Introduction

Navigating the complexities of Supplemental Security Income (SSI) can feel overwhelming, especially when it comes to understanding back pay. This financial support is crucial for individuals facing disabilities, as it provides essential funds from the moment they apply until their benefits are approved. We understand that many applicants wonder if SSI pays back pay, and the impact of these retroactive payments on financial stability is significant.

It's common to feel uncertain about how to ensure you receive the support you're entitled to. What steps can you take to effectively navigate this intricate system? We're here to help you through this journey, offering guidance and reassurance as you seek the assistance you deserve.

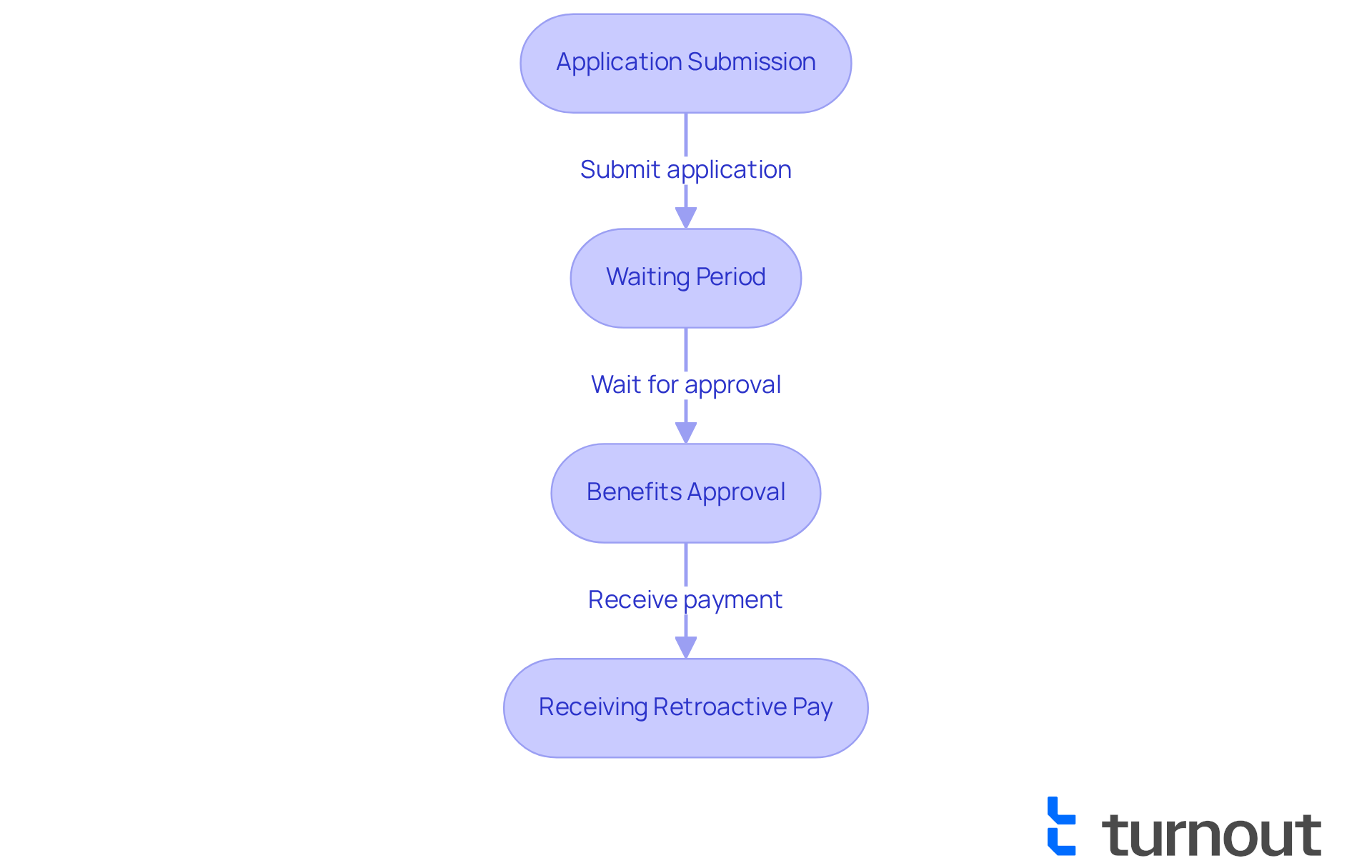

Define SSI Back Pay and Its Importance

Supplemental Security Income (SSI) does ssi pay back pay, which is more than just a financial term; it represents the support owed to individuals from the moment they apply until their benefits are approved. For those facing disabilities, this assistance is crucial. It compensates for the time they were eligible, which raises the question of whether does ssi pay back pay for the period they didn’t receive help. The importance of SSI retroactive payments is immense, playing a vital role in ensuring financial stability for individuals and families during what can be a challenging waiting period. For many, these funds are essential for managing living expenses and medical costs while they await approval.

The impact of SSI retroactive payments on financial stability is profound. Families often depend on these payments to cover essential needs like housing and healthcare, especially when there are delays in receiving benefits. Many have shared their experiences, revealing how these payments have helped them navigate financial hardships. They’ve been able to purchase necessary medical supplies and maintain their living conditions throughout the lengthy claims process, which can stretch on for months or even over a year.

Experts emphasize the importance of understanding whether does SSI pay back pay. Advocates often highlight that timely access to these funds can significantly reduce the stress tied to financial uncertainty. This relief allows individuals to focus on what truly matters: their health and recovery. As the Social Security Administration manages a high volume of requests, the role of retroactive payments in providing prompt financial assistance remains crucial for those in need.

It’s essential to clarify that SSI retroactive compensation is calculated from the application date to the approval date. This does not include retroactive payments, which can sometimes confuse applicants. Understanding how retroactive pay is calculated is key to grasping its significance, especially regarding the question of does ssi pay back pay for disabled individuals pursuing benefits. Remember, you’re not alone in this journey; we’re here to help you navigate these challenges.

