Introduction

Understanding the complexities of Social Security Disability Insurance (SSDI) is essential for those who depend on these benefits for financial stability. We know that as the landscape of taxation changes, many individuals wonder if their SSDI payments are taxable. It’s common to feel uncertain, especially as income thresholds shift and personal circumstances evolve.

This article explores the tax implications of SSDI, shedding light on how much of these benefits may be taxed. We’ll also share effective strategies to help you manage any potential tax burdens. Remember, you’re not alone in this journey. Together, we can navigate this complex terrain to ensure your financial well-being while maximizing your benefits.

Define SSDI and Its Tax Implications

Social Security Disability Insurance is a vital federal program designed to provide financial support to those unable to work due to qualifying disabilities. Funded through payroll taxes, these disability payments aim to replace a portion of lost earnings for individuals who have contributed to the Social Security system.

We understand that navigating financial matters can be overwhelming, especially when it comes to disability support payments. For 2026, if your total earnings exceed $25,000 for individual filers or $32,000 for couples filing jointly, you may wonder, does SSDI get taxed, as up to 50% of your Social Security disability payments could be subject to federal taxation. In cases where earnings are significantly higher, it is important to consider if SSDI gets taxed, as up to 85% of benefits may be taxed. This tiered taxation system, established by the Social Security Amendments of 1983, emphasizes the importance of understanding whether SSDI gets taxed for effective financial planning and tax preparation.

It's common to feel surprised when you learn how SSDI gets taxed, especially as your earnings rise with inflation. As we approach 2026, approximately 50% of disability assistance recipients will be affected by income limits that raise the question of whether SSDI gets taxed on their payments. Financial advisors often stress the importance of proactive tax planning to help reduce potential liabilities, especially for those nearing these thresholds, as they may wonder if SSDI gets taxed. By understanding whether SSDI gets taxed, you can better manage your financial situation and make informed decisions regarding your disability assistance.

Remember, you are not alone in this journey. We're here to help you navigate these complexities and ensure you have the support you need.

