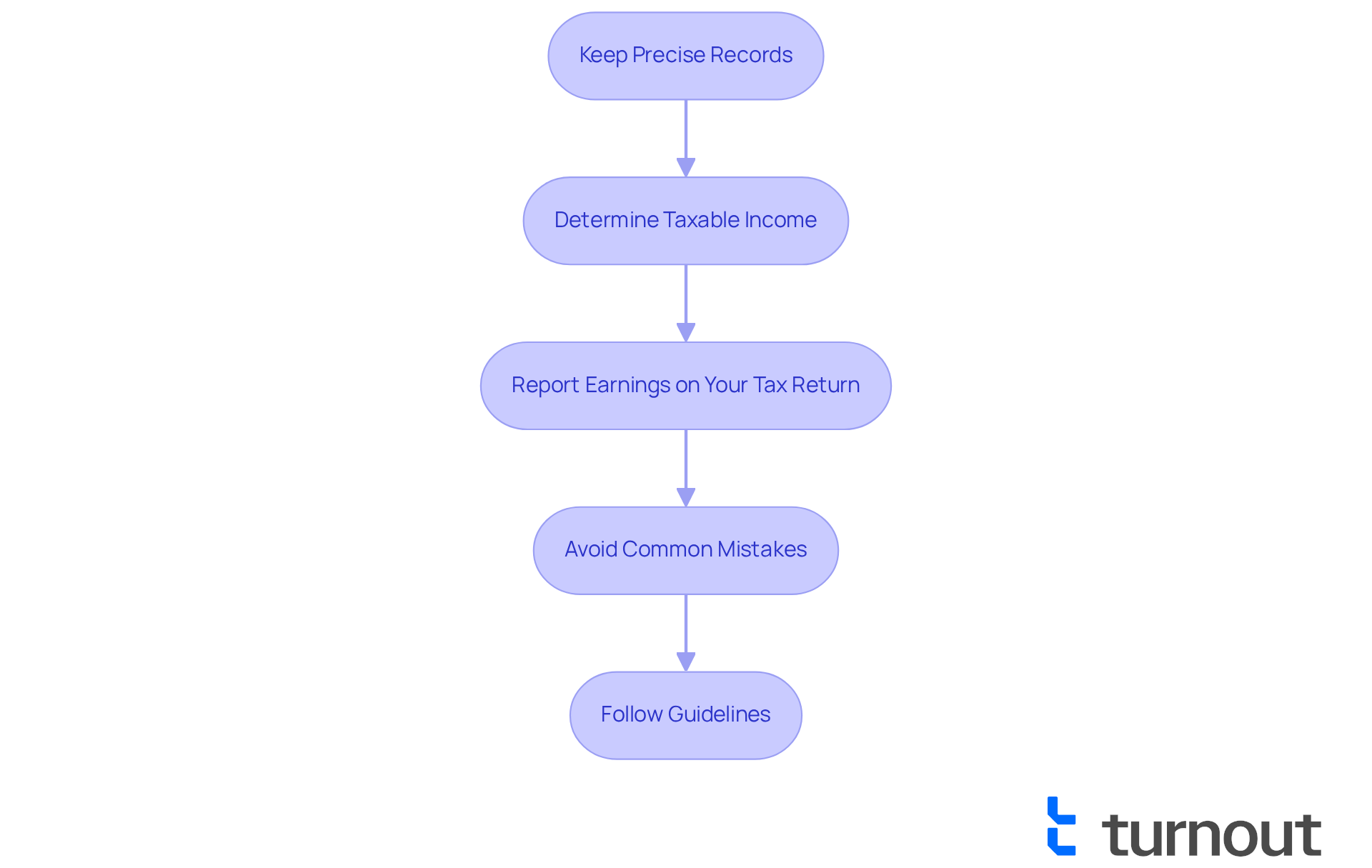

Navigating your tax responsibilities when using Zelle, particularly concerning whether Zelle sends 1099, can feel overwhelming, but you’re not alone in this journey. Here are some steps to help you manage your obligations with confidence:

-

Keep Precise Records: It’s essential to maintain a detailed log of all funds received through Zelle. Note the date, amount, and purpose of each transaction. This practice will aid in precise financial reporting and give you peace of mind.

