Introduction

Understanding tax debt can feel overwhelming, and it’s completely normal to wonder if these obligations ever really expire. This isn’t just a legal detail; it can shape your financial future, potentially offering a way out from under heavy burdens. Yet, many people don’t realize their rights or the significance of the IRS's ten-year collection window. This raises crucial questions about how to navigate this challenging landscape effectively.

What steps can you take to feel informed and empowered regarding your tax debts? We’re here to help you explore your options and find the relief you deserve.

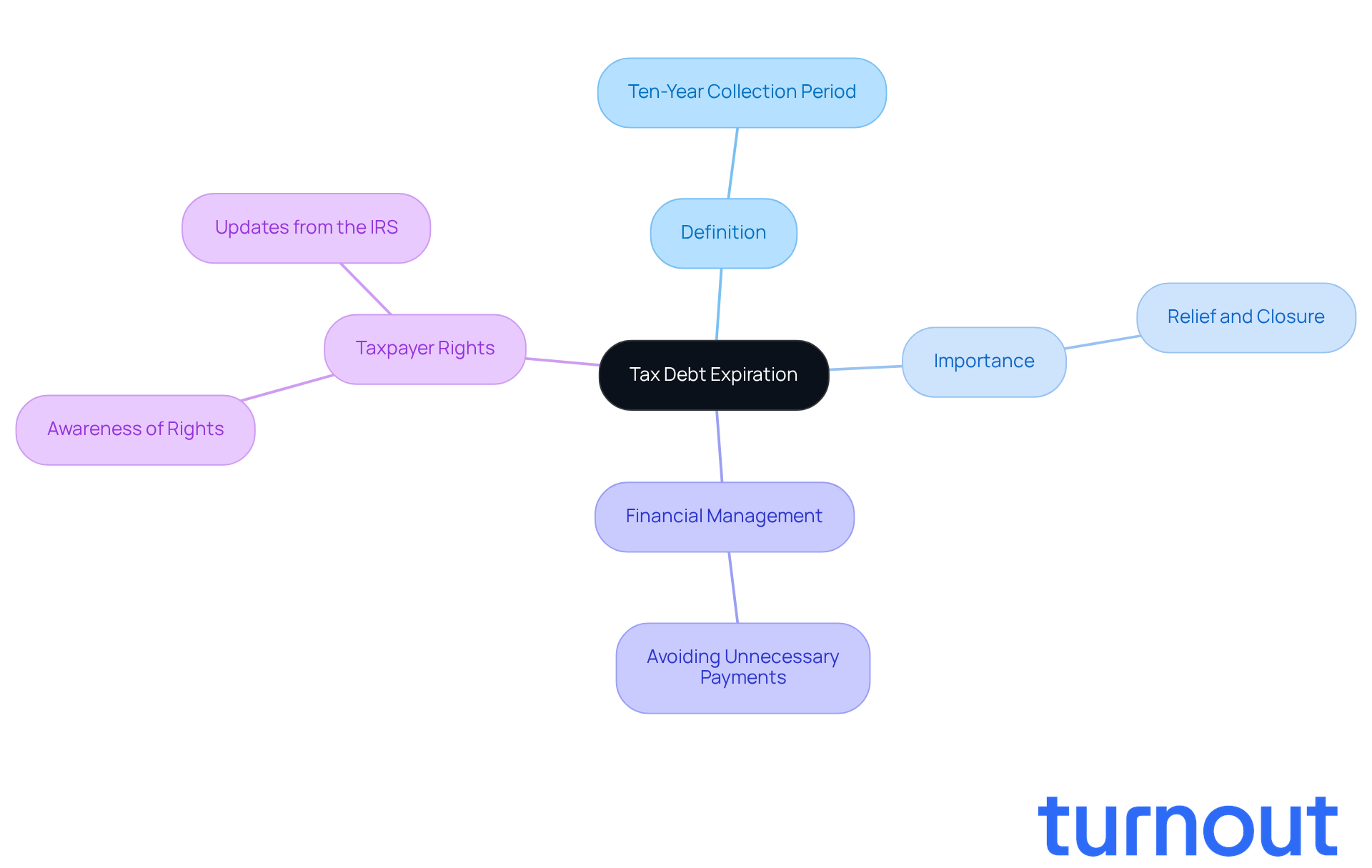

Define Tax Debt Expiration and Its Importance

A crucial concept that many individuals may not fully understand is whether or not tax debt expires. It refers to the legally defined period during which the IRS can collect unpaid taxes, typically lasting ten years from the assessment date. This timeframe is significant because it marks the moment when the IRS can no longer pursue collection, leading to the question of when tax debt expires, offering a sense of relief and closure for those affected. We understand that navigating financial circumstances can be overwhelming, and knowing about this expiration can empower you to explore potential tax relief options.

Consider this: individuals who recognize the expiration can strategically manage their finances. They might avoid unnecessary payments on obligations that are no longer collectible. Unfortunately, many people remain unaware of their rights regarding tax obligation expiration, leading to unnecessary stress and confusion. It's common to feel lost in the complexities of tax laws, but you are not alone in this journey.

Experts emphasize the importance of understanding if and when tax debt expires as a vital aspect of your rights as a citizen. The IRS must adhere to this schedule, and once it lapses, it raises the question of whether tax debt expires, meaning individuals can no longer be pursued for the obligation. Recent updates from the IRS indicate that while the agency has faced challenges in enforcement, the ten-year collection period remains a steadfast rule. This underscores the need for taxpayers to stay informed about their rights and the implications of tax obligation expiration.

Remember, we're here to help you navigate these complexities. By understanding your rights, you can take control of your financial future.

