Introduction

Navigating the complexities of Social Security can feel overwhelming, especially when you're trying to understand the financial implications of hiring an attorney. We understand that many claimants are left wondering: does Social Security cover attorney fees? This guide aims to shed light on the intricacies of attorney fees in Social Security cases, offering clarity on how these costs are structured and what you can expect.

It's common to feel anxious about the financial responsibilities that come with pursuing a claim, especially when a significant portion of claims are denied. So, how can you ensure that you're prepared and informed about your potential financial obligations? We're here to help you navigate this journey with confidence.

Understand the Structure of Attorney Fees in Social Security Cases

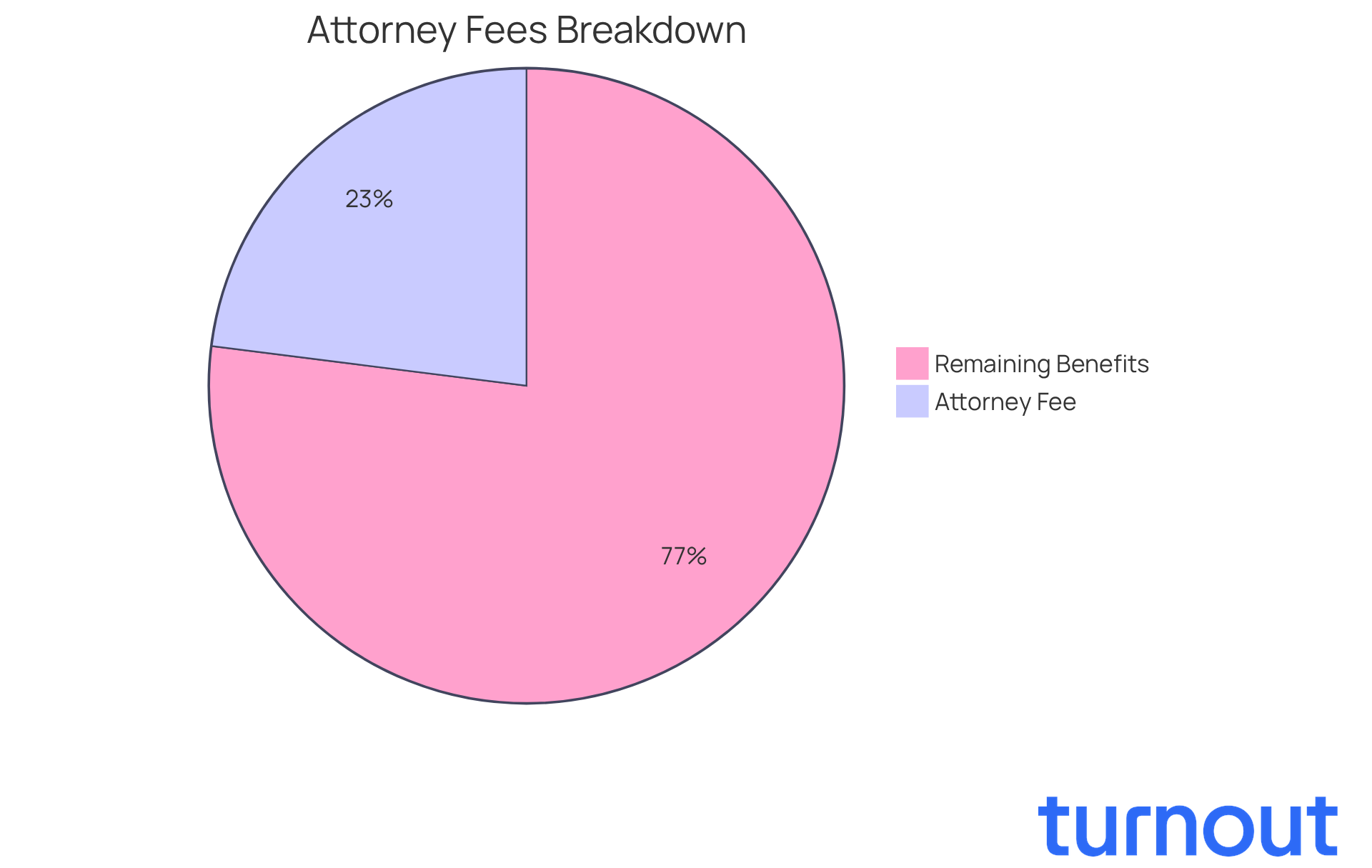

Navigating public insurance cases can be overwhelming, particularly when trying to understand if social security does pay attorney fees. We know that the financial aspect can add to your stress, so let’s break it down together. In these cases, lawyers typically work on a contingency fee basis, which leads to the question of does social security pay attorney fees, as they only get paid if they win your case. This structure is designed to protect you, with fees capped at 25% of the overdue benefits you receive, and a maximum of $9,200 set by the Administration, leading to the inquiry of how does social security pay attorney fees.