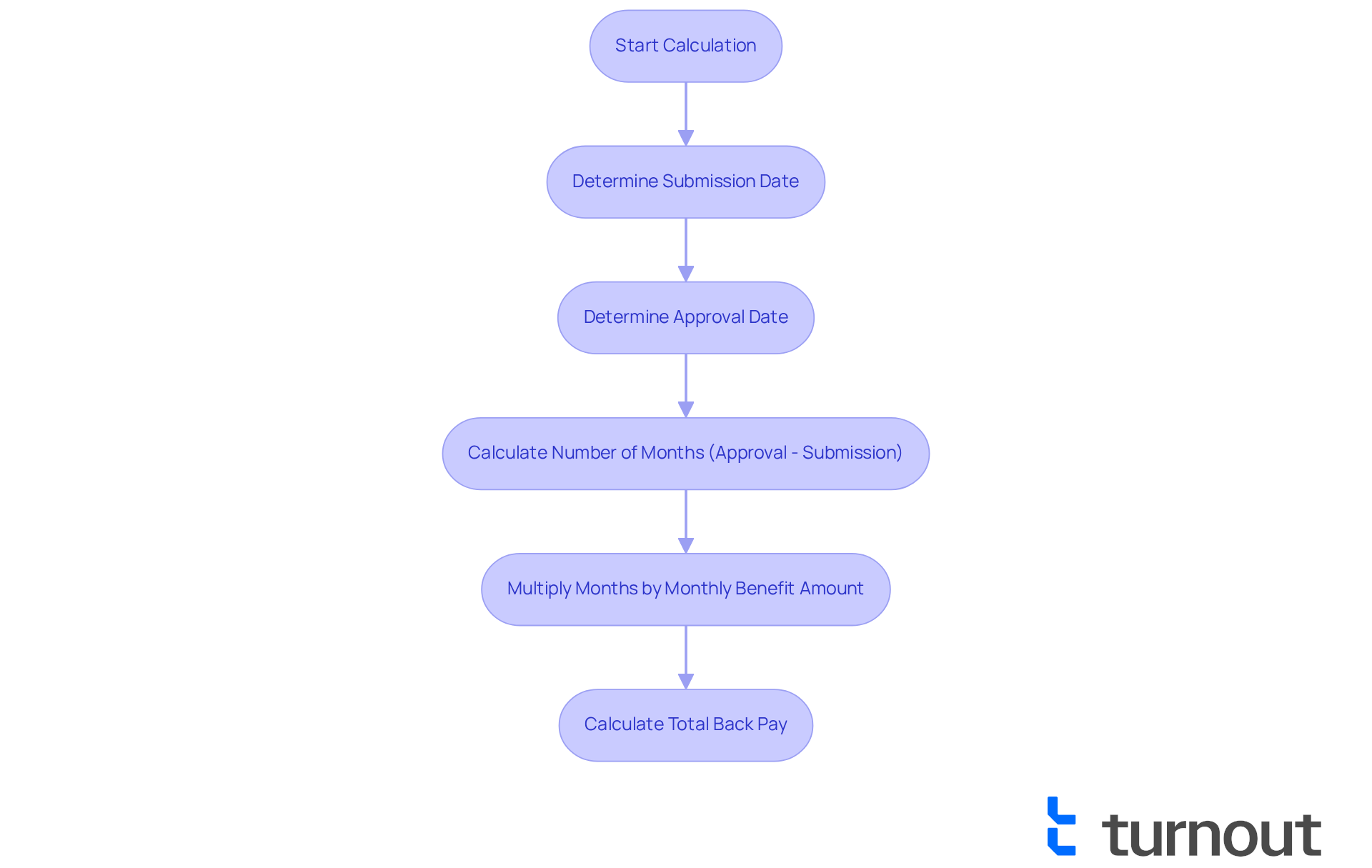

Calculate SSI Back Pay: Key Factors and Methods

Calculating your SSI back pay can feel overwhelming, but understanding a few key factors can make the process smoother:

- Submission Date: This is the date you submitted your SSI request, marking the beginning of your retroactive pay period.

- Approval Date: The date your request is approved signals the end of that pay period.

- Monthly Benefit Amount: This is the amount you’re eligible to receive each month, which may vary based on your living situation and other income sources.

Here’s how to calculate it:

- First, determine the number of months between your application date and approval date. This tells you how many months of back pay you’re owed.

- Next, multiply that number by your monthly benefit amount. For instance, if your monthly benefit is $735 and it took 8 months to approve your claim, your retroactive pay would be $5,880 (735 x 8).

Important things to keep in mind:

- It’s common to feel anxious about payment timelines. Back pay processing usually takes 60 days or more from your approval date, so managing your expectations is essential.

- Remember, regarding SSI recipients, it’s important to know does SSI pay back pay for retroactive benefits; you’ll only receive pay from the filing date to the approval date.

- Consulting with a financial advisor can be a great step in managing substantial payments. They can help you plan effectively for your financial needs.

- If you believe your compensation pay calculation is incorrect, don’t hesitate to ask for a review from your local Social Security office. They’re there to help you address any discrepancies.

- Keeping thorough documentation of your process is crucial for resolving any issues that may arise during the pay restoration process.

Understanding these factors is vital for accurately estimating your financial support and planning your budget. Recent updates suggest that SSI recipients might receive their initial payment for the month following their request, with retroactive payments typically distributed in three segments over six months.

We’re here to help you navigate this journey, and you’re not alone in seeking the support you deserve.