Identify Taxable Conditions for SSDI Benefits

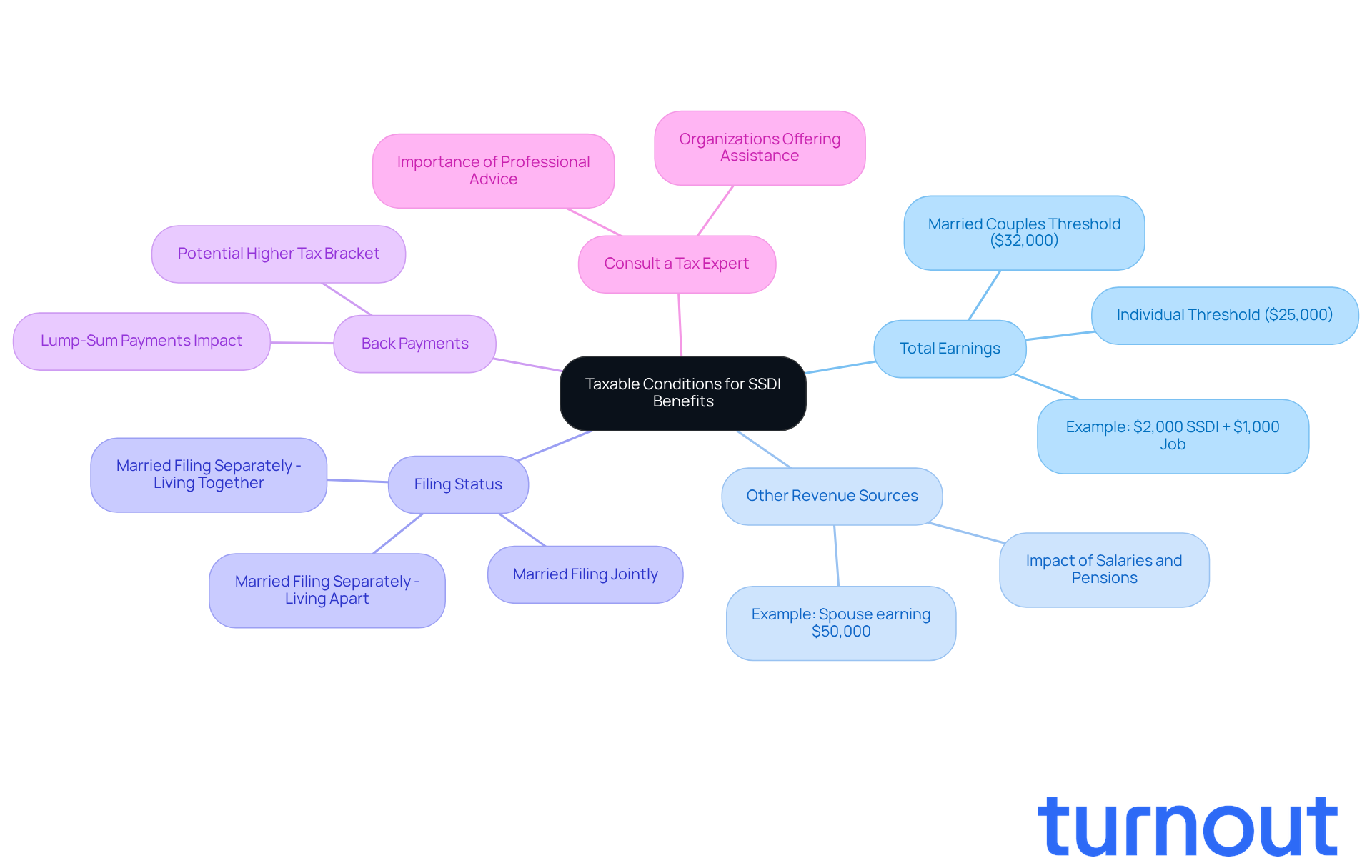

Navigating the world of SSDI benefits and taxes can feel overwhelming, but you’re not alone. Several factors can influence whether or not does SSDI get taxed, and understanding them is crucial for your financial well-being.

-

Total Earnings: If your total earnings exceed $25,000 for individual filers or $32,000 for married couples filing jointly, part of your disability payments may be taxable. For instance, if you receive $2,000 each month in disability assistance and earn an additional $1,000 from a part-time job, you might be asking, does SSDI get taxed, but you won’t have to pay taxes as long as your total earnings stay below the $25,000 threshold.

-

Other Revenue Sources: Additional income from salaries, pensions, or interest can push your total earnings above these limits, leading to taxation on your disability assistance. Imagine a married couple where one partner earns $50,000 while the other receives $2,000 monthly in disability payments. In this case, the question of does SSDI get taxed arises, as up to 85 percent of the disability funds could be taxed because their combined income exceeds $44,000.

-

Filing Status: Your tax filing status plays a significant role in determining whether does SSDI get taxed and your overall tax liability. For example, individuals filing as married but living apart may face different thresholds, potentially resulting in taxes on up to 50 percent of disability payments if their income surpasses $25,000, which leads to the inquiry of whether does SSDI get taxed.

-

Back Payments: Receiving a lump-sum back payment for Social Security Disability Insurance raises the question of how does SSDI get taxed in the year it’s received, possibly pushing you into a higher tax bracket. This is particularly important for those who may receive substantial back payments covering several months of assistance.

-

Consult a Tax Expert: We understand that tax matters can be confusing. That’s why it’s wise to consult a tax expert who can help you navigate the effects of your income and disability payments on your tax responsibilities. Organizations like Turnout offer access to trained nonlawyer advocates who are ready to assist you, ensuring you’re prepared for any potential tax liabilities associated with your disability benefits. Remember, you’re not alone in this journey, and support is available.

