Introduction

Understanding the complexities of short-term disability insurance is crucial for expecting parents. You might be wondering if pregnancy qualifies for these benefits. Many policies do recognize pregnancy as a valid medical condition for claims, which means you could secure financial support during this important time.

However, we understand that navigating the eligibility criteria and application process can feel overwhelming. What steps do you need to take to ensure coverage? How can you avoid common pitfalls? You're not alone in this journey, and this guide aims to clarify the intricacies of short-term disability related to pregnancy.

We’re here to help you make informed decisions about your insurance options. Together, we can demystify the process and empower you to seek the support you deserve.

Understand Short-Term Disability Insurance

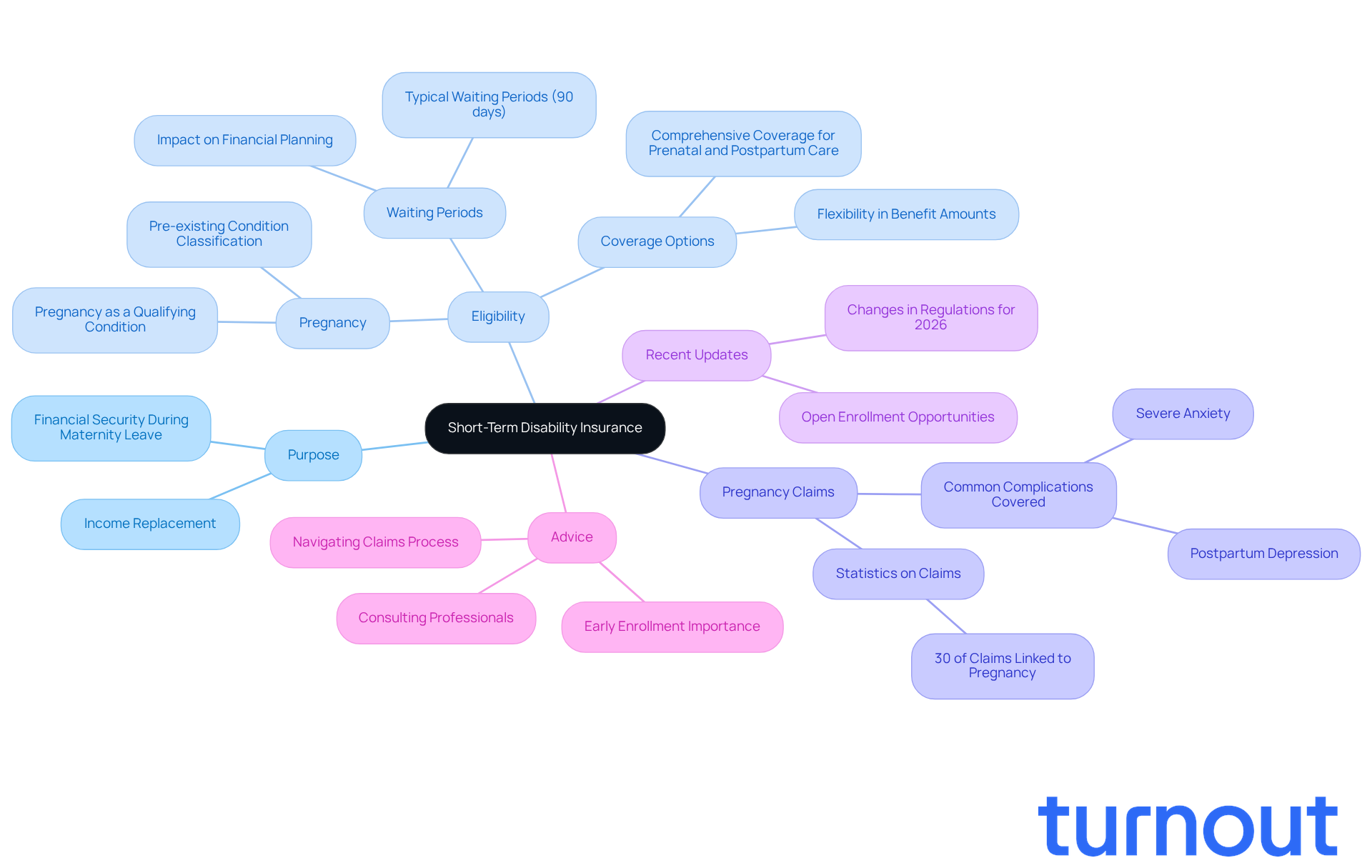

Short-term disability insurance serves as a vital safety net for those temporarily unable to work due to medical conditions, raising the question of whether pregnancy qualifies for short-term disability. It typically provides income replacement, covering a portion of your salary for a limited time, which can range from several weeks to up to a year. However, the specifics can differ significantly among various plans.

Many insurance policies address the question of whether pregnancy qualifies for short-term disability, recognizing it as a qualifying medical condition that allows individuals to claim benefits for complications such as severe anxiety, postpartum depression, or other health issues that may arise during or after childbirth. In fact, around 30% of short-term claims are linked to whether pregnancy qualifies for short-term disability, underscoring the importance of understanding your coverage options.

As we approach 2026, recent updates in short-term disability benefits make it crucial for expecting parents to determine if pregnancy qualifies for short-term disability in their insurance plans. Some regulations may impose waiting periods before benefits kick in, often lasting at least 90 days, which can impact financial planning during maternity leave. It’s also essential to ensure that your health plan comprehensively covers prenatal, delivery, and postpartum care, along with any potential complications.

We understand that navigating these details can be overwhelming. Consulting with qualified healthcare professionals and insurance advisors, including local brokers who offer free assistance, can clarify the nuances of your specific plan. This way, you can feel well-prepared for the application process. By enrolling in short-term disability insurance before childbirth, you can avoid pre-existing condition restrictions and ensure access to full benefits when you need them most. This proactive approach can significantly ease financial stress during a time that often brings uncertainty.

