Introduction

Navigating the tax implications of long-term disability benefits can feel overwhelming. We understand that many individuals are concerned about their financial futures. With the IRS classifying these payments as income, you might wonder: how does the method of premium payment impact your tax obligations? Misconceptions about the taxability of these benefits can lead to unexpected financial surprises. That’s why it’s essential to explore the nuances of taxation related to long-term disability.

What steps can you take to ensure clarity and avoid pitfalls when filing taxes on these benefits? You're not alone in this journey, and we're here to help you understand the process better.

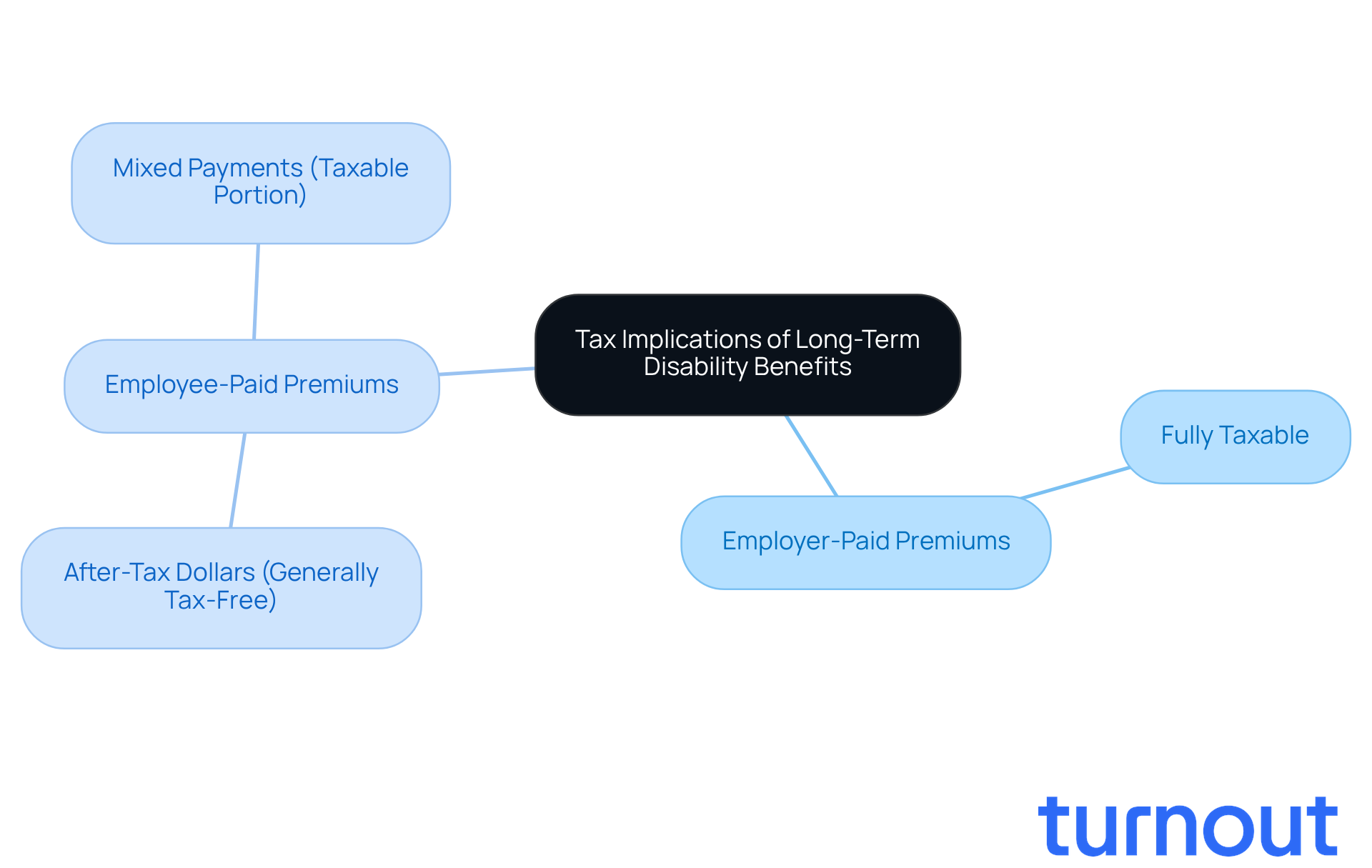

Understand Tax Implications of Long-Term Disability Benefits

Navigating the world of disability payments can be overwhelming, particularly when trying to understand do you pay taxes on long-term disability. It’s important to know that the IRS classifies long-term disability (LTD) payments as income, which leads to the question: do you pay taxes on long-term disability based on how premiums were paid? If your employer covers the entire premium for your LTD policy, you might wonder, do you pay taxes on long-term disability payments you receive, as they are fully taxable? However, if you pay for your policy with after-tax dollars, you might wonder, do you pay taxes on long-term disability benefits, which are generally tax-free.