For instance, if your overdue benefits total $40,000, the calculated fee would be $10,000. However, thanks to the cap, your legal representative would only receive $9,200, leading to the question of whether does social security pay attorney fees. This approach not only helps you anticipate your financial responsibilities but also ensures you won’t face unexpected costs.

As of November 30, 2024, the SSA has upheld this cap, which raises the question of whether does social security pay attorney fees, reflecting their commitment to fair and transparent legal representation in disability claims. Understanding these details is crucial for you as a claimant. It empowers you to navigate the complexities of the welfare system with greater confidence. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

Identify Conditions for Social Security to Pay Attorney Fees

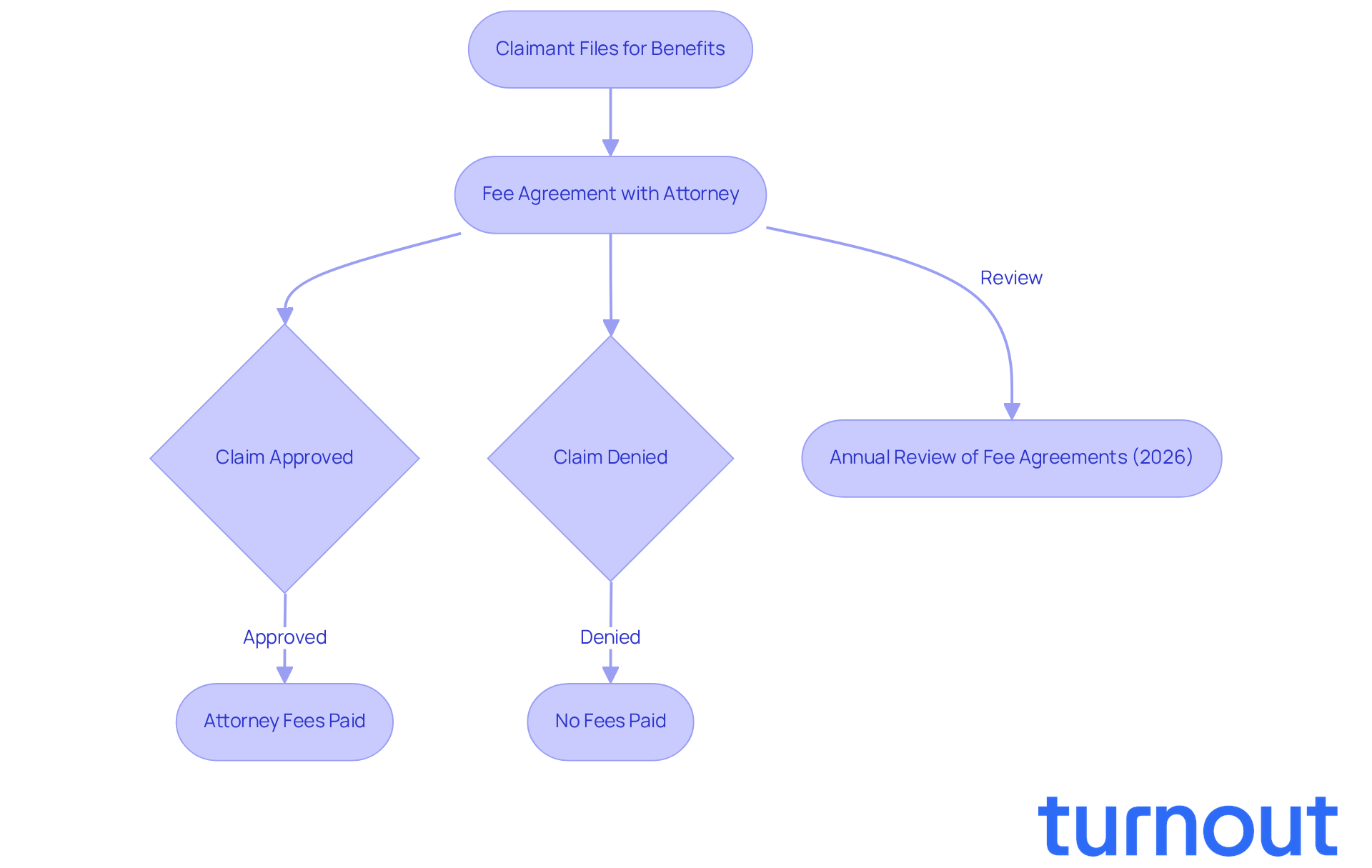

Navigating the world of Social Security can be overwhelming, especially when trying to determine if does social security pay attorney fees. We know that many claimants worry about how to manage these expenses. Under certain conditions, it is important to understand how does social security pay attorney fees, particularly when the lawyer has a payment arrangement approved by the SSA. This agreement clearly outlines the fee structure and ensures compliance with the established cap.

It's important to note that the question of does social security pay attorney fees arises only if the claimant wins their case and receives past-due benefits. If the claim is denied, the legal representative does not receive any fees. To avoid any misunderstandings about payment responsibilities, claimants must verify that their legal representative has a valid fee agreement.

Looking ahead, starting in 2026, the SSA will review fee agreements annually to reflect changes in the Cost-of-Living Adjustment (COLA). This update aims to enhance the clarity and fairness of the fee structure, making it easier for you to understand what to expect.

Comprehending these requirements is essential for claimants. A significant portion of benefits claims includes approved fee agreements, ensuring that legal representation remains accessible and effective. Remember, you are not alone in this journey, and we're here to help you navigate these important details.

