Introduction

Navigating the complex world of tax obligations can feel overwhelming, especially for those using digital payment platforms like Zelle. We understand that figuring out whether Zelle issues 1099 forms is crucial for your peace of mind regarding reporting responsibilities. This article aims to provide a clear and supportive guide to demystifying 1099 forms, outlining the steps you can take to ensure compliance and avoid potential penalties.

But what if you receive income without the expected documentation? It’s common to feel anxious about this situation. Exploring this question is essential for maintaining accurate financial records and staying on the right side of the IRS. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

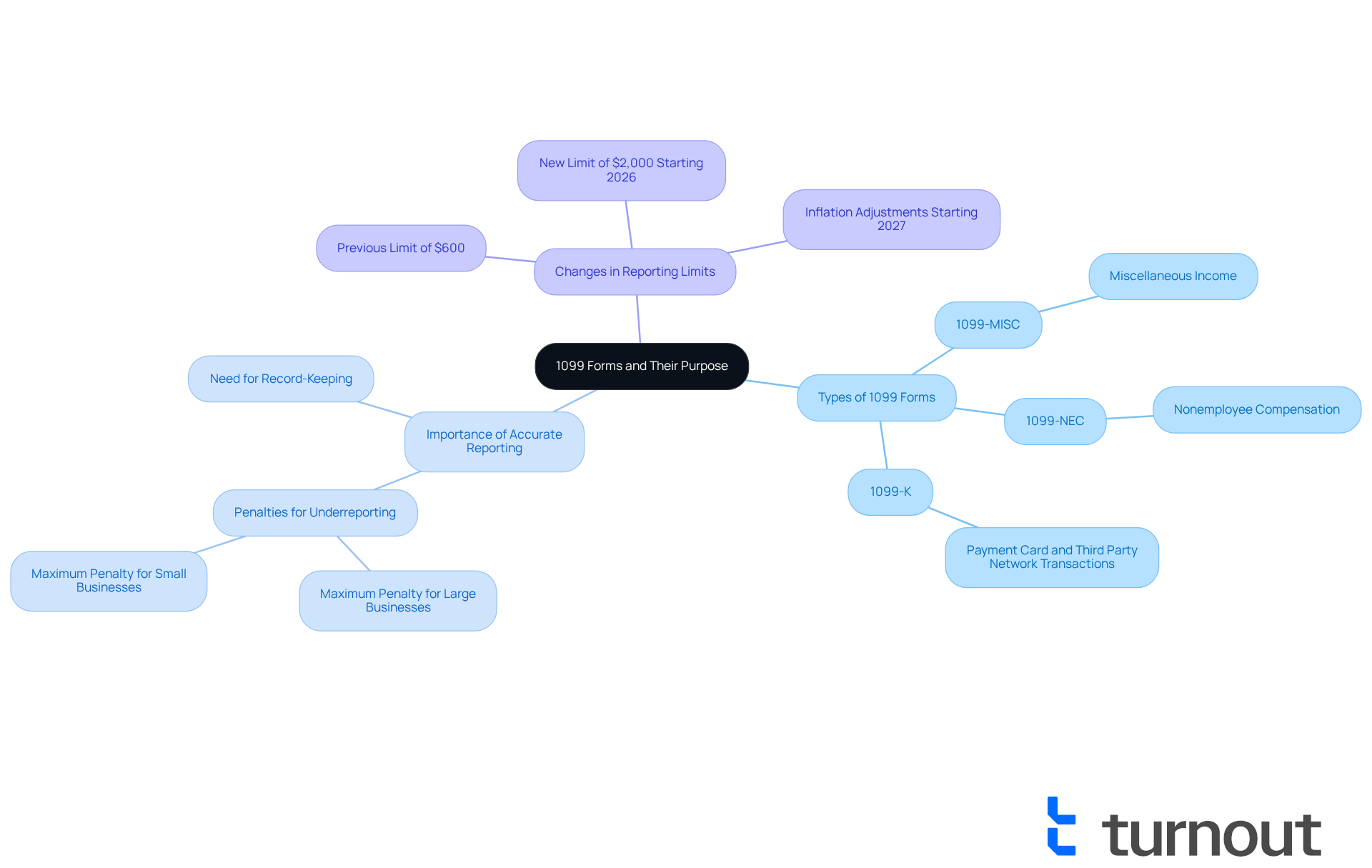

Understand 1099 Forms and Their Purpose

A 1099 document is an important IRS tax record that helps report various types of income outside standard employment wages. You might be familiar with different kinds of 1099 documents, like the 1099-MISC for miscellaneous earnings and the 1099-NEC for nonemployee compensation. These documents play a crucial role in helping the IRS monitor income earned by individuals or businesses beyond traditional employment, ensuring compliance with tax laws and reducing the risk of penalties for underreporting income.

