Overview

VA disability benefits are generally classified as non-taxable income. However, we understand that their treatment in child support calculations can vary significantly by state and court interpretation. It's common to feel overwhelmed by these complexities.

Some courts include VA disability payments as income for child support, while others choose to exclude them. This inconsistency can create confusion and frustration for veterans. It's important to recognize that understanding local regulations is crucial.

We encourage veterans to seek legal guidance to navigate these challenges effectively. You are not alone in this journey; there are resources available to help you. Remember, taking the first step towards clarity can make a significant difference in your situation.

Introduction

Navigating the intersection of VA disability benefits and child support obligations can be a perplexing journey for many veterans. We understand that these essential financial supports, designed to aid those who have served, often raise critical questions about their role in child support calculations. As states and courts grapple with varying interpretations of these benefits, it’s common to feel uncertain about how these payments impact your financial responsibilities toward your children.

Understanding the nuances of this issue is crucial for veterans seeking clarity and fairness in their child support arrangements. You are not alone in this journey; many veterans share similar concerns. We’re here to help you find the answers you need, ensuring that your rights and responsibilities are clear.

Define VA Disability Benefits and Their Classification

VA disability payments provide vital financial support for former service members who have faced injuries or illnesses related to their military service. These benefits are designed to ease the transition to civilian life, helping veterans compensate for lost income and access essential healthcare.

Understanding the nature of these benefits is crucial. They are typically classified as non-taxable income, which distinguishes them from regular wages or salaries. This distinction is important, especially when considering how benefits, specifically regarding whether does VA disability count as income for child support, might impact financial responsibilities.

We understand that navigating these financial aspects can be overwhelming. It's common to feel uncertain about how your benefits fit into your overall financial picture. Remember, you are not alone in this journey, and we’re here to help you make informed decisions.

Explore Legal Framework: Federal vs. State Regulations

Navigating the legal structure regulating VA disability assistance can be challenging, as it encompasses both federal and state regulations. At the federal level, the Department of Veterans Affairs oversees these services, setting standards for eligibility and payment amounts. However, we understand that each state has the power to determine how benefits, including whether does VA disability count as income for child support, are factored into child financial calculations.

It's common to feel confused about whether does VA disability count as income for child support, as certain states may classify these payments as earnings, while others might exclude them from earnings assessments. This discrepancy can create uncertainty for veterans who are trying to determine if does VA disability count as income for child support obligations.

That’s why it’s crucial to understand the specific regulations in your state of residence. Remember, you are not alone in this journey. We’re here to help you navigate these complexities and ensure you receive the support you deserve.