Assess Your Case to Determine Fee Coverage by Social Security

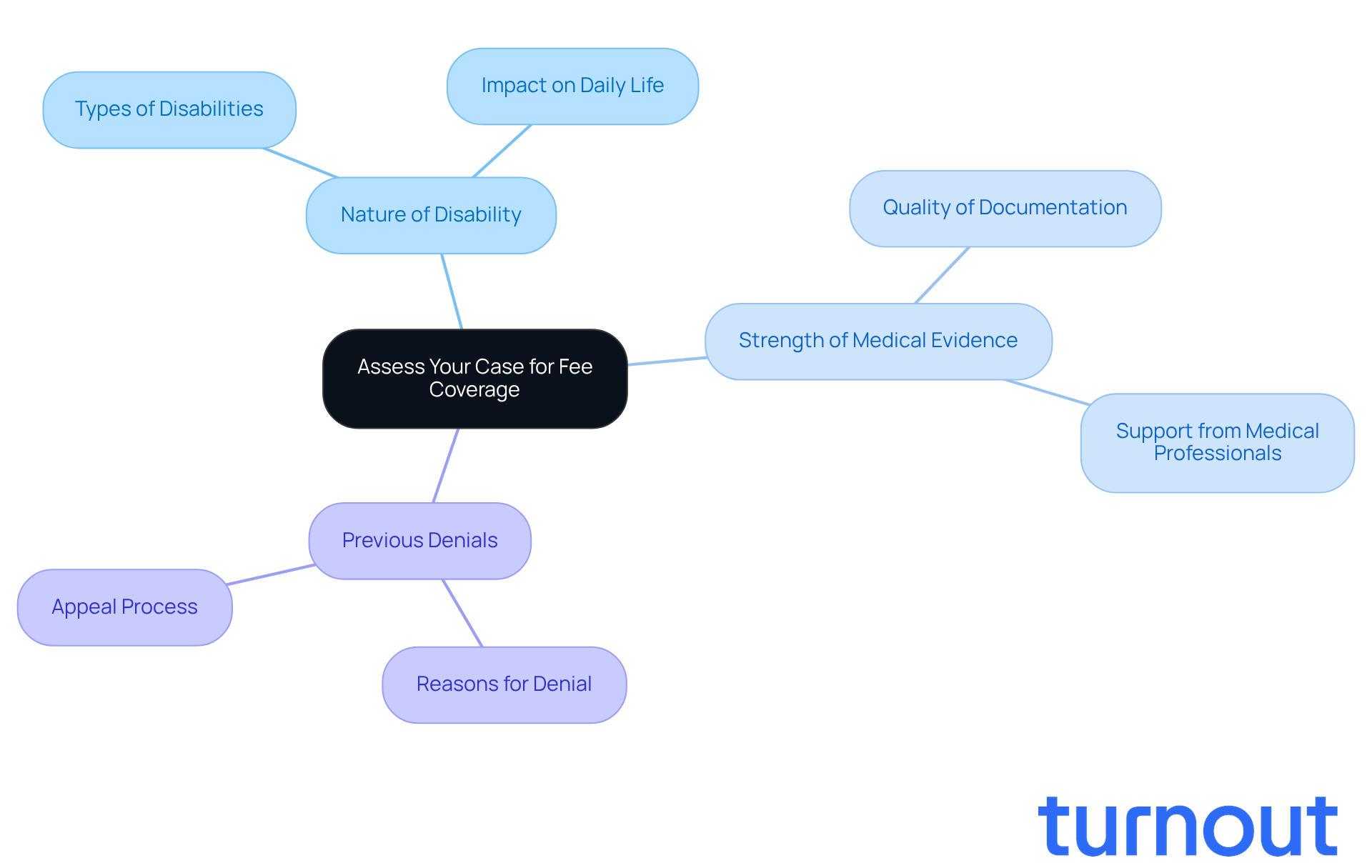

If you're wondering whether your case qualifies for legal fee coverage by Social Security, let's take a moment to evaluate your situation together to see if does social security pay attorney fees. We understand that navigating this process can be overwhelming. Key factors to consider include:

- The nature of your disability

- The strength of your medical evidence

- Any previous denials of benefits

For instance, claims that are supported by strong medical documentation tend to have a much higher chance of approval. This not only boosts your chances of success but also increases the likelihood that, if the outcome is favorable, does social security pay attorney fees for your legal costs. It's also important to talk with your legal representative about their experience with similar cases. Their insights can provide valuable guidance on potential outcomes and clarify if does social security pay attorney fees.

Remember, it's common to feel anxious about this process. With an average denial rate of around 68% for disability claims, building a compelling case is crucial. You're not alone in this journey, and we're here to help you improve your chances of success.