Implement Strategies to Reduce SSDI Tax Burden

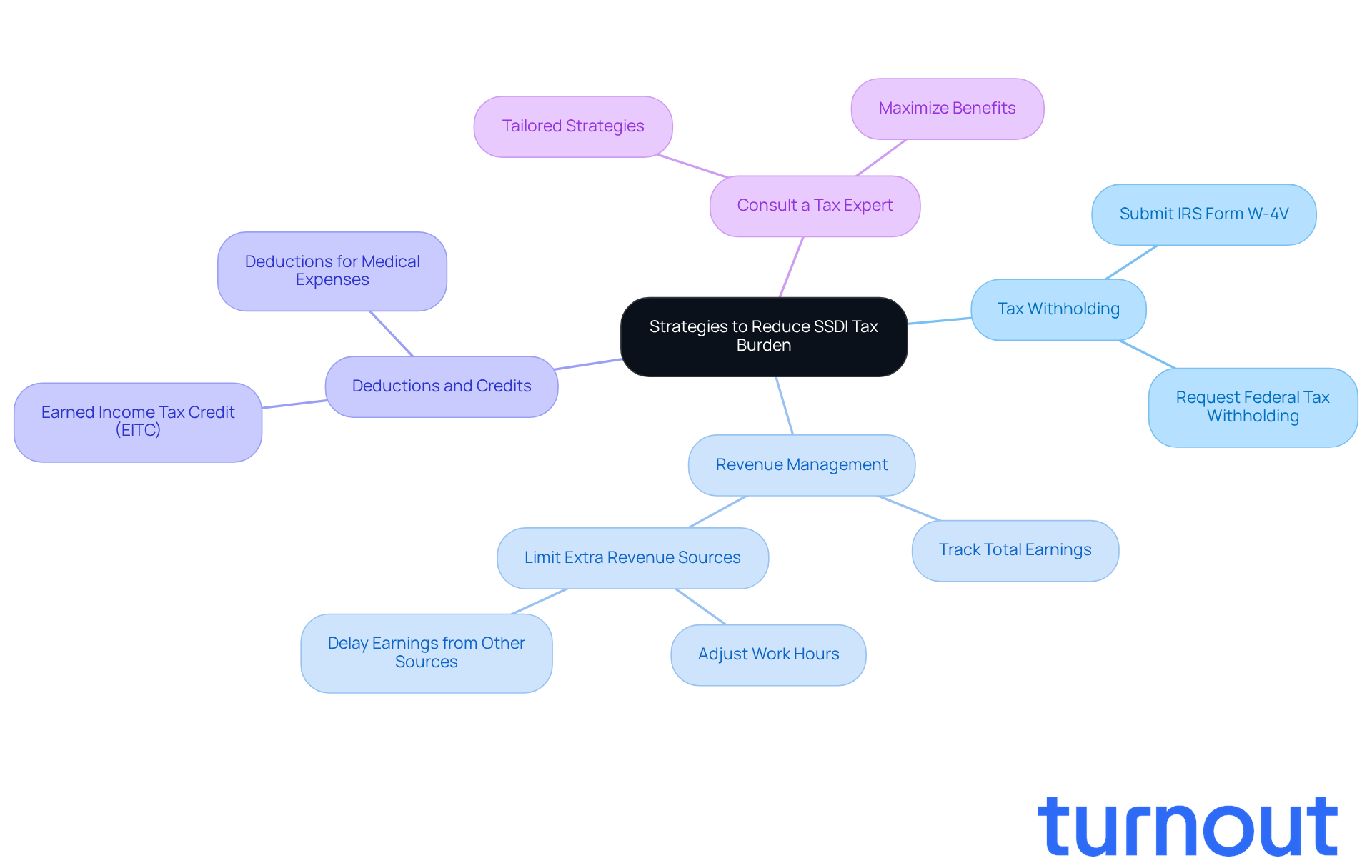

If you're feeling overwhelmed by your SSDI tax burden, you may be asking yourself, does SSDI get taxed, and know that you're not alone. Here are some caring strategies to help you navigate this challenge:

-

Tax Withholding: Have you considered having federal taxes withheld from your SSDI payments? By submitting IRS Form W-4V, you can request withholding, which is important to understand if SSDI gets taxed. This can ease your tax liability throughout the year, especially when you consider if SSDI gets taxed.

-

Revenue Management: It's important to keep track of your total earnings. If possible, think about limiting extra revenue sources that might push you over tax thresholds. This could mean adjusting your work hours or delaying earnings from other sources. We understand that this can be tough, but it’s a step towards financial peace, particularly when questioning if SSDI gets taxed.

-

Deductions and Credits: Don’t forget to take advantage of available tax deductions and credits! Options like the Earned Income Tax Credit (EITC) or deductions for medical expenses can significantly lower your taxable income. Every little bit helps, right?

-

Consult a Tax Expert: Finally, consider working with a tax expert who understands disability allowances. They can provide tailored strategies and ensure you’re following tax regulations while maximizing your benefits, including understanding how SSDI gets taxed. Remember, seeking help is a sign of strength.