Explore Statutes of Limitations on Tax Debt Collection

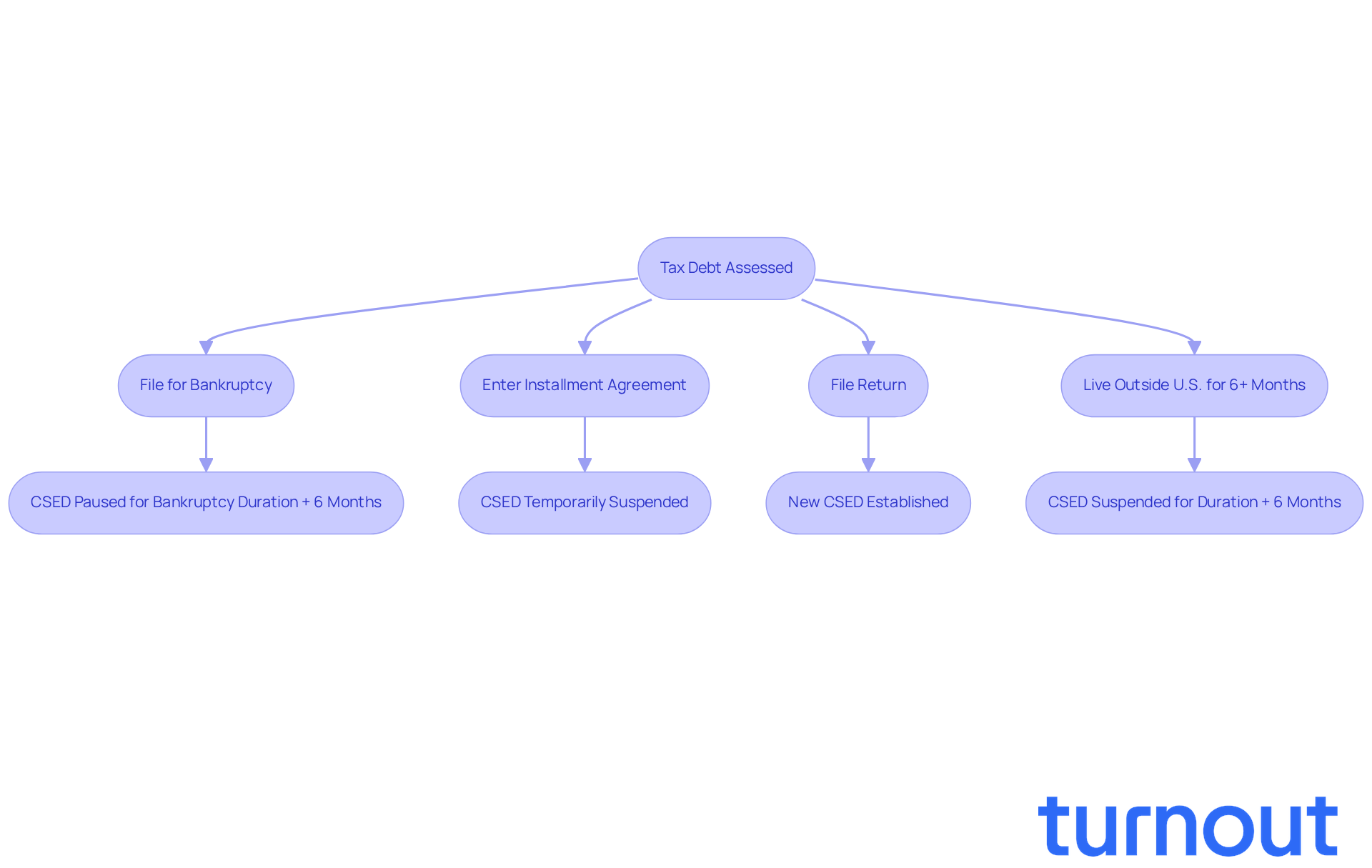

We understand that dealing with tax debts can be overwhelming. The IRS generally has a ten-year window to collect these debts, leading to the question of when does tax debt expire, starting from the date the tax is assessed. This period includes not just the owed taxes but also any penalties and interest that may accrue. However, various actions can pause or even extend this timeline, which is important to know.

For instance, if you file for bankruptcy, the collection clock stops for the duration of your bankruptcy case plus an additional six months. Similarly, entering into an installment agreement can temporarily suspend the Collection Statute Expiration Date (CSED). It’s common to feel anxious about these timelines, but understanding them can empower you.

Taxpayers should also be aware that if they don’t file a return or file fraudulently, the IRS can file a Substitute for Return, starting a new ten-year collection period. In cases of tax fraud or evasion, the IRS can pursue collection indefinitely. This highlights the importance of timely and accurate tax filings.

Moreover, if you’re living outside the U.S. for six months or more, your CSED may be suspended for that time, giving you extra breathing room before collection efforts resume. When the IRS assesses or collects taxes, they will send you a notice or letter detailing the tax year, actions being taken, and next steps. Comprehending these statutes is crucial, as it helps you navigate your rights and explore possible relief options effectively.

Many individuals have successfully managed their tax obligations by utilizing these timelines and choices. For example, those who have faced collection actions after the ten-year period often find relief, leading to the question of whether tax debt does expire, as the IRS can no longer pursue these financial obligations legally. This knowledge can be a powerful tool for you as you seek to regain control over your financial situation. Remember, you are not alone in this journey, and we’re here to help.