Explore Resources and Tools for Navigating Attorney Fees

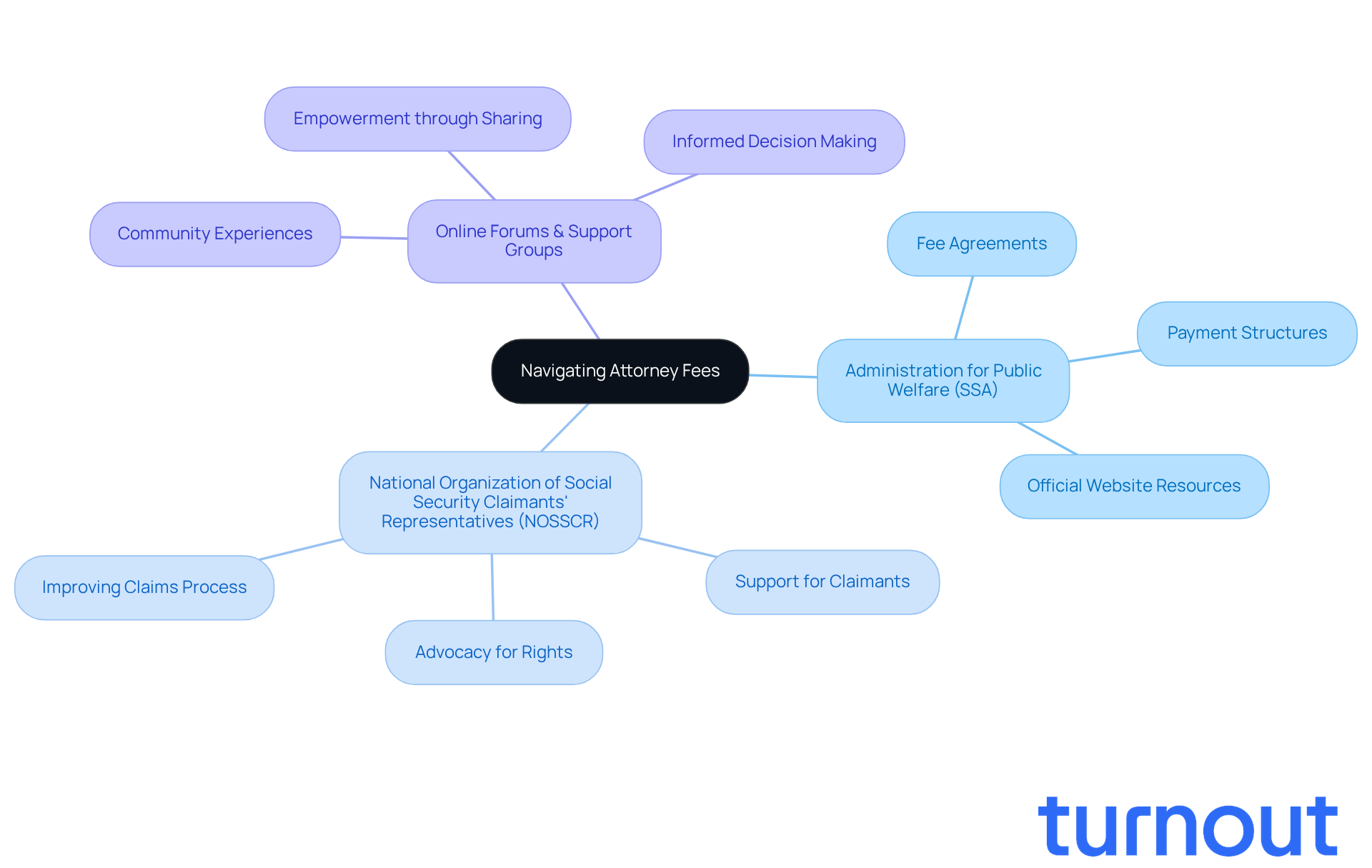

Navigating lawyer costs in disability cases can feel overwhelming, but you’re not alone. There are numerous resources available to help you through this journey. The Administration for Public Welfare (SSA) offers a comprehensive summary of fee agreements and payment structures on its official website. This is a great starting point for anyone looking to understand their options.

Additionally, the National Organization of Social Security Claimants' Representatives (NOSSCR) provides vital insights and support. They advocate for your rights and ensure you have access to qualified representation. Recent updates from NOSSCR show their ongoing commitment to improving the claims process and helping individuals like you understand your financial obligations.

We understand that sharing experiences can be incredibly helpful. Online forums and support groups serve as valuable platforms for connecting with others who have faced similar challenges. Engaging with these communities can empower you to make informed decisions about your representation and financial responsibilities.

By leveraging these resources, you can gain a clearer understanding of whether social security pays attorney fees and enhance your chances of a successful claim. Remember, you’re not alone in this journey, and there are people and organizations ready to support you.

Conclusion

Navigating the complexities of how Social Security pays attorney fees can feel overwhelming. We understand that this process is challenging, especially when you're already dealing with the stress of a disability claim. It's important to know that attorney fees typically follow a contingency fee structure, meaning you only pay if you win your case. With a cap of 25% on overdue benefits and a maximum of $9,200, this system is designed to protect you from unexpected financial burdens while keeping legal representation within reach.