We're here to help you through this journey, and with the right strategies, you can feel more confident about managing your SSDI taxes.

Examine State Tax Considerations for SSDI

Navigating state tax regulations regarding disability payments can feel overwhelming, especially when you're wondering if does ssdi get taxed, and you're not alone in this journey. It's essential to understand the differences that exist nationwide, as they can significantly impact your financial well-being, including how does ssdi get taxed. Here are some key points to consider:

-

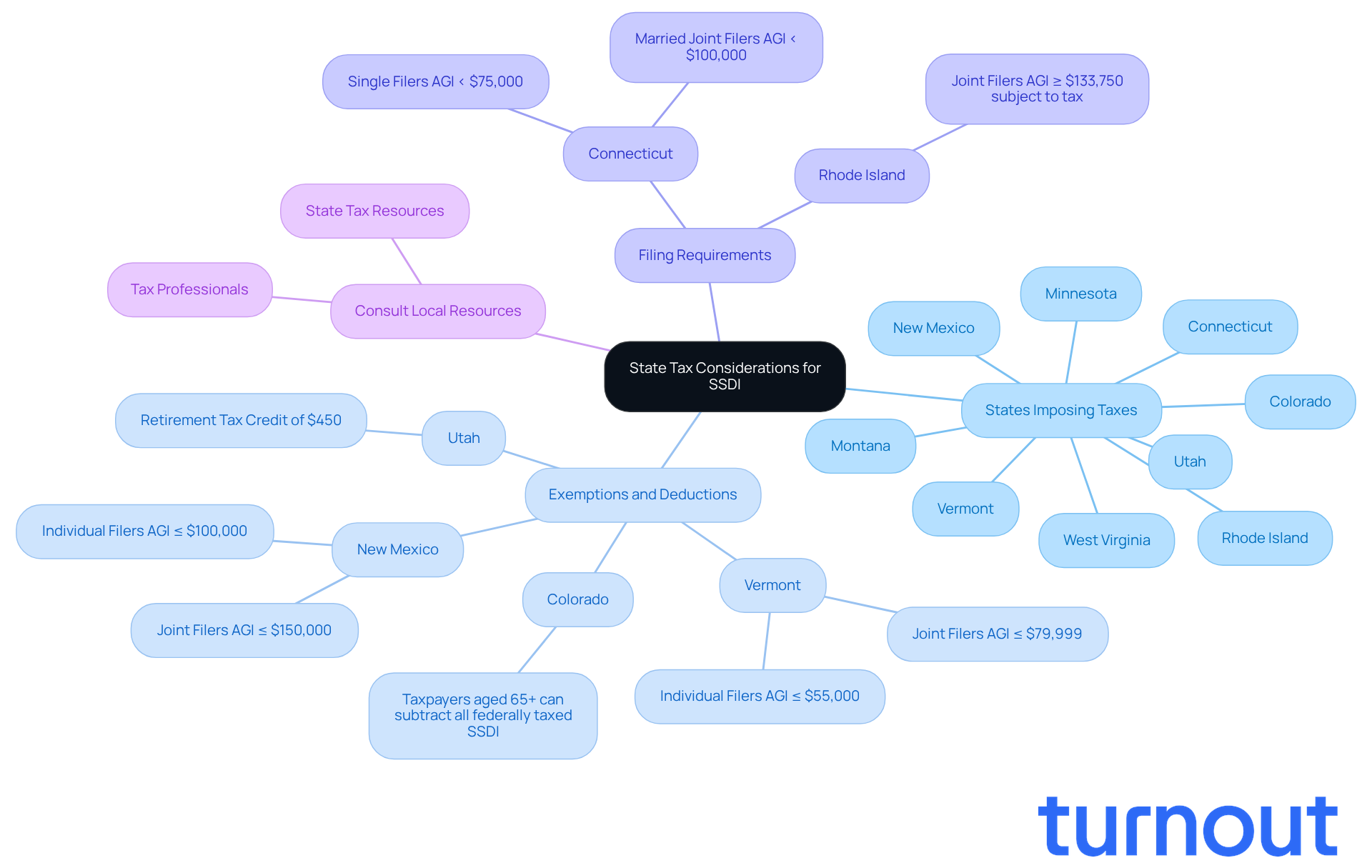

States That Impose Levies on Disability Payments: As of 2026, several states, including Colorado, Connecticut, Minnesota, Montana, New Mexico, Rhode Island, Utah, Vermont, and West Virginia, impose taxes on disability payments. Notably, New Mexico officially taxes Social Security Disability Insurance, leading to the question of does ssdi get taxed for many retirees who may not have to pay due to higher exemption thresholds. Familiarizing yourself with your state's specific regulations is crucial to understanding whether does ssdi get taxed and your overall tax obligations.

-

Many states offer exemptions or deductions for Social Security Disability Insurance payments, which can help lighten your overall tax burden. For example, in Vermont, individual filers can completely exclude disability payments if their adjusted gross income (AGI) is $55,000 or less. Joint filers can do so with an AGI of up to $79,999. Similarly, New Mexico allows individual taxpayers earning up to $100,000 and couples making up to $150,000 to avoid state taxes on disability payments. Additionally, Colorado permits taxpayers aged 65 and older to subtract all federally taxed Social Security earnings, while Utah offers a retirement tax credit of $450.

-

Filing Requirements: Each state has its own filing requirements, which can differ from federal guidelines. For instance, Connecticut exempts SSDI payments for single filers with an AGI under $75,000 and married couples filing jointly with an AGI below $100,000, leading to the question: does ssdi get taxed?. Understanding these thresholds is vital for compliance and effective tax planning.

-

Consult Local Resources: We understand that navigating these complexities can be challenging. To make the process easier, consider utilizing state tax resources or consulting with a tax professional who is knowledgeable about local laws and the lifecycle of benefits technologies. This approach will help ensure compliance and optimize your tax situation, allowing you to focus on what truly matters-your well-being.

Conclusion