Are your long-term impairment payments taxable, and do you pay taxes on long-term disability? When considering benefits linked to employer-paid premiums, it's important to ask, do you pay taxes on long-term disability benefits that are funded by employee contributions with after-tax dollars? For example, if your employer pays 60% of the premium and you cover 40% with after-tax dollars, only the 60% portion of your benefits will be taxed.

It’s a common misconception that when receiving long-term impairment assistance, do you pay taxes on long-term disability. This misunderstanding can lead to unexpected tax bills during tax season, especially if you are unsure about whether you do you pay taxes on long-term disability. To avoid surprises, it’s essential to verify how your premiums were paid, particularly in relation to whether you do you pay taxes on long-term disability.

Don’t forget to review any relevant state tax laws that may apply to your benefits. State regulations can vary significantly and may impact your overall tax obligation.

If you have specific questions about your situation, particularly concerning do you pay taxes on long-term disability, especially if you're dealing with multiple assistance policies or if your claim has been denied or delayed, consulting with a tax expert can be invaluable. A knowledgeable lawyer can provide insight into your rights and help you navigate the complexities of tax responsibilities, specifically addressing do you pay taxes on long-term disability entitlements. As BenGlassLaw mentions, "Yes, long-term impairment payments can be taxable depending on how the insurance premiums were paid." Additionally, be prepared to receive tax documents like Form W-2 or 1099 for reporting taxable long-term incapacity payments on your tax return. Remember, you’re not alone in this journey; we’re here to help.