Having a valid fee agreement with your attorney is crucial. Social Security will cover these fees under specific conditions, and strong medical evidence is essential to support your claim. Resources like the SSA and NOSSCR are here to help you, providing valuable information and support that empower you to make informed decisions throughout your journey.

While the process of securing Social Security attorney fees can seem daunting, remember that you are not alone. By understanding the fee structure, evaluating your case effectively, and utilizing available resources, you can enhance your chances of a successful claim. Engaging with communities and professionals can further bolster your confidence. We're here to help you every step of the way.

Frequently Asked Questions

Do social security cases pay attorney fees?

Yes, in social security cases, attorneys typically work on a contingency fee basis, meaning they only get paid if they win your case.

How are attorney fees structured in social security cases?

Attorney fees are capped at 25% of the overdue benefits you receive, with a maximum limit of $9,200 set by the Social Security Administration (SSA).

Can you provide an example of how attorney fees are calculated?

If your overdue benefits total $40,000, the calculated fee would be $10,000. However, due to the cap, your attorney would only receive $9,200.

What is the significance of the fee cap set by the SSA?

The fee cap helps you anticipate your financial responsibilities and ensures that you won’t face unexpected costs in your legal representation.

Has the SSA made any changes to the fee cap recently?

As of November 30, 2024, the SSA has upheld the cap of $9,200 on attorney fees in social security cases.

Why is it important to understand the structure of attorney fees in social security cases?

Understanding these details empowers you as a claimant to navigate the complexities of the welfare system with greater confidence and prepares you for any financial responsibilities related to legal representation.