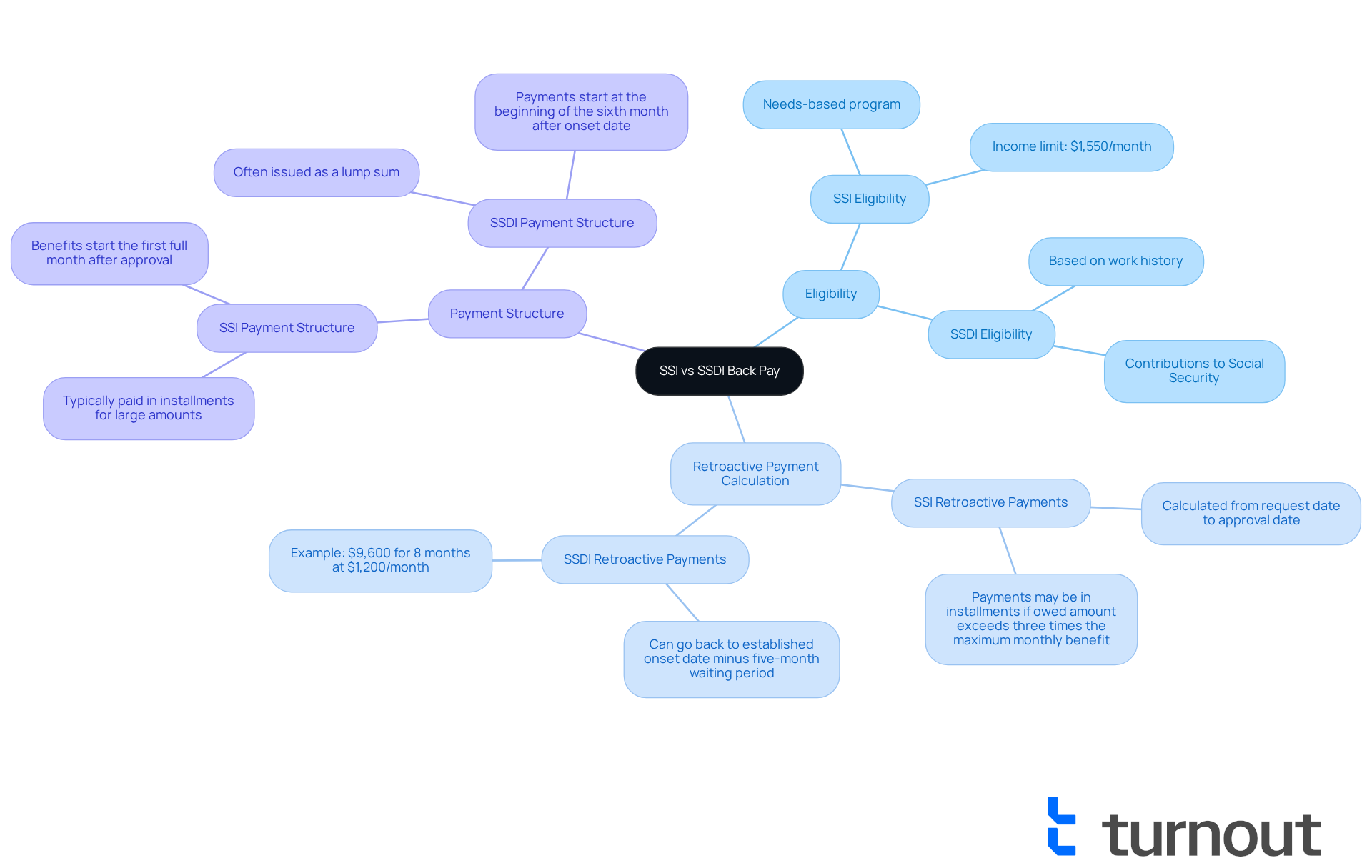

Differentiate Between SSI and SSDI Back Pay

Navigating the world of financial support can be overwhelming, especially when it comes to Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI). While both programs aim to assist individuals with disabilities, a key difference lies in how does SSI pay back pay. Understanding these differences can empower you to make informed decisions about your benefits.

Eligibility: We understand that figuring out eligibility can be a challenge. SSI is a needs-based program tailored for individuals with limited income and resources. On the other hand, SSDI eligibility is based on your work history and contributions to Social Security. In 2025, SSI eligibility rates are heavily influenced by income limits. If you earn over $1,550 per month, you may find yourself disqualified from receiving benefits. Remember, Turnout is here to help you navigate these eligibility requirements, even though we don’t provide legal representation.

Retroactive Payment Calculation: It’s common to feel confused about how retroactive payments work. For SSI, it is essential to understand how does SSI pay back pay, as these payments are calculated from the date of your request to the approval date. This means if your request takes a year to process, you could receive retroactive payments for that entire period. In contrast, SSDI retroactive payments can go back to the established onset date of your disability, minus a mandatory five-month waiting period. For instance, if your disability began in January 2024 and your application was approved in January 2025, you might receive around $9,600 in retroactive payments—covering eight months of benefits at an average monthly rate of $1,200. Our trained nonlawyer advocates at Turnout can assist you in understanding these calculations, ensuring you receive the correct amounts.