We understand that Zelle users may feel uncertain about their tax obligations, particularly regarding whether Zelle issues 1099. While it is important to know that Zelle issues 1099-K documents, you are still responsible for reporting any income received through Zelle on your tax returns, especially if it exceeds the new reporting limits set by recent legislation. Starting in 2026, the limit for issuing 1099 documents will increase from $600 to $2,000. This change will significantly impact the number of documents issued each year, making tax compliance easier for many users. It’s a notable 233% increase from the previous limit, reflecting the realities of modern business and inflation.

Tax experts emphasize the importance of keeping accurate records of all income, even if a 1099 form isn’t issued. It’s common to feel overwhelmed by tax responsibilities, but maintaining precise records can help you avoid potential penalties associated with underreporting income. The IRS can impose hefty penalties for failing to report income accurately, which can reach as high as $4,098,500 for large businesses or $1,366,000 for small enterprises. Therefore, we encourage you to diligently track your income to ensure compliance and steer clear of these penalties. Remember, you are not alone in this journey; we’re here to help.

Identify When Zelle Issues a 1099 Form

We understand that navigating tax obligations can be overwhelming, especially when it comes to reporting your earnings. It's important to note that our service does not provide 1099-K documents, and this raises the question of whether does Zelle issue 1099, as it operates as a direct bank transfer platform rather than a third-party payment processor. This distinction means that we are not required to report transactions to the IRS unless certain conditions are met.

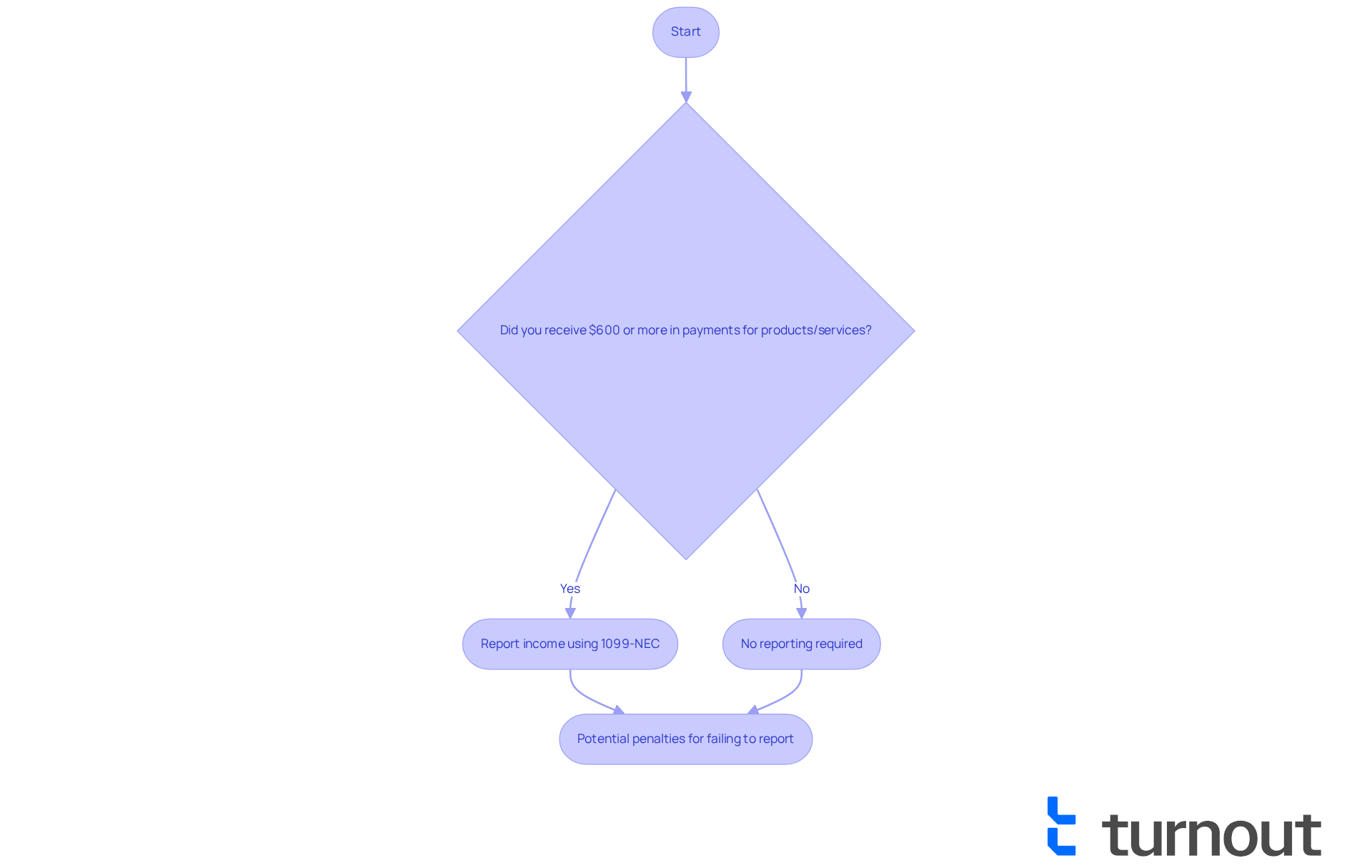

For instance, if you receive payments for products or services as a business or self-employed individual totaling $600 or more in a calendar year, you must report that income using a 1099-NEC document. Remember, in this case, it is important to know does Zelle issue 1099. It's crucial to keep an eye on your transactions and ensure that you report any taxable earnings accurately, even without a tax document from us.

