Introduction

Navigating the complexities of short-term disability insurance can feel overwhelming, especially when considering the financial implications of receiving benefits. We understand that as more workers recognize the importance of this coverage, questions naturally arise about whether short-term disability income is subject to taxation. This article aims to shed light on the nuances of short-term disability benefits, exploring how tax treatment can vary based on factors like premium payments and state regulations. With the potential for significant financial impact, it’s essential to ensure you’re making informed decisions about your coverage and tax obligations.

You are not alone in this journey. Many individuals share similar concerns, and we’re here to help you navigate through them. By understanding the intricacies involved, you can take proactive steps to secure your financial future.

Define Short-Term Disability Insurance

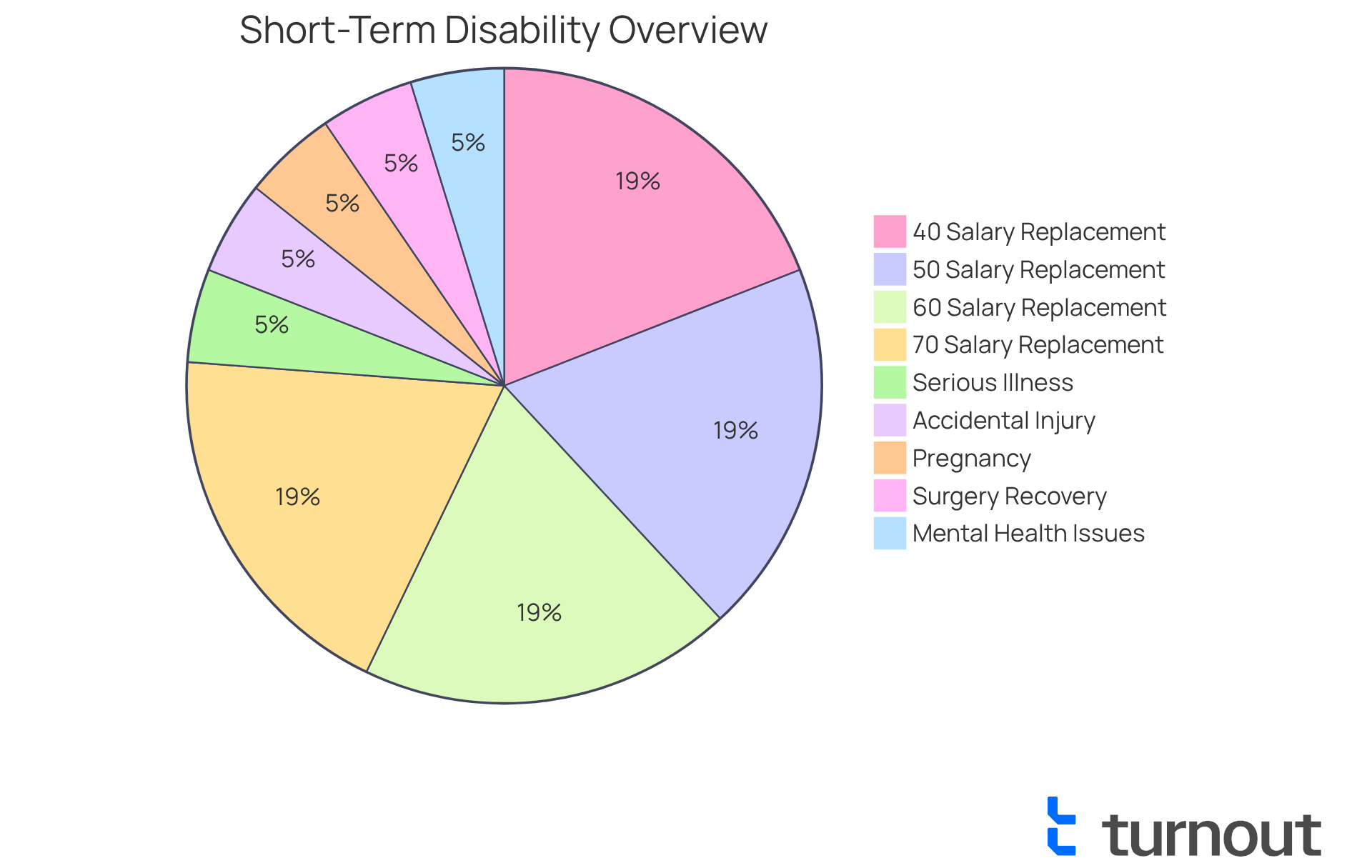

Short-term coverage (STD) serves as a vital financial safety net for those who find themselves temporarily unable to work due to non-work-related illnesses or injuries. Typically, these policies replace a percentage of your salary, often between 40% and 70%, for a limited time that can last from a few weeks to six months. This coverage is designed to ease financial worries during your recovery, allowing you to focus on what truly matters—your health—without the added stress of lost income.

We understand that facing unexpected medical challenges can be overwhelming. That’s why short-term coverage usually comes with a brief waiting period, averaging around 14 days, before benefits kick in. This quick access to funds is crucial for those who need support right away. However, it’s important to recognize that coverage details can vary significantly based on your specific policy and employer’s plan. Many policies may include exclusions for certain situations, particularly those related to work.

Typical qualifying criteria for short-term coverage include:

- Serious illnesses

- Accidental injuries

- Pregnancy

- Surgery recovery

- Mental health issues

As of 2025, about 73% of workers in the Northeast have access to short-term assistance coverage, reflecting a growing recognition of its importance in employee benefits packages. With healthcare costs on the rise, more people are seeking products like short-term protection against income loss to help cover medical expenses and provide financial stability during recovery.

This trend underscores the essential role that income protection insurance plays in safeguarding your financial well-being. Remember, you are not alone in this journey. We’re here to help you navigate these challenges and find the support you need.