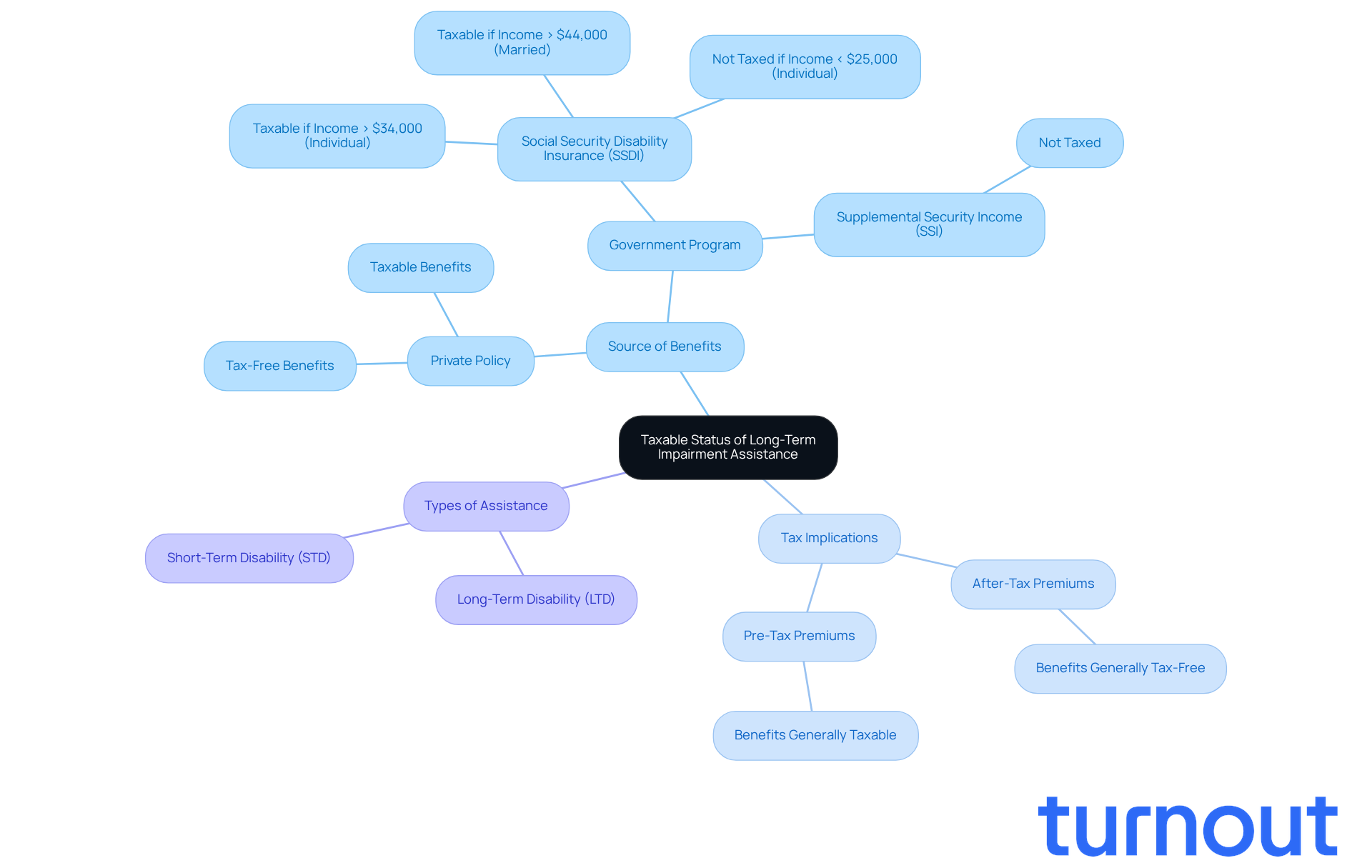

Verify Taxable Status Based on Benefit Type

Understanding the source of your long-term impairment assistance is crucial. Is it from a private policy or a government program? This distinction can significantly affect how much you need to consider, do you pay taxes on long-term disability. At Turnout, we provide tools and services to help you navigate these complexities, especially if your benefits relate to Social Security Disability Insurance (SSDI) claims.

Have you considered how your income protection insurance premiums were paid? If they were funded with after-tax dollars, the benefits are generally tax-free. However, if they were paid with pre-tax dollars, do you pay taxes on long-term disability benefits, as those benefits might be taxable. For example, if your employer covers all the premiums, you might wonder do you pay taxes on long-term disability payments as regular earnings.

It's also important to determine whether your assistance falls under SSDI or Supplemental Security Income (SSI). SSDI payments may be taxable based on your overall earnings. If your income exceeds $34,000 as an individual or $44,000 as a married couple, up to 85% of your SSDI could be subject to tax. On the other hand, SSI payments are not taxed by federal or state governments. Our trained nonlawyer advocates at Turnout can help clarify these distinctions and guide you through the SSD claims process.

Make sure to review any documentation from your insurance provider regarding do you pay taxes on long-term disability entitlements. This includes any W-2 or 1099 forms that may be necessary for tax reporting.

If you have uncertainties about your tax obligations related to impairment benefits, consider utilizing IRS resources or consulting a tax advisor. Remember, Turnout is here to support you in understanding these obligations and accessing the financial assistance you may need. You're not alone in this journey.