Identify Factors That Impact Tax Debt Expiration

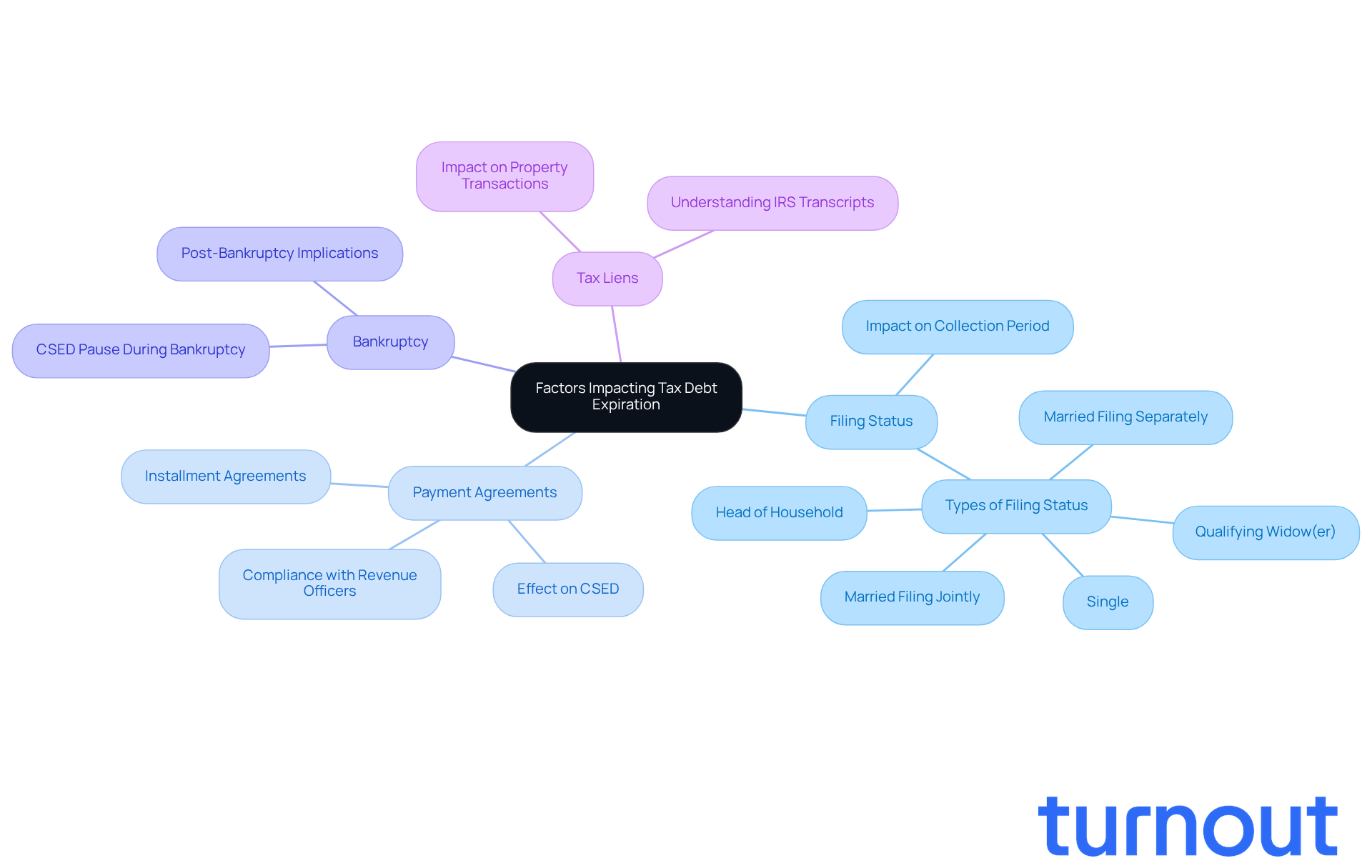

Several factors can significantly influence the expiration of tax debt, and understanding them is essential for your peace of mind:

-

Filing Status: We understand that your filing status can greatly impact how long the IRS has to collect what you owe. If you haven’t submitted a return, it raises the question of whether tax debt does tax debt expire beyond the usual ten-year timeframe. This means they can pursue your obligation indefinitely, leading to ongoing financial stress and prompting the question of whether tax debt does tax debt expire. For example, if you owe over $62,000, the IRS might even deny or revoke your passport, affecting your ability to travel freely.

-

Payment Agreements: It’s common to feel overwhelmed, but entering into an installment agreement with the IRS can help. This can pause the expiration clock on your debt. Each payment you make might reset the Collection Statute Expiration Date (CSED), leading to the consideration of whether tax debt does expire, and potentially extending the time the IRS has to collect. Remember, complying with requests from revenue officers is crucial to avoid complications.

-

Bankruptcy: If you’re facing significant tax debt, filing for bankruptcy might be a viable option. During your bankruptcy case, the CSED is paused, leading to the question of whether tax debt expires six months after the case ends. This can provide considerable relief for those dealing with older tax debts.

-

Tax Liens: We know that tax liens can complicate matters. Even after the CSED has expired, it is important to understand whether tax debt expires, as liens can remain in effect, affecting your ability to sell or refinance your property. Understanding IRS transcripts is vital, as they contain codes that indicate various actions on your tax accounts, helping you interpret your obligations more clearly.