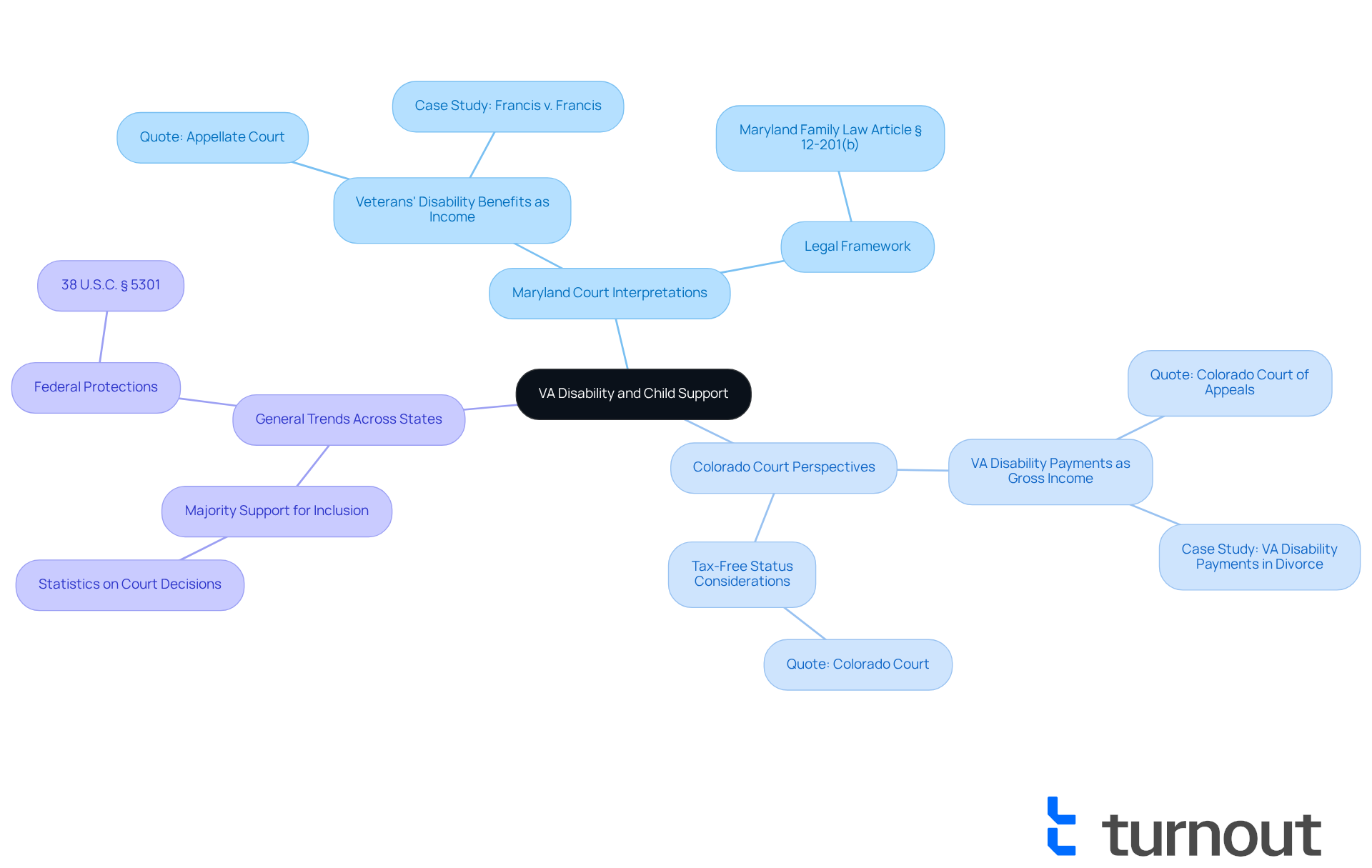

Analyze Court Interpretations of VA Disability as Income for Child Support

Court interpretations regarding whether VA disability counts as income for child support show considerable variation across regions. We understand that navigating these complexities can be challenging. In numerous instances, courts have determined that advantages, including whether VA disability counts as income for child support, must be factored into earnings assessments for child maintenance, highlighting their significance in delivering financial assistance vital for a child's well-being.

For example, the Maryland Court of Special Appeals confirmed that when considering child support, the question of whether VA disability counts as income for child support applies to veterans' disability assistance under Maryland regulations. This strengthens the idea that such assistance, particularly in understanding whether VA disability counts as income for child support, plays a role in a veteran's overall financial situation when assessing obligations for aid. Joe Whitcomb remarked, "Under Maryland’s Family Law Article § 12-201(b), it is important to understand how veterans' disability assistance, which does VA disability count as income for child support, should be factored into child care calculations."

On the other hand, some courts have chosen not to categorize VA disability payments as earnings. They reference their non-taxable nature and the initial purpose behind their allocation. The Colorado Court of Appeals, for instance, decided that VA disability payments cannot be separated as assets in a divorce, but they still raise the question of whether VA disability counts as income for child support calculations. The appellate court determined, "we find that veteran's disability payments fall within the broad definition of gross income, leading us to consider if VA disability counts as income for child support." This duality emphasizes the intricacy of legal interpretations regarding VA entitlements.

Statistics reveal a near-universal trend among states regarding the question of whether VA disability counts as income for child support in support calculations. A substantial majority of courts have supported this classification, acknowledging that these advantages function as a reliable income source for former service members, which raises the question of whether VA disability counts as income for child support. However, the interpretation of asset division can vary by state, complicating divorce proceedings for veterans.