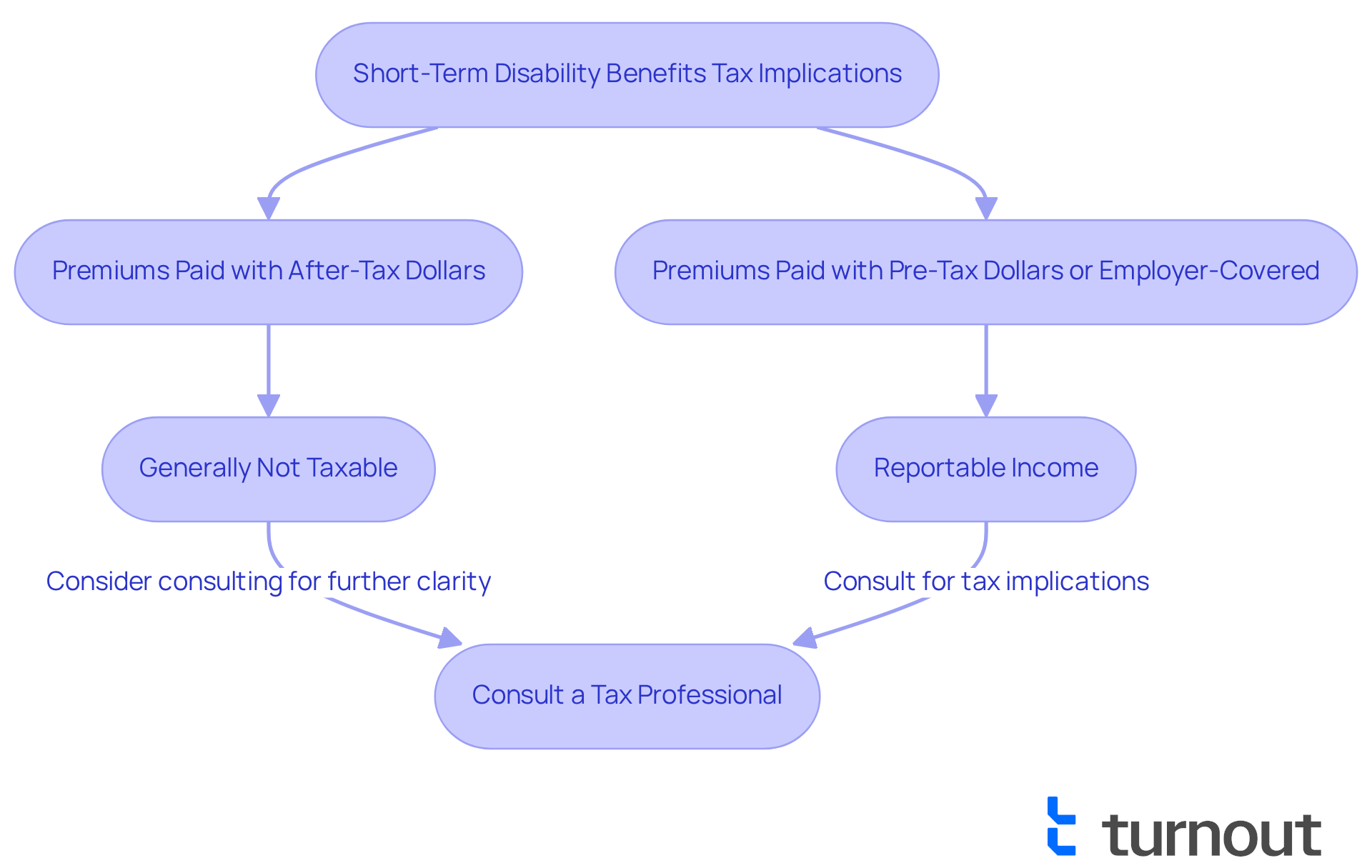

Explore Tax Implications of Short-Term Disability Benefits

Navigating the tax consequences of short-term disability support, including how does short term disability get taxed, can feel overwhelming, especially when considering how premiums are paid. If you've paid premiums with after-tax dollars, the good news is that the benefits you receive are generally not taxable. However, if your employer covers the premiums or if they were paid with pre-tax dollars, it is important to consider whether this means that short term disability benefits do short term disability get taxed.

According to IRS guidelines, any amount received for impairment through an employer-sponsored accident or health insurance plan must be reported as income. As Steven de la Fe, CPA, points out, "If premiums were paid solely with after-tax funds, then the advantages received from the individual incapacity or group incapacity policy are generally not regarded as taxable income."

It's important to understand how does short term disability get taxed, as wage replacements for temporary incapacity can vary significantly, ranging from 40% to 70% of your pre-incapacity earnings. This variation can have a substantial financial impact on your situation. In states like California and New Jersey, where short-term coverage is required, it is crucial to understand how does short term disability get taxed, as the tax treatment may differ.

Additionally, you should consider the potential tax effects of receiving Social Security assistance. We understand that these complexities can be daunting, and that's why consulting with a tax professional is essential. They can help you navigate these intricacies and ensure compliance with IRS requirements for the upcoming 2025 tax year. Remember, you're not alone in this journey; we're here to help.