Payment Structure: Understanding how payments are disbursed is crucial. SSI arrears are typically paid in installments, especially if the owed amount exceeds three times the maximum monthly benefit. Conversely, SSDI retroactive payments are often issued as a lump sum, providing immediate financial relief upon approval.

For applicants like you, it is vital to understand whether does SSI pay back pay is applicable. Real-life experiences, such as those shared by individuals like Nancy N., who faced discrepancies in payments, underscore the importance of being informed about these processes. Remember, you are not alone in this journey. Turnout is here to provide guidance and support as you navigate your benefits.

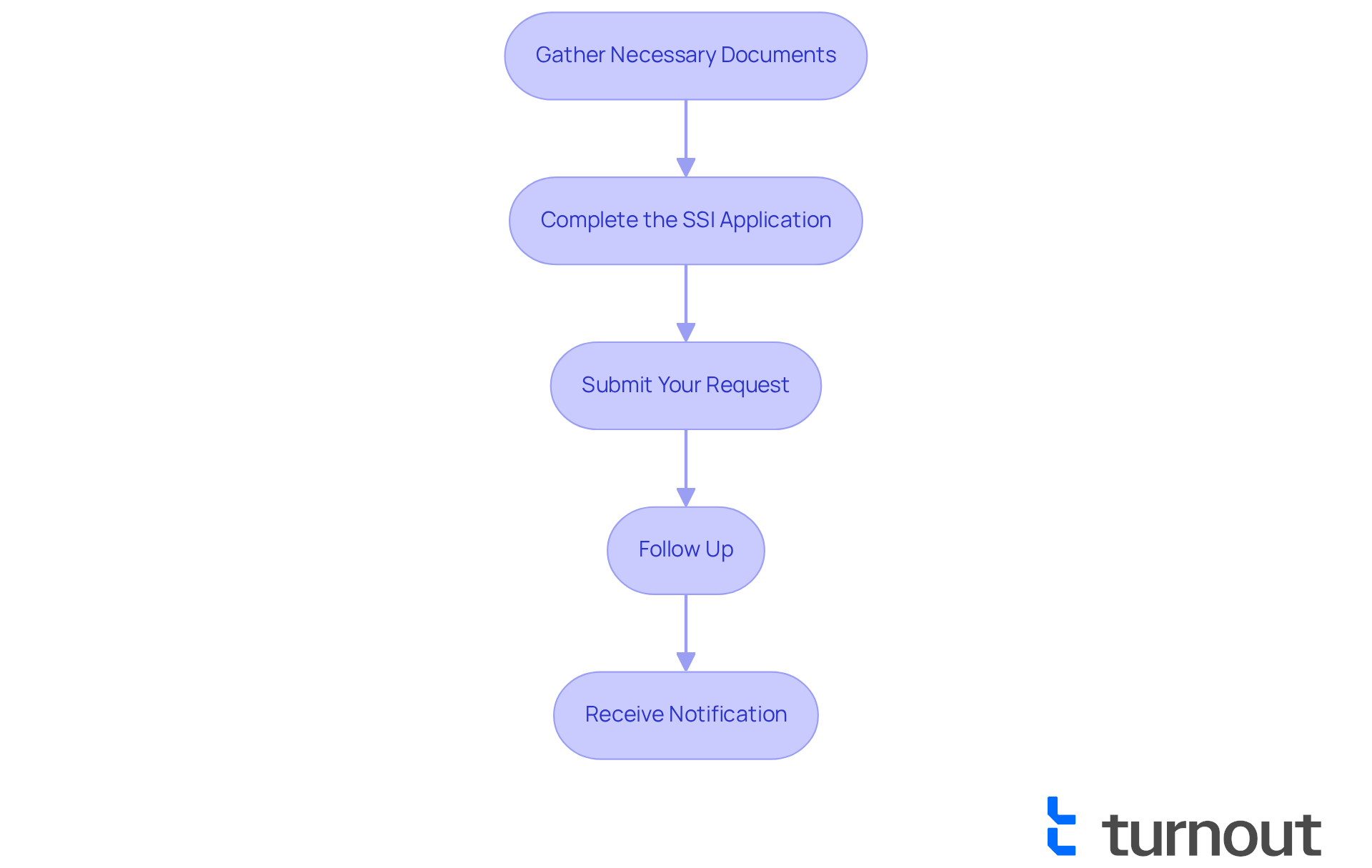

Apply for SSI Back Pay: Step-by-Step Guide

Applying for SSI back pay can feel overwhelming, and many people wonder does SSI pay back pay, but you’re not alone in this journey. Here are some essential steps to help you navigate the process with confidence:

-

Gather Necessary Documents: Start by collecting all required documentation. This includes proof of income, medical records, and identification. Having accurate banking information is crucial to ensure timely payments from the SSA.

-

Complete the SSI Application: You can submit your application online through the Social Security Administration (SSA) website, by phone, or in person at your local SSA office. Make sure all information is accurate and complete to avoid any delays.

-

Submit Your Request: Once you’ve finished the form, send it along with all supporting documents. Remember to keep copies for your records; this will help you track your submission.

-

Follow Up: After submitting your request, it’s important to monitor its status. You can check online or contact the SSA directly. Be prepared to provide additional information if requested, as this can help speed up the process.

-

Receive Notification: After your application is processed, you’ll receive a notification about your approval and the amount of retroactive pay you’re entitled to. Typically, retroactive pay is disbursed in three-month installments, so understanding the timeline is essential.

By following these steps, you can more effectively navigate the process of understanding does SSI pay back pay. Real-world examples show that thorough preparation and timely follow-ups can significantly impact the outcome of applications. For instance, most SSI cases take about 8-10 months for a decision, and having accurate documentation can help avoid unnecessary delays. Remember, we’re here to help you through this process. As noted by Turnout, "We guide clients through the appeals process to increase the likelihood of approval," highlighting the importance of support during this journey.

Conclusion

Understanding the complexities of Supplemental Security Income (SSI) back pay is essential for anyone facing the challenges of disability benefits. We know that SSI back pay can be a crucial financial lifeline, providing support for the time between when you submit your application and when your benefits are approved. This assistance can ease the burden of living expenses during those waiting periods, highlighting the importance of grasping how these payments function.

Key insights to consider include:

- How SSI back pay is calculated

- The differences between SSI and Social Security Disability Insurance (SSDI) payments

- The step-by-step process for applying for back pay

By understanding submission and approval dates, monthly benefit amounts, and the distinctions between SSI and SSDI, you can better manage your expectations and ensure you receive the financial support you deserve. Remember, thorough documentation and proactive follow-ups are vital steps in successfully navigating this process.

The significance of SSI back pay truly cannot be overstated. It not only offers immediate financial relief but also fosters a sense of security for those facing tough times. As you prepare your applications and gather the necessary documentation, we encourage you to seek support and guidance throughout this journey. By staying informed and proactive, you can navigate the complexities of SSI back pay more effectively, paving the way for financial stability and peace of mind during these challenging moments.

Frequently Asked Questions

What is SSI back pay?

SSI back pay refers to the financial support owed to individuals from the moment they apply for Supplemental Security Income (SSI) until their benefits are approved.

Why is SSI back pay important?

SSI back pay is crucial as it helps ensure financial stability for individuals and families during the waiting period for benefit approval, allowing them to manage living expenses and medical costs.

How does SSI back pay impact financial stability?

SSI back pay significantly impacts financial stability by providing necessary funds to cover essential needs like housing and healthcare, especially during delays in receiving benefits.

What do individuals often use SSI back pay for?

Individuals often use SSI back pay to purchase necessary medical supplies and maintain their living conditions while navigating the lengthy claims process.

How is SSI retroactive compensation calculated?

SSI retroactive compensation is calculated from the application date to the approval date, and it does not include retroactive payments, which can sometimes confuse applicants.

What role do advocates play in relation to SSI back pay?

Advocates emphasize the importance of timely access to SSI back pay, as it can significantly reduce financial stress and allow individuals to focus on their health and recovery.

What should applicants understand about SSI back pay?

Applicants should understand that SSI back pay is a crucial form of financial assistance that helps them during the waiting period for benefits, and they are not alone in navigating these challenges.