Identify Eligibility Criteria for Pregnancy

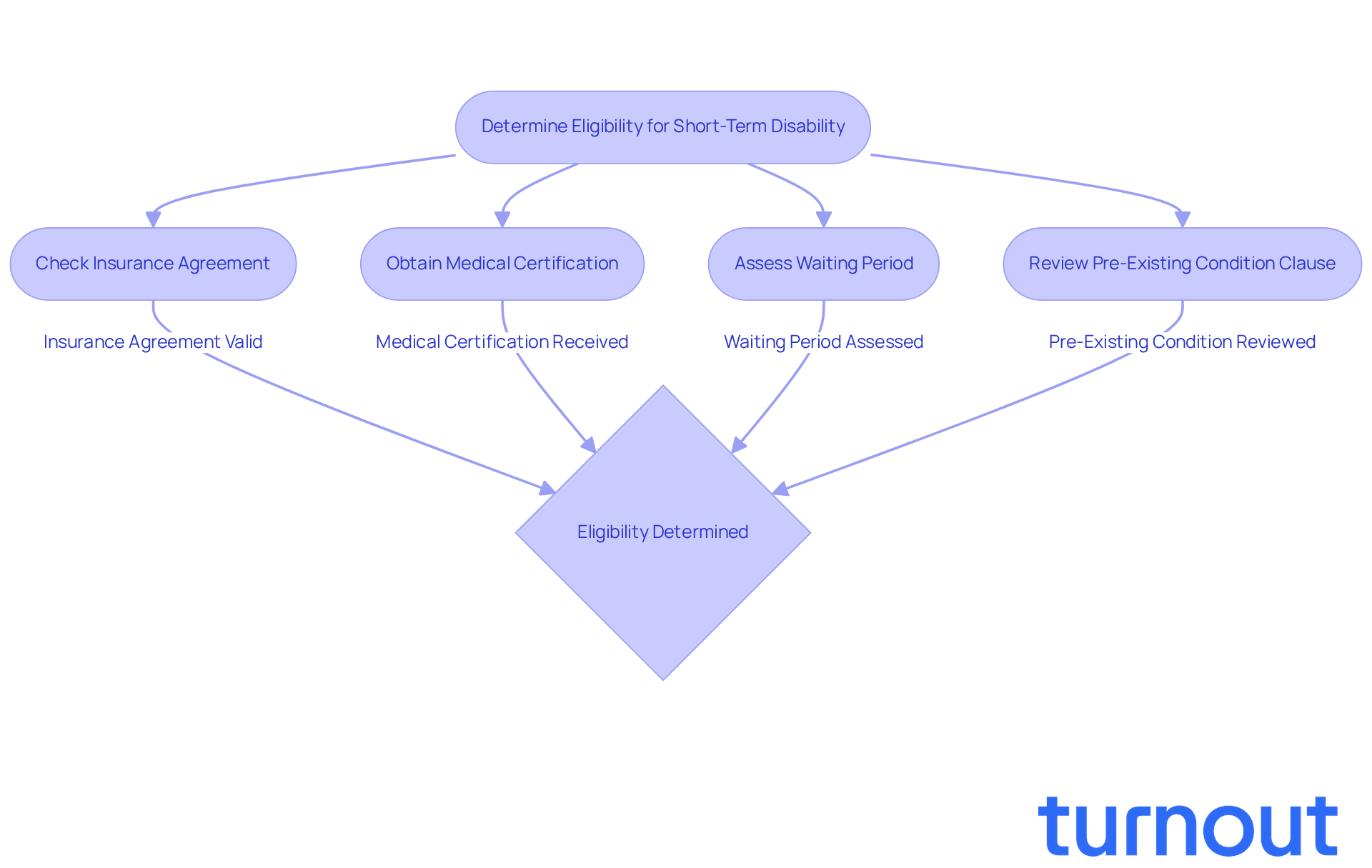

Navigating the world of short-term benefits during pregnancy raises the question of whether pregnancy qualifies for short-term disability. We understand that you may have questions about your eligibility and what steps to take. To qualify for these benefits, it’s essential to meet specific standards set by your insurance agreement. Generally, you’ll need to show that you’re unable to work due to pregnancy-related conditions to answer the question of whether pregnancy qualifies for short-term disability, which can include complications or recovery from childbirth.

Most guidelines require a medical certification from your healthcare provider to confirm your inability to work. It’s also important to be aware that many plans have a waiting period, known as an elimination period. This typically lasts from a few days to several weeks, with FEBA short-term coverage plans usually featuring a 14-day elimination period.

Additionally, check if your coverage includes a pre-existing condition clause. Some plans may not cover births that began before your coverage took effect. Remember, gestation is often classified as an 'illness' under many short-term incapacity policies, leading to the important question of whether pregnancy qualifies for short-term disability, which is crucial for understanding your coverage.

It’s vital to consider the potential financial risks that can arise from complications during pregnancy. These complications can extend your incapacity beyond the usual recovery periods. By understanding these criteria, you can better assess your eligibility and prepare for the application process. You are not alone in this journey, and we’re here to help you every step of the way.