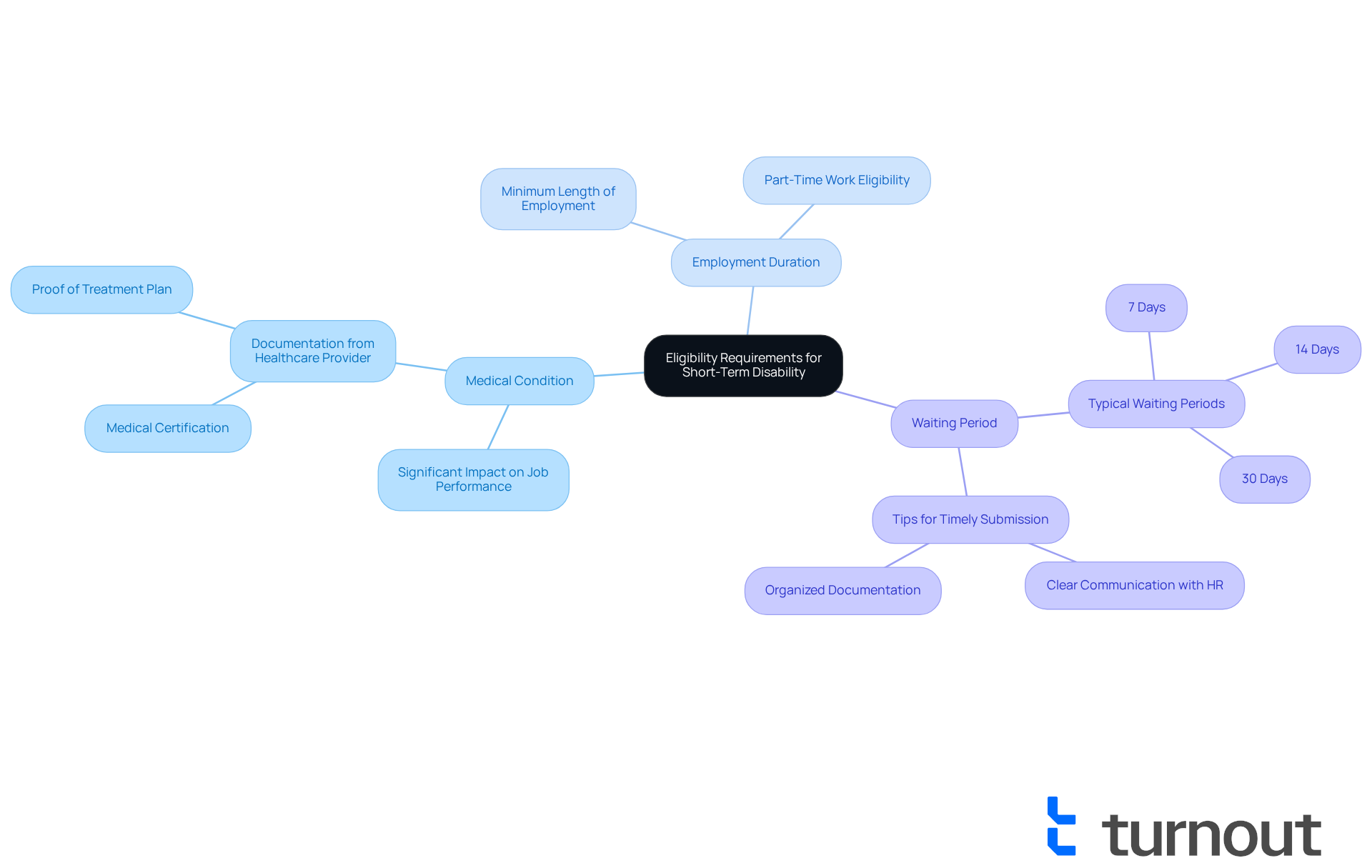

Identify Eligibility Requirements for Short-Term Disability

Navigating the process of qualifying for short-term disability assistance can feel overwhelming. We understand that many individuals face challenges when dealing with medical issues that impact their ability to work. To help you through this journey, it’s important to know the typical criteria outlined in your employer's insurance policy.

Common requirements often include:

- Having a medical condition that significantly affects your job performance

- A minimum length of employment

- Sometimes a waiting period before benefits kick in

It’s crucial to gather documentation from your healthcare provider, as this evidence is essential for substantiating your claim.