Comprehending these factors is crucial for managing your responsibilities effectively. You’re not alone in this journey. Proactive strategies, like consulting with tax advisors, can offer valuable insights into how your filing status and other elements affect tax obligation timelines. Remember, we’re here to help you navigate these challenges.

Take Action: Steps to Verify and Address Expiring Tax Debt

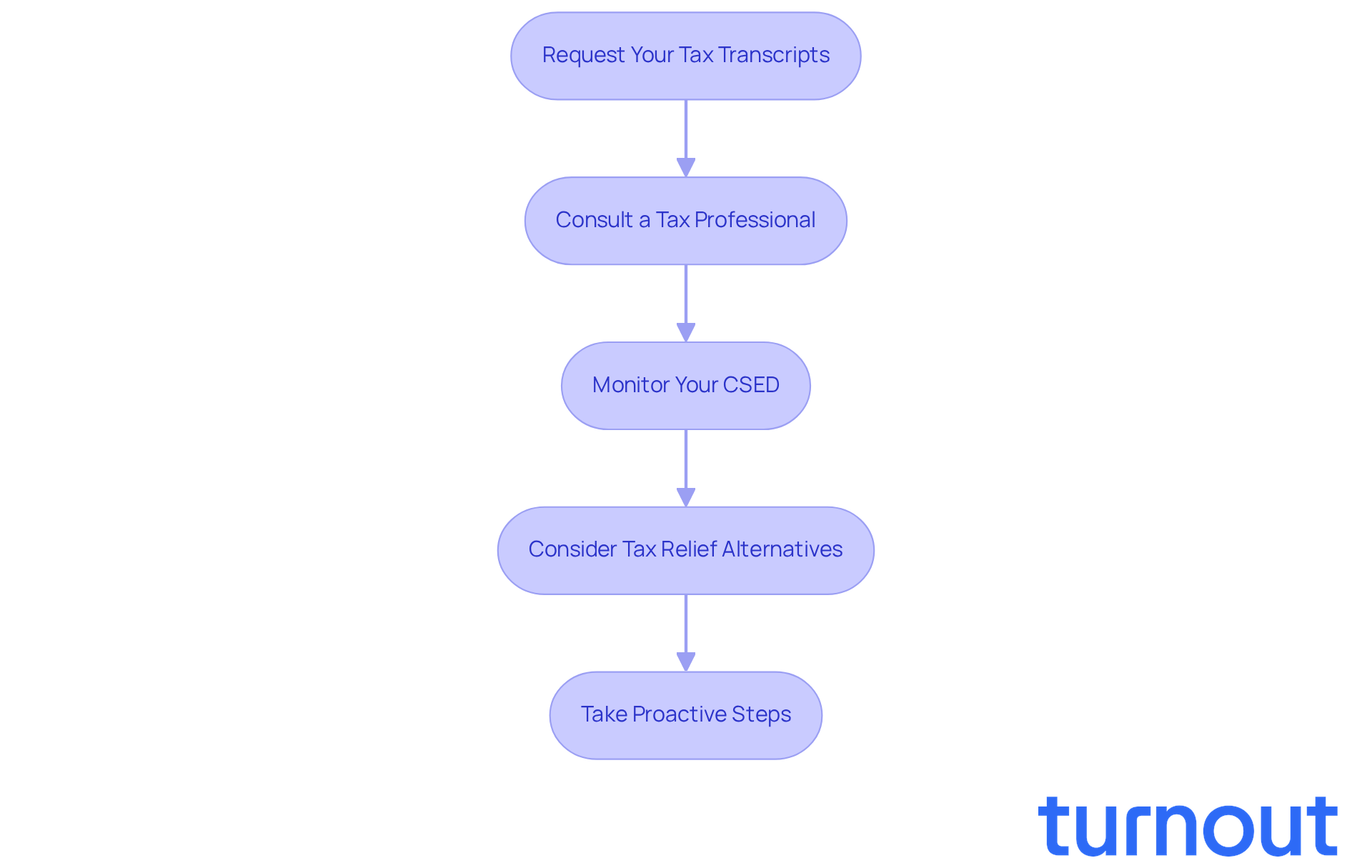

To effectively verify and manage expiring tax debt, consider these supportive steps:

-

Request Your Tax Transcripts: Start by obtaining your IRS tax transcripts. These documents will help you identify the assessment date and the Collection Statute Expiration Date (CSED), which is typically ten years from the date the tax was assessed.