Gather Required Documentation and Apply

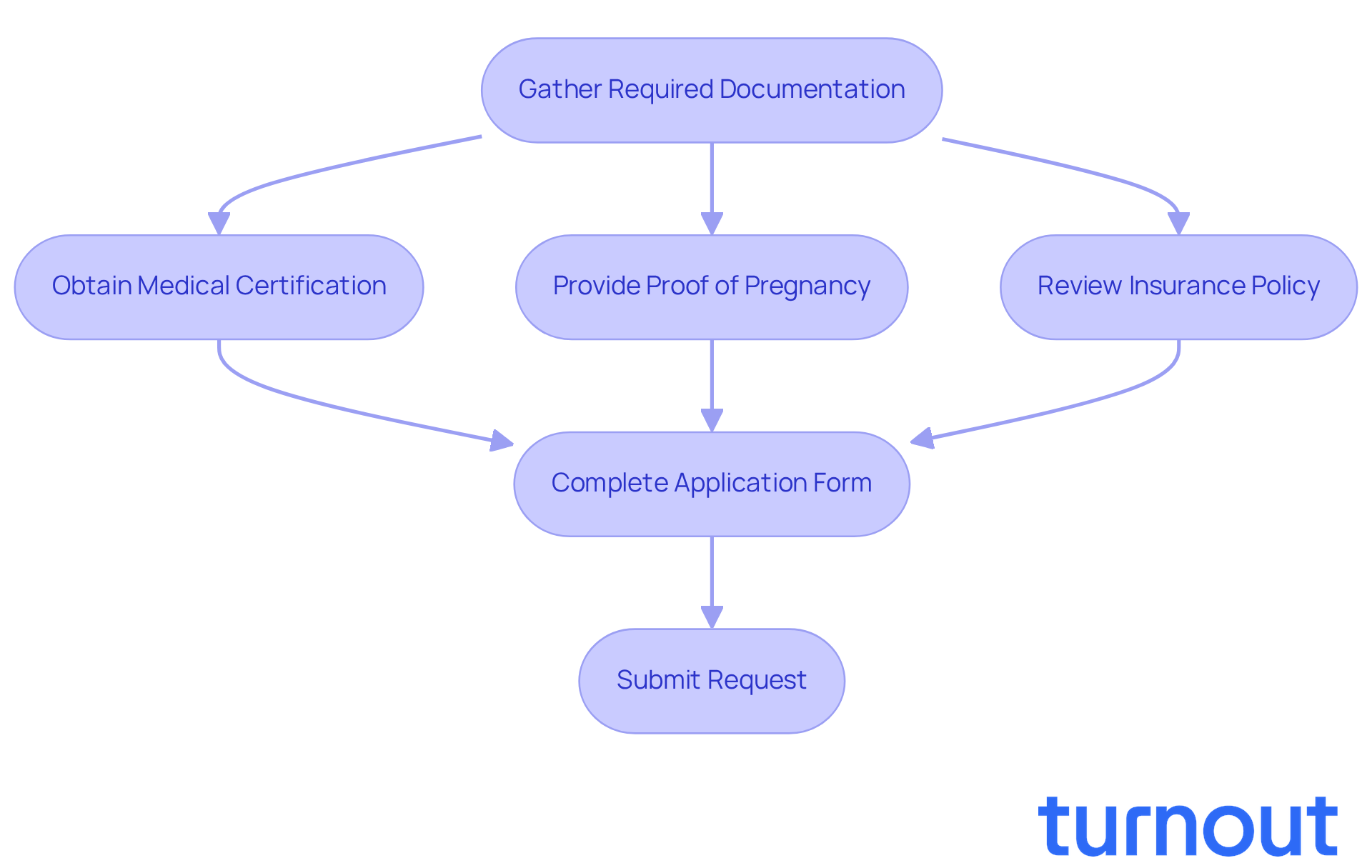

Applying for short-term disability benefits related to childbirth can feel overwhelming, especially when wondering if does pregnancy qualify for short term disability, but we're here to help you through it. Start by gathering a few key documents. First, obtain a medical certification from your healthcare provider. This document outlines your condition and confirms your inability to work, serving as crucial evidence for your claim.

You may also need to provide proof of your pregnancy, such as ultrasound images or a letter from your doctor, to establish whether does pregnancy qualify for short term disability. It’s important to review your insurance policy to identify any specific forms required for submission. Once you have all the necessary documents, complete the application form provided by your insurance company.

We understand that timing is essential. Make sure to submit your request as soon as possible-ideally before your due date-to avoid any delays in processing. If you encounter difficulties navigating the application process, remember that Turnout can assist you with understanding SSD requests and provide access to tools and services that simplify the process.

