Introduction

Navigating the intricacies of life insurance can feel overwhelming, especially when faced with sensitive situations like coverage for suicidal death in Texas. Many individuals depend on life insurance for their financial security, making it essential to understand the implications of policy exclusions and clauses. What happens when a loved one passes away under such heartbreaking circumstances? How do the stipulations of their policy influence the outcome?

In this article, we’ll explore the complexities of life insurance coverage in Texas. We’ll address critical questions surrounding:

- Suicide clauses

- Contestability periods

- The steps beneficiaries can take if claims are denied

Remember, you are not alone in this journey; we’re here to help you understand your options and navigate this challenging landscape.

Define Life Insurance and Its Coverage Scope

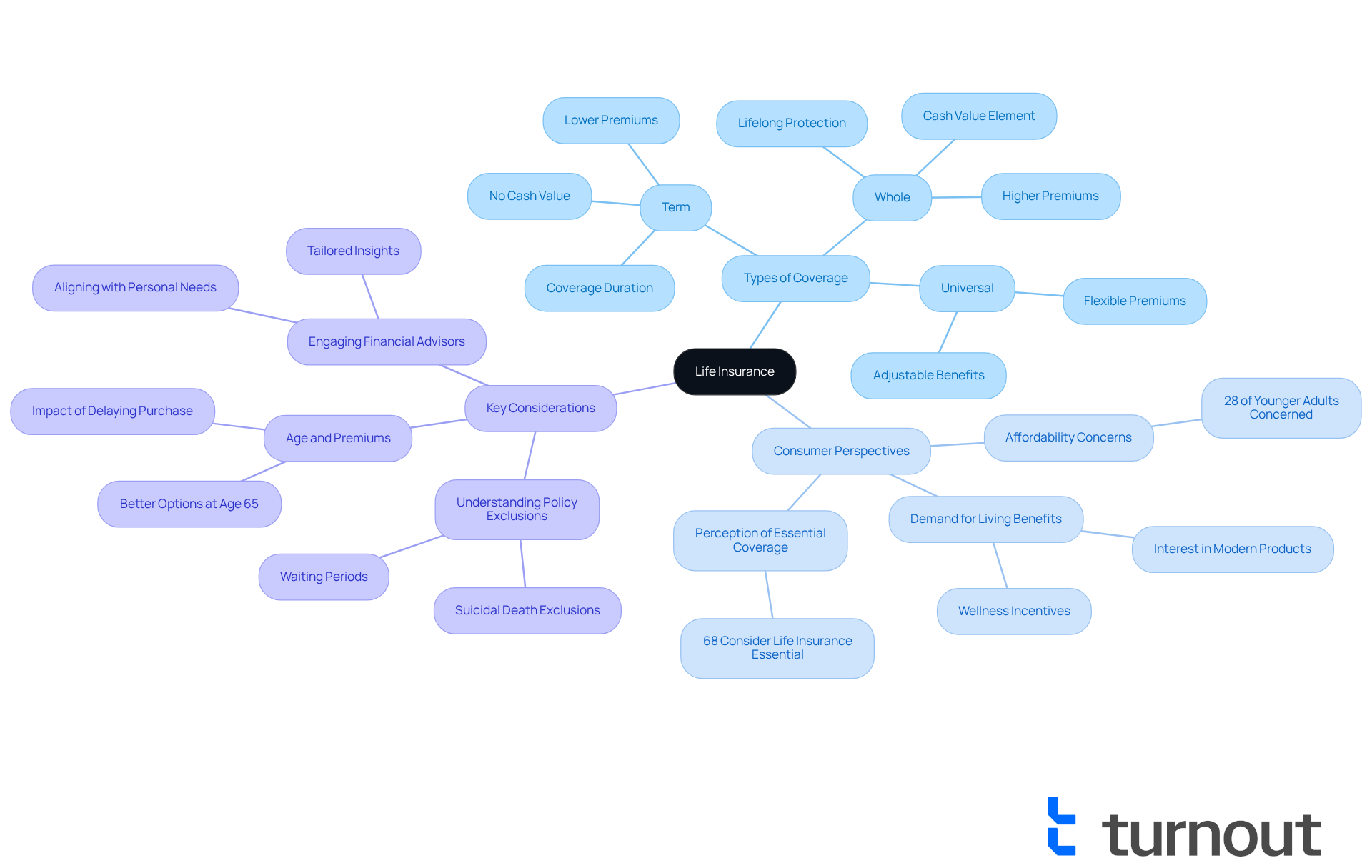

Life coverage is more than just a policy; it’s a promise between you and your insurer. When you choose a plan, you’re securing a commitment that, upon your passing, a specified sum will be paid to your loved ones. However, it’s important to understand that the extent of this coverage can vary significantly depending on the type of plan you select - be it term, whole, or universal protection. Each option has its own set of rules regarding premiums, benefits, and exclusions. This is why it’s essential to grasp these differences. For instance, whole life plans offer lifelong protection and a cash value element, while term plans provide coverage for a specific duration, often at lower premiums but without cash value growth.