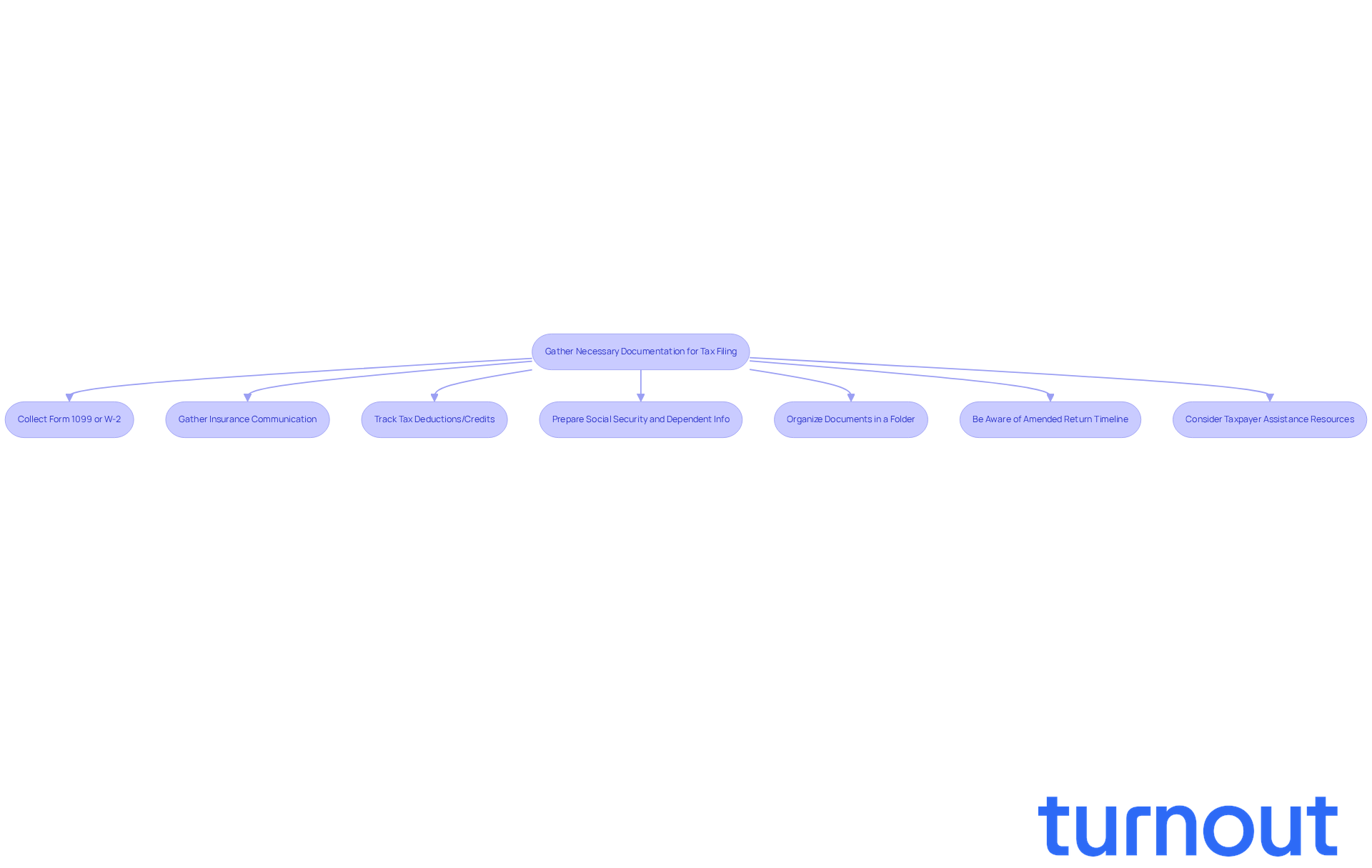

Gather Necessary Documentation for Tax Filing

Gather your Form 1099 or W-2, which outlines the benefits you’ve received. This form is essential for accurately reporting your income on your tax return. We understand that tax season can be overwhelming, but having this document ready will ease some of that stress.

Collect all communication from your insurance provider concerning your impairment assistance. This includes any letters or statements that explain the nature of your advantages and whether you need to consider do you pay taxes on long-term disability. It’s common to feel uncertain about what to include, but these documents are crucial for clarity.

Keep track of any tax deductions or credits you might be eligible for because of your condition. This could include medical expenses or other related costs that exceed the allowable threshold. Remember, every little bit helps, and you deserve to take advantage of what’s available to you.

Ensure you have your Social Security number and the information of any dependents ready for tax filing. This information is vital for completing your tax return accurately. We’re here to help you navigate this process smoothly.

Organize all these documents in a dedicated folder to facilitate easy access during tax preparation. Having everything in one place will streamline the process and help you avoid missing any important information. It’s a simple step that can make a big difference.