-

Consult a Tax Professional: We understand that navigating tax issues can be overwhelming. Engaging with a tax professional or advocate is crucial. They can help interpret your transcripts and provide tailored guidance on your options, ensuring you understand the implications of your tax situation. In fact, over 60% of taxpayers encountering financial problems consult tax professionals to help them understand their rights and options.

-

Monitor Your CSED: It's common to feel anxious about deadlines. Keep a close eye on whether tax debt expires. Being aware of this date is essential, as it marks the point at which the IRS can no longer legally collect what you owe, leading to the question of when tax debt expires unless specific actions have been taken to extend the period. As the IRS indicates, 'Once the CSED passes, the IRS can no longer legally collect the obligation, unless specific actions have been taken or extended the period, which leads to the question of does tax debt expire.'

-

Consider Tax Relief Alternatives: If your financial obligation is nearing expiration, explore relief options such as an Offer in Compromise (OIC) or other programs that may be accessible. These can potentially reduce the amount you owe or provide a manageable payment plan.

Real-life examples illustrate the effectiveness of these strategies. Many taxpayers have successfully navigated expiring tax obligations by consulting professionals who assisted them in achieving favorable outcomes, such as halting wage garnishments or negotiating settlements for less than what is owed. For instance, since 2012, Ayar Law has saved clients over $100 million, demonstrating the potential benefits of professional assistance.

Additionally, it’s important to be aware of the potential consequences of not addressing tax obligations. For example, the IRS can trigger passport denial or revocation for individuals who owe over $62,000 in back taxes, impacting their ability to travel internationally.

By taking these proactive steps, you can navigate your tax obligations with confidence. Remember, you are not alone in this journey, and we’re here to help you work towards resolving your debt effectively.

Conclusion

Understanding the expiration of tax debt is crucial for anyone navigating the complexities of financial obligations. We understand that this can be overwhelming. The clarity surrounding the ten-year collection period defined by the IRS can be a turning point for individuals seeking relief from unpaid taxes. Recognizing that tax debt can indeed expire empowers you to take control of your financial future and make informed decisions about your obligations.

Throughout this article, we’ve shared key insights regarding the factors that influence tax debt expiration, including:

- Filing status

- Payment agreements

- The implications of bankruptcy

It’s important to grasp the significance of the Collection Statute Expiration Date (CSED) and the actions that can affect it. By staying informed and proactive, you can avoid unnecessary stress and confusion while exploring potential relief options.

Ultimately, the message is clear: knowledge is power when it comes to tax debt expiration. Taking steps such as:

- Consulting tax professionals

- Monitoring your CSED

- Considering available relief options

can lead to effective management of your tax obligations. Remember, you are not alone in this journey. Support is available, and taking informed action can lead to a brighter financial future.

Frequently Asked Questions

What is tax debt expiration?

Tax debt expiration refers to the legally defined period during which the IRS can collect unpaid taxes, typically lasting ten years from the assessment date.

Why is understanding tax debt expiration important?

Knowing about tax debt expiration is significant because it marks the moment when the IRS can no longer pursue collection, providing relief and closure for individuals affected by tax debt.

How can individuals benefit from knowing about tax debt expiration?

Individuals who recognize the expiration can strategically manage their finances and avoid unnecessary payments on obligations that are no longer collectible.

What happens when the ten-year collection period lapses?

Once the ten-year collection period lapses, individuals can no longer be pursued for the tax obligation, offering them a sense of relief.

Are there any recent updates regarding tax debt expiration from the IRS?

Recent updates from the IRS indicate that while the agency has faced challenges in enforcement, the ten-year collection period remains a steadfast rule.

What should taxpayers do to stay informed about tax obligation expiration?

Taxpayers should stay informed about their rights regarding tax obligation expiration to better understand their financial situation and the implications of their tax debts.