Keep copies of all submitted documents for your records. You are not alone in this journey; we’re here to support you every step of the way.

Navigate Common Challenges and FAQs

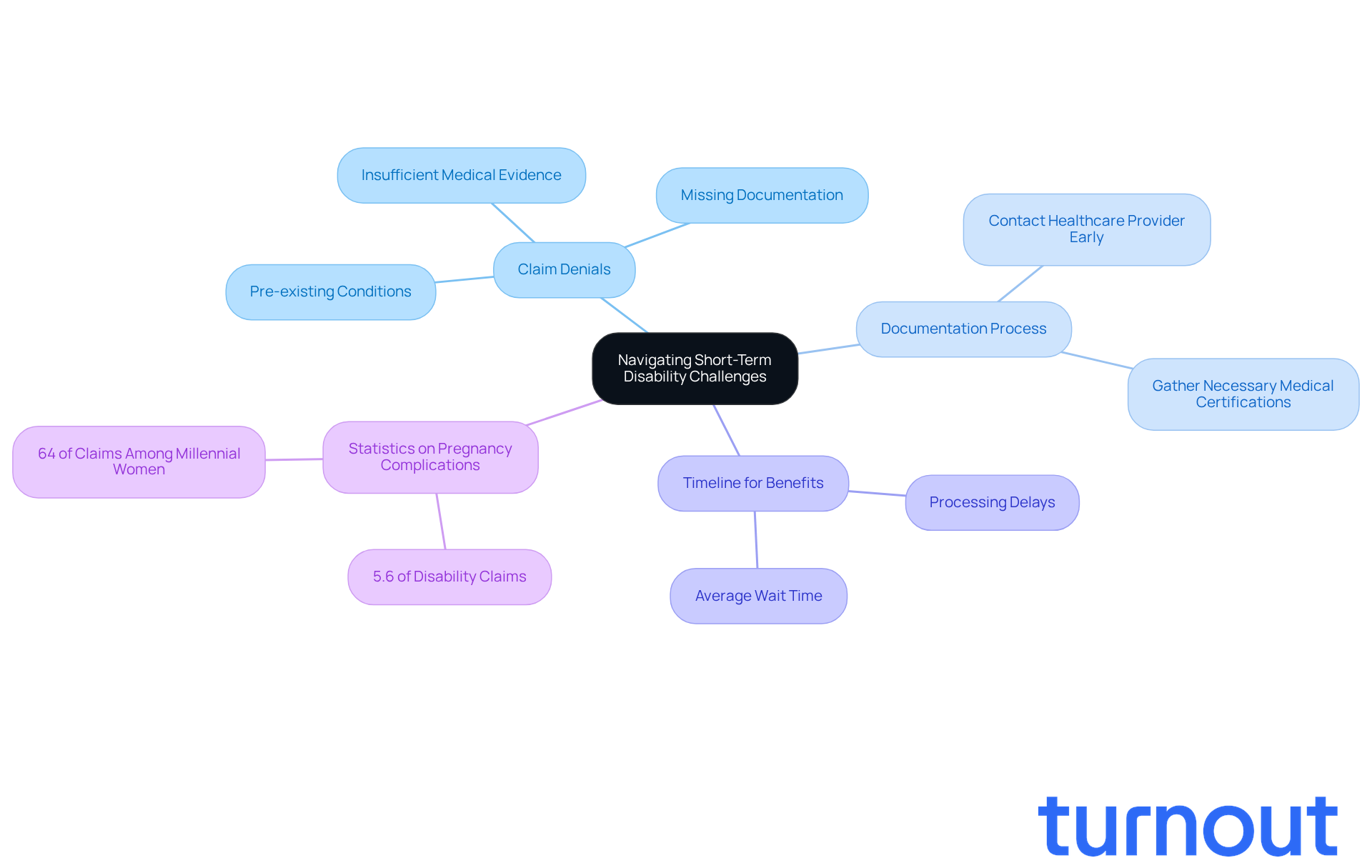

We understand that applying for short-term disability benefits can be challenging, especially when considering if pregnancy qualifies for short-term disability. One major concern is the risk of claim denials due to pre-existing conditions. It’s crucial to know your policy's specific terms regarding these conditions, as they can significantly impact your eligibility. The documentation process can also feel overwhelming; many applicants struggle to secure the necessary medical certifications in a timely manner. To ease this burden, we recommend reaching out to your healthcare provider early in your pregnancy to discuss the required documentation.

Another common worry is the timeline for receiving benefits. On average, it can take several weeks for requests to be processed, and delays are not uncommon. If you find yourself facing delays, don’t hesitate to contact your insurance provider. They can help clarify the status of your request. Did you know that pregnancy complications account for 5.6% of all disability requests? This statistic highlights the importance of being prepared for potential challenges.

Real-life experiences show how pre-existing conditions can affect requests. Many applicants have faced rejections due to insufficient medical evidence or missing documentation. Insurance experts stress the importance of thorough record-keeping and consistent treatment to navigate these hurdles successfully. By addressing these common obstacles promptly and effectively, you can enhance your chances of a successful request and secure the financial assistance you need during this important time.

Remember, while Turnout is not a law firm and does not provide legal advice, our trained advocates are here to help you navigate the claims process. You are not alone in this journey; we can assist you in accessing the tools and services necessary for a successful application.

Conclusion

Understanding whether pregnancy qualifies for short-term disability insurance is crucial for expecting parents. It can significantly impact financial stability during this transformative time. We know that navigating these waters can feel overwhelming, but being informed can empower you to make better decisions regarding your coverage and prepare adequately for maternity leave.

Key points to consider include:

- Recognizing pregnancy as a qualifying medical condition under many short-term disability plans.