Legal specialists highlight the importance for individuals dealing with these matters to comprehend local precedents. The question of whether VA disability counts as income for child support can greatly influence child maintenance responsibilities. Remember, you are not alone in this journey. The decisions highlight the significance of customized advice to manage the intricacies of VA entitlements and their effects on financial obligations.

Examine Exceptions and Special Circumstances in Child Support Calculations

Navigating the complexities of understanding if VA disability does count as income for child support in financial calculations can be challenging. We understand that various exceptions and unique situations can greatly impact how these benefits are considered. For instance, when an experienced individual has multiple income streams, courts often look at the overall financial picture rather than focusing solely on VA payments. This comprehensive approach allows for a more accurate assessment of one's ability to meet child financial responsibilities.

In cases where a disability significantly affects earning potential, courts may adopt a more flexible stance. This could mean excluding certain benefits from child expense calculations entirely. Imagine an individual with full disability benefits facing substantial medical costs; the court might recognize the importance of prioritizing their financial stability over strict adherence to obligations.

Statistics reveal that many former service members rely on diverse revenue streams, complicating child maintenance assessments. Courts have the responsibility to evaluate all income sources, including the question of whether VA disability counts as income for child support, to ensure fair calculations of assistance. This thorough assessment is vital, as it reflects the individual's overall financial health and obligations.

Real-world examples shed light on these complexities. For example, one individual with a 70% disability rating and additional income from part-time work successfully arranged a child support agreement that acknowledged their unique financial circumstances. This outcome underscores the significance of presenting a complete financial picture to the court.

Understanding these nuances is essential for former service members striving to manage their financial responsibilities effectively. We encourage veterans to seek military legal assistance resources for guidance on VA entitlements and child support matters. It's also important to note that VA assistance is generally exempt from taxation and creditor claims, which leads to the question of whether VA disability counts as income for child support, clarifying its financial implications. Courts have consistently upheld that VA resources can be utilized for child maintenance and alimony payments, as established in the U.S. Supreme Court case Rose v. Rose, which raised the question of whether VA disability counts as income for child support.

By recognizing how special circumstances can influence child support calculations, veterans can better advocate for their rights. Remember, you are not alone in this journey, and we're here to help ensure that your benefits are appropriately considered.

Conclusion

Understanding the classification of VA disability benefits is crucial for veterans as they navigate their financial responsibilities, especially concerning child support. These benefits, designed to support those who have served, can be perceived differently across various jurisdictions. This variability can significantly influence how much veterans are expected to contribute towards child support, making it essential to grasp the legal nuances involved.

Throughout this discussion, we recognize the dual nature of VA disability payments as both a financial lifeline for veterans and a complex factor in child support calculations. Key points include:

- The federal and state regulations governing these benefits

- The differing court interpretations regarding their classification as income

- The unique circumstances that can affect child support obligations

Each of these elements highlights the importance of seeking tailored legal advice to navigate the intricacies of VA entitlements.

In light of these insights, it is vital for veterans to take proactive steps in understanding their rights and the implications of their benefits on child support. Engaging with legal resources and staying informed about local regulations can empower veterans to advocate effectively for their financial well-being and that of their children. As the landscape of VA disability and child support continues to evolve, remaining vigilant and informed is key to ensuring that these benefits serve their intended purpose. Remember, you are not alone in this journey, and we are here to help you every step of the way.

Frequently Asked Questions

What are VA disability benefits?

VA disability benefits are financial support payments provided to former service members who have experienced injuries or illnesses related to their military service. They aim to assist veterans in transitioning to civilian life by compensating for lost income and providing access to essential healthcare.

Are VA disability benefits taxable?

No, VA disability benefits are classified as non-taxable income, which means they are not subject to federal income tax, unlike regular wages or salaries.

How do VA disability benefits affect child support obligations?

Since VA disability benefits are considered non-taxable income, they may impact the calculation of financial responsibilities, such as child support. It's important to understand how these benefits are viewed in relation to income for such obligations.

What should veterans consider when evaluating their financial situation regarding VA disability benefits?

Veterans should consider how their VA disability benefits fit into their overall financial picture, including their impact on income calculations for obligations like child support. Seeking guidance can help in making informed financial decisions.