Failing to report such earnings can lead to significant penalties and interest from the IRS, including an accuracy-related penalty of 20% on the underpayment due to the error. Therefore, maintaining organized records is essential. We encourage you to seek professional assistance for accurate tax reporting. You're not alone in this journey, and we're here to help you navigate these complexities.

Take Action: Steps to Obtain Your 1099 from Zelle

Navigating tax obligations can feel overwhelming, particularly when considering whether Zelle does issue 1099 forms for reporting income from digital payment services. We understand that you want to ensure everything is done correctly, so here are some steps to help you report your income accurately:

-

Track Your Transactions: It's essential to keep a detailed record of all payments you receive through Zelle. This includes noting the amounts and dates. You can do this easily by reviewing your bank statements or using accounting software.

-

Determine Taxable Earnings: Take a moment to assess whether your total revenue from Zelle exceeds the $600 threshold for reporting. If Zelle does issue 1099, then you’ll need to declare this income on your tax return.

-

Issue a 1099-NEC if Required: If you’ve compensated a contractor or received payments for services that total $600 or more, you must issue a 1099-NEC form to report this income.

-

Consult a Tax Professional: If you’re feeling uncertain about your reporting obligations or how to fill out the necessary forms, don’t hesitate to reach out to a tax professional for personalized guidance. As Kaz Weida wisely noted, "money received through the payment system for the purchase of goods and services is still regarded as taxable earnings and should be included on your federal tax return under Schedule C of your 1040 Form."

-

File Your Taxes: Remember to include any earnings received through Zelle on your tax return, and be aware of whether Zelle does issue 1099. The IRS can identify unreported earnings through audits, so accurate reporting is crucial to avoid penalties.

By following these steps, you can manage your tax obligations with confidence. Many individuals who have successfully navigated these requirements emphasize the importance of meticulous record-keeping and timely consultations with tax experts. In fact, projections for 2025 suggest that the average income reported through Zelle transactions will be around $20,000. This highlights the need for awareness and diligence in tax reporting.

You are not alone in this journey, and we’re here to help you every step of the way.

![]()

Conclusion

Understanding the nuances of tax reporting, especially with platforms like Zelle, is crucial for anyone using digital payment services. We know it can be overwhelming, but staying informed about your income reporting responsibilities is essential. While Zelle doesn’t issue 1099 forms directly, it’s important to be vigilant, particularly as reporting thresholds evolve. Remember, the responsibility to accurately report any earnings received through Zelle ultimately lies with you, especially when they exceed the specified limits.

Key insights highlight the importance of keeping meticulous records of all transactions. It’s vital to know when a 1099-NEC form is necessary. Tracking your earnings and consulting with tax professionals when in doubt can make a significant difference. By ensuring compliance with IRS regulations, you can avoid potential penalties. As the reporting landscape changes, especially with upcoming adjustments to the 1099 thresholds, taking proactive measures will be vital for effective tax management.

The significance of accurate tax reporting cannot be overstated. By understanding and fulfilling your reporting obligations, you can navigate your tax responsibilities with confidence. Diligent record-keeping and seeking professional advice empower you to manage your finances effectively and avoid the pitfalls of underreporting income. Engaging with these practices not only ensures compliance but also fosters a greater understanding of your personal financial health in an increasingly digital economy. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What is the purpose of a 1099 form?

A 1099 form is an important IRS tax record used to report various types of income outside standard employment wages, helping the IRS monitor income earned by individuals or businesses.

What are the different types of 1099 forms?

Common types of 1099 forms include the 1099-MISC for miscellaneous earnings and the 1099-NEC for nonemployee compensation.

Does Zelle issue 1099 forms?

Yes, Zelle issues 1099-K documents for reporting income, but users are still responsible for reporting any income received through Zelle on their tax returns.

What are the new reporting limits for 1099 forms starting in 2026?

Starting in 2026, the limit for issuing 1099 documents will increase from $600 to $2,000.

Why is it important to keep accurate records of all income?

Keeping accurate records is crucial to avoid potential penalties for underreporting income, as the IRS can impose hefty fines for inaccurate reporting.

What are the potential penalties for failing to report income accurately?

The IRS penalties can reach up to $4,098,500 for large businesses and $1,366,000 for small enterprises.

How can individuals ensure compliance with tax obligations?

Individuals can ensure compliance by diligently tracking their income and maintaining precise records, even if a 1099 form isn’t issued.