Understanding the tax implications of Social Security Disability Insurance (SSDI) is crucial for recipients striving to manage their financial health effectively. We understand that while SSDI provides essential support, the potential for taxation on benefits can significantly affect your take-home income. Recognizing the thresholds for taxation based on total earnings and other income sources is vital for navigating your financial landscape.

Key insights include:

- Knowing the income limits that trigger taxation

- The role of your filing status

- How back payments can impact tax liabilities

Strategies like tax withholding, revenue management, and leveraging available deductions can help ease the tax burden. Furthermore, consulting with tax experts ensures that you are informed and prepared for your specific tax situation, enhancing your ability to make sound financial decisions.

Ultimately, awareness and proactive planning are essential for SSDI recipients. By understanding how SSDI benefits are taxed and implementing effective tax strategies, you can take control of your financial future. Engaging with local resources and experts can further empower you to navigate these complexities, ensuring that you receive the full benefit of the support intended to assist you. Remember, you are not alone in this journey, and we're here to help.

Frequently Asked Questions

What is SSDI?

Social Security Disability Insurance (SSDI) is a federal program that provides financial support to individuals who are unable to work due to qualifying disabilities.

How is SSDI funded?

SSDI is funded through payroll taxes collected from individuals who have contributed to the Social Security system.

What is the purpose of SSDI payments?

The purpose of SSDI payments is to replace a portion of lost earnings for individuals who are unable to work due to disabilities.

Are SSDI payments subject to taxation?

Yes, SSDI payments can be subject to federal taxation. For 2026, if your total earnings exceed $25,000 for individual filers or $32,000 for couples filing jointly, up to 50% of your SSDI benefits may be taxed. If earnings are significantly higher, up to 85% of benefits may be taxed.

What established the tiered taxation system for SSDI?

The tiered taxation system for SSDI was established by the Social Security Amendments of 1983.

How can SSDI recipients manage potential tax liabilities?

SSDI recipients can manage potential tax liabilities by engaging in proactive tax planning, especially if their earnings approach the thresholds that trigger taxation on SSDI benefits.

Why is it important to understand SSDI taxation?

Understanding SSDI taxation is important for effective financial planning and tax preparation, allowing recipients to better manage their financial situation and make informed decisions regarding their disability assistance.

Is support available for individuals navigating SSDI tax implications?

Yes, support is available to help individuals navigate the complexities of SSDI and its tax implications.