Did you know that approximately 70% of short-term claims are approved? This statistic highlights just how vital thorough documentation and adherence to policy guidelines can be. HR experts emphasize the importance of understanding the nuances of your specific policy. They recommend taking the time to examine your employer's plan details and reaching out to your HR department or a support advocate for personalized guidance.

Successful claims often depend on clear communication and timely submission of required documents. Remember, you are not alone in this process. Being proactive and organized can make a significant difference in your experience. We're here to help you every step of the way.

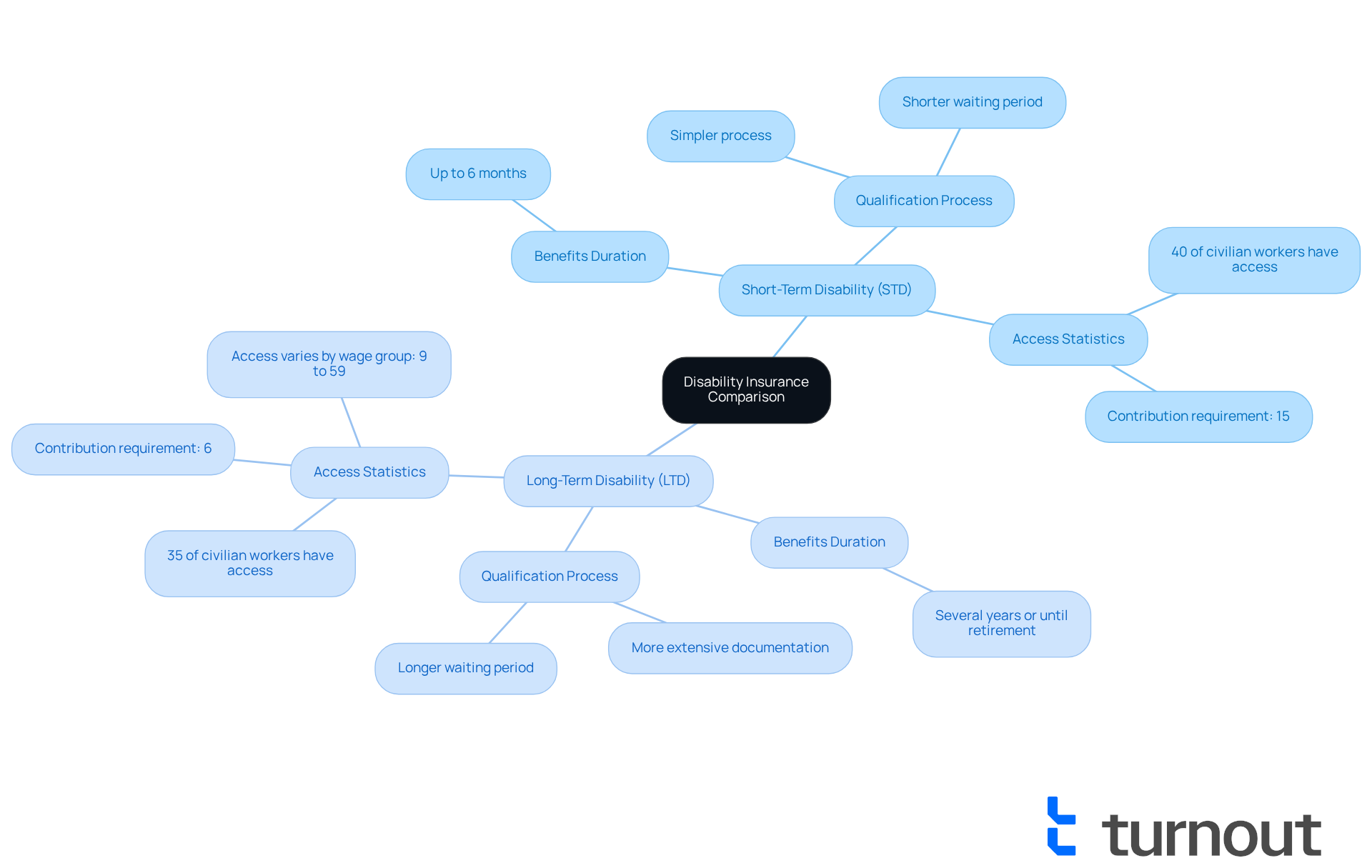

Compare Short-Term and Long-Term Disability Insurance

Short-term coverage (STD) and long-term coverage (LTD) play vital roles in providing financial assistance during challenging times of incapacity. We understand that navigating these options can be overwhelming. STD typically offers benefits for a limited period, usually up to six months, covering a portion of your salary as you recover from short-term health issues. In contrast, LTD is designed for more serious, prolonged disabilities, offering income replacement for several years or until retirement age.

The qualification process for STD is often more straightforward, with a shorter waiting period, making it accessible for those facing temporary health challenges. It's common to feel uncertain about what to expect. On the other hand, LTD usually requires more extensive documentation and a longer waiting period before benefits begin, emphasizing its focus on severe, enduring conditions.

As of 2020, around 40% of civilian employees had access to STD provisions, while only 35% had access to LTD. This highlights a significant disparity in coverage options. This gap is especially pronounced among lower-wage workers, where access to LTD can drop to as low as 9% in the lowest wage group compared to 59% in the highest.

Real-life transitions from STD to LTD often happen when individuals face ongoing health issues that extend beyond the typical recovery period. For instance, a worker recovering from surgery may initially rely on STD benefits but find themselves needing LTD if their condition doesn’t improve enough to return to work.

Understanding these differences is essential for making informed decisions regarding whether short-term disability gets taxed in your coverage. We’re here to help you select the right insurance based on your specific needs and circumstances. Remember, you are not alone in this journey.

Conclusion