-

Determine Taxable Income: Understanding the difference between taxable and non-taxable funds is crucial. Personal transfers from friends or family typically aren’t taxed, while payments for goods or services are considered taxable earnings. We understand that this distinction can be confusing, but it’s important to get it right.

-

Report Earnings on Your Tax Return: When it’s time to submit your taxes, report your Zelle earnings on Schedule C if you’re self-employed, or include them on your personal tax return as miscellaneous earnings. Remember, it’s essential to declare all taxable earnings, even if you don’t receive a 1099-K form, which raises the question, does Zelle send 1099? You’ve worked hard for your income, and it deserves to be reported accurately.

-

Avoid Common Mistakes: It’s easy to misclassify personal payments as business revenue, which can complicate your tax situation with the IRS. Be vigilant about considering all funds received via the payment service; failing to report them may lead to penalties, including interest fees and possible legal repercussions. We understand that mistakes happen, but being proactive can help you avoid these pitfalls.

In 2025, around 70% of users of the payment service reported keeping transaction records, highlighting the importance of organized documentation. Tax advisors often emphasize that misreporting income from digital payment platforms is a frequent mistake. One advisor noted, "You still must report all taxable earnings you acquired, including income from such services, on your tax return." By following these guidelines, you can effectively manage your tax obligations related to Zelle payments and steer clear of common challenges. Remember, we’re here to help you through this process.

Conclusion

Understanding how to use Zelle for your financial transactions can feel overwhelming, especially when it comes to tax responsibilities. This peer-to-peer payment service makes transferring funds between bank accounts easy, but it’s important to remember that it doesn’t issue 1099 forms. This means the responsibility for reporting income falls on you. Recognizing this distinction is crucial to navigating potential tax obligations and avoiding unexpected penalties.

We know that keeping track of your transactions can be a challenge. That’s why it’s essential to maintain detailed records, distinguish between taxable and non-taxable income, and ensure accurate reporting on your tax returns. With Zelle’s growing popularity, being informed about these tax responsibilities is more important than ever. Tax professionals emphasize that even without a 1099-K, all taxable earnings must be reported to the IRS. This reinforces the need for diligent record-keeping.

Staying proactive in managing your Zelle transactions can safeguard you against potential legal issues and promote financial transparency. By following best practices and seeking guidance when needed, you can confidently navigate your responsibilities and ensure compliance with IRS regulations. Embracing these practices not only leads to a smoother financial experience but also brings peace of mind in managing your income.

Remember, you’re not alone in this journey. We’re here to help you understand and manage your financial responsibilities with care and compassion.

Frequently Asked Questions

What is Zelle and how does it work?

Zelle is a peer-to-peer payment service that allows users to transfer and receive funds directly from their bank accounts, often within minutes. It facilitates direct transactions between banks without holding or processing funds.

How does Zelle differ from traditional transaction platforms?

Unlike traditional platforms, Zelle does not act as a third-party intermediary; it enables direct transfers from one bank account to another, simplifying the transaction process.

Does Zelle send 1099 forms for tax reporting?

Zelle does not automatically send 1099 forms for tax reporting, but users should understand their responsibilities regarding income reporting to avoid surprises.

How many users are enrolled in Zelle as of 2025?

As of 2025, approximately 151 million users have enrolled in Zelle.

What was the transaction volume managed by Zelle in 2024?

In 2024, Zelle managed $1 trillion in transactions, marking a record high for peer-to-peer applications.

What is Zelle's projected market share in U.S. mobile peer-to-peer transactions for 2025?

Zelle is projected to account for around 54.6% of U.S. mobile peer-to-peer transaction value in 2025.

What concerns have been raised regarding Zelle?

Letitia James has emphasized the need for justice for consumers affected by security issues related to the platform.