As we look ahead to 2025, it’s crucial to recognize that many coverage agreements include exclusions, particularly regarding the question of does life insurance pay for suicidal death in Texas. Typically, insurers may impose a waiting period - often two years - during which the question of does life insurance pay for suicidal death in Texas is not addressed. After this period, the plan generally pays out unless there’s been fraud or misrepresentation of health status, raising questions about whether does life insurance pay for suicidal death in Texas. Recent data shows that about 68% of Americans consider coverage essential for their financial security. Yet, the percentage of individuals with protection varies by policy type. Term coverage is often favored for its cost-effectiveness, while whole coverage appeals to those pursuing long-term financial strategies.

Understanding these nuances is vital, especially for those contemplating coverage as part of their financial plan. As Teresa Rasmussen, CEO of Thrivent, emphasizes, assessing the right type of coverage is key to aligning with your personal needs and long-term goals. Engaging with a knowledgeable financial advisor can provide tailored insights, ensuring you choose the most suitable policy for your situation. It’s also important to note that 28% of younger adults express concerns about affordability when it comes to coverage. This highlights a significant shift in consumer perspectives. Moreover, younger generations are increasingly seeking coverage options that offer living benefits, reflecting a demand for modern products that resonate with their financial aspirations.

Explore Suicide Clauses in Life Insurance Policies

Navigating the complexities of insurance policies can be overwhelming, particularly regarding the question of does life insurance pay for suicidal death in Texas. These clauses often state that if the insured passes away by suicide within a specified timeframe, usually the first one to two years of the policy, it raises the question: does life insurance pay for suicidal death in Texas? Instead, beneficiaries may only receive a refund of the premiums paid. This provision is designed to prevent individuals from obtaining coverage with the intention of committing suicide soon after, protecting the insurer from potential financial losses.

We understand that comprehending these clauses is essential for beneficiaries, especially to know if does life insurance pay for suicidal death in Texas, as they may face denial of requests related to suicide. In Texas, one of the significant concerns regarding policy denial rates is whether life insurance does pay for suicidal death in Texas, with some providers rejecting up to 50% of submissions. Overall, roughly 20% of policies are rejected, often due to significant misrepresentation or incomplete medical history in applications. It’s important to note that approximately 40% of rejected policies are successfully reversed upon appeal. This highlights the necessity of employing a proficient attorney to manage this process efficiently.

You are not alone in this journey. Seeking legal help when encountering denial of benefits is crucial, especially considering that fewer than 0.2% of life coverage denial cases are disputed by policyholders. This suggests a lack of awareness about their rights. Expert opinions indicate that these clauses aim to uphold the integrity of the insurance system, ensuring that contracts are not exploited. However, they can lead to distressing outcomes for families left managing the complexities of denial after a tragic loss.

Furthermore, it’s vital to highlight the proposed Senate Bill 5,495, which seeks to lessen the statutory suicide exclusion from two years to one year for agreements issued or renewed on or after January 1, 2026. This change could significantly affect beneficiaries, offering them a glimmer of hope in a challenging situation. Remember, we’re here to help you navigate these difficult waters.

Understand the Contestability Period and Its Impact on Claims

The contestability period, typically lasting two years from the issuance of a life insurance contract, is a crucial time for both insurers and policyholders. During this period, insurers can thoroughly review applications for any potential misrepresentation or fraud. If the insured passes away within this timeframe, the insurer may closely examine the application and the circumstances surrounding the death.

It's common to feel anxious about what this means for your loved ones. For instance, consider the case of Marcus Tillman, whose parents both passed away shortly after acquiring their policies. Their requests were denied due to the contestability period, leaving the family in a difficult situation. Unfortunately, this is not an isolated incident. Statistics show that a significant percentage of claims are denied during this time, highlighting the importance of understanding the implications of the contestability period.