Understanding the complexities of short-term disability insurance is essential for anyone considering this important financial safety net. We know that navigating these waters can be overwhelming, but being informed can make a significant difference in your financial situation. It’s crucial to understand how short-term disability benefits are taxed, as this knowledge can help you manage your benefits and obligations more effectively.

Short-term disability insurance offers vital support during times of temporary incapacity, covering a portion of lost income so you can focus on what truly matters—your recovery. The eligibility criteria for these benefits are straightforward, yet it’s important to pay close attention to the specific details of your policy. Additionally, comparing short-term and long-term disability insurance can help you select the right coverage tailored to your individual needs.

In conclusion, being proactive and informed about short-term disability insurance empowers you to make sound decisions that protect your financial well-being. With the growing awareness of the importance of income protection, it’s vital to explore your options, understand the tax implications, and seek guidance when needed. Remember, you are not alone in this journey. By taking these steps, you can prepare for unexpected challenges and secure the financial stability you deserve during difficult times.

Frequently Asked Questions

What is short-term disability insurance?

Short-term disability insurance (STD) provides financial support for individuals temporarily unable to work due to non-work-related illnesses or injuries. It typically replaces a percentage of your salary, usually between 40% and 70%, for a limited duration ranging from a few weeks to six months.

How does short-term disability insurance help during recovery?

This coverage alleviates financial concerns during recovery by providing income replacement, allowing individuals to focus on their health without the added stress of lost income.

What is the typical waiting period for short-term disability benefits?

Short-term disability insurance usually has a brief waiting period, averaging around 14 days, before benefits become available.

What conditions typically qualify for short-term disability coverage?

Common qualifying conditions include serious illnesses, accidental injuries, pregnancy, surgery recovery, and mental health issues.

How prevalent is short-term disability coverage among workers?

As of 2025, approximately 73% of workers in the Northeast have access to short-term disability assistance coverage, indicating its growing importance in employee benefits.

Why is short-term disability insurance important?

With rising healthcare costs, short-term disability insurance plays a crucial role in protecting individuals from income loss, helping them cover medical expenses and maintain financial stability during recovery.