Be aware that it can take up to 3 weeks for an amended return to show up in the IRS system, so plan accordingly. Patience is key, and we’re here to support you through this waiting period.

If you encounter issues with your tax filings, consider reaching out to the Taxpayer Advocate Service (TAS), which offers free assistance to taxpayers facing difficulties. TAS can help resolve problems that you haven’t been able to resolve with the IRS on your own. You don’t have to face this alone.

Furthermore, low-to-moderate earning individuals may gain from the IRS's Volunteer Tax Assistance (VITA) program, which offers free tax assistance. This is a wonderful resource that can provide the help you need.

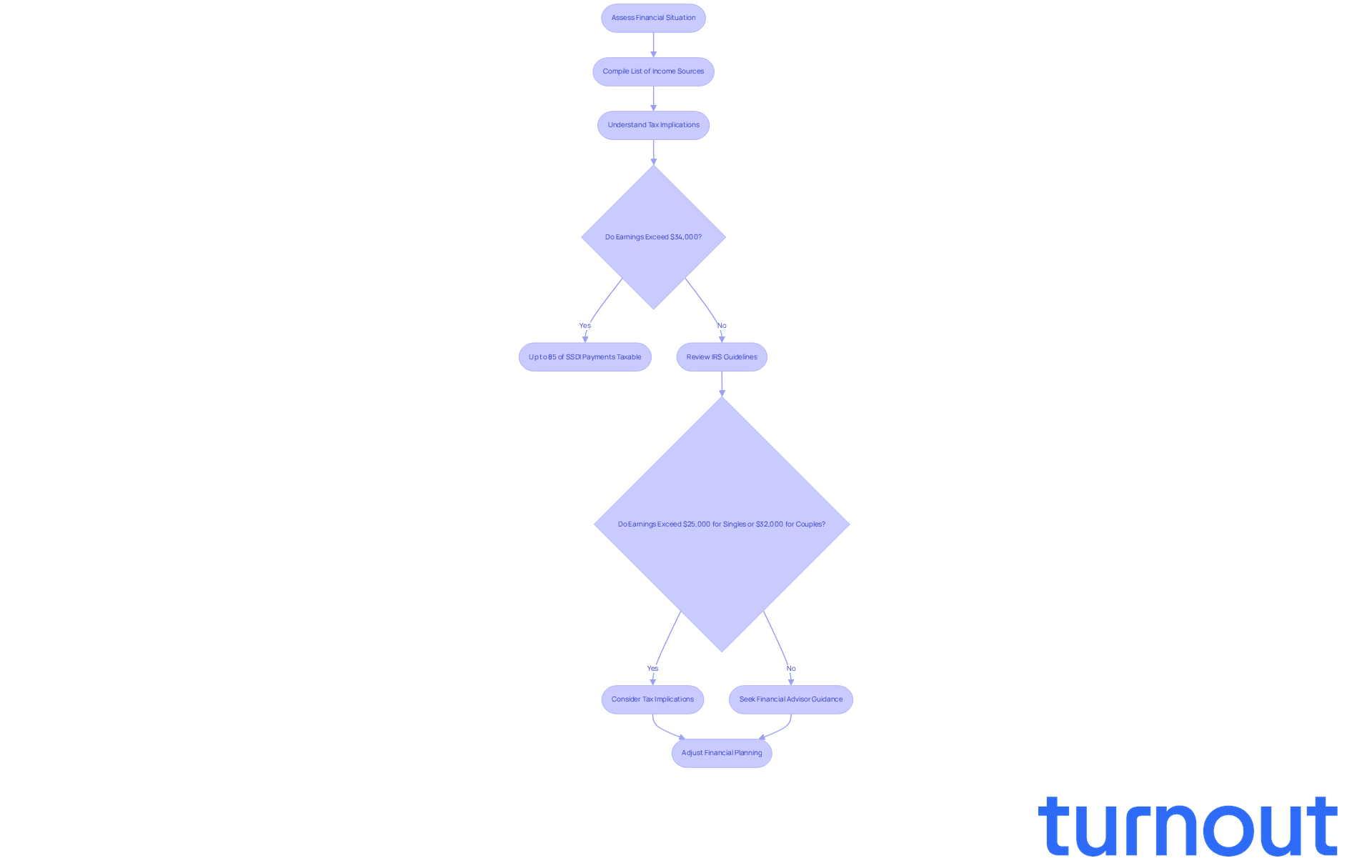

Consider Impact of Other Income on Disability Benefits

We understand that managing your finances while receiving disability payments can be challenging. Start by compiling a comprehensive list of all your revenue sources, including wages from part-time work, investment earnings, or any other streams of income. This step is crucial in understanding your overall financial picture.

It's common to feel uncertain about how these extra earnings might affect your tax bracket and obligations, particularly regarding do you pay taxes on long-term disability. For instance, if your total earnings surpass $34,000 as an individual filer, up to 85% of your SSDI payments may become taxable. Understanding this information can assist you in preparing for any potential tax implications, such as do you pay taxes on long-term disability.

Familiarize yourself with IRS guidelines regarding combined earnings and the question of do you pay taxes on long-term disability taxation. The IRS defines combined earnings as your adjusted gross earnings plus nontaxable interest and half of your SSDI payments. If your total earnings exceed $25,000 for single filers or $32,000 for married couples filing jointly, you may encounter tax implications. Understanding these thresholds can help you decide if you do you pay taxes on long-term disability.

Consider seeking counsel from a financial advisor. This professional guidance can provide clarity on how your overall earnings affect your disability benefits and whether you need to consider if do you pay taxes on long-term disability. You're not alone in this journey; having someone to help navigate these complexities can be invaluable.

Finally, adjust your financial planning to account for the potential tax impact of your total earnings. Strategies such as utilizing tax-advantaged accounts or managing your income levels can help minimize your tax burden. Remember, we're here to help you find the best path forward.

Conclusion