We understand that navigating these complexities can be overwhelming. That's why it's essential to be open and honest when applying for coverage. This honesty helps ensure that your beneficiaries receive the full death benefit without any issues. Once the contestability period concludes, insurers can only deny claims for reasons clearly stated in the policy or if fraud is proven. This leads to a more straightforward process for your loved ones when they need it most.

Remember, you are not alone in this journey. We're here to help you understand your options and ensure your family's financial security.

Outline Steps for Beneficiaries After a Claim Denial

When a policy payout is rejected, it can feel overwhelming for beneficiaries. We understand that this is a challenging time, and adopting a structured method to tackle the denial can make a difference. Start by thoroughly reviewing the denial letter to pinpoint the specific reasons cited by the insurer. Did you know that 1-3 percent of life coverage claims are examined or rejected for fraud or misrepresentation? This highlights the importance of precision in the claims process.

Next, gather all relevant documentation, such as the coverage agreement, death certificate, and any correspondence with the provider. Logging all communications with the insurer is crucial. This comprehensive record will support your appeal process and ensure you have everything you need at your fingertips.

Once you’ve compiled the necessary documents, it’s time to submit an appeal to the provider. This appeal should include any additional evidence or clarifications that counter the insurer's reasons for denial. Legal experts emphasize that understanding the specific terms and reasons for rejection is vital for crafting a persuasive appeal. If the appeal doesn’t yield a favorable result, consider consulting with a lawyer who specializes in insurance matters. Wallace Law suggests that hiring an attorney before starting the appeals process can provide valuable insights and help you explore further options, including potential litigation.

Many denials can be overturned during the appeals process, especially those based on incomplete information. To avoid claim issues in the first place, be honest on your application, stay informed about your policy, and ensure your beneficiaries understand the terms. By following these steps, you can navigate the complexities of contesting a denial with confidence. Remember, you are not alone in this journey, and we’re here to help you secure the benefits you deserve.

Conclusion

Understanding the intricacies of life insurance, especially in Texas, is crucial for anyone looking to secure their family's financial future. We know this can be overwhelming, but being informed can make a significant difference. This article sheds light on the complexities surrounding life insurance coverage, particularly concerning suicidal death and the clauses that can affect beneficiaries.

Many policies come with a waiting period that may influence whether benefits are paid out in cases of suicide. It's essential for both policyholders and beneficiaries to grasp these stipulations. Transparency in the application process is vital, as claim denials can happen if the death occurs within the contestability period. We understand that these details can be daunting, but being aware of them can empower you.

Moreover, proposed legislative changes could reshape the landscape for beneficiaries seeking coverage in tragic circumstances. It's common to feel uncertain about what lies ahead, but knowledge is your ally.

Ultimately, awareness and preparation are key. Engaging with knowledgeable advisors and legal experts can help you navigate the complexities of life insurance claims with confidence. By understanding the nuances of suicide clauses and contestability periods, you can better protect your loved ones. This proactive approach not only fosters peace of mind but also reinforces the importance of making informed decisions about life insurance coverage.

Remember, you are not alone in this journey. We're here to help you every step of the way.

Frequently Asked Questions

What is life insurance and what does it cover?

Life insurance is a promise between you and your insurer that, upon your passing, a specified sum will be paid to your loved ones. The coverage can vary significantly depending on the type of plan chosen, such as term, whole, or universal protection.

What are the different types of life insurance plans?

The main types of life insurance plans are term, whole, and universal. Whole life plans offer lifelong protection and a cash value element, while term plans provide coverage for a specific duration, often at lower premiums but without cash value growth.

Are there exclusions in life insurance coverage?

Yes, many life insurance agreements include exclusions. For example, in Texas, insurers may impose a waiting period-typically two years-regarding coverage for suicidal death. After this period, the plan generally pays out unless there has been fraud or misrepresentation of health status.

How prevalent is life insurance coverage among Americans?

Recent data indicates that about 68% of Americans consider life insurance coverage essential for their financial security, although the percentage of individuals with protection varies by policy type.

Why do people choose term coverage over whole life coverage?

Term coverage is often favored for its cost-effectiveness, while whole life coverage appeals to those pursuing long-term financial strategies.

What concerns do younger adults have regarding life insurance?

About 28% of younger adults express concerns about the affordability of life insurance coverage. Additionally, younger generations are increasingly seeking options that offer living benefits, reflecting a demand for modern products that align with their financial aspirations.

How can I choose the right life insurance policy for my needs?

It is essential to assess the right type of coverage based on your personal needs and long-term goals. Engaging with a knowledgeable financial advisor can provide tailored insights to help you choose the most suitable policy for your situation.