- Medical certification is often necessary to validate claims, so understanding your policy specifics-like waiting periods and pre-existing condition clauses-is essential.

We understand that this process can be daunting, but thorough documentation and proactive communication with healthcare providers can help ensure a smooth application experience.

Ultimately, being well-prepared and informed can alleviate the stress associated with navigating short-term disability claims during pregnancy. We encourage expecting parents to consult with insurance advisors and healthcare professionals to clarify their coverage and eligibility. Taking these steps not only enhances the chances of a successful claim but also ensures financial peace of mind during this significant life event. Remember, you are not alone in this journey, and we're here to help.

Frequently Asked Questions

What is short-term disability insurance?

Short-term disability insurance provides income replacement for individuals temporarily unable to work due to medical conditions, covering a portion of their salary for a limited time, which can range from several weeks to up to a year.

Does pregnancy qualify for short-term disability benefits?

Yes, many insurance policies recognize pregnancy as a qualifying medical condition, allowing individuals to claim benefits for complications such as severe anxiety, postpartum depression, or other health issues related to childbirth.

What percentage of short-term claims are related to pregnancy?

Approximately 30% of short-term claims are linked to whether pregnancy qualifies for short-term disability.

What should expecting parents consider regarding short-term disability insurance?

Expecting parents should determine if pregnancy qualifies for short-term disability in their insurance plans and be aware of potential waiting periods before benefits begin, which can last at least 90 days.

What additional coverage should be ensured in health plans for expecting parents?

It is essential to ensure that health plans comprehensively cover prenatal, delivery, and postpartum care, along with any potential complications.

How can individuals navigate the details of their short-term disability insurance?

Consulting with qualified healthcare professionals and insurance advisors, including local brokers who offer free assistance, can help clarify the specifics of individual plans.

What is a proactive approach to short-term disability insurance for expecting parents?

Enrolling in short-term disability insurance before childbirth can help avoid pre-existing condition restrictions and ensure access to full benefits when needed, easing financial stress during maternity leave.