Understanding the tax implications of long-term disability benefits is crucial for anyone navigating this complex financial landscape. We know it can feel overwhelming, but knowing how premiums were paid is key. This directly influences whether the benefits you receive are taxable. By clarifying the distinctions between employer-paid and employee-paid premiums, you can better prepare for your tax obligations.

It's important to verify the source of your benefits and gather the necessary documentation. Consider how additional income might impact your tax responsibilities. Whether you're dealing with private policies or government programs like SSDI, understanding these nuances can help you avoid unexpected tax bills and ensure compliance with IRS regulations. Consulting with tax experts or financial advisors can provide tailored guidance for your unique situation.

Ultimately, being informed and proactive about your tax obligations related to long-term disability benefits is essential. This knowledge empowers you to navigate your financial situation effectively, maximizing your benefits while minimizing potential tax burdens. Taking these steps not only alleviates stress during tax season but also fosters a sense of control over your financial future. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

Are long-term disability (LTD) payments considered taxable income?

Yes, the IRS classifies long-term disability payments as income, which means they can be taxable.

Do you pay taxes on long-term disability benefits if your employer covers the entire premium?

Yes, if your employer covers the entire premium for your LTD policy, the payments you receive are fully taxable.

What happens if I pay for my long-term disability policy with after-tax dollars?

If you pay for your policy with after-tax dollars, the long-term disability benefits you receive are generally tax-free.

How are long-term disability benefits taxed if the premiums are shared between employer and employee?

If your employer pays part of the premium and you cover a portion with after-tax dollars, only the employer-paid portion of your benefits will be taxed.

What should I consider to avoid unexpected tax bills regarding long-term disability payments?

It’s essential to verify how your premiums were paid to understand your tax obligations and avoid surprises during tax season.

Are there state tax laws that may affect long-term disability benefits?

Yes, state regulations can vary significantly and may impact your overall tax obligation regarding long-term disability benefits.

What should I do if I have specific questions about my long-term disability tax situation?

Consulting with a tax expert or knowledgeable lawyer can provide valuable insight into your rights and help navigate the complexities of tax responsibilities related to long-term disability.

Will I receive any tax documents for my long-term disability payments?

Yes, be prepared to receive tax documents like Form W-2 or 1099 for reporting taxable long-term disability payments on your tax return.